Key Insights

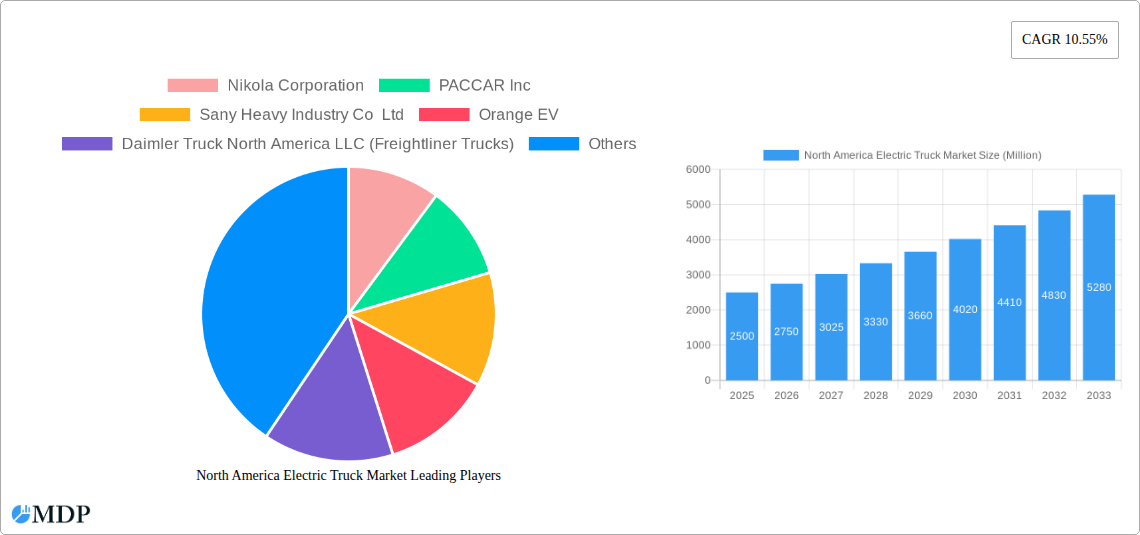

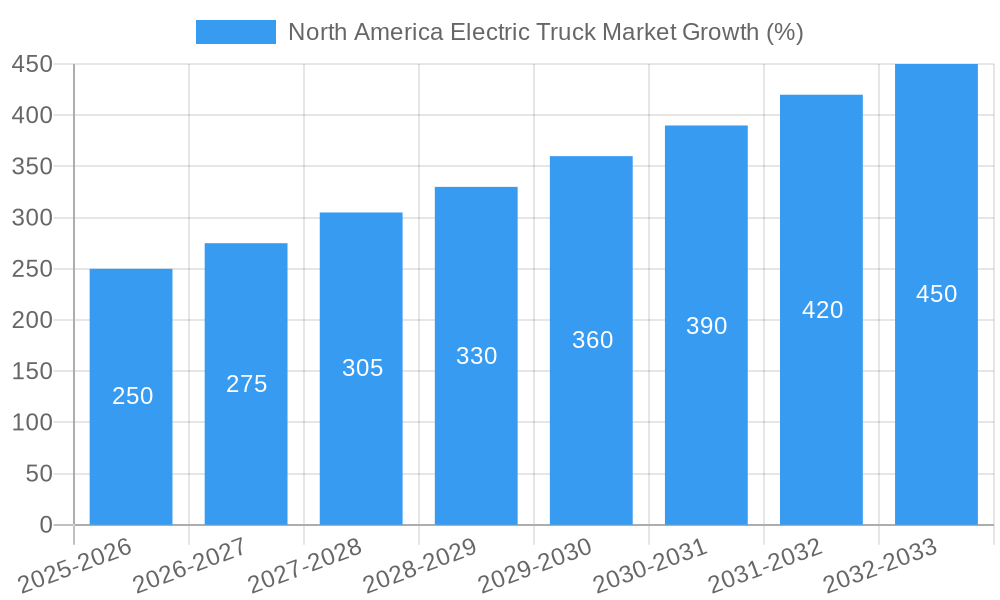

The North American electric truck market is experiencing robust growth, driven by stringent emission regulations, increasing fuel costs, and a growing focus on sustainability within the logistics and transportation sectors. A compound annual growth rate (CAGR) of 10.55% from 2019 to 2033 indicates a significant expansion, transforming the landscape of heavy-duty trucking. Key market segments include battery electric vehicles (BEVs), fuel cell electric vehicles (FCEVs), hybrid electric vehicles (HEVs), and plug-in hybrid electric vehicles (PHEVs), across various vehicle configurations like Class 8 trucks. The US market currently dominates, followed by Canada and Mexico, with significant potential for growth in all three countries fueled by government incentives, infrastructure development, and expanding charging networks. Major players like Nikola Corporation, PACCAR Inc., and Daimler Truck North America are actively investing in R&D and production to meet the surging demand. While the initial investment costs for electric trucks remain a restraint, declining battery prices and advancements in battery technology are mitigating this challenge. Furthermore, the development of comprehensive charging infrastructure is crucial for widespread adoption, particularly along major transportation corridors. The market's trajectory is strongly influenced by technological innovations, governmental policies promoting electric vehicle adoption, and the evolving demands of environmentally conscious businesses seeking to reduce their carbon footprint.

The forecast period of 2025-2033 will witness significant expansion in the electric truck market within North America. The continued improvement in battery technology will enhance range and reduce charging times, thus addressing a major consumer concern. Furthermore, increasing awareness of environmental sustainability and the potential for operational cost savings are expected to drive demand across various segments. Competition among established truck manufacturers and emerging EV startups is stimulating innovation and fostering a more diversified market. Governmental support through tax credits, subsidies, and favorable regulations will further accelerate market growth. However, challenges remain, including the need for further development of charging infrastructure, particularly outside major metropolitan areas, and addressing concerns regarding charging times and range anxiety for long-haul transportation. The market's success hinges on a collaborative effort between manufacturers, governments, and charging infrastructure providers to overcome these hurdles and unlock the full potential of electric trucks in North America.

North America Electric Truck Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America electric truck market, covering the period from 2019 to 2033. With a focus on key market dynamics, industry trends, leading players, and future opportunities, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. The report projects a market size of xx Million by 2033, driven by significant technological advancements and supportive government regulations. Download now to gain a competitive edge!

North America Electric Truck Market Dynamics & Concentration

The North American electric truck market is experiencing dynamic growth, shaped by several key factors. Market concentration is currently moderate, with a few major players holding significant shares, but the landscape is rapidly evolving due to increased competition from both established automotive manufacturers and new entrants. Innovation is a crucial driver, with ongoing advancements in battery technology, charging infrastructure, and vehicle design continuously improving range, efficiency, and cost-effectiveness. Stringent government regulations aimed at reducing carbon emissions and promoting sustainable transportation are providing a strong impetus for market expansion. Product substitutes, such as conventional diesel trucks, continue to compete, but their market share is gradually diminishing. End-user trends reveal a growing preference for electric trucks, driven by factors such as environmental concerns and operating cost savings. The market has also witnessed a significant number of mergers and acquisitions (M&A) in recent years, reflecting the strategic importance of this sector.

- Market Share: The top 5 players account for approximately xx% of the market in 2025. This is projected to decline to xx% by 2033 due to increased competition.

- M&A Activity: Over the period 2019-2024, there were approximately xx M&A deals in the North American electric truck market. This number is expected to increase significantly in the coming years.

- Innovation Drivers: Advancements in battery technology, charging infrastructure improvements, and software-defined vehicle architectures.

- Regulatory Frameworks: Stringent emission standards and government incentives are driving market growth.

North America Electric Truck Market Industry Trends & Analysis

The North American electric truck market is characterized by robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, including the development of solid-state batteries and advanced charging technologies, are significantly impacting market dynamics. Consumer preferences are increasingly shifting towards electric trucks due to their lower operating costs, reduced environmental impact, and potential for improved efficiency. Competitive dynamics are intense, with both established and new players vying for market share through product innovation, strategic partnerships, and aggressive pricing strategies. Market penetration is still relatively low compared to conventional trucks but is projected to increase rapidly in the coming years, reaching xx% by 2033.

Leading Markets & Segments in North America Electric Truck Market

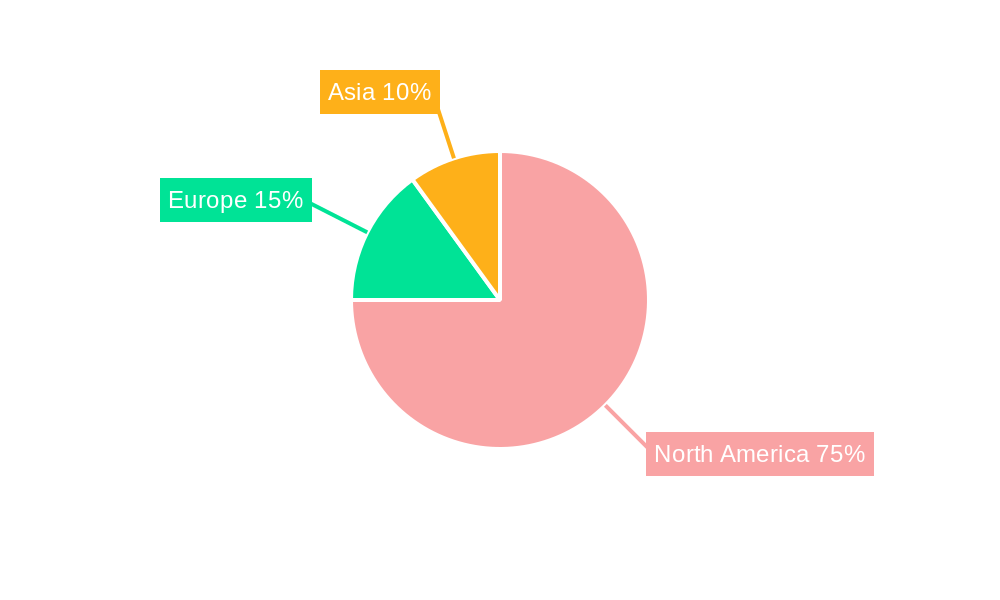

The United States represents the largest market for electric trucks in North America, driven by strong government support, a well-established automotive industry, and substantial investments in charging infrastructure. However, Canada and Mexico are also experiencing significant growth, with supportive policies and increasing demand from various industries. Within the segments, Battery Electric Vehicles (BEVs) currently dominate the fuel category, although Fuel Cell Electric Vehicles (FCEVs) are expected to gain traction in the coming years. Class 8 trucks represent the largest segment within the vehicle configuration.

- Key Drivers in the US: Strong government incentives, robust charging infrastructure development, and a large logistics sector driving adoption.

- Key Drivers in Canada: Government support for electric vehicle adoption and a focus on sustainable transportation.

- Key Drivers in Mexico: Growing industrial activity and increasing demand for efficient transportation solutions.

- Fuel Category Dominance: BEVs currently hold the largest market share, projected to remain dominant, though FCEV growth is anticipated.

- Vehicle Configuration: Class 8 trucks represent the largest segment.

North America Electric Truck Market Product Developments

Recent product innovations include advancements in battery technology, resulting in increased range and faster charging times. Electric trucks are increasingly being deployed in various applications, including long-haul transportation, urban delivery, and construction. Key competitive advantages stem from improved efficiency, lower operating costs, and reduced emissions compared to conventional trucks. The integration of advanced driver-assistance systems (ADAS) and autonomous driving technologies is gaining momentum.

Key Drivers of North America Electric Truck Market Growth

Several factors are fueling the growth of the North American electric truck market. Technological advancements, particularly in battery technology and charging infrastructure, are making electric trucks more viable and cost-effective. Government regulations and incentives, such as tax credits and emission standards, are strongly encouraging adoption. Economic factors, including decreasing battery costs and increasing fuel prices, are further boosting market growth.

Challenges in the North America Electric Truck Market Market

The market faces several challenges. High initial purchase costs and limited range remain barriers to widespread adoption. Supply chain issues, particularly for battery components and rare earth minerals, can hinder production and impact cost. Competition from established truck manufacturers and the need for robust charging infrastructure are other key challenges.

Emerging Opportunities in North America Electric Truck Market

Long-term growth is expected to be driven by technological breakthroughs in battery technology, leading to longer range and faster charging times. Strategic partnerships between automakers and charging infrastructure providers will help expand the charging network. Market expansion into new segments, such as last-mile delivery and specialized applications, will unlock further growth potential.

Leading Players in the North America Electric Truck Market Sector

- Nikola Corporation

- PACCAR Inc

- Sany Heavy Industry Co Ltd

- Orange EV

- Daimler Truck North America LLC (Freightliner Trucks)

- Mitsubishi Fuso Truck and Bus Corporation

- Volvo Group

- BYD Auto Co Ltd

- Ford Motor Company

Key Milestones in North America Electric Truck Market Industry

- December 2023: Nikola delivers its first triple battery-electric trucks to Total Transportation Services Inc., boosting zero-emission shipping at LA/Long Beach ports.

- November 2023: Partnership announced between an unnamed company and Factorial Energy for next-generation battery technology development, including module and vehicle integration.

- October 2023: Nikola Corporation and PGT Trucking Inc. partner to deploy heavy-duty electric trucks.

Strategic Outlook for North America Electric Truck Market Market

The North American electric truck market holds significant long-term growth potential. Further technological advancements, expanding charging infrastructure, and supportive government policies will accelerate market penetration. Strategic partnerships and collaborations will play a critical role in overcoming challenges and unlocking new market opportunities. The market is expected to witness sustained growth, driven by the increasing focus on sustainability and the continuous improvement of electric truck technology.

North America Electric Truck Market Segmentation

-

1. Vehicle Configuration

-

1.1. Trucks

- 1.1.1. Heavy-duty Commercial Trucks

- 1.1.2. Medium-duty Commercial Trucks

-

1.1. Trucks

-

2. Fuel Category

- 2.1. BEV

- 2.2. FCEV

- 2.3. HEV

- 2.4. PHEV

North America Electric Truck Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Electric Truck Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Travel and Tourism Industry is Driving the Car Rental Market

- 3.3. Market Restrains

- 3.3.1. Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Electric Truck Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 5.1.1. Trucks

- 5.1.1.1. Heavy-duty Commercial Trucks

- 5.1.1.2. Medium-duty Commercial Trucks

- 5.1.1. Trucks

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. BEV

- 5.2.2. FCEV

- 5.2.3. HEV

- 5.2.4. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 6. United States North America Electric Truck Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Electric Truck Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Electric Truck Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Electric Truck Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Nikola Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 PACCAR Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sany Heavy Industry Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Orange EV

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Daimler Truck North America LLC (Freightliner Trucks)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mitsubishi Fuso Truck and Bus Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Volvo Grou

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 BYD Auto Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ford Motor Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Nikola Corporation

List of Figures

- Figure 1: North America Electric Truck Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Electric Truck Market Share (%) by Company 2024

List of Tables

- Table 1: North America Electric Truck Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Electric Truck Market Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 3: North America Electric Truck Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 4: North America Electric Truck Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Electric Truck Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Electric Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Electric Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Electric Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Electric Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Electric Truck Market Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 11: North America Electric Truck Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 12: North America Electric Truck Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Electric Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Electric Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Electric Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Electric Truck Market?

The projected CAGR is approximately 10.55%.

2. Which companies are prominent players in the North America Electric Truck Market?

Key companies in the market include Nikola Corporation, PACCAR Inc, Sany Heavy Industry Co Ltd, Orange EV, Daimler Truck North America LLC (Freightliner Trucks), Mitsubishi Fuso Truck and Bus Corporation, Volvo Grou, BYD Auto Co Ltd, Ford Motor Company.

3. What are the main segments of the North America Electric Truck Market?

The market segments include Vehicle Configuration, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Travel and Tourism Industry is Driving the Car Rental Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market.

8. Can you provide examples of recent developments in the market?

December 2023: The first Nikola triple battery-electric trucks were delivered to Total Transportation Services Inc. by Nikola, accelerating the development of zero-emission shipping options at Los Angeles and Long Beach ports.November 2023: The company announced a partnership with Factorial energy for the development of next-generation battery technology. The partnership is also focused on the development of the entire module and battery integration into the vehicle. The partnership will help Mercedes-Benz to become a fully electric company.October 2023: The Nikola Corporation and PGT Trucking Inc. (PGT) established a partnership to carry heavy-duty vehicles with electric drives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Electric Truck Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Electric Truck Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Electric Truck Market?

To stay informed about further developments, trends, and reports in the North America Electric Truck Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence