Key Insights

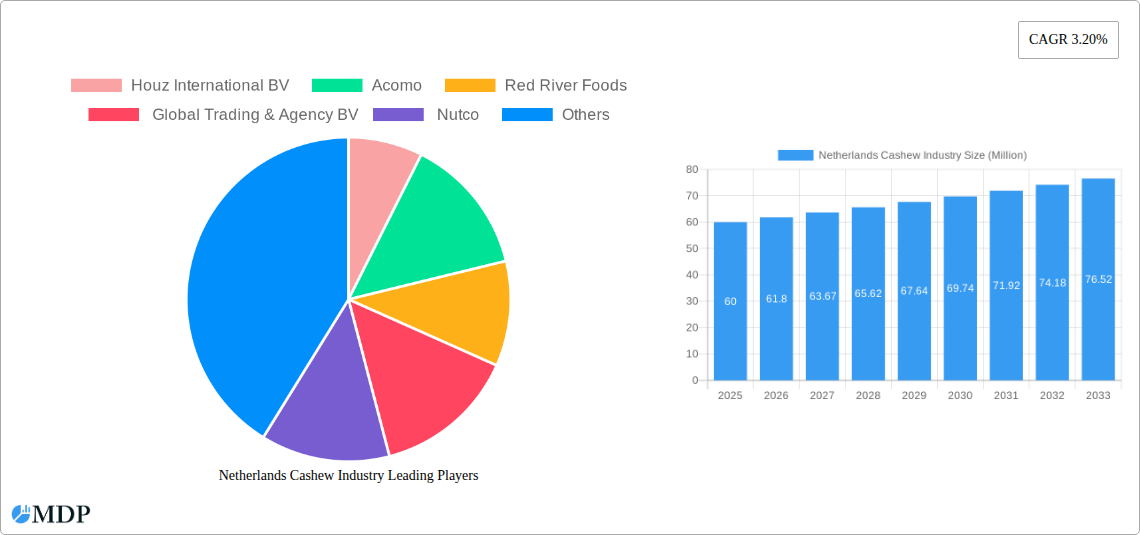

The Netherlands cashew market, a significant segment within the broader European cashew industry, exhibits robust growth potential. While precise figures for the Netherlands' specific market size in 2025 are unavailable, we can estimate it based on the provided European data and market trends. Considering the Netherlands' strong import/export activity and its position as a significant food processing and distribution hub in Europe, a reasonable estimate for the 2025 market size would be in the range of €50-70 million. This estimate considers the overall European market size and factors in the Netherlands' economic strength and consumer demand for healthy snacks and imported food products. The market is driven by increasing consumer preference for healthy snacks, rising disposable incomes, and the growing popularity of vegan and vegetarian diets. Key trends include the increasing demand for sustainably sourced cashews, innovative packaging solutions (such as recyclable and compostable options), and the expansion of e-commerce channels for cashew sales. However, market growth is restrained by fluctuating cashew prices due to global supply chain issues and potential health concerns related to high fat content if consumed excessively. The market is segmented by type (whole versus broken), processing (roasted, raw, salted), and packaging (bulk versus retail), with retail packaging and roasted cashews currently holding the largest market share. Major players, including both international and domestic companies such as Houz International BV, Nutco, and Delinuts, are vying for market dominance through product diversification, branding strategies, and strategic partnerships.

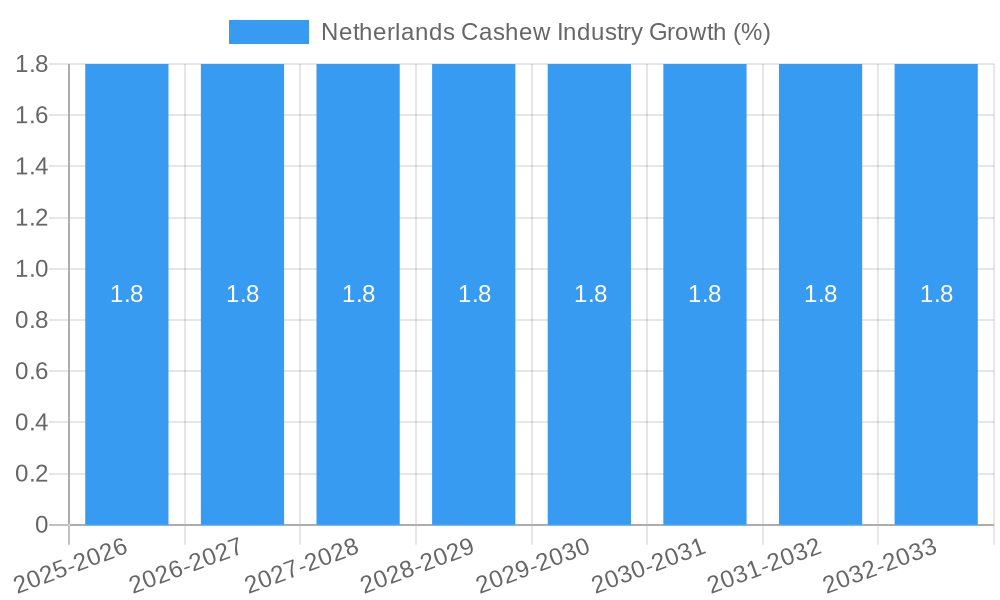

The projected Compound Annual Growth Rate (CAGR) of 3.20% for the European cashew market suggests a steady growth trajectory for the Netherlands in the forecast period (2025-2033). This growth is expected to be fuelled by continued consumer preference for nutritious snacks, further penetration of e-commerce channels, and the introduction of innovative cashew-based products. The market segmentation strategy will remain crucial for companies seeking to capitalize on this growth. For instance, focusing on specific consumer segments (e.g., health-conscious individuals) through targeted marketing and product development is likely to be a winning strategy. Similarly, investment in sustainable sourcing and eco-friendly packaging aligns with growing consumer preferences and will be critical to long-term market success. The Netherlands' strategic location and robust logistics infrastructure will continue to be significant assets for businesses operating in this market.

Netherlands Cashew Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Netherlands cashew industry, covering market dynamics, leading players, key trends, and future growth prospects from 2019 to 2033. The report leverages extensive data analysis and industry expertise to offer actionable insights for businesses, investors, and stakeholders within the cashew sector. With a focus on market segmentation (whole, broken, roasted, raw, salted cashews; bulk and retail packaging), this report delivers a crucial understanding of this dynamic market.

Netherlands Cashew Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of the Netherlands cashew industry, examining market concentration, innovation, regulations, and industry activity. The study period (2019-2024) reveals a moderately concentrated market with key players such as Houz International BV and Alamir Trading holding significant market share. Market share data for 2024 indicates that the top 5 players control approximately xx% of the market. Innovation is driven primarily by improvements in processing techniques (e.g., roasting and salting), packaging solutions, and supply chain optimization. Regulatory frameworks, including food safety standards, impact operations, while product substitutes like other nuts and seeds exert competitive pressure. End-user trends show a rising demand for healthier snacks and convenient packaging formats. M&A activity has been relatively low in recent years with only xx deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, top 5 players control approximately xx% of the market (2024).

- Innovation Drivers: Processing improvements, packaging innovations, supply chain efficiency.

- Regulatory Framework: Compliance with food safety standards and labeling regulations.

- Product Substitutes: Other nuts, seeds, and snack alternatives.

- End-User Trends: Growing demand for healthy snacks and convenient packaging.

- M&A Activity: Low activity with xx deals recorded between 2019 and 2024.

Netherlands Cashew Industry Industry Trends & Analysis

This section delves into the key trends shaping the Netherlands cashew industry. Market growth is primarily driven by increasing consumer demand for cashew nuts as a healthy snack and ingredient. The CAGR for the period 2019-2024 is estimated at xx%, with market penetration reaching xx% in 2024. Technological advancements in processing and packaging are enhancing efficiency and product quality. Consumer preferences are shifting towards sustainably sourced and ethically produced cashews. Intense competition among importers and processors creates a dynamic market landscape. The forecast period (2025-2033) projects continued growth, driven by factors such as increasing disposable incomes, expanding retail channels, and innovative product offerings.

Leading Markets & Segments in Netherlands Cashew Industry

This section identifies the dominant segments within the Netherlands cashew market. While data specifics are limited, anecdotal evidence and import/export figures suggest that Germany is a crucial export market. The most significant segments are likely whole cashews (driven by consumer preference for quality) and roasted cashews (due to convenience). Bulk packaging dominates the market, reflecting the needs of food processors and industrial buyers. Retail packaging is also growing in importance to meet consumer demand.

- Key Drivers for Whole Cashews: High consumer preference for quality and taste.

- Key Drivers for Roasted Cashews: Convenience and ready-to-eat nature.

- Key Drivers for Bulk Packaging: Demand from food processors and industrial users.

- Key Drivers for Retail Packaging: Growing consumer demand for individual portions.

- Dominant Export Market: Germany (33.2% of exports in October 2022).

Netherlands Cashew Industry Product Developments

Recent product developments focus on enhancing convenience, improving taste, and catering to specific dietary requirements. This includes the introduction of innovative packaging formats, such as single-serve pouches, and value-added products like flavored roasted cashews. Technological advances in processing are improving the consistency of cashew quality and yield. These developments contribute to increased market competitiveness and customer appeal.

Key Drivers of Netherlands Cashew Industry Growth

Growth in the Netherlands cashew industry is fueled by several factors: increasing consumer preference for healthy snacks, the expansion of retail channels (both online and offline), and the ongoing development of innovative products and packaging solutions. Economic growth and increasing disposable incomes further stimulate demand. Favorable government policies and regulations also contribute to a positive business environment.

Challenges in the Netherlands Cashew Industry Market

The Netherlands cashew industry faces challenges such as fluctuations in global cashew prices, supply chain disruptions, and intense competition. Regulatory compliance costs can also impact profitability. Furthermore, maintaining sustainable and ethical sourcing practices is crucial in meeting evolving consumer expectations.

Emerging Opportunities in Netherlands Cashew Industry

Significant opportunities lie in expanding into new markets, developing value-added cashew products, and strengthening supply chain resilience through strategic partnerships. Investing in sustainable and ethical sourcing practices will enhance brand reputation and attract environmentally conscious consumers. Technological advancements offer further opportunities to optimize processing efficiency and product quality.

Leading Players in the Netherlands Cashew Industry Sector

- Houz International BV

- Acomo

- Red River Foods

- Global Trading & Agency BV

- Nutco

- Delinuts

- Nutland BV

- Alamir Trading

- Intersnack

Key Milestones in Netherlands Cashew Industry Industry

- February 2023: Germany identified as the major export destination for Netherlands' cashew nuts. Germany exported 963.8 metric tons in October 2022 (33.2% of total exports).

- February 2023: Houz International BV and Alamir Trading identified as major importing companies, together importing 4686.5 metric tons in October 2022.

Strategic Outlook for Netherlands Cashew Industry Market

The Netherlands cashew industry is poised for continued growth, driven by evolving consumer preferences and ongoing innovation. Strategic opportunities exist in expanding into new market segments, focusing on sustainable sourcing, and developing value-added products that meet changing consumer demands. Companies that can effectively navigate the competitive landscape and adapt to evolving market trends will be best positioned for long-term success.

Netherlands Cashew Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis (Volume and Value)

- 3. Import Market Analysis (Volume and Value)

- 4. Export Market Analysis (Volume and Value)

- 5. Price Trend Analysis

- 6. Production Analysis

- 7. Consumption Analysis (Volume and Value)

- 8. Import Market Analysis (Volume and Value)

- 9. Export Market Analysis (Volume and Value)

- 10. Price Trend Analysis

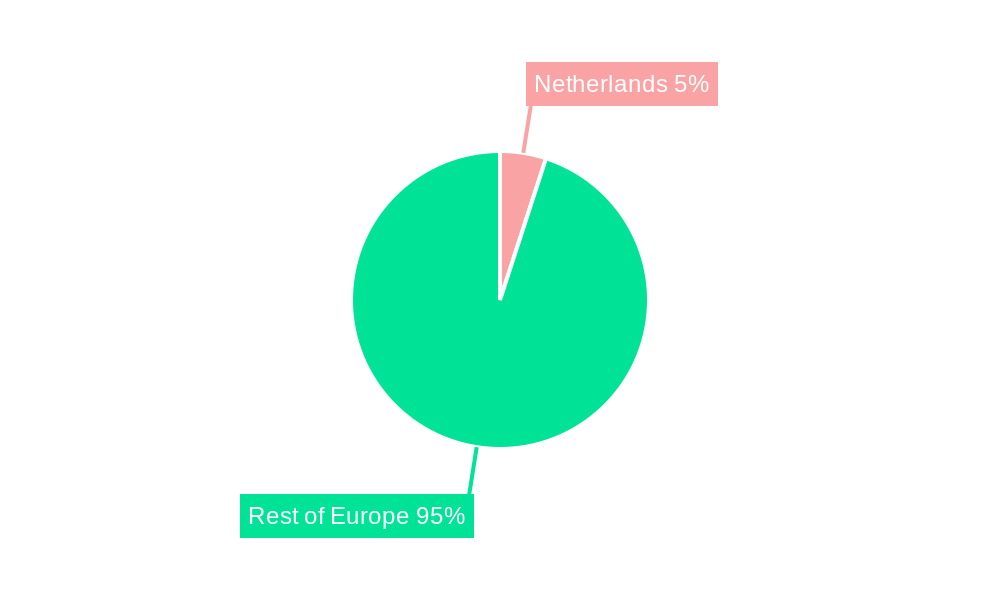

Netherlands Cashew Industry Segmentation By Geography

- 1. Netherlands

Netherlands Cashew Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production

- 3.3. Market Restrains

- 3.3.1. Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis

- 3.4. Market Trends

- 3.4.1. Increased demand to boost the cashew market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Cashew Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis (Volume and Value)

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Volume and Value)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Volume and Value)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Production Analysis

- 5.7. Market Analysis, Insights and Forecast - by Consumption Analysis (Volume and Value)

- 5.8. Market Analysis, Insights and Forecast - by Import Market Analysis (Volume and Value)

- 5.9. Market Analysis, Insights and Forecast - by Export Market Analysis (Volume and Value)

- 5.10. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Germany Netherlands Cashew Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Netherlands Cashew Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Netherlands Cashew Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Netherlands Cashew Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Netherlands Cashew Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Europe Netherlands Cashew Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Houz International BV

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Acomo

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Red River Foods

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Global Trading & Agency BV

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Nutco

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Delinuts

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Nutland BV

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Alamir Trading

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Intersnack

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Houz International BV

List of Figures

- Figure 1: Netherlands Cashew Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Netherlands Cashew Industry Share (%) by Company 2024

List of Tables

- Table 1: Netherlands Cashew Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Netherlands Cashew Industry Volume Metric Tons Forecast, by Region 2019 & 2032

- Table 3: Netherlands Cashew Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Netherlands Cashew Industry Volume Metric Tons Forecast, by Production Analysis 2019 & 2032

- Table 5: Netherlands Cashew Industry Revenue Million Forecast, by Consumption Analysis (Volume and Value) 2019 & 2032

- Table 6: Netherlands Cashew Industry Volume Metric Tons Forecast, by Consumption Analysis (Volume and Value) 2019 & 2032

- Table 7: Netherlands Cashew Industry Revenue Million Forecast, by Import Market Analysis (Volume and Value) 2019 & 2032

- Table 8: Netherlands Cashew Industry Volume Metric Tons Forecast, by Import Market Analysis (Volume and Value) 2019 & 2032

- Table 9: Netherlands Cashew Industry Revenue Million Forecast, by Export Market Analysis (Volume and Value) 2019 & 2032

- Table 10: Netherlands Cashew Industry Volume Metric Tons Forecast, by Export Market Analysis (Volume and Value) 2019 & 2032

- Table 11: Netherlands Cashew Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Netherlands Cashew Industry Volume Metric Tons Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Netherlands Cashew Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: Netherlands Cashew Industry Volume Metric Tons Forecast, by Production Analysis 2019 & 2032

- Table 15: Netherlands Cashew Industry Revenue Million Forecast, by Consumption Analysis (Volume and Value) 2019 & 2032

- Table 16: Netherlands Cashew Industry Volume Metric Tons Forecast, by Consumption Analysis (Volume and Value) 2019 & 2032

- Table 17: Netherlands Cashew Industry Revenue Million Forecast, by Import Market Analysis (Volume and Value) 2019 & 2032

- Table 18: Netherlands Cashew Industry Volume Metric Tons Forecast, by Import Market Analysis (Volume and Value) 2019 & 2032

- Table 19: Netherlands Cashew Industry Revenue Million Forecast, by Export Market Analysis (Volume and Value) 2019 & 2032

- Table 20: Netherlands Cashew Industry Volume Metric Tons Forecast, by Export Market Analysis (Volume and Value) 2019 & 2032

- Table 21: Netherlands Cashew Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 22: Netherlands Cashew Industry Volume Metric Tons Forecast, by Price Trend Analysis 2019 & 2032

- Table 23: Netherlands Cashew Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 24: Netherlands Cashew Industry Volume Metric Tons Forecast, by Region 2019 & 2032

- Table 25: Netherlands Cashew Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Netherlands Cashew Industry Volume Metric Tons Forecast, by Country 2019 & 2032

- Table 27: Germany Netherlands Cashew Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Germany Netherlands Cashew Industry Volume (Metric Tons) Forecast, by Application 2019 & 2032

- Table 29: France Netherlands Cashew Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Netherlands Cashew Industry Volume (Metric Tons) Forecast, by Application 2019 & 2032

- Table 31: Italy Netherlands Cashew Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy Netherlands Cashew Industry Volume (Metric Tons) Forecast, by Application 2019 & 2032

- Table 33: United Kingdom Netherlands Cashew Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: United Kingdom Netherlands Cashew Industry Volume (Metric Tons) Forecast, by Application 2019 & 2032

- Table 35: Netherlands Netherlands Cashew Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Netherlands Netherlands Cashew Industry Volume (Metric Tons) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Netherlands Cashew Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe Netherlands Cashew Industry Volume (Metric Tons) Forecast, by Application 2019 & 2032

- Table 39: Netherlands Cashew Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 40: Netherlands Cashew Industry Volume Metric Tons Forecast, by Production Analysis 2019 & 2032

- Table 41: Netherlands Cashew Industry Revenue Million Forecast, by Consumption Analysis (Volume and Value) 2019 & 2032

- Table 42: Netherlands Cashew Industry Volume Metric Tons Forecast, by Consumption Analysis (Volume and Value) 2019 & 2032

- Table 43: Netherlands Cashew Industry Revenue Million Forecast, by Import Market Analysis (Volume and Value) 2019 & 2032

- Table 44: Netherlands Cashew Industry Volume Metric Tons Forecast, by Import Market Analysis (Volume and Value) 2019 & 2032

- Table 45: Netherlands Cashew Industry Revenue Million Forecast, by Export Market Analysis (Volume and Value) 2019 & 2032

- Table 46: Netherlands Cashew Industry Volume Metric Tons Forecast, by Export Market Analysis (Volume and Value) 2019 & 2032

- Table 47: Netherlands Cashew Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 48: Netherlands Cashew Industry Volume Metric Tons Forecast, by Price Trend Analysis 2019 & 2032

- Table 49: Netherlands Cashew Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 50: Netherlands Cashew Industry Volume Metric Tons Forecast, by Production Analysis 2019 & 2032

- Table 51: Netherlands Cashew Industry Revenue Million Forecast, by Consumption Analysis (Volume and Value) 2019 & 2032

- Table 52: Netherlands Cashew Industry Volume Metric Tons Forecast, by Consumption Analysis (Volume and Value) 2019 & 2032

- Table 53: Netherlands Cashew Industry Revenue Million Forecast, by Import Market Analysis (Volume and Value) 2019 & 2032

- Table 54: Netherlands Cashew Industry Volume Metric Tons Forecast, by Import Market Analysis (Volume and Value) 2019 & 2032

- Table 55: Netherlands Cashew Industry Revenue Million Forecast, by Export Market Analysis (Volume and Value) 2019 & 2032

- Table 56: Netherlands Cashew Industry Volume Metric Tons Forecast, by Export Market Analysis (Volume and Value) 2019 & 2032

- Table 57: Netherlands Cashew Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 58: Netherlands Cashew Industry Volume Metric Tons Forecast, by Price Trend Analysis 2019 & 2032

- Table 59: Netherlands Cashew Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Netherlands Cashew Industry Volume Metric Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Cashew Industry?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the Netherlands Cashew Industry?

Key companies in the market include Houz International BV , Acomo , Red River Foods, Global Trading & Agency BV, Nutco , Delinuts , Nutland BV , Alamir Trading , Intersnack .

3. What are the main segments of the Netherlands Cashew Industry?

The market segments include Production Analysis, Consumption Analysis (Volume and Value), Import Market Analysis (Volume and Value), Export Market Analysis (Volume and Value), Price Trend Analysis, Production Analysis, Consumption Analysis (Volume and Value), Import Market Analysis (Volume and Value), Export Market Analysis (Volume and Value), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production.

6. What are the notable trends driving market growth?

Increased demand to boost the cashew market.

7. Are there any restraints impacting market growth?

Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis.

8. Can you provide examples of recent developments in the market?

February 2023: Germany is the major export destination for the Netherlands' cashew nuts. Germany exported 963.8 metric tons of cashews in October 2022, representing 33.2% of the total export.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Metric Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Cashew Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Cashew Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Cashew Industry?

To stay informed about further developments, trends, and reports in the Netherlands Cashew Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence