Key Insights

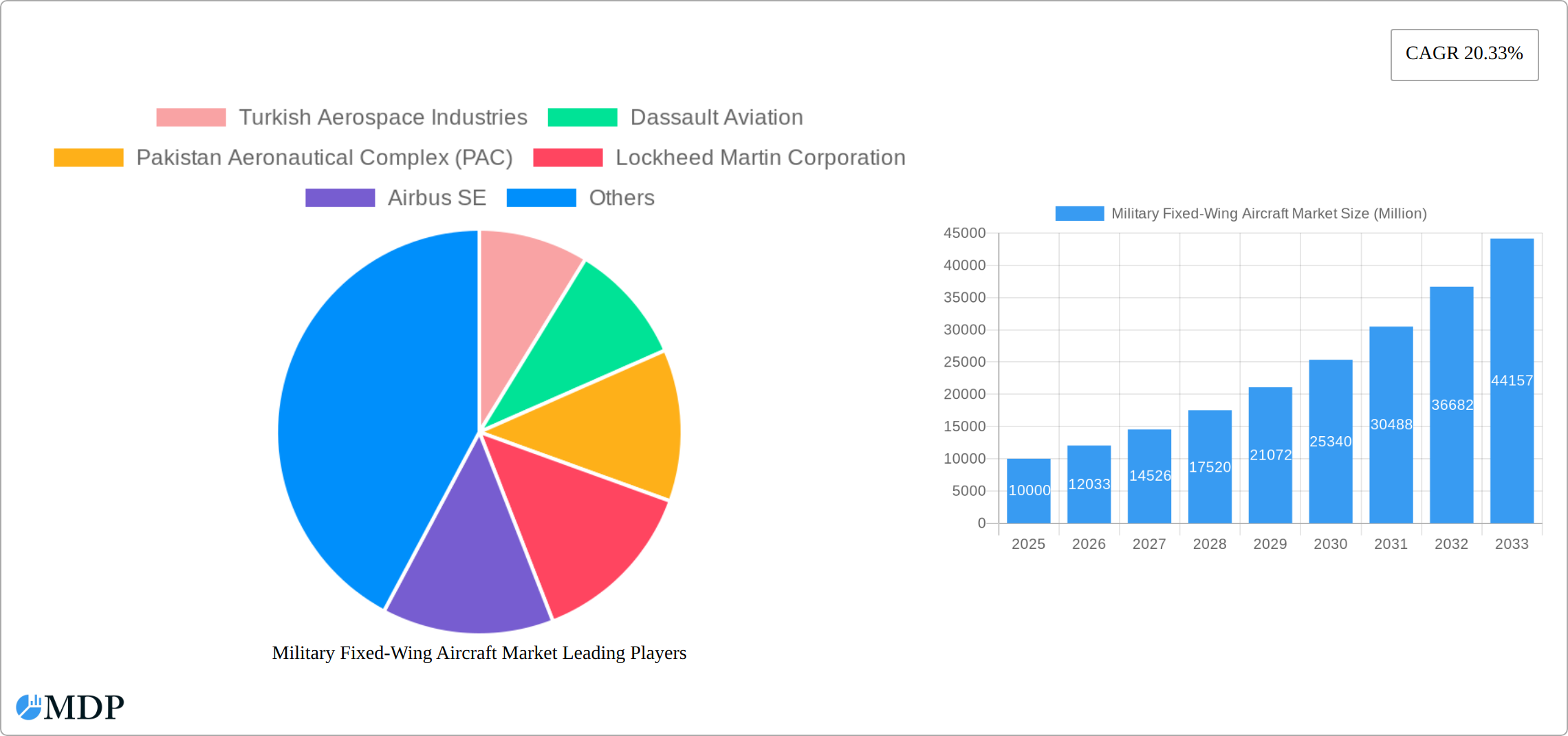

The global military fixed-wing aircraft market is experiencing robust growth, driven by increasing geopolitical instability, modernization of aging fleets, and technological advancements in aircraft design and weaponry. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation from the provided CAGR of 20.33% and the unspecified market size), is projected to expand significantly over the forecast period (2025-2033). Key drivers include the demand for advanced fighter jets, sophisticated surveillance aircraft, and robust transport capabilities for military operations. The rising adoption of unmanned aerial vehicles (UAVs) within the military sector further contributes to the overall market expansion. The segment encompassing multi-role aircraft holds a substantial market share, owing to their versatility in fulfilling diverse combat and logistical needs. However, budgetary constraints faced by some nations and potential shifts in defense spending priorities could act as restraints on market growth.

Technological advancements, such as the integration of stealth technology, artificial intelligence, and improved sensor systems, are shaping the market landscape. The increasing focus on developing next-generation fighter jets and improving the operational capabilities of existing fleets fuels the demand for advanced aircraft. Furthermore, collaborations and partnerships between leading aerospace companies and governments are playing a pivotal role in fostering innovation and accelerating technological progress in this sector. Competition among major players like Boeing, Lockheed Martin, Airbus, and Turkish Aerospace Industries is fierce, driving innovation and influencing pricing strategies. Geographic distribution of the market is likely skewed toward regions with high defense budgets and active military engagements, with North America and Europe potentially holding the largest shares. The continued emphasis on air superiority and the development of advanced air defense systems underpin the sustained growth projection for the military fixed-wing aircraft market throughout the forecast period.

Military Fixed-Wing Aircraft Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Military Fixed-Wing Aircraft Market, covering market dynamics, industry trends, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for industry stakeholders, investors, and anyone seeking a detailed understanding of this crucial sector. The report is meticulously researched and offers actionable insights for informed decision-making.

Military Fixed-Wing Aircraft Market Dynamics & Concentration

The global Military Fixed-Wing Aircraft market is characterized by a moderate level of concentration, with a few key players holding significant market share. The market is driven by continuous innovation in aircraft technology, stringent regulatory frameworks governing aircraft production and safety, and the ongoing replacement of aging fleets. Product substitutes, such as drones and unmanned aerial vehicles (UAVs), are emerging, but their capabilities are currently limited compared to fixed-wing aircraft for certain military applications. End-user trends are shifting towards multi-role aircraft and advanced technological capabilities. Mergers and acquisitions (M&A) activity within the sector has been relatively consistent, averaging xx deals annually over the historical period (2019-2024), with an estimated xx% increase in deal value during the forecast period (2025-2033).

- Market Share: The top five players hold approximately xx% of the global market share in 2025.

- M&A Activity: The average deal size increased from xx Million in 2019 to an estimated xx Million in 2025.

- Innovation Drivers: Advancements in materials science, avionics, and propulsion systems are key drivers of innovation.

- Regulatory Frameworks: Stringent safety and environmental regulations influence manufacturing and operations.

- Product Substitutes: UAVs and drones pose a competitive threat, particularly in niche applications.

Military Fixed-Wing Aircraft Market Industry Trends & Analysis

The Military Fixed-Wing Aircraft market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, driven by increasing defense budgets globally, modernization of existing fleets, and the demand for advanced capabilities such as stealth technology and enhanced situational awareness. Technological disruptions, particularly in areas such as artificial intelligence (AI) and autonomous flight systems, are reshaping the industry landscape. Consumer preferences (i.e., military end-users) are shifting towards versatile, multi-role platforms with enhanced operational capabilities. Competitive dynamics remain intense, with established players constantly striving for technological superiority and market share expansion. Market penetration of new technologies, such as hypersonic flight capabilities, is still low but expected to grow rapidly in the coming years. This growth will significantly impact the market share of existing players and the overall value chain of the industry.

Leading Markets & Segments in Military Fixed-Wing Aircraft Market

The North American region currently dominates the Military Fixed-Wing Aircraft market, driven by substantial defense spending, a robust technological base, and strong domestic demand. The Multi-Role Aircraft segment represents the largest share of the market, followed by Transport and Training aircraft.

Key Drivers by Segment:

- Multi-Role Aircraft: High demand driven by the need for versatile platforms capable of performing multiple missions.

- Training Aircraft: Growing investments in pilot training programs, particularly in developing economies.

- Transport Aircraft: Modernization of logistics and troop transport capabilities.

- Others: This segment encompasses specialized aircraft such as surveillance, reconnaissance, and electronic warfare platforms. Growth in this segment is linked to technological innovations and evolving military strategies.

Regional Dominance Analysis: North America's leading position stems from high defense budgets, advanced technological capabilities, and a large domestic air force. However, Asia-Pacific is emerging as a rapidly growing market, driven by increasing defense spending by several countries in the region.

Military Fixed-Wing Aircraft Market Product Developments

Recent product innovations emphasize advanced materials, improved avionics, and increased operational efficiency. New aircraft designs incorporate features like stealth technology, enhanced sensor systems, and advanced weaponry. These advancements provide significant competitive advantages, allowing manufacturers to capture larger market shares. The market is witnessing a gradual shift towards unmanned and remotely piloted aircraft.

Key Drivers of Military Fixed-Wing Aircraft Market Growth

The growth of the Military Fixed-Wing Aircraft market is primarily driven by several factors:

- Technological advancements: Continuous innovation in materials, avionics, and propulsion systems leading to superior aircraft performance.

- Increasing defense budgets: Nations are significantly increasing defense spending to modernize their military capabilities.

- Geopolitical instability: Global conflicts and regional tensions are driving demand for advanced military aircraft.

- Modernization of existing fleets: Many countries are replacing outdated aircraft with new, more advanced models.

Challenges in the Military Fixed-Wing Aircraft Market Market

The Military Fixed-Wing Aircraft market faces several challenges:

- Stringent regulatory hurdles: Meeting stringent safety and environmental regulations increases production costs and time-to-market.

- Supply chain disruptions: Global supply chain vulnerabilities can impact the timely production and delivery of aircraft.

- Intense competition: The market is highly competitive, with established players and new entrants vying for market share. This pressure affects pricing strategies and profit margins. Estimated xx% decline in profitability projected by 2030.

Emerging Opportunities in Military Fixed-Wing Aircraft Market

Several factors present significant growth opportunities for the Military Fixed-Wing Aircraft market:

- Technological breakthroughs: Advancements in artificial intelligence, hypersonic flight, and autonomous systems are opening up new possibilities for military aviation.

- Strategic partnerships: Collaboration between defense companies and technology firms enhances innovation and speeds up product development.

- Market expansion: Emerging markets in Asia-Pacific and other regions are presenting significant growth opportunities.

Leading Players in the Military Fixed-Wing Aircraft Market Sector

- Turkish Aerospace Industries

- Dassault Aviation

- Pakistan Aeronautical Complex (PAC)

- Lockheed Martin Corporation

- Airbus SE

- United Aircraft Corporation

- Korea Aerospace Industries

- Pilatus Aircraft Ltd

- Aviation Industry Corporation of China Ltd

- The Boeing Company

Key Milestones in Military Fixed-Wing Aircraft Industry

- February 2023: Boeing received a contract from the US Air Force for E-7 Airborne Early Warning & Control Aircraft. This contract signifies the continued demand for advanced surveillance capabilities.

- February 2023: Lockheed Martin delivered its first C-130J-30 Super Hercules to the Indonesian Air Force. This delivery underscores the growing demand for tactical airlifters in the Asia-Pacific region.

- June 2023: Airbus Flight Academy Europe signed a memorandum of understanding (MoU) with AURA AERO. This collaboration highlights the growing importance of pilot training and the emergence of new technologies in the aviation sector.

Strategic Outlook for Military Fixed-Wing Aircraft Market Market

The Military Fixed-Wing Aircraft market is poised for sustained growth in the coming years, driven by continuous technological advancements, increasing defense budgets, and geopolitical uncertainties. Strategic partnerships, investments in research and development, and a focus on emerging markets will be critical for success in this dynamic industry. The market’s future will be defined by the adoption of autonomous flight systems, AI-powered decision-making, and the development of hypersonic capabilities.

Military Fixed-Wing Aircraft Market Segmentation

-

1. Body Type

- 1.1. Multi-Role Aircraft

- 1.2. Training Aircraft

- 1.3. Transport Aircraft

- 1.4. Others

Military Fixed-Wing Aircraft Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Military Fixed-Wing Aircraft Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 20.33% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Military Fixed-Wing Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Multi-Role Aircraft

- 5.1.2. Training Aircraft

- 5.1.3. Transport Aircraft

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. North America Military Fixed-Wing Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Body Type

- 6.1.1. Multi-Role Aircraft

- 6.1.2. Training Aircraft

- 6.1.3. Transport Aircraft

- 6.1.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Body Type

- 7. South America Military Fixed-Wing Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Body Type

- 7.1.1. Multi-Role Aircraft

- 7.1.2. Training Aircraft

- 7.1.3. Transport Aircraft

- 7.1.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Body Type

- 8. Europe Military Fixed-Wing Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Body Type

- 8.1.1. Multi-Role Aircraft

- 8.1.2. Training Aircraft

- 8.1.3. Transport Aircraft

- 8.1.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Body Type

- 9. Middle East & Africa Military Fixed-Wing Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Body Type

- 9.1.1. Multi-Role Aircraft

- 9.1.2. Training Aircraft

- 9.1.3. Transport Aircraft

- 9.1.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Body Type

- 10. Asia Pacific Military Fixed-Wing Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Body Type

- 10.1.1. Multi-Role Aircraft

- 10.1.2. Training Aircraft

- 10.1.3. Transport Aircraft

- 10.1.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Body Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Turkish Aerospace Industries

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dassault Aviation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pakistan Aeronautical Complex (PAC)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lockheed Martin Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Airbus SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 United Aircraft Corporatio

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Korea Aerospace Industries

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pilatus Aircraft Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aviation Industry Corporation of China Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Boeing Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Turkish Aerospace Industries

List of Figures

- Figure 1: Global Military Fixed-Wing Aircraft Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Military Fixed-Wing Aircraft Market Revenue (Million), by Body Type 2024 & 2032

- Figure 3: North America Military Fixed-Wing Aircraft Market Revenue Share (%), by Body Type 2024 & 2032

- Figure 4: North America Military Fixed-Wing Aircraft Market Revenue (Million), by Country 2024 & 2032

- Figure 5: North America Military Fixed-Wing Aircraft Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: South America Military Fixed-Wing Aircraft Market Revenue (Million), by Body Type 2024 & 2032

- Figure 7: South America Military Fixed-Wing Aircraft Market Revenue Share (%), by Body Type 2024 & 2032

- Figure 8: South America Military Fixed-Wing Aircraft Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Military Fixed-Wing Aircraft Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Military Fixed-Wing Aircraft Market Revenue (Million), by Body Type 2024 & 2032

- Figure 11: Europe Military Fixed-Wing Aircraft Market Revenue Share (%), by Body Type 2024 & 2032

- Figure 12: Europe Military Fixed-Wing Aircraft Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Europe Military Fixed-Wing Aircraft Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Middle East & Africa Military Fixed-Wing Aircraft Market Revenue (Million), by Body Type 2024 & 2032

- Figure 15: Middle East & Africa Military Fixed-Wing Aircraft Market Revenue Share (%), by Body Type 2024 & 2032

- Figure 16: Middle East & Africa Military Fixed-Wing Aircraft Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Middle East & Africa Military Fixed-Wing Aircraft Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Military Fixed-Wing Aircraft Market Revenue (Million), by Body Type 2024 & 2032

- Figure 19: Asia Pacific Military Fixed-Wing Aircraft Market Revenue Share (%), by Body Type 2024 & 2032

- Figure 20: Asia Pacific Military Fixed-Wing Aircraft Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Military Fixed-Wing Aircraft Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Military Fixed-Wing Aircraft Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Military Fixed-Wing Aircraft Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 3: Global Military Fixed-Wing Aircraft Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Military Fixed-Wing Aircraft Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 5: Global Military Fixed-Wing Aircraft Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Military Fixed-Wing Aircraft Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 10: Global Military Fixed-Wing Aircraft Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Brazil Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Argentina Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of South America Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Military Fixed-Wing Aircraft Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 15: Global Military Fixed-Wing Aircraft Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Russia Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Benelux Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Nordics Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Military Fixed-Wing Aircraft Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 26: Global Military Fixed-Wing Aircraft Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Turkey Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Israel Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: GCC Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: North Africa Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: South Africa Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East & Africa Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Military Fixed-Wing Aircraft Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 34: Global Military Fixed-Wing Aircraft Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: China Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: India Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Japan Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: South Korea Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: ASEAN Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Oceania Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Asia Pacific Military Fixed-Wing Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Fixed-Wing Aircraft Market?

The projected CAGR is approximately 20.33%.

2. Which companies are prominent players in the Military Fixed-Wing Aircraft Market?

Key companies in the market include Turkish Aerospace Industries, Dassault Aviation, Pakistan Aeronautical Complex (PAC), Lockheed Martin Corporation, Airbus SE, United Aircraft Corporatio, Korea Aerospace Industries, Pilatus Aircraft Ltd, Aviation Industry Corporation of China Ltd, The Boeing Company.

3. What are the main segments of the Military Fixed-Wing Aircraft Market?

The market segments include Body Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2023: Airbus Flight Academy Europe, a subsidiary of Airbus that supplies training services for the pilots and civilian cadets of the French Armed Forces, signed a memorandum of understanding (MoU) with AURA AERO.February 2023: Boeing received a contract from the US Air Force for E-7 Airborne Early Warning & Control Aircraft.February 2023: Lockheed Martin delivered its first C-130J-30 Super Hercules to the Indonesian Air Force. The IDAF will receive a total of five Super Hercules tactical airlifters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Military Fixed-Wing Aircraft Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Military Fixed-Wing Aircraft Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Military Fixed-Wing Aircraft Market?

To stay informed about further developments, trends, and reports in the Military Fixed-Wing Aircraft Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence