Key Insights

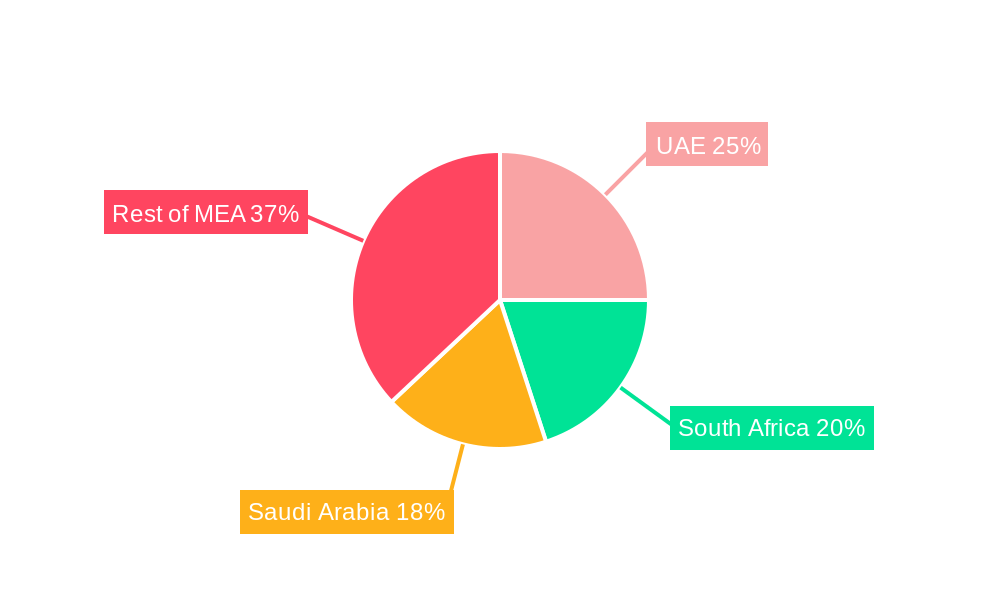

The Middle East and Africa (MEA) e-commerce apparel market is experiencing robust growth, driven by rising internet and smartphone penetration, a burgeoning young population with high disposable incomes, and a preference for convenient online shopping. The market's Compound Annual Growth Rate (CAGR) of 8.72% from 2019 to 2024 suggests a significant expansion, projected to continue through 2033. Key segments driving this growth include formal wear, casual wear, and sportswear, particularly amongst younger demographics. The increasing adoption of mobile commerce and the expansion of reliable logistics networks within the region are further fueling this expansion. While challenges exist, such as inconsistent internet infrastructure in certain areas and concerns around online payment security, these are being mitigated by investments in digital infrastructure and the growing adoption of secure payment gateways. The market is witnessing a shift towards personalized shopping experiences and the rise of influencer marketing, creating opportunities for both established international brands like Giorgio Armani and Adidas, and local players. The UAE, South Africa, and Saudi Arabia represent significant market shares within the MEA region, reflecting high levels of e-commerce adoption and consumer spending in these countries. Growth within the MEA region is also influenced by cultural factors, with specific apparel styles experiencing higher demand. The competitive landscape is dynamic, featuring a mix of international and regional players, each vying for a share of the growing market.

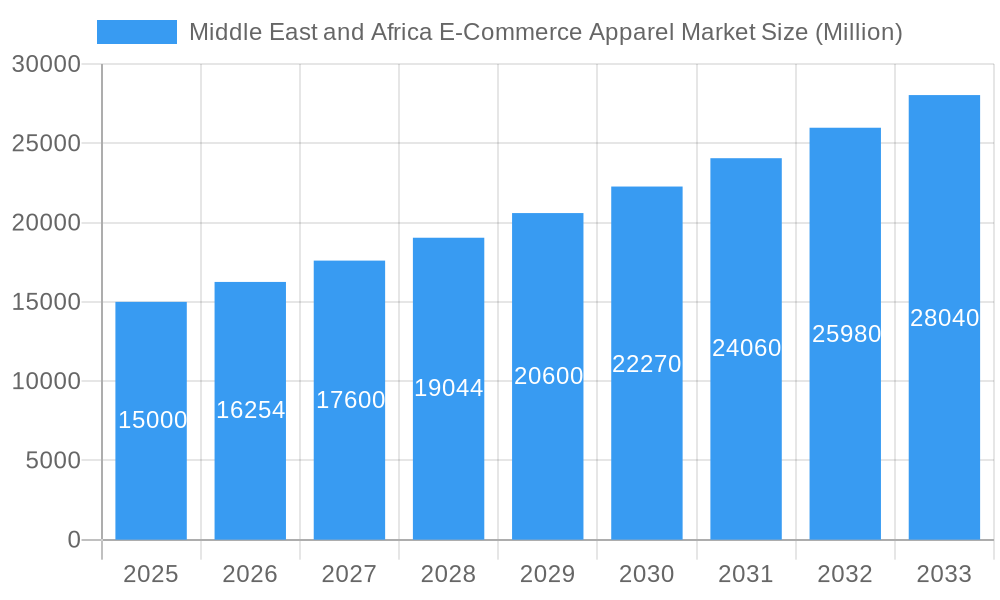

Middle East and Africa E-Commerce Apparel Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued growth, albeit potentially at a slightly moderated pace as the market matures. Factors like economic fluctuations and global geopolitical events could impact growth trajectory. However, the underlying drivers of increased digital adoption and a young, fashion-conscious population are expected to sustain a positive growth outlook. The continued investment in logistics, payment infrastructure, and marketing strategies will be crucial for companies to capitalize on the market's potential. Segmentation by product type (formal, casual, sportswear, etc.), end-user (men, women, children), and platform type (third-party retailers vs. company websites) provides valuable insights for strategic planning and investment decisions. Companies are increasingly leveraging data analytics and personalization to enhance customer experience and drive sales.

Middle East and Africa E-Commerce Apparel Market Company Market Share

Middle East & Africa E-Commerce Apparel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East and Africa e-commerce apparel market, offering invaluable insights for stakeholders across the industry. From market dynamics and concentration to leading players and future opportunities, this report covers all crucial aspects influencing this rapidly evolving sector. With data spanning the historical period (2019-2024), the base year (2025), and a forecast period extending to 2033, this report is your essential guide to navigating the complexities and unlocking the potential of this lucrative market. The market is projected to reach xx Million by 2033.

Middle East and Africa E-Commerce Apparel Market Market Dynamics & Concentration

The Middle East and Africa e-commerce apparel market is characterized by a dynamic interplay of factors influencing its concentration and growth trajectory. Market concentration is currently moderate, with a few major players holding significant market share, while numerous smaller players compete for market dominance. Key innovation drivers include advancements in mobile technology, improved logistics infrastructure, and the increasing adoption of omnichannel strategies by major apparel brands. The regulatory landscape varies across different countries in the region, impacting market entry and operations. Furthermore, the market faces competition from traditional brick-and-mortar retailers and alternative product types such as second-hand apparel.

- Market Share: The top 5 players hold approximately xx% of the market share in 2025. This is expected to slightly decrease to xx% by 2033 due to increased competition.

- M&A Activity: An estimated xx M&A deals occurred within the market from 2019-2024. A projected increase to xx deals is expected from 2025-2033.

- End-User Trends: A notable shift towards online shopping is evident, driven by increasing internet penetration and smartphone usage. Changing consumer preferences for personalized shopping experiences and faster delivery times also influence market dynamics.

Middle East and Africa E-Commerce Apparel Market Industry Trends & Analysis

The Middle East and Africa e-commerce apparel market exhibits robust growth, driven by several key factors. The region's burgeoning young population, coupled with rising disposable incomes, fuels the demand for apparel. Technological advancements such as improved mobile commerce infrastructure and seamless payment gateways enhance accessibility and convenience. Evolving consumer preferences, marked by a preference for personalized shopping experiences and the growing popularity of social commerce, create new opportunities. Competitive dynamics are intense, with both established international brands and local players vying for market share. The market is experiencing a significant shift towards omnichannel retailing, leveraging both online and offline channels to enhance customer engagement. The CAGR for the period 2025-2033 is projected to be xx%, with a market penetration rate anticipated to reach xx% by 2033.

Leading Markets & Segments in Middle East and Africa E-Commerce Apparel Market

Within the Middle East and Africa e-commerce apparel market, specific segments and regions demonstrate considerable dominance.

Dominant Region: The [country or region name – e.g., United Arab Emirates] currently holds the largest market share, driven by factors including high internet penetration, strong consumer spending, and advanced logistics infrastructure. Other key markets include [list other countries].

Dominant Product Type: Casual wear accounts for the largest share of the market, reflecting the preference for comfortable and versatile clothing options. Formal wear and sportswear segments also show significant growth potential.

Dominant End User: Women’s apparel currently holds the largest market share in the overall market, though growth is predicted to be fastest in the children's apparel sector.

Key Drivers for Leading Segments:

- United Arab Emirates: Strong economic growth, high internet and smartphone penetration, and supportive government policies related to e-commerce.

- Casual Wear: Growing popularity of casual wear in both formal and informal settings, increased affordability and accessibility of casual brands.

- Women's Apparel: High disposable incomes amongst women, larger purchasing power, and preference for trendy and fashionable apparel

Middle East and Africa E-Commerce Apparel Market Product Developments

The Middle East and Africa e-commerce apparel market witnesses continuous product innovation, incorporating sustainable and ethically sourced materials, personalized designs, and technological integrations for enhanced shopping experiences. The integration of augmented reality (AR) and virtual reality (VR) technologies is gaining traction, enabling virtual try-ons and personalized styling recommendations. Brands are also adopting innovative supply chain strategies to improve efficiency and sustainability, reducing their environmental impact. This increased focus on sustainability and ethical sourcing is proving to be a significant competitive advantage, attracting environmentally conscious consumers.

Key Drivers of Middle East and Africa E-Commerce Apparel Market Growth

Several key factors propel the growth of the Middle East and Africa e-commerce apparel market. Firstly, increasing internet and smartphone penetration across the region expands market reach and accessibility. Secondly, rising disposable incomes and a growing middle class increase consumer spending power and willingness to purchase apparel online. Government support for the digital economy through improved infrastructure and favorable regulatory frameworks further fosters market growth. The growing adoption of mobile payment systems also contributes significantly.

Challenges in the Middle East and Africa E-Commerce Apparel Market Market

Despite considerable growth potential, several challenges hinder the progress of the Middle East and Africa e-commerce apparel market. Logistical hurdles, including inefficient delivery networks and high shipping costs, pose significant obstacles. High import tariffs and customs duties also increase the cost of imported apparel, impacting profitability. The prevalence of counterfeit products and the lack of robust consumer protection mechanisms affect trust and confidence. Furthermore, concerns about cybersecurity and data privacy hinder the adoption of online shopping among consumers. These factors result in an estimated xx Million loss annually.

Emerging Opportunities in Middle East and Africa E-Commerce Apparel Market

The Middle East and Africa e-commerce apparel market presents several compelling opportunities for long-term growth. The expansion of e-commerce infrastructure, including improved logistics and payment gateways, will facilitate greater market access. The growing adoption of mobile commerce and social media marketing creates new avenues for reaching and engaging with customers. Strategic partnerships between international and local brands can drive innovation and enhance market reach. Investing in sustainable and ethical sourcing practices caters to the growing demand for environmentally responsible products.

Leading Players in the Middle East and Africa E-Commerce Apparel Market Sector

- Giorgio Armani S p A

- Landmark Group

- Adidas AG

- Burberry Group PLC

- Valentino Fashion Group S p A

- Industria de Diseño Textil S A (INDITEX)

- Prada S p A

- Dolce & Gabbana S r l

- LVMH Moët Hennessy Louis Vuitton

- H & M Hennes & Mauritz AB

- PVH Corp

- *List Not Exhaustive

Key Milestones in Middle East and Africa E-Commerce Apparel Market Industry

- March 2023: H&M launched its Limited Edition 2023 Ramadan collection in three capsules, boosting sales and brand visibility.

- February 2023: H&M South Africa partnered with Superbalist to expand its online reach, increasing market penetration.

- March 2022: H&M launched its 'H&M Ramadan & Eid Statements 2022 collection', expanding its online and offline presence.

Strategic Outlook for Middle East and Africa E-Commerce Apparel Market Market

The Middle East and Africa e-commerce apparel market exhibits substantial growth potential, driven by favorable demographic trends, technological advancements, and supportive government policies. Brands that embrace omnichannel strategies, prioritize customer experience, and invest in sustainable and ethical practices will thrive. Strategic partnerships and collaborations will play a critical role in driving innovation and expanding market reach. Focusing on localized marketing efforts and understanding the diverse cultural preferences across the region will be crucial for success in this dynamic and evolving market.

Middle East and Africa E-Commerce Apparel Market Segmentation

-

1. Product Type

- 1.1. Formal Wear

- 1.2. Casual Wear

- 1.3. Sportswear

- 1.4. Nightwear

- 1.5. Other Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids/Children

-

3. Platform Type

- 3.1. Third Party Retailer

- 3.2. Company's Own Website

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. South Africa

- 4.3. Rest of Middle East & Africa

Middle East and Africa E-Commerce Apparel Market Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. Rest of Middle East

Middle East and Africa E-Commerce Apparel Market Regional Market Share

Geographic Coverage of Middle East and Africa E-Commerce Apparel Market

Middle East and Africa E-Commerce Apparel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Internet Penetration and Increased Social Media Usage Boosting the Market; Seasonal Demand Surge & Discounts in Online Stores Driving the Market

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products Restricting the Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Internet Penetration & Increased Social Media Usage Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Formal Wear

- 5.1.2. Casual Wear

- 5.1.3. Sportswear

- 5.1.4. Nightwear

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids/Children

- 5.3. Market Analysis, Insights and Forecast - by Platform Type

- 5.3.1. Third Party Retailer

- 5.3.2. Company's Own Website

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. South Africa

- 5.4.3. Rest of Middle East & Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. South Africa

- 5.5.3. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia Middle East and Africa E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Formal Wear

- 6.1.2. Casual Wear

- 6.1.3. Sportswear

- 6.1.4. Nightwear

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Kids/Children

- 6.3. Market Analysis, Insights and Forecast - by Platform Type

- 6.3.1. Third Party Retailer

- 6.3.2. Company's Own Website

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. South Africa

- 6.4.3. Rest of Middle East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South Africa Middle East and Africa E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Formal Wear

- 7.1.2. Casual Wear

- 7.1.3. Sportswear

- 7.1.4. Nightwear

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Kids/Children

- 7.3. Market Analysis, Insights and Forecast - by Platform Type

- 7.3.1. Third Party Retailer

- 7.3.2. Company's Own Website

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. South Africa

- 7.4.3. Rest of Middle East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of Middle East Middle East and Africa E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Formal Wear

- 8.1.2. Casual Wear

- 8.1.3. Sportswear

- 8.1.4. Nightwear

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Kids/Children

- 8.3. Market Analysis, Insights and Forecast - by Platform Type

- 8.3.1. Third Party Retailer

- 8.3.2. Company's Own Website

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. South Africa

- 8.4.3. Rest of Middle East & Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Giorgio Armani S p A

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Landmark Group

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Adidas AG

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Burberry Group PLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Valentino Fashion Group S p A

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Industria de Diseño Textil S A (INDITEX)

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Prada S p A

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Dolce & Gabbana S r l

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 LVMH Moët Hennessy Louis Vuitton

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 H & M Hennes & Mauritz AB

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 PVH Corp *List Not Exhaustive

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: Middle East and Africa E-Commerce Apparel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa E-Commerce Apparel Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 4: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 9: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 13: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 14: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 19: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa E-Commerce Apparel Market?

The projected CAGR is approximately 8.72%.

2. Which companies are prominent players in the Middle East and Africa E-Commerce Apparel Market?

Key companies in the market include Giorgio Armani S p A, Landmark Group, Adidas AG, Burberry Group PLC, Valentino Fashion Group S p A, Industria de Diseño Textil S A (INDITEX), Prada S p A, Dolce & Gabbana S r l, LVMH Moët Hennessy Louis Vuitton, H & M Hennes & Mauritz AB, PVH Corp *List Not Exhaustive.

3. What are the main segments of the Middle East and Africa E-Commerce Apparel Market?

The market segments include Product Type, End User, Platform Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Internet Penetration and Increased Social Media Usage Boosting the Market; Seasonal Demand Surge & Discounts in Online Stores Driving the Market.

6. What are the notable trends driving market growth?

Rising Internet Penetration & Increased Social Media Usage Boosting the Market.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products Restricting the Market Growth.

8. Can you provide examples of recent developments in the market?

March 2023: H&M announced the launch of its Limited Edition 2023 collection for Ramadan. The products were launched in three unique capsules. The H&M Limited Edition 2023 collection prices ranged from DHS 139 in different sizes XS-XL. The first 'Ramadan Ready capsule went on sale online and in a few select stores on March 2, 2023. The second one went on sale on March 16 of that same year, and the last one went on sale on April 6 of that same year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa E-Commerce Apparel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa E-Commerce Apparel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa E-Commerce Apparel Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa E-Commerce Apparel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence