Key Insights

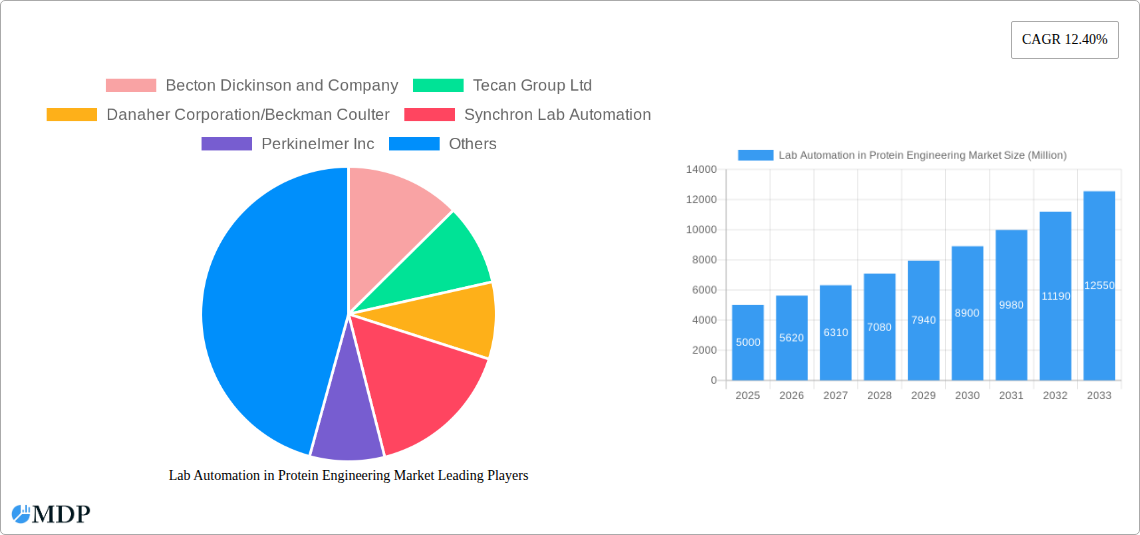

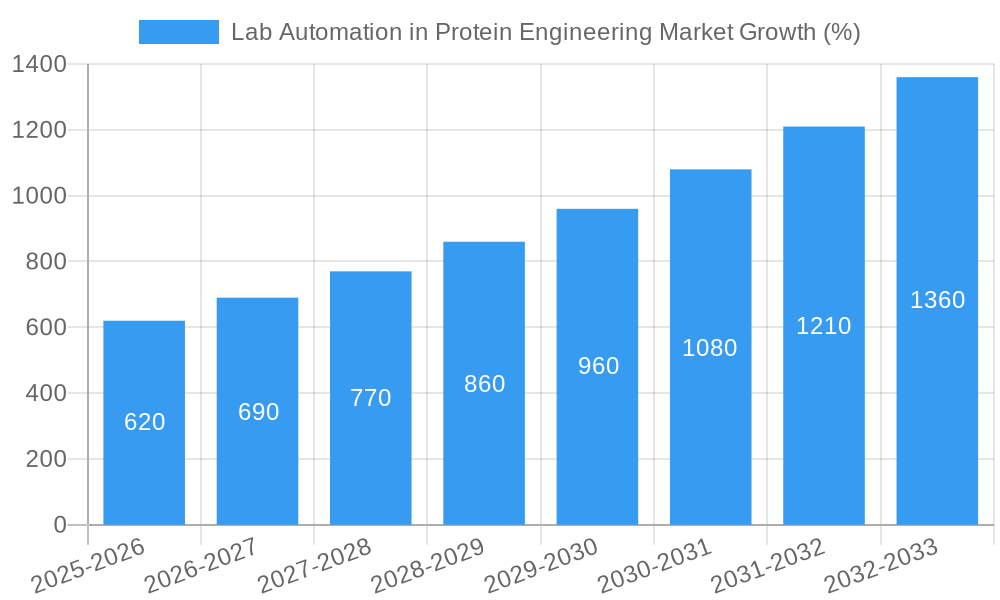

The Lab Automation in Protein Engineering market is experiencing robust growth, driven by the increasing demand for high-throughput screening, automation of complex workflows, and the rising need for faster and more efficient drug discovery and development. The market's Compound Annual Growth Rate (CAGR) of 12.40% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by several key factors. Firstly, advancements in automation technologies, such as automated liquid handlers, robotic arms, and sophisticated software, are enabling researchers to handle larger sample volumes and perform more complex experiments with greater precision and speed. Secondly, the pharmaceutical and biotechnology industries are increasingly adopting automation to reduce costs, improve reproducibility, and accelerate time-to-market for new therapeutics. The rising prevalence of chronic diseases and the growing focus on personalized medicine are further contributing to market expansion. The market is segmented by equipment type, with automated liquid handlers and robotic arms currently holding the largest shares due to their versatility and widespread applicability. Major players like Becton Dickinson, Tecan, and Danaher are driving innovation and market penetration through continuous product development and strategic acquisitions. Geographical expansion, particularly in the Asia-Pacific region driven by increasing research and development expenditure, is another significant growth driver. However, high initial investment costs associated with implementing automation technologies and a lack of skilled labor to operate and maintain these systems could present challenges to market growth in the coming years.

Despite potential restraints, the long-term outlook for the Lab Automation in Protein Engineering market remains positive. Continued advancements in artificial intelligence and machine learning will further enhance the capabilities of automation systems, leading to increased efficiency and accuracy. The integration of automation with other emerging technologies, such as CRISPR gene editing, will further broaden the applications of lab automation in protein engineering. The market is expected to see significant growth in the forecast period (2025-2033), driven by continuous innovation, increasing adoption rates across different regions, and the ever-growing demand for improved efficiency and speed in protein engineering research. The strategic partnerships and collaborations between automation technology providers and pharmaceutical/biotech companies will also accelerate market expansion in the coming years. Focusing on user-friendly interfaces and providing comprehensive training programs will mitigate the challenge of skilled labor shortages and contribute to widespread adoption.

Lab Automation in Protein Engineering Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Lab Automation in Protein Engineering Market, offering valuable insights for stakeholders across the industry. From market dynamics and leading players to future growth opportunities and challenges, this report is your essential guide to navigating this rapidly evolving sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence for informed decision-making. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Lab Automation in Protein Engineering Market Market Dynamics & Concentration

The Lab Automation in Protein Engineering market is characterized by a moderately concentrated landscape, with several key players holding significant market share. While precise figures are proprietary to the full report, Becton Dickinson and Company, Tecan Group Ltd, Danaher Corporation/Beckman Coulter, and Thermo Fisher Scientific Inc. are among the prominent companies driving innovation and market growth. The market's concentration is influenced by factors such as high initial investment costs for advanced automation systems, the need for specialized expertise, and the ongoing development of sophisticated technologies.

Market concentration is further shaped by mergers and acquisitions (M&A) activities. The number of M&A deals in this sector has shown a xx% increase in the past five years, indicating a trend toward consolidation. This strategic consolidation is driven by the desire to expand market reach, gain access to new technologies, and enhance product portfolios. Several factors stimulate innovation: increasing demand for high-throughput screening and automation in protein engineering research, stringent regulatory requirements driving the adoption of automated systems, and the development of more sophisticated and user-friendly automation technologies. Product substitutes, such as manual methods, are less prevalent due to the substantial benefits of automation in terms of speed, accuracy, and efficiency. End-user trends show an increasing preference for integrated and modular automation systems that can be adapted to evolving research needs.

Lab Automation in Protein Engineering Market Industry Trends & Analysis

The Lab Automation in Protein Engineering market is experiencing robust growth, driven by several key trends. The rising demand for higher throughput in protein engineering research and development, combined with the increasing complexity of experiments, fuels the adoption of automated solutions. Technological advancements such as artificial intelligence (AI) and machine learning (ML) are being integrated into automation systems, leading to improved efficiency and data analysis capabilities. The market's growth is further propelled by consumer preferences for faster turnaround times, reduced human error, and enhanced data reproducibility. The increasing adoption of cloud-based data management systems is streamlining workflows and improving collaboration among researchers. Competitive dynamics are intensifying, with companies investing heavily in R&D to develop advanced automation solutions and expand their market presence. The CAGR for the market is estimated to be xx% for the forecast period (2025-2033), indicating substantial growth potential. Market penetration is steadily increasing, particularly in advanced economies, with a projected xx% penetration rate by 2033.

Leading Markets & Segments in Lab Automation in Protein Engineering Market

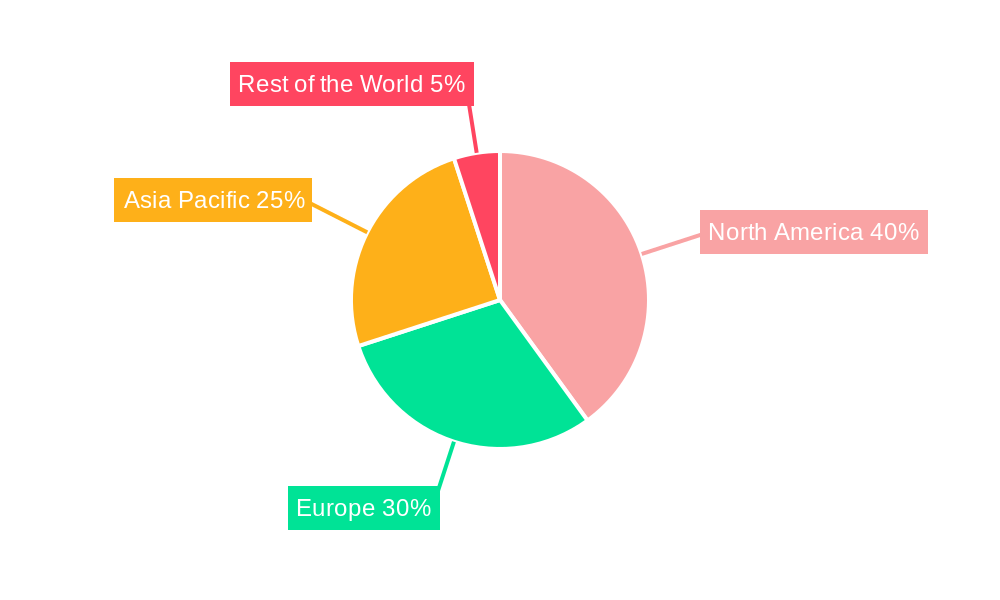

The North American market currently holds a dominant position in the Lab Automation in Protein Engineering market, driven by a strong research and development infrastructure, high adoption rates of advanced technologies, and significant investments from pharmaceutical and biotechnology companies. Europe follows as a significant market, exhibiting consistent growth spurred by supportive government initiatives and a robust life sciences sector.

- Key Drivers in North America:

- Strong government funding for scientific research.

- High concentration of pharmaceutical and biotechnology companies.

- Well-established infrastructure for technology adoption.

- Key Drivers in Europe:

- Increasing investments in life science research and development.

- Favorable regulatory frameworks promoting innovation.

- Growing collaboration between academic institutions and industry.

Among equipment segments, Automated Liquid Handlers currently holds the largest market share, followed by Automated Plate Handlers. The demand for these segments stems from the high-throughput nature of protein engineering processes. Robotic Arms and Automated Storage and Retrieval Systems (AS/RS) are experiencing increasing adoption due to their capabilities in handling complex workflows and large sample volumes. The "Other Equipment" segment represents a diverse range of specialized instruments and accessories that support the automation process. The continued growth in these segments is expected to be driven by the need for increased efficiency and reduced manual labor.

Lab Automation in Protein Engineering Market Product Developments

Recent years have witnessed significant advancements in lab automation for protein engineering. Innovations focus on miniaturization, increased throughput, and integration of advanced analytical tools. The market is seeing more compact, modular systems that offer greater flexibility and scalability. New software solutions provide advanced data analysis and integration capabilities. These improvements offer advantages such as reduced operating costs, enhanced data accuracy, and improved workflow efficiency, making them attractive to both large and small laboratories. The current trend leans towards fully integrated systems that automate entire workflows from sample preparation to data analysis.

Key Drivers of Lab Automation in Protein Engineering Market Growth

The growth of the lab automation market in protein engineering is driven by several key factors. Technological advancements, including the development of more sophisticated robots and software, are improving the efficiency and accuracy of laboratory processes. Economic pressures to reduce labor costs and increase throughput are encouraging the adoption of automation technologies. Stringent regulatory requirements for data accuracy and traceability are also driving the adoption of automated systems that provide greater control and better data management. For example, the increasing demand for personalized medicine requires the high-throughput screening and analysis that only automation can provide.

Challenges in the Lab Automation in Protein Engineering Market Market

The market faces challenges including the high initial investment costs associated with automation systems, a need for specialized training, and the complexity of integrating new automation technologies into existing laboratory workflows. Supply chain disruptions can also impact the availability of components and systems. Finally, intense competition among established players and new entrants creates pressure on pricing and margins. These challenges impact the overall market penetration and limit the adoption of automation in smaller laboratories. The estimated impact of these challenges leads to a reduction in market growth by approximately xx Million by 2033.

Emerging Opportunities in Lab Automation in Protein Engineering Market

Significant opportunities exist in the integration of artificial intelligence and machine learning into automation systems, enhancing data analysis and process optimization. Strategic partnerships between automation providers and protein engineering companies will accelerate the development and adoption of tailored solutions. Expanding into emerging markets, particularly in Asia-Pacific, presents considerable growth potential. The continued development of more user-friendly and cost-effective automation systems will also expand the market reach and accelerate adoption.

Leading Players in the Lab Automation in Protein Engineering Market Sector

- Becton Dickinson and Company

- Tecan Group Ltd

- Danaher Corporation/Beckman Coulter

- Synchron Lab Automation

- Perkinelmer Inc

- F Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc

- Eli Lilly and Company

- Siemens Healthineers AG

- Agilent Technologies Inc

- Hudson Robotics Inc

Key Milestones in Lab Automation in Protein Engineering Market Industry

- October 2022: Thermo Fisher Scientific releases the EXTREVA ASE Accelerated Solvent Extractor, a fully automated sample preparation system. This launch significantly improves sample preparation workflow efficiency.

- March 2022: Beckman Coulter Life Sciences introduces the CellMek SPS, a fully automated sample preparation system for clinical flow cytometry, addressing bottlenecks in sample preparation and data management. This system streamlines workflows and boosts lab productivity.

Strategic Outlook for Lab Automation in Protein Engineering Market Market

The Lab Automation in Protein Engineering market is poised for continued strong growth, driven by technological innovation, increasing demand for high-throughput screening, and the need for enhanced data accuracy and reproducibility. Strategic partnerships and collaborations will be key to accelerating innovation and market penetration. Companies that focus on developing user-friendly, integrated systems and providing comprehensive support services will be best positioned for success. The market's long-term outlook remains positive, with significant opportunities for expansion in both developed and emerging markets.

Lab Automation in Protein Engineering Market Segmentation

-

1. Equipment

- 1.1. Automated Liquid Handlers

- 1.2. Automated Plate Handlers

- 1.3. Robotic Arms

- 1.4. Automated Storage and Retrieval Systems (AS/RS)

- 1.5. Other Equipment

Lab Automation in Protein Engineering Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Lab Automation in Protein Engineering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend of Digital Transformation for Laboratories with IoT; Effective Management of the Huge Amount of Data Generated

- 3.3. Market Restrains

- 3.3.1. Expensive Initial Setup

- 3.4. Market Trends

- 3.4.1. Automated Liquid Handler Equipment Accounted for the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Automated Liquid Handlers

- 5.1.2. Automated Plate Handlers

- 5.1.3. Robotic Arms

- 5.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 5.1.5. Other Equipment

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. North America Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 6.1.1. Automated Liquid Handlers

- 6.1.2. Automated Plate Handlers

- 6.1.3. Robotic Arms

- 6.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 6.1.5. Other Equipment

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 7. Europe Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 7.1.1. Automated Liquid Handlers

- 7.1.2. Automated Plate Handlers

- 7.1.3. Robotic Arms

- 7.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 7.1.5. Other Equipment

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 8. Asia Pacific Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 8.1.1. Automated Liquid Handlers

- 8.1.2. Automated Plate Handlers

- 8.1.3. Robotic Arms

- 8.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 8.1.5. Other Equipment

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 9. Rest of the World Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 9.1.1. Automated Liquid Handlers

- 9.1.2. Automated Plate Handlers

- 9.1.3. Robotic Arms

- 9.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 9.1.5. Other Equipment

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 10. North America Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Becton Dickinson and Company

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Tecan Group Ltd

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Danaher Corporation/Beckman Coulter

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Synchron Lab Automation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Perkinelmer Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 F Hoffmann-La Roche Ltd*List Not Exhaustive

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Thermo Fisher Scientific Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Eli Lilly and Company

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Siemens Healthineers AG

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Agilent Technologies Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Hudson Robotics Inc

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Lab Automation in Protein Engineering Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Lab Automation in Protein Engineering Market Revenue (Million), by Equipment 2024 & 2032

- Figure 11: North America Lab Automation in Protein Engineering Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 12: North America Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Lab Automation in Protein Engineering Market Revenue (Million), by Equipment 2024 & 2032

- Figure 15: Europe Lab Automation in Protein Engineering Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 16: Europe Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Lab Automation in Protein Engineering Market Revenue (Million), by Equipment 2024 & 2032

- Figure 19: Asia Pacific Lab Automation in Protein Engineering Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 20: Asia Pacific Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Lab Automation in Protein Engineering Market Revenue (Million), by Equipment 2024 & 2032

- Figure 23: Rest of the World Lab Automation in Protein Engineering Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 24: Rest of the World Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 3: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Lab Automation in Protein Engineering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Lab Automation in Protein Engineering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Lab Automation in Protein Engineering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Lab Automation in Protein Engineering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 13: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 15: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 17: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 19: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lab Automation in Protein Engineering Market?

The projected CAGR is approximately 12.40%.

2. Which companies are prominent players in the Lab Automation in Protein Engineering Market?

Key companies in the market include Becton Dickinson and Company, Tecan Group Ltd, Danaher Corporation/Beckman Coulter, Synchron Lab Automation, Perkinelmer Inc, F Hoffmann-La Roche Ltd*List Not Exhaustive, Thermo Fisher Scientific Inc, Eli Lilly and Company, Siemens Healthineers AG, Agilent Technologies Inc, Hudson Robotics Inc.

3. What are the main segments of the Lab Automation in Protein Engineering Market?

The market segments include Equipment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend of Digital Transformation for Laboratories with IoT; Effective Management of the Huge Amount of Data Generated.

6. What are the notable trends driving market growth?

Automated Liquid Handler Equipment Accounted for the Largest Market Share.

7. Are there any restraints impacting market growth?

Expensive Initial Setup.

8. Can you provide examples of recent developments in the market?

October 2022 - Thermo Fisher Scientific releases the first fully automated, all-in-one sample preparation system. The new EXTREVA ASE Accelerated Solvent Extractor from Thermo Scientific is the first system to automatically extract and concentrate analytes of interest from solid and semi-solid samples, such as persistent organic pollutants (POPs), polycyclic aromatic hydrocarbons (PAHs), or pesticides, in a single instrument, obviating the need for manual sample transfer for a walk-away sample-to-vial workflow.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lab Automation in Protein Engineering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lab Automation in Protein Engineering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lab Automation in Protein Engineering Market?

To stay informed about further developments, trends, and reports in the Lab Automation in Protein Engineering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence