Key Insights

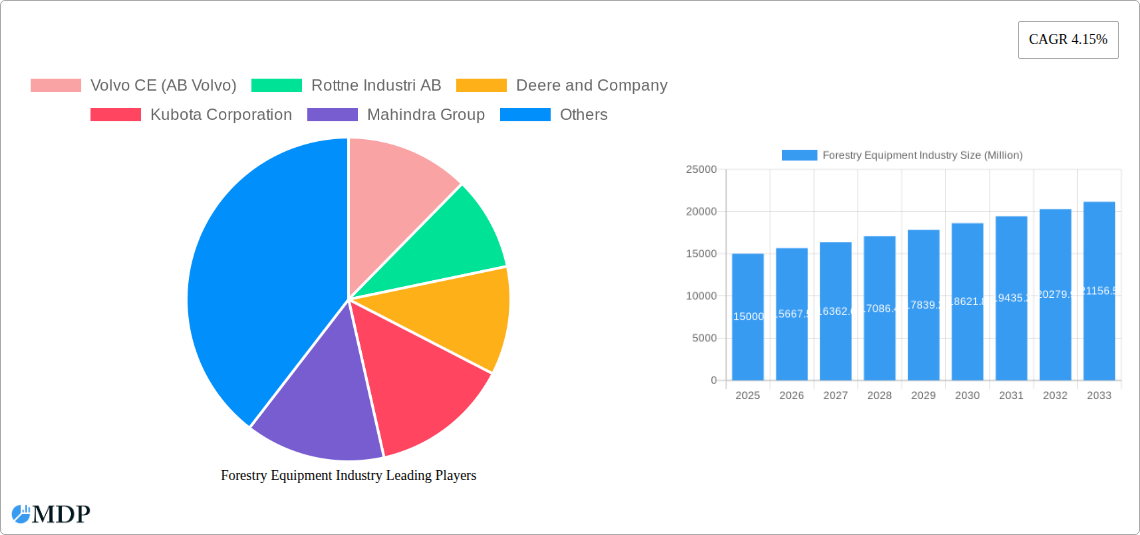

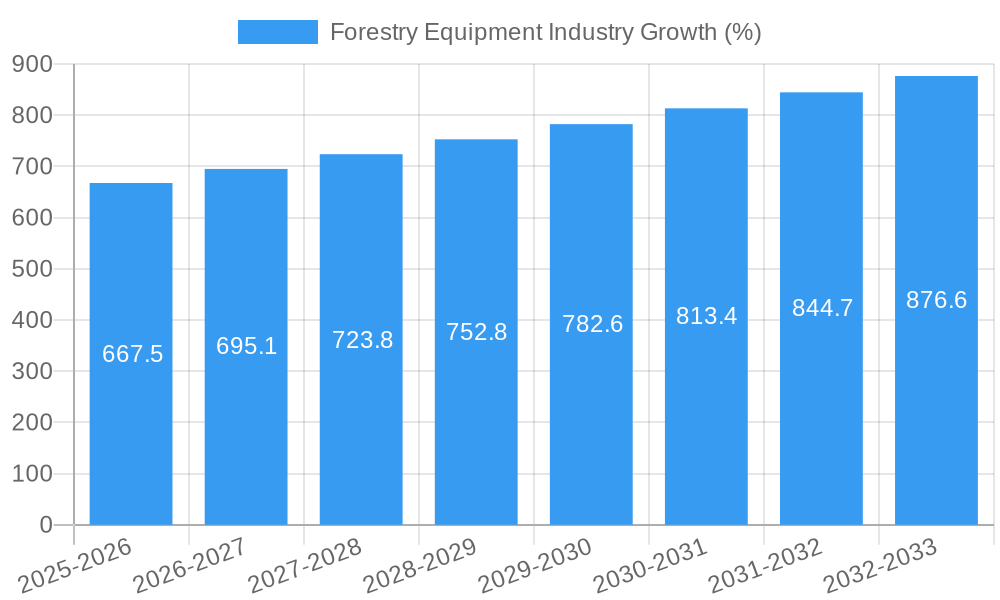

The global forestry equipment market, currently valued at approximately $XX million (estimated based on available data and industry growth trends), is projected to experience robust growth, with a compound annual growth rate (CAGR) of 4.15% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing demand for timber and wood products to meet the global construction and housing needs, coupled with a rising global population, is a primary factor. Furthermore, the growing adoption of sustainable forestry practices, emphasizing efficient and responsible logging techniques, is driving demand for advanced forestry equipment. Technological advancements, such as the incorporation of automation, precision sensors, and improved ergonomics in feller bunchers and other extracting equipment, are enhancing productivity and operational efficiency, further bolstering market growth. Government initiatives promoting sustainable forest management and reforestation efforts in various regions also contribute positively to the market outlook. However, factors such as fluctuating timber prices, stringent environmental regulations, and the high initial investment costs associated with advanced forestry equipment present potential restraints. The market is segmented by product type (felling equipment, extracting equipment, on-site processing equipment, separately sold parts and attachments) and by application, with feller bunchers representing a significant segment due to their versatility and efficiency in large-scale logging operations.

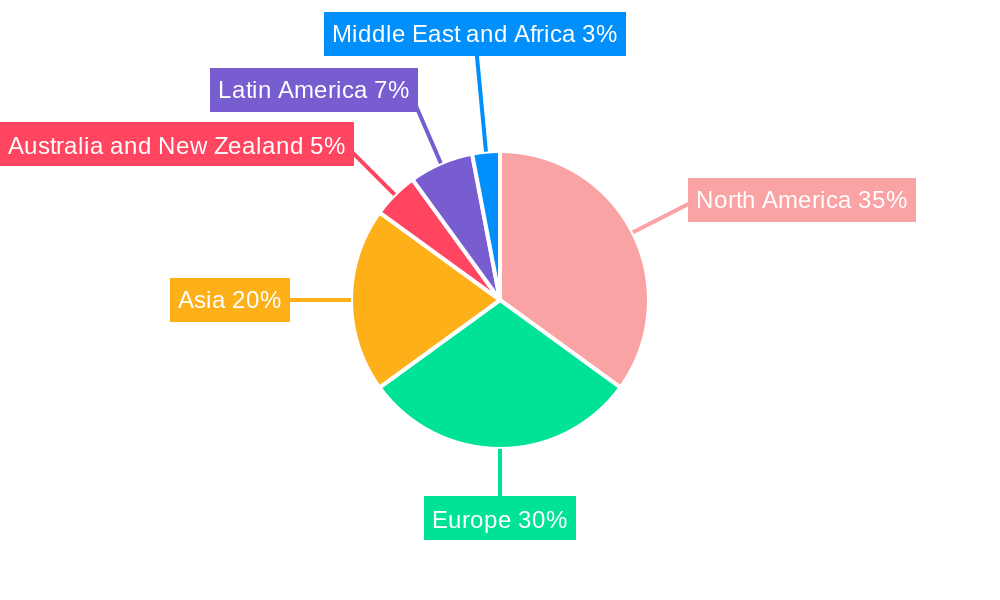

The competitive landscape is characterized by the presence of major global players such as Volvo CE, Deere & Company, Kubota, and Ponsse, alongside several regional manufacturers. These companies are engaged in intense competition, focusing on product innovation, strategic partnerships, and geographic expansion to gain market share. The North American and European markets currently hold a significant share of the global market, driven by established forestry industries and higher adoption rates of advanced technologies. However, emerging economies in Asia and Latin America are witnessing increasing demand, presenting promising growth opportunities for manufacturers. Future growth will likely be driven by ongoing technological innovation, particularly in areas such as autonomous systems and improved fuel efficiency, along with a continued emphasis on sustainable forestry practices. The market is expected to witness further consolidation, with larger players acquiring smaller companies to expand their product portfolios and geographic reach.

Forestry Equipment Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global forestry equipment industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils key market trends, growth drivers, challenges, and opportunities within this dynamic sector. The report analyzes a market valued at $XX Million in 2025, projecting a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033.

Forestry Equipment Industry Market Dynamics & Concentration

The global forestry equipment market is characterized by a moderate level of concentration, with several major players holding significant market share. Volvo CE (AB Volvo), Deere & Company, and Caterpillar Inc. are among the leading companies, collectively accounting for an estimated XX% of the global market in 2025. However, regional players and specialized manufacturers also play a crucial role, particularly in niche segments like specialized felling equipment.

Market dynamics are significantly influenced by several factors:

- Innovation Drivers: Continuous technological advancements, such as the integration of automation, telematics, and advanced engine technologies, are driving productivity gains and shaping market competitiveness. The development of sustainable and efficient equipment is also a major driver.

- Regulatory Frameworks: Stringent environmental regulations regarding emissions and sustainable forestry practices are shaping the demand for eco-friendly and compliant equipment. This is influencing manufacturers to invest in cleaner technologies and more efficient machinery.

- Product Substitutes: While limited, alternative approaches to harvesting, such as manual labor in certain contexts, offer limited substitutes. However, the efficiency and scale of modern forestry equipment maintain its dominant market position.

- End-User Trends: Increasing demand for sustainable timber products and the growing focus on responsible forestry practices are driving demand for efficient and environmentally conscious equipment. The trend towards precision forestry and reduced environmental impact is a crucial factor shaping the market.

- M&A Activities: The industry has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years. The number of deals has averaged approximately XX per year over the past five years, reflecting strategic efforts by companies to expand their product portfolios and geographic reach. This consolidation is further concentrating the market in the hands of larger players.

Forestry Equipment Industry Industry Trends & Analysis

The forestry equipment market is experiencing robust growth, driven by several key factors. The global market size is estimated at $XX Million in 2025 and is projected to reach $XX Million by 2033. This growth is fueled by:

- Rising demand for timber and wood products: A growing global population and increasing urbanization drive demand for housing, construction materials, and paper products. This directly translates into increased demand for forestry equipment.

- Technological advancements: Innovations in automation, GPS-guided systems, and remote-controlled machines are improving efficiency, precision, and safety in forestry operations. This drives adoption and increases the market size.

- Shifting consumer preferences towards sustainable forestry: Growing awareness of environmental concerns is pushing the adoption of sustainable forestry practices, leading to investments in equipment that minimizes environmental impact.

- Competitive dynamics: Intense competition among manufacturers is driving innovation and pushing down prices, making forestry equipment more accessible to smaller operators. This competitive landscape encourages continuous improvements in both technology and pricing.

Leading Markets & Segments in Forestry Equipment Industry

The North American and European markets currently dominate the global forestry equipment industry, accounting for a combined XX% of the global market share in 2025. Strong timber industries and robust infrastructure development in these regions are key drivers. Within segments:

- Feller Bunchers: Extracting Equipment: This segment holds the largest market share, driven by the high demand for efficient tree harvesting.

- Other Extracting Equipment: This includes skidders and forwarders, contributing significantly to the overall market.

- Other On-Site Processing Equipment: This segment encompasses equipment used for debarking, chipping, and other on-site processing tasks, experiencing moderate growth.

- Other Forestry Equipment: This category includes a wide range of tools and machinery, contributing consistently to the overall industry.

- Separately Sold Parts and Attachments: A steady and crucial segment, vital for maintenance and upgrades.

- By Product Type: Felling Equipment: This core segment remains a major driver of the overall market.

Key Drivers for Leading Markets:

- Favorable economic policies: Government support for sustainable forestry practices and infrastructure development.

- Robust timber industry: A strong and expanding domestic timber market.

- Well-developed infrastructure: Efficient transportation networks facilitating equipment deployment and timber transport.

Forestry Equipment Industry Product Developments

Recent years have witnessed significant product innovations in the forestry equipment sector, focusing on enhanced efficiency, safety, and environmental sustainability. The integration of advanced technologies like telematics, automation, and improved engine efficiency is a leading trend. New models boast improved fuel economy, reduced emissions, and enhanced operator comfort, leading to increased productivity and reduced operational costs. These innovations directly address growing market demands for efficient and sustainable forestry practices.

Key Drivers of Forestry Equipment Industry Growth

The forestry equipment industry's growth is fueled by several factors:

- Technological advancements: Automation, telematics, and advanced engine technologies are enhancing efficiency and productivity.

- Economic growth: Increased demand for timber and wood products in developing economies fuels equipment demand.

- Stringent environmental regulations: The need to comply with emission standards is driving the adoption of cleaner technologies.

Challenges in the Forestry Equipment Industry Market

The industry faces several challenges:

- Fluctuating timber prices: Price volatility can impact investment decisions and overall market demand.

- Supply chain disruptions: Global supply chain complexities can affect the availability of components and impact production.

- Intense competition: A competitive landscape requires continuous innovation and cost optimization.

Emerging Opportunities in Forestry Equipment Industry

Emerging opportunities include:

- Precision forestry technologies: Advanced sensors and data analytics are optimizing harvesting and reducing environmental impact.

- Strategic partnerships: Collaborations between equipment manufacturers and forestry companies drive innovation and market penetration.

- Expansion into new markets: Growing demand in developing countries presents significant growth potential.

Leading Players in the Forestry Equipment Industry Sector

- Volvo CE (AB Volvo)

- Rottne Industri AB

- Deere and Company

- Kubota Corporation

- Mahindra Group

- Ponsse Oyj

- Barko Hydraulics LLC

- AGCO Corporation

- Develon (HD Hyundai Infracore)

- Caterpillar Inc

- Komatsu Ltd

- Bell Equipment Limited

- Kesla Oyj

- Hitachi Construction Machinery Co Ltd (HCM)

- Eco Log Sweden AB

Key Milestones in Forestry Equipment Industry Industry

- June 2023: Volvo Construction Equipment (Volvo CE) launched its new Compact Business Unit, focusing on growth in compact equipment.

- May 2023: Caterpillar launched the MH3050 material handler, enhancing its material handling capabilities.

Strategic Outlook for Forestry Equipment Industry Market

The future of the forestry equipment industry is bright, driven by technological innovation, sustainable practices, and growing global demand for timber products. Strategic partnerships, investments in research and development, and expansion into emerging markets are key to unlocking further growth potential. The continued focus on sustainable and efficient equipment will be critical for long-term success within this dynamic industry.

Forestry Equipment Industry Segmentation

-

1. Product Type

-

1.1. Felling Equipment

- 1.1.1. Chainsaws

- 1.1.2. Harvesters

- 1.1.3. Feller Bunchers

-

1.2. Extracting Equipment

- 1.2.1. Forwarders

- 1.2.2. Skidders

- 1.2.3. Other Extracting Equipment

-

1.3. On-Site Processing Equipment

- 1.3.1. Chippers and Grinders

- 1.3.2. Delimbers and Slashers

- 1.3.3. Other On-Site Processing Equipment

-

1.4. Other Forestry Equipment

- 1.4.1. Loaders

- 1.4.2. Mulchers

-

1.5. Separately Sold Parts and Attachments

- 1.5.1. Saw Chain, Guide Bars, Discs, and Teeth

- 1.5.2. Harvesting and Other Cutting Heads

- 1.5.3. Other Parts and Attachments

-

1.1. Felling Equipment

Forestry Equipment Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Forestry Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.15% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Automation to Boost the Forestry Equipment Demand; Replacement of Older

- 3.2.2 Less Productive Forestry Machinery by Logging Firms

- 3.3. Market Restrains

- 3.3.1. High Cost of Forestry Equipment; Lack of Information About Forestry Equipment

- 3.4. Market Trends

- 3.4.1. Chippers and Grinders to be the Largest On-site Processing Equipment Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Forestry Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Felling Equipment

- 5.1.1.1. Chainsaws

- 5.1.1.2. Harvesters

- 5.1.1.3. Feller Bunchers

- 5.1.2. Extracting Equipment

- 5.1.2.1. Forwarders

- 5.1.2.2. Skidders

- 5.1.2.3. Other Extracting Equipment

- 5.1.3. On-Site Processing Equipment

- 5.1.3.1. Chippers and Grinders

- 5.1.3.2. Delimbers and Slashers

- 5.1.3.3. Other On-Site Processing Equipment

- 5.1.4. Other Forestry Equipment

- 5.1.4.1. Loaders

- 5.1.4.2. Mulchers

- 5.1.5. Separately Sold Parts and Attachments

- 5.1.5.1. Saw Chain, Guide Bars, Discs, and Teeth

- 5.1.5.2. Harvesting and Other Cutting Heads

- 5.1.5.3. Other Parts and Attachments

- 5.1.1. Felling Equipment

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Forestry Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Felling Equipment

- 6.1.1.1. Chainsaws

- 6.1.1.2. Harvesters

- 6.1.1.3. Feller Bunchers

- 6.1.2. Extracting Equipment

- 6.1.2.1. Forwarders

- 6.1.2.2. Skidders

- 6.1.2.3. Other Extracting Equipment

- 6.1.3. On-Site Processing Equipment

- 6.1.3.1. Chippers and Grinders

- 6.1.3.2. Delimbers and Slashers

- 6.1.3.3. Other On-Site Processing Equipment

- 6.1.4. Other Forestry Equipment

- 6.1.4.1. Loaders

- 6.1.4.2. Mulchers

- 6.1.5. Separately Sold Parts and Attachments

- 6.1.5.1. Saw Chain, Guide Bars, Discs, and Teeth

- 6.1.5.2. Harvesting and Other Cutting Heads

- 6.1.5.3. Other Parts and Attachments

- 6.1.1. Felling Equipment

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Forestry Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Felling Equipment

- 7.1.1.1. Chainsaws

- 7.1.1.2. Harvesters

- 7.1.1.3. Feller Bunchers

- 7.1.2. Extracting Equipment

- 7.1.2.1. Forwarders

- 7.1.2.2. Skidders

- 7.1.2.3. Other Extracting Equipment

- 7.1.3. On-Site Processing Equipment

- 7.1.3.1. Chippers and Grinders

- 7.1.3.2. Delimbers and Slashers

- 7.1.3.3. Other On-Site Processing Equipment

- 7.1.4. Other Forestry Equipment

- 7.1.4.1. Loaders

- 7.1.4.2. Mulchers

- 7.1.5. Separately Sold Parts and Attachments

- 7.1.5.1. Saw Chain, Guide Bars, Discs, and Teeth

- 7.1.5.2. Harvesting and Other Cutting Heads

- 7.1.5.3. Other Parts and Attachments

- 7.1.1. Felling Equipment

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Forestry Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Felling Equipment

- 8.1.1.1. Chainsaws

- 8.1.1.2. Harvesters

- 8.1.1.3. Feller Bunchers

- 8.1.2. Extracting Equipment

- 8.1.2.1. Forwarders

- 8.1.2.2. Skidders

- 8.1.2.3. Other Extracting Equipment

- 8.1.3. On-Site Processing Equipment

- 8.1.3.1. Chippers and Grinders

- 8.1.3.2. Delimbers and Slashers

- 8.1.3.3. Other On-Site Processing Equipment

- 8.1.4. Other Forestry Equipment

- 8.1.4.1. Loaders

- 8.1.4.2. Mulchers

- 8.1.5. Separately Sold Parts and Attachments

- 8.1.5.1. Saw Chain, Guide Bars, Discs, and Teeth

- 8.1.5.2. Harvesting and Other Cutting Heads

- 8.1.5.3. Other Parts and Attachments

- 8.1.1. Felling Equipment

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia and New Zealand Forestry Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Felling Equipment

- 9.1.1.1. Chainsaws

- 9.1.1.2. Harvesters

- 9.1.1.3. Feller Bunchers

- 9.1.2. Extracting Equipment

- 9.1.2.1. Forwarders

- 9.1.2.2. Skidders

- 9.1.2.3. Other Extracting Equipment

- 9.1.3. On-Site Processing Equipment

- 9.1.3.1. Chippers and Grinders

- 9.1.3.2. Delimbers and Slashers

- 9.1.3.3. Other On-Site Processing Equipment

- 9.1.4. Other Forestry Equipment

- 9.1.4.1. Loaders

- 9.1.4.2. Mulchers

- 9.1.5. Separately Sold Parts and Attachments

- 9.1.5.1. Saw Chain, Guide Bars, Discs, and Teeth

- 9.1.5.2. Harvesting and Other Cutting Heads

- 9.1.5.3. Other Parts and Attachments

- 9.1.1. Felling Equipment

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Latin America Forestry Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Felling Equipment

- 10.1.1.1. Chainsaws

- 10.1.1.2. Harvesters

- 10.1.1.3. Feller Bunchers

- 10.1.2. Extracting Equipment

- 10.1.2.1. Forwarders

- 10.1.2.2. Skidders

- 10.1.2.3. Other Extracting Equipment

- 10.1.3. On-Site Processing Equipment

- 10.1.3.1. Chippers and Grinders

- 10.1.3.2. Delimbers and Slashers

- 10.1.3.3. Other On-Site Processing Equipment

- 10.1.4. Other Forestry Equipment

- 10.1.4.1. Loaders

- 10.1.4.2. Mulchers

- 10.1.5. Separately Sold Parts and Attachments

- 10.1.5.1. Saw Chain, Guide Bars, Discs, and Teeth

- 10.1.5.2. Harvesting and Other Cutting Heads

- 10.1.5.3. Other Parts and Attachments

- 10.1.1. Felling Equipment

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Middle East and Africa Forestry Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Felling Equipment

- 11.1.1.1. Chainsaws

- 11.1.1.2. Harvesters

- 11.1.1.3. Feller Bunchers

- 11.1.2. Extracting Equipment

- 11.1.2.1. Forwarders

- 11.1.2.2. Skidders

- 11.1.2.3. Other Extracting Equipment

- 11.1.3. On-Site Processing Equipment

- 11.1.3.1. Chippers and Grinders

- 11.1.3.2. Delimbers and Slashers

- 11.1.3.3. Other On-Site Processing Equipment

- 11.1.4. Other Forestry Equipment

- 11.1.4.1. Loaders

- 11.1.4.2. Mulchers

- 11.1.5. Separately Sold Parts and Attachments

- 11.1.5.1. Saw Chain, Guide Bars, Discs, and Teeth

- 11.1.5.2. Harvesting and Other Cutting Heads

- 11.1.5.3. Other Parts and Attachments

- 11.1.1. Felling Equipment

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. North America Forestry Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Forestry Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Forestry Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand Forestry Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America Forestry Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East and Africa Forestry Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Volvo CE (AB Volvo)

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Rottne Industri AB

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Deere and Company

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Kubota Corporation

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Mahindra Group

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Ponsse Oyj

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Barko Hydraulics LLC

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 AGCO Corporation

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Develon (HD Hyundai Infracore)

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Caterpillar Inc

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Komatsu Ltd

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Bell Equipment Limited

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Kesla Oyj

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 Hitachi Construction Machinery Co Ltd (HCM)

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.15 Eco Log Sweden AB

- 18.2.15.1. Overview

- 18.2.15.2. Products

- 18.2.15.3. SWOT Analysis

- 18.2.15.4. Recent Developments

- 18.2.15.5. Financials (Based on Availability)

- 18.2.1 Volvo CE (AB Volvo)

List of Figures

- Figure 1: Global Forestry Equipment Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Forestry Equipment Industry Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America Forestry Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Forestry Equipment Industry Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America Forestry Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Forestry Equipment Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Forestry Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Forestry Equipment Industry Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe Forestry Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Forestry Equipment Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Forestry Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Forestry Equipment Industry Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Forestry Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Forestry Equipment Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: Australia and New Zealand Forestry Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: Australia and New Zealand Forestry Equipment Industry Volume (K Unit), by Country 2024 & 2032

- Figure 17: Australia and New Zealand Forestry Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Australia and New Zealand Forestry Equipment Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: Latin America Forestry Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: Latin America Forestry Equipment Industry Volume (K Unit), by Country 2024 & 2032

- Figure 21: Latin America Forestry Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Latin America Forestry Equipment Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: Middle East and Africa Forestry Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 24: Middle East and Africa Forestry Equipment Industry Volume (K Unit), by Country 2024 & 2032

- Figure 25: Middle East and Africa Forestry Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East and Africa Forestry Equipment Industry Volume Share (%), by Country 2024 & 2032

- Figure 27: North America Forestry Equipment Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 28: North America Forestry Equipment Industry Volume (K Unit), by Product Type 2024 & 2032

- Figure 29: North America Forestry Equipment Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: North America Forestry Equipment Industry Volume Share (%), by Product Type 2024 & 2032

- Figure 31: North America Forestry Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 32: North America Forestry Equipment Industry Volume (K Unit), by Country 2024 & 2032

- Figure 33: North America Forestry Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: North America Forestry Equipment Industry Volume Share (%), by Country 2024 & 2032

- Figure 35: Europe Forestry Equipment Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 36: Europe Forestry Equipment Industry Volume (K Unit), by Product Type 2024 & 2032

- Figure 37: Europe Forestry Equipment Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Europe Forestry Equipment Industry Volume Share (%), by Product Type 2024 & 2032

- Figure 39: Europe Forestry Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 40: Europe Forestry Equipment Industry Volume (K Unit), by Country 2024 & 2032

- Figure 41: Europe Forestry Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: Europe Forestry Equipment Industry Volume Share (%), by Country 2024 & 2032

- Figure 43: Asia Forestry Equipment Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 44: Asia Forestry Equipment Industry Volume (K Unit), by Product Type 2024 & 2032

- Figure 45: Asia Forestry Equipment Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 46: Asia Forestry Equipment Industry Volume Share (%), by Product Type 2024 & 2032

- Figure 47: Asia Forestry Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 48: Asia Forestry Equipment Industry Volume (K Unit), by Country 2024 & 2032

- Figure 49: Asia Forestry Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 50: Asia Forestry Equipment Industry Volume Share (%), by Country 2024 & 2032

- Figure 51: Australia and New Zealand Forestry Equipment Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 52: Australia and New Zealand Forestry Equipment Industry Volume (K Unit), by Product Type 2024 & 2032

- Figure 53: Australia and New Zealand Forestry Equipment Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 54: Australia and New Zealand Forestry Equipment Industry Volume Share (%), by Product Type 2024 & 2032

- Figure 55: Australia and New Zealand Forestry Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 56: Australia and New Zealand Forestry Equipment Industry Volume (K Unit), by Country 2024 & 2032

- Figure 57: Australia and New Zealand Forestry Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 58: Australia and New Zealand Forestry Equipment Industry Volume Share (%), by Country 2024 & 2032

- Figure 59: Latin America Forestry Equipment Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 60: Latin America Forestry Equipment Industry Volume (K Unit), by Product Type 2024 & 2032

- Figure 61: Latin America Forestry Equipment Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 62: Latin America Forestry Equipment Industry Volume Share (%), by Product Type 2024 & 2032

- Figure 63: Latin America Forestry Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 64: Latin America Forestry Equipment Industry Volume (K Unit), by Country 2024 & 2032

- Figure 65: Latin America Forestry Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 66: Latin America Forestry Equipment Industry Volume Share (%), by Country 2024 & 2032

- Figure 67: Middle East and Africa Forestry Equipment Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 68: Middle East and Africa Forestry Equipment Industry Volume (K Unit), by Product Type 2024 & 2032

- Figure 69: Middle East and Africa Forestry Equipment Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 70: Middle East and Africa Forestry Equipment Industry Volume Share (%), by Product Type 2024 & 2032

- Figure 71: Middle East and Africa Forestry Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 72: Middle East and Africa Forestry Equipment Industry Volume (K Unit), by Country 2024 & 2032

- Figure 73: Middle East and Africa Forestry Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 74: Middle East and Africa Forestry Equipment Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Forestry Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Forestry Equipment Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Forestry Equipment Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Global Forestry Equipment Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 5: Global Forestry Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Forestry Equipment Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Global Forestry Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Forestry Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Forestry Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Forestry Equipment Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: Global Forestry Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Forestry Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Forestry Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Forestry Equipment Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Global Forestry Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Forestry Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Forestry Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Forestry Equipment Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Global Forestry Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Forestry Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: Forestry Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Forestry Equipment Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Global Forestry Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Forestry Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: Forestry Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Forestry Equipment Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Global Forestry Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Forestry Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: Forestry Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Forestry Equipment Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Global Forestry Equipment Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 32: Global Forestry Equipment Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 33: Global Forestry Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global Forestry Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Global Forestry Equipment Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 36: Global Forestry Equipment Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 37: Global Forestry Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Forestry Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 39: Global Forestry Equipment Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 40: Global Forestry Equipment Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 41: Global Forestry Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global Forestry Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: Global Forestry Equipment Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 44: Global Forestry Equipment Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 45: Global Forestry Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Global Forestry Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 47: Global Forestry Equipment Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 48: Global Forestry Equipment Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 49: Global Forestry Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Global Forestry Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 51: Global Forestry Equipment Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 52: Global Forestry Equipment Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 53: Global Forestry Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Global Forestry Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Forestry Equipment Industry?

The projected CAGR is approximately 4.15%.

2. Which companies are prominent players in the Forestry Equipment Industry?

Key companies in the market include Volvo CE (AB Volvo), Rottne Industri AB, Deere and Company, Kubota Corporation, Mahindra Group, Ponsse Oyj, Barko Hydraulics LLC, AGCO Corporation, Develon (HD Hyundai Infracore), Caterpillar Inc, Komatsu Ltd, Bell Equipment Limited, Kesla Oyj, Hitachi Construction Machinery Co Ltd (HCM), Eco Log Sweden AB.

3. What are the main segments of the Forestry Equipment Industry?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Automation to Boost the Forestry Equipment Demand; Replacement of Older. Less Productive Forestry Machinery by Logging Firms.

6. What are the notable trends driving market growth?

Chippers and Grinders to be the Largest On-site Processing Equipment Segment.

7. Are there any restraints impacting market growth?

High Cost of Forestry Equipment; Lack of Information About Forestry Equipment.

8. Can you provide examples of recent developments in the market?

June 2023 - Volvo Construction Equipment (Volvo CE) announced the launch of its new Compact Business Unit. Volvo CE has set up a dedicated business unit for its range of compact equipment machines and solutions to drive growth and profitability in this important and growing product segment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Forestry Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Forestry Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Forestry Equipment Industry?

To stay informed about further developments, trends, and reports in the Forestry Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence