Key Insights

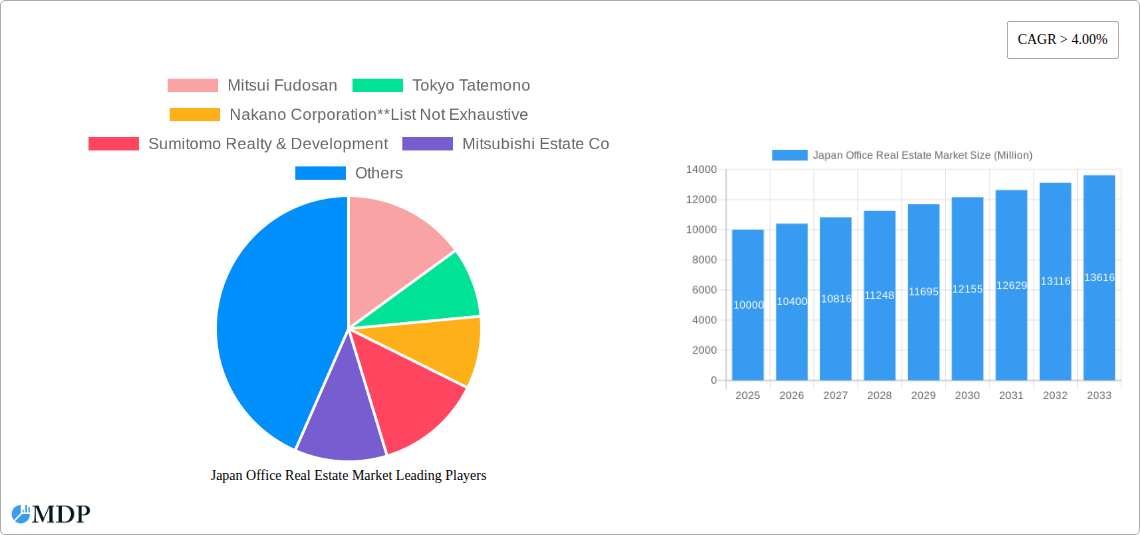

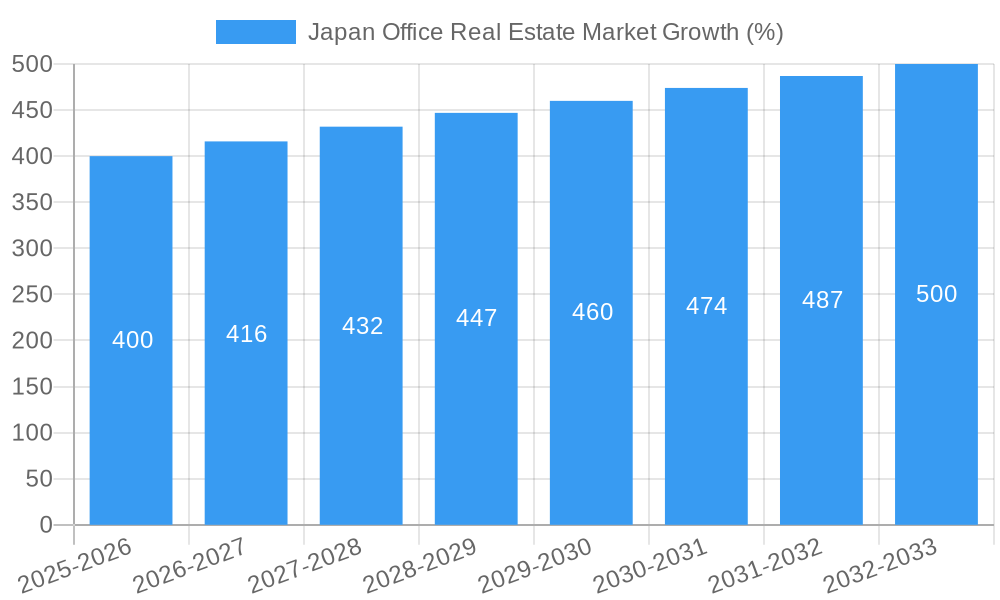

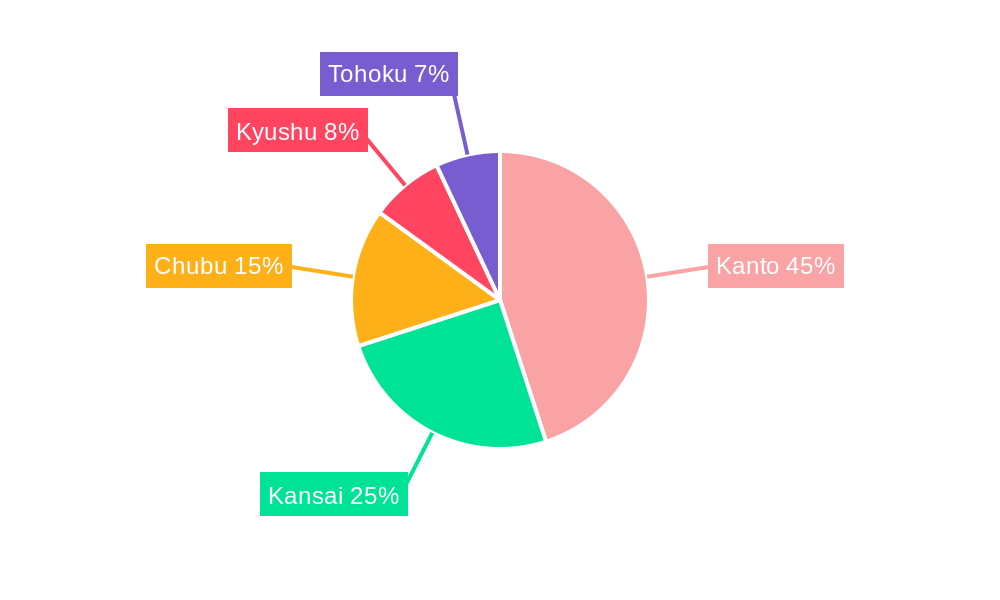

The Japan office real estate market, currently valued at approximately $XX million (estimated based on provided CAGR and market size), is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. Key drivers include a recovering Japanese economy, increasing demand from technology companies and expanding foreign investment in major metropolitan areas like Tokyo and Kyoto. The concentration of businesses in these cities fuels competition for prime office space, particularly in central business districts, resulting in upward pressure on rental rates and property values. However, the market isn't without its challenges. Constraints include limited land availability in desirable locations, particularly in Tokyo, and the potential impact of remote work trends on long-term office space demand. While remote work adoption is increasing, the demand for flexible and collaborative workspaces is also rising, suggesting a shift rather than a complete decline in office space needs. The market is segmented geographically, with Tokyo and Kyoto commanding the largest shares, reflecting their established role as financial and cultural hubs. Leading players, including Mitsui Fudosan, Sumitomo Realty & Development, and Mitsubishi Estate Co., are strategically adapting to these evolving trends through developments emphasizing sustainability, advanced technology, and flexible lease options to cater to the changing needs of businesses. The regional distribution of the market showcases a concentration in Kanto, Kansai, and Chubu regions, aligning with the economic activity and population density of these areas.

The forecast period (2025-2033) presents both opportunities and risks for investors. While the positive CAGR suggests continued market expansion, careful consideration of the potential impact of remote work, economic fluctuations, and land scarcity is crucial. Successful strategies will involve adapting to the evolving preferences of tenants and embracing sustainable and technologically advanced building solutions. This will include a focus on attracting and retaining talent by offering high-quality, adaptable office spaces that promote collaboration and productivity, effectively balancing the demand for traditional office spaces with the growth of hybrid work models. The long-term outlook for the Japan office real estate market remains positive, but strategic adaptation to evolving market dynamics will be vital for continued success.

Japan Office Real Estate Market Report: 2019-2033 Forecast

Unlocking Growth Opportunities in Japan's Dynamic Office Real Estate Sector

This comprehensive report provides an in-depth analysis of the Japan office real estate market, covering the period from 2019 to 2033. With a focus on key cities like Tokyo and Kyoto, we delve into market dynamics, industry trends, leading players, and future growth potential. This crucial data empowers investors, developers, and industry stakeholders to make informed decisions in this thriving market. The report leverages extensive research, incorporating data from the base year 2025 and projecting forward to 2033. Market values are expressed in Millions.

Japan Office Real Estate Market Dynamics & Concentration

The Japan office real estate market is characterized by a high degree of concentration, with a few major players dominating the landscape. Mitsui Fudosan, Sumitomo Realty & Development, Mitsubishi Estate Co., and Mori Building consistently rank among the top players, holding a significant market share collectively estimated at xx%. This concentration stems from their extensive portfolios, strong financial positions, and long-standing industry experience. The market's dynamics are influenced by several factors:

- Innovation Drivers: Technological advancements, such as smart building technologies and flexible workspace solutions, are reshaping the market.

- Regulatory Framework: Government regulations related to building codes, environmental standards, and zoning laws play a crucial role.

- Product Substitutes: The rise of co-working spaces and remote work options presents a degree of substitution for traditional office spaces.

- End-User Trends: A shift towards smaller, more flexible office spaces, driven by changes in work styles and cost-optimization strategies, is noticeable.

- M&A Activities: Consolidation in the sector continues, with an estimated xx M&A deals occurring between 2019 and 2024, further influencing market concentration. Larger firms are actively acquiring smaller companies to expand their market reach and diversify their portfolios. The average deal size is estimated to be xx Million.

Japan Office Real Estate Market Industry Trends & Analysis

The Japan office real estate market demonstrates robust growth, driven by factors including a recovering economy, increasing urbanization, and ongoing technological advancements. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 is estimated at xx%, and is projected to reach xx% from 2025 to 2033. Market penetration of smart building technologies is steadily increasing, with an estimated xx% penetration rate by 2025. Consumer preferences are evolving towards sustainable, technologically advanced, and flexible office spaces. Competitive dynamics are intensifying, with companies continually seeking to differentiate their offerings through innovative design, technological integration, and superior location. The expansion of the tech sector, coupled with government initiatives to attract foreign investment, are key factors contributing to this positive trend. However, the impact of global economic uncertainties and potential changes in work patterns needs careful monitoring.

Leading Markets & Segments in Japan Office Real Estate Market

Tokyo unequivocally dominates the Japan office real estate market, accounting for approximately xx% of the total market value in 2025. This dominance is attributable to a concentration of businesses, robust economic activity, and superior infrastructure.

Tokyo's dominance is driven by:

- Strong Economic Base: Tokyo's position as Japan's economic and financial hub attracts a high concentration of businesses, leading to significant demand for office space.

- Extensive Infrastructure: Excellent public transportation, advanced communication networks, and strategically located office buildings make Tokyo an attractive location.

- Government Policies: Pro-business government policies and investment in infrastructure continue to foster growth in the Tokyo office market.

Kyoto holds a smaller yet significant share, representing approximately xx% of the market, due to its tourism sector and presence of various industries. The "Rest of Japan" segment comprises the remaining xx% of the market, with growth rates varying by region and dependent on local economic conditions.

Japan Office Real Estate Market Product Developments

Product innovations are primarily focused on enhancing efficiency, sustainability, and occupant experience. Smart building technologies, including energy-efficient systems, advanced security features, and integrated workspace management solutions, are gaining traction. The market is witnessing increased adoption of flexible workspace solutions like co-working spaces and modular office designs to meet changing user needs. This adaptability creates a competitive advantage for developers who can cater to diverse business models and tenant requirements.

Key Drivers of Japan Office Real Estate Market Growth

Several key factors are propelling the growth of the Japan office real estate market.

- Technological Advancements: Smart building technologies and flexible workspace solutions are attracting tenants and increasing property values.

- Economic Growth: Continued economic expansion, particularly in key sectors like technology and finance, drives demand for office space.

- Government Initiatives: Supportive government policies and infrastructure investments are creating a favorable environment for market expansion.

Challenges in the Japan Office Real Estate Market Market

Despite its positive trajectory, the Japan office real estate market faces certain challenges:

- Regulatory Hurdles: Navigating complex regulations and obtaining necessary approvals can be time-consuming and costly, potentially delaying projects.

- Supply Chain Issues: Disruptions to global supply chains can impact construction timelines and increase costs.

- Competitive Pressures: Intense competition among developers requires innovative strategies and efficient cost management.

Emerging Opportunities in Japan Office Real Estate Market

The future of the Japan office real estate market holds significant opportunities. Technological breakthroughs, such as advancements in sustainable building materials and improved energy efficiency systems, will attract environmentally conscious tenants. Strategic partnerships between developers and technology companies can lead to innovative workspace solutions. Furthermore, expanding into secondary markets with high growth potential and focusing on niche segments can unlock new avenues for growth.

Leading Players in the Japan Office Real Estate Market Sector

- Mitsui Fudosan

- Tokyo Tatemono

- Nakano Corporation

- Sumitomo Realty & Development

- Mitsubishi Estate Co

- Mori Trust

- Hulic

- Mori Building

- Nomura Real Estate Holdings

- Tokyu Land Corporation

Key Milestones in Japan Office Real Estate Market Industry

- 2020: Increased adoption of remote work practices due to the COVID-19 pandemic.

- 2022: Government initiatives to promote sustainable building practices.

- 2023: Significant investment in smart building technology by leading developers.

- 2024: Several key mergers and acquisitions reshaping the market landscape.

Strategic Outlook for Japan Office Real Estate Market Market

The Japan office real estate market is poised for continued growth, driven by strong economic fundamentals, technological innovation, and government support. Strategic opportunities exist for companies focusing on sustainability, flexible workspaces, and smart building technologies. The market will continue to see consolidation as larger firms acquire smaller players, further solidifying market concentration. This presents significant opportunities for investment and strategic partnerships. The long-term outlook is positive, with the market expected to experience steady growth throughout the forecast period.

Japan Office Real Estate Market Segmentation

-

1. Key Cities

- 1.1. Tokyo

- 1.2. Kyoto

- 1.3. Rest of Japan

Japan Office Real Estate Market Segmentation By Geography

- 1. Japan

Japan Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urbanization is driving the market4.; Government Initiatives Actively promoting the Construction Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Limited Infrastructure4.; Shortage of Skilled Labours

- 3.4. Market Trends

- 3.4.1. Rise in Start-ups Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 5.1.1. Tokyo

- 5.1.2. Kyoto

- 5.1.3. Rest of Japan

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 6. Kanto Japan Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Mitsui Fudosan

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tokyo Tatemono

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nakano Corporation**List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sumitomo Realty & Development

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mitsubishi Estate Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mori Trust

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hulic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mori Building

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nomura Real Estate Holdings

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tokyu Land Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Mitsui Fudosan

List of Figures

- Figure 1: Japan Office Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Office Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Office Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Office Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 3: Japan Office Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Japan Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Kanto Japan Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Kansai Japan Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Chubu Japan Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Kyushu Japan Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tohoku Japan Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Office Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 11: Japan Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Office Real Estate Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Japan Office Real Estate Market?

Key companies in the market include Mitsui Fudosan, Tokyo Tatemono, Nakano Corporation**List Not Exhaustive, Sumitomo Realty & Development, Mitsubishi Estate Co, Mori Trust, Hulic, Mori Building, Nomura Real Estate Holdings, Tokyu Land Corporation.

3. What are the main segments of the Japan Office Real Estate Market?

The market segments include Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urbanization is driving the market4.; Government Initiatives Actively promoting the Construction Activities.

6. What are the notable trends driving market growth?

Rise in Start-ups Driving the Market.

7. Are there any restraints impacting market growth?

4.; Limited Infrastructure4.; Shortage of Skilled Labours.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Japan Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence