Key Insights

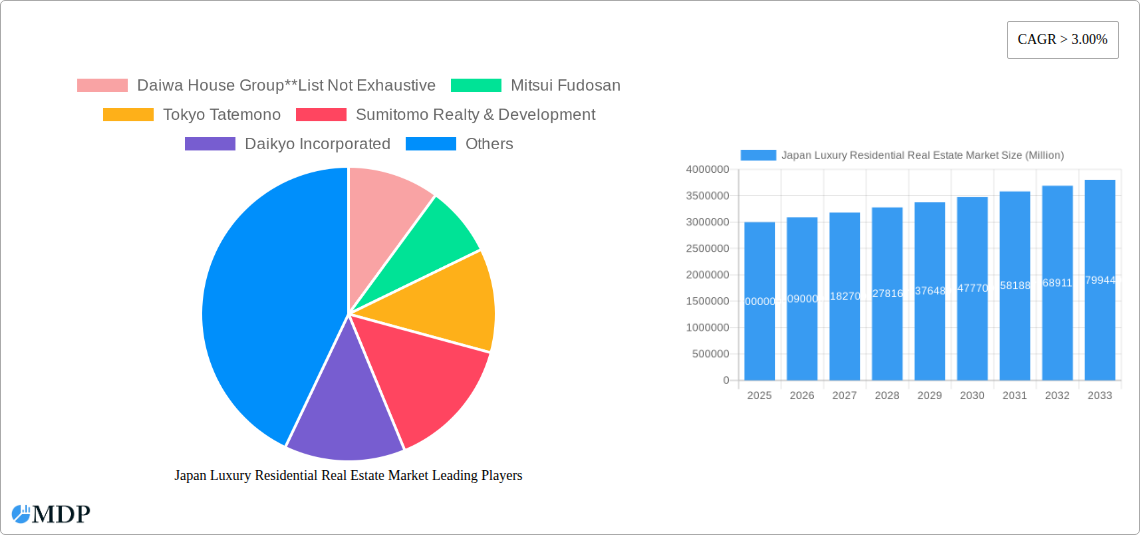

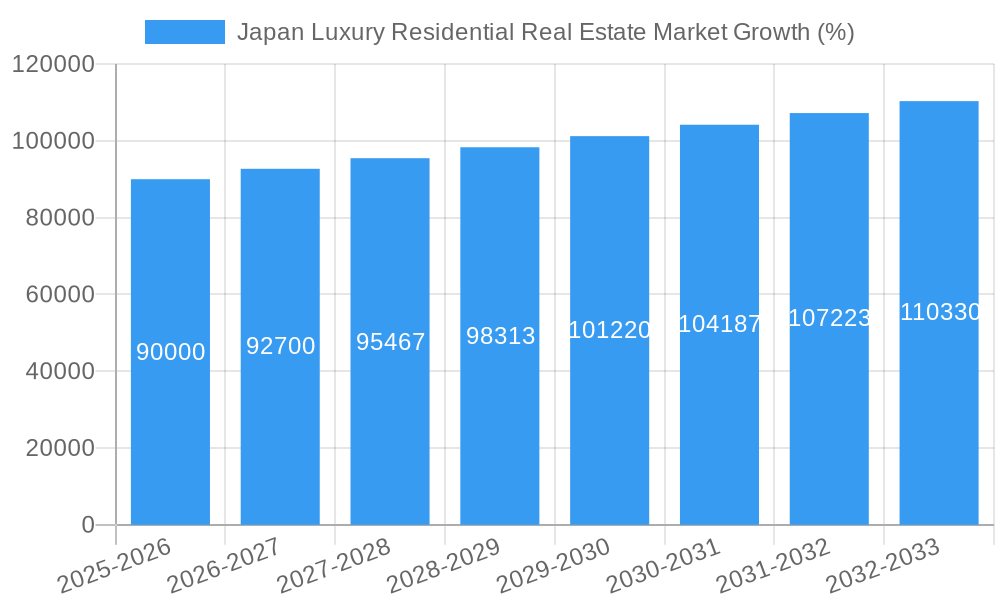

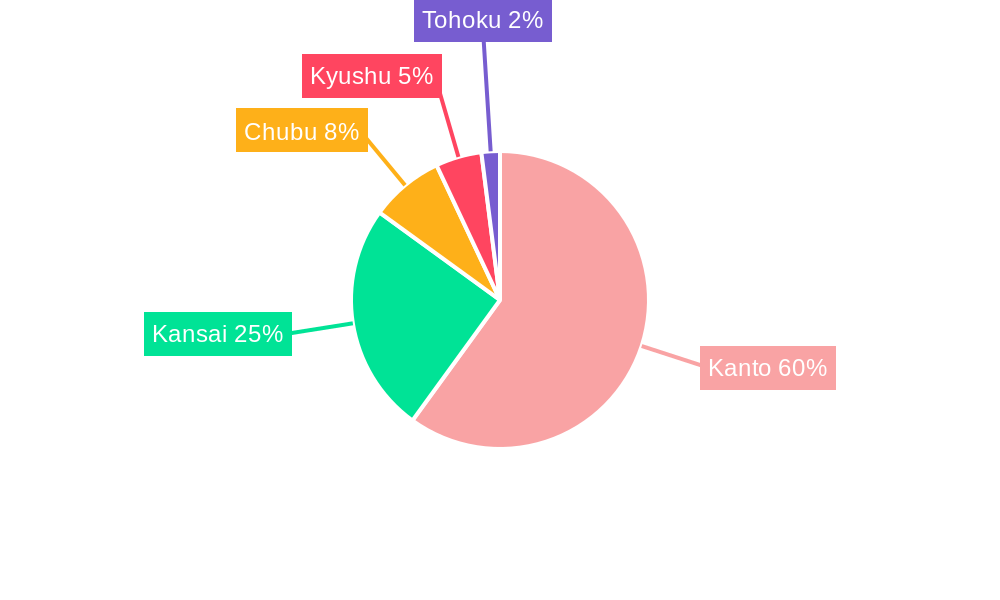

The Japan luxury residential real estate market, valued at approximately ¥3 trillion (assuming a market size "XX" in the millions translates to a reasonable estimate considering the listed companies and market players) in 2025, is projected to experience robust growth with a compound annual growth rate (CAGR) exceeding 3.00% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, Japan's strong economy and increasing high-net-worth individuals (HNWIs) are driving demand for premium properties in prime locations like Tokyo, Kyoto, and Osaka. Secondly, a growing preference for larger, more luxurious homes, particularly among younger affluent professionals and families, contributes significantly to market growth. The increasing popularity of sustainable and technologically advanced homes further adds to the appeal. While limited land availability, particularly in major cities, acts as a restraint, ongoing urban redevelopment projects are helping mitigate this constraint to some degree. The market is segmented by property type (apartments and condominiums, villas and landed houses) and city (Tokyo, Kyoto, Osaka, and other cities), with Tokyo commanding the largest market share. Leading developers like Daiwa House Group, Mitsui Fudosan, and Mitsubishi Estate are major players, shaping market trends through innovative designs and strategic land acquisitions. The regional distribution of luxury properties aligns with population density and economic activity, with Kanto (including Tokyo) holding the dominant position.

The forecast period (2025-2033) anticipates continued growth, albeit at a potentially moderated pace towards the latter half. Factors such as economic fluctuations, interest rate changes, and shifts in government policies could influence the market trajectory. However, the long-term outlook remains positive due to the underlying strength of the Japanese economy and the enduring appeal of luxury real estate as a significant investment and lifestyle asset. Competition among developers will likely intensify, driving further innovation in design, amenities, and sustainability features to cater to the discerning needs of high-end buyers. The market will continue to see a strong demand for high-quality, location-premium properties, reflecting a resilient and steadily expanding segment within the overall Japanese real estate sector.

Japan Luxury Residential Real Estate Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Japan luxury residential real estate market, covering the period from 2019 to 2033. It delves into market dynamics, industry trends, leading players, and future growth opportunities, offering valuable insights for investors, developers, and industry stakeholders. With a focus on key cities like Tokyo, Kyoto, and Osaka, and segments including apartments, condominiums, villas, and landed houses, this report presents a crucial understanding of this lucrative market. The report's base year is 2025, with estimates and forecasts extending to 2033. Expect actionable insights and data-driven predictions to navigate the complexities of this dynamic market.

Japan Luxury Residential Real Estate Market Dynamics & Concentration

The Japanese luxury residential real estate market, valued at xx Million in 2024, exhibits a moderately concentrated landscape dominated by major players like Daiwa House Group, Mitsui Fudosan, and Mitsubishi Estate. Market share analysis reveals these companies hold a significant portion (xx%) of the overall market. This concentration stems from their extensive land holdings, established brand reputation, and access to substantial capital for large-scale developments. Innovation in the sector is driven by advancements in sustainable building materials, smart home technology integration, and the increasing demand for high-end amenities. The regulatory framework, while generally stable, undergoes periodic revisions impacting construction permits and zoning regulations. Product substitutes, such as luxury serviced apartments or high-end rentals, pose some competitive pressure, particularly within the rental segment. End-user trends reflect a growing preference for properties offering exceptional privacy, sustainable features, and seamless integration of technology. M&A activity in the sector remains relatively steady, with an average of xx deals annually over the historical period (2019-2024). These mergers and acquisitions often focus on expanding land banks and consolidating market share.

- Market Concentration: High, with top 3 players holding xx% of the market share.

- Innovation Drivers: Sustainable building materials, smart home technology, luxury amenities.

- Regulatory Framework: Stable, with periodic updates affecting construction and zoning.

- Product Substitutes: Luxury serviced apartments and high-end rental properties.

- End-User Trends: Demand for privacy, sustainability, and technology integration.

- M&A Activity: Average xx deals annually (2019-2024).

Japan Luxury Residential Real Estate Market Industry Trends & Analysis

The Japanese luxury residential real estate market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Several key factors contribute to this expansion. Firstly, the ongoing urbanization of major cities like Tokyo, Kyoto, and Osaka is driving increased demand for premium residential properties. Secondly, the rise of high-net-worth individuals (HNWIs) within Japan, coupled with increased foreign investment, fuels the luxury segment's growth. Technological disruptions are transforming the industry, with the integration of smart home technology, building automation systems, and virtual reality tours becoming increasingly common in marketing and property management. Consumer preferences are shifting towards sustainable and eco-friendly designs, prompting developers to incorporate green building practices and energy-efficient technologies. Competitive dynamics are influenced by both established giants and new entrants specializing in niche luxury developments. The market penetration of smart home technology in new luxury constructions is steadily increasing, exceeding xx% in 2024 and projected to reach xx% by 2033.

Leading Markets & Segments in Japan Luxury Residential Real Estate Market

Tokyo remains the undisputed leader in the Japanese luxury residential market, accounting for xx% of the total market value in 2024. This dominance is attributed to several key drivers:

- Economic Strength: Tokyo's robust economy attracts significant domestic and international investment.

- Infrastructure: Exceptional infrastructure, including transport and amenities, adds to its appeal.

- Prestige: Owning property in Tokyo carries significant social and economic prestige.

Kyoto and Osaka hold considerably smaller but still significant shares of the market. While apartments and condominiums comprise the largest segment of the luxury market, the villa and landed house segment is experiencing growth, particularly amongst HNWIs seeking expansive properties outside the city centers. Other cities show potential for future growth, primarily driven by regional economic development and improvements in infrastructure.

- Tokyo: Dominant due to economic strength, infrastructure, and prestige.

- Kyoto & Osaka: Significant, but smaller shares than Tokyo.

- Apartments & Condominiums: Largest market segment.

- Villas & Landed Houses: Growing segment catering to HNWIs.

Japan Luxury Residential Real Estate Market Product Developments

Product innovation in the Japanese luxury residential real estate market is characterized by a focus on sustainability, technology integration, and personalized design. Developers are incorporating smart home features, renewable energy solutions, and high-end finishes to attract discerning buyers. This focus on creating bespoke, high-tech, and environmentally conscious homes is shaping the competitive landscape, offering distinct advantages to developers who embrace these innovations. The integration of advanced security systems and wellness features further enhances the appeal of these luxury properties.

Key Drivers of Japan Luxury Residential Real Estate Market Growth

Several key factors are driving the growth of the Japan luxury residential real estate market. Firstly, the strong economic performance of Japan and the continued increase in HNWIs are boosting demand for high-end properties. Secondly, advancements in technology, such as smart home integration and sustainable building materials, enhance the appeal of luxury residences. Finally, supportive government policies and infrastructure development in major cities create favorable conditions for market expansion. The increasing preference for larger living spaces, coupled with a focus on enhanced privacy and security, is also significant.

Challenges in the Japan Luxury Residential Real Estate Market Market

The Japanese luxury residential real estate market faces several challenges. Land scarcity in major cities restricts development, leading to higher prices and limited supply. Stringent building regulations and bureaucratic processes can delay construction and increase costs. Competition from both established developers and smaller boutique firms necessitates differentiation and innovative approaches. Finally, economic fluctuations and shifts in interest rates can influence buyer sentiment and investment levels, potentially impacting market stability. The impact of these challenges is estimated to reduce the annual growth rate by xx% in certain periods.

Emerging Opportunities in Japan Luxury Residential Real Estate Market

The Japanese luxury residential real estate market presents several promising opportunities. The growth of eco-tourism and the increasing demand for sustainable living create opportunities for developers to build environmentally conscious luxury properties. Strategic partnerships between developers and technology companies can lead to the creation of truly intelligent homes with advanced automation and personalized features. Furthermore, expanding into secondary markets with strong potential for growth can diversify investment portfolios and unlock new revenue streams.

Leading Players in the Japan Luxury Residential Real Estate Market Sector

- Daiwa House Group

- Mitsui Fudosan

- Tokyo Tatemono

- Sumitomo Realty & Development

- Daikyo Incorporated

- Nakano Corporation

- Mori Trust

- Nomura Real Estate

- Mitsubishi Estate

- Tokyu Land Corporation

Key Milestones in Japan Luxury Residential Real Estate Market Industry

- January 2022: Mitsubishi Estate announces the development of 50 luxury rental apartments in the Tokyo Station Tokiwabashi Project (Torch Tower), marking the first rental units in the Otemachi, Marunouchi, and Yurakucho areas.

- April 2022: Mitsui Fudosan Residential and Mitsubishi Estate Residence unveil "Mita Garden Hills," a large-scale luxury condominium project featuring 1,002 units in Minato-ku, Tokyo. This project showcases significant investment in luxury high-rise living.

Strategic Outlook for Japan Luxury Residential Real Estate Market Market

The Japan luxury residential real estate market is poised for continued growth, driven by robust economic conditions, technological advancements, and evolving consumer preferences. Strategic opportunities lie in adopting sustainable practices, embracing technological innovations in building design and management, and targeting specific niche segments within the luxury market. Expanding into secondary cities with promising growth potential and fostering strategic partnerships to leverage technological expertise will be crucial for long-term success in this dynamic market.

Japan Luxury Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. City

- 2.1. Tokyo

- 2.2. Kyoto

- 2.3. Osaka

- 2.4. Other Cities

Japan Luxury Residential Real Estate Market Segmentation By Geography

- 1. Japan

Japan Luxury Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urbanization is driving the market4.; Government Initiatives Actively promoting the Construction Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Limited Infrastructure4.; Shortage of Skilled Labours

- 3.4. Market Trends

- 3.4.1. High Concentration of UHNWI in Tokyo Driving the Sales of Luxury Homes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. Tokyo

- 5.2.2. Kyoto

- 5.2.3. Osaka

- 5.2.4. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Kanto Japan Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Daiwa House Group**List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mitsui Fudosan

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tokyo Tatemono

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sumitomo Realty & Development

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Daikyo Incorporated

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nakano Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mori Trust

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nomura Real Estate

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mitsubishi Estate

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tokyu Land Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Daiwa House Group**List Not Exhaustive

List of Figures

- Figure 1: Japan Luxury Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Luxury Residential Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Luxury Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Japan Luxury Residential Real Estate Market Revenue Million Forecast, by City 2019 & 2032

- Table 4: Japan Luxury Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Japan Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Kanto Japan Luxury Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Kansai Japan Luxury Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Chubu Japan Luxury Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kyushu Japan Luxury Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tohoku Japan Luxury Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Japan Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Japan Luxury Residential Real Estate Market Revenue Million Forecast, by City 2019 & 2032

- Table 13: Japan Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Luxury Residential Real Estate Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Japan Luxury Residential Real Estate Market?

Key companies in the market include Daiwa House Group**List Not Exhaustive, Mitsui Fudosan, Tokyo Tatemono, Sumitomo Realty & Development, Daikyo Incorporated, Nakano Corporation, Mori Trust, Nomura Real Estate, Mitsubishi Estate, Tokyu Land Corporation.

3. What are the main segments of the Japan Luxury Residential Real Estate Market?

The market segments include Type, City.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urbanization is driving the market4.; Government Initiatives Actively promoting the Construction Activities.

6. What are the notable trends driving market growth?

High Concentration of UHNWI in Tokyo Driving the Sales of Luxury Homes.

7. Are there any restraints impacting market growth?

4.; Limited Infrastructure4.; Shortage of Skilled Labours.

8. Can you provide examples of recent developments in the market?

On January 13th, 2022, Mitsubishi Estate announced rental residences would be included on the upper floors of Torch Tower, a mixed-use building to be developed in the Tokyo Torch complex, officially named the Tokyo Station Tokiwabashi Project. These will be the first residential units for rent in the Otemachi, Marunouchi, and Yurakucho areas, according to Mitsubishi Estate. There will be approximately 50 luxury rental apartments planned, between roughly 70 to 400 square meters in exclusive use spaces. Torch Tower will be a 63-story, 4-level basement complex consisting of a hotel, offices, event spaces, and retail stores in addition to the luxury rental units. Construction is scheduled to begin in the fiscal year 2023 and be completed in the fiscal year 2027.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Luxury Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Luxury Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Luxury Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Japan Luxury Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence