Key Insights

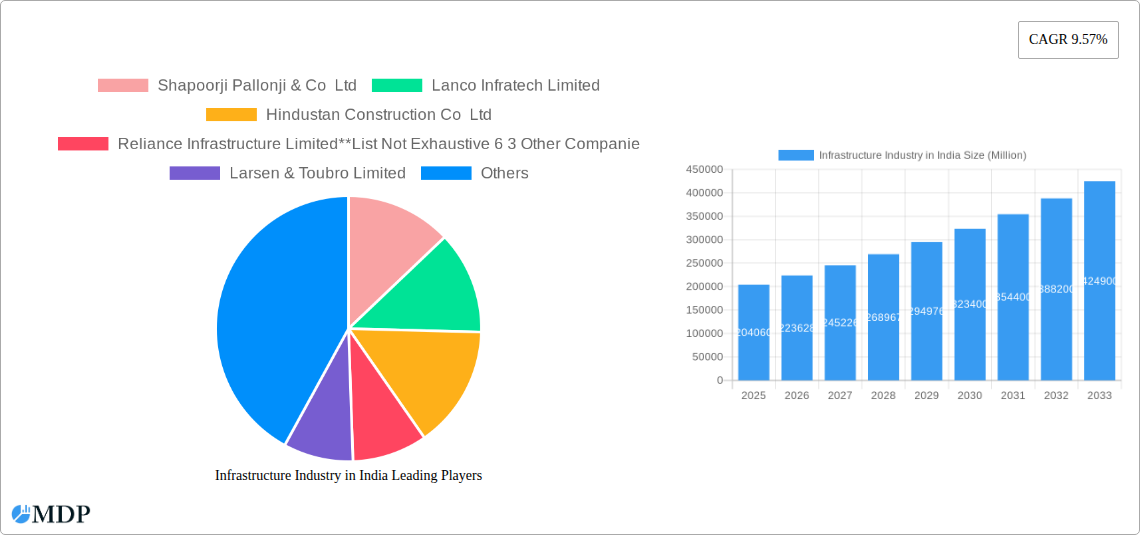

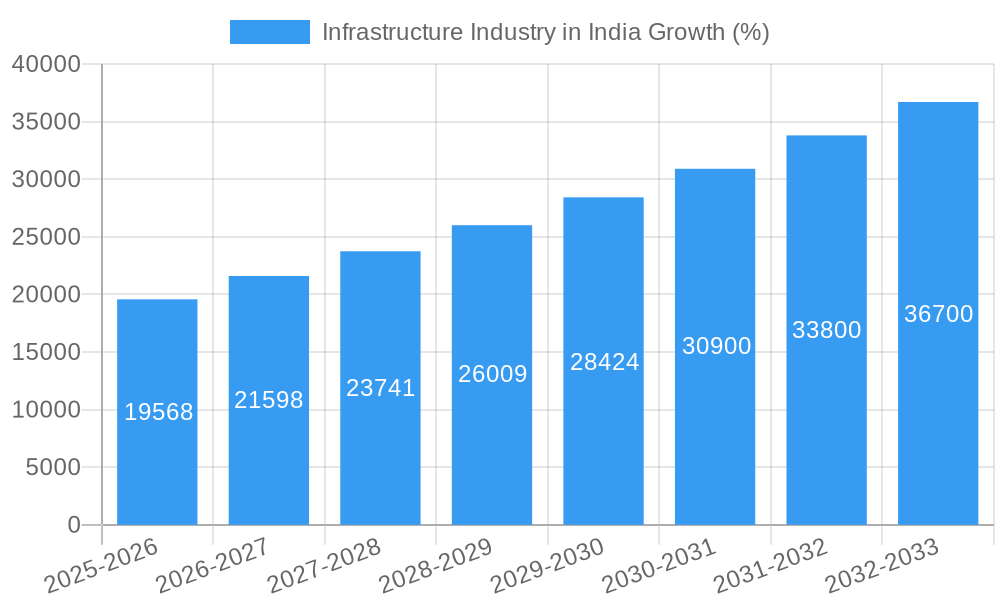

The Indian infrastructure industry is experiencing robust growth, projected to reach \$204.06 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 9.57% from 2025 to 2033. This expansion is fueled by significant government investment in social infrastructure projects (like affordable housing, schools, and hospitals), a burgeoning transportation network encompassing roads, railways, and airports, and the continuous need for upgrades to energy and water utilities. Increased industrialization and urbanization are further stimulating demand for manufacturing and extraction infrastructure. Key states like Maharashtra, Karnataka, Delhi, and Telangana are leading this growth, attracting substantial investments and creating numerous employment opportunities. While challenges such as land acquisition complexities and regulatory hurdles exist, the long-term outlook remains positive, driven by sustained economic growth and the government's focus on infrastructure development as a cornerstone of national progress.

The industry's competitive landscape is shaped by a mix of large established players like Larsen & Toubro, Shapoorji Pallonji, and Reliance Infrastructure, alongside several mid-sized and smaller companies. Competition is intense, with companies vying for large-scale projects and focusing on specialization in specific infrastructure segments. Technological advancements, including the adoption of Building Information Modeling (BIM) and advanced construction techniques, are enhancing efficiency and productivity. The sector is also witnessing increasing adoption of sustainable practices and environmentally friendly materials, in line with global sustainability goals. The forecast period of 2025-2033 promises continued expansion, with opportunities for both established and emerging players to capitalize on the growing demand for infrastructure across various segments and regions within India.

Infrastructure Industry in India: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Indian infrastructure industry, covering market dynamics, leading players, key trends, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders, investors, and policymakers seeking to understand and capitalize on opportunities within this dynamic sector. The report incorporates detailed data and analysis, leveraging high-traffic keywords such as "Indian infrastructure market," "infrastructure development India," "Indian construction market," and more to ensure maximum search visibility.

Infrastructure Industry in India Market Dynamics & Concentration

The Indian infrastructure industry, valued at xx Million USD in 2024, exhibits a moderately concentrated market structure. Key players like Shapoorji Pallonji & Co Ltd, Lanco Infratech Limited, Hindustan Construction Co Ltd, and Reliance Infrastructure Limited hold significant market share, although the presence of numerous smaller players contributes to competitive intensity. Market concentration is influenced by factors including access to capital, project execution capabilities, and regulatory compliance. Innovation drivers encompass technological advancements like BIM (Building Information Modeling) and the adoption of sustainable construction practices. The regulatory framework, while evolving, presents both opportunities and challenges, with policies like the National Infrastructure Pipeline (NIP) aiming to stimulate growth. Product substitutes are limited, given the unique nature of infrastructure projects, although alternative materials and construction techniques are gaining traction. End-user trends favor sustainable and technologically advanced infrastructure solutions, leading to increased demand for green buildings and smart city initiatives. Mergers and acquisitions (M&A) activity remains significant, with xx M&A deals recorded in 2024, primarily driven by consolidation efforts and strategic expansions. Market share dynamics are influenced by large-scale projects awarded to major players and the emergence of new entrants in specialized segments.

Infrastructure Industry in India Industry Trends & Analysis

The Indian infrastructure industry is experiencing robust growth, driven by government initiatives like the NIP and a rising need for improved infrastructure to support economic development. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 is estimated at xx%, reflecting significant investment in transportation, energy, and urban infrastructure. Technological disruptions, such as the adoption of prefabricated construction techniques and the increasing use of data analytics for project management, are transforming the industry. Consumer preferences are increasingly focused on sustainable and resilient infrastructure, pushing companies towards eco-friendly materials and practices. Competitive dynamics are characterized by both intense competition among established players and the emergence of new entrants specializing in niche segments. Market penetration of advanced technologies varies across segments, with the transportation sector showing faster adoption compared to others. Challenges include land acquisition complexities, regulatory hurdles, and the availability of skilled labor. However, the long-term outlook remains positive, driven by continued government investment and rising private sector participation.

Leading Markets & Segments in Infrastructure Industry in India

Dominant Segments: Transportation infrastructure commands the largest market share, driven by massive investments in highways, railways, and airports. This segment's dominance is fueled by India's expanding economy and the need for improved connectivity. Utilities infrastructure (power generation & distribution, water management) constitutes another significant sector, influenced by rapidly increasing energy demands and urbanization.

Dominant States: Maharashtra, Karnataka, Delhi, and Telangana are leading markets, owing to high economic activity, substantial government spending on infrastructure, and the presence of key industrial hubs. However, significant opportunities exist in other states with developing infrastructure needs.

Key Drivers:

- Government policies promoting infrastructure development (e.g., NIP).

- Growing urbanization and population requiring better infrastructure.

- Increased private sector participation through PPP models.

- Rising disposable incomes leading to higher consumer demand for better services.

The dominance of these segments and states is expected to continue in the forecast period, with potential shifts driven by emerging growth areas and regional development plans.

Infrastructure Industry in India Product Developments

Recent product innovations focus on sustainable materials, modular construction techniques, and digital technologies for project management and monitoring. These innovations offer improved efficiency, reduced costs, and minimized environmental impact. Companies are leveraging technological advantages to enhance project execution, optimize resource allocation, and improve overall customer satisfaction. The increasing use of prefabricated components and smart technologies represents a key market trend.

Key Drivers of Infrastructure Industry in India Growth

Government initiatives like the NIP and various state-level infrastructure development programs are primary growth drivers. Economic growth, fueled by increased industrialization and urbanization, fuels demand for infrastructure. Regulatory reforms aimed at streamlining approvals and promoting private sector participation play a crucial role. For example, the easing of land acquisition procedures in some states has significantly accelerated project execution.

Challenges in the Infrastructure Industry in India Market

Land acquisition remains a major hurdle, often leading to project delays and cost overruns. Supply chain disruptions due to material shortages and logistical challenges can impact project timelines and budgets. Intense competition among players can result in price wars, affecting profitability. Regulatory complexities and bureaucratic processes contribute to project delays. These challenges, if not addressed effectively, could impact the overall growth trajectory of the sector.

Emerging Opportunities in Infrastructure Industry in India

The burgeoning smart city initiatives present significant opportunities for growth in sectors like smart grids, intelligent transportation systems, and water management technologies. The expanding renewable energy sector is creating opportunities in transmission and distribution infrastructure. Strategic partnerships between public and private entities are accelerating infrastructure development, creating new avenues for growth. Technological advancements, such as the use of drones for surveying and 3D printing for construction, promise increased efficiency and cost savings.

Leading Players in the Infrastructure Industry in India Sector

- Shapoorji Pallonji & Co Ltd

- Lanco Infratech Limited

- Hindustan Construction Co Ltd

- Reliance Infrastructure Limited

- Larsen & Toubro Limited

- Gammon India Ltd

- Tata Projects Ltd

- Nagarjuna Construction Company Limited (NCC Ltd)

- Jaiprakash Associates Ltd

- Simplex Infrastructures Ltd

- 63 Other Companies

Key Milestones in Infrastructure Industry in India Industry

- January 2024: Highway Infrastructure Trust (HIT) acquired 12 road projects worth USD 1.08 Billion, significantly boosting investment in road infrastructure.

- February 2024: Tata Steel's partnership with South Eastern Railway (SER) promotes sustainable rail infrastructure development through the use of slag-based aggregates, highlighting a move towards environmentally friendly practices.

Strategic Outlook for Infrastructure Industry in India Market

The Indian infrastructure industry is poised for sustained growth, driven by continued government investment, increasing private sector participation, and technological advancements. Strategic opportunities lie in adopting sustainable and smart technologies, focusing on niche segments, and leveraging strategic partnerships to capitalize on the vast potential of this dynamic sector. The long-term outlook remains optimistic, with significant growth expected across various infrastructure segments.

Infrastructure Industry in India Segmentation

-

1. Infrastructure segment

- 1.1. Social Infrastructure

- 1.2. Transportation Infrastructure

- 1.3. Extraction Infrastructure

- 1.4. Manufacturing Infrastructure

- 1.5. Utilities Infrastructure

-

2. Key States

- 2.1. Maharashtra

- 2.2. Karnataka

- 2.3. Delhi

- 2.4. Telangana

- 2.5. Other States

Infrastructure Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Infrastructure Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Urbanization is Driving the Market; Surge in Foreign Direct Investments is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Bureaucratic Processes are Affecting the Market; Environmental Concerns and Regulatory Hurdles are Affecting the Market

- 3.4. Market Trends

- 3.4.1. Increase in Road Infrastructure Investment is Expected to Propel the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Infrastructure Industry in India Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 5.1.1. Social Infrastructure

- 5.1.2. Transportation Infrastructure

- 5.1.3. Extraction Infrastructure

- 5.1.4. Manufacturing Infrastructure

- 5.1.5. Utilities Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Key States

- 5.2.1. Maharashtra

- 5.2.2. Karnataka

- 5.2.3. Delhi

- 5.2.4. Telangana

- 5.2.5. Other States

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 6. North America Infrastructure Industry in India Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 6.1.1. Social Infrastructure

- 6.1.2. Transportation Infrastructure

- 6.1.3. Extraction Infrastructure

- 6.1.4. Manufacturing Infrastructure

- 6.1.5. Utilities Infrastructure

- 6.2. Market Analysis, Insights and Forecast - by Key States

- 6.2.1. Maharashtra

- 6.2.2. Karnataka

- 6.2.3. Delhi

- 6.2.4. Telangana

- 6.2.5. Other States

- 6.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 7. South America Infrastructure Industry in India Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 7.1.1. Social Infrastructure

- 7.1.2. Transportation Infrastructure

- 7.1.3. Extraction Infrastructure

- 7.1.4. Manufacturing Infrastructure

- 7.1.5. Utilities Infrastructure

- 7.2. Market Analysis, Insights and Forecast - by Key States

- 7.2.1. Maharashtra

- 7.2.2. Karnataka

- 7.2.3. Delhi

- 7.2.4. Telangana

- 7.2.5. Other States

- 7.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 8. Europe Infrastructure Industry in India Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 8.1.1. Social Infrastructure

- 8.1.2. Transportation Infrastructure

- 8.1.3. Extraction Infrastructure

- 8.1.4. Manufacturing Infrastructure

- 8.1.5. Utilities Infrastructure

- 8.2. Market Analysis, Insights and Forecast - by Key States

- 8.2.1. Maharashtra

- 8.2.2. Karnataka

- 8.2.3. Delhi

- 8.2.4. Telangana

- 8.2.5. Other States

- 8.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 9. Middle East & Africa Infrastructure Industry in India Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 9.1.1. Social Infrastructure

- 9.1.2. Transportation Infrastructure

- 9.1.3. Extraction Infrastructure

- 9.1.4. Manufacturing Infrastructure

- 9.1.5. Utilities Infrastructure

- 9.2. Market Analysis, Insights and Forecast - by Key States

- 9.2.1. Maharashtra

- 9.2.2. Karnataka

- 9.2.3. Delhi

- 9.2.4. Telangana

- 9.2.5. Other States

- 9.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 10. Asia Pacific Infrastructure Industry in India Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 10.1.1. Social Infrastructure

- 10.1.2. Transportation Infrastructure

- 10.1.3. Extraction Infrastructure

- 10.1.4. Manufacturing Infrastructure

- 10.1.5. Utilities Infrastructure

- 10.2. Market Analysis, Insights and Forecast - by Key States

- 10.2.1. Maharashtra

- 10.2.2. Karnataka

- 10.2.3. Delhi

- 10.2.4. Telangana

- 10.2.5. Other States

- 10.1. Market Analysis, Insights and Forecast - by Infrastructure segment

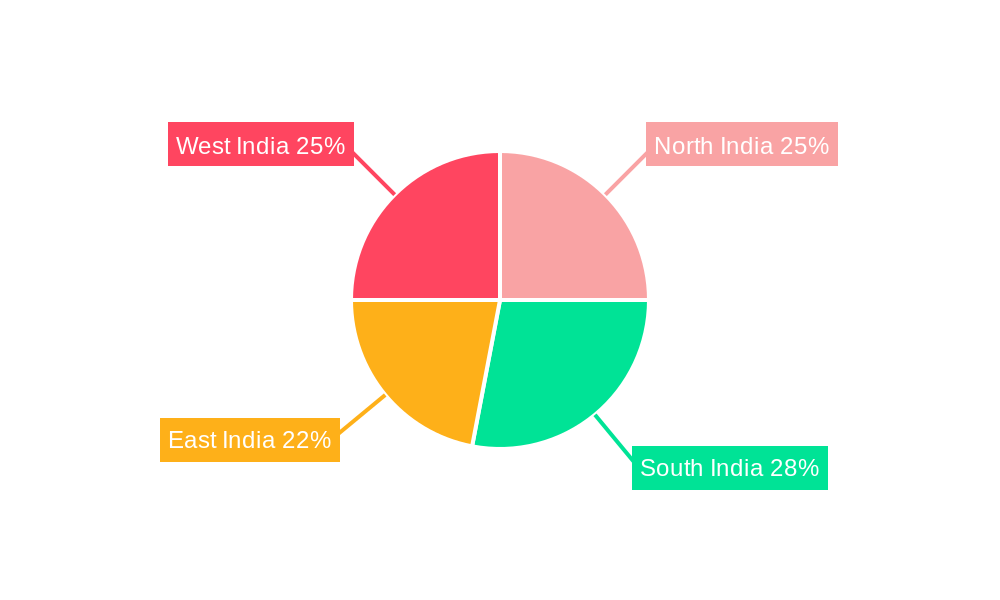

- 11. North India Infrastructure Industry in India Analysis, Insights and Forecast, 2019-2031

- 12. South India Infrastructure Industry in India Analysis, Insights and Forecast, 2019-2031

- 13. East India Infrastructure Industry in India Analysis, Insights and Forecast, 2019-2031

- 14. West India Infrastructure Industry in India Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Shapoorji Pallonji & Co Ltd

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Lanco Infratech Limited

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Hindustan Construction Co Ltd

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Reliance Infrastructure Limited**List Not Exhaustive 6 3 Other Companie

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Larsen & Toubro Limited

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Gammon India Ltd

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Tata Projects Ltd

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Nagarjuna Construction Company Limited (NCC Ltd)

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Jaiprakash Associates Ltd

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Simplex Infrastructures Ltd

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Shapoorji Pallonji & Co Ltd

List of Figures

- Figure 1: Global Infrastructure Industry in India Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: India Infrastructure Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 3: India Infrastructure Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Infrastructure Industry in India Revenue (Million), by Infrastructure segment 2024 & 2032

- Figure 5: North America Infrastructure Industry in India Revenue Share (%), by Infrastructure segment 2024 & 2032

- Figure 6: North America Infrastructure Industry in India Revenue (Million), by Key States 2024 & 2032

- Figure 7: North America Infrastructure Industry in India Revenue Share (%), by Key States 2024 & 2032

- Figure 8: North America Infrastructure Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Infrastructure Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Infrastructure Industry in India Revenue (Million), by Infrastructure segment 2024 & 2032

- Figure 11: South America Infrastructure Industry in India Revenue Share (%), by Infrastructure segment 2024 & 2032

- Figure 12: South America Infrastructure Industry in India Revenue (Million), by Key States 2024 & 2032

- Figure 13: South America Infrastructure Industry in India Revenue Share (%), by Key States 2024 & 2032

- Figure 14: South America Infrastructure Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Infrastructure Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Infrastructure Industry in India Revenue (Million), by Infrastructure segment 2024 & 2032

- Figure 17: Europe Infrastructure Industry in India Revenue Share (%), by Infrastructure segment 2024 & 2032

- Figure 18: Europe Infrastructure Industry in India Revenue (Million), by Key States 2024 & 2032

- Figure 19: Europe Infrastructure Industry in India Revenue Share (%), by Key States 2024 & 2032

- Figure 20: Europe Infrastructure Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Infrastructure Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Infrastructure Industry in India Revenue (Million), by Infrastructure segment 2024 & 2032

- Figure 23: Middle East & Africa Infrastructure Industry in India Revenue Share (%), by Infrastructure segment 2024 & 2032

- Figure 24: Middle East & Africa Infrastructure Industry in India Revenue (Million), by Key States 2024 & 2032

- Figure 25: Middle East & Africa Infrastructure Industry in India Revenue Share (%), by Key States 2024 & 2032

- Figure 26: Middle East & Africa Infrastructure Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Infrastructure Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Infrastructure Industry in India Revenue (Million), by Infrastructure segment 2024 & 2032

- Figure 29: Asia Pacific Infrastructure Industry in India Revenue Share (%), by Infrastructure segment 2024 & 2032

- Figure 30: Asia Pacific Infrastructure Industry in India Revenue (Million), by Key States 2024 & 2032

- Figure 31: Asia Pacific Infrastructure Industry in India Revenue Share (%), by Key States 2024 & 2032

- Figure 32: Asia Pacific Infrastructure Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Infrastructure Industry in India Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Infrastructure Industry in India Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Infrastructure Industry in India Revenue Million Forecast, by Infrastructure segment 2019 & 2032

- Table 3: Global Infrastructure Industry in India Revenue Million Forecast, by Key States 2019 & 2032

- Table 4: Global Infrastructure Industry in India Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Infrastructure Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Infrastructure Industry in India Revenue Million Forecast, by Infrastructure segment 2019 & 2032

- Table 11: Global Infrastructure Industry in India Revenue Million Forecast, by Key States 2019 & 2032

- Table 12: Global Infrastructure Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Infrastructure Industry in India Revenue Million Forecast, by Infrastructure segment 2019 & 2032

- Table 17: Global Infrastructure Industry in India Revenue Million Forecast, by Key States 2019 & 2032

- Table 18: Global Infrastructure Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Brazil Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Argentina Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of South America Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Infrastructure Industry in India Revenue Million Forecast, by Infrastructure segment 2019 & 2032

- Table 23: Global Infrastructure Industry in India Revenue Million Forecast, by Key States 2019 & 2032

- Table 24: Global Infrastructure Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Kingdom Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Germany Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: France Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Spain Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Russia Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Benelux Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Nordics Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Infrastructure Industry in India Revenue Million Forecast, by Infrastructure segment 2019 & 2032

- Table 35: Global Infrastructure Industry in India Revenue Million Forecast, by Key States 2019 & 2032

- Table 36: Global Infrastructure Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Turkey Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Israel Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: GCC Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: North Africa Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: South Africa Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Middle East & Africa Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Infrastructure Industry in India Revenue Million Forecast, by Infrastructure segment 2019 & 2032

- Table 44: Global Infrastructure Industry in India Revenue Million Forecast, by Key States 2019 & 2032

- Table 45: Global Infrastructure Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 46: China Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: India Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Japan Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Korea Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: ASEAN Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Oceania Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Asia Pacific Infrastructure Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Infrastructure Industry in India?

The projected CAGR is approximately 9.57%.

2. Which companies are prominent players in the Infrastructure Industry in India?

Key companies in the market include Shapoorji Pallonji & Co Ltd, Lanco Infratech Limited, Hindustan Construction Co Ltd, Reliance Infrastructure Limited**List Not Exhaustive 6 3 Other Companie, Larsen & Toubro Limited, Gammon India Ltd, Tata Projects Ltd, Nagarjuna Construction Company Limited (NCC Ltd), Jaiprakash Associates Ltd, Simplex Infrastructures Ltd.

3. What are the main segments of the Infrastructure Industry in India?

The market segments include Infrastructure segment, Key States.

4. Can you provide details about the market size?

The market size is estimated to be USD 204.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Urbanization is Driving the Market; Surge in Foreign Direct Investments is Driving the Market.

6. What are the notable trends driving market growth?

Increase in Road Infrastructure Investment is Expected to Propel the Market Growth.

7. Are there any restraints impacting market growth?

Bureaucratic Processes are Affecting the Market; Environmental Concerns and Regulatory Hurdles are Affecting the Market.

8. Can you provide examples of recent developments in the market?

February 2024: Tata Steel, a prominent private steel firm, unveiled its partnership with South Eastern Railway (SER). The collaboration aims to foster sustainable rail infrastructure by leveraging slag-based aggregates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Infrastructure Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Infrastructure Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Infrastructure Industry in India?

To stay informed about further developments, trends, and reports in the Infrastructure Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence