Key Insights

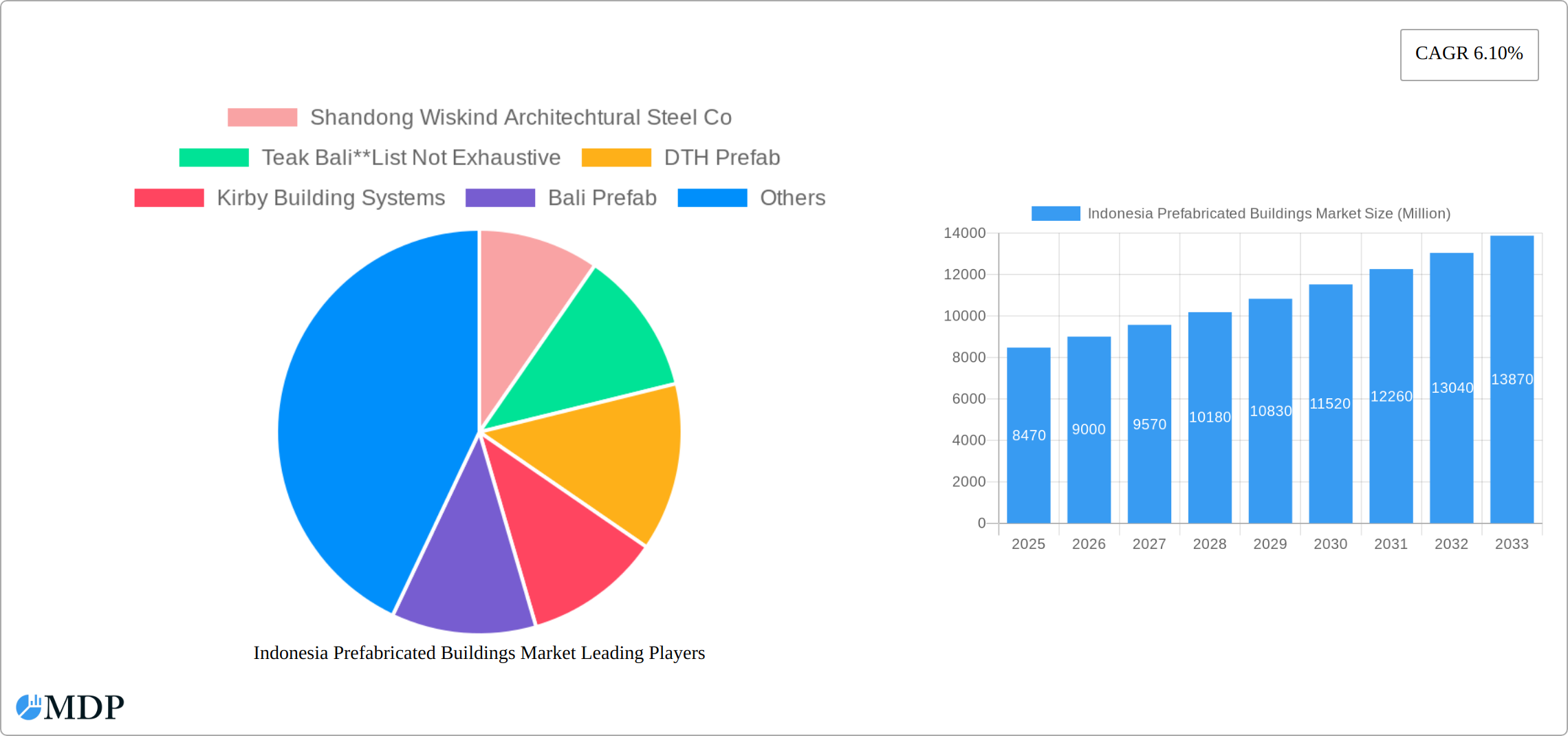

The Indonesian prefabricated buildings market, valued at $8.47 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.10% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, rapid urbanization and infrastructure development in Indonesia are creating a significant demand for cost-effective and quickly deployable housing and commercial spaces. Prefabricated buildings offer a compelling solution, reducing construction time and labor costs compared to traditional methods. Secondly, the government's focus on improving housing affordability and addressing the country's housing deficit is further stimulating market growth. This is evident in supportive policies and initiatives promoting sustainable and efficient construction techniques. Finally, increasing awareness of prefabricated building's environmental benefits, such as reduced waste and energy consumption, is contributing to their rising popularity among environmentally conscious developers and consumers. The market is segmented by material type (concrete, glass, metal, timber, and others) and application (residential, commercial, and others encompassing industrial, institutional, and infrastructure projects). Key players in the Indonesian market include Shandong Wiskind Architectural Steel Co., Teak Bali, DTH Prefab, Kirby Building Systems, Bali Prefab, PT Touchwood, Laras Bali, Sanwa Prefab Technology, Karmod Prefabricated Technologies, and Prefab World Bali International, although the market also features numerous smaller, local companies.

The market's growth trajectory is expected to remain positive throughout the forecast period (2025-2033), although potential challenges exist. These include fluctuating material prices, the need for skilled labor to ensure quality construction, and potential regulatory hurdles. However, the long-term outlook remains optimistic, with continued government support, technological advancements in prefabrication, and a growing understanding of its advantages likely to offset these challenges. The dominance of specific material types and application segments will likely evolve as the market matures, with trends potentially favoring sustainable and innovative building solutions. Further research into specific regional variations within Indonesia and the competitive landscape could provide a more granular understanding of market dynamics and opportunities.

Indonesia Prefabricated Buildings Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Indonesia Prefabricated Buildings Market, offering invaluable insights for investors, industry stakeholders, and businesses seeking to enter this dynamic sector. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's current state, future trajectory, and key growth drivers. Expect detailed segmentation, analysis of leading players, and identification of lucrative opportunities. The report's findings are based on rigorous research, incorporating real-world data and expert analysis.

Indonesia Prefabricated Buildings Market Market Dynamics & Concentration

The Indonesian prefabricated buildings market exhibits a moderately concentrated landscape with several key players vying for market share. Market concentration is influenced by factors such as technological advancements, regulatory changes, and the increasing demand for sustainable construction solutions. While precise market share figures for individual companies remain proprietary, Shandong Wiskind Architectural Steel Co., Kirby Building Systems, and Karmod Prefabricated Technologies are recognized as significant players. The market has witnessed a moderate number of M&A activities (xx deals in the last 5 years) primarily focused on expanding geographic reach and enhancing technological capabilities.

- Innovation Drivers: Increased adoption of sustainable materials, advancements in modular construction techniques, and the integration of smart technologies are key innovation drivers.

- Regulatory Frameworks: Government initiatives promoting affordable housing and sustainable development significantly impact market growth. The regulatory environment continues to evolve, potentially creating both opportunities and challenges.

- Product Substitutes: Traditional construction methods remain a primary substitute; however, the rising demand for faster construction timelines and cost-effectiveness is driving the adoption of prefabricated buildings.

- End-User Trends: The increasing urbanization and the growing middle class fuel demand, particularly within the residential and commercial sectors. A shift toward sustainable and eco-friendly construction practices is also impacting consumer choices.

- M&A Activities: Consolidation is expected to increase in the coming years as larger players seek to gain scale and technological advantages.

Indonesia Prefabricated Buildings Market Industry Trends & Analysis

The Indonesian prefabricated buildings market is experiencing robust growth, driven by several key factors. The market's Compound Annual Growth Rate (CAGR) from 2019 to 2024 is estimated at xx%, with projections indicating continued expansion at a CAGR of xx% during the forecast period (2025-2033). Market penetration is currently at approximately xx%, expected to rise to xx% by 2033. This growth is largely propelled by government initiatives supporting infrastructure development, increasing urbanization, and rising demand for efficient and cost-effective construction solutions. Technological advancements, such as the use of Building Information Modeling (BIM) and 3D printing, are further accelerating market growth. Consumer preferences are shifting towards sustainable and eco-friendly building materials, creating opportunities for manufacturers offering such solutions. The competitive landscape is dynamic, with both domestic and international players vying for market dominance.

Leading Markets & Segments in Indonesia Prefabricated Buildings Market

The residential segment dominates the Indonesian prefabricated buildings market, accounting for approximately xx% of the total market share in 2024. This is primarily due to the high demand for affordable housing in rapidly urbanizing areas. Java remains the leading region, driven by high population density and substantial infrastructure investments. Within material types, metal is the most prevalent due to cost-effectiveness and durability, followed by concrete, which is favored for its strength and resilience.

Key Drivers for Residential Segment Dominance:

- Government Policies: Affordable housing initiatives and infrastructure development programs.

- Urbanization: Rapid population growth and migration to urban centers.

- Cost-Effectiveness: Prefabricated buildings often offer lower construction costs.

Key Drivers for Java's Market Leadership:

- High Population Density: Java is the most populous island in Indonesia.

- Infrastructure Development: Significant investments in infrastructure projects.

- Economic Activity: Higher concentration of economic activity and construction projects.

Material Type Dominance Analysis: Metal's popularity stems from its versatility, durability, and relatively lower cost compared to other materials. Concrete is used extensively in high-rise and larger-scale projects, while timber finds niche applications in certain architectural styles. The "Other Material Types" segment includes a variety of innovative materials, such as composite materials, that are gaining traction due to their enhanced performance characteristics.

Indonesia Prefabricated Buildings Market Product Developments

Recent product innovations in the Indonesian prefabricated buildings market focus on enhancing structural integrity, improving energy efficiency, and incorporating sustainable materials. Prefabricated modules are increasingly being designed for rapid assembly and adaptability to various climates and site conditions. The integration of smart building technologies is also gaining momentum, offering features such as energy monitoring and automated control systems. This trend reflects a broader shift towards smart and sustainable construction practices, aligning with evolving consumer preferences and regulatory requirements.

Key Drivers of Indonesia Prefabricated Buildings Market Growth

The rapid expansion of the Indonesian prefabricated buildings market is driven by a confluence of factors. Government initiatives promoting affordable housing and infrastructure development play a significant role. Technological advancements, including innovative construction techniques and the adoption of sustainable materials, are further accelerating market growth. The increasing urbanization and the growing middle class contribute to a surge in housing demand, providing a substantial impetus for this sector's expansion. The cost-effectiveness and efficiency of prefabricated construction methods compared to traditional methods also serve as a key growth driver.

Challenges in the Indonesia Prefabricated Buildings Market Market

The Indonesian prefabricated buildings market faces several challenges. Supply chain disruptions can impact the availability of materials and components, potentially leading to project delays and cost overruns. Regulatory hurdles and bureaucratic processes can create uncertainties and slow down project approvals. Competition from established traditional construction methods and the presence of numerous smaller players in the market can create pricing pressures. Furthermore, educating the market and potential clients on the benefits and acceptance of prefabricated construction methods remains an ongoing challenge. These issues collectively limit market growth to some extent.

Emerging Opportunities in Indonesia Prefabricated Buildings Market

The Indonesian prefabricated buildings market presents significant long-term growth potential. Technological breakthroughs in materials science and construction methods are expected to create opportunities for innovative product development. Strategic partnerships between manufacturers, developers, and technology providers can streamline construction processes and improve efficiency. Government policies promoting sustainable and affordable housing further enhance market prospects. The expansion of the market into previously underserved regions presents significant untapped opportunities.

Leading Players in the Indonesia Prefabricated Buildings Market Sector

- Shandong Wiskind Architectural Steel Co

- Teak Bali

- DTH Prefab

- Kirby Building Systems

- Bali Prefab

- PT Touchwood

- Laras Bali

- Sanwa Prefab Technology

- Karmod Prefabricated Technologies

- Prefab World Bali International

Key Milestones in Indonesia Prefabricated Buildings Market Industry

- April 2022: PT. Modern Panel Indonesia's new housing project utilizing earthquake-safe precast elements demonstrates the market's increasing focus on advanced construction techniques and sustainable solutions. This signifies a positive trend toward adoption of innovative materials and methods for improved safety and resilience.

- April 2022: NTT's Jakarta 3 Data Center showcases the applicability of prefabricated construction in large-scale commercial projects, highlighting the market's capacity to cater to the diverse needs of multiple sectors. The use of a modular design demonstrates a successful application of prefabrication in a high-demand segment.

Strategic Outlook for Indonesia Prefabricated Buildings Market Market

The Indonesian prefabricated buildings market holds immense future potential, driven by sustained infrastructure investments, urbanization, and technological advancements. Strategic collaborations among industry players, focusing on innovation and sustainability, will be crucial for realizing this potential. Companies that can effectively leverage technological advancements to create cost-effective, sustainable, and high-quality prefabricated buildings will be well-positioned to capture significant market share. Government support for sustainable construction practices will further enhance market growth and sustainability throughout the forecast period.

Indonesia Prefabricated Buildings Market Segmentation

-

1. Material Type

- 1.1. Concrete

- 1.2. Glass

- 1.3. Metal

- 1.4. Timber

- 1.5. Other Material Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Other Ap

Indonesia Prefabricated Buildings Market Segmentation By Geography

- 1. Indonesia

Indonesia Prefabricated Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Transport Infrstructure Investment

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Rising Property Prices to Increase the Adoption of Prefab Construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Prefabricated Buildings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Concrete

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Timber

- 5.1.5. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Shandong Wiskind Architechtural Steel Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Teak Bali**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DTH Prefab

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kirby Building Systems

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bali Prefab

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Touchwood

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Laras Bali

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sanwa Prefab Technology

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Karmod Prefabricated Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Prefab World Bali International

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Shandong Wiskind Architechtural Steel Co

List of Figures

- Figure 1: Indonesia Prefabricated Buildings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Prefabricated Buildings Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Prefabricated Buildings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Prefabricated Buildings Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 3: Indonesia Prefabricated Buildings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Indonesia Prefabricated Buildings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Indonesia Prefabricated Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Indonesia Prefabricated Buildings Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 7: Indonesia Prefabricated Buildings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Indonesia Prefabricated Buildings Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Prefabricated Buildings Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Indonesia Prefabricated Buildings Market?

Key companies in the market include Shandong Wiskind Architechtural Steel Co, Teak Bali**List Not Exhaustive, DTH Prefab, Kirby Building Systems, Bali Prefab, PT Touchwood, Laras Bali, Sanwa Prefab Technology, Karmod Prefabricated Technologies, Prefab World Bali International.

3. What are the main segments of the Indonesia Prefabricated Buildings Market?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Transport Infrstructure Investment.

6. What are the notable trends driving market growth?

Rising Property Prices to Increase the Adoption of Prefab Construction.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor.

8. Can you provide examples of recent developments in the market?

April 2022: PT. Modern Panel Indonesia, a subsidiary of Modernland, one of Indonesia's leading developers, announced a new housing project using tested, earthquake-safe precast elements. The prefabricated elements are produced at the company's own automated precast plant equipped by the PROGRESS GROUP. The reinforcement for the precast elements is processed more effectively and automated with the new mesh welding plant M-System BlueMesh from the leading automation machinery provider.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Prefabricated Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Prefabricated Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Prefabricated Buildings Market?

To stay informed about further developments, trends, and reports in the Indonesia Prefabricated Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence