Key Insights

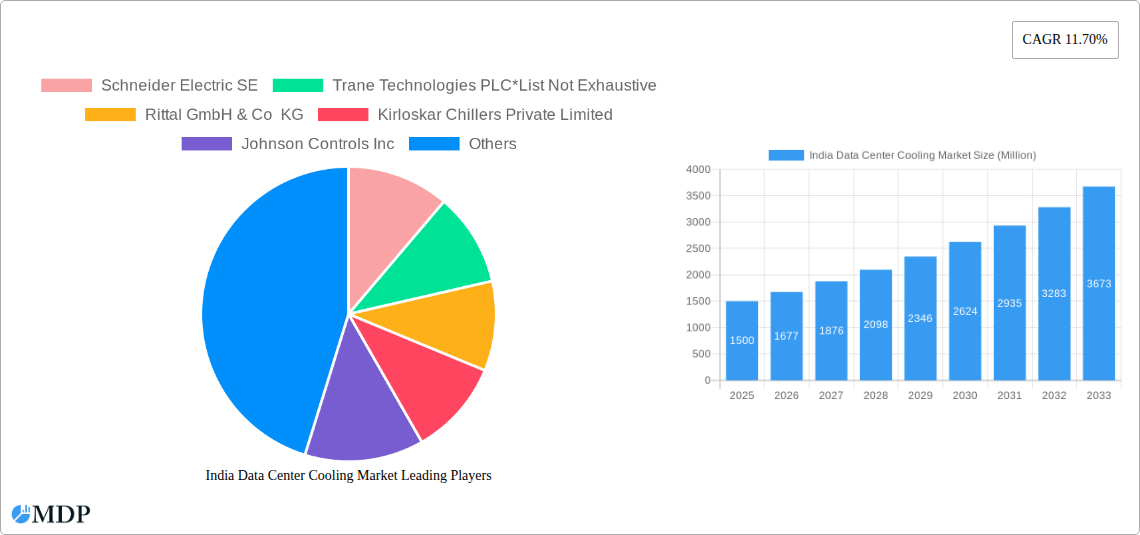

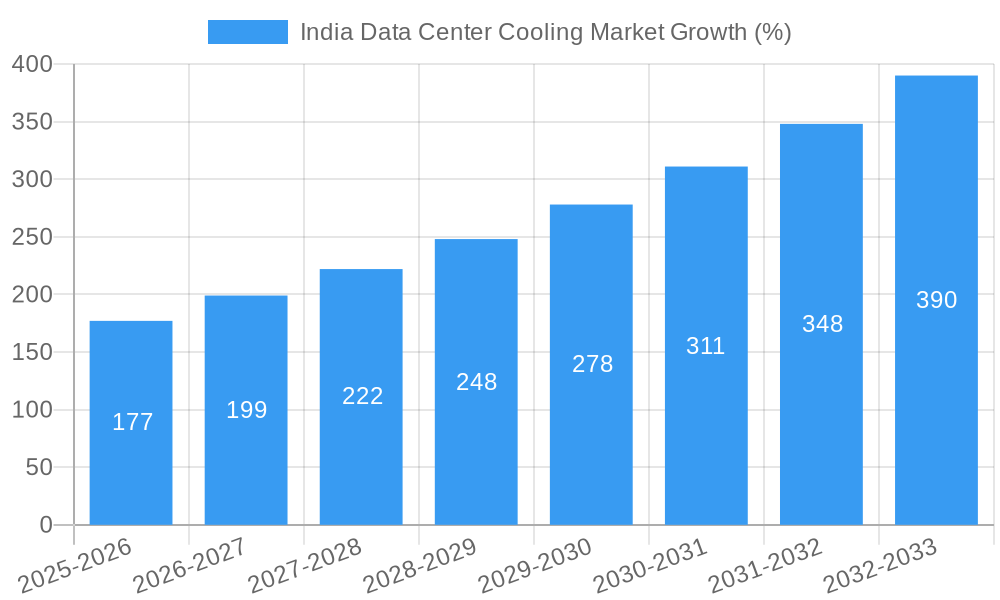

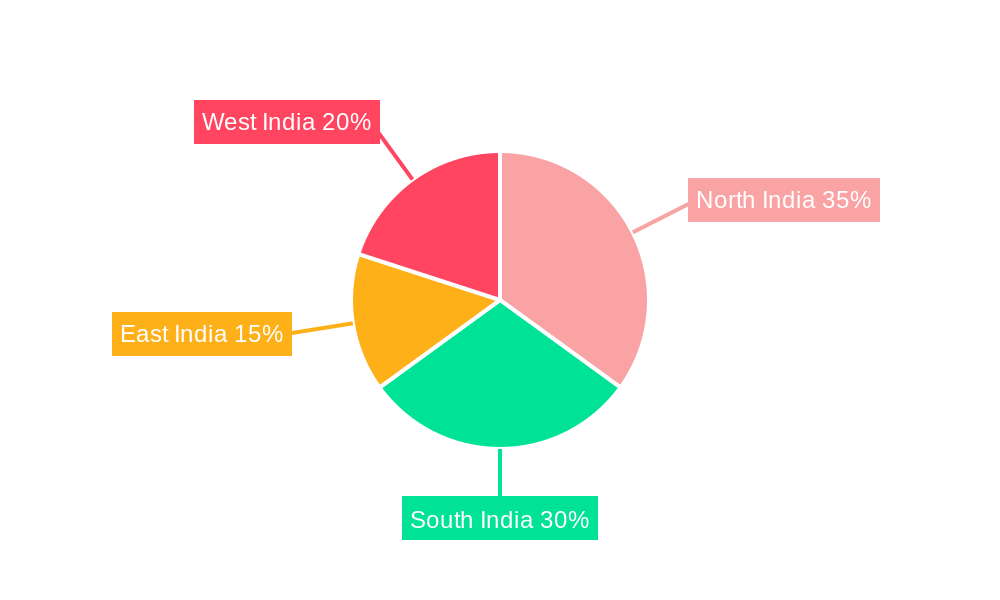

The India data center cooling market is experiencing robust growth, driven by the burgeoning digital economy and increasing adoption of cloud computing and big data analytics. The market's compound annual growth rate (CAGR) of 11.70% from 2019 to 2024 indicates significant expansion, projected to continue throughout the forecast period (2025-2033). Key drivers include rising data center construction, stringent requirements for reliable power and cooling infrastructure, and the increasing demand for energy-efficient cooling solutions. The market is segmented by cooling technology (air-based, liquid-based, and evaporative cooling) and end-user (IT & telecommunication, BFSI, government, media & entertainment, and others). Air-based cooling currently dominates the market due to its cost-effectiveness and established infrastructure; however, liquid-based and evaporative cooling technologies are gaining traction due to their higher efficiency and capacity to handle increasingly dense server deployments. Regional variations exist, with metropolitan areas in North and South India demonstrating higher market concentration due to established IT hubs and greater demand. Leading companies like Schneider Electric, Trane Technologies, Rittal, and others are actively engaged in providing a comprehensive range of cooling solutions to meet the growing needs of data centers across India. This market presents significant investment opportunities for vendors focusing on advanced technologies like liquid cooling and innovative energy management strategies.

The significant growth in the India data center cooling market is fueled by several factors, including government initiatives to promote digital infrastructure, a thriving startup ecosystem, and expanding 5G network deployments. The BFSI and IT & Telecommunication sectors are major drivers, demanding reliable and efficient cooling solutions to ensure the uptime and performance of their critical IT infrastructure. While air-based cooling remains prevalent, the rising power consumption and heat density in data centers are pushing adoption of more efficient technologies like liquid cooling and evaporative cooling. The focus is shifting towards sustainability and energy efficiency, leading to increased adoption of solutions that minimize environmental impact. Over the next decade, the continued growth of the data center market, coupled with technological advancements in cooling solutions, will propel the India data center cooling market to substantial heights. Regional disparities will likely persist, but significant investments in infrastructure across all regions of India promise to foster a more evenly distributed market over the long term.

India Data Center Cooling Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning India Data Center Cooling market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages rigorous research methodologies to deliver actionable intelligence. The market is segmented by cooling technology (Air-based, Liquid-based, Evaporative) and end-user (IT & Telecommunication, BFSI, Government, Media & Entertainment, Other). Key players like Schneider Electric SE, Trane Technologies PLC, Rittal GmbH & Co KG, Kirloskar Chillers Private Limited, Johnson Controls Inc, Mitsubishi Heavy Industries Thermal Systems Ltd, Stulz GmbH, Vertiv Group Corp, Asetek AS, and Alfa Laval AB are analyzed for their market presence and strategic initiatives. The report projects a market valued at XX Million by 2025, exhibiting a CAGR of XX% during the forecast period.

India Data Center Cooling Market Market Dynamics & Concentration

The India Data Center Cooling market is characterized by a moderately concentrated landscape, with a handful of multinational corporations holding significant market share. However, the presence of several domestic players and emerging startups is fostering healthy competition. Market concentration is influenced by factors such as technological innovation, regulatory policies promoting energy efficiency, the increasing adoption of sustainable cooling solutions, and the growing demand for advanced data center infrastructure.

Several key factors drive innovation:

- Stringent energy regulations: Government initiatives promoting energy efficiency are pushing adoption of energy-saving cooling technologies.

- Growing data center density: Increased data traffic and digital transformation initiatives necessitate more efficient cooling systems.

- Technological advancements: The introduction of liquid cooling and immersion cooling technologies is disrupting the traditional air-based cooling dominance.

Mergers and acquisitions (M&A) activity is relatively moderate, with xx deals reported between 2019 and 2024. Key drivers for M&A include expansion into new markets, access to advanced technologies, and enhanced market share. The market share of the top 5 players is estimated at approximately XX% in 2025, indicating a moderately consolidated market structure. However, this is expected to evolve with technological innovation and increasing competition from smaller players entering the sector. The substitution of traditional cooling methods with more efficient and environmentally friendly technologies is a significant trend impacting the market dynamics.

India Data Center Cooling Market Industry Trends & Analysis

The India Data Center Cooling market is experiencing robust growth, fueled by several key factors. The rapid expansion of the IT and telecommunications sector, the increasing adoption of cloud computing and big data analytics, and the rising demand for reliable and efficient data center infrastructure are major growth drivers. The market’s CAGR is projected at XX% during the forecast period (2025-2033), indicating a significant expansion. Market penetration of advanced cooling technologies like liquid cooling is still relatively low, presenting considerable growth opportunities. Consumer preferences are shifting towards energy-efficient and environmentally sustainable solutions, leading to increased adoption of green cooling technologies. The competitive dynamics are shaped by technological advancements, price competition, and the growing focus on providing customized solutions tailored to specific data center needs. The market is witnessing a gradual shift from traditional air-based cooling towards more efficient liquid and evaporative cooling solutions. This transition is driven by the increasing need to handle higher heat loads in data centers while reducing energy consumption.

Leading Markets & Segments in India Data Center Cooling Market

The IT & Telecommunication sector is the dominant end-user segment, accounting for approximately XX% of the market share in 2025. This is primarily driven by the rapid growth of the digital economy and the increasing demand for data storage and processing capabilities.

Key Drivers for IT & Telecommunication Segment:

- High data center density.

- Growing cloud adoption.

- Significant investments in data infrastructure.

Among cooling technologies, air-based cooling continues to dominate in 2025, holding approximately XX% market share due to its relatively lower initial investment cost. However, liquid-based cooling is witnessing substantial growth, driven by its higher efficiency and ability to handle higher heat loads. The BFSI and Government sectors also present significant growth potential, driven by the increasing adoption of digital technologies and enhanced security needs. Major metropolitan areas are witnessing higher growth rates owing to the concentration of data centers and IT infrastructure. Government policies aimed at stimulating digital transformation and providing tax incentives are further propelling the market’s expansion.

India Data Center Cooling Market Product Developments

Recent years have witnessed significant product innovations in the India Data Center Cooling market, with a focus on developing energy-efficient and sustainable solutions. The introduction of advanced liquid cooling technologies, including immersion cooling, is gaining traction due to their superior heat dissipation capabilities. Manufacturers are also integrating advanced features such as AI-powered monitoring and control systems to optimize cooling efficiency and reduce energy consumption. These advancements are improving the overall reliability and cost-effectiveness of data center cooling systems, enhancing their market fit and competitiveness.

Key Drivers of India Data Center Cooling Market Growth

The growth of the India Data Center Cooling market is driven by a combination of technological, economic, and regulatory factors. Technological advancements, such as liquid cooling and AI-powered management systems, are enhancing efficiency and reducing energy costs. The booming digital economy is fueling increased demand for data centers, leading to high growth in the market. Furthermore, supportive government regulations, aimed at promoting energy efficiency and sustainable practices, are creating a favorable environment for growth.

Challenges in the India Data Center Cooling Market

The India Data Center Cooling market faces challenges such as high initial investment costs for advanced cooling technologies, potential supply chain disruptions impacting the availability of components, and intense competition among established players and new entrants. Regulatory hurdles related to environmental compliance and energy efficiency standards also pose challenges. These factors can lead to increased operational costs and potentially hinder market growth. The xx% increase in raw material costs during 2022-2023 also added to the financial challenges.

Emerging Opportunities in India Data Center Cooling Market

The long-term growth of the India Data Center Cooling market is supported by several promising opportunities. Technological breakthroughs in areas like immersion cooling and AI-driven optimization are expected to unlock significant efficiency gains. Strategic partnerships between technology providers and data center operators can accelerate the adoption of innovative solutions. Moreover, the expansion of data center infrastructure across tier-2 and tier-3 cities presents considerable growth potential.

Leading Players in the India Data Center Cooling Market Sector

- Schneider Electric SE

- Trane Technologies PLC

- Rittal GmbH & Co KG

- Kirloskar Chillers Private Limited

- Johnson Controls Inc

- Mitsubishi Heavy Industries Thermal Systems Ltd

- Stulz GmbH

- Vertiv Group Corp

- Asetek AS

- Alfa Laval AB

Key Milestones in India Data Center Cooling Market Industry

- May 2022: Intel invested USD 700 Million in liquid and immersion cooling research, launching a reference design. This significantly boosted interest in advanced cooling technologies.

- July 2022: ST Engineering launched a new cooling technology promising a 20% energy reduction (SGD104/kWh savings) for tropical climates, introducing a new competitor and innovative solution.

Strategic Outlook for India Data Center Cooling Market Market

The India Data Center Cooling market is poised for significant growth, driven by increasing data center deployments, technological innovation, and favorable government policies. Strategic partnerships, investments in research and development, and a focus on sustainable solutions will be crucial for companies seeking to capitalize on the market's long-term potential. The market's future trajectory is positive, with considerable opportunities for players who can adapt to evolving technological trends and customer needs.

India Data Center Cooling Market Segmentation

-

1. Cooling Technology

-

1.1. Air-based Cooling

- 1.1.1. Chiller and Economizer

- 1.1.2. CRAH

- 1.1.3. Cooling

- 1.1.4. Other Air-based Cooling Technologies

-

1.2. Liquid-based Cooling

- 1.2.1. Immersion Cooling

- 1.2.2. Direct-to-Chip Cooling

- 1.2.3. Rear-door Heat Exchanger

-

1.1. Air-based Cooling

-

2. Type

- 2.1. Hyperscaler (Owned and Leased)

- 2.2. Enterprise (On-premise)

- 2.3. Colocation

-

3. End-user Industry

- 3.1. IT and Telecom

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. Media and Entertainment

- 3.5. Federal and Institutional agencies

- 3.6. Other End-user Industries

India Data Center Cooling Market Segmentation By Geography

- 1. India

India Data Center Cooling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Volume of Digital Data; Emergence of Green Data Centers

- 3.3. Market Restrains

- 3.3.1 Costs

- 3.3.2 Adaptability Requirements

- 3.3.3 and Power Outages

- 3.4. Market Trends

- 3.4.1. Liquid-based Cooling is the Fastest Growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Data Center Cooling Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 5.1.1. Air-based Cooling

- 5.1.1.1. Chiller and Economizer

- 5.1.1.2. CRAH

- 5.1.1.3. Cooling

- 5.1.1.4. Other Air-based Cooling Technologies

- 5.1.2. Liquid-based Cooling

- 5.1.2.1. Immersion Cooling

- 5.1.2.2. Direct-to-Chip Cooling

- 5.1.2.3. Rear-door Heat Exchanger

- 5.1.1. Air-based Cooling

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Hyperscaler (Owned and Leased)

- 5.2.2. Enterprise (On-premise)

- 5.2.3. Colocation

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT and Telecom

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. Media and Entertainment

- 5.3.5. Federal and Institutional agencies

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 6. North India India Data Center Cooling Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Data Center Cooling Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Data Center Cooling Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Data Center Cooling Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Schneider Electric SE

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Trane Technologies PLC*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Rittal GmbH & Co KG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kirloskar Chillers Private Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Johnson Controls Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mitsubishi Heavy Industries Thermal Systems Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Stulz GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Vertiv Group Corp

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Asetek AS

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Alfa Laval AB

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Schneider Electric SE

List of Figures

- Figure 1: India Data Center Cooling Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Data Center Cooling Market Share (%) by Company 2024

List of Tables

- Table 1: India Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 3: India Data Center Cooling Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: India Data Center Cooling Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: India Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Data Center Cooling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Data Center Cooling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Data Center Cooling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Data Center Cooling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 12: India Data Center Cooling Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: India Data Center Cooling Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: India Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Data Center Cooling Market?

The projected CAGR is approximately 11.70%.

2. Which companies are prominent players in the India Data Center Cooling Market?

Key companies in the market include Schneider Electric SE, Trane Technologies PLC*List Not Exhaustive, Rittal GmbH & Co KG, Kirloskar Chillers Private Limited, Johnson Controls Inc, Mitsubishi Heavy Industries Thermal Systems Ltd, Stulz GmbH, Vertiv Group Corp, Asetek AS, Alfa Laval AB.

3. What are the main segments of the India Data Center Cooling Market?

The market segments include Cooling Technology, Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Volume of Digital Data; Emergence of Green Data Centers.

6. What are the notable trends driving market growth?

Liquid-based Cooling is the Fastest Growing Segment.

7. Are there any restraints impacting market growth?

Costs. Adaptability Requirements. and Power Outages.

8. Can you provide examples of recent developments in the market?

July 2022: ST Engineering, a prominent defense and engineering group, ventured into the data center cooling sector, introducing an innovative cooling technology. They claim that this technology has the potential to reduce energy consumption by 20% for operators situated in tropical climates, translating to an estimated saving of SGD104 per kilowatt-hour of heat load annually.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Data Center Cooling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Data Center Cooling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Data Center Cooling Market?

To stay informed about further developments, trends, and reports in the India Data Center Cooling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence