Key Insights

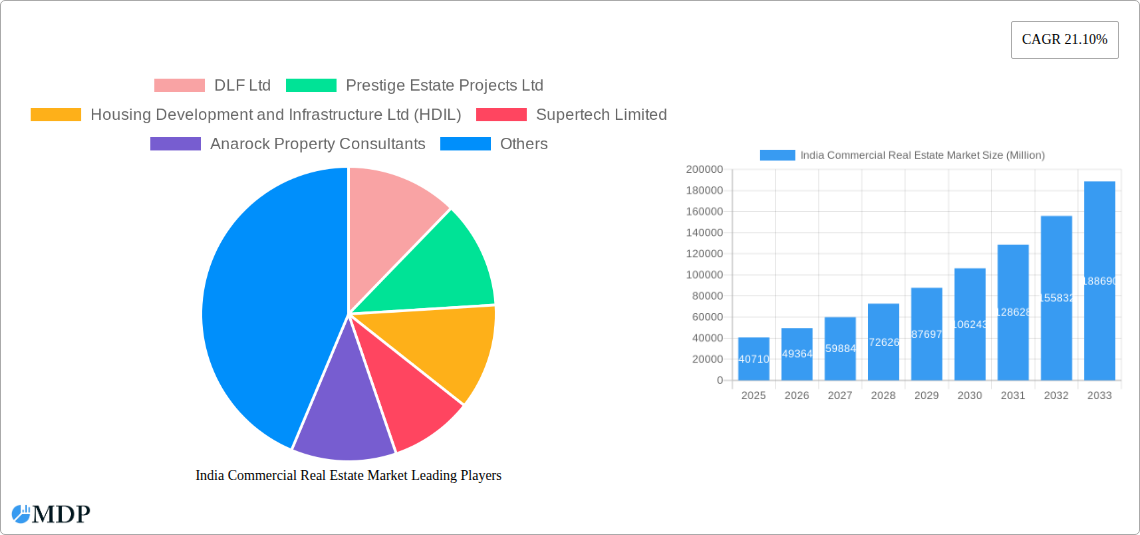

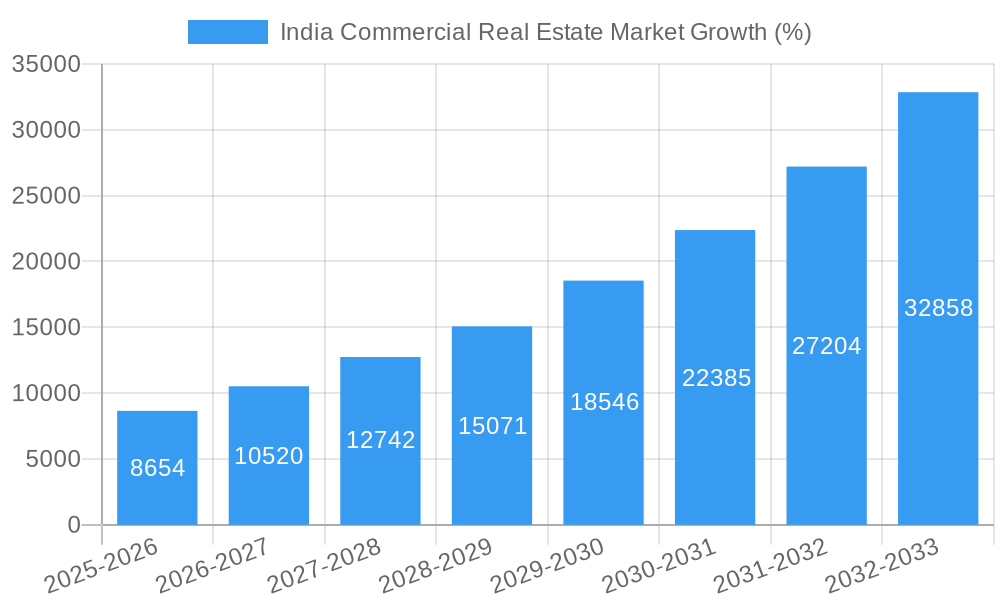

The India commercial real estate market, valued at ₹40.71 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 21.10% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning Indian economy, particularly in sectors like IT and technology, is creating significant demand for office spaces in major metropolitan areas like Mumbai, Bangalore, Delhi, and Hyderabad. The rise of e-commerce and the subsequent need for warehousing and logistics facilities are significantly boosting the industrial and logistics segment. Furthermore, increasing urbanization and a growing middle class are driving demand within the hospitality and retail sectors. While factors like fluctuating interest rates and potential economic slowdowns could present challenges, the overall market outlook remains positive, supported by continued government investments in infrastructure and a favorable regulatory environment.

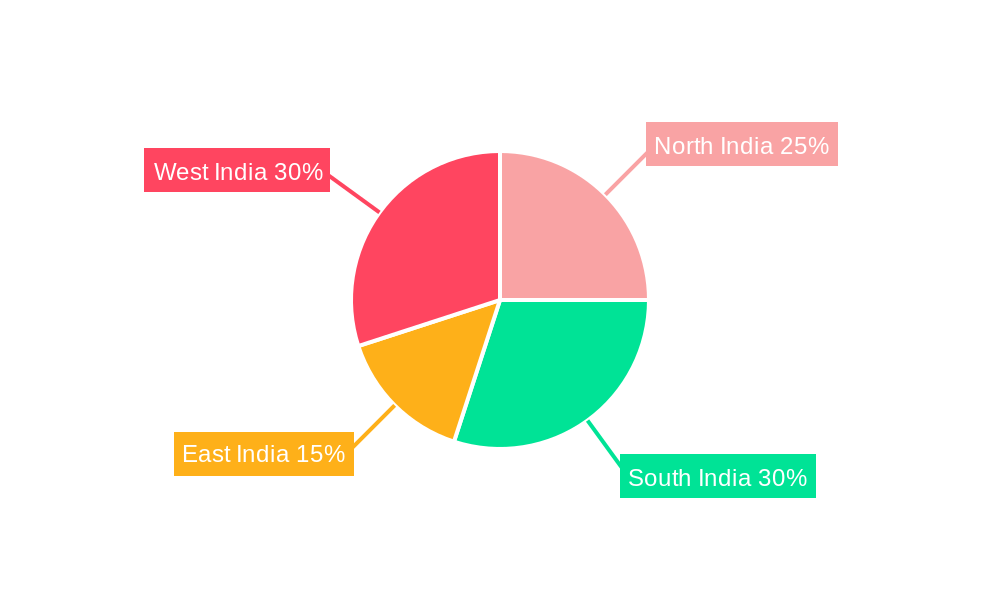

However, the market is not without its complexities. Competition among developers and real estate agencies is intense, requiring companies to offer innovative solutions and competitive pricing. The market's growth is concentrated in major cities, leaving smaller urban areas comparatively underserved. Successful companies will need to adapt to evolving technological advancements, such as smart building technologies and PropTech solutions, and also to focus on sustainability, given the growing environmental consciousness among businesses and investors. Analyzing market segmentation (offices, retail, industrial & logistics, hospitality) across key regions (North, South, East, and West India) will allow for a targeted approach and better risk mitigation. This market analysis highlights the potential for significant returns while emphasizing the need for strategic planning and a thorough understanding of the diverse factors shaping this dynamic market.

India Commercial Real Estate Market Report: 2019-2033

Uncover lucrative investment opportunities and navigate the dynamic landscape of India's commercial real estate sector with this comprehensive market analysis. This in-depth report provides a detailed examination of the Indian commercial real estate market from 2019 to 2033, offering invaluable insights for investors, developers, and industry stakeholders. We analyze market dynamics, trends, leading players, and future growth prospects, covering key segments and cities across India. The report uses 2025 as the base year and provides forecasts until 2033.

India Commercial Real Estate Market Dynamics & Concentration

This section analyzes the competitive landscape, regulatory environment, and key market forces shaping the Indian commercial real estate sector. The report examines market concentration, highlighting the market share of leading players such as DLF Ltd, Prestige Estate Projects Ltd, and Oberoi Realty. We explore the impact of mergers and acquisitions (M&A) activities, estimating xx Million deals in the historical period (2019-2024) and projecting xx Million deals for the forecast period (2025-2033). Innovation drivers, such as the adoption of PropTech solutions and sustainable building practices, are also analyzed, along with their impact on market growth. Regulatory frameworks, including zoning laws and environmental regulations, are evaluated for their influence on market dynamics. The report further examines the impact of substitute products, like co-working spaces, on traditional office spaces and emerging end-user trends, such as demand for flexible workspaces and green buildings.

- Market Concentration: DLF Ltd holds an estimated xx% market share in 2025, followed by Prestige Estate Projects Ltd with xx%.

- M&A Activity: xx Million deals were recorded between 2019 and 2024. The forecast suggests xx Million deals between 2025 and 2033.

- Innovation Drivers: Increased adoption of Building Information Modeling (BIM) and smart building technologies.

- Regulatory Framework: Impact of RERA (Real Estate (Regulation and Development) Act, 2016) on market transparency and consumer protection.

India Commercial Real Estate Market Industry Trends & Analysis

This section delves into the key trends driving the growth of the Indian commercial real estate market. We analyze market growth drivers, such as economic expansion, urbanization, and increasing foreign direct investment (FDI). Technological disruptions, like the rise of PropTech platforms and the adoption of smart building technologies, are examined for their influence on market dynamics. The report also explores evolving consumer preferences, focusing on the growing demand for flexible workspaces, sustainable buildings, and technologically advanced office spaces. Competitive dynamics, including the strategies of major players and the emergence of new entrants, are analyzed. We estimate a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033) and project a market penetration rate of xx% by 2033 for smart building technologies.

Leading Markets & Segments in India Commercial Real Estate Market

This section identifies the dominant regions and segments within the Indian commercial real estate market. Mumbai, Bangalore, Delhi, and Hyderabad are analyzed as key cities, along with other significant urban centers. We analyze the market performance of different commercial real estate types – offices, retail, industrial and logistics, and hospitality. Key drivers for each segment's dominance are identified using bullet points.

- Mumbai: Strong financial services sector, high demand for office spaces, and limited land availability drive high prices and strong growth.

- Bangalore: Tech hub status, significant IT/ITeS employment, and robust infrastructure development.

- Delhi: Government activity, presence of numerous multinational companies, and established real estate infrastructure.

- Hyderabad: Growing IT sector, presence of educational institutions, and lower property costs compared to Mumbai and Bangalore.

By Type:

- Offices: High demand from IT/ITeS, BFSI, and other sectors fuels significant growth.

- Retail: Growing consumer spending and the expansion of organized retail drive market expansion.

- Industrial & Logistics: E-commerce boom and the growth of manufacturing industries contribute to significant expansion.

- Hospitality: Tourism growth and increasing business travel boost demand for hotels and serviced apartments.

India Commercial Real Estate Market Product Developments

This section summarizes recent product innovations, applications, and competitive advantages in the Indian commercial real estate market. Technological advancements like smart building technologies, sustainable building materials, and integrated building management systems are key drivers of product innovation. These innovations offer enhanced operational efficiency, improved energy performance, and increased tenant satisfaction. The market is witnessing increased adoption of flexible workspace models (co-working spaces, serviced offices) catering to evolving tenant needs.

Key Drivers of India Commercial Real Estate Market Growth

The Indian commercial real estate market is propelled by several key growth drivers. Economic growth, increasing urbanization, and rising foreign direct investment (FDI) are major factors. Technological advancements, particularly in the areas of smart building technologies and PropTech solutions, are enhancing efficiency and attracting investment. Government initiatives promoting infrastructure development and affordable housing also contribute positively.

Challenges in the India Commercial Real Estate Market Market

Despite significant growth potential, the Indian commercial real estate market faces several challenges. Regulatory hurdles, including land acquisition complexities and bureaucratic processes, can delay projects and increase costs. Supply chain disruptions and fluctuations in material prices can affect profitability. Intense competition among developers and the availability of alternative investment options can also pose challenges. These factors can negatively impact project timelines and investor returns.

Emerging Opportunities in India Commercial Real Estate Market

The long-term growth prospects for the Indian commercial real estate market remain strong. Technological advancements, particularly in areas like artificial intelligence (AI) and the Internet of Things (IoT), offer significant opportunities for innovation and increased efficiency. Strategic partnerships between developers and technology providers can create new revenue streams and improve operational efficiencies. Expansion into Tier-2 and Tier-3 cities offers significant growth potential.

Leading Players in the India Commercial Real Estate Market Sector

- DLF Ltd

- Prestige Estate Projects Ltd

- Housing Development and Infrastructure Ltd (HDIL)

- Supertech Limited

- Anarock Property Consultants

- 99 Acres

- Oberoi Realty

- Sulekha Properties

- Godrej Properties Ltd

- Unitech Real Estate Pvt Ltd

- 6 3 Other Companies (Real Estate Agencies Startups Associations Etc )

- Brigade Group

- JLL India

- IndiaBulls Real Estate

- RE/MAX India

- MagicBricks

- HDIL Ltd

- Awfis

Key Milestones in India Commercial Real Estate Market Industry

- 2020: Increased adoption of virtual property tours due to COVID-19 pandemic.

- 2021: Government initiatives to boost infrastructure development and attract FDI.

- 2022: Significant increase in demand for flexible workspaces.

- 2023: Launch of several PropTech platforms focused on improving transparency and efficiency.

- 2024: Growth in sustainable building certifications.

Strategic Outlook for India Commercial Real Estate Market Market

The Indian commercial real estate market is poised for sustained growth, driven by robust economic expansion, urbanization, and technological advancements. The increasing demand for flexible workspaces, sustainable buildings, and technologically advanced office spaces presents significant opportunities for developers and investors. Strategic partnerships and the adoption of innovative technologies will be crucial for success in this dynamic market. Expansion into Tier-II and Tier-III cities offers substantial untapped potential.

India Commercial Real Estate Market Segmentation

-

1. Type

- 1.1. Offices

- 1.2. Retail

- 1.3. Industrial and Logistics

- 1.4. Hospitality

-

2. Key Cities

- 2.1. Mumbai

- 2.2. Bangalore

- 2.3. Delhi

- 2.4. Hyderabad

- 2.5. Other Cities

India Commercial Real Estate Market Segmentation By Geography

- 1. India

India Commercial Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 21.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing need for contemporary office spaces; Urban and semi-urban lodging are acting as other significant growth-inducing factors

- 3.3. Market Restrains

- 3.3.1. Availability of Financing

- 3.4. Market Trends

- 3.4.1. Office space demand to propel the market in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Offices

- 5.1.2. Retail

- 5.1.3. Industrial and Logistics

- 5.1.4. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Mumbai

- 5.2.2. Bangalore

- 5.2.3. Delhi

- 5.2.4. Hyderabad

- 5.2.5. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 DLF Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Prestige Estate Projects Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Housing Development and Infrastructure Ltd (HDIL)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Supertech Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Anarock Property Consultants

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 99 Acres

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Oberoi Realty

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Sulekha Properties

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Godrej Properties Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Unitech Real Estate Pvt Ltd*6 3 Other Companies (Real Estate Agencies Startups Associations Etc )

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Brigade Group

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 JLL India

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 IndiaBulls Real Estate

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 RE/MAX India

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 MagicBricks

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 HDIL Ltd

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Awfis

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.1 DLF Ltd

List of Figures

- Figure 1: India Commercial Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Commercial Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: India Commercial Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Commercial Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Commercial Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: India Commercial Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Commercial Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Commercial Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Commercial Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Commercial Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Commercial Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Commercial Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: India Commercial Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 12: India Commercial Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Commercial Real Estate Market?

The projected CAGR is approximately 21.10%.

2. Which companies are prominent players in the India Commercial Real Estate Market?

Key companies in the market include DLF Ltd, Prestige Estate Projects Ltd, Housing Development and Infrastructure Ltd (HDIL), Supertech Limited, Anarock Property Consultants, 99 Acres, Oberoi Realty, Sulekha Properties, Godrej Properties Ltd, Unitech Real Estate Pvt Ltd*6 3 Other Companies (Real Estate Agencies Startups Associations Etc ), Brigade Group, JLL India, IndiaBulls Real Estate, RE/MAX India, MagicBricks, HDIL Ltd, Awfis.

3. What are the main segments of the India Commercial Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing need for contemporary office spaces; Urban and semi-urban lodging are acting as other significant growth-inducing factors.

6. What are the notable trends driving market growth?

Office space demand to propel the market in India.

7. Are there any restraints impacting market growth?

Availability of Financing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Commercial Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Commercial Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Commercial Real Estate Market?

To stay informed about further developments, trends, and reports in the India Commercial Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence