Key Insights

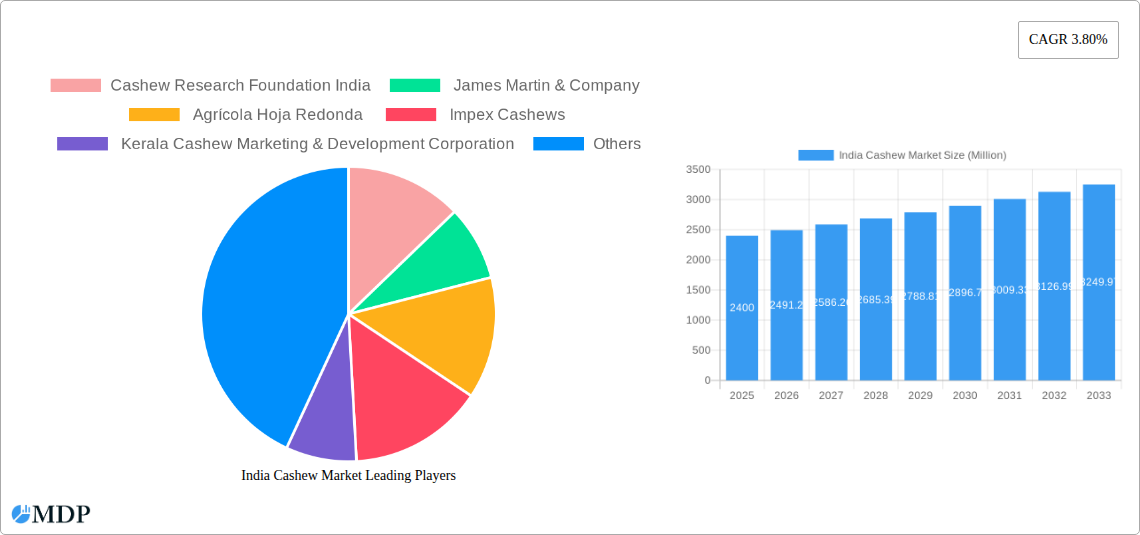

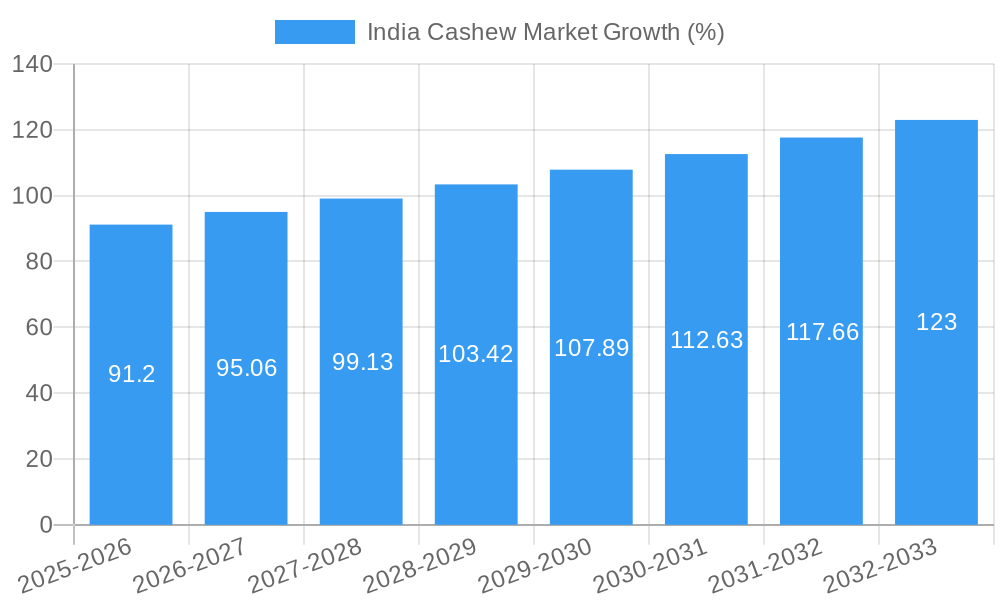

The India cashew market, valued at $2.40 billion in 2025, is projected to experience steady growth, driven by increasing consumer demand for nutritious snacks and the expanding food processing industry. The market's Compound Annual Growth Rate (CAGR) of 3.80% from 2025 to 2033 indicates a promising outlook. Key drivers include rising disposable incomes, shifting consumer preferences towards healthier snacks, and the growing popularity of cashew-based products in confectionery, baking, and ready-to-eat meals. The diverse product types, including whole cashews, broken cashews, cashew kernels, and cashew paste, cater to various applications and consumer needs. Export-oriented growth contributes significantly to the market's expansion, with major export destinations likely including Southeast Asia, the Middle East, and Europe. However, fluctuating cashew prices due to weather patterns and global supply chain disruptions pose a challenge. Competition among numerous domestic and international players, along with potential health concerns related to high-fat content, are factors that might restrain market growth to some extent. Nevertheless, strategic investments in processing technologies, focus on value-added products, and increased adoption of sustainable farming practices will likely shape the future of the India cashew market positively.

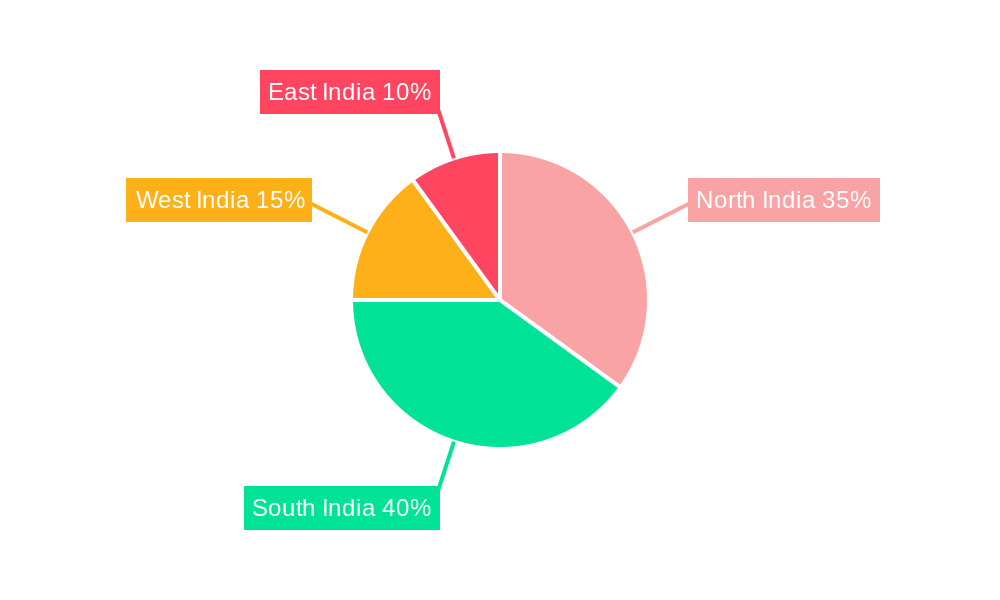

The segmentation of the market reveals strong performance across applications, with the food and beverage industry (including confectionery and baking) and the retail and consumer packaged goods sectors being major consumers. The regional distribution within India is likely skewed towards regions with robust agricultural infrastructure and export capabilities. Leading companies like Cashew Research Foundation India, James Martin & Company, and others, are playing a significant role in shaping the market dynamics through production, processing, and distribution networks. The forecast period of 2025-2033 offers promising opportunities for market expansion, with strategic initiatives by key players likely playing a key role in capturing market share and driving growth. Further analysis could focus on specific regional trends, consumer preference shifts, and evolving regulatory frameworks to generate more detailed market forecasts.

India Cashew Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India cashew market, covering market dynamics, industry trends, leading segments, key players, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders, investors, and researchers seeking to understand and capitalize on the growth potential of this dynamic market. The report leverages extensive data analysis and insights to deliver actionable strategies for success in the competitive Indian cashew landscape. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, registering a CAGR of xx% during the forecast period.

India Cashew Market Market Dynamics & Concentration

The Indian cashew market is characterized by a moderate level of concentration, with a few large players and numerous smaller firms. Market share is primarily divided among domestic processors and exporters. While exact figures are proprietary, key players collectively hold an estimated xx% market share. Innovation in processing techniques, particularly in kernel extraction (as detailed in the Key Milestones section), is a significant driver. Regulatory frameworks, including those related to food safety and export standards, play a vital role in shaping market dynamics. Product substitutes, such as other nuts and confectionery items, exert competitive pressure, impacting market growth. Consumer preferences are shifting towards healthier, sustainably sourced products, influencing demand for premium cashew varieties. M&A activity in the sector has been relatively modest in recent years, with an estimated xx M&A deals recorded during the historical period (2019-2024). Further consolidation is anticipated in the forecast period, driven by the desire for economies of scale and access to new markets.

India Cashew Market Industry Trends & Analysis

The Indian cashew market exhibits robust growth, propelled by rising domestic consumption fueled by increasing disposable incomes and changing dietary habits. Export demand, particularly to regions with a strong preference for Indian cashews, further contributes to market expansion. Technological advancements, such as the recently developed cashew kernel extraction machine, are improving efficiency and reducing costs, enhancing competitiveness. Consumer preferences are increasingly leaning towards convenient, ready-to-eat cashew products and value-added options. The competitive landscape is marked by both price competition and differentiation strategies based on quality, sustainability, and brand reputation. The market penetration of processed cashew products remains significant, particularly in urban areas, presenting opportunities for growth in untapped rural markets. The overall market is expected to experience a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033).

Leading Markets & Segments in India Cashew Market

By Application: The food and beverage industry accounts for the largest share of cashew consumption, followed by the confectionery and baking segments. The retail and consumer packaged goods sector also demonstrates substantial growth potential.

By Product Type: Cashew kernels constitute the dominant product segment, driven by their versatility and widespread use in various applications. Whole cashews and cashew paste also contribute significantly to overall market volume. Broken cashews represent a smaller but still important segment.

By End User: Exports account for a significant proportion of the total cashew market volume, with major export destinations including the xx, xx and xx. Domestic consumption also constitutes a considerable market segment, with regional variations in consumption patterns.

The Southern states of India, particularly Kerala and Karnataka, are the leading producers and processors of cashews in the country. This dominance is attributed to favorable climatic conditions, well-established processing infrastructure, and a skilled workforce. Key drivers for this regional dominance include supportive government policies, investment in research and development, and efficient supply chains.

India Cashew Market Product Developments

Recent product innovations focus on enhancing processing efficiency, improving product quality, and expanding the range of value-added cashew products. The introduction of the new cashew kernel extraction machine is a prime example of this technological advancement. This innovation optimizes kernel yield, reduces processing time, and improves overall cost-effectiveness, positioning Indian cashew processors competitively on the global stage. Market fit is strong for convenience-oriented products and those emphasizing health and sustainability.

Key Drivers of India Cashew Market Growth

Several factors contribute to the growth of the Indian cashew market. Rising disposable incomes and changing dietary preferences towards healthier snacks are major contributors. Government initiatives aimed at promoting cashew cultivation and supporting the industry also play a crucial role. Export demand, driven by global preference for Indian cashews' quality and taste, further fuels market growth. Technological advancements, such as the improved cashew kernel extraction machine, significantly improve efficiency and reduce production costs. Furthermore, the growing popularity of cashew-based confectionery and value-added products contribute to market expansion.

Challenges in the India Cashew Market Market

The Indian cashew market faces various challenges. Fluctuations in raw cashew prices and unpredictable weather patterns impact production and profitability. Competition from other nut varieties and confectionery items creates price pressure and affects market share. Furthermore, supply chain inefficiencies and the need for improved infrastructure in certain regions pose significant operational hurdles. Regulatory compliance and export procedures also present some difficulties for producers and exporters. These factors, collectively, limit the market's potential growth rate.

Emerging Opportunities in India Cashew Market

Significant opportunities exist for growth in the Indian cashew market. Technological innovations, such as automated processing and improved quality control, can enhance efficiency and product quality. Strategic partnerships between producers, processors, and retailers can improve supply chain management and market access. Expansion into new product categories, including organic and value-added cashew products, creates further opportunities for diversification and growth. Finally, tapping into the growing demand in untapped domestic and international markets can unlock considerable growth potential.

Leading Players in the India Cashew Market Sector

- Cashew Research Foundation India

- James Martin & Company

- Agrícola Hoja Redonda

- Impex Cashews

- Kerala Cashew Marketing & Development Corporation

- Agroindustrial Paramonga

- JK Cashews

- La Calera

- Agroindustrias Nobex

- Danper

- Camposol

- Hortifrut

Key Milestones in India Cashew Market Industry

- January 2024: Development of a groundbreaking cashew kernel extraction machine in New Delhi, boosting efficiency and output.

- October 2022: Proposal for a cashew festival in Goa to promote cashew cultivation and self-sufficiency.

- March 2022: Inauguration of a new research building for the Indian Council of Agricultural Research (ICAR)-Directorate of Cashew Research, enhancing research capabilities.

Strategic Outlook for India Cashew Market Market

The Indian cashew market presents a promising outlook for long-term growth. Technological advancements, strategic partnerships, and expansion into new markets are expected to drive future market potential. Focus on sustainable practices, product diversification, and enhanced supply chain efficiency will be crucial for maximizing growth opportunities. The market's ability to adapt to evolving consumer preferences and effectively address challenges will be instrumental in shaping its future trajectory.

India Cashew Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis (Volume and Value)

- 3. Import Market Analysis (Volume and Value)

- 4. Export Market Analysis (Volume and Value)

- 5. Price Trend Analysis

- 6. Production Analysis

- 7. Consumption Analysis (Volume and Value)

- 8. Import Market Analysis (Volume and Value)

- 9. Export Market Analysis (Volume and Value)

- 10. Price Trend Analysis

India Cashew Market Segmentation By Geography

- 1. India

India Cashew Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Climatic Conditions; Blooming Export Opportunities

- 3.3. Market Restrains

- 3.3.1. High Adoption Cost of Modern Technology; Increasing Insect Infestations

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Cashew Snacks

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Cashew Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis (Volume and Value)

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Volume and Value)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Volume and Value)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Production Analysis

- 5.7. Market Analysis, Insights and Forecast - by Consumption Analysis (Volume and Value)

- 5.8. Market Analysis, Insights and Forecast - by Import Market Analysis (Volume and Value)

- 5.9. Market Analysis, Insights and Forecast - by Export Market Analysis (Volume and Value)

- 5.10. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China India Cashew Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan India Cashew Market Analysis, Insights and Forecast, 2019-2031

- 8. India India Cashew Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea India Cashew Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan India Cashew Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia India Cashew Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific India Cashew Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Cashew Research Foundation India

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 James Martin & Company

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Agrícola Hoja Redonda

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Impex Cashews

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Kerala Cashew Marketing & Development Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Agroindustrial Paramonga

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 JK Cashews

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 La Calera

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Agroindustrias Nobex

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Danper

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Camposol

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Hortifrut

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Cashew Research Foundation India

List of Figures

- Figure 1: India Cashew Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Cashew Market Share (%) by Company 2024

List of Tables

- Table 1: India Cashew Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Cashew Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: India Cashew Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: India Cashew Market Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 5: India Cashew Market Revenue Million Forecast, by Consumption Analysis (Volume and Value) 2019 & 2032

- Table 6: India Cashew Market Volume Kiloton Forecast, by Consumption Analysis (Volume and Value) 2019 & 2032

- Table 7: India Cashew Market Revenue Million Forecast, by Import Market Analysis (Volume and Value) 2019 & 2032

- Table 8: India Cashew Market Volume Kiloton Forecast, by Import Market Analysis (Volume and Value) 2019 & 2032

- Table 9: India Cashew Market Revenue Million Forecast, by Export Market Analysis (Volume and Value) 2019 & 2032

- Table 10: India Cashew Market Volume Kiloton Forecast, by Export Market Analysis (Volume and Value) 2019 & 2032

- Table 11: India Cashew Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: India Cashew Market Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: India Cashew Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: India Cashew Market Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 15: India Cashew Market Revenue Million Forecast, by Consumption Analysis (Volume and Value) 2019 & 2032

- Table 16: India Cashew Market Volume Kiloton Forecast, by Consumption Analysis (Volume and Value) 2019 & 2032

- Table 17: India Cashew Market Revenue Million Forecast, by Import Market Analysis (Volume and Value) 2019 & 2032

- Table 18: India Cashew Market Volume Kiloton Forecast, by Import Market Analysis (Volume and Value) 2019 & 2032

- Table 19: India Cashew Market Revenue Million Forecast, by Export Market Analysis (Volume and Value) 2019 & 2032

- Table 20: India Cashew Market Volume Kiloton Forecast, by Export Market Analysis (Volume and Value) 2019 & 2032

- Table 21: India Cashew Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 22: India Cashew Market Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 23: India Cashew Market Revenue Million Forecast, by Region 2019 & 2032

- Table 24: India Cashew Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 25: India Cashew Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: India Cashew Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 27: China India Cashew Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: China India Cashew Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 29: Japan India Cashew Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Japan India Cashew Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 31: India India Cashew Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: India India Cashew Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 33: South Korea India Cashew Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: South Korea India Cashew Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 35: Taiwan India Cashew Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Taiwan India Cashew Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 37: Australia India Cashew Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Australia India Cashew Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 39: Rest of Asia-Pacific India Cashew Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Asia-Pacific India Cashew Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 41: India Cashew Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 42: India Cashew Market Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 43: India Cashew Market Revenue Million Forecast, by Consumption Analysis (Volume and Value) 2019 & 2032

- Table 44: India Cashew Market Volume Kiloton Forecast, by Consumption Analysis (Volume and Value) 2019 & 2032

- Table 45: India Cashew Market Revenue Million Forecast, by Import Market Analysis (Volume and Value) 2019 & 2032

- Table 46: India Cashew Market Volume Kiloton Forecast, by Import Market Analysis (Volume and Value) 2019 & 2032

- Table 47: India Cashew Market Revenue Million Forecast, by Export Market Analysis (Volume and Value) 2019 & 2032

- Table 48: India Cashew Market Volume Kiloton Forecast, by Export Market Analysis (Volume and Value) 2019 & 2032

- Table 49: India Cashew Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 50: India Cashew Market Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 51: India Cashew Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 52: India Cashew Market Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 53: India Cashew Market Revenue Million Forecast, by Consumption Analysis (Volume and Value) 2019 & 2032

- Table 54: India Cashew Market Volume Kiloton Forecast, by Consumption Analysis (Volume and Value) 2019 & 2032

- Table 55: India Cashew Market Revenue Million Forecast, by Import Market Analysis (Volume and Value) 2019 & 2032

- Table 56: India Cashew Market Volume Kiloton Forecast, by Import Market Analysis (Volume and Value) 2019 & 2032

- Table 57: India Cashew Market Revenue Million Forecast, by Export Market Analysis (Volume and Value) 2019 & 2032

- Table 58: India Cashew Market Volume Kiloton Forecast, by Export Market Analysis (Volume and Value) 2019 & 2032

- Table 59: India Cashew Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 60: India Cashew Market Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 61: India Cashew Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: India Cashew Market Volume Kiloton Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Cashew Market?

The projected CAGR is approximately 3.80%.

2. Which companies are prominent players in the India Cashew Market?

Key companies in the market include Cashew Research Foundation India , James Martin & Company , Agrícola Hoja Redonda , Impex Cashews , Kerala Cashew Marketing & Development Corporation , Agroindustrial Paramonga , JK Cashews , La Calera , Agroindustrias Nobex , Danper , Camposol , Hortifrut.

3. What are the main segments of the India Cashew Market?

The market segments include Production Analysis, Consumption Analysis (Volume and Value), Import Market Analysis (Volume and Value), Export Market Analysis (Volume and Value), Price Trend Analysis, Production Analysis, Consumption Analysis (Volume and Value), Import Market Analysis (Volume and Value), Export Market Analysis (Volume and Value), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Climatic Conditions; Blooming Export Opportunities.

6. What are the notable trends driving market growth?

Increasing Demand for Cashew Snacks.

7. Are there any restraints impacting market growth?

High Adoption Cost of Modern Technology; Increasing Insect Infestations.

8. Can you provide examples of recent developments in the market?

January 2024: Agricultural experts and engineers in New Delhi developed a groundbreaking machine that simplifies cashew kernel extraction. This will make kernel extraction faster and more cost-effective, saving labor costs and significantly increasing their overall cashew output.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Cashew Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Cashew Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Cashew Market?

To stay informed about further developments, trends, and reports in the India Cashew Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence