Key Insights

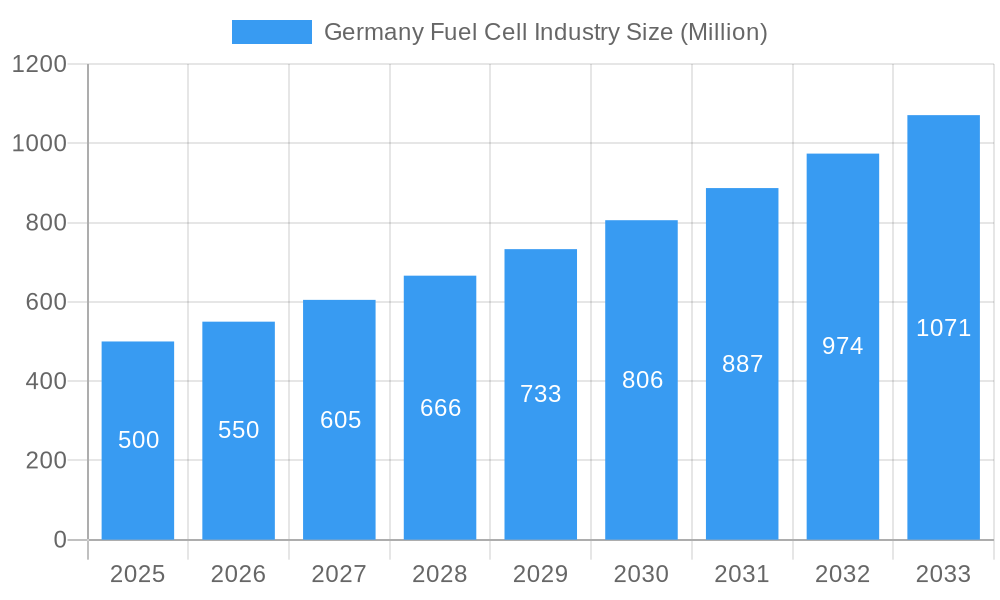

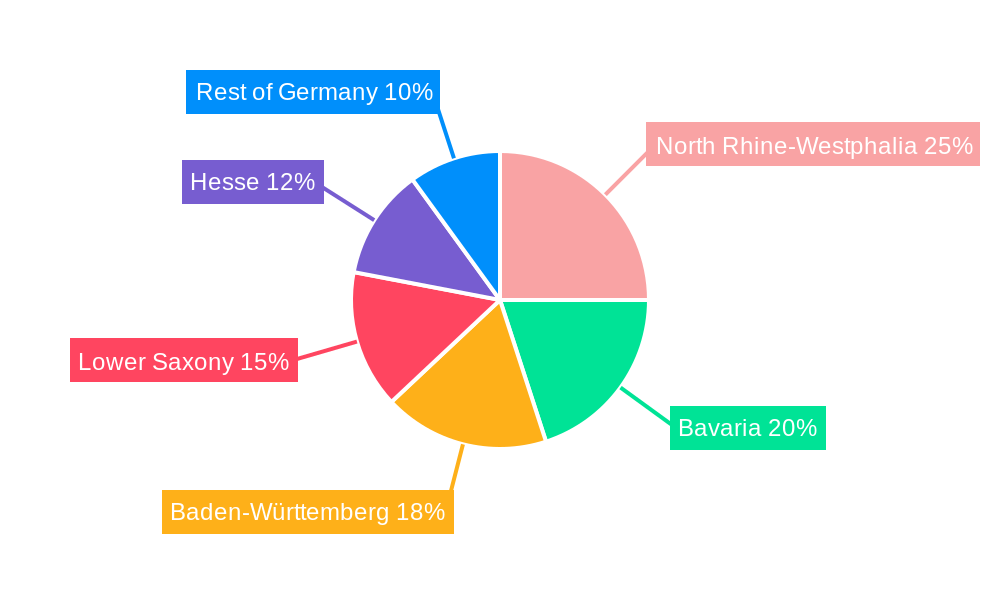

Germany's fuel cell sector is poised for substantial expansion, propelled by robust government backing for renewables and a decisive shift towards decarbonization. The market, projected to reach €10.64 billion in 2025, is forecast to achieve a Compound Annual Growth Rate (CAGR) of 25.9% by 2033. Key growth drivers include escalating demand for portable power in military and emergency services, alongside increasing adoption in stationary applications such as data center and residential backup power. While nascent, the transportation sector offers significant long-term potential for Fuel Cell Electric Vehicles (FCEVs) as technology and infrastructure mature. Technological advancements in Polymer Electrolyte Membrane Fuel Cells (PEMFC) and Solid Oxide Fuel Cells (SOFC) are enhancing efficiency and reducing costs. Leading companies are actively investing in R&D and market expansion, supported by Germany's strong industrial base and commitment to sustainability. Key regions driving this growth include North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse.

Germany Fuel Cell Industry Market Size (In Billion)

Challenges such as high initial investment costs and limited hydrogen refueling infrastructure require continued innovation, government incentives, and strategic partnerships. While PEMFCs currently lead, SOFCs are gaining traction for stationary power. Ongoing R&D is crucial for cost-effectiveness and market appeal, with supportive government policies for hydrogen production and utilization instrumental in fostering sustained industry growth.

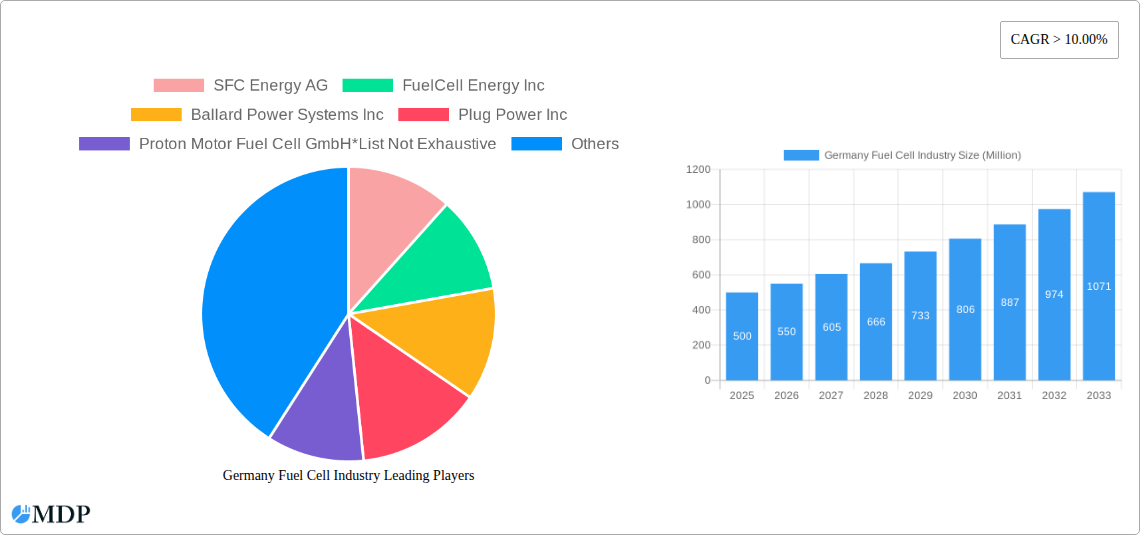

Germany Fuel Cell Industry Company Market Share

Germany Fuel Cell Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the booming German fuel cell industry, projecting significant growth from €XX Million in 2025 to €XX Million by 2033. Uncover key market dynamics, leading players, and emerging opportunities, empowering you to make informed strategic decisions. This report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The historical period analyzed is 2019-2024.

Germany Fuel Cell Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of the German fuel cell market, focusing on market concentration, innovation, regulations, and market activities. The German fuel cell market exhibits a moderately concentrated structure, with key players such as SFC Energy AG, FuelCell Energy Inc, Ballard Power Systems Inc, Plug Power Inc, Proton Motor Fuel Cell GmbH, and Hydrogenics Corporation holding significant market share. However, the presence of numerous smaller players indicates a dynamic and competitive environment.

- Market Share: The top 5 players account for approximately XX% of the market share in 2025, with SFC Energy AG holding the largest share at approximately XX%. This concentration is expected to slightly decrease by 2033 due to increased competition and market entry.

- Innovation Drivers: Government incentives, stringent emission regulations, and growing demand for clean energy are driving innovation in fuel cell technology. Research and development efforts focusing on improving efficiency, reducing costs, and expanding applications are prevalent.

- Regulatory Framework: Germany’s supportive policies, including subsidies and tax breaks for fuel cell technologies, have accelerated market growth. However, ongoing regulatory adjustments related to hydrogen infrastructure development will continue to influence market dynamics.

- Product Substitutes: The primary substitutes for fuel cells include traditional combustion engines, batteries, and other renewable energy sources. However, the increasing focus on decarbonization is bolstering the competitive advantage of fuel cells, particularly in transportation and stationary power applications.

- End-User Trends: The transportation sector is experiencing the most rapid adoption of fuel cell technology, driven by the increasing demand for zero-emission vehicles. The stationary power segment is also witnessing significant growth, especially in distributed generation applications.

- M&A Activities: The German fuel cell market has seen XX M&A deals in the last five years, with a focus on consolidating smaller players and accelerating technology integration. The deal count is expected to rise in the forecast period.

Germany Fuel Cell Industry Industry Trends & Analysis

The German fuel cell market is experiencing robust growth, driven by several key factors. The compound annual growth rate (CAGR) is estimated at XX% during the forecast period (2025-2033). This growth is fueled by increasing investments in renewable energy infrastructure, stringent environmental regulations aimed at reducing carbon emissions, and a growing awareness of the need for sustainable energy solutions. Technological advancements, leading to improved efficiency and reduced costs, also contribute significantly to the market's expansion.

Market penetration is steadily increasing across various segments, notably in transportation, where fuel cell electric vehicles (FCEVs) are gaining traction, and stationary power applications, which includes backup power and distributed generation. Consumer preferences are shifting towards cleaner and more sustainable energy options, further driving market growth. Intense competition among existing players and new entrants is fostering innovation and price optimization.

Leading Markets & Segments in Germany Fuel Cell Industry

The transportation segment dominates the German fuel cell market, fueled by government initiatives promoting hydrogen mobility and the increasing demand for zero-emission vehicles. This is followed by the stationary power segment, which benefits from the growing need for reliable and clean energy sources for buildings and industrial applications.

- Dominant Application Segment: Transportation (fuel cell buses, trains, and potentially other transportation modes) accounts for the largest market share, driven by ambitious government targets for hydrogen mobility and the successful deployment of the first fuel cell train fleet in Lower Saxony in August 2022 and a bus contract with Cologne in May 2022.

- Dominant Fuel Cell Technology: Polymer Electrolyte Membrane Fuel Cells (PEMFCs) currently hold the largest market share due to their suitability for various applications, particularly transportation. However, Solid Oxide Fuel Cells (SOFCs) are gaining traction for stationary power applications due to their high efficiency.

- Key Drivers:

- Government Policies: Significant government funding and supportive regulatory frameworks are crucial drivers.

- Infrastructure Development: Investments in hydrogen refueling infrastructure are essential for the widespread adoption of fuel cell vehicles.

- Technological Advancements: Continuous improvements in fuel cell technology, particularly in terms of efficiency, durability, and cost-effectiveness, are key to market expansion.

Germany Fuel Cell Industry Product Developments

Recent product innovations focus on improving fuel cell efficiency, durability, and reducing production costs. New materials and designs are being explored to enhance performance across various applications. The market is also witnessing the emergence of integrated fuel cell systems combining fuel cells with other technologies, such as energy storage, for enhanced functionality. This trend aims to improve market fit by addressing specific customer needs and expanding applications.

Key Drivers of Germany Fuel Cell Industry Growth

Several factors are driving the growth of the German fuel cell industry:

- Stringent Environmental Regulations: Germany's commitment to reducing greenhouse gas emissions is creating a strong demand for clean energy solutions, including fuel cells.

- Government Incentives: Substantial government funding and subsidies for fuel cell research, development, and deployment are accelerating market growth.

- Technological Advancements: Improvements in fuel cell technology, leading to higher efficiency and lower costs, are expanding their market appeal.

- Growing Energy Security Concerns: The increasing focus on energy independence and reducing reliance on fossil fuels is boosting the adoption of fuel cells.

Challenges in the Germany Fuel Cell Industry Market

Despite significant growth potential, the German fuel cell industry faces several challenges:

- High Initial Investment Costs: The relatively high cost of fuel cell systems compared to traditional energy solutions remains a barrier to widespread adoption. This represents a barrier to entry for smaller companies.

- Hydrogen Infrastructure Limitations: The lack of a comprehensive hydrogen refueling infrastructure limits the widespread adoption of fuel cell vehicles and other applications dependent on hydrogen supply.

- Competition from Other Technologies: Fuel cells face competition from other clean energy technologies, such as batteries and solar power, which are also undergoing rapid development.

Emerging Opportunities in Germany Fuel Cell Industry

The long-term growth of the German fuel cell industry is driven by several emerging opportunities:

- Technological Breakthroughs: Ongoing research and development efforts promise significant advancements in fuel cell technology, resulting in improved efficiency, cost reductions, and wider application range.

- Strategic Partnerships: Collaboration among fuel cell manufacturers, energy companies, and automotive players is fostering innovation and accelerating market penetration.

- Market Expansion: Expanding the applications of fuel cells to new sectors, such as maritime and aviation, offers significant growth potential.

Leading Players in the Germany Fuel Cell Industry Sector

- SFC Energy AG

- FuelCell Energy Inc

- Ballard Power Systems Inc

- Plug Power Inc

- Proton Motor Fuel Cell GmbH

- Hydrogenics Corporation

Key Milestones in Germany Fuel Cell Industry Industry

- May 2022: Wrightbus secured a contract to supply 60 single-deck hydrogen fuel cell buses to Cologne, showcasing growing adoption in public transport.

- August 2022: Successful trials of hydrogen-fueled passenger trains led to the deployment of a 14-train fleet in Lower Saxony, marking a significant step towards decarbonizing the rail sector.

Strategic Outlook for Germany Fuel Cell Industry Market

The German fuel cell market is poised for continued expansion, driven by supportive government policies, technological advancements, and the increasing demand for clean energy solutions. Strategic partnerships and investments in hydrogen infrastructure will be critical for unlocking the full market potential. The focus on enhancing fuel cell efficiency, reducing costs, and expanding applications will shape the future of the industry. The market is expected to experience strong growth in both the transportation and stationary power sectors.

Germany Fuel Cell Industry Segmentation

-

1. Application

- 1.1. Portable

- 1.2. Stationary

- 1.3. Transportation

-

2. Fuel Cell Technology

- 2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 2.2. Solid Oxide Fuel Cell (SOFC)

- 2.3. Other Fuel Cell Technologies

Germany Fuel Cell Industry Segmentation By Geography

- 1. Germany

Germany Fuel Cell Industry Regional Market Share

Geographic Coverage of Germany Fuel Cell Industry

Germany Fuel Cell Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government Supportive Policies and Incentives4.; Renewable Energy Integration

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Costs

- 3.4. Market Trends

- 3.4.1. Polymer Electrolyte Membrane Fuel Cell (PEM) to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Fuel Cell Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Portable

- 5.1.2. Stationary

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 5.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2. Solid Oxide Fuel Cell (SOFC)

- 5.2.3. Other Fuel Cell Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SFC Energy AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FuelCell Energy Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ballard Power Systems Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Plug Power Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Proton Motor Fuel Cell GmbH*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hydrogenics Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 SFC Energy AG

List of Figures

- Figure 1: Germany Fuel Cell Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Fuel Cell Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Fuel Cell Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Germany Fuel Cell Industry Revenue billion Forecast, by Fuel Cell Technology 2020 & 2033

- Table 3: Germany Fuel Cell Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Fuel Cell Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Germany Fuel Cell Industry Revenue billion Forecast, by Fuel Cell Technology 2020 & 2033

- Table 6: Germany Fuel Cell Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Fuel Cell Industry?

The projected CAGR is approximately 25.9%.

2. Which companies are prominent players in the Germany Fuel Cell Industry?

Key companies in the market include SFC Energy AG, FuelCell Energy Inc, Ballard Power Systems Inc, Plug Power Inc, Proton Motor Fuel Cell GmbH*List Not Exhaustive, Hydrogenics Corporation.

3. What are the main segments of the Germany Fuel Cell Industry?

The market segments include Application, Fuel Cell Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.64 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Supportive Policies and Incentives4.; Renewable Energy Integration.

6. What are the notable trends driving market growth?

Polymer Electrolyte Membrane Fuel Cell (PEM) to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Costs.

8. Can you provide examples of recent developments in the market?

August 2022: The successful trials of hydrogen-fuelled passenger trains in Germany led to the deployment of the first fuel cell train fleet (14 trains) in Lower Saxony.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Fuel Cell Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Fuel Cell Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Fuel Cell Industry?

To stay informed about further developments, trends, and reports in the Germany Fuel Cell Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence