Key Insights

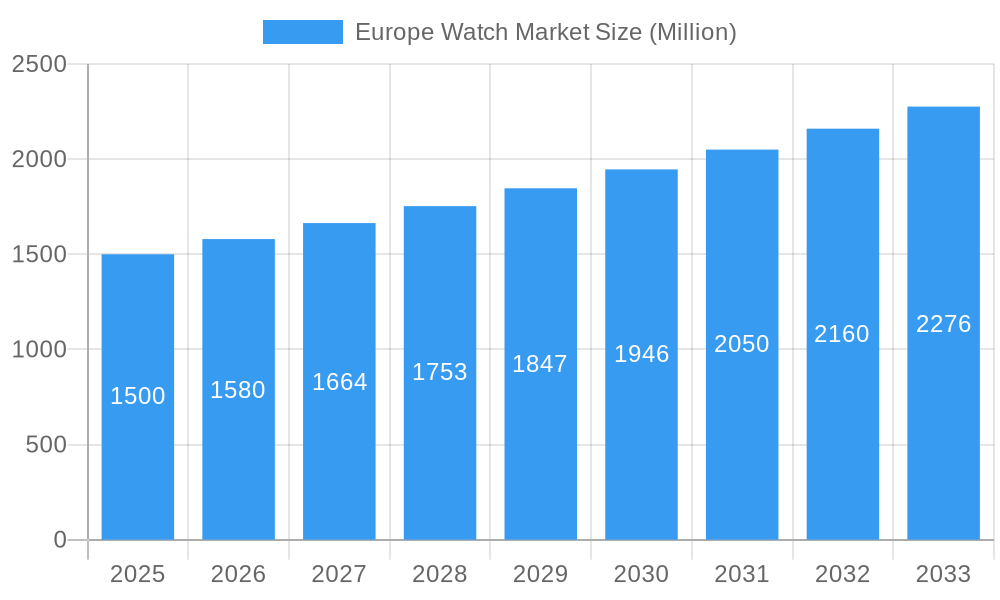

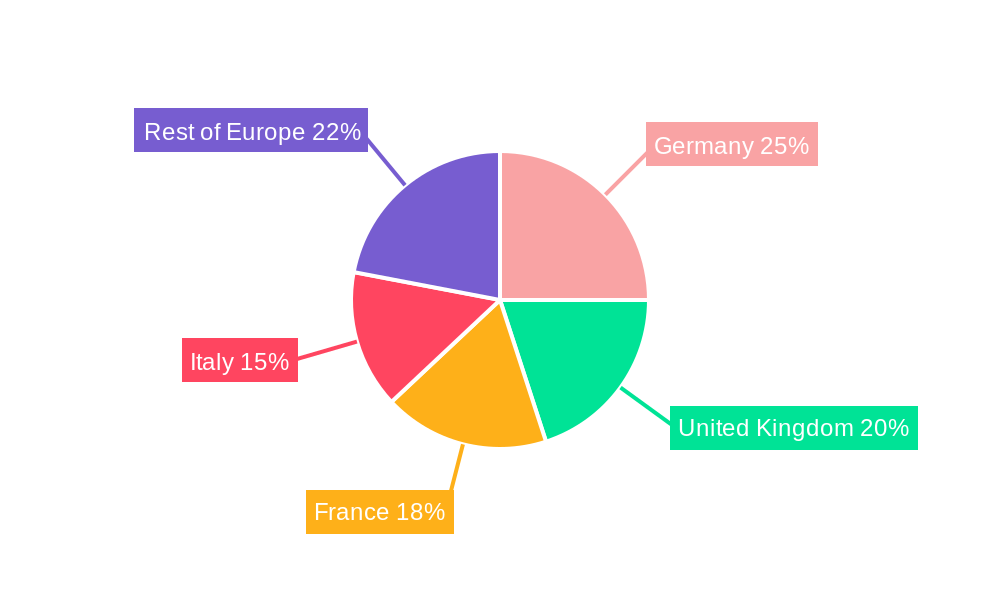

The European watch market, projected to reach €6.34 billion by 2025, is forecast for significant expansion, with an estimated Compound Annual Growth Rate (CAGR) of 3.4% from 2025 to 2033. This growth is primarily driven by the rising popularity of smartwatches and fitness trackers among younger consumers, alongside the persistent demand for traditional analogue timepieces, valued for their classic aesthetics and collector appeal. Increasing disposable incomes across European nations and a heightened focus on fashion are also boosting consumer expenditure on premium and luxury watches. Key challenges include the prevalence of counterfeit products, currency exchange rate volatility, and broader economic uncertainties within the EU. The market is segmented by watch type (analogue vs. digital) and distribution channel, with online retail channels experiencing substantial growth. Germany, the UK, France, and Italy are the leading national markets.

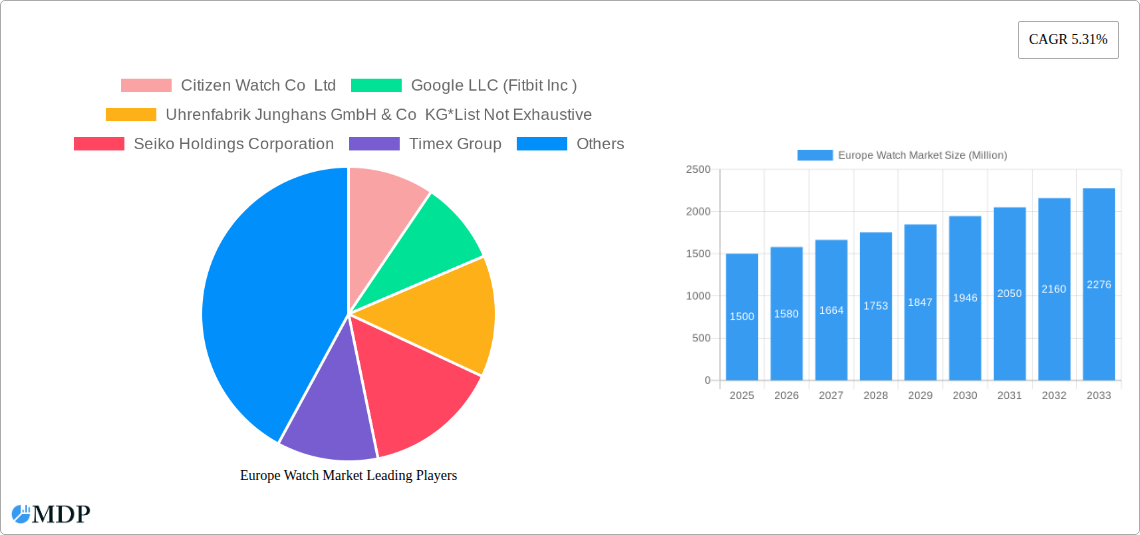

Europe Watch Market Market Size (In Billion)

The competitive environment features established luxury brands such as Rolex, Richemont, and Swatch Group, as well as technology firms like Google (Fitbit) and renowned watchmakers including Citizen and Seiko. Strategic focuses include innovation, brand development, and targeted marketing. Future market expansion will hinge on integrating smart technology into traditional watch designs, effectively combating counterfeiting, and aligning with evolving consumer preferences across diverse demographics and countries. The continued growth of e-commerce platforms will be instrumental in ensuring widespread market access and consumer convenience.

Europe Watch Market Company Market Share

Europe Watch Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Watch Market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, industry trends, leading players, and future growth opportunities, making it an essential resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive data analysis and incorporates key milestones to offer actionable intelligence for navigating this dynamic market. The total market size in 2025 is estimated at XX Million.

Europe Watch Market Market Dynamics & Concentration

The European watch market is characterized by a blend of established luxury brands and emerging tech-driven players, resulting in a moderately concentrated market. Market share is largely dominated by a few key players, with the top five holding an estimated xx% of the market in 2025. However, the market exhibits significant dynamism driven by technological innovations, evolving consumer preferences, and strategic mergers and acquisitions (M&A). Innovation in areas like smartwatches and connected technology is reshaping the competitive landscape.

- Market Concentration: Top 5 players hold approximately xx% market share (2025).

- Innovation Drivers: Smartwatch features, material innovation, personalized designs.

- Regulatory Frameworks: EU regulations on product safety and data privacy impact market dynamics.

- Product Substitutes: Smartphones with fitness trackers pose a competitive threat.

- End-User Trends: Increasing demand for smartwatches and personalized designs, especially among younger demographics.

- M&A Activities: The number of M&A deals in the European watch market averaged xx per year between 2019 and 2024.

Europe Watch Market Industry Trends & Analysis

The European watch market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Growth is fueled by several factors including the rising adoption of smartwatches, increasing disposable incomes in key European markets, and the growing popularity of fashion accessories, particularly among younger consumers. Technological advancements, particularly in miniaturization, enhanced battery life, and integrated health monitoring features, have significantly contributed to market expansion. However, the market faces challenges, with increased competition from both established and new entrants impacting market penetration. The shift towards online retail channels is also altering distribution dynamics.

Leading Markets & Segments in Europe Watch Market

The United Kingdom, Germany, and France represent the largest national markets within Europe, collectively accounting for approximately xx% of the total market value in 2025. The online retail channel is witnessing significant growth, driven by consumer preference for convenience and wider product selection. Smartwatches are becoming increasingly popular and are experiencing higher growth rates compared to traditional analogue watches.

- Dominant Regions: United Kingdom, Germany, France. Key Drivers: Strong consumer spending, established retail infrastructure.

- Dominant Segments: Online retail stores are rapidly growing. Smartwatches (digital watches) show higher growth than analogue watches. Men's and Unisex segments represent the largest end-user markets.

Europe Watch Market Product Developments

The European watch market is currently experiencing a dynamic evolution in product development, characterized by a seamless fusion of cutting-edge technology with timeless horological craftsmanship. The standout trend is the rapid advancement of smartwatches, which are increasingly equipped with sophisticated health monitoring suites, offering features like ECG, blood oxygen tracking, and advanced sleep analysis. Enhanced battery life is a key focus, addressing a common consumer pain point. Beyond functionality, aesthetics are paramount, with manufacturers prioritizing stylish, customizable designs that cater to diverse fashion preferences. The growing consumer desire for personalization and customization is also a significant driver, with brands offering a wider range of strap options, watch faces, and even engraving services to create unique timepieces.

Key Drivers of Europe Watch Market Growth

The European watch market is propelled by a confluence of robust growth factors:

- Technological Advancements: The relentless integration of smart features, including sophisticated health and fitness tracking, seamless contactless payment solutions, and the development of vibrant, energy-efficient display technologies, is continuously enhancing the appeal and utility of modern timepieces.

- Economic Growth and Consumer Spending Power: A generally strong economic climate across major European economies translates to increased disposable incomes, empowering consumers to invest in both luxury and technologically advanced watches. This growing purchasing power is a significant contributor to market expansion.

- Favorable Regulatory Environment and Consumer Trust: The presence of well-defined and consistently enforced regulations concerning product safety, data privacy, and consumer protection instills confidence in the market. This secure environment encourages both manufacturers and consumers, fostering sustained growth.

- Growing Demand for Luxury and Heritage Brands: Beyond technology, there's a persistent and strong demand for high-end mechanical watches from established European heritage brands, valued for their craftsmanship, heritage, and investment potential.

Challenges in the Europe Watch Market Market

The Europe Watch Market faces challenges such as:

- Intense Competition: The market is fiercely competitive, with numerous established and emerging brands vying for market share.

- Supply Chain Disruptions: Global supply chain disruptions and increased raw material costs impact production costs and market profitability.

- Economic Uncertainty: Economic downturns or geopolitical instability can dampen consumer spending and affect market growth.

Emerging Opportunities in Europe Watch Market

The future of the European watch market is ripe with promising opportunities, particularly driven by the integration of advanced technologies and strategic market expansion:

- AI and ML Integration in Smartwatches: The incorporation of artificial intelligence (AI) and machine learning (ML) functionalities within smartwatches offers immense potential for personalized insights, predictive health analytics, and more intuitive user experiences.

- Expansion into New Markets and Underserved Segments: Exploring and capitalizing on emerging markets within Europe and identifying and catering to underserved consumer segments (e.g., specific age groups, niche hobbyists) can unlock significant growth potential.

- Strategic Partnerships and Collaborations: Forging strategic alliances, especially with leading technology companies, can accelerate innovation, broaden product offerings, and provide access to new distribution channels. Collaborations with fashion and lifestyle brands also offer avenues for unique product lines.

- Focus on Sustainable and Ethical Timepieces: Developing and marketing watches made from recycled materials, with ethical sourcing practices, and a transparent production process can resonate deeply with environmentally conscious consumers, creating a strong brand differentiator.

- Growth of the Pre-Owned and Certified Pre-Owned Market: The increasing popularity of the secondary market for watches presents an opportunity for brands to engage with a wider customer base and build loyalty through certified pre-owned programs.

Leading Players in the Europe Watch Market Sector

- Citizen Watch Co Ltd

- Google LLC (Fitbit Inc)

- Uhrenfabrik Junghans GmbH & Co KG

- Seiko Holdings Corporation

- Timex Group

- Compagnie Financière Richemont SA

- The Swatch Group Ltd

- Rolex SA

- Casio Computer Co Ltd

- Fossil Group Inc

Key Milestones in Europe Watch Market Industry

- October 2022: Huawei made a significant entry into the German market with the launch of the Huawei Watch D, a smartwatch featuring advanced blood pressure monitoring capabilities, highlighting the growing emphasis on health-focused wearables.

- October 2022: Amazfit introduced its robust and water-resistant smartwatch, the Amazfit Falcon, to the German market. This launch underscored the demand for durable and high-performance sports and outdoor-oriented smartwatches.

- January 2023: Fossil Group launched its innovative 'Katchin' marketplace in the United Kingdom. This platform dedicated to jewelry and watches signifies a strategic move to enhance online sales channels and provide a curated shopping experience for consumers.

- Q1 2023: Several luxury watch brands across Europe reported strong sales figures for their heritage mechanical timepieces, demonstrating the enduring appeal and resilience of traditional watchmaking amidst technological advancements.

- Ongoing 2023: A notable trend is the increasing investment by watch brands in developing proprietary operating systems and AI-driven features for their smartwatches, aiming to differentiate themselves in the competitive tech-wearable space.

Strategic Outlook for Europe Watch Market Market

The European watch market is poised for sustained growth, driven by continued technological innovation, evolving consumer preferences, and the emergence of new market segments. Strategic partnerships, focus on personalized products, and expansion into new geographical markets offer significant opportunities for growth and market leadership. The market is expected to reach XX Million by 2033.

Europe Watch Market Segmentation

-

1. Type

- 1.1. Analogue Watch

- 1.2. Digital Watch

-

2. End Users

- 2.1. Women

- 2.2. Men

- 2.3. Unisex

-

3. Distribution Channel

- 3.1. Offline Retail Stores

- 3.2. Online Retail Stores

Europe Watch Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Watch Market Regional Market Share

Geographic Coverage of Europe Watch Market

Europe Watch Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Blending Adventure Sports With Smarter Wearables; The Preference for Luxury Time

- 3.3. Market Restrains

- 3.3.1. Increased Prevalence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Blending Adventure Sports With Smarter Wearables

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Watch Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analogue Watch

- 5.1.2. Digital Watch

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. Women

- 5.2.2. Men

- 5.2.3. Unisex

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Retail Stores

- 5.3.2. Online Retail Stores

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Citizen Watch Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Google LLC (Fitbit Inc )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Uhrenfabrik Junghans GmbH & Co KG*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Seiko Holdings Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Timex Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Compagnie Financire Richemont SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Swatch Group Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rolex SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Casio Computer Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fossil Group Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Citizen Watch Co Ltd

List of Figures

- Figure 1: Europe Watch Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Watch Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Watch Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Watch Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 3: Europe Watch Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Watch Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Watch Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Europe Watch Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 7: Europe Watch Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Europe Watch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Watch Market?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the Europe Watch Market?

Key companies in the market include Citizen Watch Co Ltd, Google LLC (Fitbit Inc ), Uhrenfabrik Junghans GmbH & Co KG*List Not Exhaustive, Seiko Holdings Corporation, Timex Group, Compagnie Financire Richemont SA, The Swatch Group Ltd, Rolex SA, Casio Computer Co Ltd, Fossil Group Inc.

3. What are the main segments of the Europe Watch Market?

The market segments include Type, End Users, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.34 billion as of 2022.

5. What are some drivers contributing to market growth?

Blending Adventure Sports With Smarter Wearables; The Preference for Luxury Time.

6. What are the notable trends driving market growth?

Blending Adventure Sports With Smarter Wearables.

7. Are there any restraints impacting market growth?

Increased Prevalence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

January 2023: Fossil Group launched a new marketplace, 'Katchin,' in the United Kingdom specifically for jewelry and watches. The company claimed that Katchin aims to offer consumers a new way to shop for accessories, bringing together 'the most sought-after names together in a one-stop-shop' alongside curated content and how-to-style guides.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Watch Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Watch Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Watch Market?

To stay informed about further developments, trends, and reports in the Europe Watch Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence