Key Insights

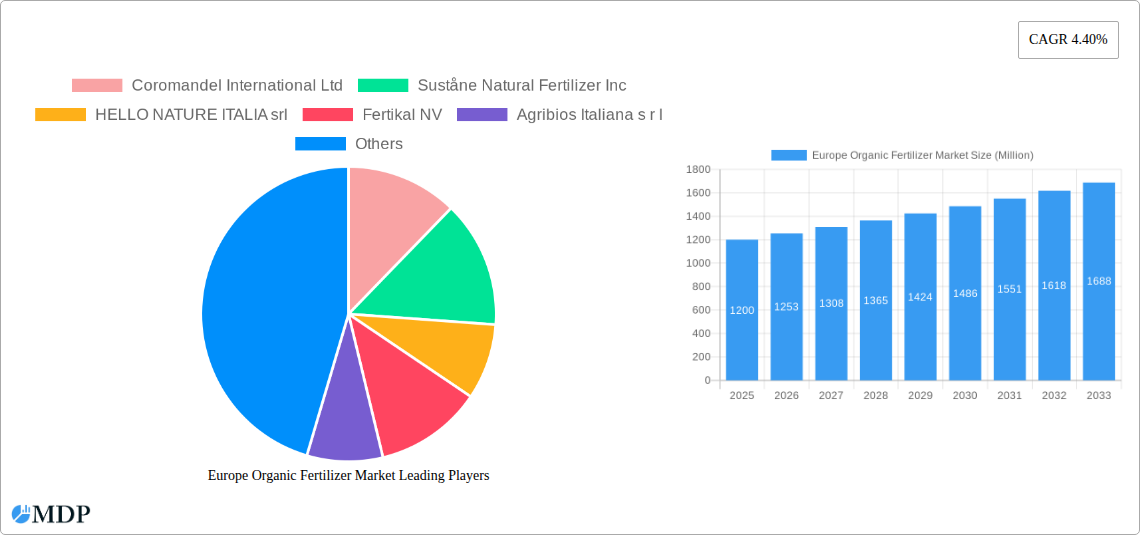

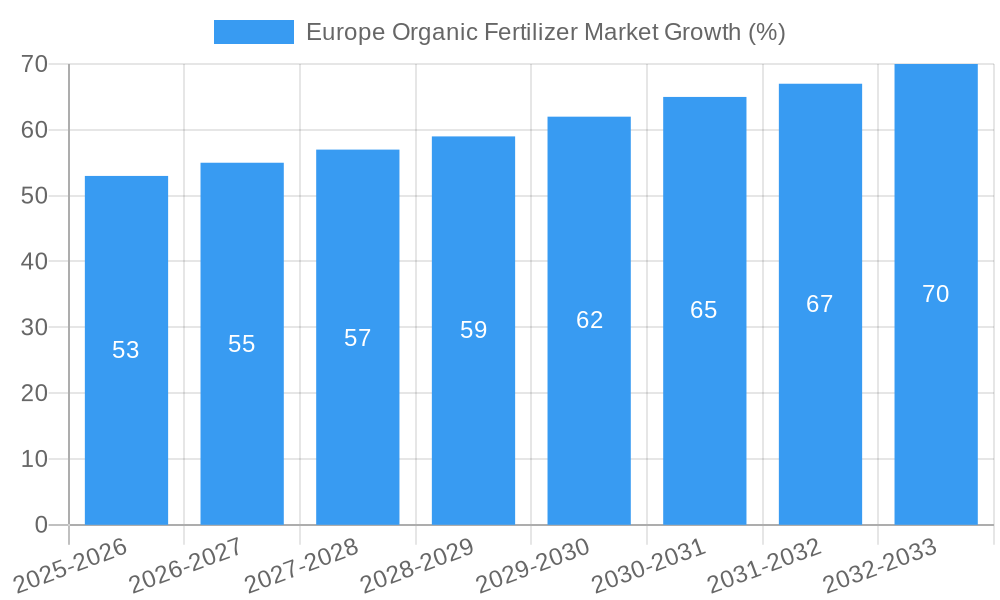

The European organic fertilizer market, valued at approximately €X million in 2025 (estimated based on provided CAGR and market size), is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.40% from 2025 to 2033. This expansion is driven by several key factors. Increasing consumer demand for organically produced food, coupled with stricter regulations on synthetic fertilizers and growing awareness of environmental sustainability are major catalysts. The rising popularity of organic farming practices across Europe, particularly in countries like Germany, France, and the Netherlands, is fueling the market's ascent. Furthermore, the increasing availability of diverse organic fertilizer types, including manure, meal-based fertilizers, and oilcakes, caters to the varied needs of different crops (cash crops, horticultural crops, and row crops) and farming systems. However, the market faces challenges, including the relatively higher cost of organic fertilizers compared to synthetic alternatives and fluctuations in raw material prices, potentially hindering broader adoption. The competitive landscape involves both established players like Coromandel International Ltd and Suståne Natural Fertilizer Inc., and regional companies catering to specific national markets.

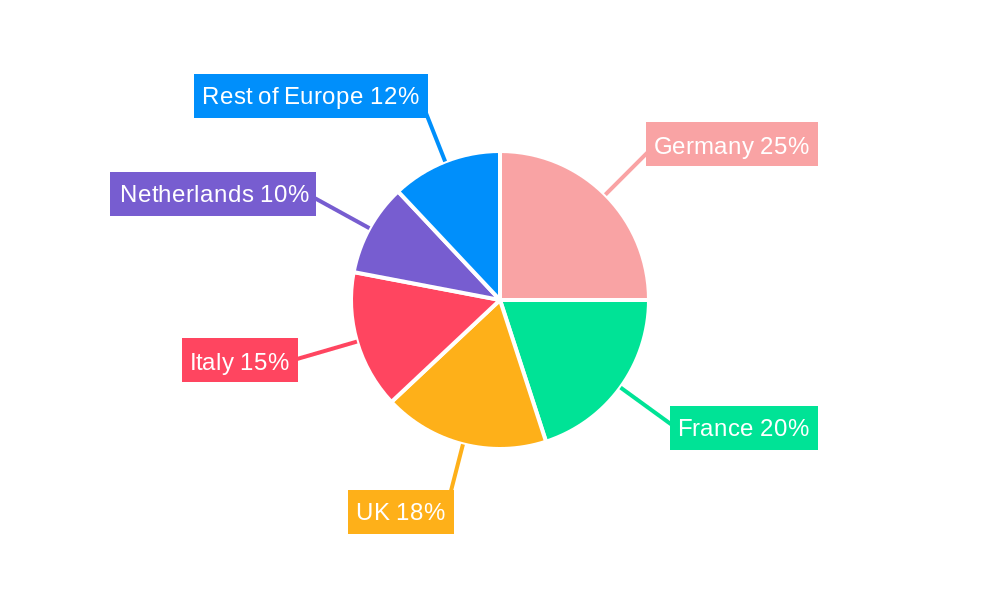

The segment analysis indicates strong growth prospects across various crop types and countries. Germany, France, and the UK represent significant market shares, driven by established organic farming sectors and supportive government policies. However, opportunities exist for market expansion within other European countries, especially those with growing organic agricultural practices. The market's future trajectory will likely be shaped by government initiatives promoting sustainable agriculture, technological advancements in organic fertilizer production, and increased consumer education regarding the benefits of organic farming practices. Further market penetration depends on overcoming price sensitivity and ensuring a consistent supply chain capable of meeting the growing demand across Europe.

This in-depth report provides a comprehensive analysis of the Europe Organic Fertilizer Market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period and utilizes 2025 as the base year. Expect detailed analysis across key segments, including form, crop type, and country, alongside competitive landscaping and future growth projections. The market size is projected to reach xx Million by 2033.

Europe Organic Fertilizer Market Dynamics & Concentration

The European organic fertilizer market is characterized by a moderately concentrated landscape with several key players vying for market share. Market concentration is influenced by factors including the scale of operations, technological capabilities, and distribution networks. While precise market share figures for individual players are proprietary, leading companies are estimated to collectively hold approximately xx% of the market. Innovation within the organic fertilizer industry is driven by the demand for sustainable and environmentally friendly agricultural practices. Stringent regulatory frameworks are in place across Europe, mandating standards for organic fertilizer production and use. These regulations vary across nations, impacting market dynamics and driving product development to meet these standards. Consumer trends are heavily favoring organic products, increasing demand for environmentally responsible agricultural practices, further fueling market growth. The market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years, with xx M&A deals recorded between 2019 and 2024. These deals typically aim to expand product portfolios, increase market reach, and consolidate market share.

- Market Concentration: Moderately concentrated, with leading players holding approximately xx% of market share.

- Innovation Drivers: Demand for sustainable agriculture and stricter environmental regulations.

- Regulatory Frameworks: Vary across European countries, impacting product development and market access.

- Product Substitutes: Conventional chemical fertilizers present a major competitive challenge.

- End-User Trends: Growing consumer preference for organically produced food drives demand.

- M&A Activity: Moderate level of activity, driven by expansion and consolidation strategies (xx deals 2019-2024).

Europe Organic Fertilizer Market Industry Trends & Analysis

The Europe organic fertilizer market exhibits a robust growth trajectory, driven by several key factors. The increasing awareness of the environmental impact of conventional farming practices and the growing consumer preference for organically produced food are major catalysts. Technological advancements in organic fertilizer production and application methods are improving efficiency and effectiveness. The market's compound annual growth rate (CAGR) during the historical period (2019-2024) was estimated at xx%, and this is projected to continue at xx% during the forecast period (2025-2033). Market penetration of organic fertilizers is gradually increasing, particularly in segments with higher consumer awareness and stricter environmental regulations. Competitive dynamics are characterized by innovation, brand building, and strategic partnerships. Pricing strategies vary depending on product type, brand reputation, and market conditions.

Leading Markets & Segments in Europe Organic Fertilizer Market

The European organic fertilizer market is geographically diverse, with several key countries driving growth. Germany, France, and the United Kingdom are among the largest markets due to their established organic farming sectors and supportive government policies. Italy and Spain also contribute significantly to overall market demand. Within the market segmentation:

Form: Manure consistently holds a significant market share due to its widespread availability and affordability. Meal-based fertilizers are gaining traction due to their nutrient-rich composition.

Crop Type: Horticultural crops are a major driver of demand, followed by cash crops and row crops.

Key Drivers by Country:

- Germany: Strong organic farming tradition, supportive government policies, and high consumer demand.

- France: Large agricultural sector, increasing awareness of sustainable practices, and government incentives.

- United Kingdom: Growing consumer preference for organic food, strict environmental regulations.

- Italy: Significant horticultural sector, favorable climatic conditions.

- Spain: Expanding organic farming practices, government support for sustainable agriculture.

Europe Organic Fertilizer Market Product Developments

Recent product developments focus on improving the efficiency and effectiveness of organic fertilizers. This includes innovations in formulation, application methods, and nutrient delivery systems. Technological advancements, such as precision agriculture techniques, optimize the use of organic fertilizers. Companies are increasingly focusing on developing customized products tailored to specific crops and soil conditions to enhance their competitive advantage.

Key Drivers of Europe Organic Fertilizer Market Growth

Several factors fuel the growth of the European organic fertilizer market:

- Growing consumer demand for organic food: Increased consumer awareness of the benefits of organic produce.

- Stringent environmental regulations: Stricter standards for sustainable agricultural practices.

- Government initiatives and subsidies: Support for organic farming through financial incentives and policies.

- Technological advancements: Improved production methods and application techniques for organic fertilizers.

Challenges in the Europe Organic Fertilizer Market Market

Several challenges hamper market growth:

- Higher cost compared to conventional fertilizers: Limiting affordability for some farmers.

- Supply chain disruptions: Impacts availability and pricing.

- Variability in product quality: Requires stringent quality control measures.

- Competition from conventional fertilizers: Requires effective marketing and education efforts.

Emerging Opportunities in Europe Organic Fertilizer Market

Several emerging opportunities promise long-term growth:

- Development of innovative organic fertilizer products: Enhanced efficiency and effectiveness through technological advancements.

- Strategic partnerships and collaborations: Leveraging expertise and resources across the value chain.

- Expansion into new markets and segments: Targeting underserved regions and crop types.

- Increased adoption of precision agriculture techniques: Optimizing fertilizer application for enhanced efficacy.

Leading Players in the Europe Organic Fertilizer Market Sector

- Coromandel International Ltd

- Suståne Natural Fertilizer Inc

- HELLO NATURE ITALIA srl

- Fertikal NV

- Agribios Italiana s r l

- ORGANAZOTO FERTILIZZANTI SPA

- Angibaud

- APC AGRO

- Plantin

- Indogulf BioAg LLC (Biotech Division of Indogulf Company)

Key Milestones in Europe Organic Fertilizer Market Industry

- April 2022: Merger of Liberty Pesticides and Fertilizers Limited (LPFL) and Coromandel SQM (India) Private Limited (CSQM), expanding Coromandel's organic fertilizer portfolio.

- May 2021: Launch of 'Godavari BhuBhagya,' a bio-enriched organic manure by Coromandel International Ltd.

Strategic Outlook for Europe Organic Fertilizer Market Market

The Europe organic fertilizer market is poised for sustained growth, driven by factors such as rising consumer demand, supportive government policies, and technological innovations. Strategic partnerships, product diversification, and expansion into new markets will be crucial for companies seeking to capitalize on emerging opportunities. The focus on sustainable agriculture and the growing awareness of the environmental impact of farming practices are key trends to watch. Companies adopting innovative technologies and sustainable practices will be well-positioned for success in this dynamic and evolving market.

Europe Organic Fertilizer Market Segmentation

-

1. Form

- 1.1. Manure

- 1.2. Meal Based Fertilizers

- 1.3. Oilcakes

- 1.4. Other Organic Fertilizers

-

2. Crop Type

- 2.1. Cash Crops

- 2.2. Horticultural Crops

- 2.3. Row Crops

-

3. Form

- 3.1. Manure

- 3.2. Meal Based Fertilizers

- 3.3. Oilcakes

- 3.4. Other Organic Fertilizers

-

4. Crop Type

- 4.1. Cash Crops

- 4.2. Horticultural Crops

- 4.3. Row Crops

Europe Organic Fertilizer Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Organic Fertilizer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Meat and Meat Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Organic Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Manure

- 5.1.2. Meal Based Fertilizers

- 5.1.3. Oilcakes

- 5.1.4. Other Organic Fertilizers

- 5.2. Market Analysis, Insights and Forecast - by Crop Type

- 5.2.1. Cash Crops

- 5.2.2. Horticultural Crops

- 5.2.3. Row Crops

- 5.3. Market Analysis, Insights and Forecast - by Form

- 5.3.1. Manure

- 5.3.2. Meal Based Fertilizers

- 5.3.3. Oilcakes

- 5.3.4. Other Organic Fertilizers

- 5.4. Market Analysis, Insights and Forecast - by Crop Type

- 5.4.1. Cash Crops

- 5.4.2. Horticultural Crops

- 5.4.3. Row Crops

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Germany Europe Organic Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Organic Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Organic Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Organic Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Organic Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Organic Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Organic Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Coromandel International Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Suståne Natural Fertilizer Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 HELLO NATURE ITALIA srl

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Fertikal NV

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Agribios Italiana s r l

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 ORGANAZOTO FERTILIZZANTI SPA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Angibaud

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 APC AGRO

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Plantin

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Indogulf BioAg LLC (Biotech Division of Indogulf Company)

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Coromandel International Ltd

List of Figures

- Figure 1: Europe Organic Fertilizer Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Organic Fertilizer Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Organic Fertilizer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Organic Fertilizer Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: Europe Organic Fertilizer Market Revenue Million Forecast, by Form 2019 & 2032

- Table 4: Europe Organic Fertilizer Market Volume Kiloton Forecast, by Form 2019 & 2032

- Table 5: Europe Organic Fertilizer Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 6: Europe Organic Fertilizer Market Volume Kiloton Forecast, by Crop Type 2019 & 2032

- Table 7: Europe Organic Fertilizer Market Revenue Million Forecast, by Form 2019 & 2032

- Table 8: Europe Organic Fertilizer Market Volume Kiloton Forecast, by Form 2019 & 2032

- Table 9: Europe Organic Fertilizer Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 10: Europe Organic Fertilizer Market Volume Kiloton Forecast, by Crop Type 2019 & 2032

- Table 11: Europe Organic Fertilizer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Europe Organic Fertilizer Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 13: Europe Organic Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe Organic Fertilizer Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 15: Germany Europe Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Germany Europe Organic Fertilizer Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 17: France Europe Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Organic Fertilizer Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Europe Organic Fertilizer Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 21: United Kingdom Europe Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Kingdom Europe Organic Fertilizer Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Netherlands Europe Organic Fertilizer Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Sweden Europe Organic Fertilizer Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 27: Rest of Europe Europe Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Europe Organic Fertilizer Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 29: Europe Organic Fertilizer Market Revenue Million Forecast, by Form 2019 & 2032

- Table 30: Europe Organic Fertilizer Market Volume Kiloton Forecast, by Form 2019 & 2032

- Table 31: Europe Organic Fertilizer Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 32: Europe Organic Fertilizer Market Volume Kiloton Forecast, by Crop Type 2019 & 2032

- Table 33: Europe Organic Fertilizer Market Revenue Million Forecast, by Form 2019 & 2032

- Table 34: Europe Organic Fertilizer Market Volume Kiloton Forecast, by Form 2019 & 2032

- Table 35: Europe Organic Fertilizer Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 36: Europe Organic Fertilizer Market Volume Kiloton Forecast, by Crop Type 2019 & 2032

- Table 37: Europe Organic Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Europe Organic Fertilizer Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Europe Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Europe Organic Fertilizer Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 41: Germany Europe Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Germany Europe Organic Fertilizer Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 43: France Europe Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: France Europe Organic Fertilizer Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 45: Italy Europe Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Europe Organic Fertilizer Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 47: Spain Europe Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Spain Europe Organic Fertilizer Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 49: Netherlands Europe Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Netherlands Europe Organic Fertilizer Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 51: Belgium Europe Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Belgium Europe Organic Fertilizer Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 53: Sweden Europe Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Sweden Europe Organic Fertilizer Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 55: Norway Europe Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Norway Europe Organic Fertilizer Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 57: Poland Europe Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Poland Europe Organic Fertilizer Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 59: Denmark Europe Organic Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Denmark Europe Organic Fertilizer Market Volume (Kiloton) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Organic Fertilizer Market?

The projected CAGR is approximately 4.40%.

2. Which companies are prominent players in the Europe Organic Fertilizer Market?

Key companies in the market include Coromandel International Ltd, Suståne Natural Fertilizer Inc, HELLO NATURE ITALIA srl, Fertikal NV, Agribios Italiana s r l, ORGANAZOTO FERTILIZZANTI SPA, Angibaud, APC AGRO, Plantin, Indogulf BioAg LLC (Biotech Division of Indogulf Company).

3. What are the main segments of the Europe Organic Fertilizer Market?

The market segments include Form, Crop Type, Form, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Increasing Demand for Meat and Meat Products.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

April 2022: The company approved the merger between Liberty Pesticides and Fertilizers Limited (LPFL) and Coromandel SQM (India) Private Limited (CSQM) (wholly-owned subsidiaries), which came into effect on April 1, 2021. This merger is anticipated to expand the company's product portfolio, including its organic fertilizers, in the long run.May 2021: The company launched 'Godavari BhuBhagya,' a bio-enriched organic manure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Organic Fertilizer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Organic Fertilizer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Organic Fertilizer Market?

To stay informed about further developments, trends, and reports in the Europe Organic Fertilizer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence