Key Insights

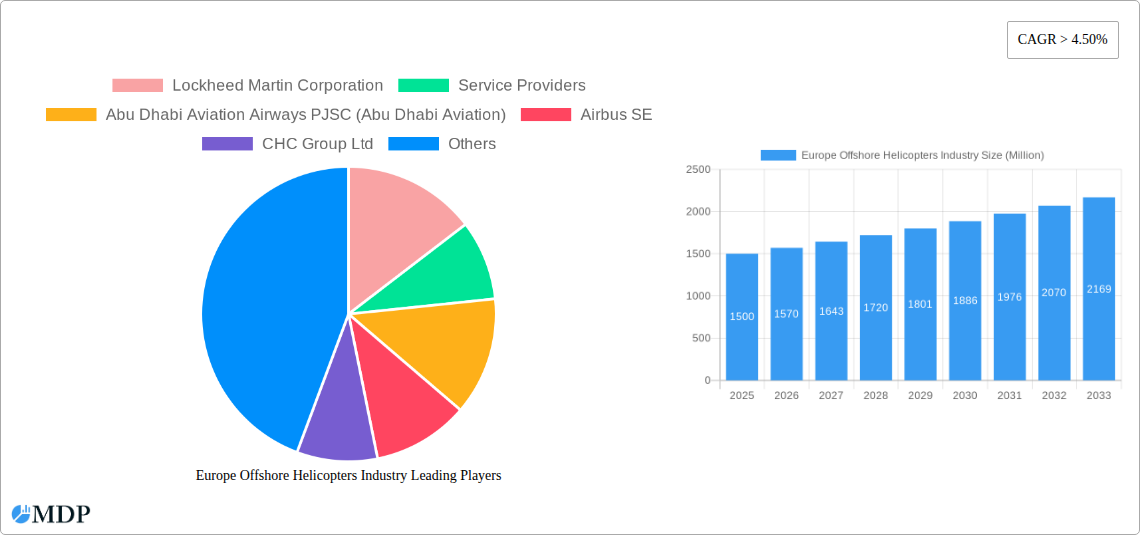

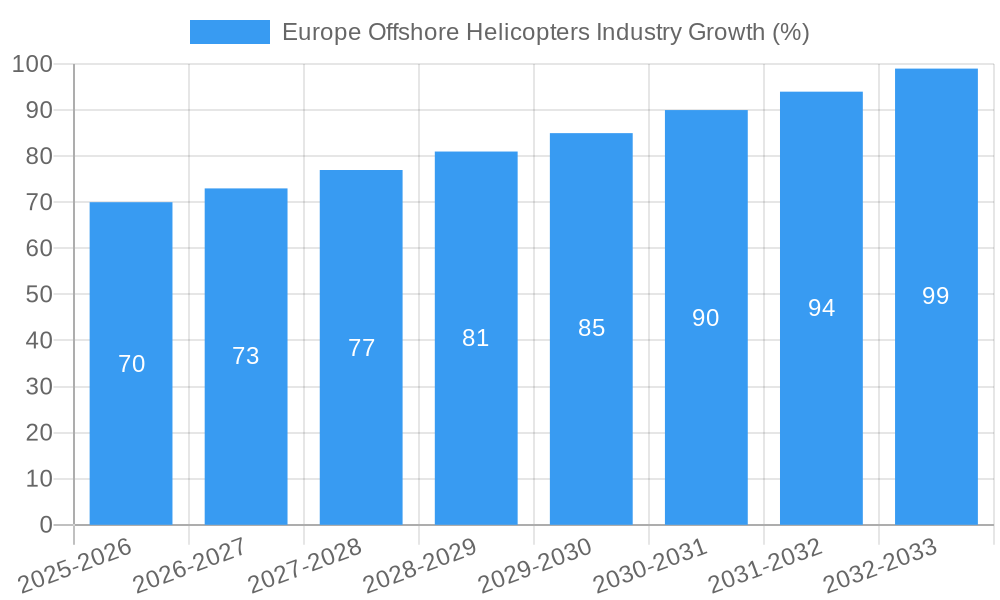

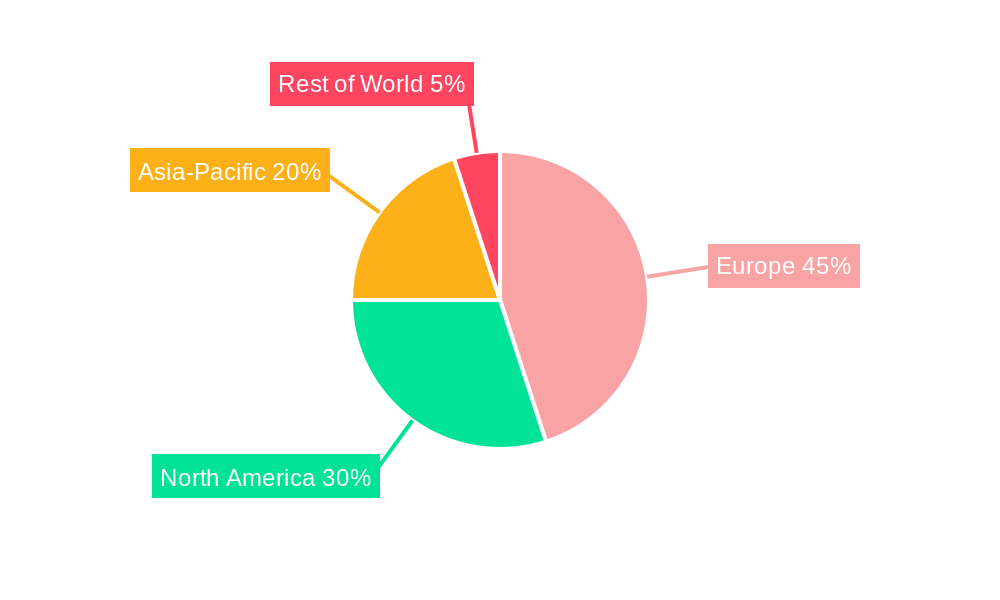

The European offshore helicopter market, valued at approximately €1.5 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 4.5% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning offshore wind energy sector, driven by the EU's ambitious renewable energy targets, is a major catalyst. Increased investment in offshore wind farms necessitates efficient and reliable transportation of personnel and equipment, creating significant demand for helicopter services. Furthermore, ongoing operations within the established oil and gas industry, particularly in the North Sea, continue to contribute significantly to market demand. The trend towards larger, more powerful helicopters capable of carrying heavier payloads further supports market expansion. However, potential restraints include fluctuating oil and gas prices, regulatory hurdles related to safety and emissions, and the need for continuous investment in helicopter maintenance and upgrades. Germany, the UK, and France are currently the leading markets within Europe, representing a considerable portion of the total market size. The segment focusing on medium and heavy helicopters is expected to dominate, given their superior cargo-carrying capacity and suitability for offshore operations.

The market's growth is not without challenges. Stringent safety regulations, increasing fuel costs, and potential workforce shortages pose significant obstacles. Nevertheless, the long-term outlook remains positive due to the continued expansion of offshore renewable energy projects across Europe. Companies such as Airbus, Leonardo, and Lockheed Martin are key players, engaging in competition and collaboration to enhance technological advancements and service offerings. The market is also witnessing the growth of specialized service providers catering to specific client needs in the offshore wind and oil & gas sectors. This competitive landscape, coupled with technological innovation in areas like electric and hybrid helicopters, will shape the future trajectory of the European offshore helicopter market.

Europe Offshore Helicopters Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe offshore helicopters industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report unveils key trends, growth drivers, challenges, and opportunities within the sector. The study meticulously examines market dynamics, competition, leading players, and future projections, providing actionable intelligence for strategic decision-making. Expected market value is projected to reach xx Million by 2033.

Europe Offshore Helicopters Industry Market Dynamics & Concentration

The European offshore helicopters market exhibits a moderately concentrated landscape, with key players such as Airbus SE, Leonardo SpA, and CHC Group Ltd holding significant market share. The market is influenced by several factors, including stringent safety regulations, technological advancements in helicopter design and maintenance, and fluctuating demand from the oil and gas and offshore wind sectors. Innovation drivers include the development of more fuel-efficient and technologically advanced helicopters, as well as advancements in maintenance and operational technologies.

The market is characterized by mergers and acquisitions (M&A) activity, with approximately xx M&A deals recorded between 2019 and 2024. These activities often aim to consolidate market share and leverage synergies. The report analyzes the market share distribution among key players, highlighting their competitive strategies and market positions. Substitute products, such as fixed-wing aircraft for certain applications, exert limited pressure due to the unique advantages of helicopters in offshore operations, specifically in challenging weather conditions and access to remote locations. End-user trends indicate a growing demand for specialized helicopters equipped with advanced technologies for enhanced safety and operational efficiency.

- Market Share: Airbus SE (xx%), Leonardo SpA (xx%), CHC Group Ltd (xx%), Others (xx%)

- M&A Deal Count (2019-2024): xx

- Key Innovation Drivers: Fuel efficiency improvements, advanced avionics, improved maintenance technologies

Europe Offshore Helicopters Industry Industry Trends & Analysis

The European offshore helicopters market is witnessing significant growth, driven by the expansion of the offshore wind energy sector and increasing offshore oil and gas exploration and production activities. The industry's CAGR during the forecast period (2025-2033) is projected to be xx%. Market penetration of new technologies such as advanced flight control systems and predictive maintenance is steadily increasing, contributing to enhanced safety and operational efficiency. The preference for environmentally friendly helicopters, coupled with strict emission regulations, is prompting manufacturers to develop and deploy sustainable and quieter aircraft. Competitive dynamics are shaped by factors like pricing strategies, technological innovation, and service capabilities of the leading players.

Leading Markets & Segments in Europe Offshore Helicopters Industry

The UK and Norway are expected to be the leading markets within Europe for offshore helicopter services. The Oil & Gas industry continues to dominate the end-user segment, although the Offshore Wind industry is experiencing substantial growth, further expanding the market. Medium and Heavy helicopters constitute the largest segment by type, owing to their greater payload capacity and range required for offshore operations.

Key Drivers:

- UK: Strong Oil & Gas sector, established infrastructure, and government support for offshore wind development.

- Norway: Robust Oil & Gas activities, strategic geographical location, and high demand for helicopter transport.

- Oil & Gas Industry: Continued exploration and production activities despite energy transition efforts.

- Offshore Wind Industry: Rapid expansion of offshore wind farms, creating a surge in demand for helicopter services.

- Medium and Heavy Helicopters: High payload capacity suitable for offshore operations.

Dominance Analysis: The UK's established infrastructure and regulatory framework in conjunction with a mature oil and gas sector gives it a leading position. Norway's strategic location and its significant activity in North Sea oil and gas reserves also contribute to its prominence. The growing investment in offshore wind energy projects is a crucial factor driving segment growth across multiple European countries.

Europe Offshore Helicopters Industry Product Developments

Recent product innovations focus on enhanced safety features, improved fuel efficiency, and reduced noise pollution. Manufacturers are incorporating advanced technologies such as fly-by-wire systems, advanced avionics, and predictive maintenance capabilities to enhance helicopter performance and reduce operational costs. These innovations are crucial for maintaining market competitiveness and meeting increasingly stringent safety and environmental regulations.

Key Drivers of Europe Offshore Helicopters Industry Growth

The growth of the European offshore helicopters industry is fueled by several key factors:

- Expansion of Offshore Wind Energy: The rapid development of offshore wind farms is driving significant demand for helicopter services.

- Technological Advancements: Innovations in helicopter design, avionics, and maintenance technologies are enhancing efficiency and safety.

- Increasing Oil & Gas Activity: Continued offshore exploration and production activities contribute to sustained demand.

- Favorable Government Policies: Government support for renewable energy and offshore oil & gas development is creating favorable market conditions.

Challenges in the Europe Offshore Helicopters Industry Market

The industry faces several challenges:

- Strict Safety Regulations: Compliance with stringent safety standards increases operational costs.

- Fluctuating Oil & Gas Prices: Volatility in oil prices can impact the demand for helicopter services.

- Intense Competition: Competition among operators and manufacturers for market share remains intense.

- Supply Chain Disruptions: Global supply chain uncertainties can impact helicopter maintenance and operations.

Emerging Opportunities in Europe Offshore Helicopters Industry

Significant opportunities exist in the development and deployment of sustainable and environmentally friendly helicopters, the use of advanced data analytics for predictive maintenance, and the exploration of new applications such as search and rescue (SAR) services in offshore regions. Strategic partnerships between helicopter operators and renewable energy companies can unlock further growth potential.

Leading Players in the Europe Offshore Helicopters Industry Sector

- Lockheed Martin Corporation

- Service Providers

- Abu Dhabi Aviation Airways PJSC (Abu Dhabi Aviation)

- Airbus SE

- CHC Group Ltd

- Textron Inc

- Leonardo SpA

- Bristow Group Inc

- Babcock International Group PLC

- Helicopter Manufacturers

Key Milestones in Europe Offshore Helicopters Industry Industry

- 2020: Introduction of new safety regulations impacting helicopter operations.

- 2021: Launch of a new fuel-efficient helicopter model by Airbus SE.

- 2022: Merger between two major helicopter service providers.

- 2023: Significant investment in offshore wind farm projects across Europe.

- 2024: Adoption of advanced maintenance technologies by several leading operators.

Strategic Outlook for Europe Offshore Helicopters Industry Market

The future of the European offshore helicopters industry looks positive, driven by the sustained growth of the offshore wind energy sector, ongoing exploration and production activities in the oil & gas industry, and the adoption of advanced technologies. Strategic partnerships, focused innovation, and adaptability to evolving environmental regulations will be crucial for success in this dynamic market. The market shows significant potential for continued expansion, presenting lucrative opportunities for both established players and new entrants.

Europe Offshore Helicopters Industry Segmentation

-

1. Type

- 1.1. Light Helicopters

- 1.2. Medium and Heavy Helicopters

-

2. End-user Industry

- 2.1. Oil & Gas Industry

- 2.2. Offshore Wind Industry

- 2.3. Other End-user Industries

-

3. Application

- 3.1. Drilling

- 3.2. Production

- 3.3. Relocation and Decommissioning

- 3.4. OtherApplications

Europe Offshore Helicopters Industry Segmentation By Geography

- 1. United Kingdom

- 2. Norway

- 3. Netherlands

- 4. Rest of Europe

Europe Offshore Helicopters Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Deep-Water Offshore Development Activity4.; Improved Viability of Offshore Oil and Gas Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Competition from Crew Transfer Ships

- 3.4. Market Trends

- 3.4.1. Oil & Gas Industry Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Offshore Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Light Helicopters

- 5.1.2. Medium and Heavy Helicopters

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil & Gas Industry

- 5.2.2. Offshore Wind Industry

- 5.2.3. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Drilling

- 5.3.2. Production

- 5.3.3. Relocation and Decommissioning

- 5.3.4. OtherApplications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Norway

- 5.4.3. Netherlands

- 5.4.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Kingdom Europe Offshore Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Light Helicopters

- 6.1.2. Medium and Heavy Helicopters

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil & Gas Industry

- 6.2.2. Offshore Wind Industry

- 6.2.3. Other End-user Industries

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Drilling

- 6.3.2. Production

- 6.3.3. Relocation and Decommissioning

- 6.3.4. OtherApplications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Norway Europe Offshore Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Light Helicopters

- 7.1.2. Medium and Heavy Helicopters

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil & Gas Industry

- 7.2.2. Offshore Wind Industry

- 7.2.3. Other End-user Industries

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Drilling

- 7.3.2. Production

- 7.3.3. Relocation and Decommissioning

- 7.3.4. OtherApplications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Netherlands Europe Offshore Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Light Helicopters

- 8.1.2. Medium and Heavy Helicopters

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil & Gas Industry

- 8.2.2. Offshore Wind Industry

- 8.2.3. Other End-user Industries

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Drilling

- 8.3.2. Production

- 8.3.3. Relocation and Decommissioning

- 8.3.4. OtherApplications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Europe Europe Offshore Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Light Helicopters

- 9.1.2. Medium and Heavy Helicopters

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil & Gas Industry

- 9.2.2. Offshore Wind Industry

- 9.2.3. Other End-user Industries

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Drilling

- 9.3.2. Production

- 9.3.3. Relocation and Decommissioning

- 9.3.4. OtherApplications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Germany Europe Offshore Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 11. France Europe Offshore Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 12. Italy Europe Offshore Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 13. United Kingdom Europe Offshore Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 14. Netherlands Europe Offshore Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 15. Sweden Europe Offshore Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Europe Europe Offshore Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Lockheed Martin Corporation

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Service Providers

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Abu Dhabi Aviation Airways PJSC (Abu Dhabi Aviation)

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Airbus SE

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 CHC Group Ltd

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Textron Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Leonardo SpA

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Bristow Group Inc

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Babcock International Group PLC

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Helicopter Manufacturers

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Lockheed Martin Corporation

List of Figures

- Figure 1: Europe Offshore Helicopters Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Offshore Helicopters Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Offshore Helicopters Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Offshore Helicopters Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Offshore Helicopters Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Europe Offshore Helicopters Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Europe Offshore Helicopters Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Offshore Helicopters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Offshore Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Offshore Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Offshore Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Offshore Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Offshore Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Offshore Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Offshore Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Offshore Helicopters Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Europe Offshore Helicopters Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 16: Europe Offshore Helicopters Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Europe Offshore Helicopters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Offshore Helicopters Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Europe Offshore Helicopters Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Europe Offshore Helicopters Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Europe Offshore Helicopters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Offshore Helicopters Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Europe Offshore Helicopters Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: Europe Offshore Helicopters Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Europe Offshore Helicopters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Europe Offshore Helicopters Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Europe Offshore Helicopters Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 28: Europe Offshore Helicopters Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Europe Offshore Helicopters Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Offshore Helicopters Industry?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the Europe Offshore Helicopters Industry?

Key companies in the market include Lockheed Martin Corporation, Service Providers, Abu Dhabi Aviation Airways PJSC (Abu Dhabi Aviation), Airbus SE, CHC Group Ltd, Textron Inc, Leonardo SpA, Bristow Group Inc, Babcock International Group PLC, Helicopter Manufacturers.

3. What are the main segments of the Europe Offshore Helicopters Industry?

The market segments include Type, End-user Industry, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Deep-Water Offshore Development Activity4.; Improved Viability of Offshore Oil and Gas Projects.

6. What are the notable trends driving market growth?

Oil & Gas Industry Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Competition from Crew Transfer Ships.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Offshore Helicopters Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Offshore Helicopters Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Offshore Helicopters Industry?

To stay informed about further developments, trends, and reports in the Europe Offshore Helicopters Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence