Key Insights

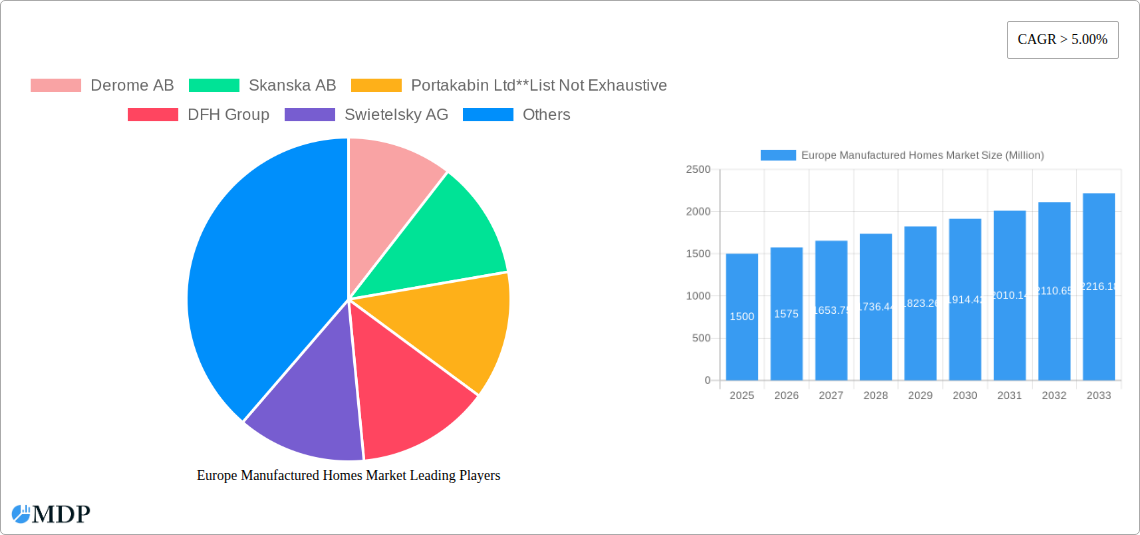

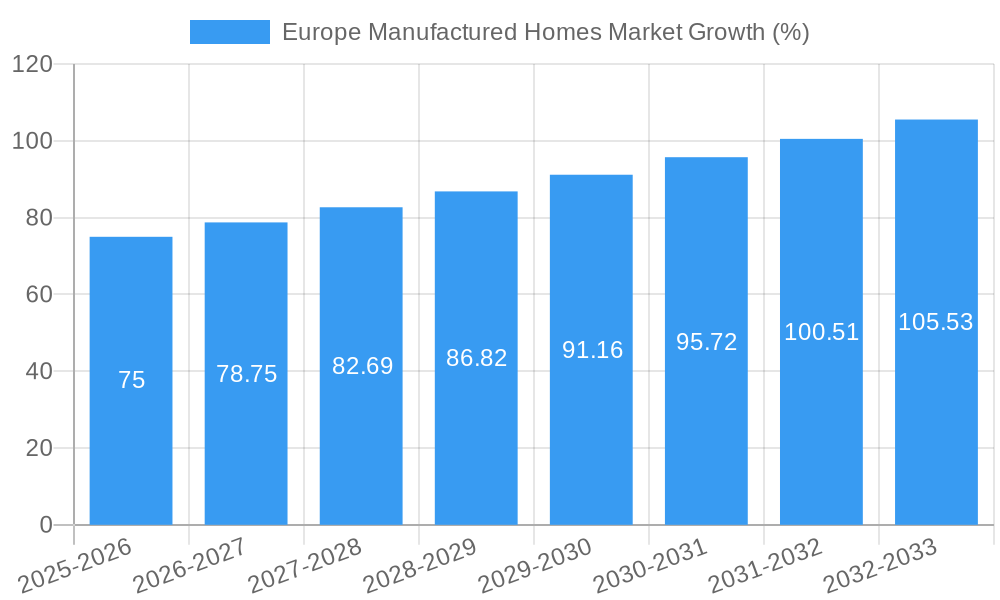

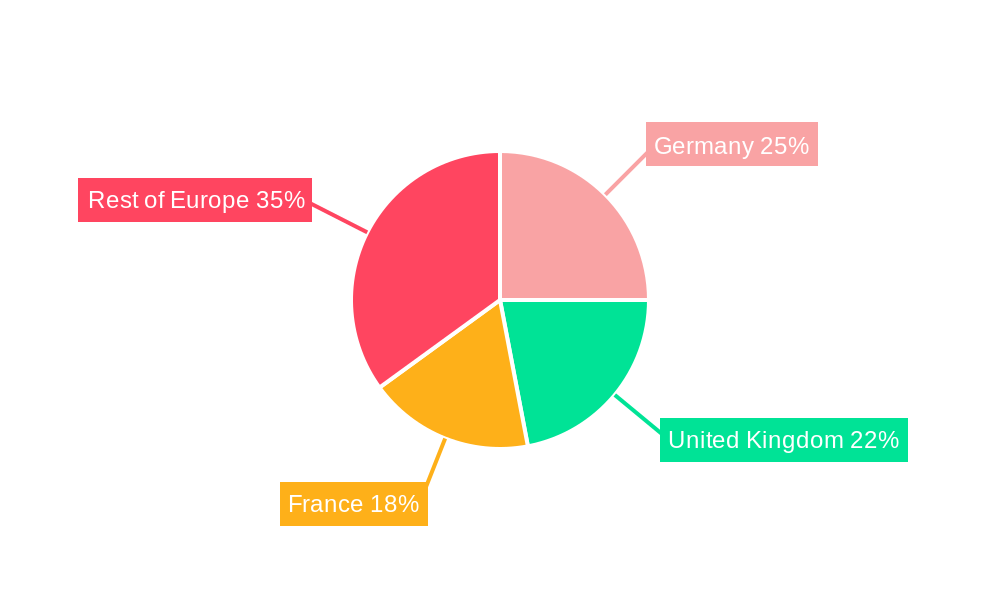

The European manufactured homes market is experiencing robust growth, driven by increasing demand for affordable and sustainable housing solutions. With a market size exceeding €X million in 2025 (estimated based on provided CAGR and market size), and a Compound Annual Growth Rate (CAGR) exceeding 5%, the market is projected to reach €Y million by 2033. This expansion is fueled by several key factors. Firstly, rising construction costs and housing shortages across major European nations like Germany, the UK, and France are pushing consumers towards more cost-effective alternatives like manufactured homes. Secondly, growing environmental concerns are promoting the adoption of sustainable building practices, and manufactured homes often boast better energy efficiency compared to traditional constructions. Finally, the increasing popularity of modular and off-site construction methods contributes to faster build times and reduced on-site disruptions. The market segmentation reveals a significant demand in both single-family and multi-family dwellings across different countries. Germany, the UK, and France represent the largest national markets within Europe, benefiting from strong economies and established housing infrastructure. Key players like Derome AB, Skanska AB, and Portakabin Ltd are driving innovation and market competition, offering a diverse range of manufactured homes to meet varying consumer needs.

However, market growth faces some challenges. Strict building regulations and planning permissions in certain European countries can increase development costs and timeline, potentially hindering market expansion. Furthermore, public perception of manufactured homes sometimes lags behind their modern counterparts, creating a perception hurdle that requires proactive marketing and educational initiatives to overcome. Despite these restraints, the long-term outlook for the European manufactured homes market remains positive, driven by sustained demand for affordable, efficient, and sustainable housing, particularly in densely populated urban areas and regions grappling with housing shortages. This presents significant opportunities for manufacturers, developers, and related industries to invest and grow within this dynamic sector. The continued focus on innovation and sustainability will be crucial for future success in this evolving market landscape.

Europe Manufactured Homes Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Manufactured Homes Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, leading players, emerging trends, and future growth prospects. Expect detailed data and analysis across key segments and geographies, including Germany, the United Kingdom, France, and the Rest of Europe. The total market size is projected to reach xx Million by 2033.

Europe Manufactured Homes Market Market Dynamics & Concentration

The European manufactured homes market exhibits a moderately concentrated landscape, with several key players holding significant market share. Market concentration is influenced by factors such as economies of scale in production, access to capital, and brand recognition. The market share of the top five players is estimated at approximately xx%, indicating room for both consolidation and new entrants. Innovation is a key driver, with companies continuously investing in new technologies and designs to improve efficiency, sustainability, and affordability. Regulatory frameworks, including building codes and environmental regulations, play a significant role, influencing both production processes and market access. Prefabricated housing faces competition from traditional construction methods, but growing demand for faster, more cost-effective housing solutions is steadily expanding the market. Mergers and acquisitions (M&A) activity is also impacting market concentration. The number of M&A deals in the sector averaged xx per year during the historical period (2019-2024).

- Market Concentration: Top 5 players hold approximately xx% market share.

- Innovation Drivers: Focus on sustainable materials, smart home technologies, and efficient construction methods.

- Regulatory Framework: Building codes, environmental standards, and zoning regulations impact market growth.

- Product Substitutes: Traditional construction methods and other forms of affordable housing.

- End-User Trends: Increasing demand for affordable, sustainable, and quickly deployable housing solutions.

- M&A Activity: Average of xx M&A deals per year (2019-2024).

Europe Manufactured Homes Market Industry Trends & Analysis

The European manufactured homes market is experiencing robust growth, driven by several key factors. Rising urbanization, increasing housing shortages in major cities, and a growing preference for sustainable and affordable housing are all contributing to market expansion. Technological advancements, such as modular construction and the use of advanced materials, are enhancing efficiency and reducing construction times. The shift in consumer preferences towards sustainable and energy-efficient housing is also boosting demand for manufactured homes. Competitive dynamics are shaping the market, with companies vying for market share through product differentiation, strategic partnerships, and technological innovation. The market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033), with market penetration projected to increase to xx% by 2033.

Leading Markets & Segments in Europe Manufactured Homes Market

The United Kingdom currently holds the largest market share within Europe, followed by Germany and France. Several factors contribute to this dominance, including robust economic conditions, supportive government policies, and a well-developed infrastructure for the construction and distribution of manufactured homes. The single-family segment dominates the market due to higher individual housing demand.

- United Kingdom: Strong housing demand, supportive government policies, and established infrastructure.

- Germany: Large population, growing demand for affordable housing, and increasing adoption of sustainable building practices.

- France: Significant urbanization, government initiatives promoting affordable housing, and favorable economic conditions.

- Rest of Europe: Varied market dynamics influenced by local economic conditions and regulatory frameworks.

- Single-Family Segment: Dominates due to higher individual housing demand.

- Multi-Family Segment: Growing steadily, driven by rental market expansion and increasing urbanization.

Europe Manufactured Homes Market Product Developments

Recent product innovations include the integration of smart home technologies, the use of sustainable and recyclable materials, and improved modular design for faster and easier assembly. These developments offer significant competitive advantages by enhancing energy efficiency, reducing environmental impact, and speeding up construction times. The market is seeing a trend towards larger, more customizable manufactured homes, blurring the lines between traditional and manufactured housing.

Key Drivers of Europe Manufactured Homes Market Growth

Several key factors are driving the growth of the European manufactured homes market:

- Technological advancements: Modular construction, sustainable materials, and smart home integration.

- Economic factors: Rising demand for affordable housing and increasing urbanization.

- Regulatory support: Government initiatives promoting sustainable housing and reducing construction times.

Challenges in the Europe Manufactured Homes Market Market

The market faces challenges, including:

- Regulatory hurdles: Varying building codes and permitting processes across different European countries.

- Supply chain issues: Potential disruptions affecting the availability of materials and components.

- Competitive pressures: Competition from traditional construction methods and other affordable housing options. These factors can lead to price fluctuations and potentially reduce profit margins.

Emerging Opportunities in Europe Manufactured Homes Market

Significant growth opportunities exist in the expanding market for sustainable and energy-efficient manufactured homes, strategic partnerships between manufacturers and technology providers, and expansion into underserved markets across Europe. Technological breakthroughs, such as advanced construction techniques and innovative materials, present substantial potential for market growth.

Leading Players in the Europe Manufactured Homes Market Sector

- Derome AB

- Skanska AB

- Portakabin Ltd

- DFH Group

- Swietelsky AG

- Bouygues Batiment International

- Wolf Holding GmbH

- Peab AB

- Containex

- Laing O'Rourke

Key Milestones in Europe Manufactured Homes Market Industry

- June 2022: TopHat announces plans for a new factory in Corby, UK, expected to produce 4,000 homes annually by 2023.

- April 2022: HusCompagniet acquires a prefabricated factory in Esbjerg, Denmark, with an order book of around DKK 200 Million.

Strategic Outlook for Europe Manufactured Homes Market Market

The European manufactured homes market is poised for continued growth, driven by increasing demand for affordable and sustainable housing. Strategic partnerships, technological innovation, and expansion into new markets will be crucial for success. The market offers significant opportunities for companies that can leverage technology, efficiency, and sustainable practices to meet the evolving needs of consumers and address the challenges of housing shortages across Europe.

Europe Manufactured Homes Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

Europe Manufactured Homes Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Manufactured Homes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Huge Demand for Prefabricated Housing Driving the Market; Huge Demand for Multi-family Houses Driving Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness of Prefabricated Market; Lack of Standardization and Regulation in the Prefabricated Buildings Industry

- 3.4. Market Trends

- 3.4.1. Demand of Prefabricated Houses is Increasing in Sweden

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Derome AB

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Skanska AB

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Portakabin Ltd**List Not Exhaustive

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 DFH Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Swietelsky AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Bouygues Batiment International

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Wolf Holding GmbH

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Peab AB

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Containex

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Laing O'Rourke

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Derome AB

List of Figures

- Figure 1: Europe Manufactured Homes Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Manufactured Homes Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Manufactured Homes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Manufactured Homes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Manufactured Homes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Manufactured Homes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Europe Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Manufactured Homes Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Europe Manufactured Homes Market?

Key companies in the market include Derome AB, Skanska AB, Portakabin Ltd**List Not Exhaustive, DFH Group, Swietelsky AG, Bouygues Batiment International, Wolf Holding GmbH, Peab AB, Containex, Laing O'Rourke.

3. What are the main segments of the Europe Manufactured Homes Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Huge Demand for Prefabricated Housing Driving the Market; Huge Demand for Multi-family Houses Driving Market Growth.

6. What are the notable trends driving market growth?

Demand of Prefabricated Houses is Increasing in Sweden.

7. Are there any restraints impacting market growth?

Lack of Awareness of Prefabricated Market; Lack of Standardization and Regulation in the Prefabricated Buildings Industry.

8. Can you provide examples of recent developments in the market?

June 2022 - TopHat, a modular housing developer, which is 70 percent owned by US bank Goldman Sachs, is planning a new factory in Corby, Northamptonshire. The facility, by 2023, will be capable of producing 4,000 homes a year, making it Europe's largest modular housing factory, according to TopHat.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Manufactured Homes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Manufactured Homes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Manufactured Homes Market?

To stay informed about further developments, trends, and reports in the Europe Manufactured Homes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence