Key Insights

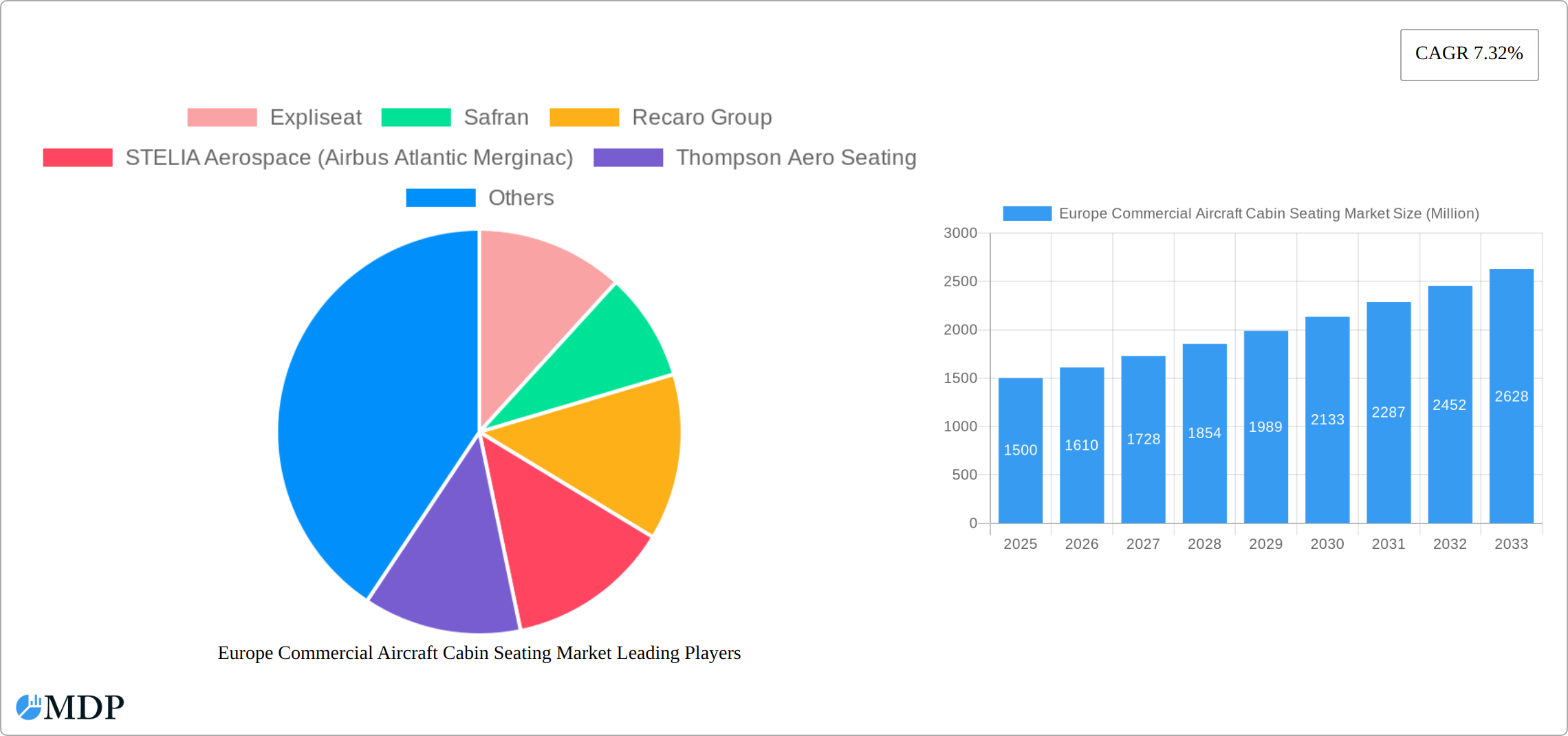

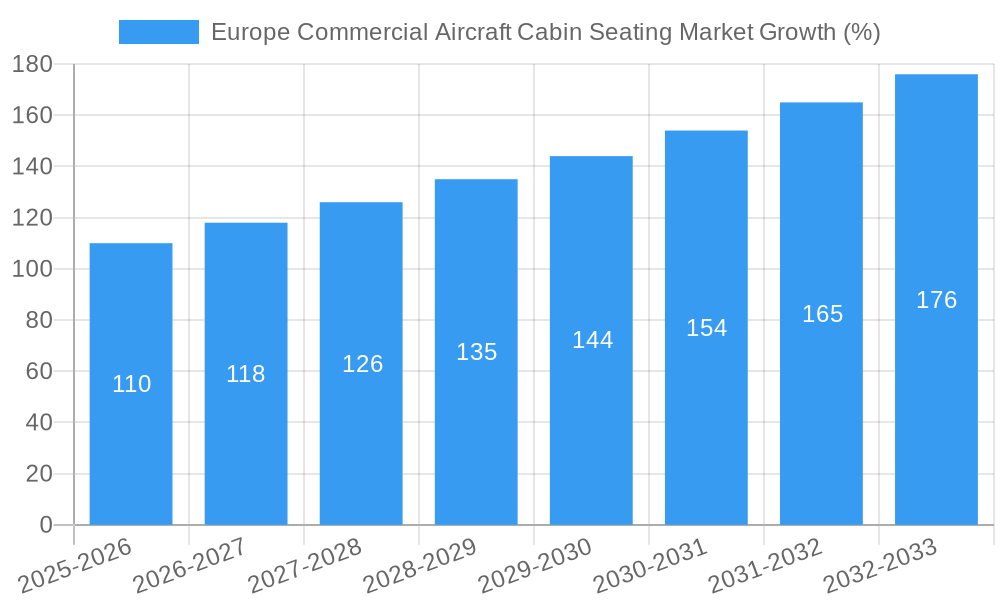

The European commercial aircraft cabin seating market, valued at approximately €X million in 2025 (assuming a logical extrapolation based on the provided CAGR and market size), is projected to experience robust growth, driven by a 7.32% CAGR from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the resurgence in air travel post-pandemic is significantly boosting demand for new aircraft and cabin refurbishment, leading to increased requirements for modern, comfortable, and technologically advanced seating. Secondly, a growing focus on enhancing passenger experience through innovative seating designs, improved ergonomics, and in-seat entertainment systems is driving market growth. Finally, the increasing adoption of lighter-weight materials in seating manufacturing contributes to fuel efficiency and operational cost reductions for airlines, further stimulating market demand. Key market segments include narrowbody and widebody aircraft seating, with significant contributions from major European countries such as Germany, France, the United Kingdom, and Spain. The competitive landscape is characterized by established players like Safran, Recaro Group, and Collins Aerospace, alongside innovative companies such as Expliseat, constantly striving for differentiation through technological advancements and customized solutions.

Despite the positive outlook, market growth faces some challenges. Supply chain disruptions, fluctuating raw material prices, and potential economic downturns could influence manufacturing costs and overall market expansion. Furthermore, the increasing focus on sustainability and the adoption of eco-friendly materials within the aviation industry will require manufacturers to adapt and invest in sustainable technologies and processes. However, the long-term prospects for the European commercial aircraft cabin seating market remain strong, underpinned by consistent air travel growth, technological advancements, and the unwavering pursuit of enhanced passenger comfort and operational efficiency within the aviation sector. The market is expected to witness continued innovation in areas such as personalized seating, improved safety features, and integrated in-flight connectivity.

Europe Commercial Aircraft Cabin Seating Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Commercial Aircraft Cabin Seating Market, offering invaluable insights for stakeholders across the aviation industry. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, key players, and future growth potential. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period runs from 2025 to 2033, and the historical period covers 2019-2024. Expect detailed analysis on market size (in Millions), CAGR, and market share across key segments and countries.

Europe Commercial Aircraft Cabin Seating Market Market Dynamics & Concentration

The European commercial aircraft cabin seating market is characterized by a moderate level of concentration, with several major players holding significant market share. The market exhibits dynamic interplay between established giants and innovative newcomers. Market share distribution amongst the top players is estimated to be around xx%, with the leading five companies accounting for approximately xx Million in revenue in 2025. Innovation is a key driver, spurred by the demand for lighter, more comfortable, and technologically advanced seating solutions. Stringent safety regulations and evolving passenger expectations further shape market dynamics. Product substitution is minimal, given the specialized nature of aircraft seating. The market is witnessing increased M&A activity, with xx mergers and acquisitions recorded between 2019 and 2024, indicating consolidation and expansion strategies amongst key players. End-user trends point towards a growing preference for personalized, ergonomic seating with improved in-flight entertainment options.

- Market Concentration: Moderately concentrated, top 5 players holding approximately xx% market share in 2025.

- Innovation Drivers: Lightweight materials, improved ergonomics, integrated technology.

- Regulatory Framework: Stringent safety standards and environmental regulations.

- Product Substitutes: Limited due to specialized nature of aircraft seating.

- End-User Trends: Growing preference for personalized comfort and in-flight entertainment.

- M&A Activities: xx mergers and acquisitions between 2019 and 2024.

Europe Commercial Aircraft Cabin Seating Market Industry Trends & Analysis

The European commercial aircraft cabin seating market is poised for significant growth, driven by a resurgence in air travel post-pandemic and the ongoing fleet modernization initiatives of major airlines. The market is estimated to grow at a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the integration of advanced materials and digital technologies, are reshaping the competitive landscape. Consumer preferences are shifting towards enhanced comfort, personalized experiences, and sustainable solutions. Competitive dynamics are intensifying, with companies focusing on product differentiation, technological innovation, and strategic partnerships to gain market share. Market penetration is expected to increase significantly due to rising demand and the introduction of new aircraft models. The market's growth trajectory is also influenced by evolving passenger demographics, changing travel patterns, and economic conditions across Europe.

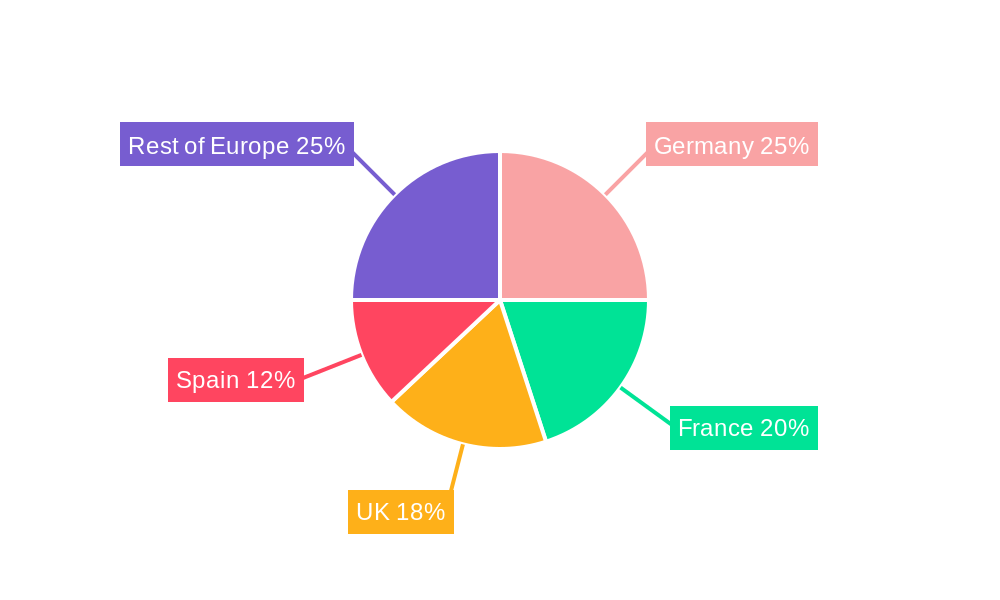

Leading Markets & Segments in Europe Commercial Aircraft Cabin Seating Market

The United Kingdom and Germany represent the leading national markets in Europe, driven by strong domestic air travel and the presence of major airlines and aircraft manufacturers. The narrowbody aircraft segment dominates, owing to the prevalence of single-aisle aircraft in European airlines' fleets.

Key Drivers:

- United Kingdom: Strong domestic air travel, large airline base, and substantial aircraft manufacturing presence.

- Germany: Significant airline presence, advanced manufacturing capabilities, and strong economic growth.

- Narrowbody Segment: High demand driven by the popularity of single-aisle aircraft in short-to-medium haul flights.

Dominance Analysis: The UK and Germany benefit from robust aviation infrastructure, favorable regulatory environments, and substantial investments in airline expansion and fleet modernization. The narrowbody segment's dominance stems from the efficient cost structure and high passenger capacity of single-aisle aircraft.

Europe Commercial Aircraft Cabin Seating Market Product Developments

Recent years have witnessed significant advancements in aircraft seating technology, marked by the introduction of lighter weight materials, improved ergonomics, and the integration of advanced passenger comfort features. This is particularly evident in the introduction of seats with enhanced in-flight entertainment systems and improved adjustability options. Companies are aggressively pursuing product differentiation through innovation in design, materials, and functionalities to meet evolving passenger expectations. Key technological trends include the increased use of composite materials, advanced cushioning systems, and the integration of personal devices. The market fit is strong, as these innovations directly address the growing demand for comfort, personalized experiences, and eco-friendly solutions.

Key Drivers of Europe Commercial Aircraft Cabin Seating Market Growth

The European commercial aircraft cabin seating market's growth is fueled by a confluence of factors. The increasing number of air travelers is a significant driver, pushing airlines to upgrade their fleets and cabin interiors to enhance passenger experience. Technological advancements, including lighter and more durable materials, are also increasing demand. Furthermore, favorable economic conditions in several European countries and supportive government policies have created a conducive environment for market expansion. The growing focus on sustainability is leading to the development of eco-friendly seating solutions, further boosting market growth.

Challenges in the Europe Commercial Aircraft Cabin Seating Market Market

The market faces challenges such as stringent regulatory compliance requirements that add to manufacturing costs. Fluctuations in raw material prices and potential supply chain disruptions due to global events represent significant obstacles. Intense competition among established and emerging players also presents a challenge in securing market share. These factors can impact profitability and hinder growth, necessitating adaptive strategies from companies in the sector. The estimated negative impact on market growth from these factors is approximately xx% annually.

Emerging Opportunities in Europe Commercial Aircraft Cabin Seating Market

The burgeoning market for sustainable and lightweight seating options presents a significant opportunity. Strategic partnerships between seating manufacturers and technology providers can lead to innovative product development and market penetration. Expansion into new markets through strategic alliances and international collaborations can unlock substantial growth potential. Moreover, the development of advanced cabin management systems and improved in-flight entertainment technology will drive demand for upgraded seating solutions.

Leading Players in the Europe Commercial Aircraft Cabin Seating Market Sector

- Expliseat

- Safran

- Recaro Group

- STELIA Aerospace (Airbus Atlantic Merginac)

- Thompson Aero Seating

- Jamco Corporation

- Adient Aerospace

- Collins Aerospace

- ZIM Aircraft Seating Gmb

Key Milestones in Europe Commercial Aircraft Cabin Seating Market Industry

- May 2022: Thompson Aero Seating launches next generation VantageXL. This launch signaled a significant advancement in seat technology, impacting market competition through enhanced product features.

- June 2022: Recaro Aircraft Seating was selected by KLM Royal Dutch Airlines (KLM), Transavia France, and Netherlands-based Transavia Airlines to outfit new Airbus aircraft with economy class seats. This large-scale contract significantly boosted Recaro's market share and visibility.

- June 2022: STELIA Aerospace and AERQ to collaborate on Cabin Digital Signage integration of OPERA seats for the A320neo family. This partnership highlights the growing trend of integrating technology into aircraft seating, influencing future product development.

Strategic Outlook for Europe Commercial Aircraft Cabin Seating Market Market

The European commercial aircraft cabin seating market exhibits strong growth potential, driven by factors like rising air travel, fleet modernization, and technological advancements. Strategic opportunities abound for companies focused on innovation, sustainability, and customer-centric solutions. By capitalizing on these trends, manufacturers can secure a leading position in this dynamic market and capture a significant share of the projected growth. The market's future success hinges on companies’ ability to adapt to shifting passenger preferences and technological innovations, while maintaining a focus on cost-effectiveness and operational efficiency.

Europe Commercial Aircraft Cabin Seating Market Segmentation

-

1. Aircraft Type

- 1.1. Narrowbody

- 1.2. Widebody

Europe Commercial Aircraft Cabin Seating Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Commercial Aircraft Cabin Seating Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Commercial Aircraft Cabin Seating Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Narrowbody

- 5.1.2. Widebody

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. Germany Europe Commercial Aircraft Cabin Seating Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Commercial Aircraft Cabin Seating Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Commercial Aircraft Cabin Seating Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Commercial Aircraft Cabin Seating Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Commercial Aircraft Cabin Seating Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Commercial Aircraft Cabin Seating Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Commercial Aircraft Cabin Seating Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Expliseat

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Safran

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Recaro Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 STELIA Aerospace (Airbus Atlantic Merginac)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Thompson Aero Seating

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Jamco Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Adient Aerospace

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Collins Aerospace

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 ZIM Aircraft Seating Gmb

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Expliseat

List of Figures

- Figure 1: Europe Commercial Aircraft Cabin Seating Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Commercial Aircraft Cabin Seating Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Commercial Aircraft Cabin Seating Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Commercial Aircraft Cabin Seating Market Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 3: Europe Commercial Aircraft Cabin Seating Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Commercial Aircraft Cabin Seating Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Commercial Aircraft Cabin Seating Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Commercial Aircraft Cabin Seating Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Commercial Aircraft Cabin Seating Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Commercial Aircraft Cabin Seating Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Commercial Aircraft Cabin Seating Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Commercial Aircraft Cabin Seating Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Commercial Aircraft Cabin Seating Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Commercial Aircraft Cabin Seating Market Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 13: Europe Commercial Aircraft Cabin Seating Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Commercial Aircraft Cabin Seating Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Commercial Aircraft Cabin Seating Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Commercial Aircraft Cabin Seating Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Commercial Aircraft Cabin Seating Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Commercial Aircraft Cabin Seating Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Commercial Aircraft Cabin Seating Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Commercial Aircraft Cabin Seating Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Commercial Aircraft Cabin Seating Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Commercial Aircraft Cabin Seating Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Commercial Aircraft Cabin Seating Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Commercial Aircraft Cabin Seating Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Commercial Aircraft Cabin Seating Market?

The projected CAGR is approximately 7.32%.

2. Which companies are prominent players in the Europe Commercial Aircraft Cabin Seating Market?

Key companies in the market include Expliseat, Safran, Recaro Group, STELIA Aerospace (Airbus Atlantic Merginac), Thompson Aero Seating, Jamco Corporation, Adient Aerospace, Collins Aerospace, ZIM Aircraft Seating Gmb.

3. What are the main segments of the Europe Commercial Aircraft Cabin Seating Market?

The market segments include Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2022: Recaro Aircraft Seating was selected by KLM Royal Dutch Airlines (KLM), Transavia France, and Netherlands-based Transavia Airlines to outfit new Airbus aircraft with economy class seats.June 2022: STELIA Aerospace and AERQ to collaborate on Cabin Digital Signage integration of OPERA seats for the A320neo family.May 2022: Thompson Aero Seating launches next generation VantageXL.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Commercial Aircraft Cabin Seating Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Commercial Aircraft Cabin Seating Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Commercial Aircraft Cabin Seating Market?

To stay informed about further developments, trends, and reports in the Europe Commercial Aircraft Cabin Seating Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence