Key Insights

The Egypt condominiums and apartments market exhibits robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 11% from 2025 to 2033. This expansion is fueled by several key drivers. A burgeoning population, particularly in urban centers like Cairo, Alexandria, and Hurghada, necessitates increased housing supply. Furthermore, rising disposable incomes and a growing middle class are fueling demand for improved living standards, including modern condominiums and apartments. Tourism's significant contribution to the Egyptian economy also stimulates investment in high-quality residential properties, especially in popular tourist destinations such as Luxor and Aswan. Government initiatives aimed at improving infrastructure and attracting foreign investment further bolster the market's trajectory. Leading developers such as SODIC, Orascom Development, and Hassan Allam Properties are actively shaping the market landscape through innovative projects and upscale developments. Competition within the sector is healthy, driving innovation and providing a diverse range of options for buyers. However, challenges remain; economic volatility and fluctuating construction costs can impact development timelines and pricing. Nevertheless, the long-term outlook for the Egyptian condominium and apartment market remains positive, underpinned by fundamental demographic and economic trends.

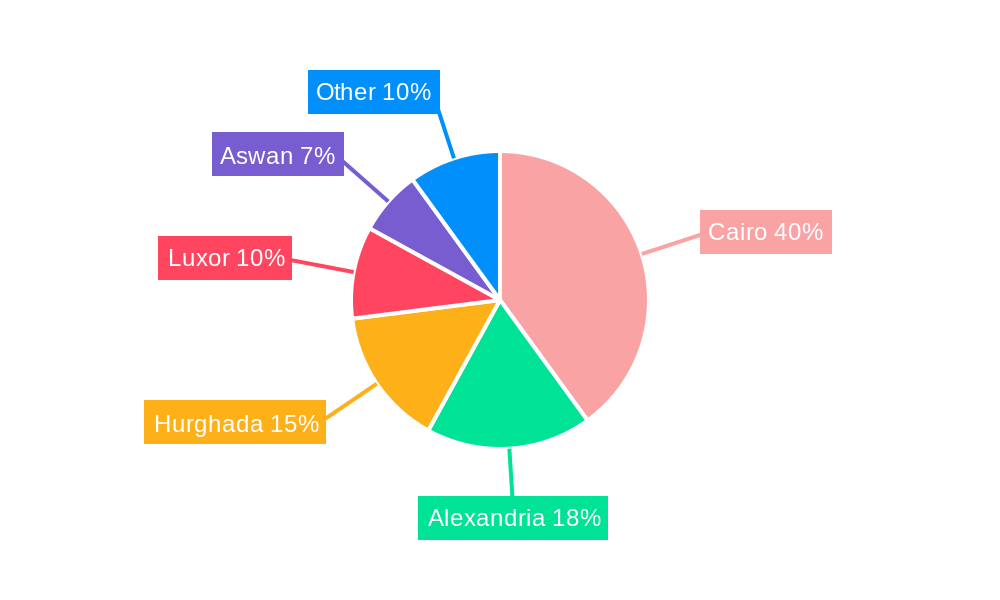

The market segmentation reveals significant activity across key cities. Cairo, as the largest metropolitan area, naturally commands the largest market share. However, coastal cities like Hurghada and Alexandria also experience substantial growth driven by tourism and a desirable lifestyle. Luxor and Aswan benefit from their historical significance and the associated tourism-driven demand for upscale residential options. The market is characterized by a mix of high-end luxury developments catering to affluent buyers and more affordable options aimed at the growing middle class, demonstrating a wide range of price points and catering to varying demands. This diverse offering contributes to the market's overall resilience and sustained growth potential. The presence of numerous established and emerging developers indicates a competitive market dynamic, with ongoing innovation in design, amenities, and sustainable practices.

Egypt Condominiums and Apartments Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Egypt condominiums and apartments market, offering invaluable insights for investors, developers, and industry stakeholders. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, trends, leading players, and future growth opportunities. Unlock strategic advantages and navigate the evolving landscape of Egypt's vibrant real estate sector.

Egypt Condominiums and Apartments Market Market Dynamics & Concentration

The Egyptian condominiums and apartments market exhibits a dynamic interplay of factors shaping its concentration and trajectory. Market share is currently dominated by a few large players like SODIC, Orascom Development, and Hassan Allam Properties, accounting for approximately xx% of the total market, while numerous smaller developers contribute to a fragmented landscape.

Market Concentration: The market demonstrates moderate concentration, with a Herfindahl-Hirschman Index (HHI) estimated at xx, indicating room for both consolidation and niche player expansion. This is influenced by factors including access to capital, land availability, and brand recognition.

Innovation Drivers: Technological advancements in construction techniques, sustainable building materials, and smart home integration are driving innovation. Increased adoption of PropTech solutions is also improving efficiency and enhancing customer experience.

Regulatory Frameworks: Government policies, including land allocation and building regulations, play a crucial role in shaping market dynamics. Recent initiatives aimed at streamlining approvals and encouraging foreign investment are expected to impact market growth.

Product Substitutes: The market faces competition from alternative housing options such as villas and townhouses, particularly in certain price segments. However, the convenience and affordability of apartments often give them a competitive edge.

End-User Trends: Growing urbanization, rising disposable incomes, and a preference for modern living spaces are key end-user trends fueling demand. The demand for environmentally conscious and technologically advanced properties is also on the rise.

M&A Activities: The number of M&A deals within the sector has fluctuated over the historical period, with xx major deals recorded in 2024. Consolidation is expected to continue, particularly among mid-sized developers seeking to improve market share and competitive positioning.

Egypt Condominiums and Apartments Market Industry Trends & Analysis

The Egyptian condominiums and apartments market is experiencing robust growth driven by a multitude of factors. The Compound Annual Growth Rate (CAGR) between 2019 and 2024 is estimated at xx%, with market penetration increasing by xx percentage points.

Several key trends shape market dynamics:

- Urbanization: Rapid urbanization, particularly in Cairo and Alexandria, significantly fuels demand for apartments and condominiums.

- Economic Growth: Steady economic growth, although subject to volatility, supports rising disposable incomes and increased purchasing power.

- Government Initiatives: Government initiatives aimed at developing new cities, such as the New Administrative Capital, are creating opportunities for new developments.

- Tourism: The strong tourism sector contributes to demand for apartments, particularly in coastal cities like Hurghada.

- Changing Lifestyle Preferences: Increased preferences for smaller, modern, and well-equipped apartments drive demand for high-quality, contemporary properties.

- Technological Disruptions: PropTech adoption continues to enhance efficiencies across project development, sales, and management.

- Competitive Dynamics: A large player base creates competitive pressure with regard to pricing and project features, fostering innovation and improved customer service.

The market is also characterized by strong price fluctuations depending on location, amenities, and developer reputation, with average prices expected to remain volatile in the near future.

Leading Markets & Segments in Egypt Condominiums and Apartments Market

Cairo maintains its position as the leading market for condominiums and apartments in Egypt, accounting for approximately xx% of the total market value. This dominance is a result of several key factors.

Key Drivers of Cairo's Dominance:

- High Population Density: Cairo’s exceptionally high population density creates significant housing demand.

- Economic Center: Cairo's status as Egypt's economic and employment hub contributes to strong demand for housing.

- Infrastructure Development: Continued investment in Cairo’s infrastructure enhances the attractiveness of the residential real estate sector.

- Established Market: Cairo boasts a mature and well-established market that already has the infrastructure to accommodate considerable expansion.

- Government Support: Government investment in new urban developments and infrastructure adds to the city's appeal for both residential and commercial investments.

Alexandria, Hurghada, Luxor, and Aswan represent other significant but smaller markets, each catering to distinct segments and demographics. The expansion of tourism in certain regions has contributed to the growth of the residential market there.

Egypt Condominiums and Apartments Market Product Developments

Recent product innovations are focused on enhancing sustainability, incorporating smart home technologies, and offering more flexible living spaces. Green building certifications and the utilization of energy-efficient materials are becoming increasingly prevalent. Smart home features, such as automated lighting and security systems, are gaining traction, while modular and prefabricated construction methods are improving efficiency and reducing construction time. These trends are aligned with evolving consumer preferences, adding a significant competitive advantage to developers offering such features.

Key Drivers of Egypt Condominiums and Apartments Market Growth

Several factors are driving growth in the Egyptian condominiums and apartments market:

- Increasing Urbanization: The ongoing migration from rural to urban areas fuels strong demand for housing.

- Rising Disposable Incomes: A growing middle class with increased disposable incomes is contributing to greater purchasing power and affordability of residential property.

- Government Initiatives: The government's continuous investments in infrastructure and development projects are making housing more accessible and attracting foreign investors.

- Tourism: The tourism sector also drives demand for rental apartments and high-end condominiums in popular tourist destinations.

Challenges in the Egypt Condominiums and Apartments Market Market

Challenges faced by the market include:

- Regulatory Hurdles: Complex bureaucratic processes and regulatory inconsistencies can delay projects and increase development costs.

- Financing Constraints: Access to financing for developers and buyers can be restrictive, particularly for larger projects and high-rise constructions.

- Supply Chain Issues: Fluctuations in material costs and supply chain disruptions can impact project timelines and profitability.

- Inflation: High inflation rates impacting construction costs and housing prices can result in slower sales and higher development costs.

Emerging Opportunities in Egypt Condominiums and Apartments Market

The Egyptian condominiums and apartments market presents significant long-term growth opportunities, driven by:

- New City Developments: Large-scale development projects in new cities are providing a steady supply of land and attracting investment.

- Technological Advancements: The use of sustainable building materials and smart home technologies presents strong opportunities for growth.

- Strategic Partnerships: Collaborative efforts between developers, technology companies, and financial institutions can support market growth.

- Affordable Housing Initiatives: Addressing the demand for affordable housing will unlock vast opportunities for developers targeting specific demographics.

Leading Players in the Egypt Condominiums and Apartments Market Sector

- Iwan Developments

- ERA Real Estate Egypt

- Orascom Development (Orascom Development)

- Coldwell Banker Egypt (Coldwell Banker)

- ORA Developments

- ERG Developments

- Wadi Degla Developments

- SODIC (SODIC)

- NEWGIZA

- El Shams

- LA Vista Developments

- Hassan Allam Properties (Hassan Allam Properties)

Key Milestones in Egypt Condominiums and Apartments Market Industry

- October 2022: ERG Developments launched the Ri8 project in the New Administrative Capital (NAC), a USD 178 Million investment comprising 1,063 apartments across 34 buildings.

- October 2022: Ora Developers partnered with JLL for project management services on a large-scale mixed-use development encompassing 407 residential units.

Strategic Outlook for Egypt Condominiums and Apartments Market Market

The Egyptian condominiums and apartments market exhibits strong long-term growth potential. Continued urbanization, rising disposable incomes, and government support will drive demand. Strategic opportunities lie in adopting sustainable practices, leveraging technological advancements, and developing innovative financing models to cater to the evolving needs of the market. Focusing on specific underserved segments and catering to demand in developing areas represent avenues for market expansion.

Egypt Condominiums and Apartments Market Segmentation

-

1. Key Cities

- 1.1. Cairo

- 1.2. Luxor

- 1.3. Aswan

- 1.4. Alexandria

- 1.5. Hurghada

Egypt Condominiums and Apartments Market Segmentation By Geography

- 1. Egypt

Egypt Condominiums and Apartments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 11.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Private Investment in Real Estate Sector; Growth in the Luxury Housing Market

- 3.3. Market Restrains

- 3.3.1. Increase in primary and secondary rents in the market

- 3.4. Market Trends

- 3.4.1. Apartments Construction Gaining Traction in Egypt

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 5.1.1. Cairo

- 5.1.2. Luxor

- 5.1.3. Aswan

- 5.1.4. Alexandria

- 5.1.5. Hurghada

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Iwan Developments

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ERA Real Estate Egypt

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Orascom Development

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Coldwell Banker Egypt

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ORA Developments

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ERG Developments

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wadi Degla Developments

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SODIC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 NEWGIZA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 El Shams**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 LA Vista Developments

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hassan Allam Properties

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Iwan Developments

List of Figures

- Figure 1: Egypt Condominiums and Apartments Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Egypt Condominiums and Apartments Market Share (%) by Company 2024

List of Tables

- Table 1: Egypt Condominiums and Apartments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Egypt Condominiums and Apartments Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 3: Egypt Condominiums and Apartments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Egypt Condominiums and Apartments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Egypt Condominiums and Apartments Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 6: Egypt Condominiums and Apartments Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Condominiums and Apartments Market?

The projected CAGR is approximately > 11.00%.

2. Which companies are prominent players in the Egypt Condominiums and Apartments Market?

Key companies in the market include Iwan Developments, ERA Real Estate Egypt, Orascom Development, Coldwell Banker Egypt, ORA Developments, ERG Developments, Wadi Degla Developments, SODIC, NEWGIZA, El Shams**List Not Exhaustive, LA Vista Developments, Hassan Allam Properties.

3. What are the main segments of the Egypt Condominiums and Apartments Market?

The market segments include Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Private Investment in Real Estate Sector; Growth in the Luxury Housing Market.

6. What are the notable trends driving market growth?

Apartments Construction Gaining Traction in Egypt.

7. Are there any restraints impacting market growth?

Increase in primary and secondary rents in the market.

8. Can you provide examples of recent developments in the market?

October 2022- ERG Developments (the developer of the residential projects) launched residential project Ri8 in the New Administrative Capital (NAC) with an investment of more than USD 178 million. The project is spread over 25-acre land and consists of 34 residential buildings incorporating 1,063 apartments. This project will be completed in three phases.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Condominiums and Apartments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Condominiums and Apartments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Condominiums and Apartments Market?

To stay informed about further developments, trends, and reports in the Egypt Condominiums and Apartments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence