Key Insights

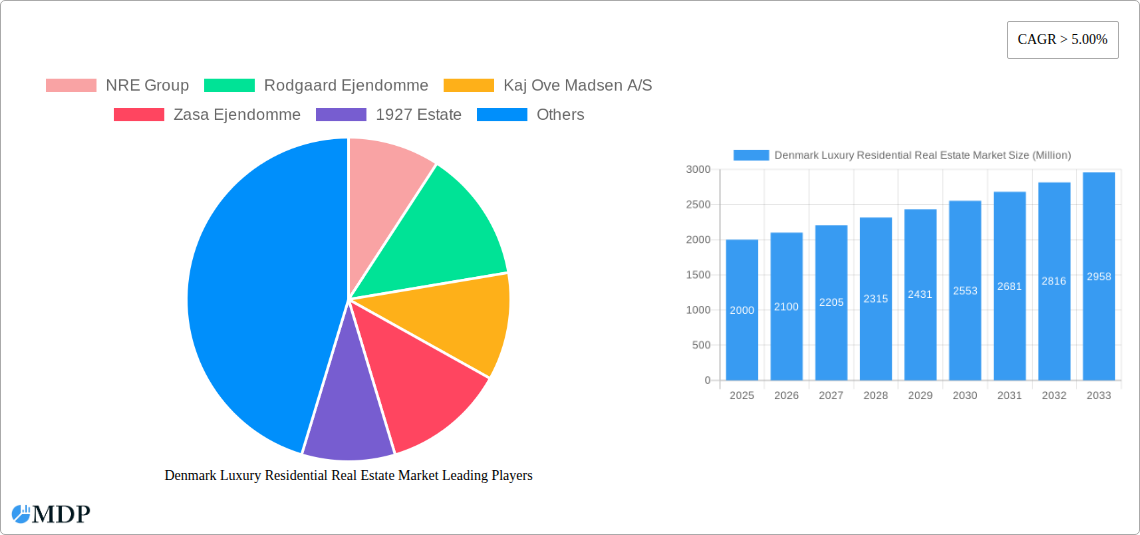

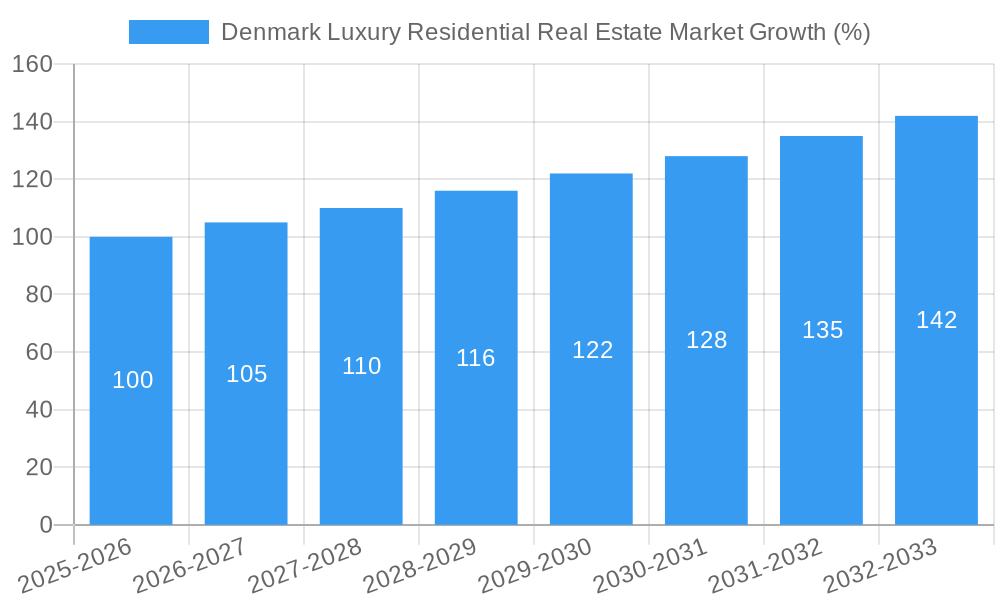

The Denmark luxury residential real estate market, valued at approximately €2 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% through 2033. This expansion is fueled by several key factors. Firstly, a strong Danish economy and increasing high-net-worth individuals are driving demand for premium properties. Secondly, a limited supply of luxury villas and landed houses, coupled with rising urbanization and a preference for upscale condominiums and apartments in prime locations, creates a seller's market. Furthermore, Denmark's attractive lifestyle, stable political climate, and robust infrastructure continue to attract international buyers, contributing to market dynamism. The segment encompassing villas and landed houses currently commands a larger market share, but the condominium/apartment segment is showing significant growth, mirroring global trends in urban luxury living. Leading developers like NRE Group, Rodgaard Ejendomme, and others are strategically capitalizing on these market trends through innovative projects and targeted marketing.

However, certain restraints temper this growth. Rising construction costs and stringent building regulations can impact the availability of new luxury units. Furthermore, fluctuations in the global economy and potential interest rate hikes could moderate buyer demand, though the inherent resilience of the luxury market is anticipated to mitigate these effects. Competition among developers remains intense, necessitating strategic differentiation through unique architectural designs, sustainable features, and prime locations to secure a competitive advantage. The forecast period (2025-2033) promises continued expansion for the Danish luxury residential real estate sector, fueled by persistent strong economic fundamentals and evolving consumer preferences, with the condominium market showing particular promise for future growth.

Denmark Luxury Residential Real Estate Market: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Denmark luxury residential real estate market from 2019 to 2033, offering invaluable insights for investors, developers, and industry stakeholders. With a focus on market dynamics, key players, and future trends, this report is essential for navigating the complexities of this lucrative sector. The report utilizes data from 2019-2024 (Historical Period), with an estimated year of 2025 and a forecast period of 2025-2033. The Base Year for projections is 2025.

High-traffic Keywords: Denmark luxury real estate, Danish luxury homes, Copenhagen real estate market, Aarhus real estate, Danish real estate investment, luxury villas Denmark, luxury apartments Denmark, Danish property market trends, real estate market forecast Denmark, residential real estate Denmark

Denmark Luxury Residential Real Estate Market Dynamics & Concentration

The Danish luxury residential real estate market exhibits a moderately concentrated landscape, with a few key players holding significant market share. While precise market share figures for individual companies are unavailable (xx%), key players such as NRE Group, Rodgaard Ejendomme, and Kaj Ove Madsen A/S contribute significantly to the overall market volume. Innovation is driven by sustainable building practices, smart home technology integration, and architectural design advancements. Regulatory frameworks, including building codes and environmental regulations, play a vital role in shaping market development. Product substitutes are limited, as luxury properties offer unique features and locations not easily replicated. End-user trends show a preference for sustainable, energy-efficient properties in prime locations with exceptional amenities. M&A activity, exemplified by Orange Capital Partners' acquisition of a significant portfolio from NREP in June 2022, signals ongoing consolidation within the sector. The number of M&A deals in the historical period (2019-2024) is estimated at xx.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Drivers: Sustainable building, smart home technology, architectural design.

- Regulatory Framework: Building codes, environmental regulations significantly impact market dynamics.

- Product Substitutes: Limited; luxury homes offer unique value propositions.

- End-User Trends: Strong preference for sustainable, high-amenity properties in prime locations.

- M&A Activity: Moderate level, with significant deals indicating consolidation (e.g., Orange Capital Partners' acquisition of NREP portfolio).

Denmark Luxury Residential Real Estate Market Industry Trends & Analysis

The Danish luxury residential real estate market is experiencing robust growth, driven by a combination of factors. A strong economy, increasing disposable incomes among high-net-worth individuals, and limited housing supply in prime areas fuel demand. Technological disruptions, such as the adoption of smart home technologies and sustainable building materials, influence consumer preferences. Competitive dynamics involve price competition, differentiation through unique architectural design and amenities, and branding strategies. The Compound Annual Growth Rate (CAGR) for the historical period (2019-2024) is estimated at xx%, with a projected CAGR of xx% for the forecast period (2025-2033). Market penetration of luxury residential properties remains relatively low compared to the overall residential market. This suggests significant untapped potential for expansion.

Leading Markets & Segments in Denmark Luxury Residential Real Estate Market

Copenhagen and Aarhus represent the dominant markets for luxury residential real estate in Denmark. Copenhagen's central location, historical significance, and high concentration of affluent individuals fuel demand, while Aarhus's growing economy and appeal as a vibrant city attract investment.

Key Drivers for Copenhagen & Aarhus Dominance:

- Strong Economies: Both cities boast robust economies and high disposable incomes.

- Limited Supply: Shortage of luxury properties contributes to high demand and prices.

- Prime Locations: Exceptional locations, views, and proximity to amenities drive demand.

- Infrastructure: Well-developed infrastructure enhances the desirability of these locations.

Segment Analysis (By Type):

Both Villas/Landed Houses and Condominiums/Apartments contribute significantly to the luxury segment. However, the preference might lean towards Condominiums/Apartments (xx%) due to their relative convenience and access to amenities within urban centers. Villas/Landed Houses cater to a specific niche of buyers who prefer larger spaces and privacy. The demand for both types is high in the prime areas of Copenhagen and Aarhus, and this demand is predicted to remain consistent in the forecast period.

Denmark Luxury Residential Real Estate Market Product Developments

Product innovations focus on sustainable and energy-efficient designs, integrating smart home technologies and emphasizing high-quality materials. This reflects broader consumer preferences and aligns with the country's focus on environmental sustainability. Competitive advantages stem from unique architectural designs, prime locations, bespoke finishes, and superior amenities, creating a truly differentiated luxury offering.

Key Drivers of Denmark Luxury Residential Real Estate Market Growth

Several factors drive growth in the Danish luxury residential market. A strong economy with increasing high-net-worth individuals fuels demand. Limited supply in prime urban areas creates scarcity and drives up prices. Government policies and infrastructure development contribute to the overall attractiveness of the market. Lastly, technological advancements in construction and smart home technology increase the appeal of luxury properties.

Challenges in the Denmark Luxury Residential Real Estate Market

The Danish luxury residential market faces challenges such as stringent building regulations and potentially high construction costs, potentially limiting supply and driving up prices. Competition from existing high-end developments and global luxury real estate markets creates competitive pressures. Supply chain issues associated with materials and skilled labor, as well as fluctuating interest rates can also impact the market. These factors might result in a xx% reduction in new project launches in the forecast period if not addressed effectively.

Emerging Opportunities in Denmark Luxury Residential Real Estate Market

Emerging opportunities include increased demand for sustainable and energy-efficient luxury homes, creating a niche for developers. Strategic partnerships between developers and technology companies can lead to innovative and technologically advanced properties. Expanding into smaller Danish cities with attractive lifestyle features could unlock new market segments. Increased investment from international sources further propels growth opportunities.

Leading Players in the Denmark Luxury Residential Real Estate Market Sector

- NRE Group

- Rodgaard Ejendomme

- Kaj Ove Madsen A/S

- Zasa Ejendomme

- 1927 Estate

- Krobi (List Not Exhaustive)

- Juvel Ejendomme

- Bruce Turner

- Fink Ejendomme

- Unika Ejendomme ApS

Key Milestones in Denmark Luxury Residential Real Estate Market Industry

- November 2022: AkademikerPension announces a significant shift in its real estate portfolio, increasing its allocation to residential properties (50% target by 2026), indicating strong investor confidence in the sector. This will primarily focus on Copenhagen and Aarhus with 25% investment allocated to smaller cities.

- June 2022: Orange Capital Partners' purchase of a large residential portfolio from NREP showcases substantial investor interest and consolidation within the market. This acquisition highlights the attractiveness of the Danish rental market.

Strategic Outlook for Denmark Luxury Residential Real Estate Market

The Danish luxury residential real estate market offers significant potential for long-term growth. Continued economic strength, limited supply in prime areas, and increasing demand from high-net-worth individuals will drive market expansion. Strategic opportunities include focusing on sustainable development, integrating smart home technologies, and exploring emerging markets within Denmark. The market's resilience, coupled with ongoing investment and innovation, positions it for continued success.

Denmark Luxury Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Villas/Landed Houses

- 1.2. Condominiums/Apartments

-

2. Geography

- 2.1. Copenhagen

- 2.2. Aarhus

- 2.3. Odense

- 2.4. Aalborg

- 2.5. Rest of Denmark

Denmark Luxury Residential Real Estate Market Segmentation By Geography

- 1. Copenhagen

- 2. Aarhus

- 3. Odense

- 4. Aalborg

- 5. Rest of Denmark

Denmark Luxury Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing manufacturing sites4.; The increasing middle-income group and access to mortgage finance

- 3.3. Market Restrains

- 3.3.1. 4.; Rising cost of construction materials.

- 3.4. Market Trends

- 3.4.1. Increasing demand for luxury residences driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas/Landed Houses

- 5.1.2. Condominiums/Apartments

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Copenhagen

- 5.2.2. Aarhus

- 5.2.3. Odense

- 5.2.4. Aalborg

- 5.2.5. Rest of Denmark

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Copenhagen

- 5.3.2. Aarhus

- 5.3.3. Odense

- 5.3.4. Aalborg

- 5.3.5. Rest of Denmark

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Copenhagen Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Villas/Landed Houses

- 6.1.2. Condominiums/Apartments

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Copenhagen

- 6.2.2. Aarhus

- 6.2.3. Odense

- 6.2.4. Aalborg

- 6.2.5. Rest of Denmark

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Aarhus Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Villas/Landed Houses

- 7.1.2. Condominiums/Apartments

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Copenhagen

- 7.2.2. Aarhus

- 7.2.3. Odense

- 7.2.4. Aalborg

- 7.2.5. Rest of Denmark

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Odense Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Villas/Landed Houses

- 8.1.2. Condominiums/Apartments

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Copenhagen

- 8.2.2. Aarhus

- 8.2.3. Odense

- 8.2.4. Aalborg

- 8.2.5. Rest of Denmark

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Aalborg Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Villas/Landed Houses

- 9.1.2. Condominiums/Apartments

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Copenhagen

- 9.2.2. Aarhus

- 9.2.3. Odense

- 9.2.4. Aalborg

- 9.2.5. Rest of Denmark

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Denmark Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Villas/Landed Houses

- 10.1.2. Condominiums/Apartments

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Copenhagen

- 10.2.2. Aarhus

- 10.2.3. Odense

- 10.2.4. Aalborg

- 10.2.5. Rest of Denmark

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 NRE Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rodgaard Ejendomme

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kaj Ove Madsen A/S

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Zasa Ejendomme

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 1927 Estate

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Krobi**List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Juvel Ejendomme

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bruce Turner

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fink Ejendomme

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Unika Ejendomme ApS

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 NRE Group

List of Figures

- Figure 1: Denmark Luxury Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Denmark Luxury Residential Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 11: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Luxury Residential Real Estate Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Denmark Luxury Residential Real Estate Market?

Key companies in the market include NRE Group, Rodgaard Ejendomme, Kaj Ove Madsen A/S, Zasa Ejendomme, 1927 Estate, Krobi**List Not Exhaustive, Juvel Ejendomme, Bruce Turner, Fink Ejendomme, Unika Ejendomme ApS.

3. What are the main segments of the Denmark Luxury Residential Real Estate Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing manufacturing sites4.; The increasing middle-income group and access to mortgage finance.

6. What are the notable trends driving market growth?

Increasing demand for luxury residences driving the market.

7. Are there any restraints impacting market growth?

4.; Rising cost of construction materials..

8. Can you provide examples of recent developments in the market?

November 2022: The AkademikerPension expands real estate allocation. Whereas the portfolio currently consists primarily of offices in Copenhagen, the distribution in 2026 should be 50% residential, 30% offices, and various construction projects. Most investments will be made in Copenhagen and Aarhus, but approximately 25% of the real estate investments will be made in smaller Danish cities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Luxury Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Luxury Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Luxury Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Denmark Luxury Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence