Key Insights

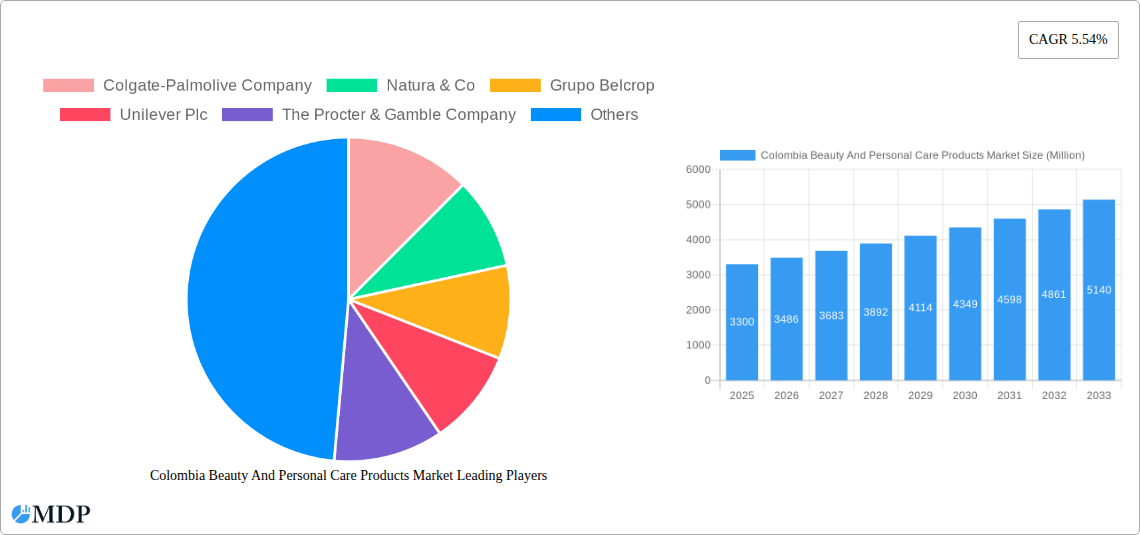

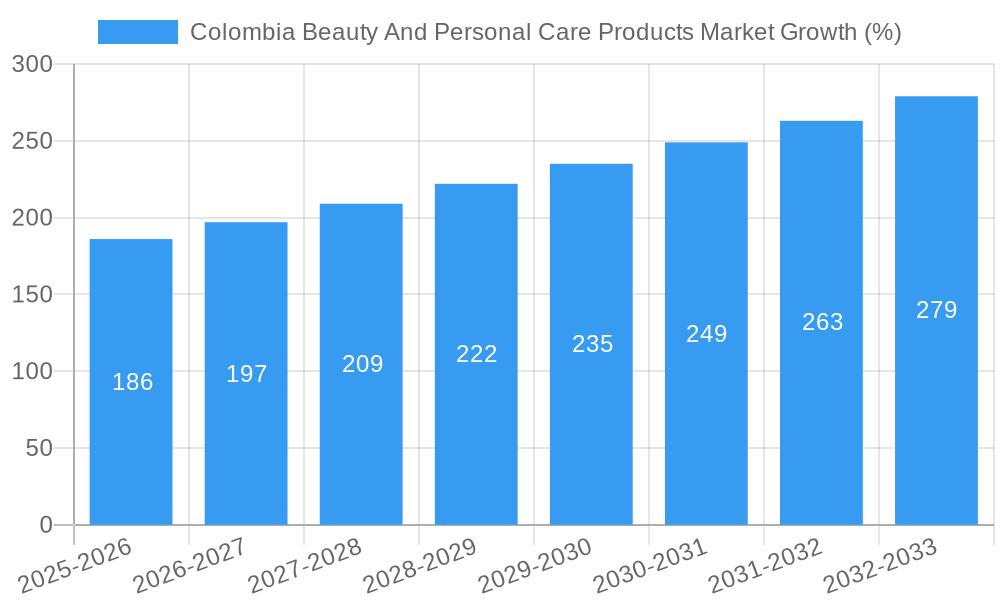

The Colombian beauty and personal care products market presents a compelling investment opportunity, exhibiting robust growth potential. With a 2025 market size of $3.30 billion and a projected Compound Annual Growth Rate (CAGR) of 5.54% from 2025 to 2033, the market is poised for significant expansion. This growth is fueled by several key factors. Rising disposable incomes among the Colombian middle class are driving increased spending on premium and diverse beauty and personal care products. A growing young population, increasingly influenced by social media trends and global beauty standards, fuels demand for innovative products and experiences. Furthermore, the expanding e-commerce sector provides convenient access to a wider range of products, further accelerating market growth. Leading players like Colgate-Palmolive, Unilever, L'Oreal, and Natura & Co. are strategically investing in product innovation, targeted marketing campaigns, and expanding distribution networks to capitalize on this burgeoning market. However, economic volatility and fluctuating currency exchange rates could pose challenges. Competition remains intense, requiring companies to differentiate their offerings and establish strong brand loyalty. The market is segmented by product category (skincare, haircare, makeup, fragrances, etc.), price point (mass, premium), and distribution channel (online, offline).

The forecast period (2025-2033) anticipates continued growth driven by sustained economic expansion and increasing consumer awareness of personal care. The market's segmentation offers opportunities for niche players to cater to specific consumer needs. Companies are likely to focus on sustainable and ethically sourced ingredients to appeal to environmentally conscious consumers. Furthermore, personalized beauty products and services tailored to individual needs are expected to gain traction. While challenges exist, the long-term outlook for the Colombian beauty and personal care market remains optimistic, promising significant returns for companies adept at navigating the dynamic market landscape and catering to evolving consumer preferences.

Colombia Beauty and Personal Care Products Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the dynamic Colombia beauty and personal care products market, offering invaluable insights for industry stakeholders. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive market research and data analysis to deliver actionable intelligence, forecasting substantial growth and identifying key opportunities.

Colombia Beauty And Personal Care Products Market Market Dynamics & Concentration

The Colombian beauty and personal care market is characterized by a moderate level of concentration, with key players such as Colgate-Palmolive Company, Natura & Co, Grupo Belcorp, Unilever Plc, The Procter & Gamble Company, Yanbal de Colombia SAS, L'Oreal SA, The Estee Lauder Companies Inc, Grupo Familia, and Johnson & Johnson Services Inc. holding significant market share. However, the market also features a vibrant landscape of smaller, niche players, particularly in the natural and organic segments.

Market share data suggests that the top 5 players collectively account for approximately xx% of the market in 2025, indicating a competitive but not overly dominated landscape. Innovation is a key driver, with companies constantly introducing new products and formulations to cater to evolving consumer preferences. The regulatory framework, while generally supportive of market growth, presents some challenges related to labeling and ingredient regulations. Product substitutes, particularly within the skincare segment (e.g., homemade remedies, natural alternatives), pose a competitive threat to established brands.

End-user trends show a growing preference for natural, organic, and ethically sourced products, alongside a rising demand for personalized and specialized beauty solutions. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with xx major deals recorded between 2019 and 2024. These acquisitions often reflect strategies to expand product portfolios, tap into new market segments, or enhance brand presence across Latin America.

Colombia Beauty And Personal Care Products Market Industry Trends & Analysis

The Colombian beauty and personal care market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: a rising middle class with increased disposable income, growing awareness of personal care and beauty, and a rising influence of social media and digital marketing on consumer behavior. Technological disruptions, particularly in e-commerce and personalized beauty solutions, are reshaping market dynamics, with online sales contributing significantly to market expansion.

Consumer preferences are shifting towards natural and sustainable products, demanding transparency in ingredient sourcing and environmentally friendly packaging. This trend presents both opportunities and challenges for established players, requiring them to adapt their product offerings and marketing strategies. Competitive dynamics are marked by both intense rivalry among large multinational companies and the emergence of innovative, smaller brands, creating a highly dynamic market landscape. Market penetration of premium skincare products remains relatively low compared to mass-market segments, indicating an untapped opportunity for growth.

Leading Markets & Segments in Colombia Beauty And Personal Care Products Market

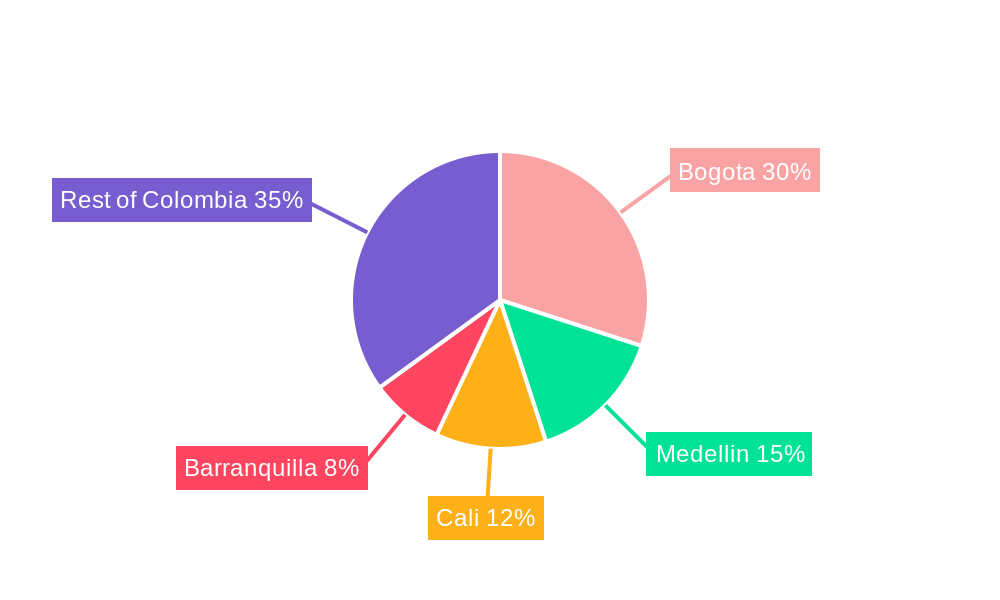

The Colombian beauty and personal care market displays substantial regional variations in growth and demand. While precise data on regional dominance may vary depending on the product category, major cities like Bogotá, Medellín, and Cali generally exhibit the strongest demand due to higher population density, purchasing power, and increased access to beauty products and services.

- Key Drivers for Regional Dominance:

- Higher disposable incomes and spending power.

- Increased accessibility to beauty products and services through retail outlets and online channels.

- Strong influence of fashion and beauty trends concentrated in metropolitan areas.

- Higher concentration of beauty salons, spas, and other professional services.

The market is segmented by product type (skincare, haircare, makeup, fragrances, personal hygiene products), price point (mass-market, premium), and distribution channel (retail stores, online marketplaces, direct selling). While exact market share data varies from segment to segment, skincare is generally observed to be the largest segment in terms of revenue, driven by increasing consumer awareness of skincare routines and the growing popularity of natural and specialized products. The premium segment demonstrates consistent growth, reflecting the increasing affluence of a section of the population.

Colombia Beauty And Personal Care Products Market Product Developments

Recent product innovations in the Colombian market showcase a strong focus on natural and organic ingredients, personalized formulations, and technologically advanced delivery systems. Companies are emphasizing sustainable packaging and ethical sourcing to appeal to the growing environmentally conscious consumer base. Product developments are also driven by addressing specific skin and hair concerns, such as sensitivity, dryness, and hair loss, leading to specialized product lines targeted at niche market segments. The incorporation of smart technologies in beauty devices (e.g., skincare tools with sensors and apps) is also beginning to gain traction.

Key Drivers of Colombia Beauty And Personal Care Products Market Growth

Several key factors contribute to the growth of the Colombian beauty and personal care market. The rising disposable income of the middle class, coupled with increased awareness of personal care and beauty, is a major driver. The growing influence of social media and digital marketing, particularly among younger consumers, has significantly impacted consumer preferences and purchasing behavior. Favorable government regulations and the expansion of organized retail channels also create a supportive environment for market growth. Finally, technological advancements in product development and distribution contribute to increased efficiency and market access.

Challenges in the Colombia Beauty And Personal Care Products Market Market

Despite the market's positive outlook, several challenges persist. Fluctuations in the Colombian peso impact the cost of imported raw materials and products. Supply chain disruptions and logistical complexities, particularly in accessing remote areas, pose hurdles to efficient distribution. Intense competition from both established multinational companies and smaller, nimble players creates a challenging competitive landscape. Stringent regulatory requirements regarding product labeling, ingredients, and safety standards can be demanding. These factors contribute to a complex market that requires agile strategies and effective supply chain management.

Emerging Opportunities in Colombia Beauty And Personal Care Products Market

The long-term growth potential of the Colombian beauty and personal care market is considerable. The increasing penetration of e-commerce and digital marketing provides substantial growth opportunities for brands capable of leveraging these channels effectively. The rising popularity of natural and sustainable products opens up opportunities for companies focusing on organic and ethically sourced ingredients. Strategic partnerships between international and local brands can facilitate market access and knowledge sharing, leading to accelerated expansion. Moreover, tapping into underserved markets within the country through targeted product development and distribution strategies could drive further growth.

Leading Players in the Colombia Beauty And Personal Care Products Market Sector

- Colgate-Palmolive Company

- Natura & Co

- Grupo Belcrop

- Unilever Plc

- The Procter & Gamble Company

- Yanbal de Colombia SAS

- L'Oreal SA

- The Estee Lauder Companies Inc

- Grupo Familia

- Johnson & Johnson Services Inc

- List Not Exhaustive

Key Milestones in Colombia Beauty And Personal Care Products Market Industry

- July 2022: Loto del Sur, a natural cosmetics brand, was acquired by the Puig Group, signaling increased interest in the natural cosmetics sector and Latin American expansion.

- August 2023: Ésika (Belcorp) partnered with Proximity BBDO Colombia to strengthen its fragrance offerings, indicating a strategic focus on this segment.

- August 2023: L'Oréal Professionnel Paris launched Scalp Advanced, highlighting innovation in hair care and addressing consumer concerns about scalp health.

Strategic Outlook for Colombia Beauty And Personal Care Products Market Market

The future of the Colombian beauty and personal care market appears bright. Continued economic growth and rising disposable incomes will fuel demand. Strategic investments in innovation, sustainable practices, and targeted marketing campaigns will be crucial for success. Brands that embrace e-commerce and leverage data-driven insights will be well-positioned to capture significant market share. The increasing consumer focus on natural, ethical, and personalized products underscores the importance of developing products that align with these evolving preferences. Long-term growth hinges on adapting to the dynamic market landscape and strategically navigating both opportunities and challenges.

Colombia Beauty And Personal Care Products Market Segmentation

-

1. Product Type

-

1.1. Personal Care Products

-

1.1.1. Hair Care Products

- 1.1.1.1. Shampoo

- 1.1.1.2. Conditioner

- 1.1.1.3. Other Hair Care Products

-

1.1.2. Skincare Products

- 1.1.2.1. Facial Care Products

- 1.1.2.2. Body Care Products

- 1.1.2.3. Lip Care Products

-

1.1.3. Bath and Shower

- 1.1.3.1. Shower Gels

- 1.1.3.2. Soaps

- 1.1.3.3. Other Bath and Shower Products

-

1.1.4. Oral Care

- 1.1.4.1. Toothbrush and Replacements

- 1.1.4.2. Toothpaste

- 1.1.4.3. Other Oral Care Products

- 1.1.5. Men's Grooming Products

- 1.1.6. Deodorants and Antiperspirants

-

1.1.1. Hair Care Products

-

1.2. Cosmetics/Make-up Products

- 1.2.1. Facial Cosmetics

- 1.2.2. Eye Cosmetics

- 1.2.3. Lip and Nail Make-up Products

- 1.2.4. Hair Styling and Coloring Products

- 1.3. Fragrances

-

1.1. Personal Care Products

-

2. Category

- 2.1. Mass Products

- 2.2. Premium Products

-

3. Distribution Channel

- 3.1. Specialty Stores

- 3.2. Supermarkets/Hypermarkets

- 3.3. Convenience Stores

- 3.4. Pharmacies/Drug Stores

- 3.5. Online Retail Stores

- 3.6. Direct Selling

- 3.7. Other Distribution Channels

Colombia Beauty And Personal Care Products Market Segmentation By Geography

- 1. Colombia

Colombia Beauty And Personal Care Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.54% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Focus on Personal Health and Hygiene; Aggressive Marketing and Advertising Strategies by Brands

- 3.3. Market Restrains

- 3.3.1. Strong Focus on Personal Health and Hygiene; Aggressive Marketing and Advertising Strategies by Brands

- 3.4. Market Trends

- 3.4.1. The Bath and Shower Products Segment is the Fastest-growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Colombia Beauty And Personal Care Products Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Personal Care Products

- 5.1.1.1. Hair Care Products

- 5.1.1.1.1. Shampoo

- 5.1.1.1.2. Conditioner

- 5.1.1.1.3. Other Hair Care Products

- 5.1.1.2. Skincare Products

- 5.1.1.2.1. Facial Care Products

- 5.1.1.2.2. Body Care Products

- 5.1.1.2.3. Lip Care Products

- 5.1.1.3. Bath and Shower

- 5.1.1.3.1. Shower Gels

- 5.1.1.3.2. Soaps

- 5.1.1.3.3. Other Bath and Shower Products

- 5.1.1.4. Oral Care

- 5.1.1.4.1. Toothbrush and Replacements

- 5.1.1.4.2. Toothpaste

- 5.1.1.4.3. Other Oral Care Products

- 5.1.1.5. Men's Grooming Products

- 5.1.1.6. Deodorants and Antiperspirants

- 5.1.1.1. Hair Care Products

- 5.1.2. Cosmetics/Make-up Products

- 5.1.2.1. Facial Cosmetics

- 5.1.2.2. Eye Cosmetics

- 5.1.2.3. Lip and Nail Make-up Products

- 5.1.2.4. Hair Styling and Coloring Products

- 5.1.3. Fragrances

- 5.1.1. Personal Care Products

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass Products

- 5.2.2. Premium Products

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Specialty Stores

- 5.3.2. Supermarkets/Hypermarkets

- 5.3.3. Convenience Stores

- 5.3.4. Pharmacies/Drug Stores

- 5.3.5. Online Retail Stores

- 5.3.6. Direct Selling

- 5.3.7. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Colombia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Colgate-Palmolive Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Natura & Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Grupo Belcrop

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Unilever Plc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Procter & Gamble Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Yanbal de Colombia SAS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 L'Oreal SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Estee Lauder Companies Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Grupo Familia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Johnson & Johnson Services Inc *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Colgate-Palmolive Company

List of Figures

- Figure 1: Colombia Beauty And Personal Care Products Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Colombia Beauty And Personal Care Products Market Share (%) by Company 2024

List of Tables

- Table 1: Colombia Beauty And Personal Care Products Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Colombia Beauty And Personal Care Products Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Colombia Beauty And Personal Care Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Colombia Beauty And Personal Care Products Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 5: Colombia Beauty And Personal Care Products Market Revenue Million Forecast, by Category 2019 & 2032

- Table 6: Colombia Beauty And Personal Care Products Market Volume Billion Forecast, by Category 2019 & 2032

- Table 7: Colombia Beauty And Personal Care Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Colombia Beauty And Personal Care Products Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 9: Colombia Beauty And Personal Care Products Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Colombia Beauty And Personal Care Products Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Colombia Beauty And Personal Care Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: Colombia Beauty And Personal Care Products Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 13: Colombia Beauty And Personal Care Products Market Revenue Million Forecast, by Category 2019 & 2032

- Table 14: Colombia Beauty And Personal Care Products Market Volume Billion Forecast, by Category 2019 & 2032

- Table 15: Colombia Beauty And Personal Care Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Colombia Beauty And Personal Care Products Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 17: Colombia Beauty And Personal Care Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Colombia Beauty And Personal Care Products Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colombia Beauty And Personal Care Products Market?

The projected CAGR is approximately 5.54%.

2. Which companies are prominent players in the Colombia Beauty And Personal Care Products Market?

Key companies in the market include Colgate-Palmolive Company, Natura & Co, Grupo Belcrop, Unilever Plc, The Procter & Gamble Company, Yanbal de Colombia SAS, L'Oreal SA, The Estee Lauder Companies Inc, Grupo Familia, Johnson & Johnson Services Inc *List Not Exhaustive.

3. What are the main segments of the Colombia Beauty And Personal Care Products Market?

The market segments include Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Strong Focus on Personal Health and Hygiene; Aggressive Marketing and Advertising Strategies by Brands.

6. What are the notable trends driving market growth?

The Bath and Shower Products Segment is the Fastest-growing Segment.

7. Are there any restraints impacting market growth?

Strong Focus on Personal Health and Hygiene; Aggressive Marketing and Advertising Strategies by Brands.

8. Can you provide examples of recent developments in the market?

August 2023: Ésika, the beauty brand owned by Belcorp, partnered with Proximity BBDO Colombia. The partnership was intended to concentrate the brand's initial efforts on the fragrances segment of the market. The strategic step sought to inject vitality into the brand's presence in Colombia and Latin America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colombia Beauty And Personal Care Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colombia Beauty And Personal Care Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colombia Beauty And Personal Care Products Market?

To stay informed about further developments, trends, and reports in the Colombia Beauty And Personal Care Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence