Key Insights

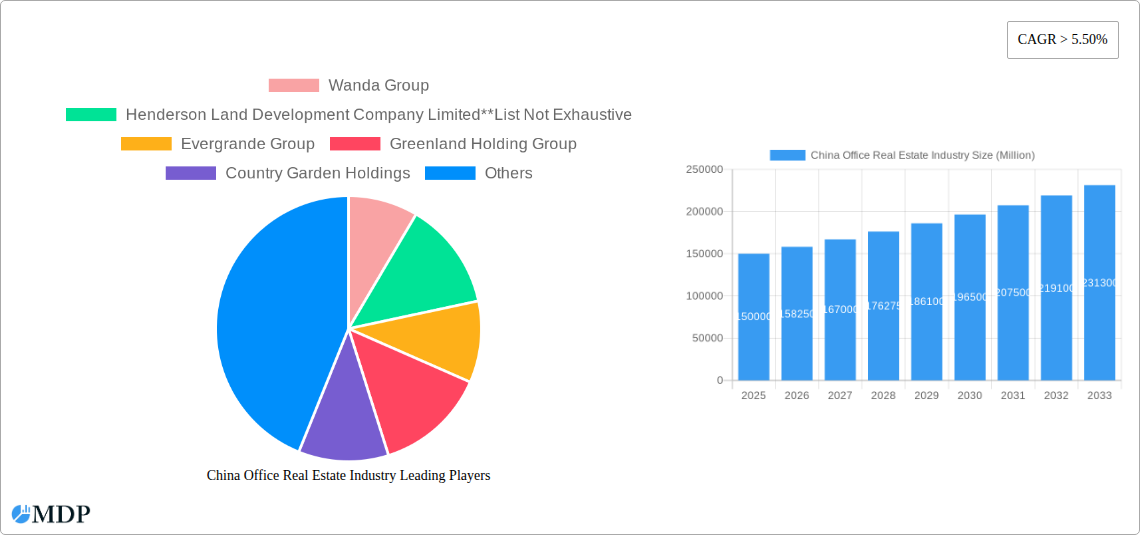

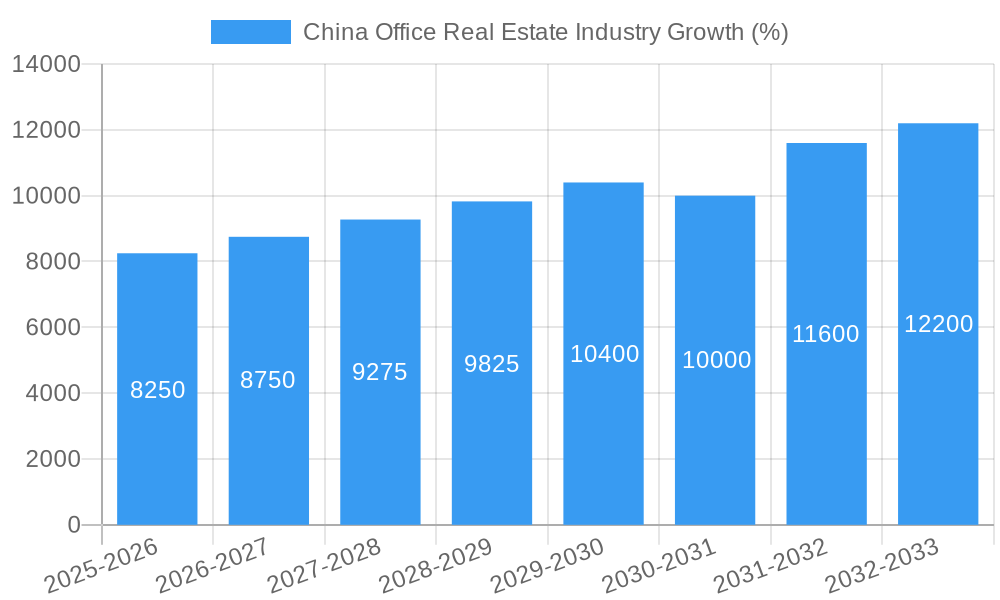

The China office real estate market, currently exhibiting robust growth, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5.5% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the continuous expansion of China's technology sector (IT and ITES), coupled with the growth of the BFSI and consulting industries, creates a significant demand for modern office spaces in major cities like Beijing and Shanghai. Secondly, increasing urbanization and a burgeoning middle class contribute to a larger workforce requiring office accommodations. While the market faces restraints such as economic fluctuations and government regulations impacting construction and development, the long-term outlook remains positive. The market segmentation reveals a concentration in major cities, with Beijing and Shanghai commanding a larger share. Key players like Wanda Group, Henderson Land, and Evergrande Group are actively shaping the market landscape through large-scale developments and strategic acquisitions. The historical period (2019-2024) likely saw variations influenced by economic conditions and government policies, impacting both market size and growth rate. The forecast period will be further influenced by the ongoing technological advancements shaping the workspace and the government’s continued focus on sustainable development. The "Rest of China" segment represents a considerable growth opportunity, driven by the expansion of business activities into secondary and tertiary cities.

The robust growth projection indicates a significant investment opportunity in the China office real estate sector. However, careful consideration of potential economic volatility and regulatory changes is crucial for investors and developers. Successfully navigating these factors will be key to maximizing returns in this dynamic and competitive market. Analyzing specific sub-sectors within IT, BFSI, and manufacturing will provide a more nuanced understanding of future demand. Furthermore, tracking evolving workplace trends like flexible work arrangements and the adoption of smart office technologies will be essential for accurately forecasting future market performance. The presence of several large, established players suggests a degree of market consolidation, which may influence competition and pricing in the coming years.

China Office Real Estate Industry Report: 2019-2033 Forecast

Uncover lucrative investment opportunities and navigate the complexities of China's dynamic office real estate market with this comprehensive report. This in-depth analysis provides a 360° view of the sector, covering market dynamics, leading players, emerging trends, and future growth projections from 2019 to 2033. Benefit from actionable insights to inform strategic decision-making and capitalize on the significant potential within this rapidly evolving landscape. This report is essential for investors, developers, and industry stakeholders seeking a competitive edge in the Chinese office real estate market.

China Office Real Estate Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of China's office real estate market from 2019-2024, examining market concentration, innovation, regulatory influences, and key market activities.

The market is characterized by a moderate level of concentration, with a few major players holding significant market share. While precise figures are proprietary, analysis suggests that Wanda Group and Greenland Holding Group, along with other significant players like Country Garden Holdings and China Vanke Co, control a considerable portion (estimated xx%) of the market. The remaining market share is distributed among numerous smaller firms, creating a competitive yet consolidated environment.

- Market Concentration: Estimated xx% controlled by top 5 players (Wanda Group, Greenland Holding Group, Country Garden Holdings, China Vanke Co, and China Overseas Land & Investment Ltd.) in 2024.

- Innovation Drivers: Demand for smart office spaces and sustainable building practices drives innovation in design and technology.

- Regulatory Frameworks: Government policies impacting land use, foreign investment, and environmental regulations shape market dynamics significantly. Recent policy changes have focused on debt reduction within the industry.

- Product Substitutes: The rise of co-working spaces and flexible office solutions presents a competitive challenge to traditional office rentals.

- End-User Trends: A shift toward flexible work arrangements and a preference for high-quality, amenity-rich office spaces influence market demand.

- M&A Activities: The number of M&A deals in the sector has fluctuated (xx deals in 2022, xx projected for 2023), largely influenced by economic conditions and government regulations.

China Office Real Estate Industry Industry Trends & Analysis

This section dives deep into the historical and projected trends shaping the Chinese office real estate industry. The industry experienced significant growth from 2019 to 2024, primarily driven by urbanization, economic expansion, and increasing demand from various sectors. The Compound Annual Growth Rate (CAGR) during this period was approximately xx%, though certain market segments have experienced higher growth rates. Market penetration of modern office spaces has increased significantly, driven particularly by the IT and BFSI sectors, but is still below saturation, signaling ongoing growth potential.

Technological disruptions, such as the increasing adoption of smart building technologies and data-driven property management systems, are transforming the industry. Consumer preferences lean towards environmentally sustainable and technologically advanced office spaces, influencing developers to invest in green building certifications and intelligent office solutions. Intense competition, especially in major cities like Beijing and Shanghai, is pushing companies to adopt innovative strategies and value-added services to attract tenants.

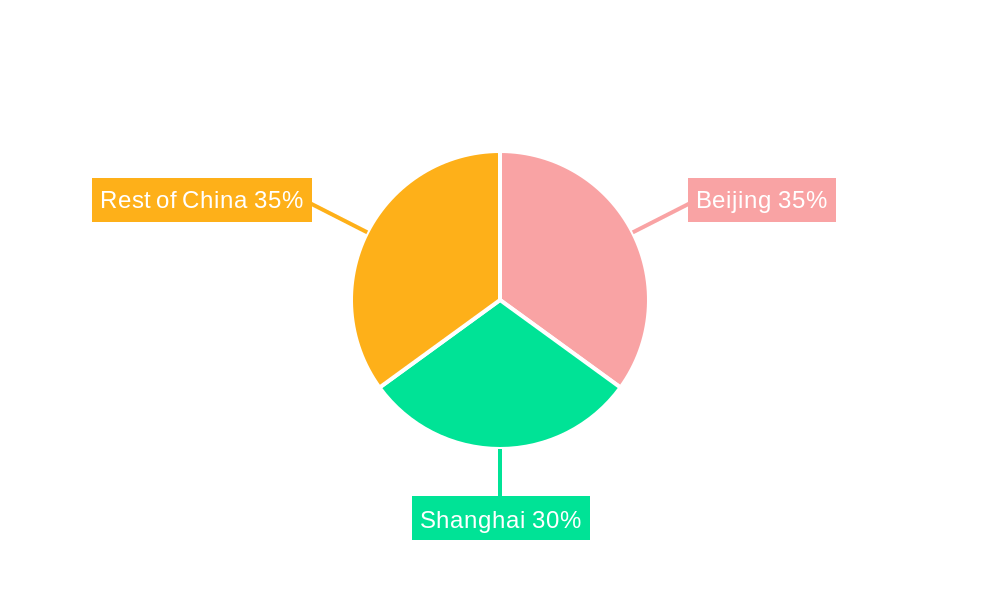

Leading Markets & Segments in China Office Real Estate Industry

Beijing and Shanghai remain the dominant markets for office real estate in China.

By Major Cities:

- Beijing: Strong government presence, robust financial sector, and high concentration of multinational corporations fuel high demand. Key drivers include government initiatives promoting technological innovation and strategic infrastructure development.

- Shanghai: A major financial hub and a center for international trade, Shanghai's office market is highly competitive, with strong demand driven by diverse industries. Excellent infrastructure and a large pool of skilled labor further contribute to its dominance.

- Rest of China: Growth is occurring in tier-2 and tier-3 cities, fueled by economic development and decentralization of businesses. However, growth rates are lower compared to Beijing and Shanghai.

By Sector:

- Information Technology (IT and ITES): This sector is a significant driver of office space demand, particularly in technology hubs. Demand is expected to continue its upward trajectory.

- BFSI (Banking, Financial Services, and Insurance): The BFSI sector remains a key driver of premium office space demand in major cities. Their high occupancy rates significantly impact the market.

- Manufacturing: While manufacturing demand for office space is strong, it is often concentrated in specific industrial parks and regions.

- Consulting: The consulting sector drives demand for high-quality, centrally located office spaces, fueling a preference for premium offerings.

- Other Services: This category encompasses various sectors with diverse office space needs, resulting in less focused demand compared to IT, BFSI, and Consulting.

China Office Real Estate Industry Product Developments

Recent product innovations in the Chinese office real estate market focus on enhancing sustainability, technology integration, and occupant experience. Smart building technologies, such as energy-efficient systems and advanced security measures, are becoming standard features. Developers are increasingly incorporating flexible workspace designs and amenities to cater to evolving tenant preferences. This focus on technological integration and sustainable practices provides a competitive advantage, attracting tenants seeking modern and efficient workspaces. The focus on flexible workspace solutions increases market penetration and appeals to a wider range of clients.

Key Drivers of China Office Real Estate Industry Growth

The growth of the Chinese office real estate industry is fueled by several key drivers:

- Rapid Urbanization: The ongoing migration from rural to urban areas drives demand for housing and commercial spaces, including offices.

- Economic Growth: Sustained economic growth generates increased business activity and the need for more office space.

- Government Policies: Supportive government policies, including infrastructure development and investment incentives, stimulate the industry. The recent private equity pilot program is a clear example.

- Technological Advancements: The adoption of smart building technologies and efficient workspace designs boosts sector appeal and productivity.

Challenges in the China Office Real Estate Industry Market

The Chinese office real estate market faces several challenges:

- Regulatory Uncertainty: Changes in government regulations and policies can create uncertainty for developers and investors.

- High Construction Costs: Rising construction costs and land prices squeeze profit margins and impact project viability.

- Increased Competition: High competition among developers puts pressure on pricing and profit margins.

- Economic Slowdowns: Economic downturns can reduce demand for office space and negatively impact market values. The estimated impact on market values in 2023 due to these factors is xx Million.

Emerging Opportunities in China Office Real Estate Industry

Several emerging opportunities promise to shape the future of the Chinese office real estate sector:

- Rise of Co-working Spaces: The increasing popularity of co-working spaces presents opportunities for developers to create flexible and shared office environments.

- Green Building Initiatives: Growing environmental awareness creates demand for green and sustainable office buildings, leading to niche market development and investment opportunities.

- Smart Building Technology: Integrating technology into office buildings enhances efficiency, sustainability, and tenant experience.

- Expansion into Tier-2 and Tier-3 Cities: Investing in developing cities offers opportunities for growth and market expansion.

Leading Players in the China Office Real Estate Industry Sector

- Wanda Group

- Henderson Land Development Company Limited

- Evergrande Group

- Greenland Holding Group

- Country Garden Holdings

- China Overseas Land & Investment Ltd

- China Vanke Co

- Gemdale Corporation

- Sunac China Holdings

- China Merchants Shekou Industrial Zone Holdings

- China Resources Land Ltd

- Poly Real Estate

Key Milestones in China Office Real Estate Industry Industry

- April 2023: Launch of China's new private equity real estate pilot program, aimed at boosting investment and attracting foreign capital. This is expected to significantly improve liquidity and reduce developers' debt ratios within the next 2-3 years.

- March 2023: CapitaLand Investment Private Fund's acquisition of the Beijing Suning Life Plaza for approximately US$400 Million, highlighting ongoing M&A activity in the market.

Strategic Outlook for China Office Real Estate Industry Market

The Chinese office real estate market is poised for continued growth, driven by long-term economic expansion, urbanization, and technological advancements. Strategic opportunities lie in developing sustainable and technologically advanced office spaces, catering to evolving tenant needs, and expanding into secondary and tertiary cities. Addressing regulatory challenges and managing risks associated with economic fluctuations will be crucial for sustained success. The projected market size in 2033 is estimated at xx Million, indicating substantial growth potential for investors and developers who strategically navigate the market's complexities.

China Office Real Estate Industry Segmentation

-

1. Major Cities

- 1.1. Beijing

- 1.2. Shanghai

- 1.3. Rest of China

-

2. Sector

- 2.1. Information Technology (IT and ITES)

- 2.2. Manufacturing

- 2.3. BFSI (Banking, Financial Services, and Insurance)

- 2.4. Consulting

- 2.5. Other Services

China Office Real Estate Industry Segmentation By Geography

- 1. China

China Office Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Demand and Rising Construction Activities to Drive the Market; Rising House Prices in Germany Affecting Demand in the Market

- 3.3. Market Restrains

- 3.3.1. Weak economic environment

- 3.4. Market Trends

- 3.4.1. Robust Leasing Demand For the Office Spaces Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Major Cities

- 5.1.1. Beijing

- 5.1.2. Shanghai

- 5.1.3. Rest of China

- 5.2. Market Analysis, Insights and Forecast - by Sector

- 5.2.1. Information Technology (IT and ITES)

- 5.2.2. Manufacturing

- 5.2.3. BFSI (Banking, Financial Services, and Insurance)

- 5.2.4. Consulting

- 5.2.5. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Major Cities

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Wanda Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Henderson Land Development Company Limited**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Evergrande Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Greenland Holding Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Country Garden Holdings

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China Overseas Land & Investment Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Vanke Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gemdale Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sunac China Holdings

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Merchants Shekou Industrial Zone Holdings

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 China Resources Land Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Poly Real Estate

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Wanda Group

List of Figures

- Figure 1: China Office Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Office Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: China Office Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Office Real Estate Industry Revenue Million Forecast, by Major Cities 2019 & 2032

- Table 3: China Office Real Estate Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 4: China Office Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Office Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Office Real Estate Industry Revenue Million Forecast, by Major Cities 2019 & 2032

- Table 7: China Office Real Estate Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 8: China Office Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Office Real Estate Industry?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the China Office Real Estate Industry?

Key companies in the market include Wanda Group, Henderson Land Development Company Limited**List Not Exhaustive, Evergrande Group, Greenland Holding Group, Country Garden Holdings, China Overseas Land & Investment Ltd, China Vanke Co, Gemdale Corporation, Sunac China Holdings, China Merchants Shekou Industrial Zone Holdings, China Resources Land Ltd, Poly Real Estate.

3. What are the main segments of the China Office Real Estate Industry?

The market segments include Major Cities, Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Strong Demand and Rising Construction Activities to Drive the Market; Rising House Prices in Germany Affecting Demand in the Market.

6. What are the notable trends driving market growth?

Robust Leasing Demand For the Office Spaces Driving the Market.

7. Are there any restraints impacting market growth?

Weak economic environment.

8. Can you provide examples of recent developments in the market?

April 2023: China's new private equity real estate pilot programme is designed to boost investment in the property sector and attract increased foreign investment. The pilot programme, announced by the Securities Regulatory Commission (CSRC) last month, is intended to boost private investment in the Chinese real estate market and open the door to foreign investors. The aim is to improve liquidity and reduce property developers' debt ratios.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Office Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Office Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Office Real Estate Industry?

To stay informed about further developments, trends, and reports in the China Office Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence