Key Insights

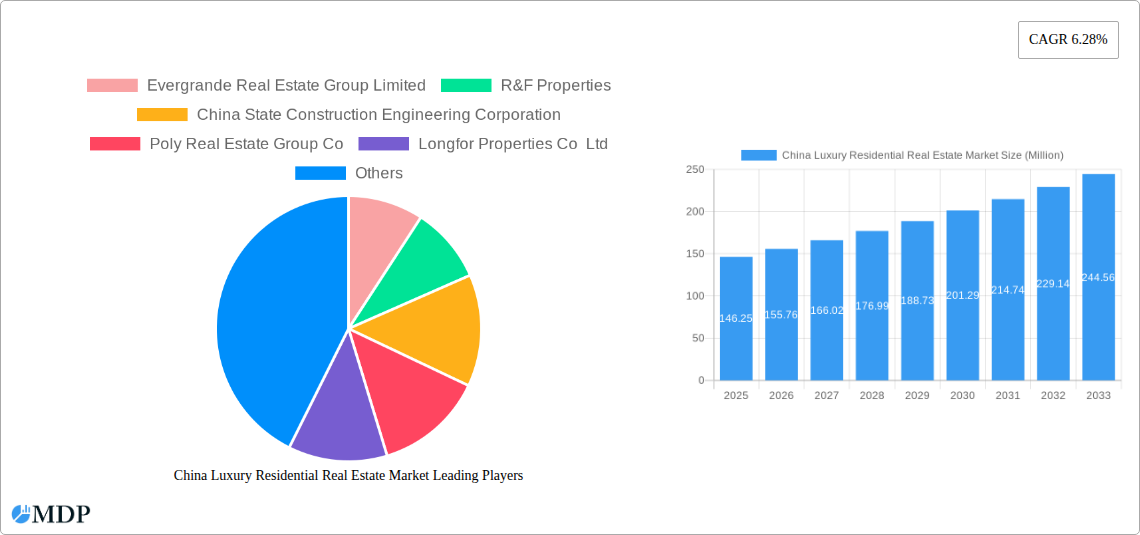

The China luxury residential real estate market, valued at $146.25 million in 2025, is poised for robust growth, exhibiting a compound annual growth rate (CAGR) of 6.28% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, a burgeoning high-net-worth individual (HNWI) population in China continues to drive demand for premium properties in prime locations like Beijing, Shanghai, and Shenzhen. Secondly, increasing disposable incomes and a growing preference for luxury lifestyles contribute significantly to this market's dynamism. Furthermore, the government's ongoing infrastructure development and investments in urban renewal projects in major cities enhance the appeal and value of luxury residential properties. The market is segmented by property type (villas and landed houses, apartments and condominiums) and location, with Beijing, Shanghai, and Shenzhen representing the most significant segments due to their established economies and high concentration of HNWIs. Competition among established developers like Evergrande Real Estate, China Vanke, and Longfor Properties, alongside international players like Christie's International Real Estate, ensures a diverse and dynamic market landscape.

However, the market faces some challenges. Stringent government regulations aimed at curbing speculative investment and ensuring market stability might dampen growth temporarily. Furthermore, fluctuations in the global economy and potential shifts in domestic economic policies could influence investor sentiment and overall market performance. Despite these challenges, the long-term outlook remains positive, driven by the consistent increase in wealth among Chinese HNWIs and the enduring allure of owning luxury residential properties in key urban centers. The market is expected to see continued growth, albeit at a pace moderated by regulatory interventions and broader economic conditions. The ongoing urbanization and development of sophisticated infrastructure will continue to be key drivers of the market's performance.

China Luxury Residential Real Estate Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the China luxury residential real estate market, covering market dynamics, industry trends, leading segments, and key players. With a forecast period spanning 2025-2033 and a base year of 2025, this report is an indispensable resource for investors, developers, and industry stakeholders seeking to navigate this dynamic market. The study period covers 2019-2024, providing valuable historical context.

China Luxury Residential Real Estate Market Market Dynamics & Concentration

The China luxury residential real estate market is characterized by high concentration, driven by a few major players and significant regulatory influence. Market share is dominated by established developers such as Evergrande Real Estate Group Limited, R&F Properties, China State Construction Engineering Corporation, Poly Real Estate Group Co, Longfor Properties Co Ltd, and China Vanke Co, though smaller, boutique firms like 4321 Property and Christie's International Real Estate are carving out niches in specific luxury segments. The market's concentration ratio (CR4 or CR5) is estimated at xx%, indicating a relatively concentrated market structure. M&A activity has been significant in recent years, with an estimated xx number of deals completed between 2019 and 2024, mostly focused on land acquisition and project development. However, the regulatory environment, including tightening lending policies in recent years, has impacted the volume of deals, resulting in a downward trend with projected xx deals by 2033. Innovation is driven by the introduction of smart home technology, sustainable building practices, and unique architectural designs catering to the preferences of high-net-worth individuals. The regulatory framework heavily influences market dynamics, with government policies affecting land acquisition, construction approvals, and pricing. Substitute products, such as high-end vacation homes or overseas properties, also influence consumer choices. Trends indicate a shift towards smaller, more sustainable, and technologically advanced luxury residences.

China Luxury Residential Real Estate Market Industry Trends & Analysis

The China luxury residential real estate market experienced a CAGR of xx% during the historical period (2019-2024), driven primarily by rising disposable incomes among high-net-worth individuals, a growing preference for larger homes and upgraded amenities, and increased urbanization. However, recent regulatory changes led to a market correction, resulting in a projected deceleration to a CAGR of xx% during the forecast period (2025-2033). Market penetration of luxury housing is estimated to be at xx% in 2025, with projected growth to xx% by 2033. Technological advancements like smart home integration, increased energy efficiency, and advanced building materials are reshaping the market. Shifting consumer preferences toward sustainability, wellness features, and exclusive location are influencing product development. Intense competition among established players, with rising land costs and limited availability in prime urban locations, will continue to shape the market. This competitiveness is driving innovation and price adjustments, affecting profitability and investment strategies.

Leading Markets & Segments in China Luxury Residential Real Estate Market

By Type: The Villas and Landed Houses segment continues to dominate the luxury market, accounting for xx% of total sales in 2025, driven by the prestige and privacy they offer. Apartments and Condominiums, while a smaller share (xx%), are seeing growth in luxury high-rise developments in prime locations.

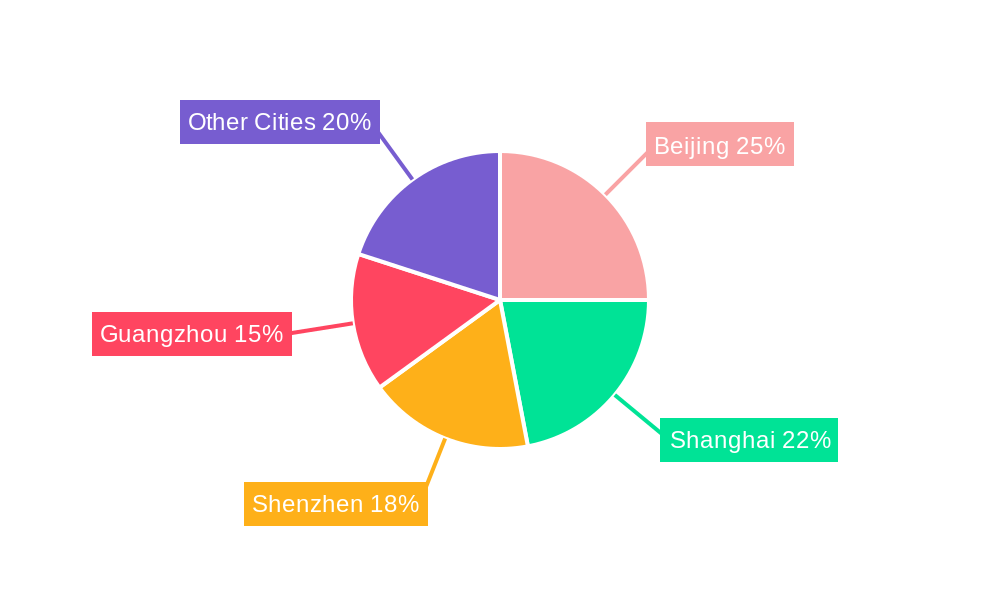

By Cities: Shanghai, Beijing, and Shenzhen remain the leading markets for luxury residential real estate in China. Shanghai’s strong economic performance, sophisticated infrastructure, and cultural attractions drive demand. Beijing’s political significance and established luxury sector sustain high-end property prices. Shenzhen's tech-driven economy and futuristic urban development attracts high-net-worth individuals. Guangzhou and Wuhan also present significant, though smaller, luxury markets, fueled by regional economic growth and infrastructure development. Other cities are expected to exhibit slower but steady growth due to factors such as economic activity, infrastructure development, and access to amenities. The dominance of these Tier 1 and Tier 2 cities is underpinned by established economic strength, sophisticated infrastructure, and readily available luxury amenities and services.

China Luxury Residential Real Estate Market Product Developments

Luxury residential real estate in China is witnessing a surge in smart home technology integration, sustainable building materials, and personalized design solutions. Developers are focusing on enhanced security features, private amenities, and bespoke interior design services to cater to the discerning needs of high-net-worth individuals. The integration of advanced technologies enhances the living experience and increases property value. Emphasis on sustainability aligns with global environmental awareness and appeals to eco-conscious buyers. The market fit for these innovative products is strong, driven by the increasing willingness of luxury buyers to invest in technologically advanced and environmentally conscious residences.

Key Drivers of China Luxury Residential Real Estate Market Growth

Several key factors drive the growth of China's luxury residential real estate market. Firstly, the expanding high-net-worth individual (HNWI) population fuels demand for luxury properties. Secondly, government policies promoting urbanization and infrastructure development create opportunities in various locations. Thirdly, technological innovations improve construction efficiency and product appeal, leading to increased sales and investment.

Challenges in the China Luxury Residential Real Estate Market Market

The China luxury residential real estate market faces significant challenges, including stringent regulatory policies that limit development and financing. Supply chain disruptions and fluctuations in raw material costs increase construction expenses and limit supply. Furthermore, intensifying competition from both domestic and international players exerts pressure on profit margins and market share. These challenges, along with fluctuating economic conditions, can impact market growth and investment returns, leading to project delays or cancellations.

Emerging Opportunities in China Luxury Residential Real Estate Market

Long-term growth in the China luxury residential real estate market is driven by several key opportunities. Technological advancements continue to improve the efficiency and quality of construction, enhancing product appeal. Strategic partnerships between developers and luxury brands create unique and highly desirable housing options. Expansion into secondary and tertiary cities with developing infrastructure and rising HNWIs presents significant growth potential. These opportunities, combined with governmental support for sustainable development, point to the continuing expansion of China's luxury residential sector.

Leading Players in the China Luxury Residential Real Estate Market Sector

- Evergrande Real Estate Group Limited

- R&F Properties

- China State Construction Engineering Corporation

- Poly Real Estate Group Co

- Longfor Properties Co Ltd

- Christie's International Real Estate

- China Vanke Co

- 4321 Property

- China Merchants Property Development Co Ltd

- LuxuryEstate

Key Milestones in China Luxury Residential Real Estate Market Industry

November 2022: China’s largest lenders pledged USD 162 Billion in credit to property developers, signaling a shift in government policy towards easing restrictions on leverage in the real estate sector. This injection of capital is expected to revitalize development activity and stabilize the market.

December 2022: A joint venture secured land-use rights for a USD 340 Million high-end residential development in Shanghai’s Yangpu district, signifying sustained interest in luxury projects despite market fluctuations. This investment shows confidence in the ongoing demand for luxury properties, particularly in prime locations.

Strategic Outlook for China Luxury Residential Real Estate Market Market

The China luxury residential real estate market is poised for continued growth, driven by the ongoing expansion of the HNWI population, robust infrastructure development, and a sustained appetite for high-end properties. Strategic partnerships, technological advancements, and focus on sustainable development will shape the market's future, presenting considerable opportunities for both established players and new entrants. The long-term outlook is positive, with a continued focus on prime locations, bespoke designs, and technological integrations to cater to the evolving needs of sophisticated buyers.

China Luxury Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Villas and Landed Houses

- 1.2. Apartments and Condominiums

-

2. Cities

- 2.1. Beijing

- 2.2. Wuhan

- 2.3. Shanghai

- 2.4. Shenzhen

- 2.5. Guangzhou

- 2.6. Other Cities

China Luxury Residential Real Estate Market Segmentation By Geography

- 1. China

China Luxury Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Higher incomes support4.; Massive industry change

- 3.3. Market Restrains

- 3.3.1. 4.; High imbalance in population versus real estate index

- 3.4. Market Trends

- 3.4.1. Growth of urbanization driving luxury residential real estate market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas and Landed Houses

- 5.1.2. Apartments and Condominiums

- 5.2. Market Analysis, Insights and Forecast - by Cities

- 5.2.1. Beijing

- 5.2.2. Wuhan

- 5.2.3. Shanghai

- 5.2.4. Shenzhen

- 5.2.5. Guangzhou

- 5.2.6. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Evergrande Real Estate Group Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 R&F Properties

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China State Construction Engineering Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Poly Real Estate Group Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Longfor Properties Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Christie's International Real Estate

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Vanke Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 4321 Property

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China Merchants Property Development Co Ltd**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LuxuryEstate

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Evergrande Real Estate Group Limited

List of Figures

- Figure 1: China Luxury Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Luxury Residential Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: China Luxury Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: China Luxury Residential Real Estate Market Revenue Million Forecast, by Cities 2019 & 2032

- Table 4: China Luxury Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: China Luxury Residential Real Estate Market Revenue Million Forecast, by Cities 2019 & 2032

- Table 8: China Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Luxury Residential Real Estate Market?

The projected CAGR is approximately 6.28%.

2. Which companies are prominent players in the China Luxury Residential Real Estate Market?

Key companies in the market include Evergrande Real Estate Group Limited, R&F Properties, China State Construction Engineering Corporation, Poly Real Estate Group Co, Longfor Properties Co Ltd, Christie's International Real Estate, China Vanke Co, 4321 Property, China Merchants Property Development Co Ltd**List Not Exhaustive, LuxuryEstate.

3. What are the main segments of the China Luxury Residential Real Estate Market?

The market segments include Type, Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 146.25 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Higher incomes support4.; Massive industry change.

6. What are the notable trends driving market growth?

Growth of urbanization driving luxury residential real estate market.

7. Are there any restraints impacting market growth?

4.; High imbalance in population versus real estate index.

8. Can you provide examples of recent developments in the market?

December 2022: A joint venture led by Shui On Land has won the land-use rights to develop a residential project on a plot in Shanghai’s Yangpu district with a bid of RMB 2.38 billion (USD 340 million). The parties plan to develop the 16,993.8 square metre (182,920 square foot) parcel on Pingliang Street into a heritage preservation project incorporating a high-end, low-density residential community. A wholly owned subsidiary of Shui On holds 60% of the JV, with the remaining 40% held by state-owned developer Shanghai Yangshupu.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Luxury Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Luxury Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Luxury Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the China Luxury Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence