Key Insights

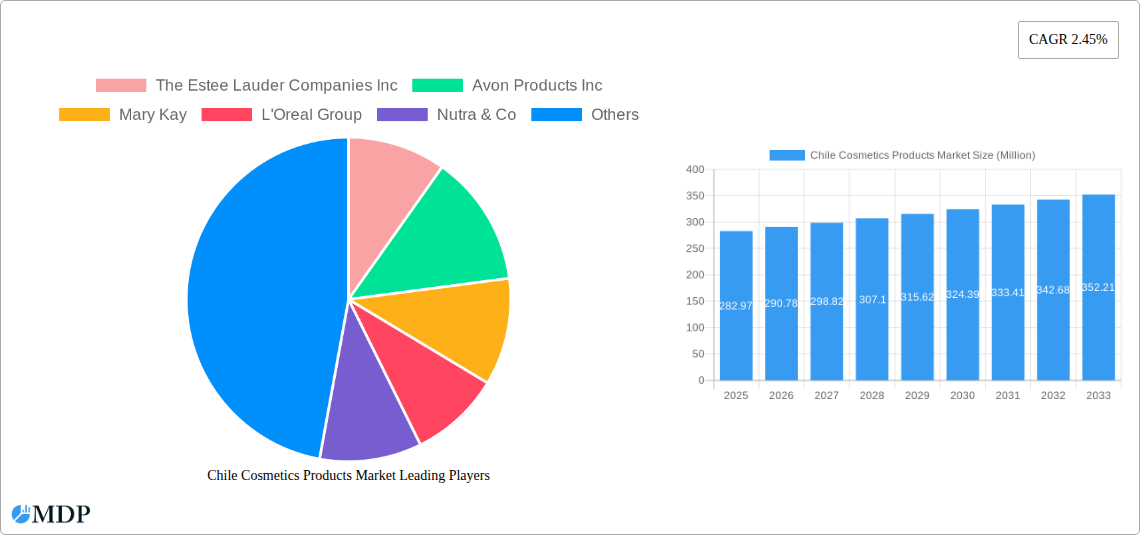

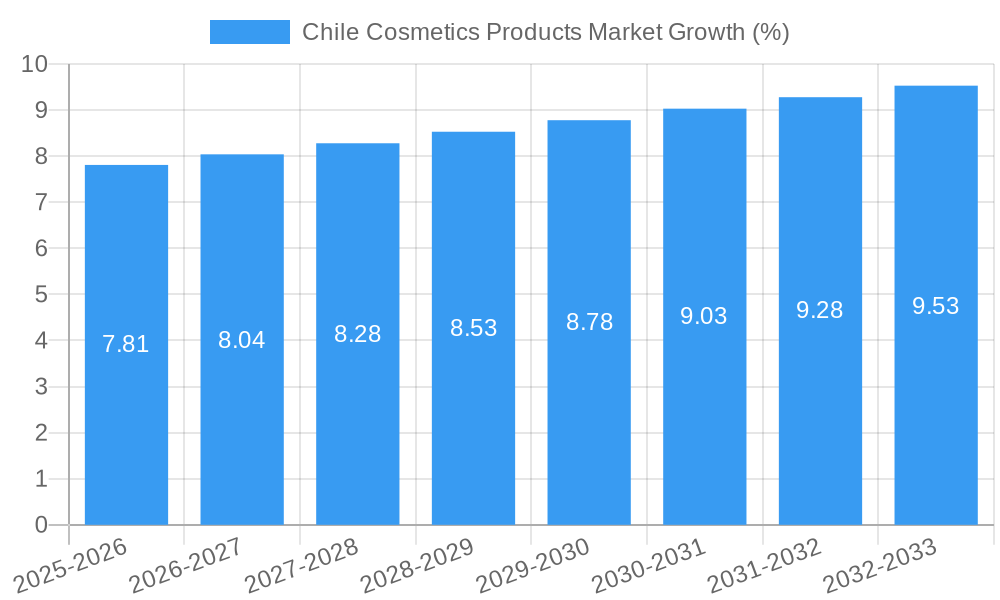

The Chilean cosmetics market, valued at $282.97 million in 2025, is projected to experience steady growth, driven by increasing disposable incomes, a rising young population embracing beauty trends, and a growing preference for premium and specialized cosmetic products. The market's Compound Annual Growth Rate (CAGR) of 2.45% from 2019 to 2024 suggests a relatively stable trajectory, indicating consistent demand across various product categories. Key growth drivers include the expanding online retail channel, mirroring global trends of e-commerce penetration in the beauty sector. This ease of access combined with targeted marketing campaigns by established brands and the emergence of niche players fuels market expansion. The premium segment is expected to witness stronger growth compared to the mass merchandiser segment, indicating a consumer shift towards higher-quality and specialized products. While the dominance of established international players like L'Oréal and Estée Lauder is significant, the presence of local and regional brands presents opportunities for competitive innovation and targeted product development catered to the specific needs and preferences of Chilean consumers. Challenges, however, include economic volatility and potential shifts in consumer spending behavior influenced by broader macroeconomic conditions. The sustained growth in the market, however, points towards a promising outlook for both established and emerging players in the Chilean cosmetics landscape.

Further analysis reveals a diversified market across product types. Face cosmetics, encompassing foundations, concealers, and powders, are likely to remain a significant revenue contributor, followed by eye and lip cosmetics. Hair styling and coloring products also represent a substantial market segment, reflecting the importance of personal grooming in Chilean consumer culture. The distribution channel analysis indicates a growing reliance on online retail, but traditional channels like supermarkets/hypermarkets and specialist retailers continue to maintain a significant presence, suggesting a multifaceted approach is crucial for successful market penetration. The forecast period (2025-2033) presents lucrative opportunities for businesses to strategize for sustained growth by leveraging digital marketing, adapting to evolving consumer preferences, and strategically targeting specific market segments with innovative product offerings.

Chile Cosmetics Products Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Chile Cosmetics Products Market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to understand this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence based on rigorous market research. The market size is predicted to reach xx Million by 2033.

Chile Cosmetics Products Market Dynamics & Concentration

The Chilean cosmetics market is characterized by a blend of international giants and local players, resulting in a moderately concentrated landscape. Market share data reveals that the top 5 players control approximately xx% of the market in 2025, indicating room for both expansion and competition. Innovation is a key driver, with companies continuously launching new products and formulations to cater to evolving consumer preferences. The regulatory framework, while generally supportive of the industry, presents some challenges regarding labeling and ingredient regulations. Product substitutes, such as natural and homemade cosmetics, are gaining traction, putting pressure on established brands. Consumer trends lean towards natural, organic, and ethically sourced products, driving a shift in formulation and marketing strategies. M&A activity in the sector has been moderate in the historical period (2019-2024), with approximately xx deals recorded. This trend is expected to remain relatively stable during the forecast period, driven by a need for expansion and diversification.

- Market Concentration: Top 5 players hold xx% market share (2025).

- Innovation Drivers: Focus on natural, organic, and ethically sourced ingredients.

- Regulatory Framework: Challenges exist in labeling and ingredient regulations.

- Product Substitutes: Growth of natural and homemade cosmetics.

- End-User Trends: Increasing demand for sustainable and cruelty-free products.

- M&A Activity: Approximately xx deals recorded (2019-2024).

Chile Cosmetics Products Market Industry Trends & Analysis

The Chilean cosmetics market exhibits a robust growth trajectory, driven by a combination of factors. The increasing disposable income among the middle class fuels demand for premium and mass-merchandiser products alike. Technological advancements in formulation and packaging enhance product appeal and longevity, further boosting market growth. The strong influence of social media and beauty influencers shapes consumer preferences, impacting product trends and marketing strategies. Competitive dynamics are fierce, with established brands facing challenges from both international and local competitors. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033), indicating significant growth potential. Market penetration for online retail channels is steadily increasing, currently estimated at xx% in 2025, and projected to reach xx% by 2033. Consumer preference for specific product types and categories varies across demographics, indicating a segmented market ripe for targeted marketing efforts.

Leading Markets & Segments in Chile Cosmetics Products Market

The Chilean cosmetics market is predominantly driven by the urban centers. Within product types, Face Cosmetics holds the largest market share, followed by Eye Cosmetics and Lip Cosmetics. The Mass Merchandiser category enjoys higher market penetration than the Premium category, reflecting the purchasing power of a significant portion of the consumer base. Supermarkets/Hypermarkets account for the largest distribution channel, followed by Specialist Retailers and increasingly, Online Retail.

Key Drivers:

- Economic Growth: Rising disposable incomes in urban centers.

- Infrastructure Development: Improved logistics and distribution networks.

- Changing Consumer Preferences: Increased preference for natural, organic, and ethically sourced products.

Dominance Analysis:

- Product Type: Face Cosmetics commands the largest market share due to high demand.

- Category: Mass Merchandiser segment dominates due to affordability.

- Distribution Channel: Supermarkets/Hypermarkets represent the primary sales channel, offering broad consumer reach.

Chile Cosmetics Products Market Product Developments

Recent product innovations focus on incorporating natural ingredients, sustainable packaging, and technologically advanced formulations. Companies are leveraging AI and big data analytics to understand consumer preferences and tailor product offerings accordingly. This includes incorporating advanced skincare ingredients, innovative makeup textures, and eco-friendly packaging options. These developments are enhancing product effectiveness and marketability.

Key Drivers of Chile Cosmetics Products Market Growth

The Chilean cosmetics market's growth is propelled by several key factors: rising disposable incomes among consumers, a strong focus on personal care and appearance, and the growing popularity of beauty influencers and social media marketing. Furthermore, the increasing availability of diverse and specialized products and improvements in supply chain efficiency further contribute to the market’s expansion.

Challenges in the Chile Cosmetics Products Market Market

The market faces challenges such as fluctuating raw material prices, stringent regulatory requirements, and increasing competition from both local and international players. Supply chain disruptions can also impact product availability and pricing, leading to reduced profitability for some businesses. The need to comply with evolving consumer preferences for sustainable and ethically sourced products further complicates the business landscape.

Emerging Opportunities in Chile Cosmetics Products Market

The market presents opportunities for companies focused on sustainable and ethical sourcing practices, personalized cosmetics, and innovative product formulations that address specific skincare concerns. Strategic partnerships with local distributors and retailers provide access to untapped market segments. Expansion into online retail channels offers additional growth potential for companies able to adapt to evolving consumer behavior.

Leading Players in the Chile Cosmetics Products Market Sector

- The Estee Lauder Companies Inc. The Estee Lauder Companies Inc.

- Avon Products Inc. Avon Products Inc.

- Mary Kay Mary Kay

- L'Oreal Group L'Oreal Group

- Nutra & Co

- Oriflame Cosmetics S A Oriflame Cosmetics S A

- Beiersdorf AG Beiersdorf AG

- Granasur S A

- Belcorp

- Kosmetik Chile Ltd

Key Milestones in Chile Cosmetics Products Market Industry

- February 2023: Maybelline New York launched its Falsies Surreal Extensions mascara.

- August 2023: KVD Beauty introduced its Full Sleeve Long + Defined Tubing Mascara.

- September 2023: NYX Professional Makeup unveiled its "Mon-Star Bash" Halloween campaign.

These product launches and marketing campaigns demonstrate the continuous innovation and competitive activity within the Chilean cosmetics market.

Strategic Outlook for Chile Cosmetics Products Market Market

The Chilean cosmetics market shows considerable promise for long-term growth, fueled by consistent economic expansion, evolving consumer preferences, and the continuous innovation by market players. Strategic opportunities exist for companies focusing on sustainable practices, personalized products, and effective online marketing strategies. This market is ripe for expansion, especially for brands catering to the growing demand for natural, organic, and ethically sourced cosmetics.

Chile Cosmetics Products Market Segmentation

-

1. Product Type

- 1.1. Face Cosmetics

- 1.2. Eye Cosmetics

- 1.3. Lip Cosmetics

- 1.4. Hair styling and coloring products

-

2. Category

- 2.1. Premium

- 2.2. Mass Merchandiser

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Beauty Salons

- 3.3. Specialist Retailers

- 3.4. Online Retail

- 3.5. Other Distribution Channels

Chile Cosmetics Products Market Segmentation By Geography

- 1. Chile

Chile Cosmetics Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Vegan and Organic Cosmetic Products; Growing Consumer Inclination Towards Grooming and Appearance

- 3.3. Market Restrains

- 3.3.1. High Import Dependency Leading to High Price of the Final Products

- 3.4. Market Trends

- 3.4.1. Hair Styling and Coloring Products are in Trend

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile Cosmetics Products Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Face Cosmetics

- 5.1.2. Eye Cosmetics

- 5.1.3. Lip Cosmetics

- 5.1.4. Hair styling and coloring products

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Premium

- 5.2.2. Mass Merchandiser

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Beauty Salons

- 5.3.3. Specialist Retailers

- 5.3.4. Online Retail

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 The Estee Lauder Companies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Avon Products Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mary Kay

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 L'Oreal Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nutra & Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oriflame Cosmetics S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Beiersdorf AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Granasur S A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Belcorp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kosmetik Chile Ltd*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Estee Lauder Companies Inc

List of Figures

- Figure 1: Chile Cosmetics Products Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Chile Cosmetics Products Market Share (%) by Company 2024

List of Tables

- Table 1: Chile Cosmetics Products Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Chile Cosmetics Products Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Chile Cosmetics Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Chile Cosmetics Products Market Volume K Units Forecast, by Product Type 2019 & 2032

- Table 5: Chile Cosmetics Products Market Revenue Million Forecast, by Category 2019 & 2032

- Table 6: Chile Cosmetics Products Market Volume K Units Forecast, by Category 2019 & 2032

- Table 7: Chile Cosmetics Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Chile Cosmetics Products Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 9: Chile Cosmetics Products Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Chile Cosmetics Products Market Volume K Units Forecast, by Region 2019 & 2032

- Table 11: Chile Cosmetics Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Chile Cosmetics Products Market Volume K Units Forecast, by Country 2019 & 2032

- Table 13: Chile Cosmetics Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Chile Cosmetics Products Market Volume K Units Forecast, by Product Type 2019 & 2032

- Table 15: Chile Cosmetics Products Market Revenue Million Forecast, by Category 2019 & 2032

- Table 16: Chile Cosmetics Products Market Volume K Units Forecast, by Category 2019 & 2032

- Table 17: Chile Cosmetics Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 18: Chile Cosmetics Products Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 19: Chile Cosmetics Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Chile Cosmetics Products Market Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile Cosmetics Products Market?

The projected CAGR is approximately 2.45%.

2. Which companies are prominent players in the Chile Cosmetics Products Market?

Key companies in the market include The Estee Lauder Companies Inc, Avon Products Inc, Mary Kay, L'Oreal Group, Nutra & Co, Oriflame Cosmetics S A, Beiersdorf AG, Granasur S A, Belcorp, Kosmetik Chile Ltd*List Not Exhaustive.

3. What are the main segments of the Chile Cosmetics Products Market?

The market segments include Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 282.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Vegan and Organic Cosmetic Products; Growing Consumer Inclination Towards Grooming and Appearance.

6. What are the notable trends driving market growth?

Hair Styling and Coloring Products are in Trend.

7. Are there any restraints impacting market growth?

High Import Dependency Leading to High Price of the Final Products.

8. Can you provide examples of recent developments in the market?

September 2023: NYX Professional Makeup unveiled its "Mon-Star Bash" Halloween campaign, a limited-edition collection inspired by Universal Pictures' timeless Universal Monsters. This thrilling campaign features a diverse ensemble of emerging Gen Z talents. NYX Professional Makeup offers its exclusive products in Chile through a variety of online distribution channels, such as Amazon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile Cosmetics Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile Cosmetics Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile Cosmetics Products Market?

To stay informed about further developments, trends, and reports in the Chile Cosmetics Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence