Key Insights

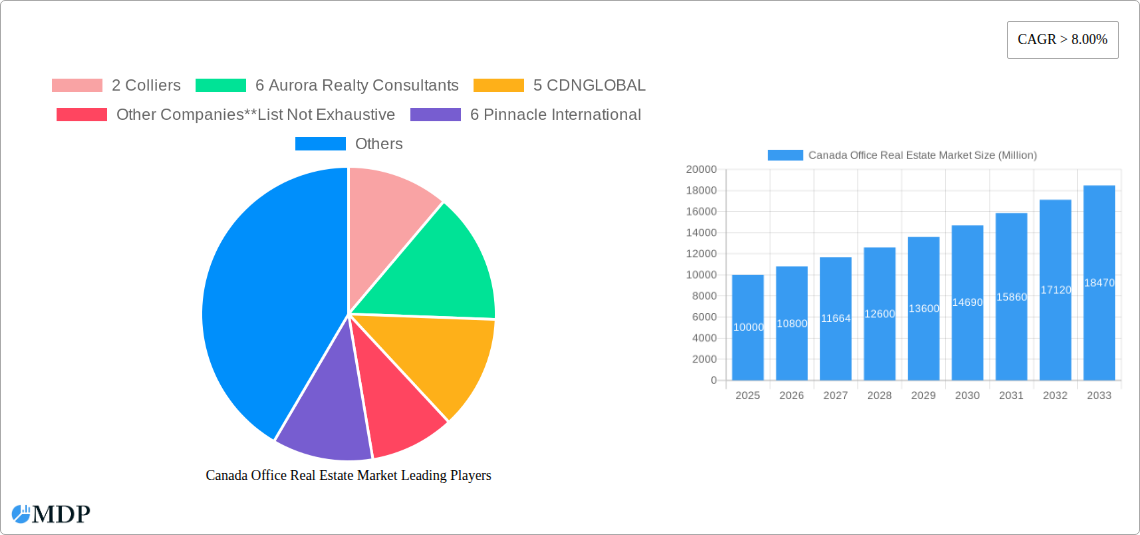

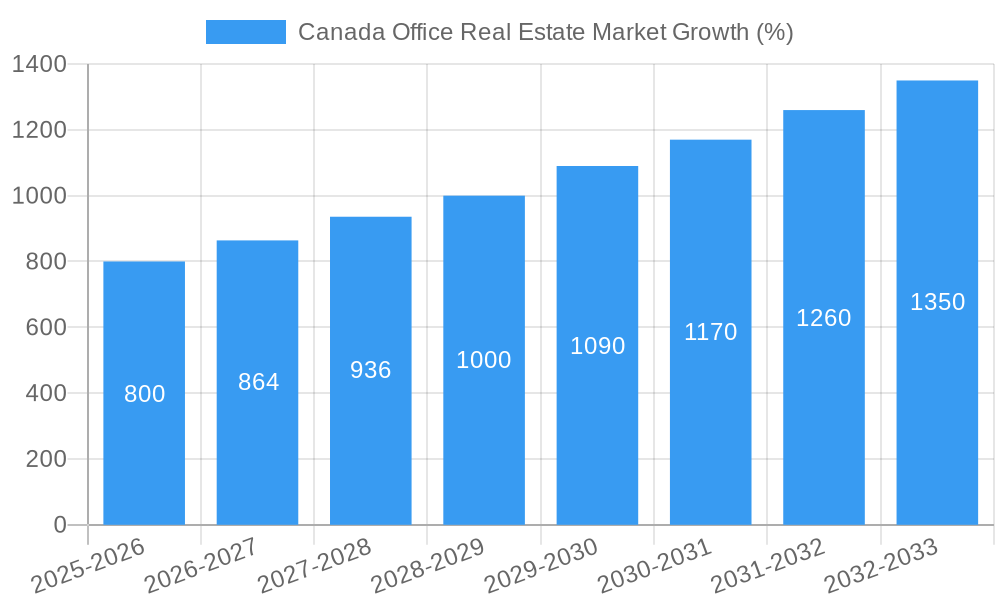

The Canadian office real estate market, currently exhibiting robust growth with a CAGR exceeding 8%, presents a compelling investment landscape. The market size in 2025 is estimated at $XX million (this value needs to be provided to complete the analysis; a reasonable estimate would be necessary based on available market data and reports from similar markets, or external research). Major cities like Toronto, Ottawa, and Montreal are key drivers, fueled by a thriving tech sector, expanding financial services, and government initiatives. Trends like the increasing adoption of hybrid work models and a focus on sustainable buildings are shaping the market's trajectory. However, challenges such as rising interest rates, inflation, and potential economic downturns represent potential restraints. The competitive landscape includes prominent players like Brookfield Asset Management, CBRE Canada, Colliers, and Avison Young, alongside numerous regional and boutique firms. The market's segmentation by major cities provides valuable insights for targeted investment strategies, allowing investors to focus on areas with the highest growth potential. The forecast period (2025-2033) anticipates continued expansion, albeit potentially at a moderated pace depending on macroeconomic factors. Western Canada, in particular, may witness increased growth due to resource sector development and ongoing urbanization.

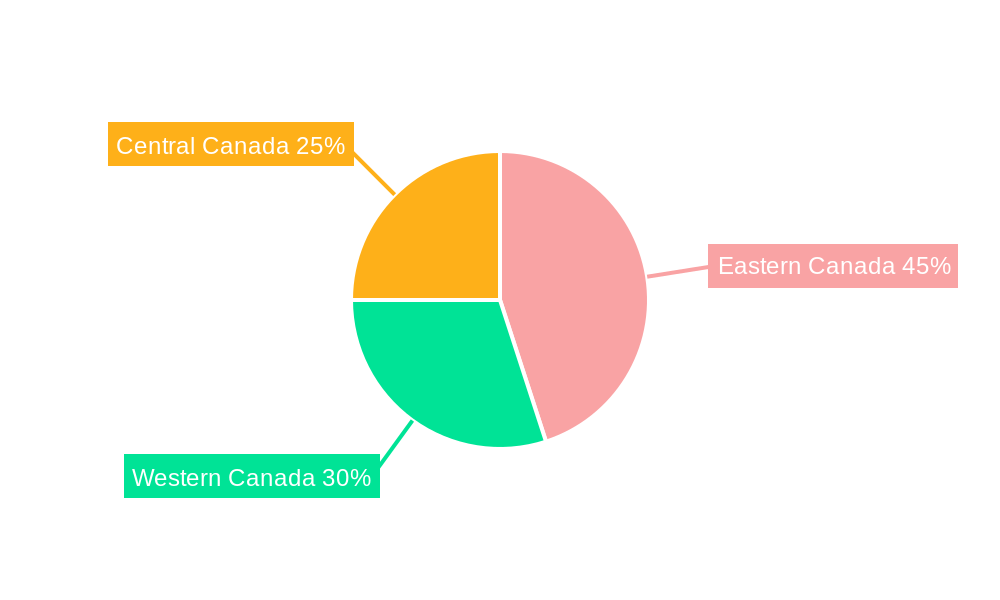

Analyzing the market’s regional distribution across Eastern, Western, and Central Canada reveals distinct dynamics. Eastern Canada, anchored by major metropolitan areas like Toronto and Montreal, is expected to maintain a significant market share due to its concentration of established businesses and a strong talent pool. However, the Western provinces, boosted by resource-based industries, are poised for accelerated growth. Central Canada's performance will likely be influenced by the overall Canadian economy and the diversification of its industries. Competitive analysis reveals a mix of large multinational firms and regional players vying for market share. This dynamic environment encourages innovation and specialization, ultimately benefiting market participants and investors who can effectively identify opportunities and adapt to evolving market conditions. Understanding these multifaceted dynamics is crucial for investors and stakeholders seeking to navigate the evolving Canadian office real estate market.

Canada Office Real Estate Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canadian office real estate market, offering invaluable insights for investors, developers, and industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025, this report forecasts market trends and identifies key opportunities and challenges. The report utilizes data from leading firms including Colliers, Aurora Realty Consultants, CDNGLOBAL, Pinnacle International, Avison Young (Canada) Inc, CBRE Canada, Brookfield Asset Management, QUADREAL, EllisDon Inc, BROCCOLINI, Amacon, Hines, and JLL, among others. Download now to gain a competitive edge.

Canada Office Real Estate Market Dynamics & Concentration

The Canadian office real estate market exhibits a moderately concentrated landscape, with a few major players dominating specific segments and regions. Market share analysis reveals that CBRE Canada, Colliers, and Avison Young (Canada) Inc. hold significant portions of the brokerage and property management sectors. The level of concentration varies across major cities, with Toronto displaying higher concentration compared to secondary markets. Market dynamics are significantly influenced by several factors:

- Innovation Drivers: Technological advancements, such as smart building technologies and flexible workspace solutions, are reshaping the office market, attracting tech-driven companies and influencing tenant preferences.

- Regulatory Frameworks: Federal and provincial regulations concerning zoning, building codes, and environmental sustainability impact development timelines and costs.

- Product Substitutes: The rise of remote work and co-working spaces presents alternative options to traditional office leases, affecting demand for traditional office space.

- End-User Trends: Shifting demographics and evolving workplace needs are driving demand for more flexible and amenity-rich office spaces.

- M&A Activities: Mergers and acquisitions among real estate firms are leading to increased consolidation and market share shifts. Over the historical period (2019-2024), an estimated xx M&A deals were recorded, indicating a moderate pace of consolidation. This is projected to increase to xx deals annually during the forecast period (2025-2033).

Canada Office Real Estate Market Industry Trends & Analysis

The Canadian office real estate market experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024). This growth was driven by factors such as a robust economy, population growth in major cities (particularly Toronto, Montreal, and Vancouver), and increased demand from technology and financial services sectors. Market penetration of flexible office spaces increased significantly during this period. However, the recent emergence of remote work models and economic uncertainty has introduced challenges to the market's growth trajectory. The forecast period (2025-2033) is expected to see a CAGR of xx%, influenced by various factors, including:

- Technological Disruptions: The adoption of smart building technologies and flexible workspace solutions are expected to continue influencing market trends, creating both opportunities and challenges.

- Consumer Preferences: Demand for sustainable and amenity-rich office spaces is increasing.

- Competitive Dynamics: Competition among developers and landlords is intense, putting pressure on rental rates and occupancy levels.

Leading Markets & Segments in Canada Office Real Estate Market

Toronto remains the dominant market within the Canadian office real estate sector, accounting for approximately xx% of total office space. This dominance is attributable to:

- Economic Strength: Toronto's robust economy, particularly in the financial and technology sectors, fuels strong demand for office space.

- Infrastructure: Extensive transportation networks and a well-developed infrastructure support efficient business operations.

- Talent Pool: A large and diverse talent pool attracts businesses and supports a vibrant office market.

Montreal and Ottawa also represent significant markets, though their scales are smaller compared to Toronto. Montreal's strength lies in its bilingual workforce and thriving tech sector, while Ottawa benefits from its strong government presence and related industries.

Canada Office Real Estate Market Product Developments

Recent product developments in the Canadian office real estate market have focused on enhancing sustainability, flexibility, and tenant experience. Smart building technologies, such as energy-efficient systems and advanced security measures, are becoming increasingly common. The integration of collaborative workspaces and flexible lease terms are designed to attract tech companies and modern businesses, thereby improving market fit.

Key Drivers of Canada Office Real Estate Market Growth

Several key factors contribute to the growth of the Canadian office real estate market:

- Economic Growth: A strong and diversified economy creates demand for office space across various sectors.

- Population Growth: Urban population growth in major cities fuels demand for office space.

- Technological Advancements: Smart building technologies and flexible workspaces are enhancing the appeal of office spaces.

- Government Policies: Supportive government policies related to infrastructure development and foreign investment stimulate the sector.

Challenges in the Canada Office Real Estate Market Market

The Canadian office real estate market faces several challenges:

- High Construction Costs: Rising construction costs and material prices increase development risks.

- Supply Chain Disruptions: Global supply chain issues can delay projects and inflate costs.

- Remote Work Trend: The increasing adoption of remote work models impacts demand for traditional office spaces. This is expected to affect occupancy rates by xx% by 2033.

- Increased Competition: Increased competition among landlords and developers puts downward pressure on rental rates.

Emerging Opportunities in Canada Office Real Estate Market

The Canadian office real estate market presents several emerging opportunities:

- Sustainable Development: Growing demand for environmentally friendly office spaces creates opportunities for developers focusing on LEED certification and energy efficiency.

- Technology Integration: Smart building technologies offer opportunities for enhancing operational efficiency and tenant satisfaction.

- Expansion into Secondary Markets: Growth potential exists in secondary markets with lower costs and emerging economic opportunities.

Leading Players in the Canada Office Real Estate Market Sector

- Colliers

- Aurora Realty Consultants

- CDNGLOBAL

- Other Companies (List Not Exhaustive)

- Pinnacle International

- Avison Young (Canada) Inc

- CBRE Canada

- Brookfield Asset Management

- QUADREAL

- EllisDon Inc

- BROCCOLINI

- Amacon

- Hines

- JLL

Key Milestones in Canada Office Real Estate Market Industry

- February 2022: Crown Realty Partners completed the acquisition of the Park of Commerce property in Ottawa, marking a significant milestone for their value-add fund.

- April 2022: Canadian Net Real Estate Investment Trust purchased four properties in Quebec and Nova Scotia for USD 18,800,000, reflecting a capitalization rate of approximately 6.5%.

Strategic Outlook for Canada Office Real Estate Market Market

The Canadian office real estate market is poised for continued growth, albeit at a moderated pace compared to the pre-pandemic era. Strategic opportunities exist in focusing on sustainable development, technology integration, and adapting to evolving tenant needs. The long-term outlook remains positive, driven by population growth, economic diversification, and the ongoing evolution of the workplace. Adaptability and innovation will be key to success in the coming years.

Canada Office Real Estate Market Segmentation

-

1. Major Cities

- 1.1. Toronto

- 1.2. Ottawa

- 1.3. Montreal

Canada Office Real Estate Market Segmentation By Geography

- 1. Canada

Canada Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing new construction activity as well as expansion of new startups and small enterprises; Increasing demand for affordable housing units

- 3.3. Market Restrains

- 3.3.1. Lack of housing spaces and mortgage regulation

- 3.4. Market Trends

- 3.4.1. Office spaces in Toronto and Vancouver are increasing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Major Cities

- 5.1.1. Toronto

- 5.1.2. Ottawa

- 5.1.3. Montreal

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Major Cities

- 6. Eastern Canada Canada Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 2 Colliers

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 6 Aurora Realty Consultants

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 5 CDNGLOBAL

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Other Companies**List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 6 Pinnacle International

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 4 Avison Young (Canada) Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 3 CBRE Canada

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 1 Brookfield Asset Management

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 5 QUADREAL

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 2 EllisDon Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 4 BROCCOLINI

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 7 Amacon

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 3 Hines

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 1 JLL

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.1 2 Colliers

List of Figures

- Figure 1: Canada Office Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Office Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Office Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Office Real Estate Market Revenue Million Forecast, by Major Cities 2019 & 2032

- Table 3: Canada Office Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Canada Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Eastern Canada Canada Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Western Canada Canada Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Central Canada Canada Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Office Real Estate Market Revenue Million Forecast, by Major Cities 2019 & 2032

- Table 9: Canada Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Office Real Estate Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Canada Office Real Estate Market?

Key companies in the market include 2 Colliers, 6 Aurora Realty Consultants, 5 CDNGLOBAL, Other Companies**List Not Exhaustive, 6 Pinnacle International, 4 Avison Young (Canada) Inc, 3 CBRE Canada, 1 Brookfield Asset Management, 5 QUADREAL, 2 EllisDon Inc, 4 BROCCOLINI, 7 Amacon, 3 Hines, 1 JLL.

3. What are the main segments of the Canada Office Real Estate Market?

The market segments include Major Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing new construction activity as well as expansion of new startups and small enterprises; Increasing demand for affordable housing units.

6. What are the notable trends driving market growth?

Office spaces in Toronto and Vancouver are increasing.

7. Are there any restraints impacting market growth?

Lack of housing spaces and mortgage regulation.

8. Can you provide examples of recent developments in the market?

April 2022: Canadian Net Real Estate Investment Trust announced the purchase of four properties in Quebec and Nova Scotia. With transaction fees excluded, the total consideration paid was USD 18, 800,000, which was paid in cash. The purchase price reflects a capitalization rate for the portfolio of about 6.5%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Canada Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence