Key Insights

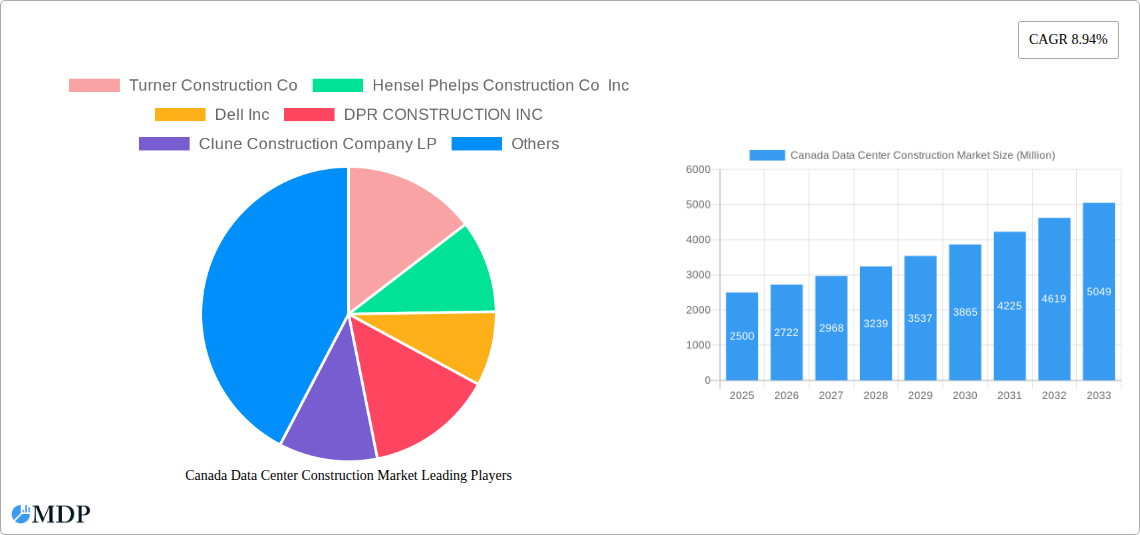

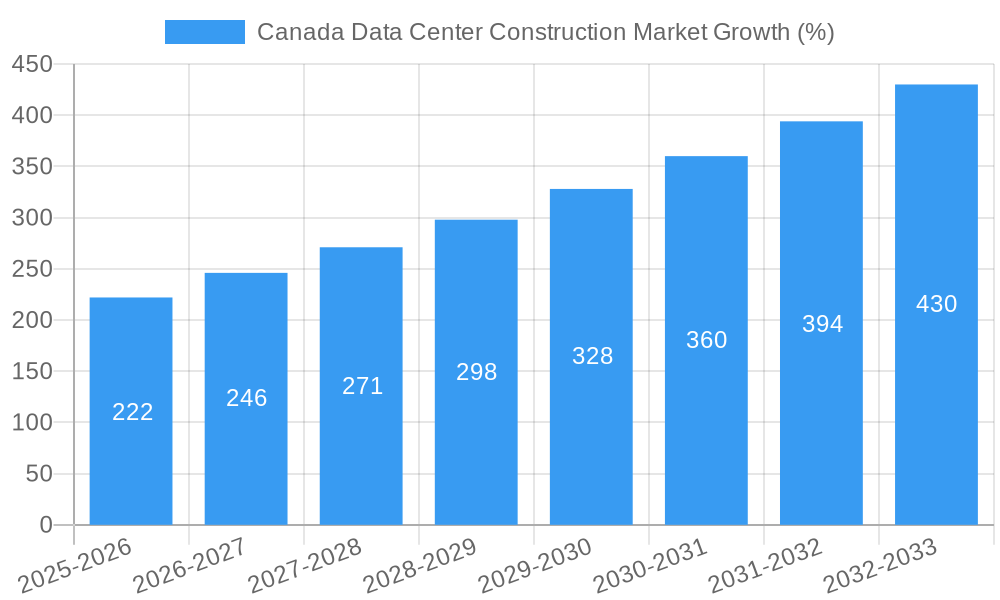

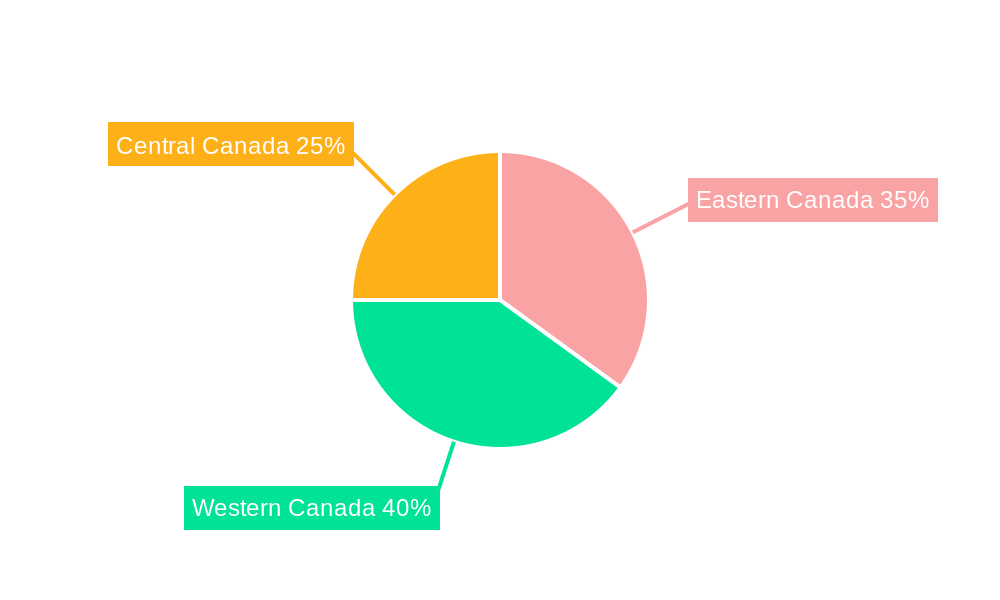

The Canada data center construction market, exhibiting a robust CAGR of 8.94%, presents significant growth opportunities. Driven by increasing digitalization, the burgeoning cloud computing sector, and the expanding need for robust IT infrastructure across key sectors like IT & Telecommunications, BFSI (Banking, Financial Services, and Insurance), and Government, the market is poised for substantial expansion. The preference for colocation facilities, fueled by the desire for scalability and reduced capital expenditure, further stimulates demand. While challenges like land scarcity in urban centers and rising construction costs act as restraints, the market's growth trajectory remains positive. Segmentation reveals that Electrical Infrastructure constitutes a significant portion of the construction expenditure, followed by Mechanical Infrastructure. The IT & Telecommunication sector leads end-user demand, reflecting the intensive IT requirements of this sector. Key players like Turner Construction Co, Hensel Phelps Construction Co Inc, and IBM Corporation, alongside regional specialists, are shaping the market landscape through strategic partnerships and innovative construction methodologies. The geographic distribution reveals strong growth potential across Eastern, Western, and Central Canada, mirroring regional economic activity and technological adoption rates. The market's growth is anticipated to be fairly consistent across the forecast period (2025-2033) based on the provided CAGR, with a higher growth rate likely in the earlier years of the forecast due to the pent-up demand and the ongoing expansion of the digital economy.

The market's continued growth is underpinned by government initiatives promoting digital infrastructure development and the increasing adoption of 5G technology. The ongoing focus on cybersecurity and data sovereignty further enhances the need for secure, locally-based data centers. While supply chain disruptions and skilled labor shortages could pose challenges, the long-term outlook remains positive. The market is projected to witness a steady influx of investment in green data centers, driven by sustainability concerns and government regulations. This focus on sustainable practices adds another layer of complexity and cost to projects, but also represents a considerable opportunity for construction firms specializing in green building technologies. The Canadian data center construction market will likely see consolidation among key players, leading to increased competitiveness and innovation.

Canada Data Center Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada Data Center Construction Market, offering invaluable insights for stakeholders across the industry. From market dynamics and leading players to emerging opportunities and future trends, this report is your essential guide to navigating this rapidly evolving sector. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year.

Canada Data Center Construction Market Market Dynamics & Concentration

The Canadian data center construction market is experiencing robust growth, driven by increasing digitalization, cloud adoption, and the burgeoning need for robust IT infrastructure. Market concentration is moderate, with a few large players like Turner Construction Co, Hensel Phelps Construction Co Inc, and Dell Inc holding significant market share, estimated at approximately xx% collectively in 2025. However, several mid-sized and smaller firms also contribute significantly, fostering a dynamic competitive landscape.

Innovation is a key driver, with advancements in sustainable technologies (e.g., energy-efficient cooling systems) and modular construction methods gaining traction. The regulatory framework, while generally supportive of data center development, faces ongoing evolution to address issues like energy consumption and environmental impact. Product substitutes are limited, given the specialized nature of data center construction. End-user trends reflect a growing preference for hyperscale facilities and colocation services. M&A activity has been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024, indicating a blend of organic growth and strategic acquisitions.

- Market Share (2025 Estimate): Top 3 players hold xx%, others xx%.

- M&A Deal Count (2019-2024): Approximately xx deals.

- Key Innovation Drivers: Sustainable technologies, modular construction.

- Regulatory Focus: Energy efficiency, environmental impact.

Canada Data Center Construction Market Industry Trends & Analysis

The Canadian data center construction market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by several key factors. The increasing adoption of cloud computing and big data analytics is fueling demand for robust data center infrastructure. Government initiatives promoting digital transformation and investments in 5G networks are further boosting the market. Technological disruptions, such as the rise of edge computing and AI, are creating new opportunities for specialized data center designs. Consumer preferences increasingly favor secure, reliable, and energy-efficient data center solutions. Competitive dynamics are characterized by ongoing investments in capacity expansion, strategic partnerships, and technological advancements. Market penetration of sustainable data center technologies is expected to reach xx% by 2033, demonstrating growing industry focus on environmental responsibility.

Leading Markets & Segments in Canada Data Center Construction Market

The IT & Telecommunication segment dominates the end-user landscape, accounting for approximately xx% of the market in 2025. This high demand stems from the significant expansion of cloud services and the need for high-bandwidth connectivity. The BFSI sector also contributes substantially, driven by stringent data security and regulatory compliance requirements. Geographically, Ontario and Quebec are leading markets, benefiting from established IT hubs and supportive government policies.

By Infrastructure:

- Electrical Infrastructure: Dominates due to the power-intensive nature of data centers.

- Mechanical Infrastructure: Crucial for maintaining optimal operating temperatures.

- Other Infrastructures: Includes security, fire suppression, and networking.

By End User:

- IT & Telecommunication: Leading segment due to cloud expansion and 5G deployment.

- BFSI: High demand driven by regulatory compliance and security needs.

- Government: Increasing investments in digital infrastructure.

- Healthcare: Growing adoption of telehealth and electronic health records.

- Other End Users: Includes education, retail, and manufacturing sectors.

Key Drivers:

- Ontario and Quebec: Established IT hubs, supportive government policies, and strong demand.

- IT & Telecommunication: Cloud computing, 5G rollout, data analytics.

- BFSI: Stringent data security and regulatory compliance.

Canada Data Center Construction Market Product Developments

Recent advancements in prefabricated modular data centers are significantly impacting the market. These modules offer faster deployment times, reduced construction costs, and improved scalability, making them an increasingly attractive option for businesses. Furthermore, innovations in energy-efficient cooling technologies, such as liquid cooling and AI-powered thermal management systems, are enhancing the sustainability and operational efficiency of data centers. These developments contribute to increased market competitiveness by providing differentiated solutions to meet diverse client needs and preferences.

Key Drivers of Canada Data Center Construction Market Growth

Several factors fuel the growth of the Canadian data center construction market. These include the surging demand for cloud-based services, government initiatives aimed at digital transformation, expanding 5G networks requiring substantial infrastructure upgrades, and the increasing adoption of AI and big data analytics. Economic growth and rising foreign direct investment in the technology sector further contribute to market expansion.

Challenges in the Canada Data Center Construction Market Market

Challenges include securing skilled labor, navigating complex regulatory requirements, and managing supply chain disruptions which have led to material cost increases of approximately xx% in 2024 compared to 2019. Competition is intense, putting pressure on pricing and margins. The high capital expenditure required for data center construction also poses a barrier for some developers.

Emerging Opportunities in Canada Data Center Construction Market

The market presents several promising opportunities. The expansion of edge computing creates demand for smaller, geographically dispersed data centers. Strategic partnerships between data center operators and technology providers offer lucrative avenues for growth. Continued government investment in digital infrastructure will sustain demand for many years.

Leading Players in the Canada Data Center Construction Market Sector

- Turner Construction Co

- Hensel Phelps Construction Co Inc

- Dell Inc

- DPR CONSTRUCTION INC

- Clune Construction Company LP

- IBM Corporation

- Holder Construction Company

- Nabholz Construction Corporation

- Rittal GMBH & Co KG

- AECOM

- HITT Contrating Inc

- Hewlett Packard Enterprise (HPE)

- Fortis Construction Inc

- Schneider Electric SE

Key Milestones in Canada Data Center Construction Market Industry

- June 2022: Cologix partnered with Console Connect, expanding its interconnection ecosystem in Toronto and Montreal. This strategic move enhances the connectivity and appeal of Cologix's data centers, stimulating further development.

- May 2022: NetIX and eStruxture's partnership broadened global connectivity options within Canada, attracting international businesses and boosting market growth. This collaboration indicates increasing interest in Canadian data center infrastructure from international players.

Strategic Outlook for Canada Data Center Construction Market Market

The Canadian data center construction market holds significant long-term potential. Continued technological advancements, coupled with robust government support and growing demand from various sectors, position the market for sustained growth. Strategic investments in sustainable technologies and skilled workforce development will be crucial for maximizing future opportunities. The focus on hybrid and multi-cloud strategies will also drive significant demand.

Canada Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. By Electrical Infrastructure

-

1.1.1. Power Distribution Solution

- 1.1.1.1. PDU - Ba

-

1.1.1.2. Transfer Switches

- 1.1.1.2.1. Static

- 1.1.1.2.2. Automatic (ATS)

-

1.1.1.3. Switchgear

- 1.1.1.3.1. Low-voltage

- 1.1.1.3.2. Medium-voltage

- 1.1.1.4. Power Panels and Components

- 1.1.1.5. Others

-

1.1.2. Power Back-up Solutions

- 1.1.2.1. UPS

- 1.1.2.2. Generators

- 1.1.3. Service

-

1.1.1. Power Distribution Solution

-

1.2. By Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.2.1.1. Immersion Cooling

- 1.2.1.2. Direct-to-Chip Cooling

- 1.2.1.3. Rear Door Heat Exchanger

- 1.2.1.4. In-row and In-rack Cooling

- 1.2.2. Racks

- 1.2.3. Other Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.3. General Construction

-

1.1. By Electrical Infrastructure

-

2. Tier Type

- 2.1. Tier 1 and 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. End User

- 3.1. Banking, Financial Services, and Insurance

- 3.2. IT and Telecommunications

- 3.3. Government and Defense

- 3.4. Healthcare

- 3.5. Other End Users

Canada Data Center Construction Market Segmentation By Geography

- 1. Canada

Canada Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.94% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 9.1 Growing Cloud Applications

- 3.2.2 AI

- 3.2.3 and Big Data9.2 Growing Adoption of Hyperscale Data Centers in Large Enterprises9.3 Advent Green Data Center

- 3.3. Market Restrains

- 3.3.1 10.1 High CaPex

- 3.3.2 OpEx & TCO for building Data Center

- 3.4. Market Trends

- 3.4.1. BFSI to hold major market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. By Electrical Infrastructure

- 5.1.1.1. Power Distribution Solution

- 5.1.1.1.1. PDU - Ba

- 5.1.1.1.2. Transfer Switches

- 5.1.1.1.2.1. Static

- 5.1.1.1.2.2. Automatic (ATS)

- 5.1.1.1.3. Switchgear

- 5.1.1.1.3.1. Low-voltage

- 5.1.1.1.3.2. Medium-voltage

- 5.1.1.1.4. Power Panels and Components

- 5.1.1.1.5. Others

- 5.1.1.2. Power Back-up Solutions

- 5.1.1.2.1. UPS

- 5.1.1.2.2. Generators

- 5.1.1.3. Service

- 5.1.1.1. Power Distribution Solution

- 5.1.2. By Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.1.1. Immersion Cooling

- 5.1.2.1.2. Direct-to-Chip Cooling

- 5.1.2.1.3. Rear Door Heat Exchanger

- 5.1.2.1.4. In-row and In-rack Cooling

- 5.1.2.2. Racks

- 5.1.2.3. Other Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.3. General Construction

- 5.1.1. By Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 and 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Banking, Financial Services, and Insurance

- 5.3.2. IT and Telecommunications

- 5.3.3. Government and Defense

- 5.3.4. Healthcare

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. Eastern Canada Canada Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Turner Construction Co

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Hensel Phelps Construction Co Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Dell Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 DPR CONSTRUCTION INC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Clune Construction Company LP

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 IBM Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Holder Construction Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Nabholz Construction Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Rittal GMBH & Co KG

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 AECOM

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 HITT Contrating Inc

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Hewlett Packard Enterprise (HPE)

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Fortis ConstructionInc

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 Schneider Electric SE

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.1 Turner Construction Co

List of Figures

- Figure 1: Canada Data Center Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Data Center Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 3: Canada Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Canada Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Canada Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Canada Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Eastern Canada Canada Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Western Canada Canada Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Central Canada Canada Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 11: Canada Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 12: Canada Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 13: Canada Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Data Center Construction Market?

The projected CAGR is approximately 8.94%.

2. Which companies are prominent players in the Canada Data Center Construction Market?

Key companies in the market include Turner Construction Co, Hensel Phelps Construction Co Inc, Dell Inc, DPR CONSTRUCTION INC, Clune Construction Company LP, IBM Corporation, Holder Construction Company, Nabholz Construction Corporation, Rittal GMBH & Co KG, AECOM, HITT Contrating Inc, Hewlett Packard Enterprise (HPE), Fortis ConstructionInc, Schneider Electric SE.

3. What are the main segments of the Canada Data Center Construction Market?

The market segments include Infrastructure, Tier Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

9.1 Growing Cloud Applications. AI. and Big Data9.2 Growing Adoption of Hyperscale Data Centers in Large Enterprises9.3 Advent Green Data Center.

6. What are the notable trends driving market growth?

BFSI to hold major market share.

7. Are there any restraints impacting market growth?

10.1 High CaPex. OpEx & TCO for building Data Center.

8. Can you provide examples of recent developments in the market?

June 2022: Cologix announced its continued strategic partnership with Console Connect by PCCW Global by deploying the Console Connect Software-Defined Interconnection platform at Cologix's TOR1 data center in Toronto-this marked Console Connect's second PoP within Cologix's Canadian market and interconnection ecosystem. The first was available in December 2021 at Cologix's MTL7 data center in Montréal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Data Center Construction Market?

To stay informed about further developments, trends, and reports in the Canada Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence