Key Insights

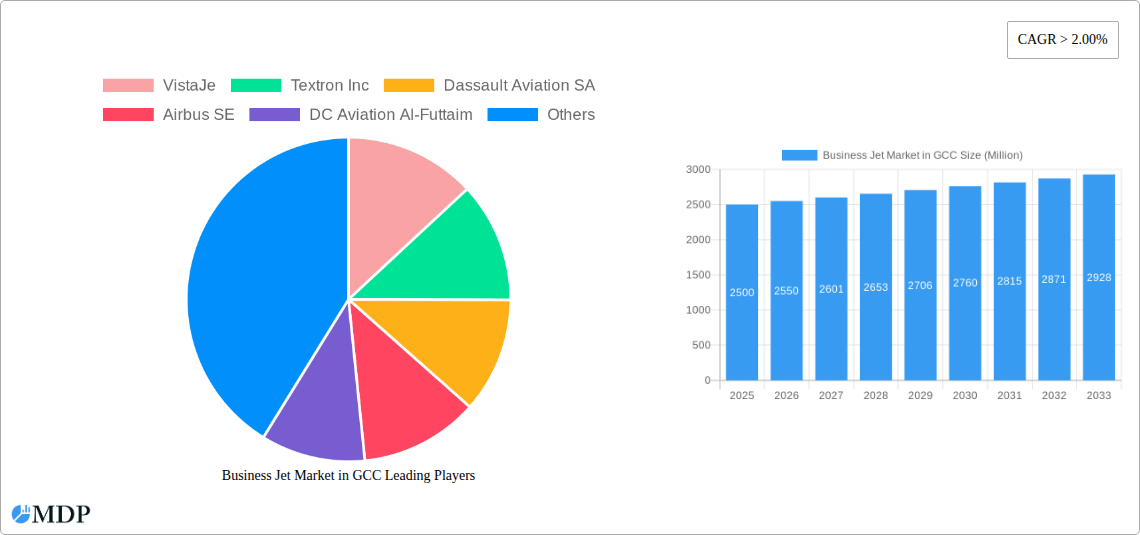

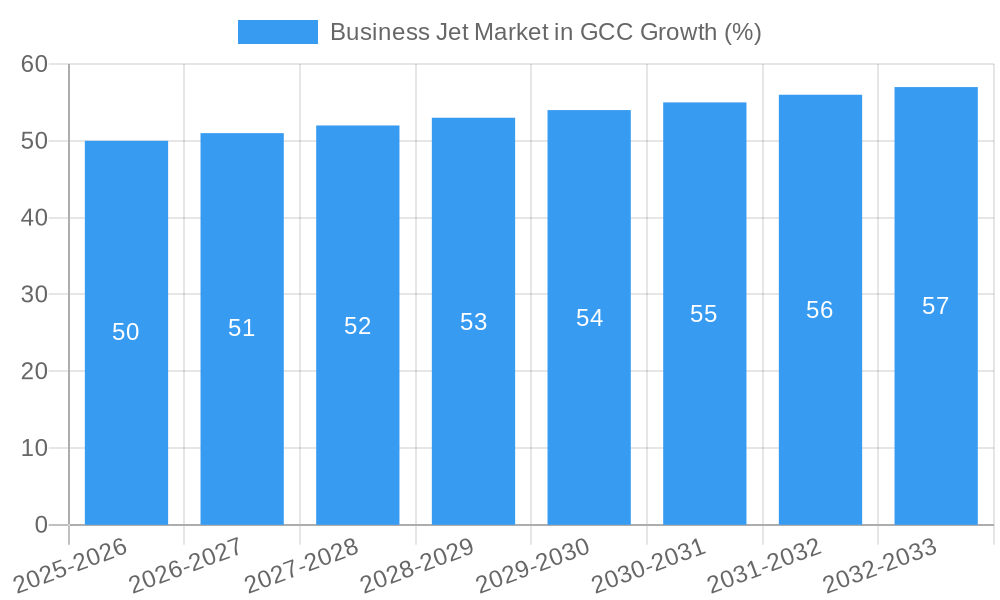

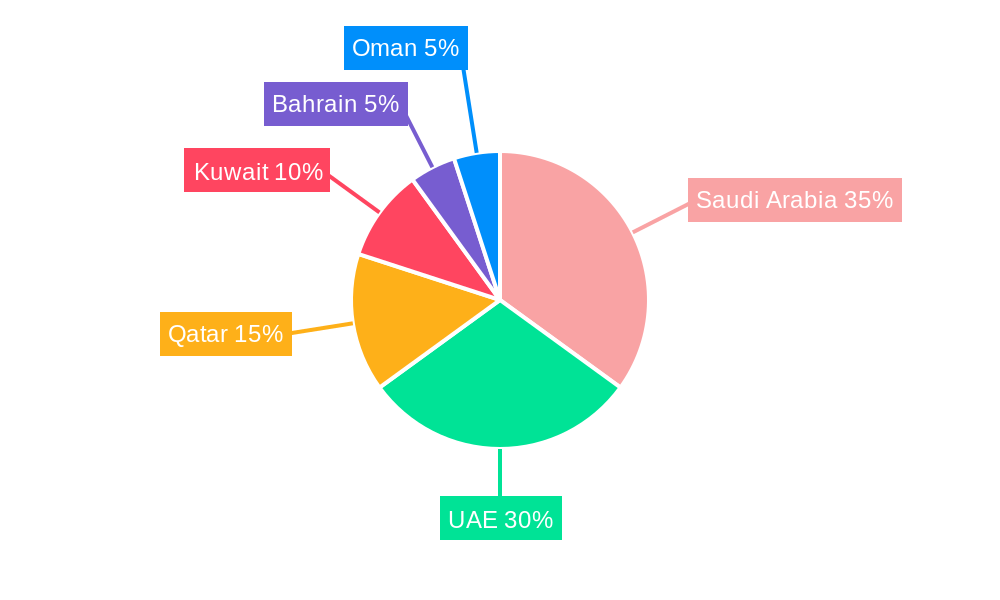

The Business Jet Market in the Gulf Cooperation Council (GCC) is experiencing robust growth, driven by increasing high-net-worth individuals, burgeoning tourism, and a strong emphasis on business travel within the region. The market, estimated at approximately $XX million in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 2.00% through 2033. This expansion is fueled by several key factors. Firstly, the ongoing diversification of GCC economies beyond oil and gas is creating a wealthier, more mobile business class requiring efficient and luxurious private travel. Secondly, the region's strategic location facilitates both regional and international business connectivity, making business jets essential for time-sensitive transactions and meetings. Furthermore, government initiatives promoting tourism and infrastructure development indirectly contribute to the growth of the business aviation sector. The market segmentation reveals a significant demand for light and mid-size jets, reflecting the typical needs of individual business owners and smaller corporations. Larger jets cater to corporate giants and high-profile individuals requiring greater capacity and range. Within the GCC, Saudi Arabia, the United Arab Emirates, and Qatar represent the largest market segments due to their economic strength and developed aviation infrastructure. However, other nations within the GCC, such as Kuwait, Bahrain, and Oman, are showing signs of increasing participation, reflecting a broader economic prosperity and infrastructural development. Competitive pressures among established players like VistaJet, Textron, Dassault Aviation, Airbus, and Gulfstream Aerospace, alongside regional operators, continue to drive innovation and service enhancements, keeping the market dynamic and competitive.

While the GCC business jet market enjoys significant advantages, challenges such as fluctuating fuel prices, regulatory hurdles in airspace management, and occasional geopolitical uncertainties may pose temporary headwinds. However, the long-term outlook remains optimistic, with continued investment in airport infrastructure and ongoing economic diversification within the GCC underpinning sustained growth. The expansion of maintenance, repair, and overhaul (MRO) services and the rise of fractional ownership models further contribute to market evolution and accessibility. The forecast period (2025-2033) anticipates consistent growth, propelled by the aforementioned positive factors outweighing potential short-term obstacles. The long-term potential for the GCC business jet market is significant, driven by continued economic development and evolving business travel needs within the region.

Business Jet Market in GCC: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Business Jet Market in the Gulf Cooperation Council (GCC) region, covering the period from 2019 to 2033. Leveraging extensive market research and data analysis, this report offers invaluable insights for industry stakeholders, investors, and businesses seeking to understand the dynamics and future trajectory of this lucrative sector. The report incorporates detailed analysis of market size, segmentation, leading players, and growth drivers, delivering actionable intelligence for informed decision-making. This report predicts a market valued at xx Million by 2025 and xx Million by 2033.

Business Jet Market in GCC Market Dynamics & Concentration

The GCC business jet market exhibits a moderate level of concentration, with several key players dominating the landscape. Market share is primarily influenced by factors such as fleet size, operational capabilities, and brand reputation. Key players such as Gulfstream Aerospace Corporation and Bombardier Inc. hold significant market shares, driven by their extensive product portfolios and established customer base. However, smaller operators like Royal Jet and DC Aviation Al-Futtaim also play a notable role, catering to specific niche segments. The market dynamic is further shaped by continuous innovation, stringent regulatory frameworks enforced by the individual GCC states, and the presence of substitute modes of private air travel, ultimately affecting market concentration levels.

Market Dynamics:

- Innovation Drivers: Continuous advancements in aircraft technology, focusing on fuel efficiency, range, and passenger comfort, are major innovation drivers.

- Regulatory Frameworks: Stringent safety regulations and operational standards across the GCC influence market dynamics.

- Product Substitutes: Private yachts and high-speed rail offer alternative travel options, influencing market share.

- End-User Trends: Growing demand from high-net-worth individuals (HNWIs) and corporate clients fuels market growth.

- M&A Activities: A moderate number of M&A deals (xx in the last 5 years) have reshaped the competitive landscape, leading to increased market consolidation. This consolidation is projected to continue at a rate of xx deals annually through 2033.

Business Jet Market in GCC Industry Trends & Analysis

The GCC business jet market is experiencing robust growth, driven by several key factors. The region’s expanding economy, increasing HNWIs, and government investments in infrastructure are fueling demand. The average annual growth rate (CAGR) between 2019 and 2024 was approximately xx%, and is projected to reach xx% during the forecast period (2025-2033). Technological disruptions, including the introduction of more fuel-efficient and technologically advanced aircraft, are transforming the market. Consumer preferences are shifting towards larger, more luxurious jets, and increased demand for personalized services. The market continues to be characterized by intense competition, forcing companies to focus on differentiated services and innovative solutions to attract and retain clients. Market penetration remains relatively high in the UAE and Saudi Arabia compared to other GCC countries, however overall penetration is forecast to increase.

Leading Markets & Segments in Business Jet Market in GCC

The United Arab Emirates (UAE) and Saudi Arabia represent the leading markets within the GCC, accounting for approximately xx% of the total market share. This dominance is primarily due to their robust economies, extensive airport infrastructure, and large populations of HNWIs.

Key Drivers of Dominance:

- Economic Strength: Robust economic growth and high per capita income in the UAE and Saudi Arabia directly drive demand.

- Airport Infrastructure: Well-developed airport infrastructure, including dedicated business aviation terminals, supports the market.

- Government Initiatives: Government support for tourism and business travel positively impacts the sector.

Segment Analysis:

- Range: Jets with a range of 5,000 nm and above are highly sought after, especially for long-haul international travel.

- Aircraft Type: The demand for mid-size and large jets dominates the market, reflecting the preference for spaciousness and comfort among passengers. The light jet segment demonstrates consistent growth, catering to shorter-range travel and cost-conscious clients.

Business Jet Market in GCC Product Developments

Recent years have witnessed significant product innovations in the GCC business jet market. Manufacturers are focusing on developing fuel-efficient, technologically advanced aircraft with enhanced comfort features, advanced cabin amenities, and increased range. These innovations improve operational efficiency and cater to evolving passenger preferences, thus enhancing market competitiveness. The focus is also on integrating advanced technologies such as improved in-flight entertainment systems, enhanced connectivity, and advanced safety features.

Key Drivers of Business Jet Market in GCC Growth

The growth of the GCC business jet market is fueled by several key factors. Firstly, the burgeoning economies of the region, particularly the UAE and Saudi Arabia, generate substantial wealth and disposable income among HNWIs. Secondly, government initiatives supporting tourism and business travel stimulate demand. Lastly, continuous advancements in aircraft technology, leading to more efficient and comfortable jets, are pivotal to market growth.

Challenges in the Business Jet Market in GCC Market

Despite robust growth, the GCC business jet market faces challenges. High operating costs, including fuel prices and maintenance expenses, can impact profitability. Regulatory hurdles and stringent safety standards impose operational complexities. Intense competition among operators necessitates strategic differentiation and efficient cost management to maintain profitability. Supply chain disruptions, particularly evident in recent years, are impacting the timely delivery of new aircraft and maintenance parts. These challenges are expected to affect profit margins by an average of xx% over the next 5 years.

Emerging Opportunities in Business Jet Market in GCC

The long-term growth of the GCC business jet market is promising. Technological advancements, including the development of sustainable aviation fuels and improved aircraft designs, present significant opportunities for growth. Strategic partnerships between operators and maintenance providers can optimize operational efficiency and enhance service offerings. Furthermore, expanding into new market segments, such as fractional ownership models, can broaden market reach and attract a wider customer base.

Leading Players in the Business Jet Market in GCC Sector

- VistaJet

- Textron Inc

- Dassault Aviation SA

- Airbus SE

- DC Aviation Al-Futtaim

- Saudia Private Aviation (SPA)

- Royal Jet

- Falcon Aviation

- Embraer SA

- Bombardier Inc

- ExecuJet Aviation Group

- Gulfstream Aerospace Corporation

- Empire Aviation Group

- Qatar Executive

- The Boeing Company

Key Milestones in Business Jet Market in GCC Industry

- 2020: Introduction of stricter emission regulations across several GCC countries.

- 2022: Launch of several new business jet models by major manufacturers focusing on enhanced fuel efficiency.

- 2023: Several key M&A deals reshaped the competitive landscape, resulting in increased market consolidation.

Strategic Outlook for Business Jet Market in GCC Market

The GCC business jet market is poised for continued growth, driven by long-term economic expansion and increased demand for private air travel. Strategic partnerships, investments in advanced technologies, and expansion into new market segments represent key opportunities for market players. Focusing on sustainability and operational efficiency will be crucial for long-term success in this dynamic and competitive market. The focus on sustainability is expected to lead to a xx% increase in environmentally friendly aircraft within the next 10 years.

Business Jet Market in GCC Segmentation

-

1. Range

- 1.1. < 3,000 nm

- 1.2. 3,000 - 5,000 nm

- 1.3. > 5000 nm

-

2. Aircraft Type

- 2.1. Light Jet

- 2.2. Mid-size Jet

- 2.3. Large Jet

Business Jet Market in GCC Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Business Jet Market in GCC REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The >5000 Nm Segment Held the Largest Market Share in 2019

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Business Jet Market in GCC Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Range

- 5.1.1. < 3,000 nm

- 5.1.2. 3,000 - 5,000 nm

- 5.1.3. > 5000 nm

- 5.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.2.1. Light Jet

- 5.2.2. Mid-size Jet

- 5.2.3. Large Jet

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Range

- 6. North America Business Jet Market in GCC Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Range

- 6.1.1. < 3,000 nm

- 6.1.2. 3,000 - 5,000 nm

- 6.1.3. > 5000 nm

- 6.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.2.1. Light Jet

- 6.2.2. Mid-size Jet

- 6.2.3. Large Jet

- 6.1. Market Analysis, Insights and Forecast - by Range

- 7. South America Business Jet Market in GCC Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Range

- 7.1.1. < 3,000 nm

- 7.1.2. 3,000 - 5,000 nm

- 7.1.3. > 5000 nm

- 7.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.2.1. Light Jet

- 7.2.2. Mid-size Jet

- 7.2.3. Large Jet

- 7.1. Market Analysis, Insights and Forecast - by Range

- 8. Europe Business Jet Market in GCC Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Range

- 8.1.1. < 3,000 nm

- 8.1.2. 3,000 - 5,000 nm

- 8.1.3. > 5000 nm

- 8.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.2.1. Light Jet

- 8.2.2. Mid-size Jet

- 8.2.3. Large Jet

- 8.1. Market Analysis, Insights and Forecast - by Range

- 9. Middle East & Africa Business Jet Market in GCC Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Range

- 9.1.1. < 3,000 nm

- 9.1.2. 3,000 - 5,000 nm

- 9.1.3. > 5000 nm

- 9.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.2.1. Light Jet

- 9.2.2. Mid-size Jet

- 9.2.3. Large Jet

- 9.1. Market Analysis, Insights and Forecast - by Range

- 10. Asia Pacific Business Jet Market in GCC Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Range

- 10.1.1. < 3,000 nm

- 10.1.2. 3,000 - 5,000 nm

- 10.1.3. > 5000 nm

- 10.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.2.1. Light Jet

- 10.2.2. Mid-size Jet

- 10.2.3. Large Jet

- 10.1. Market Analysis, Insights and Forecast - by Range

- 11. Singapore Business Jet Market in GCC Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Indonesia Business Jet Market in GCC Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Thailand Business Jet Market in GCC Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Philippines Business Jet Market in GCC Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Vietnam Business Jet Market in GCC Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Rest of Southeast Asia Business Jet Market in GCC Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 VistaJe

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Textron Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Dassault Aviation SA

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Airbus SE

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 DC Aviation Al-Futtaim

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Saudia Private Aviation (SPA)

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Royal Jet

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Falcon Aviaton

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Embraer SA

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Bombardier Inc

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 ExecuJet Aviation Group

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Gulfstream Aerospace Corporation

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 Empire Aviation Group

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.14 Qatar Executive

- 17.2.14.1. Overview

- 17.2.14.2. Products

- 17.2.14.3. SWOT Analysis

- 17.2.14.4. Recent Developments

- 17.2.14.5. Financials (Based on Availability)

- 17.2.15 The Boeing Company

- 17.2.15.1. Overview

- 17.2.15.2. Products

- 17.2.15.3. SWOT Analysis

- 17.2.15.4. Recent Developments

- 17.2.15.5. Financials (Based on Availability)

- 17.2.1 VistaJe

List of Figures

- Figure 1: Global Business Jet Market in GCC Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Singapore Business Jet Market in GCC Revenue (Million), by Country 2024 & 2032

- Figure 3: Singapore Business Jet Market in GCC Revenue Share (%), by Country 2024 & 2032

- Figure 4: Indonesia Business Jet Market in GCC Revenue (Million), by Country 2024 & 2032

- Figure 5: Indonesia Business Jet Market in GCC Revenue Share (%), by Country 2024 & 2032

- Figure 6: Thailand Business Jet Market in GCC Revenue (Million), by Country 2024 & 2032

- Figure 7: Thailand Business Jet Market in GCC Revenue Share (%), by Country 2024 & 2032

- Figure 8: Philippines Business Jet Market in GCC Revenue (Million), by Country 2024 & 2032

- Figure 9: Philippines Business Jet Market in GCC Revenue Share (%), by Country 2024 & 2032

- Figure 10: Vietnam Business Jet Market in GCC Revenue (Million), by Country 2024 & 2032

- Figure 11: Vietnam Business Jet Market in GCC Revenue Share (%), by Country 2024 & 2032

- Figure 12: Rest of Southeast Asia Business Jet Market in GCC Revenue (Million), by Country 2024 & 2032

- Figure 13: Rest of Southeast Asia Business Jet Market in GCC Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Business Jet Market in GCC Revenue (Million), by Range 2024 & 2032

- Figure 15: North America Business Jet Market in GCC Revenue Share (%), by Range 2024 & 2032

- Figure 16: North America Business Jet Market in GCC Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 17: North America Business Jet Market in GCC Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 18: North America Business Jet Market in GCC Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Business Jet Market in GCC Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America Business Jet Market in GCC Revenue (Million), by Range 2024 & 2032

- Figure 21: South America Business Jet Market in GCC Revenue Share (%), by Range 2024 & 2032

- Figure 22: South America Business Jet Market in GCC Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 23: South America Business Jet Market in GCC Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 24: South America Business Jet Market in GCC Revenue (Million), by Country 2024 & 2032

- Figure 25: South America Business Jet Market in GCC Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Business Jet Market in GCC Revenue (Million), by Range 2024 & 2032

- Figure 27: Europe Business Jet Market in GCC Revenue Share (%), by Range 2024 & 2032

- Figure 28: Europe Business Jet Market in GCC Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 29: Europe Business Jet Market in GCC Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 30: Europe Business Jet Market in GCC Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Business Jet Market in GCC Revenue Share (%), by Country 2024 & 2032

- Figure 32: Middle East & Africa Business Jet Market in GCC Revenue (Million), by Range 2024 & 2032

- Figure 33: Middle East & Africa Business Jet Market in GCC Revenue Share (%), by Range 2024 & 2032

- Figure 34: Middle East & Africa Business Jet Market in GCC Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 35: Middle East & Africa Business Jet Market in GCC Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 36: Middle East & Africa Business Jet Market in GCC Revenue (Million), by Country 2024 & 2032

- Figure 37: Middle East & Africa Business Jet Market in GCC Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Pacific Business Jet Market in GCC Revenue (Million), by Range 2024 & 2032

- Figure 39: Asia Pacific Business Jet Market in GCC Revenue Share (%), by Range 2024 & 2032

- Figure 40: Asia Pacific Business Jet Market in GCC Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 41: Asia Pacific Business Jet Market in GCC Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 42: Asia Pacific Business Jet Market in GCC Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific Business Jet Market in GCC Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Business Jet Market in GCC Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Business Jet Market in GCC Revenue Million Forecast, by Range 2019 & 2032

- Table 3: Global Business Jet Market in GCC Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 4: Global Business Jet Market in GCC Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Business Jet Market in GCC Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Business Jet Market in GCC Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Business Jet Market in GCC Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Business Jet Market in GCC Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Business Jet Market in GCC Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Business Jet Market in GCC Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Business Jet Market in GCC Revenue Million Forecast, by Range 2019 & 2032

- Table 18: Global Business Jet Market in GCC Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 19: Global Business Jet Market in GCC Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Canada Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Business Jet Market in GCC Revenue Million Forecast, by Range 2019 & 2032

- Table 24: Global Business Jet Market in GCC Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 25: Global Business Jet Market in GCC Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Brazil Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Argentina Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of South America Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Business Jet Market in GCC Revenue Million Forecast, by Range 2019 & 2032

- Table 30: Global Business Jet Market in GCC Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 31: Global Business Jet Market in GCC Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United Kingdom Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Germany Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: France Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Italy Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Spain Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Russia Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Benelux Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Nordics Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Business Jet Market in GCC Revenue Million Forecast, by Range 2019 & 2032

- Table 42: Global Business Jet Market in GCC Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 43: Global Business Jet Market in GCC Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Turkey Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Israel Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: GCC Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: North Africa Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East & Africa Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Business Jet Market in GCC Revenue Million Forecast, by Range 2019 & 2032

- Table 51: Global Business Jet Market in GCC Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 52: Global Business Jet Market in GCC Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: India Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Japan Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Korea Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: ASEAN Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Oceania Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Asia Pacific Business Jet Market in GCC Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Business Jet Market in GCC?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Business Jet Market in GCC?

Key companies in the market include VistaJe, Textron Inc, Dassault Aviation SA, Airbus SE, DC Aviation Al-Futtaim, Saudia Private Aviation (SPA), Royal Jet, Falcon Aviaton, Embraer SA, Bombardier Inc, ExecuJet Aviation Group, Gulfstream Aerospace Corporation, Empire Aviation Group, Qatar Executive, The Boeing Company.

3. What are the main segments of the Business Jet Market in GCC?

The market segments include Range, Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The >5000 Nm Segment Held the Largest Market Share in 2019.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Business Jet Market in GCC," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Business Jet Market in GCC report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Business Jet Market in GCC?

To stay informed about further developments, trends, and reports in the Business Jet Market in GCC, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence