Key Insights

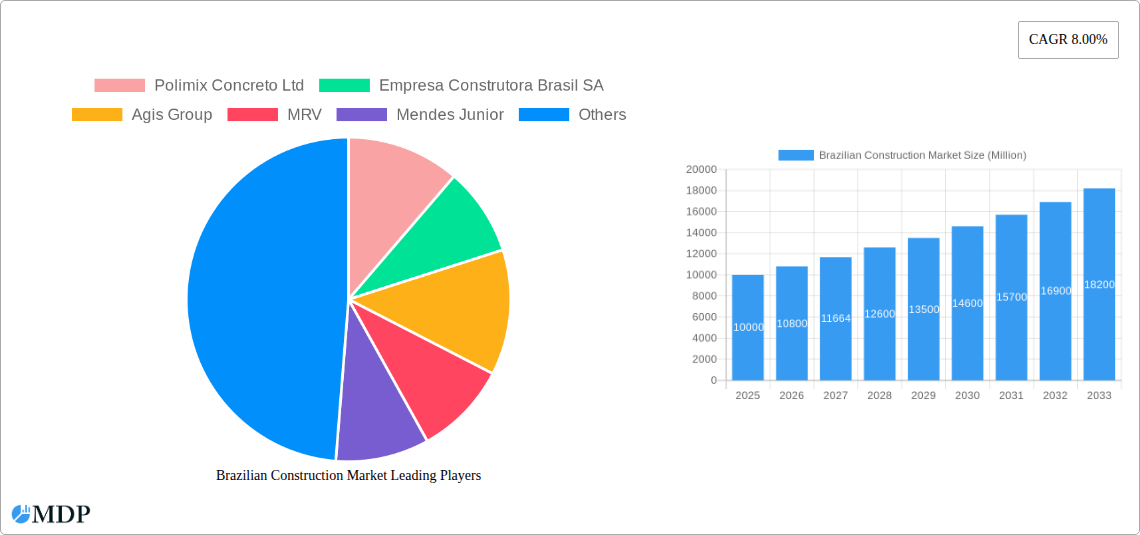

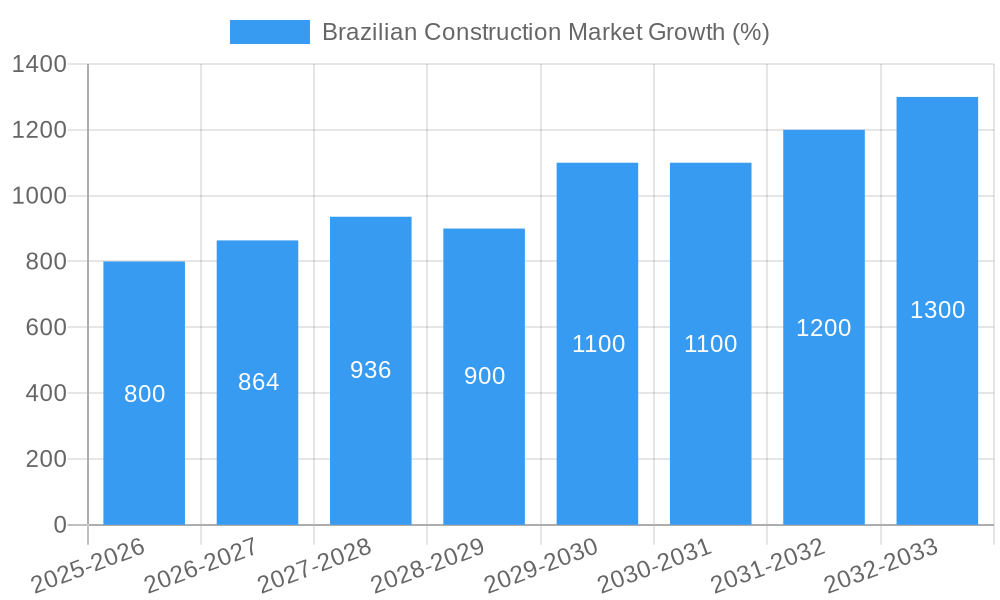

The Brazilian construction market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 8% from 2025 to 2033. This expansion is fueled by several key factors. Government investments in infrastructure projects, particularly in transportation networks, are significantly boosting demand. Furthermore, a growing population and rising urbanization are driving the need for new residential and commercial buildings. The energy and utility sector also contributes significantly, with ongoing investments in renewable energy sources and modernization of existing infrastructure. While challenges like economic volatility and material cost fluctuations exist, the long-term outlook remains positive, supported by continued government initiatives and a burgeoning middle class with increased purchasing power. Specific market segments, like infrastructure construction, are poised for particularly strong growth, outpacing other sectors due to the strategic focus on upgrading Brazil's national infrastructure. Competition within the market is intense, with both large multinational firms and local players vying for market share. Successful companies are those adapting to changing regulations, implementing sustainable practices, and effectively managing supply chains to navigate material cost pressures.

The segmentation of the Brazilian construction market reveals significant opportunities across various sectors. Commercial construction, fueled by burgeoning business activity and the need for modern office spaces and retail developments, remains a significant driver of growth. Similarly, the residential sector, especially in urban areas, experiences sustained demand. Industrial construction projects, linked to increased manufacturing activity, and energy & utility investments in renewable energy infrastructure, further diversify the market and ensure its resilience to potential downturns in any single segment. Key players like Polimix Concreto Ltd, Empresa Construtora Brasil SA, and Andrade Gutierrez Engenharia SA are likely to benefit from this positive outlook, but navigating the competitive landscape requires strategic investment and a keen awareness of both opportunities and challenges.

Brazilian Construction Market Report: 2019-2033

Unlocking Growth Opportunities in Brazil's Thriving Construction Sector

This comprehensive report provides a detailed analysis of the Brazilian construction market from 2019 to 2033, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. The report leverages extensive data analysis, covering market dynamics, key trends, leading players, and future growth projections. With a focus on actionable intelligence, this report is your essential guide to navigating the complexities and capitalizing on the immense potential of the Brazilian construction market.

Brazilian Construction Market Market Dynamics & Concentration

The Brazilian construction market, valued at xx Million in 2024, exhibits a moderately concentrated landscape, with several large players holding significant market share. Market concentration is influenced by factors including access to capital, project scale, and technological capabilities. Innovation is driven by the need to improve efficiency, sustainability, and safety standards. Regulatory frameworks, such as environmental regulations and building codes, significantly impact operations. Substitutes, such as prefabricated building components, are gaining traction. End-user preferences shift towards sustainable and technologically advanced solutions. The M&A landscape has been dynamic, with several major transactions shaping market dynamics.

- Market Share: Top 5 players hold approximately xx% of the market share (2024).

- M&A Deal Count: An estimated xx deals were recorded between 2019-2024.

- Key Regulatory Factors: Environmental legislation, building codes, and labor regulations.

- Innovation Drivers: Sustainability, digitalization (BIM adoption), and prefabrication.

Brazilian Construction Market Industry Trends & Analysis

The Brazilian construction market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million by 2033. Several factors drive this growth, including government infrastructure investments, increasing urbanization, and a growing middle class. Technological disruptions, such as Building Information Modeling (BIM) and the use of advanced construction materials, are transforming the industry. Consumer preferences are shifting towards sustainable, energy-efficient, and technologically advanced buildings. The competitive landscape remains intense, with companies competing on price, quality, and innovation. Market penetration of sustainable building practices is expected to increase from xx% in 2024 to xx% by 2033.

Leading Markets & Segments in Brazilian Construction Market

Residential construction dominates the Brazilian construction market, driven by robust population growth and government housing initiatives. Infrastructure (transportation) construction also holds significant potential, fueled by government investment in road networks, railways, and airports.

- Residential Construction: Key Drivers – Government housing programs, urbanization, growing middle class.

- Infrastructure (Transportation) Construction: Key Drivers – Government investments in transport infrastructure, expanding urban areas.

- Commercial Construction: Key Drivers – Growth in retail, office, and hospitality sectors.

- Industrial Construction: Key Drivers – Expansion of manufacturing and industrial activity.

- Energy and Utility Construction: Key Drivers – Investments in renewable energy projects and upgrading of energy infrastructure.

The Southeast region, encompassing major cities like São Paulo and Rio de Janeiro, remains the most dominant market due to high population density and economic activity.

Brazilian Construction Market Product Developments

The market is witnessing significant innovations in construction materials, technologies, and techniques. Prefabrication, modular construction, and the adoption of BIM are gaining prominence, improving efficiency and reducing construction times. Sustainable materials and green building technologies are increasing in popularity as consumers and regulators prioritize environmental sustainability. The emphasis on technological advancements improves the overall quality and reduces the project timeline significantly.

Key Drivers of Brazilian Construction Market Growth

Several factors contribute to the growth of the Brazilian construction market:

- Government Infrastructure Spending: Significant investments in transportation, energy, and sanitation.

- Urbanization and Population Growth: Driving demand for housing and commercial space.

- Economic Growth: Boosting construction activity across various sectors.

- Technological Advancements: Enhancing efficiency, productivity, and sustainability.

Challenges in the Brazilian Construction Market

The Brazilian construction market faces challenges such as:

- Regulatory Hurdles: Complex permitting processes and bureaucratic delays.

- Supply Chain Issues: Volatility in material prices and availability.

- Competitive Pressures: Intense competition amongst construction companies.

- Economic Volatility: Fluctuations in the Brazilian economy can impact construction activity.

Emerging Opportunities in Brazilian Construction Market

Long-term growth is spurred by:

- Sustainable Construction: Growing demand for environmentally friendly buildings.

- Technological Innovation: Adoption of advanced construction technologies and materials.

- Infrastructure Development: Government initiatives to modernize infrastructure.

- Strategic Partnerships: Collaboration between construction companies and technology providers.

Leading Players in the Brazilian Construction Market Sector

- Polimix Concreto Ltd

- Empresa Construtora Brasil SA

- Agis Group

- MRV

- Mendes Junior

- Teixeira Duarte

- Constran Internacional

- Andrade Gutierrez Engenharia SA

- ARG Group

- Construtora Oas SA

Key Milestones in Brazilian Construction Market Industry

- August 2022: CADE approves USD 1.025 billion sale of Holcim AG's cement division to CSN, signaling consolidation in the cement industry.

- July 2022: ArcelorMittal's proposed USD 2.2 billion acquisition of Companhia Siderúrgica do Pecém (CSP) awaits regulatory approval, potentially strengthening its steel market position.

Strategic Outlook for Brazilian Construction Market Market

The Brazilian construction market offers significant long-term growth potential. Strategic opportunities exist for companies that can adapt to technological advancements, embrace sustainability, and effectively navigate regulatory hurdles. The focus on infrastructure development and housing presents significant potential. The market's growth trajectory remains positive, with considerable opportunities for both established players and new entrants.

Brazilian Construction Market Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utility Construction

Brazilian Construction Market Segmentation By Geography

- 1. Brazil

Brazilian Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. Government Initiatives for Infrastructural Development

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazilian Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utility Construction

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Polimix Concreto Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Empresa Construtora Brasil SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Agis Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MRV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mendes Junior

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Teixeira Duarte

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Constran Internacional

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Andrade Gutierrez Engenharia SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ARG Group**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Construtora Oas SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Polimix Concreto Ltd

List of Figures

- Figure 1: Brazilian Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazilian Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Brazilian Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazilian Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Brazilian Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Brazilian Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Brazilian Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Brazilian Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazilian Construction Market?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Brazilian Construction Market?

Key companies in the market include Polimix Concreto Ltd, Empresa Construtora Brasil SA, Agis Group, MRV, Mendes Junior, Teixeira Duarte, Constran Internacional, Andrade Gutierrez Engenharia SA, ARG Group**List Not Exhaustive, Construtora Oas SA.

3. What are the main segments of the Brazilian Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits.

6. What are the notable trends driving market growth?

Government Initiatives for Infrastructural Development.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

August 2022: Brazilian antitrust watchdog CADE gave the go-ahead for the USD 1.025 billion transactions and cleared Holcim AG's local cement division to be sold to steelmaker Cia Siderurgica Nacional. Holcim, the largest cement manufacturer in the world with headquarters in Switzerland attempts to diversify away from its core industry, CSN initially announced the acquisition of LafargeHolcim Brasil in September 2021.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazilian Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazilian Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazilian Construction Market?

To stay informed about further developments, trends, and reports in the Brazilian Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence