Key Insights

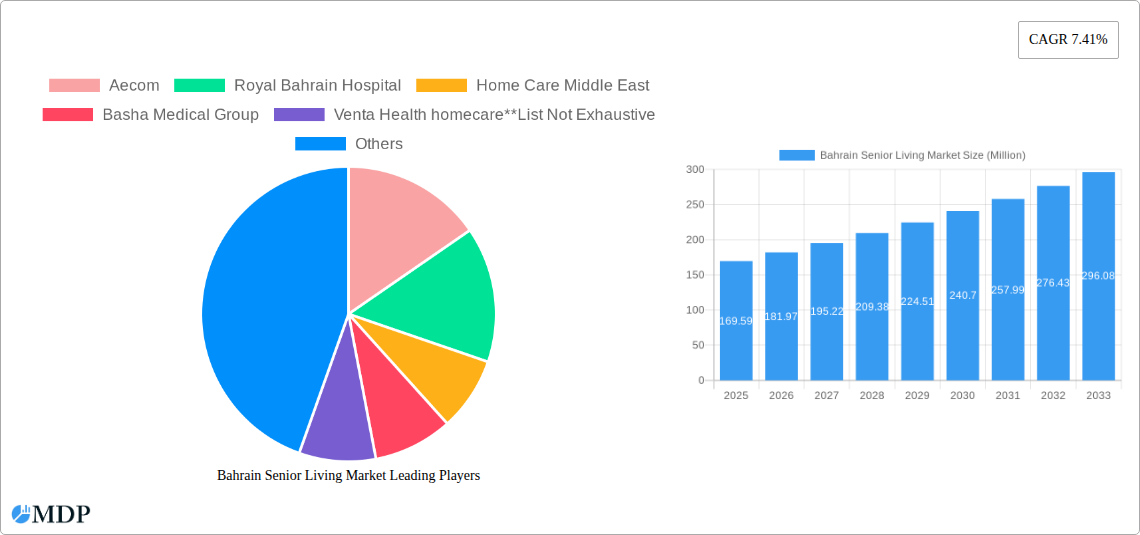

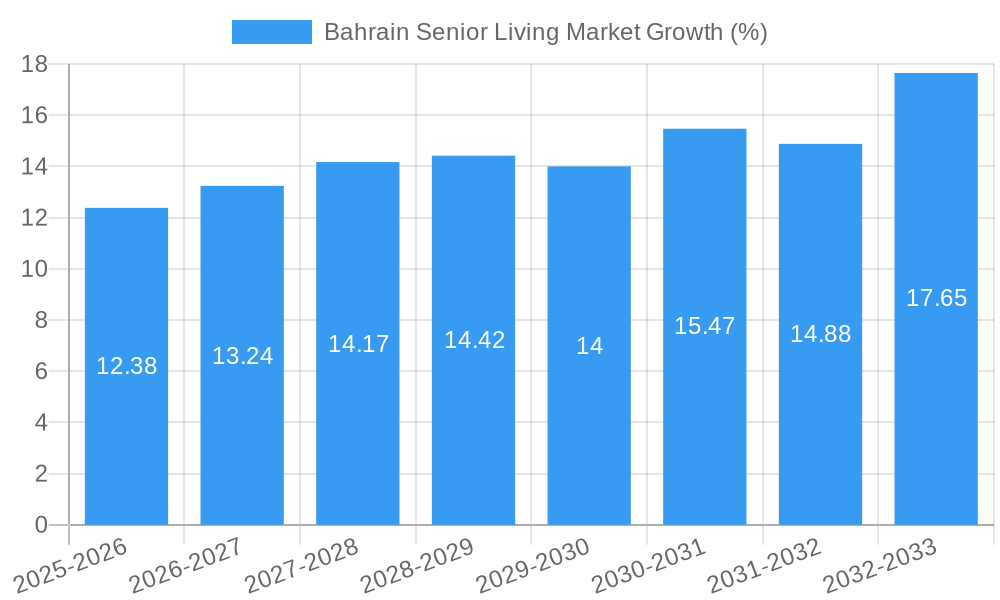

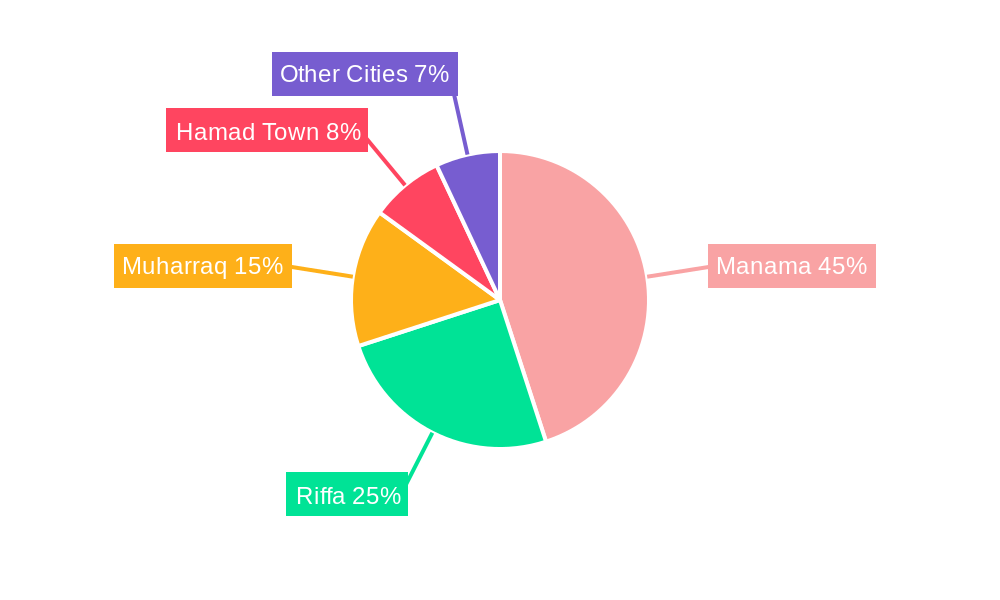

The Bahrain senior living market, valued at $169.59 million in 2025, is projected to experience robust growth, driven by several key factors. An aging population, increasing prevalence of chronic diseases requiring specialized care, and rising disposable incomes among Bahrain's older adults are fueling demand for senior living solutions. The preference for quality healthcare and assisted living services, coupled with a growing awareness of senior-specific care needs, is further stimulating market expansion. Significant investments in healthcare infrastructure and the entry of both established healthcare providers like Aecom and Royal Bahrain Hospital and specialized home healthcare companies like Home Care Middle East and KIMS Health at Home indicate a vibrant and competitive landscape. This growth is expected to continue throughout the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of 7.41%. Geographic segmentation reveals Manama as the leading market, followed by Riffa and Muharraq, reflecting population density and infrastructure development. While the market faces challenges, such as potential regulatory hurdles and the need for continuous investment in skilled workforce training, the overall outlook remains positive, indicating substantial growth opportunities for investors and providers.

The market's segmentation by city showcases variations in demand. Manama, as the capital and largest city, naturally dominates the market. Riffa and Muharraq, significant urban centers, also contribute substantially. However, growth potential exists in Hamad Town and other smaller cities as infrastructure improves and awareness of senior living options increases. The competitive landscape is diverse, including international players and local providers, creating both competition and opportunities for collaboration and innovation within the sector. The continued focus on improving the quality of care, offering diverse service packages catering to various needs and budgets, and strengthening partnerships with healthcare professionals will prove crucial for success in this expanding market. The long-term forecast suggests a sustained upward trajectory, driven by ongoing demographic shifts and increasing focus on elderly care.

Bahrain Senior Living Market Report: 2019-2033 Forecast

Unlocking Growth Opportunities in Bahrain's Expanding Senior Care Sector

This comprehensive report provides an in-depth analysis of the Bahrain senior living market, offering invaluable insights for investors, healthcare providers, and industry stakeholders. Covering the period 2019-2033, with a focus on 2025, this study unveils market dynamics, trends, and future prospects, enabling informed decision-making and strategic planning. The report projects a market valued at XX Million in 2025, poised for significant growth over the forecast period (2025-2033).

Bahrain Senior Living Market Market Dynamics & Concentration

The Bahrain senior living market exhibits a moderately concentrated landscape, with a handful of major players alongside numerous smaller providers. Market share is currently dominated by a few established players, including Aecom, Royal Bahrain Hospital, and Basha Medical Group, though this distribution is expected to evolve with increasing market penetration and the entry of new companies. Innovation is driven by technological advancements in assisted living technologies and telehealth services. Regulatory frameworks, while supportive, are undergoing revisions to accommodate the growing needs of the aging population. The market witnesses limited M&A activity, with an estimated XX deals in the historical period (2019-2024), pointing towards potential consolidation in the coming years. Product substitutes, primarily home-based care services, pose a competitive pressure, driving innovation in senior living facilities to offer superior value propositions. End-user trends indicate a growing preference for personalized care and community-based solutions.

Bahrain Senior Living Market Industry Trends & Analysis

The Bahrain senior living market is experiencing robust growth, projected at a CAGR of XX% during the forecast period (2025-2033). This expansion is fueled by several factors, including an aging population, rising disposable incomes, and increasing awareness of the benefits of specialized senior care. Technological disruptions, particularly the adoption of telehealth and remote monitoring solutions, are reshaping the delivery of care. Consumer preferences lean towards holistic, person-centered approaches that integrate medical care, social engagement, and recreational activities. The competitive landscape is dynamic, with both established players and new entrants vying for market share. Market penetration of specialized senior living facilities is expected to increase from XX% in 2025 to XX% by 2033.

Leading Markets & Segments in Bahrain Senior Living Market

Manama, the capital city, holds the largest market share within the Bahrain senior living sector, representing approximately XX% of the total market in 2025. This dominance is primarily driven by:

- Higher Population Density: Manama's concentrated population offers a larger potential customer base.

- Developed Infrastructure: Existing healthcare infrastructure and proximity to specialized medical facilities provide logistical advantages.

- Economic Activity: A higher concentration of high-income earners and a robust healthcare sector support the demand for high-quality senior living solutions.

Riffa and Muharraq follow Manama in market size, with Hamad Town and other cities representing smaller but growing segments. While Manama holds the leading position, growth in other regions is anticipated, particularly in Riffa, as infrastructure develops and awareness of senior living services increases.

Bahrain Senior Living Market Product Developments

Recent product innovations center around technology-driven solutions such as smart home technology, wearable health trackers, and telehealth platforms to enhance care delivery and resident safety. These developments cater to the increasing demand for personalized and convenient senior living options. Competitive advantages are increasingly built around the quality of care provided, the technological sophistication of facilities, and the creation of supportive and engaging community environments.

Key Drivers of Bahrain Senior Living Market Growth

Several factors are driving the expansion of the Bahrain senior living market:

- Aging Population: The growing number of elderly individuals necessitates an increase in senior care services.

- Rising Disposable Incomes: Increased economic prosperity allows for greater spending on healthcare and senior living options.

- Government Initiatives: Supportive policies and investments in healthcare infrastructure are facilitating market growth.

Challenges in the Bahrain Senior Living Market Market

The market faces several challenges, including:

- Regulatory Hurdles: Navigating regulatory approvals and licensing requirements can be complex and time-consuming.

- Labor Shortages: Attracting and retaining qualified healthcare professionals poses a significant challenge.

- Cost of Services: High operational costs and the need for specialized equipment can limit market accessibility for certain segments.

Emerging Opportunities in Bahrain Senior Living Market

Significant opportunities exist for market expansion through strategic partnerships between healthcare providers and technology companies. Furthermore, the development of specialized senior living facilities that cater to specific needs, such as dementia care or rehabilitation, offers promising avenues for growth. Increased government support for home-based care can also expand market potential.

Leading Players in the Bahrain Senior Living Market Sector

- Aecom

- Royal Bahrain Hospital

- Home Care Middle East

- Basha Medical Group

- Venta Health homecare

- Alsalama Healthcare

- Al-Hikma Society

- Home Health Care Centre

- KIMS Health at Home

- Intercol

Key Milestones in Bahrain Senior Living Market Industry

- November 2023: Increased focus on policy adjustments in response to the growing demand for senior living solutions driven by the expanding retiree population in Saudi Arabia. This signifies a potential influx of patients and a need for capacity expansion in Bahrain.

Strategic Outlook for Bahrain Senior Living Market Market

The Bahrain senior living market is poised for sustained growth, driven by demographic shifts, technological advancements, and government support. Strategic partnerships, investments in technology, and the development of specialized care services will be crucial for success. The market holds significant potential for both established players and new entrants seeking to capitalize on the growing demand for high-quality senior living solutions.

Bahrain Senior Living Market Segmentation

-

1. City

- 1.1. Manama

- 1.2. Riffa

- 1.3. Muharraq

- 1.4. Hamad Town

- 1.5. Other Cities

Bahrain Senior Living Market Segmentation By Geography

- 1. Bahrain

Bahrain Senior Living Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Growing cases of chronic disease among senior citizens

- 3.3. Market Restrains

- 3.3.1. High cost of elderly care services; Lack of skilled staff

- 3.4. Market Trends

- 3.4.1. Increase in Senior Population and Life Expectancy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bahrain Senior Living Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by City

- 5.1.1. Manama

- 5.1.2. Riffa

- 5.1.3. Muharraq

- 5.1.4. Hamad Town

- 5.1.5. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Bahrain

- 5.1. Market Analysis, Insights and Forecast - by City

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Aecom

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Royal Bahrain Hospital

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Home Care Middle East

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Basha Medical Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Venta Health homecare**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alsalama Healthcare

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Al-Hikma Society

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Home Health Care Centre

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 KIMS Health at Home

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Intercol

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aecom

List of Figures

- Figure 1: Bahrain Senior Living Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bahrain Senior Living Market Share (%) by Company 2024

List of Tables

- Table 1: Bahrain Senior Living Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bahrain Senior Living Market Revenue Million Forecast, by City 2019 & 2032

- Table 3: Bahrain Senior Living Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Bahrain Senior Living Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Bahrain Senior Living Market Revenue Million Forecast, by City 2019 & 2032

- Table 6: Bahrain Senior Living Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bahrain Senior Living Market?

The projected CAGR is approximately 7.41%.

2. Which companies are prominent players in the Bahrain Senior Living Market?

Key companies in the market include Aecom, Royal Bahrain Hospital, Home Care Middle East, Basha Medical Group, Venta Health homecare**List Not Exhaustive, Alsalama Healthcare, Al-Hikma Society, Home Health Care Centre, KIMS Health at Home, Intercol.

3. What are the main segments of the Bahrain Senior Living Market?

The market segments include City.

4. Can you provide details about the market size?

The market size is estimated to be USD 169.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Growing cases of chronic disease among senior citizens.

6. What are the notable trends driving market growth?

Increase in Senior Population and Life Expectancy.

7. Are there any restraints impacting market growth?

High cost of elderly care services; Lack of skilled staff.

8. Can you provide examples of recent developments in the market?

November 2023: As the number of Saudis entering retirement grows, demand for senior living solutions is expected to expand strongly in the coming decade, necessitating policy adjustments from both the healthcare sector and the government.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bahrain Senior Living Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bahrain Senior Living Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bahrain Senior Living Market?

To stay informed about further developments, trends, and reports in the Bahrain Senior Living Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence