Key Insights

The Asia-Pacific shared office space market is poised for significant expansion, driven by the widespread adoption of flexible work strategies, a thriving startup landscape, and multinational corporations' pursuit of efficient and adaptable workspace solutions. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.2%, indicating sustained demand for collaborative office environments. Key growth catalysts include the increasing requirement for team synergy, the imperative to minimize overhead expenses, and the agility to scale office footprints according to evolving business demands. Prominent sectors driving this demand include IT and ITES, followed by BFSI, legal services, and consulting. While large enterprises constitute a significant market share, Small and Medium-sized Enterprises (SMEs) are increasingly contributing to growth due to the cost-effectiveness and accessibility of shared office spaces. Market segmentation reveals a strong preference for managed and serviced offices, catering to a spectrum of users from independent professionals to large corporations. Urbanization and the proliferation of remote work, particularly in key economies such as China, India, and Japan, further bolster market expansion.

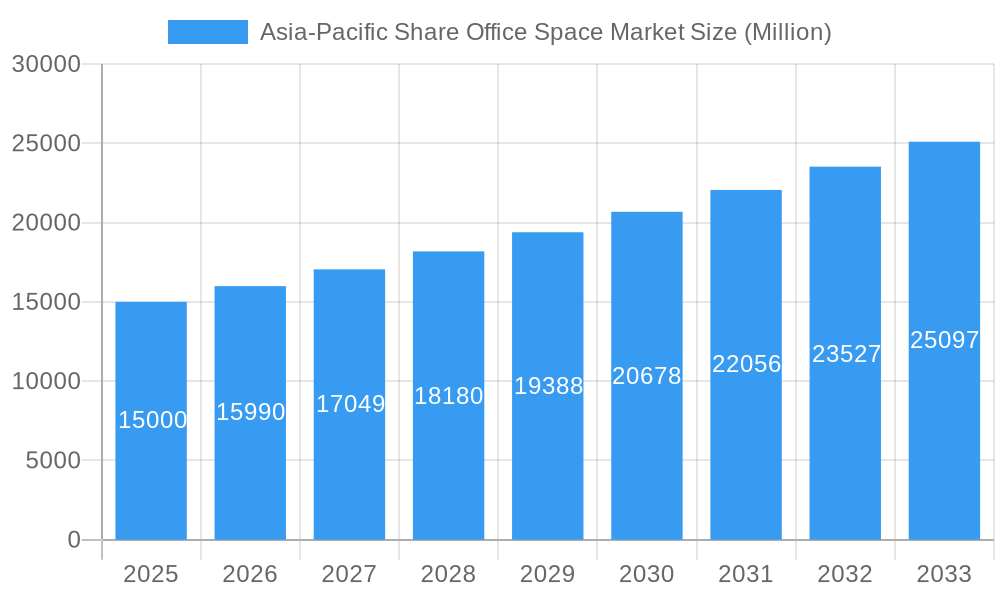

Asia-Pacific Share Office Space Market Market Size (In Million)

While the market trajectory is largely positive, potential headwinds include economic volatility, which may affect business expansion and influence demand for premium workspaces. Intense competition from both global leaders like IWG and WeWork, and prominent regional players, could impact pricing strategies and market positioning. Nevertheless, the overarching trend indicates continued growth, propelled by technological advancements, shifting workplace paradigms, and robust industrial expansion across the Asia-Pacific region. Ongoing innovation in service delivery, encompassing advanced amenities and technological integration, will be vital for providers to maintain competitive advantage in this dynamic sector. The market is forecasted to experience substantial growth over the coming years.

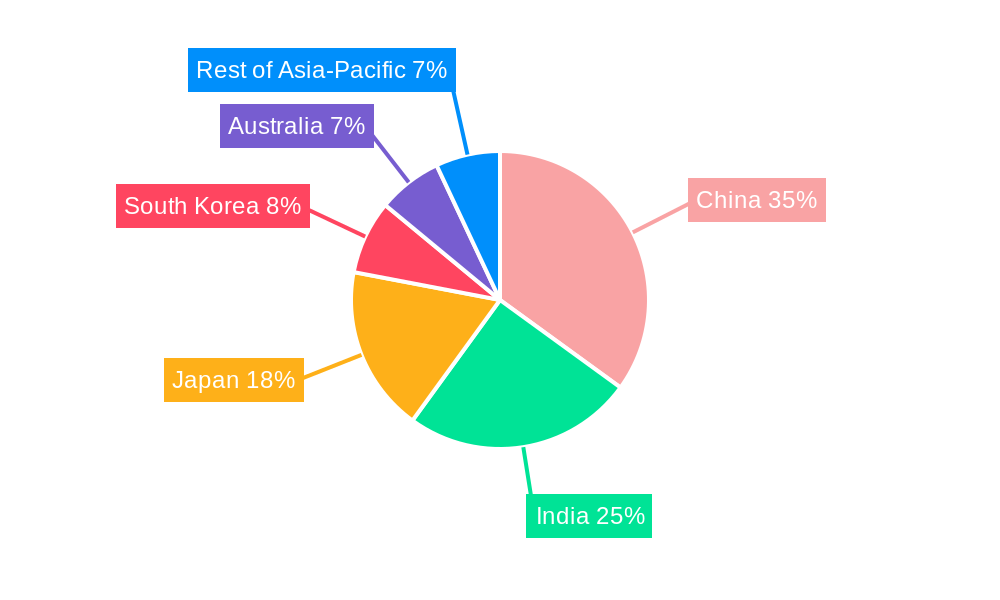

Asia-Pacific Share Office Space Market Company Market Share

The Asia-Pacific shared office space market size was valued at 3300.85 billion in the base year 2025.

Asia-Pacific Share Office Space Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific share office space market, offering invaluable insights for investors, industry stakeholders, and businesses seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils key trends, growth drivers, challenges, and opportunities shaping the future of flexible workspaces across the region. The report leverages extensive data analysis and industry expertise to provide actionable intelligence for informed decision-making.

Asia-Pacific Share Office Space Market Market Dynamics & Concentration

The Asia-Pacific share office space market is characterized by a complex interplay of factors influencing its growth and concentration. Market concentration is moderate, with several large players such as IWG, WeWork Management LLC, and Servcorp holding significant market share, but numerous smaller, localized operators also thriving. Innovation drives the market, with technological advancements in building management systems, booking platforms, and collaborative tools significantly enhancing the user experience. Regulatory frameworks vary across countries, influencing operational costs and market entry barriers. The rise of remote work and the increasing demand for flexible work arrangements are creating strong demand for alternatives to traditional office spaces, acting as a substantial substitute for traditional leases. End-user trends reveal a shift towards value-added services such as community building and networking opportunities, driving operator differentiation. M&A activity is relatively high, with several significant mergers and acquisitions occurring in recent years, indicative of market consolidation efforts. For example, the merger of The Hive, The Cluster, and Common Ground to form FlexiGroup illustrates this trend. The report includes a detailed analysis of market share distribution and the number of M&A deals within the historical and forecast periods, providing a granular understanding of market dynamics.

Asia-Pacific Share Office Space Market Industry Trends & Analysis

The Asia-Pacific share office space market is experiencing robust growth, driven by several key factors. The increasing adoption of flexible work models by businesses of all sizes is a primary driver. Technological advancements, such as improved communication tools and virtual collaboration platforms, have facilitated the transition to remote and hybrid work arrangements, fueling the demand for flexible office spaces. Consumer preferences are increasingly favoring convenient, cost-effective, and collaborative work environments, driving the market towards serviced and flexible office spaces. The market's competitive landscape is dynamic, with both established players and new entrants vying for market share, further stimulating innovation and diversification of offerings. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated to be xx%, reflecting the sustained market expansion. Market penetration in major cities across the region is also expected to increase significantly, driven by favourable economic conditions and supportive government policies in certain markets.

Leading Markets & Segments in Asia-Pacific Share Office Space Market

Within the Asia-Pacific region, several markets and segments demonstrate strong dominance. Specific countries, such as Singapore, Hong Kong, and Australia, are leading the way in terms of market size and growth rate, primarily due to well-developed infrastructure, strong economic performance, and a large base of multinational companies.

Key Drivers for Leading Markets:

- Singapore: Strong government support for innovation and a thriving tech sector.

- Hong Kong: Strategic location and established financial services industry.

- Australia: High concentration of multinational corporations and a robust economy.

Dominant Segments:

By Type: Serviced offices currently hold a larger market share than flexible managed offices, but the latter is growing rapidly, attracting businesses seeking greater customization and cost flexibility.

By Application: The Information Technology (IT and ITES) sector is a major driver, representing a substantial portion of demand due to its flexible workforce needs. The BFSI (Banking, Financial Services, and Insurance) sector also shows significant adoption due to its need for flexible workspace solutions for project-based teams and temporary staff.

By End-User: Small and medium-sized enterprises (SMEs) represent a substantial portion of the market, with large-scale companies increasingly adopting flexible workspace strategies for specific teams or projects.

The report delves into a detailed analysis of each segment, providing a comprehensive understanding of its growth trajectory, key players, and influencing factors.

Asia-Pacific Share Office Space Market Product Developments

Recent product developments in the Asia-Pacific share office space market are largely focused on enhancing the user experience and incorporating advanced technologies. This includes the integration of smart building management systems, improving workspace booking platforms, and incorporating more collaborative workspaces. The focus is on providing a holistic and technologically advanced ecosystem that caters to the diverse needs of modern businesses. Companies are also incorporating wellness features, sustainability initiatives, and community building programs to attract and retain customers. These innovations reflect the market's evolving preferences and the demand for higher quality, more flexible and technologically advanced workspace solutions.

Key Drivers of Asia-Pacific Share Office Space Market Growth

Several factors fuel the growth of the Asia-Pacific share office space market. The increasing adoption of flexible work models by businesses of all sizes, driven by technological advancements and changing work preferences, is a major driver. Strong economic growth in many parts of the region also increases demand. Supportive government policies, such as tax incentives and infrastructure development, facilitate the growth of flexible workspaces in certain markets. Lastly, the growing awareness of the environmental benefits of shared spaces and the increasing focus on sustainability are contributing factors.

Challenges in the Asia-Pacific Share Office Space Market Market

The Asia-Pacific share office space market faces several challenges. Varying regulatory frameworks across different countries create complexities in operations and compliance. Supply chain disruptions can impact the availability of building materials and equipment. Intense competition among numerous operators, both large and small, puts pressure on pricing and profitability. These factors can significantly impact operational costs and market entry barriers for new players.

Emerging Opportunities in Asia-Pacific Share Office Space Market

The Asia-Pacific share office space market presents several significant long-term growth opportunities. Technological advancements, particularly in areas like artificial intelligence and automation, are likely to further enhance workspace efficiency and productivity. Strategic partnerships between established players and innovative technology companies can unlock new markets and improve customer offerings. Market expansion into less-developed areas of the region holds substantial potential, given the growing need for flexible workspace solutions across various industries.

Leading Players in the Asia-Pacific Share Office Space Market Sector

- the Hive Worldwide Ltd

- Servcorp

- The Work Project Management Pte Ltd

- IWG

- Spaces

- WeWork Management LLC

- THE GREAT ROOM

- Compass Offices

- WOTSO Limited

- GARAGE SOCIETY

- JustCo

- The Executive Centre

List Not Exhaustive

Key Milestones in Asia-Pacific Share Office Space Market Industry

November 2022: FlexiGroup, formed through the merger of The Hive, The Cluster, and Common Ground, becomes the largest coworking space operator in the Asia-Pacific region with 45 locations across nine countries. This signifies significant market consolidation.

January 2023: Colony Coworking Space invests in 5X Capital, a major Malaysian coworking operator. This strategic move reflects the growing interest in expanding within the Malaysian market, driven by its considerable growth potential. Colony Coworking Space’s impressive 74% revenue increase and 265% EBITDA growth in 2022 highlights the financial viability of the sector and further strengthens its expansion strategy.

Strategic Outlook for Asia-Pacific Share Office Space Market Market

The future of the Asia-Pacific share office space market is bright. Continued economic growth, technological advancements, and evolving work preferences will drive sustained demand for flexible workspace solutions. Strategic partnerships, targeted market expansion, and product innovation will be crucial for success in this competitive landscape. The market’s potential for growth remains substantial, particularly in less developed areas of the region, and strategic players are well-positioned to capitalize on this potential.

Asia-Pacific Share Office Space Market Segmentation

-

1. Type

- 1.1. Flexible Managed Office

- 1.2. Serviced Office

-

2. Application

- 2.1. Information Technology (IT and ITES)

- 2.2. Legal Services

- 2.3. BFSI (Banking, Financial Services, and Insurance)

- 2.4. Consulting

- 2.5. Other Services

-

3. End-User

- 3.1. Personal User

- 3.2. Small Scale Company

- 3.3. Large Scale Company

- 3.4. Other End-Users

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. South Korea

- 4.5. Australia

- 4.6. Rest of Asia-Pacific

Asia-Pacific Share Office Space Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Australia

- 6. Rest of Asia Pacific

Asia-Pacific Share Office Space Market Regional Market Share

Geographic Coverage of Asia-Pacific Share Office Space Market

Asia-Pacific Share Office Space Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid urbanization driving the growth of the market4.; Increasing commerical buildings in philippines prefabricated buildings market

- 3.3. Market Restrains

- 3.3.1. 4.; Availability of skilled labor in the market4.; The quality of the material used in construction

- 3.4. Market Trends

- 3.4.1. Demand for Co-working Spaces from Start-ups is supporting the significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Share Office Space Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flexible Managed Office

- 5.1.2. Serviced Office

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Information Technology (IT and ITES)

- 5.2.2. Legal Services

- 5.2.3. BFSI (Banking, Financial Services, and Insurance)

- 5.2.4. Consulting

- 5.2.5. Other Services

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Personal User

- 5.3.2. Small Scale Company

- 5.3.3. Large Scale Company

- 5.3.4. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Australia

- 5.4.6. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. South Korea

- 5.5.5. Australia

- 5.5.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Share Office Space Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Flexible Managed Office

- 6.1.2. Serviced Office

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Information Technology (IT and ITES)

- 6.2.2. Legal Services

- 6.2.3. BFSI (Banking, Financial Services, and Insurance)

- 6.2.4. Consulting

- 6.2.5. Other Services

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Personal User

- 6.3.2. Small Scale Company

- 6.3.3. Large Scale Company

- 6.3.4. Other End-Users

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. South Korea

- 6.4.5. Australia

- 6.4.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia-Pacific Share Office Space Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Flexible Managed Office

- 7.1.2. Serviced Office

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Information Technology (IT and ITES)

- 7.2.2. Legal Services

- 7.2.3. BFSI (Banking, Financial Services, and Insurance)

- 7.2.4. Consulting

- 7.2.5. Other Services

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Personal User

- 7.3.2. Small Scale Company

- 7.3.3. Large Scale Company

- 7.3.4. Other End-Users

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. South Korea

- 7.4.5. Australia

- 7.4.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Share Office Space Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Flexible Managed Office

- 8.1.2. Serviced Office

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Information Technology (IT and ITES)

- 8.2.2. Legal Services

- 8.2.3. BFSI (Banking, Financial Services, and Insurance)

- 8.2.4. Consulting

- 8.2.5. Other Services

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Personal User

- 8.3.2. Small Scale Company

- 8.3.3. Large Scale Company

- 8.3.4. Other End-Users

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. South Korea

- 8.4.5. Australia

- 8.4.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Korea Asia-Pacific Share Office Space Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Flexible Managed Office

- 9.1.2. Serviced Office

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Information Technology (IT and ITES)

- 9.2.2. Legal Services

- 9.2.3. BFSI (Banking, Financial Services, and Insurance)

- 9.2.4. Consulting

- 9.2.5. Other Services

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Personal User

- 9.3.2. Small Scale Company

- 9.3.3. Large Scale Company

- 9.3.4. Other End-Users

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. South Korea

- 9.4.5. Australia

- 9.4.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Australia Asia-Pacific Share Office Space Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Flexible Managed Office

- 10.1.2. Serviced Office

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Information Technology (IT and ITES)

- 10.2.2. Legal Services

- 10.2.3. BFSI (Banking, Financial Services, and Insurance)

- 10.2.4. Consulting

- 10.2.5. Other Services

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Personal User

- 10.3.2. Small Scale Company

- 10.3.3. Large Scale Company

- 10.3.4. Other End-Users

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. India

- 10.4.3. Japan

- 10.4.4. South Korea

- 10.4.5. Australia

- 10.4.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Asia Pacific Asia-Pacific Share Office Space Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Flexible Managed Office

- 11.1.2. Serviced Office

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Information Technology (IT and ITES)

- 11.2.2. Legal Services

- 11.2.3. BFSI (Banking, Financial Services, and Insurance)

- 11.2.4. Consulting

- 11.2.5. Other Services

- 11.3. Market Analysis, Insights and Forecast - by End-User

- 11.3.1. Personal User

- 11.3.2. Small Scale Company

- 11.3.3. Large Scale Company

- 11.3.4. Other End-Users

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. China

- 11.4.2. India

- 11.4.3. Japan

- 11.4.4. South Korea

- 11.4.5. Australia

- 11.4.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 the Hive Worldwide Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Servcorp

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 The Work Project Management Pte Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 IWG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Spaces

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 WeWork Management LLC

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 THE GREAT ROOM

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Compass Offices

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 WOTSO Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 GARAGE SOCIETY

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 JustCo

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 The Executive Centre**List Not Exhaustive

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 the Hive Worldwide Ltd

List of Figures

- Figure 1: Asia-Pacific Share Office Space Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Share Office Space Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Share Office Space Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Asia-Pacific Share Office Space Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 9: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Application 2020 & 2033

- Table 13: Asia-Pacific Share Office Space Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 14: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Asia-Pacific Share Office Space Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 19: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Asia-Pacific Share Office Space Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 24: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Type 2020 & 2033

- Table 27: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Asia-Pacific Share Office Space Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 29: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Type 2020 & 2033

- Table 32: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Application 2020 & 2033

- Table 33: Asia-Pacific Share Office Space Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 34: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 35: Asia-Pacific Share Office Space Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Share Office Space Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Asia-Pacific Share Office Space Market?

Key companies in the market include the Hive Worldwide Ltd, Servcorp, The Work Project Management Pte Ltd, IWG, Spaces, WeWork Management LLC, THE GREAT ROOM, Compass Offices, WOTSO Limited, GARAGE SOCIETY, JustCo, The Executive Centre**List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Share Office Space Market?

The market segments include Type, Application, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3300.85 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid urbanization driving the growth of the market4.; Increasing commerical buildings in philippines prefabricated buildings market.

6. What are the notable trends driving market growth?

Demand for Co-working Spaces from Start-ups is supporting the significant Market Growth.

7. Are there any restraints impacting market growth?

4.; Availability of skilled labor in the market4.; The quality of the material used in construction.

8. Can you provide examples of recent developments in the market?

January 2023: Colony Coworking Space has invested in one of the biggest coworking operators in Malaysia, 5X Capital. Colony Coworking Space has a total space of 170,000 square feet in Kuala Lumpur and now runs 12 sites there under both its eponymous brand and its mass-market brand Jerry. Revenue for the group increased by 74% in 2022, while EBITDA reached an all-time high by growing by 265% annually. By funding 5X Capital, it hopes to take advantage of Malaysia's expanding flexible workspace market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Share Office Space Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Share Office Space Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Share Office Space Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Share Office Space Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence