Key Insights

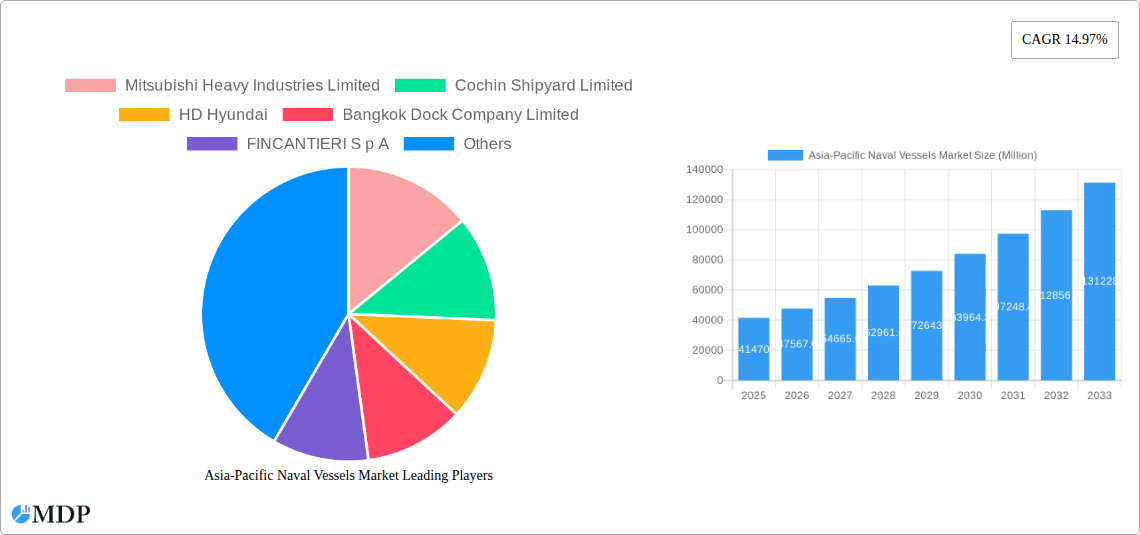

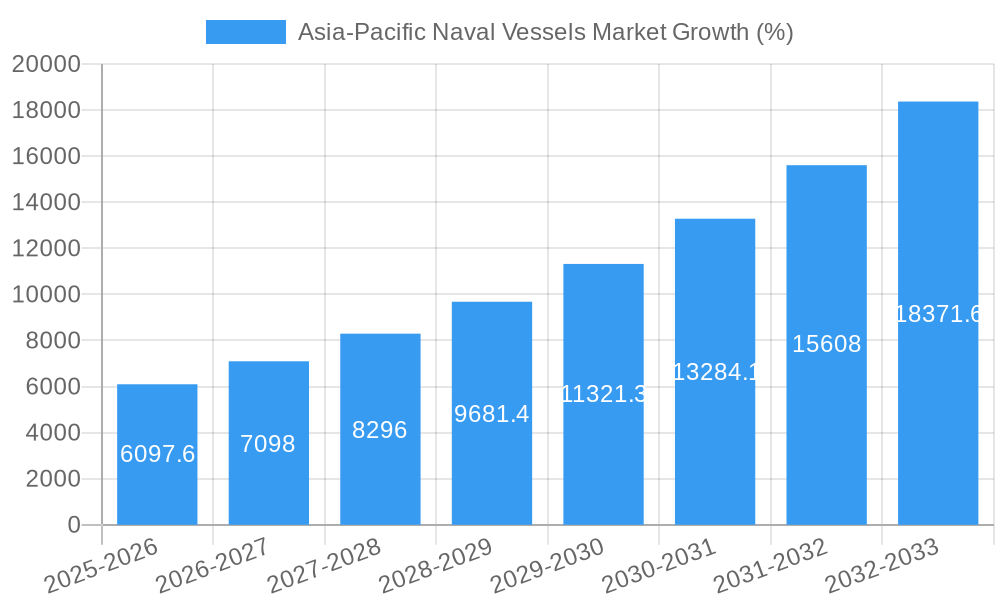

The Asia-Pacific Naval Vessels market is experiencing robust growth, projected to reach \$41.47 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 14.97% from 2025 to 2033. This expansion is driven by several key factors. Rising geopolitical tensions and the need for enhanced maritime security across the region are primary motivators for increased naval investment. Modernization of existing fleets and the development of new shipbuilding capabilities in countries like China, India, and South Korea further fuel this growth. Technological advancements in naval vessel design, including incorporating advanced sensor systems, improved weaponry, and autonomous capabilities, also contribute significantly to market expansion. The segment of larger vessels, including destroyers, frigates, and aircraft carriers, is expected to dominate the market share, reflecting a strategic emphasis on projecting naval power and enhancing regional influence. However, the market faces potential restraints such as fluctuations in government defense budgets and potential supply chain disruptions impacting the procurement of advanced components.

Competition in the Asia-Pacific Naval Vessels market is fierce, with a mix of established global players and regional shipbuilders vying for contracts. Companies like Mitsubishi Heavy Industries, HD Hyundai, and Fincantieri are major international contenders, while Cochin Shipyard, Mazagon Dock Shipbuilders, and others represent strong regional players. The market is characterized by strategic partnerships, joint ventures, and technological collaborations between these companies, aiming to secure a competitive edge. The focus is shifting towards building more sophisticated vessels with advanced technological capabilities. The continuous rise in demand for technologically advanced naval vessels will necessitate strategic investments in research and development to maintain competitiveness in this dynamic market. The increasing adoption of sustainable shipbuilding practices and environmentally friendly technologies will further shape the landscape in the coming years.

This in-depth report provides a comprehensive analysis of the Asia-Pacific Naval Vessels Market, covering market dynamics, industry trends, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers seeking to navigate this dynamic market. The market size in 2025 is estimated at xx Million and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Asia-Pacific Naval Vessels Market Market Dynamics & Concentration

The Asia-Pacific naval vessels market is characterized by a moderate level of concentration, with key players holding significant market share. Mitsubishi Heavy Industries Limited, HD Hyundai, and China State Shipbuilding Corporation, amongst others, dominate the landscape. However, the market is also witnessing increased participation from regional players, particularly in countries with growing naval modernization programs.

Market concentration is influenced by factors including:

- Technological Advancements: Continuous innovation in vessel design, propulsion systems, and weaponry drives competition and shapes market dynamics.

- Government Regulations & Policies: Stringent regulatory frameworks governing naval procurement and shipbuilding influence market access and growth.

- Geopolitical Factors: Regional tensions and evolving security concerns fuel demand for advanced naval vessels, impacting market size and growth trajectory.

- Mergers & Acquisitions (M&A): The market has seen a moderate number of M&A deals (xx in the last 5 years), primarily aimed at expanding capabilities and market reach. Major players are strategically acquiring smaller companies with specialized technologies or regional presence.

- Product Substitutes: The absence of significant substitutes for specialized naval vessels ensures strong market demand.

The market share distribution among the top 5 players is approximately xx%, reflecting a competitive yet concentrated market structure.

Asia-Pacific Naval Vessels Market Industry Trends & Analysis

The Asia-Pacific naval vessels market exhibits robust growth, driven by escalating geopolitical tensions, increasing defense budgets, and modernization of naval fleets across the region. Technological advancements, such as AI-powered systems, unmanned vehicles, and improved sensor technologies, are significantly shaping the market landscape. Consumer preferences are shifting toward more advanced, technologically sophisticated vessels with enhanced capabilities, leading to increased demand for sophisticated systems and integrated solutions. The market's growth is also fueled by government initiatives supporting domestic shipbuilding industries and the strategic partnerships between nations for joint naval projects.

The market penetration of advanced technologies, such as integrated combat management systems, is gradually increasing, with a xx% penetration rate as of 2024, projected to reach xx% by 2033.

Leading Markets & Segments in Asia-Pacific Naval Vessels Market

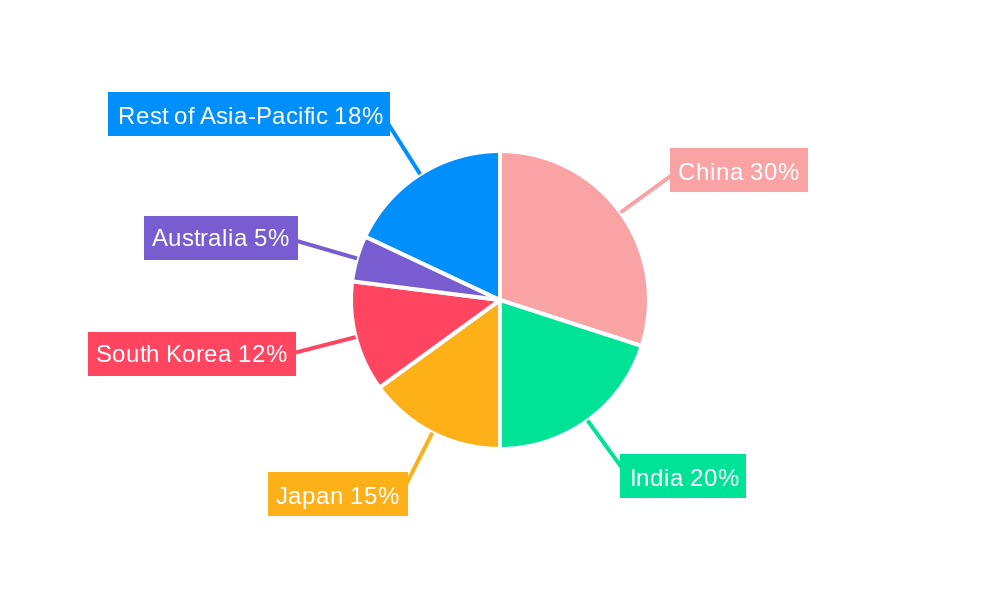

Within the Asia-Pacific region, several key markets exhibit substantial growth in naval vessel demand. India, China, and South Korea lead the market, driven by robust defense budgets and ambitious naval modernization plans.

- India: The "Make in India" initiative is a key growth driver, promoting indigenous shipbuilding and fostering technological self-reliance. The commissioning of INS Vikrant signifies this strategy's impact.

- China: Continuous expansion of its naval fleet, driven by its growing global influence and maritime ambitions, is a major factor in the country's significant market share.

- South Korea: Strong domestic shipbuilding capabilities and the export of its naval vessels contribute substantially to market growth.

The Frigates and Corvettes segments are currently dominant, fueled by the need for versatile and cost-effective naval vessels suitable for a range of operations. The Aircraft Carrier and Submarine segments, though smaller, are demonstrating significant growth, particularly in countries with ambitious naval expansion projects.

Asia-Pacific Naval Vessels Market Product Developments

Recent years have witnessed substantial product innovations, including the incorporation of advanced sensors, unmanned systems, and improved propulsion technologies. These enhancements enhance vessels' stealth capabilities, operational efficiency, and combat effectiveness. Companies are focusing on developing adaptable designs, enabling quicker integration of new technologies and improved lifecycle management. This ensures vessels remain technologically relevant and competitive.

Key Drivers of Asia-Pacific Naval Vessels Market Growth

Several factors propel the growth of the Asia-Pacific naval vessels market:

- Rising Geopolitical Tensions: Increased regional instability and territorial disputes drive demand for advanced naval capabilities.

- Modernization of Naval Fleets: Countries are modernizing their naval forces with advanced vessels and technologies.

- Increased Defense Spending: Growing defense budgets across the Asia-Pacific region provide funding for naval procurement programs.

- Technological Advancements: Innovations in shipbuilding and naval technologies continue to enhance vessel capabilities.

Challenges in the Asia-Pacific Naval Vessels Market Market

The market faces several challenges:

- High Procurement Costs: Advanced naval vessels are expensive, potentially limiting acquisitions for smaller nations.

- Complex Procurement Processes: Naval procurement often involves lengthy and complex processes, potentially delaying projects.

- Supply Chain Disruptions: Global supply chain issues can affect the timely delivery of components and materials.

- Intense Competition: The competitive landscape necessitates continuous innovation and cost optimization.

Emerging Opportunities in Asia-Pacific Naval Vessels Market

The Asia-Pacific naval vessels market offers significant long-term opportunities:

- Growth in Unmanned and Autonomous Systems: The integration of unmanned and autonomous technologies presents opportunities for innovation and cost reduction.

- Strategic Partnerships and Collaborations: Joint ventures and technology sharing agreements can enhance efficiency and innovation.

- Expansion into Emerging Markets: Southeast Asian countries present emerging opportunities for naval vessel procurement.

Leading Players in the Asia-Pacific Naval Vessels Market Sector

- Mitsubishi Heavy Industries Limited

- Cochin Shipyard Limited

- HD Hyundai

- Bangkok Dock Company Limited

- FINCANTIERI S p A

- Garden Reach Shipbuilders and Engineers Limited

- thyssenkrupp AG

- Singapore Technologies Engineering Limited

- ASC Pty Ltd

- Mazagon Dock Shipbuilders Limited

- LARSEN & TOUBRO LIMITED

- Navantia S A SM E

- China State Shipbuilding Corporation

- Boustead Heavy Industries Corporation Berhad

- Kawasaki Heavy Industries Ltd

- PT PAL Indonesia

Key Milestones in Asia-Pacific Naval Vessels Market Industry

- September 2022: India’s first indigenously built aircraft carrier, INS Vikrant, was commissioned into service under the Make in India initiative. This milestone showcased India's growing shipbuilding capabilities and boosted confidence in the domestic industry.

- April 2023: Hyundai Heavy Industries launched its Chungnam frigate (FFX) at its shipyard in Ulsan, South Korea. The launch marked a significant step in South Korea's naval modernization program, showcasing its advanced shipbuilding expertise.

Strategic Outlook for Asia-Pacific Naval Vessels Market Market

The Asia-Pacific naval vessels market is poised for sustained growth, driven by persistent geopolitical tensions, technological advancements, and ongoing naval modernization efforts. Strategic partnerships, investments in R&D, and the adoption of innovative technologies will play crucial roles in shaping future market dynamics. Companies that can adapt to evolving technological trends and address the challenges of cost-effective and efficient naval vessel construction are well-positioned to capitalize on the significant growth opportunities within this dynamic sector.

Asia-Pacific Naval Vessels Market Segmentation

-

1. Vessel Type

- 1.1. Submarines

- 1.2. Frigates

- 1.3. Corvettes

- 1.4. Aircraft Carrier

- 1.5. Destroyers

- 1.6. Other Vessel Types

-

2. Geography

-

2.1. Asia-Pacific

- 2.1.1. China

- 2.1.2. India

- 2.1.3. Japan

- 2.1.4. South Korea

- 2.1.5. Australia

- 2.1.6. Singapore

- 2.1.7. Rest of Asia-Pacific

-

2.1. Asia-Pacific

Asia-Pacific Naval Vessels Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia

- 1.6. Singapore

- 1.7. Rest of Asia Pacific

Asia-Pacific Naval Vessels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Destroyers to Exhibit the Highest Growth Rate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vessel Type

- 5.1.1. Submarines

- 5.1.2. Frigates

- 5.1.3. Corvettes

- 5.1.4. Aircraft Carrier

- 5.1.5. Destroyers

- 5.1.6. Other Vessel Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Asia-Pacific

- 5.2.1.1. China

- 5.2.1.2. India

- 5.2.1.3. Japan

- 5.2.1.4. South Korea

- 5.2.1.5. Australia

- 5.2.1.6. Singapore

- 5.2.1.7. Rest of Asia-Pacific

- 5.2.1. Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vessel Type

- 6. China Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Mitsubishi Heavy Industries Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Cochin Shipyard Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 HD Hyundai

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bangkok Dock Company Limited

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 FINCANTIERI S p A

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Garden Reach Shipbuilders and Engineers Limited

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 thyssenkrupp AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Singapore Technologies Engineering Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 ASC Pty Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Mazagon Dock Shipbuilders Limited

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 LARSEN & TOUBRO LIMITED

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Navantia S A SM E

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 China State Shipbuilding Corporation

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Boustead Heavy Industries Corporation Berhad

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Kawasaki Heavy Industries Ltd

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 PT PAL Indonesia

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.1 Mitsubishi Heavy Industries Limited

List of Figures

- Figure 1: Asia-Pacific Naval Vessels Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Naval Vessels Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 3: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 14: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Singapore Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Naval Vessels Market?

The projected CAGR is approximately 14.97%.

2. Which companies are prominent players in the Asia-Pacific Naval Vessels Market?

Key companies in the market include Mitsubishi Heavy Industries Limited, Cochin Shipyard Limited, HD Hyundai, Bangkok Dock Company Limited, FINCANTIERI S p A, Garden Reach Shipbuilders and Engineers Limited, thyssenkrupp AG, Singapore Technologies Engineering Limited, ASC Pty Ltd, Mazagon Dock Shipbuilders Limited, LARSEN & TOUBRO LIMITED, Navantia S A SM E, China State Shipbuilding Corporation, Boustead Heavy Industries Corporation Berhad, Kawasaki Heavy Industries Ltd, PT PAL Indonesia.

3. What are the main segments of the Asia-Pacific Naval Vessels Market?

The market segments include Vessel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.47 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Destroyers to Exhibit the Highest Growth Rate During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

April 2023: Hyundai Heavy Industries launched its Chungnam frigate (FFX) at its shipyard in Ulsan, South Korea. The Chungnam is the first of six vessels that comprise the Ulsan-class FFX Batch III, which will be inducted into the Republic of Korea (ROK) Navy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Naval Vessels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Naval Vessels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Naval Vessels Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Naval Vessels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence