Key Insights

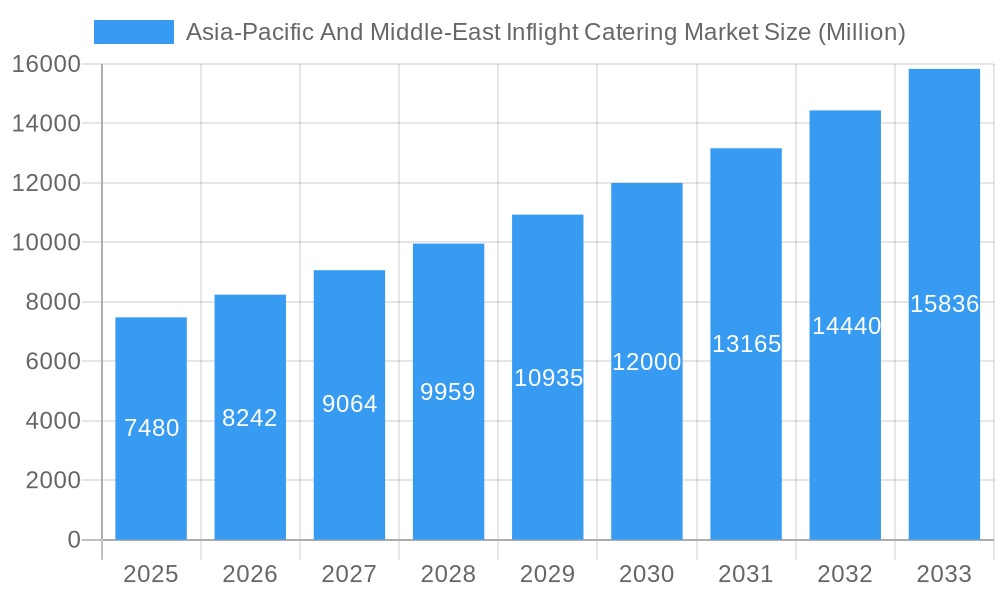

The Asia-Pacific and Middle-East inflight catering market, currently valued at $7.48 billion (2025), is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 10.05% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning air travel sector within the region, particularly the rise of low-cost carriers and increased passenger numbers, significantly boosts demand for in-flight meals and beverages. Growing disposable incomes, especially in emerging economies like India and China, are leading to increased spending on premium inflight services. Furthermore, evolving consumer preferences towards healthier and more diverse meal options are driving innovation within the industry, with caterers focusing on customizable menus and locally sourced ingredients. The increasing adoption of advanced technologies in food preparation and delivery, coupled with a focus on sustainability, also contribute to market growth. However, challenges exist, including fluctuating fuel prices impacting airline profitability and consequently, their inflight catering budgets, as well as stringent food safety regulations and supply chain complexities across diverse regions.

Asia-Pacific And Middle-East Inflight Catering Market Market Size (In Billion)

The market segmentation reveals significant opportunities across various categories. The full-service carriers segment currently dominates, reflecting the higher standards of inflight service they typically provide. However, the low-cost carrier segment exhibits high growth potential due to its increasing market share. Within food types, meals continue to hold the largest portion of the market, yet bakery and confectionery items show significant growth potential, driven by increasing passenger demand for convenient snacks and desserts. Geographic variations exist within the Asia-Pacific region. While China, Japan, and India represent substantial markets, the "Rest of Asia-Pacific" region also shows significant growth prospects, particularly as air travel expands across Southeast Asia. Key players like Ambassadors Sky Chef, Emirates Group, and others are strategically investing in technology, expanding their service offerings, and focusing on regional preferences to maintain a competitive edge in this dynamic marketplace. The forecast period of 2025-2033 promises substantial expansion, with the market expected to reach approximately $20 billion by 2033 based on a 10.05% CAGR.

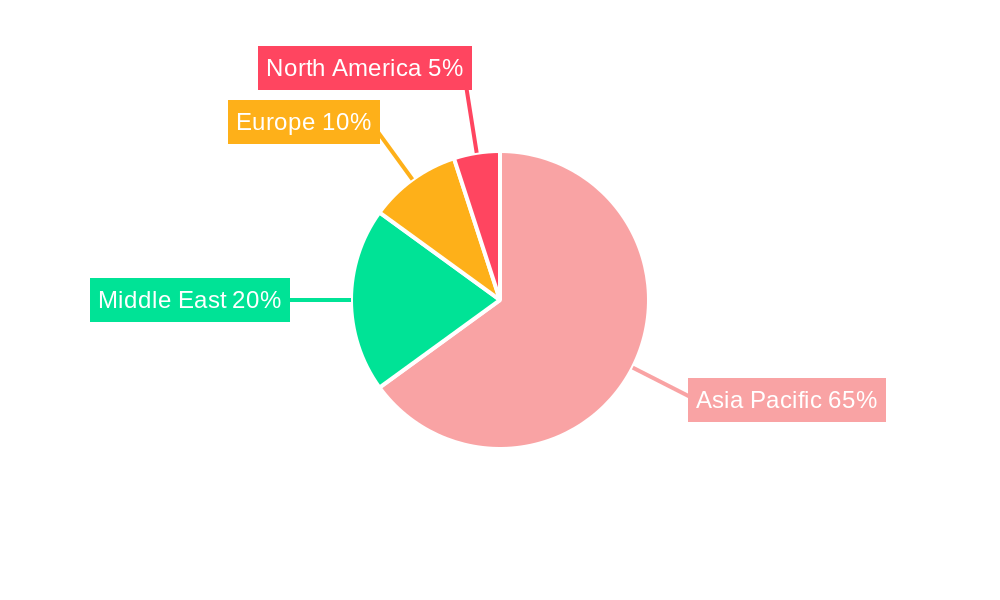

Asia-Pacific And Middle-East Inflight Catering Market Company Market Share

Asia-Pacific and Middle-East Inflight Catering Market Report: 2019-2033

Unlocking Growth in a Billion-Dollar Industry: This comprehensive report provides an in-depth analysis of the Asia-Pacific and Middle-East inflight catering market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. The report covers the period 2019-2033, with a focus on 2025, utilizing a robust methodology to forecast market trends and opportunities. From market size and segmentation analysis to competitive landscapes and future projections, this report is your essential guide to success in the inflight catering industry. Discover key growth drivers, emerging trends, and potential challenges, enabling informed decision-making and strategic planning.

Asia-Pacific And Middle-East Inflight Catering Market Market Dynamics & Concentration

The Asia-Pacific and Middle-East inflight catering market is characterized by a moderate level of concentration, with a handful of major players holding significant market share. The market size in 2025 is estimated at $XX Billion, expected to reach $YY Billion by 2033. Market share distribution amongst the top 5 players is approximately 60%, indicating the presence of smaller, regional players. Innovation is a crucial driver, with companies constantly seeking to enhance their offerings, improve efficiency, and cater to evolving consumer preferences. Stringent regulatory frameworks governing food safety and hygiene significantly impact operational costs and strategies. The market experiences limited substitution, with core offerings (meals, beverages) being difficult to replace. End-user trends, such as increasing demand for healthier and customized options, are reshaping the market. M&A activity is moderate, with approximately xx deals recorded over the past five years, primarily focused on expansion and consolidation.

- Market Concentration: Moderately concentrated, with top 5 players holding ~60% market share in 2025.

- Innovation Drivers: Demand for customized meals, sustainable practices, and technological advancements in food preparation and delivery.

- Regulatory Frameworks: Stringent food safety regulations influencing operational costs and strategies.

- Product Substitutes: Limited substitutes for core offerings (meals and beverages).

- End-User Trends: Growing preference for healthier, customized, and culturally diverse meal options.

- M&A Activity: Approximately xx deals over the past five years, driving consolidation and expansion.

Asia-Pacific And Middle-East Inflight Catering Market Industry Trends & Analysis

The Asia-Pacific and Middle-East inflight catering market is experiencing robust growth, driven by factors such as the burgeoning air travel industry, rising disposable incomes, and increasing demand for diverse and high-quality inflight meals. The compound annual growth rate (CAGR) from 2025 to 2033 is projected to be xx%, indicating significant market expansion. Technological advancements, such as advanced food preservation techniques and automated meal assembly systems, are improving efficiency and reducing costs. Consumer preferences are shifting towards healthier, customized, and ethnically diverse menu options, compelling caterers to adapt their offerings. Competitive dynamics are intense, with established players facing challenges from new entrants and regional competitors. Market penetration for premium inflight meal services is growing steadily, driven by the increasing number of business and first-class travelers.

Leading Markets & Segments in Asia-Pacific And Middle-East Inflight Catering Market

The Asia-Pacific region dominates the inflight catering market, with China, India, and Japan being key contributors. Within this, the Middle East exhibits strong growth due to its expanding aviation industry. Among segments, the "Meals" category holds the largest share due to its fundamental role in inflight service.

- Dominant Regions: Asia-Pacific (China, India, Japan leading), followed by the Middle East.

- Dominant Segments:

- Food Type: Meals (highest market share) followed by Beverages, Bakery and Confectionary, and Other Food Types.

- Flight Type: Full-service carriers dominate due to their higher meal offerings, followed by Hybrid and Other Flight Types, with Low-cost carriers having the smallest share.

- Aircraft Seating Class: Business and First Class segments show higher average revenue per meal compared to Economy Class.

Key Drivers:

- Economic Growth: Rising disposable incomes and increased air travel in Asia-Pacific and Middle East.

- Infrastructure Development: Expansion of airports and air routes.

- Tourism: Growth in tourism, boosting demand for air travel.

- Government Policies: Supportive aviation policies and regulations.

Asia-Pacific And Middle-East Inflight Catering Market Product Developments

Recent product innovations focus on enhancing sustainability (using eco-friendly packaging, reducing food waste), customization (offering tailored meal options), and technological integration (e.g., using AI for demand forecasting). Companies are leveraging technology to improve efficiency, traceability and to meet growing demand for healthier, more appealing and culturally sensitive meals that satisfy diverse preferences. These innovations are strengthening the competitive landscape by offering value-added services and tailored offerings to airlines and passengers.

Key Drivers of Asia-Pacific And Middle-East Inflight Catering Market Growth

The market's growth is fuelled by several factors, including the rising number of air passengers, especially in the Asia-Pacific region; increasing disposable incomes leading to higher demand for premium inflight services; and government initiatives promoting tourism and aviation infrastructure development. Technological advancements in food preservation and delivery systems also contribute significantly to improving efficiency and reducing operational costs. Furthermore, the growing trend of personalized and healthy meal options is driving innovation in the market.

Challenges in the Asia-Pacific And Middle-East Inflight Catering Market Market

The Asia-Pacific and Middle-East inflight catering market faces challenges such as stringent food safety regulations that impact operational costs and complexities; fluctuating fuel prices affecting airline profitability and consequently impacting catering budgets; and intense competition from both established players and new entrants, placing pressure on pricing and margins. Supply chain disruptions, particularly concerning ingredients sourcing and logistics, can also significantly impact operational efficiency and costs. These challenges contribute to a complex operating environment requiring robust adaptation and strategic planning.

Emerging Opportunities in Asia-Pacific And Middle-East Inflight Catering Market

Long-term growth hinges on capitalizing on opportunities such as expanding into emerging markets within the Asia-Pacific and Middle East regions; developing innovative meal solutions catering to specific dietary needs and preferences; and leveraging technology to enhance efficiency, traceability, and sustainability. Strategic partnerships with airlines and technology providers, and diversification of service offerings can further propel growth. Exploring the potential of personalized meal choices through data analytics and pre-flight orders represents an exciting avenue for innovation and customer engagement.

Leading Players in the Asia-Pacific And Middle-East Inflight Catering Market Sector

Key Milestones in Asia-Pacific And Middle-East Inflight Catering Market Industry

- August 2023: TajSATS Air Catering Limited opened a new kitchen at the newly inaugurated Manohar International Airport at Mopa in Goa, expanding its operational footprint and capacity.

- June 2023: Emirates Flight Catering signed its first deal with GMG to provide ready-to-go meals, signaling expansion into the rapidly growing ready-to-eat meal segment in the UAE, driven by changing demographics and urbanization.

Strategic Outlook for Asia-Pacific And Middle-East Inflight Catering Market Market

The Asia-Pacific and Middle-East inflight catering market holds immense potential for growth, driven by increasing air travel, rising disposable incomes, and evolving consumer preferences. Strategic opportunities lie in leveraging technology to enhance efficiency and sustainability, focusing on personalized and healthy meal options, and expanding into emerging markets within the region. Companies that successfully adapt to these trends and foster innovative solutions are poised to capture significant market share in the years to come.

Asia-Pacific And Middle-East Inflight Catering Market Segmentation

-

1. Food Type

- 1.1. Meals

- 1.2. Bakery and Confectionary

- 1.3. Beverages

- 1.4. Other Food Types

-

2. Flight Type

- 2.1. Full-service Carriers

- 2.2. Low-cost Carriers

- 2.3. Hybrid and Other Flight Types

-

3. Aircraft Seating Class

- 3.1. Economy Class

- 3.2. Business Class

- 3.3. First Class

-

4. Geography

-

4.1. Asia-Pacific

- 4.1.1. China

- 4.1.2. India

- 4.1.3. Japan

- 4.1.4. Australia

- 4.1.5. New Zealand

- 4.1.6. Indonesia

- 4.1.7. Thailand

- 4.1.8. Malaysia

- 4.1.9. Rest of Asia-Pacific

-

4.2. Middle-East

- 4.2.1. United Arab Emirates

- 4.2.2. Saudi Arabia

- 4.2.3. Qatar

- 4.2.4. Israel

- 4.2.5. Egypt

- 4.2.6. Oman

- 4.2.7. Rest of Middle-East

-

4.1. Asia-Pacific

Asia-Pacific And Middle-East Inflight Catering Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. Australia

- 1.5. New Zealand

- 1.6. Indonesia

- 1.7. Thailand

- 1.8. Malaysia

- 1.9. Rest of Asia Pacific

-

2. Middle East

- 2.1. United Arab Emirates

- 2.2. Saudi Arabia

- 2.3. Qatar

- 2.4. Israel

- 2.5. Egypt

- 2.6. Oman

- 2.7. Rest of Middle East

Asia-Pacific And Middle-East Inflight Catering Market Regional Market Share

Geographic Coverage of Asia-Pacific And Middle-East Inflight Catering Market

Asia-Pacific And Middle-East Inflight Catering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Full-service Carriers Segment is Anticipated to Show Significant Growth During the Forecasted Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific And Middle-East Inflight Catering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Food Type

- 5.1.1. Meals

- 5.1.2. Bakery and Confectionary

- 5.1.3. Beverages

- 5.1.4. Other Food Types

- 5.2. Market Analysis, Insights and Forecast - by Flight Type

- 5.2.1. Full-service Carriers

- 5.2.2. Low-cost Carriers

- 5.2.3. Hybrid and Other Flight Types

- 5.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 5.3.1. Economy Class

- 5.3.2. Business Class

- 5.3.3. First Class

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Asia-Pacific

- 5.4.1.1. China

- 5.4.1.2. India

- 5.4.1.3. Japan

- 5.4.1.4. Australia

- 5.4.1.5. New Zealand

- 5.4.1.6. Indonesia

- 5.4.1.7. Thailand

- 5.4.1.8. Malaysia

- 5.4.1.9. Rest of Asia-Pacific

- 5.4.2. Middle-East

- 5.4.2.1. United Arab Emirates

- 5.4.2.2. Saudi Arabia

- 5.4.2.3. Qatar

- 5.4.2.4. Israel

- 5.4.2.5. Egypt

- 5.4.2.6. Oman

- 5.4.2.7. Rest of Middle-East

- 5.4.1. Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.5.2. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Food Type

- 6. Asia Pacific Asia-Pacific And Middle-East Inflight Catering Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Food Type

- 6.1.1. Meals

- 6.1.2. Bakery and Confectionary

- 6.1.3. Beverages

- 6.1.4. Other Food Types

- 6.2. Market Analysis, Insights and Forecast - by Flight Type

- 6.2.1. Full-service Carriers

- 6.2.2. Low-cost Carriers

- 6.2.3. Hybrid and Other Flight Types

- 6.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 6.3.1. Economy Class

- 6.3.2. Business Class

- 6.3.3. First Class

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Asia-Pacific

- 6.4.1.1. China

- 6.4.1.2. India

- 6.4.1.3. Japan

- 6.4.1.4. Australia

- 6.4.1.5. New Zealand

- 6.4.1.6. Indonesia

- 6.4.1.7. Thailand

- 6.4.1.8. Malaysia

- 6.4.1.9. Rest of Asia-Pacific

- 6.4.2. Middle-East

- 6.4.2.1. United Arab Emirates

- 6.4.2.2. Saudi Arabia

- 6.4.2.3. Qatar

- 6.4.2.4. Israel

- 6.4.2.5. Egypt

- 6.4.2.6. Oman

- 6.4.2.7. Rest of Middle-East

- 6.4.1. Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Food Type

- 7. Middle East Asia-Pacific And Middle-East Inflight Catering Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Food Type

- 7.1.1. Meals

- 7.1.2. Bakery and Confectionary

- 7.1.3. Beverages

- 7.1.4. Other Food Types

- 7.2. Market Analysis, Insights and Forecast - by Flight Type

- 7.2.1. Full-service Carriers

- 7.2.2. Low-cost Carriers

- 7.2.3. Hybrid and Other Flight Types

- 7.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 7.3.1. Economy Class

- 7.3.2. Business Class

- 7.3.3. First Class

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Asia-Pacific

- 7.4.1.1. China

- 7.4.1.2. India

- 7.4.1.3. Japan

- 7.4.1.4. Australia

- 7.4.1.5. New Zealand

- 7.4.1.6. Indonesia

- 7.4.1.7. Thailand

- 7.4.1.8. Malaysia

- 7.4.1.9. Rest of Asia-Pacific

- 7.4.2. Middle-East

- 7.4.2.1. United Arab Emirates

- 7.4.2.2. Saudi Arabia

- 7.4.2.3. Qatar

- 7.4.2.4. Israel

- 7.4.2.5. Egypt

- 7.4.2.6. Oman

- 7.4.2.7. Rest of Middle-East

- 7.4.1. Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Food Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Ambassadors Sky Chef

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 The Emirates Group

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Newrest Group Services SAS

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 LSG Airline Catering & Retail GmbH

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Air China

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 SATS Ltd

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Aerofood ACS

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Gategroup

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Cathay Pacific Catering Services Ltd

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 JAL Royal Catering

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 Ambassadors Sky Chef

List of Figures

- Figure 1: Asia-Pacific And Middle-East Inflight Catering Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific And Middle-East Inflight Catering Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Food Type 2020 & 2033

- Table 2: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 3: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 4: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Food Type 2020 & 2033

- Table 7: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 8: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 9: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: China Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Japan Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Australia Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: New Zealand Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Indonesia Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Thailand Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Asia Pacific Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Food Type 2020 & 2033

- Table 21: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 22: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 23: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: United Arab Emirates Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Saudi Arabia Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Qatar Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Israel Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Egypt Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Oman Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific And Middle-East Inflight Catering Market?

The projected CAGR is approximately 10.05%.

2. Which companies are prominent players in the Asia-Pacific And Middle-East Inflight Catering Market?

Key companies in the market include Ambassadors Sky Chef, The Emirates Group, Newrest Group Services SAS, LSG Airline Catering & Retail GmbH, Air China, SATS Ltd, Aerofood ACS, Gategroup, Cathay Pacific Catering Services Ltd, JAL Royal Catering.

3. What are the main segments of the Asia-Pacific And Middle-East Inflight Catering Market?

The market segments include Food Type, Flight Type, Aircraft Seating Class, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.48 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Full-service Carriers Segment is Anticipated to Show Significant Growth During the Forecasted Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2023: TajSATS Air Catering Limited opened a new kitchen at the newly inaugurated Manohar International Airport at Mopa in Goa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific And Middle-East Inflight Catering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific And Middle-East Inflight Catering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific And Middle-East Inflight Catering Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific And Middle-East Inflight Catering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence