Key Insights

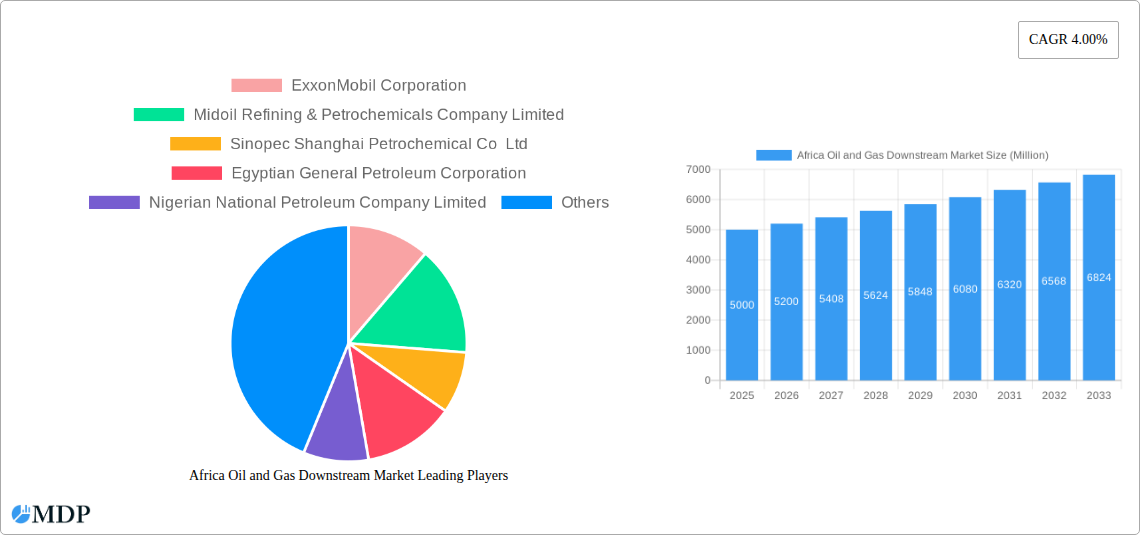

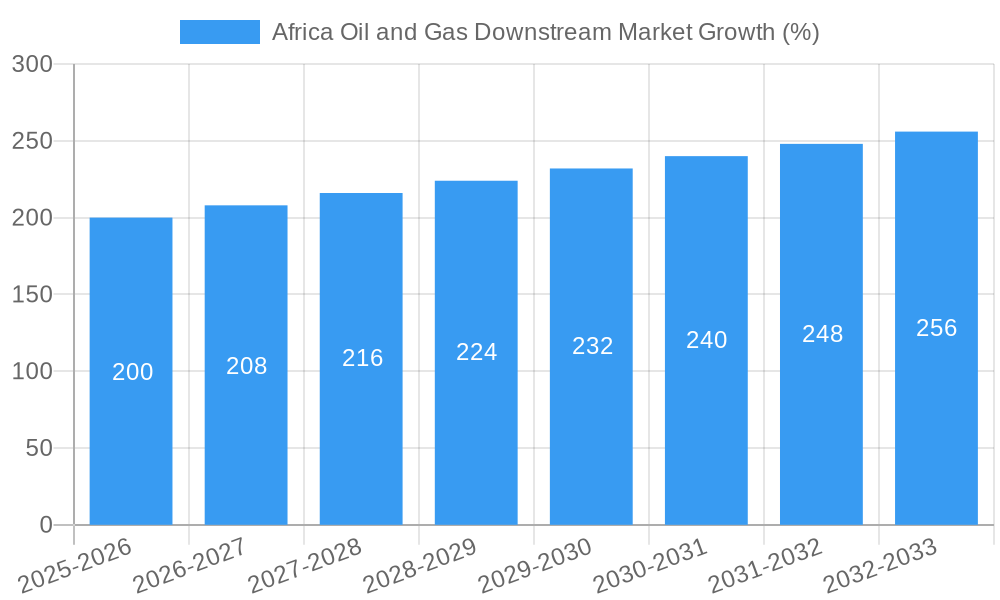

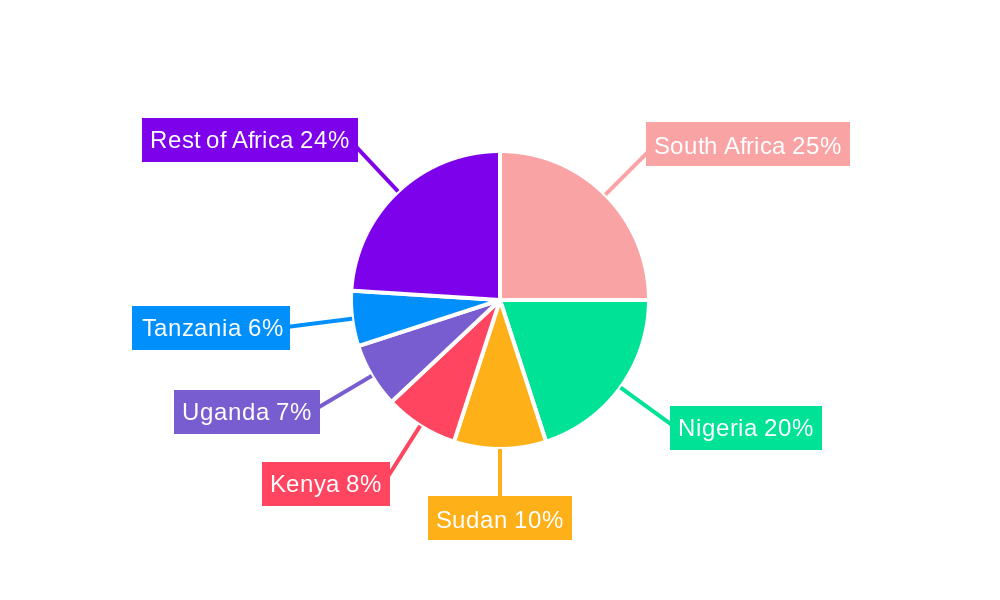

The African Oil and Gas Downstream Market, valued at approximately $XX million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.00% from 2025 to 2033. This growth is driven by several key factors. Firstly, the increasing urbanization and industrialization across the continent are fueling demand for refined petroleum products like gasoline, diesel, and jet fuel. Secondly, the expanding transportation sector, particularly in rapidly developing economies like Kenya and Tanzania, is a significant contributor to the market's expansion. Finally, the growing petrochemical industry, utilizing feedstock from refineries, further boosts market volume. However, market expansion faces challenges. These include infrastructure limitations in certain regions hindering efficient distribution networks, price volatility influenced by global oil market fluctuations, and environmental concerns pushing towards cleaner energy alternatives. The refinery sector plays a crucial role, with significant players such as ExxonMobil Corporation and Sinopec Shanghai Petrochemical Co Ltd operating across the region. The market is segmented by product (Gasoline, Diesel, Jet Fuel, LPG, Petrochemicals) and sector (Refinery, Petrochemical), offering diverse investment opportunities. South Africa, Sudan, Uganda, and Nigeria represent key markets, showcasing the regional disparities within the African downstream oil and gas landscape. Further growth hinges on effective policy frameworks promoting investment in refining capacity, infrastructure improvements, and diversifying the energy mix sustainably.

The forecast period of 2025-2033 presents a significant opportunity for industry players to capitalize on the expanding African market. While challenges exist, the long-term growth prospects remain positive. The development of local refining capacity and strategic partnerships between international and national companies will be vital in navigating the market's complexities and ensuring sustainable growth. Focus on technological advancements for efficiency and cleaner energy solutions will also play a critical role in shaping the future of the African Oil and Gas Downstream Market. Understanding regional dynamics and adapting to evolving regulatory environments will be crucial for success in this dynamic sector. The market's resilience and potential for growth will depend upon addressing infrastructure gaps and embracing sustainable practices while meeting the rising energy demands of a growing population.

Africa Oil & Gas Downstream Market Report: 2019-2033

Unlocking Growth in Africa's Thriving Energy Sector: A Comprehensive Market Analysis

This comprehensive report provides an in-depth analysis of the Africa Oil & Gas Downstream Market, covering the period from 2019 to 2033. With a focus on key segments like Refinery and Petrochemical sectors, and products including Gasoline, Diesel, Jet Fuel, LPG, and Petrochemicals, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. Expect detailed analysis on market dynamics, leading players, emerging opportunities, and key challenges impacting this rapidly evolving market. Discover crucial information on market concentration, industry trends, leading markets and segments, product developments, and growth drivers, all presented with clear metrics and actionable insights. The report also details key milestones and offers a strategic outlook for future growth, enabling informed decision-making in this lucrative sector.

Africa Oil and Gas Downstream Market Market Dynamics & Concentration

The Africa Oil & Gas Downstream market is characterized by a complex interplay of factors influencing its dynamics and concentration. Market concentration is currently moderate, with a few major players holding significant shares, but a fragmented landscape of smaller regional players also exists. Innovation is driven by the need to improve efficiency, enhance product quality, and meet evolving environmental regulations. Regulatory frameworks vary across African nations, impacting investment and operations. Product substitutes, such as biofuels and renewable energy sources, are gaining traction, posing both challenges and opportunities. End-user trends reflect a growing demand for refined petroleum products driven by increasing urbanization and industrialization. M&A activity has been relatively modest, but strategic partnerships are increasingly prevalent, as companies seek to expand their market reach and access resources.

- Market Share: The top 5 players account for approximately xx% of the market share in 2025, with ExxonMobil, Midoil, and Sinopec holding the largest individual shares.

- M&A Deal Count: An estimated xx M&A deals occurred between 2019 and 2024, with a predicted increase in the forecast period.

Africa Oil and Gas Downstream Market Industry Trends & Analysis

The Africa Oil & Gas Downstream market is experiencing robust growth, fueled by several key factors. The rising population and expanding middle class are driving increased demand for refined petroleum products. Rapid urbanization and industrialization across the continent necessitate increased energy consumption, boosting market growth. Technological advancements, particularly in refining processes and petrochemical production, are enhancing efficiency and improving product quality. However, consumer preferences are shifting towards cleaner fuels and greater environmental consciousness, necessitating adaptation and innovation. Competitive dynamics are intense, with both local and international players vying for market share. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

Leading Markets & Segments in Africa Oil and Gas Downstream Market

The leading markets and segments within the African Oil & Gas Downstream sector are dynamically evolving. While several countries show promising growth, Nigeria and South Africa currently represent significant market share due to their large populations, established infrastructure, and relatively advanced economies. The Refinery sector is the most dominant segment due to the continued reliance on conventional fuels, while the Petrochemical sector is experiencing rapid expansion driven by industrial growth. Gasoline, Diesel, and LPG are currently the leading products due to their broad applications.

Key Drivers:

- Nigeria: Large population, existing refinery infrastructure, and ongoing investments in new refinery capacity.

- South Africa: Established economy, advanced infrastructure, and government plans to build mega refineries.

- Refinery Sector: High demand for refined fuels, driven by increasing vehicle ownership and industrial activities.

- Petrochemical Sector: Growing demand from various industries, including plastics, fertilizers, and packaging.

- Gasoline and Diesel: Essential for transportation, driving significant demand across the continent.

The dominance of these markets and segments is expected to persist, but with notable shifts in market share anticipated due to new capacity additions and evolving consumer behaviors.

Africa Oil and Gas Downstream Market Product Developments

The African Oil & Gas Downstream market is witnessing significant product developments, focused on enhancing efficiency, reducing emissions, and improving quality. Innovations in refining technologies aim to maximize yield and minimize environmental impact. The increasing adoption of cleaner fuels, such as low-sulfur diesel and gasoline, is driven by stringent environmental regulations and growing environmental awareness. The development of new petrochemical products is catering to the growing demand from various industrial applications. Technological trends towards automation and digitalization are improving operational efficiency and safety. The market fit of these new products is largely dependent on factors like affordability, accessibility, and compliance with regulatory requirements.

Key Drivers of Africa Oil and Gas Downstream Market Growth

Several factors are driving the growth of the African Oil & Gas Downstream market. Economic growth across the continent fuels rising energy demand, particularly in rapidly urbanizing areas. Government initiatives promoting infrastructural development, including pipelines and storage facilities, facilitate efficient product distribution. Technological advancements lead to increased refining capacity and the development of higher-value products. Supportive regulatory frameworks that encourage private sector investment further stimulate market growth. The ongoing construction of the Dangote refinery in Nigeria, the largest in Africa, is a major catalyst for growth.

Challenges in the Africa Oil and Gas Downstream Market Market

The African Oil & Gas Downstream market faces significant challenges. Inadequate infrastructure, particularly in distribution and storage, hampers efficient delivery of products and increases transportation costs. Regulatory hurdles and inconsistent policy frameworks create uncertainty for investors. Supply chain vulnerabilities and geopolitical risks can disrupt product availability and pricing. Intense competition from international and regional players puts pressure on profit margins. These challenges can collectively reduce market penetration by an estimated xx% by 2033 without adequate solutions.

Emerging Opportunities in Africa Oil and Gas Downstream Market

Significant opportunities exist within the African Oil & Gas Downstream market. The growing demand for refined products presents a vast market potential for expansion. Strategic partnerships between international and local players can leverage expertise and resources to accelerate development. Technological breakthroughs, such as advancements in biofuel production and renewable energy integration, can drive diversification and sustainability within the sector. Expanding into underserved markets and adopting innovative distribution models can unlock new growth avenues.

Leading Players in the Africa Oil and Gas Downstream Market Sector

- ExxonMobil Corporation

- Midoil Refining & Petrochemicals Company Limited

- Sinopec Shanghai Petrochemical Co Ltd

- Egyptian General Petroleum Corporation

- Nigerian National Petroleum Company Limited

Key Milestones in Africa Oil and Gas Downstream Market Industry

- October 2022: The Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) announced that the Dangote Refinery project is 97% completed. This signifies a significant boost to Africa's refining capacity.

- March 2022: South Africa's Parliament recommended the construction of a mega fuel refinery. This highlights the strategic importance placed on energy security.

Strategic Outlook for Africa Oil and Gas Downstream Market Market

The Africa Oil & Gas Downstream market presents significant long-term growth potential. Continued population growth, urbanization, and industrialization will drive increased energy demand. Strategic investments in infrastructure development, technological innovation, and sustainable practices will be crucial for unlocking this potential. The growing emphasis on energy security and diversification will shape future market dynamics. The successful completion and operation of mega-refineries will significantly alter the market landscape.

Africa Oil and Gas Downstream Market Segmentation

-

1. Sector

- 1.1. Refinery Sector

- 1.2. Petrochemical Sector

-

2. Geography

- 2.1. Nigeria

- 2.2. Egypt

- 2.3. South Africa

- 2.4. Others

Africa Oil and Gas Downstream Market Segmentation By Geography

- 1. Nigeria

- 2. Egypt

- 3. South Africa

- 4. Others

Africa Oil and Gas Downstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Favorable Government Initiatives4.; Increasing Adoption of Solar Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Adoption of Alternative Clean Energy

- 3.4. Market Trends

- 3.4.1. Refining Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Refinery Sector

- 5.1.2. Petrochemical Sector

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Nigeria

- 5.2.2. Egypt

- 5.2.3. South Africa

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Nigeria

- 5.3.2. Egypt

- 5.3.3. South Africa

- 5.3.4. Others

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Nigeria Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Refinery Sector

- 6.1.2. Petrochemical Sector

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Nigeria

- 6.2.2. Egypt

- 6.2.3. South Africa

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. Egypt Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Refinery Sector

- 7.1.2. Petrochemical Sector

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Nigeria

- 7.2.2. Egypt

- 7.2.3. South Africa

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. South Africa Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Refinery Sector

- 8.1.2. Petrochemical Sector

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Nigeria

- 8.2.2. Egypt

- 8.2.3. South Africa

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Others Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Refinery Sector

- 9.1.2. Petrochemical Sector

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Nigeria

- 9.2.2. Egypt

- 9.2.3. South Africa

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. South Africa Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 11. Sudan Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 12. Uganda Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 14. Kenya Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 ExxonMobil Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Midoil Refining & Petrochemicals Company Limited

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Sinopec Shanghai Petrochemical Co Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Egyptian General Petroleum Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Nigerian National Petroleum Company Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.1 ExxonMobil Corporation

List of Figures

- Figure 1: Africa Oil and Gas Downstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Oil and Gas Downstream Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 4: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Sector 2019 & 2032

- Table 5: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 7: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: South Africa Africa Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa Africa Oil and Gas Downstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Sudan Africa Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sudan Africa Oil and Gas Downstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Uganda Africa Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Uganda Africa Oil and Gas Downstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Tanzania Africa Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Tanzania Africa Oil and Gas Downstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Kenya Africa Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya Africa Oil and Gas Downstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Rest of Africa Africa Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Africa Africa Oil and Gas Downstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 24: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Sector 2019 & 2032

- Table 25: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 27: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 29: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 30: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Sector 2019 & 2032

- Table 31: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 33: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 35: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 36: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Sector 2019 & 2032

- Table 37: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 39: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 41: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 42: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Sector 2019 & 2032

- Table 43: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 44: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 45: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Oil and Gas Downstream Market?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Africa Oil and Gas Downstream Market?

Key companies in the market include ExxonMobil Corporation, Midoil Refining & Petrochemicals Company Limited, Sinopec Shanghai Petrochemical Co Ltd, Egyptian General Petroleum Corporation, Nigerian National Petroleum Company Limited.

3. What are the main segments of the Africa Oil and Gas Downstream Market?

The market segments include Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Favorable Government Initiatives4.; Increasing Adoption of Solar Energy.

6. What are the notable trends driving market growth?

Refining Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Adoption of Alternative Clean Energy.

8. Can you provide examples of recent developments in the market?

In October 2022, The Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) announced that the Dangote Refinery project is 97% completed. Dangote Oil Refinery is a 650,000 barrels per day (BPD) integrated refinery project under construction in the Lekki Free Trade Zone, Lagos. It is expected to be Africa's biggest oil refinery and the world's most extensive single-train facility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Oil and Gas Downstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Oil and Gas Downstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Oil and Gas Downstream Market?

To stay informed about further developments, trends, and reports in the Africa Oil and Gas Downstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence