Key Insights

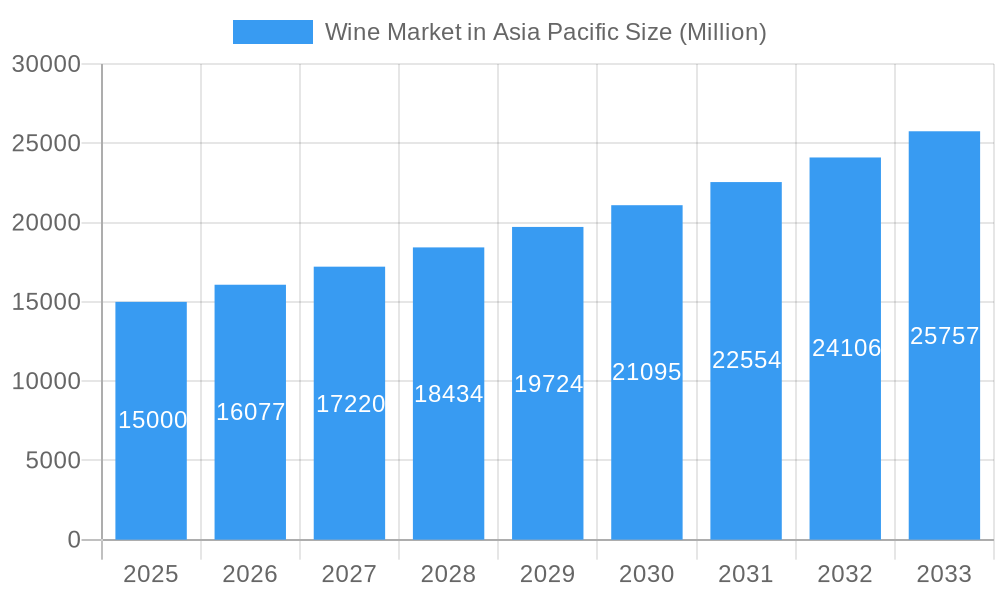

The Asia-Pacific wine market is poised for significant expansion, projected to reach $53.61 billion by 2033, with a compound annual growth rate (CAGR) of 6.85% from the base year 2025. This robust growth is propelled by increasing disposable incomes in emerging economies, a growing middle class embracing Western lifestyles, and evolving consumption patterns favoring moderate alcohol intake and wine tourism. The market segmentation includes still, sparkling, fortified, and other wine types, along with red, rosé, and white varietals, distributed through on-trade and off-trade channels, presenting varied opportunities. Key growth drivers include China and Japan, supported by established wine cultures and expanding retail infrastructure.

Wine Market in Asia Pacific Market Size (In Billion)

Despite a positive outlook, the market faces challenges including consumer price sensitivity in developing regions and cultural preferences that may influence wine adoption rates. Regulatory policies on alcohol sales and import duties also impact market dynamics. Key market players are expected to focus on distribution network expansion, product diversification to meet regional tastes, and strategic marketing to build brand loyalty. Successfully addressing these factors will be crucial for capitalizing on the Asia-Pacific wine market's considerable growth potential.

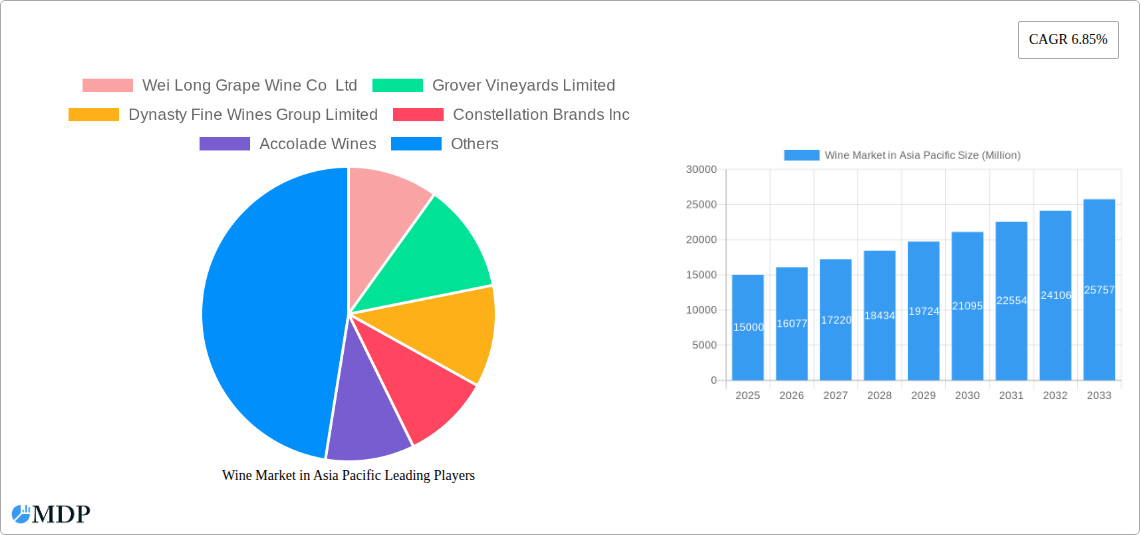

Wine Market in Asia Pacific Company Market Share

Wine Market in Asia Pacific: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic Asia Pacific wine market, offering invaluable insights for industry stakeholders. From market size and segmentation to key players and future trends, this report covers all the essential aspects influencing growth within the region. The study period spans from 2019 to 2033, with a focus on 2025 as the base and estimated year. The report provides historical data (2019-2024) and forecasts (2025-2033) to paint a holistic picture of market evolution. Expect detailed analysis of market concentration, leading players like Constellation Brands Inc and Yantai Changyu Pioneer Wine Co Ltd, and emerging opportunities across various segments, including Still Wine, Sparkling Wine, and Red Wine. Download now to gain a competitive edge.

Wine Market in Asia Pacific Market Dynamics & Concentration

This section analyzes the competitive landscape of the Asia Pacific wine market, examining market concentration, innovation, regulatory factors, and market dynamics. The market is characterized by a mix of established multinational players and emerging regional brands.

Market Concentration: The market exhibits a moderately concentrated structure, with the top five players holding an estimated xx% market share in 2025. However, smaller regional players are increasingly gaining traction, particularly in niche segments. M&A activity has been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024.

Innovation Drivers: Innovation in the wine industry is driven by evolving consumer preferences, including demand for organic, biodynamic, and low-alcohol wines. Technological advancements in viticulture and winemaking processes are also contributing factors.

Regulatory Frameworks: Varied regulations across different Asia Pacific countries impact market access and distribution. These regulations relate to labeling, taxation, and alcohol content limits. Compliance is essential for successful market entry.

Product Substitutes: The wine market faces competition from other alcoholic beverages, such as beer and spirits, as well as non-alcoholic alternatives. Consumer preference shifts and health consciousness influence the dynamics.

End-User Trends: Growing disposable incomes and changing lifestyles in several key markets are driving demand for premium wines. Consumers are increasingly seeking authentic, high-quality products and unique experiences.

Wine Market in Asia Pacific Industry Trends & Analysis

The Asia Pacific wine market is experiencing robust growth, fueled by several key factors.

The market is expected to register a CAGR of xx% during the forecast period (2025-2033), driven primarily by increasing consumer awareness of wine culture, rising disposable incomes, and expanding distribution channels. Market penetration is currently at xx% in major markets but has significant room for expansion, particularly in emerging economies. Technological disruptions, including online wine sales and direct-to-consumer marketing, are changing the industry landscape. Competitive dynamics involve the balancing act of established international brands and rapidly growing local players. Consumer preferences are trending towards premiumization, organic options, and diverse flavor profiles.

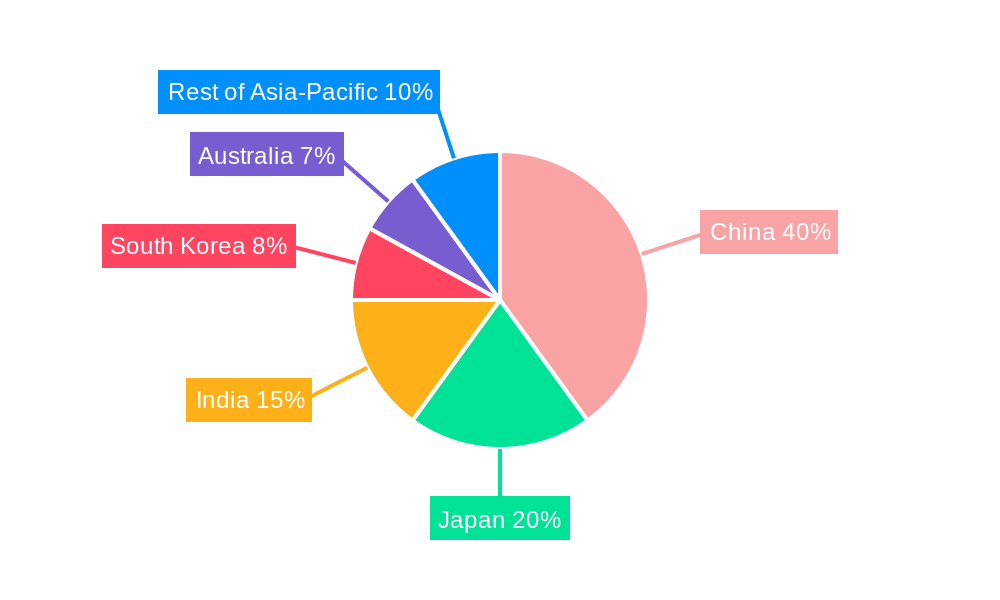

Leading Markets & Segments in Wine Market in Asia Pacific

This section identifies the dominant regions, countries, and segments within the Asia Pacific wine market.

Dominant Regions/Countries: China and Japan remain the largest markets, driven by factors such as increasing affluence, burgeoning middle class, and growing wine appreciation. Other significant markets include Australia, South Korea, and Singapore.

Dominant Segments:

By Product Type: Still wine dominates the market, accounting for approximately xx% of total volume in 2025. Sparkling wine and fortified wines are also experiencing steady growth.

By Colour: Red wine enjoys a significant market share due to its popularity among consumers. However, the demand for white and rosé wines is also increasing.

By Distribution Channel: The off-trade channel currently holds the largest market share; however, the on-trade sector shows considerable potential for growth.

Key Drivers (by region/segment):

- China: Rapid economic growth, expanding middle class, and increasing wine consumption.

- Japan: Established wine culture, high disposable incomes, and sophisticated consumer tastes.

- Still Wine: High demand among consumers, relatively lower price point than other wine types.

- Red Wine: Strong preference among consumers, diverse flavor profiles.

- Off-Trade: Convenience, wide product selection.

Wine Market in Asia Pacific Product Developments

The wine industry is witnessing continuous innovation, with a focus on developing new product formats, enhanced flavor profiles, and improved packaging. Technological advancements in winemaking, such as precision fermentation and sustainable practices, are improving quality and enhancing the consumer experience. The market is seeing increased availability of organic and biodynamic wines, catering to growing health consciousness. This aligns with shifting consumer preferences towards premiumization, sustainability, and unique wine experiences.

Key Drivers of Wine Market in Asia Pacific Growth

Several factors contribute to the growth trajectory of the Asia Pacific wine market:

- Rising Disposable Incomes: Increased purchasing power in several key markets drives demand for premium wines.

- Changing Lifestyle & Consumption Patterns: Growing appreciation for wine culture is further stimulating demand.

- E-commerce and Digital Marketing: The increasing adoption of e-commerce and digital marketing strategies expands market access and promotes sales.

- Government Initiatives: Supportive government policies and infrastructure development create a favorable environment for market expansion.

Challenges in the Wine Market in Asia Pacific Market

The market faces several challenges:

- Regulatory Hurdles: Varying regulations across different countries can complicate market entry and distribution. Tariffs and import duties can affect pricing.

- Supply Chain Issues: Ensuring a consistent supply chain, particularly for premium imports, can be demanding, causing disruptions.

- Competitive Pressures: Competition from both domestic and international brands is intense, particularly in the premium segment. Marketing and branding are critical for differentiation.

Emerging Opportunities in Wine Market in Asia Pacific

The Asia Pacific wine market presents significant long-term growth potential:

- Market Expansion: Untapped potential exists in several emerging economies, where wine consumption is still relatively low. Strategic expansions into these markets offer considerable opportunities.

- Premiumization: Growing demand for high-quality and premium wines creates opportunities for brands offering unique and sophisticated products.

- Sustainability: Increasing consumer awareness regarding sustainability and ethical sourcing presents opportunities for brands that prioritize sustainable practices.

Leading Players in the Wine Market in Asia Pacific Sector

- Wei Long Grape Wine Co Ltd

- Grover Vineyards Limited

- Dynasty Fine Wines Group Limited

- Constellation Brands Inc

- Accolade Wines

- Yantai Changyu Pioneer Wine Co Ltd

- Tonghuagrape Wine Co Ltd

- Sula Vineyards Limited

- Treasury Wine Estates

- The Wine Group LLC

Key Milestones in Wine Market in Asia Pacific Industry

- July 2022: Milestone Beverages relaunches Blowfish Australian wine in China with a new design.

- May 2022: Juvé Camps partners with Nimbility to expand its presence in Greater China and South Korea.

- March 2022: Mercian Corporation launches a new wine brand, Mercian Wines, featuring multi-country blends.

Strategic Outlook for Wine Market in Asia Pacific Market

The Asia Pacific wine market is poised for sustained growth, driven by strong underlying economic factors, changing consumer preferences, and technological advancements. Strategic partnerships, investment in premiumization, and expansion into untapped markets will be crucial for success. The focus on sustainability, digital marketing, and unique consumer experiences will shape the future of this dynamic industry. The report's forecast indicates substantial growth, presenting lucrative opportunities for both established players and new entrants.

Wine Market in Asia Pacific Segmentation

-

1. Product Type

- 1.1. Still Wine

- 1.2. Sparkling Wine

- 1.3. Fortified Wine and Vermouth

- 1.4. Others

-

2. Colour

- 2.1. Red Wine

- 2.2. Rose Wine

- 2.3. White Wine

-

3. Distibution Channel

- 3.1. On-Trade

- 3.2. Off-Trade

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

- 4.5. Rest of Asia-Pacific

Wine Market in Asia Pacific Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

Wine Market in Asia Pacific Regional Market Share

Geographic Coverage of Wine Market in Asia Pacific

Wine Market in Asia Pacific REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications of Oils and Fats in Different End-Use Industries; Government Initiatives and Key Players Adopting Innovative Market Expansion Strategies

- 3.3. Market Restrains

- 3.3.1. Volatility in Imports and Supply Chain of Oils

- 3.4. Market Trends

- 3.4.1. Increase in the Frequency of Wine Consumption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Wine Market in Asia Pacific Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Still Wine

- 5.1.2. Sparkling Wine

- 5.1.3. Fortified Wine and Vermouth

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Colour

- 5.2.1. Red Wine

- 5.2.2. Rose Wine

- 5.2.3. White Wine

- 5.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.3.1. On-Trade

- 5.3.2. Off-Trade

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Wine Market in Asia Pacific Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Still Wine

- 6.1.2. Sparkling Wine

- 6.1.3. Fortified Wine and Vermouth

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Colour

- 6.2.1. Red Wine

- 6.2.2. Rose Wine

- 6.2.3. White Wine

- 6.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.3.1. On-Trade

- 6.3.2. Off-Trade

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Japan Wine Market in Asia Pacific Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Still Wine

- 7.1.2. Sparkling Wine

- 7.1.3. Fortified Wine and Vermouth

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Colour

- 7.2.1. Red Wine

- 7.2.2. Rose Wine

- 7.2.3. White Wine

- 7.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.3.1. On-Trade

- 7.3.2. Off-Trade

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India Wine Market in Asia Pacific Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Still Wine

- 8.1.2. Sparkling Wine

- 8.1.3. Fortified Wine and Vermouth

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Colour

- 8.2.1. Red Wine

- 8.2.2. Rose Wine

- 8.2.3. White Wine

- 8.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.3.1. On-Trade

- 8.3.2. Off-Trade

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Wine Market in Asia Pacific Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Still Wine

- 9.1.2. Sparkling Wine

- 9.1.3. Fortified Wine and Vermouth

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Colour

- 9.2.1. Red Wine

- 9.2.2. Rose Wine

- 9.2.3. White Wine

- 9.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.3.1. On-Trade

- 9.3.2. Off-Trade

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific Wine Market in Asia Pacific Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Still Wine

- 10.1.2. Sparkling Wine

- 10.1.3. Fortified Wine and Vermouth

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Colour

- 10.2.1. Red Wine

- 10.2.2. Rose Wine

- 10.2.3. White Wine

- 10.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 10.3.1. On-Trade

- 10.3.2. Off-Trade

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. Australia

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Wei Long Grape Wine Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Grover Vineyards Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dynasty Fine Wines Group Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Constellation Brands Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Accolade Wines

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Yantai Changyu Pioneer Wine Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tonghuagrape Wine Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sula Vineyards Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Treasury Wine Estates*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Wine Group LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Wei Long Grape Wine Co Ltd

List of Figures

- Figure 1: Wine Market in Asia Pacific Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Wine Market in Asia Pacific Share (%) by Company 2025

List of Tables

- Table 1: Wine Market in Asia Pacific Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Wine Market in Asia Pacific Volume K Liters Forecast, by Product Type 2020 & 2033

- Table 3: Wine Market in Asia Pacific Revenue billion Forecast, by Colour 2020 & 2033

- Table 4: Wine Market in Asia Pacific Volume K Liters Forecast, by Colour 2020 & 2033

- Table 5: Wine Market in Asia Pacific Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 6: Wine Market in Asia Pacific Volume K Liters Forecast, by Distibution Channel 2020 & 2033

- Table 7: Wine Market in Asia Pacific Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Wine Market in Asia Pacific Volume K Liters Forecast, by Geography 2020 & 2033

- Table 9: Wine Market in Asia Pacific Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Wine Market in Asia Pacific Volume K Liters Forecast, by Region 2020 & 2033

- Table 11: Wine Market in Asia Pacific Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Wine Market in Asia Pacific Volume K Liters Forecast, by Product Type 2020 & 2033

- Table 13: Wine Market in Asia Pacific Revenue billion Forecast, by Colour 2020 & 2033

- Table 14: Wine Market in Asia Pacific Volume K Liters Forecast, by Colour 2020 & 2033

- Table 15: Wine Market in Asia Pacific Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 16: Wine Market in Asia Pacific Volume K Liters Forecast, by Distibution Channel 2020 & 2033

- Table 17: Wine Market in Asia Pacific Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Wine Market in Asia Pacific Volume K Liters Forecast, by Geography 2020 & 2033

- Table 19: Wine Market in Asia Pacific Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Wine Market in Asia Pacific Volume K Liters Forecast, by Country 2020 & 2033

- Table 21: Wine Market in Asia Pacific Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Wine Market in Asia Pacific Volume K Liters Forecast, by Product Type 2020 & 2033

- Table 23: Wine Market in Asia Pacific Revenue billion Forecast, by Colour 2020 & 2033

- Table 24: Wine Market in Asia Pacific Volume K Liters Forecast, by Colour 2020 & 2033

- Table 25: Wine Market in Asia Pacific Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 26: Wine Market in Asia Pacific Volume K Liters Forecast, by Distibution Channel 2020 & 2033

- Table 27: Wine Market in Asia Pacific Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Wine Market in Asia Pacific Volume K Liters Forecast, by Geography 2020 & 2033

- Table 29: Wine Market in Asia Pacific Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Wine Market in Asia Pacific Volume K Liters Forecast, by Country 2020 & 2033

- Table 31: Wine Market in Asia Pacific Revenue billion Forecast, by Product Type 2020 & 2033

- Table 32: Wine Market in Asia Pacific Volume K Liters Forecast, by Product Type 2020 & 2033

- Table 33: Wine Market in Asia Pacific Revenue billion Forecast, by Colour 2020 & 2033

- Table 34: Wine Market in Asia Pacific Volume K Liters Forecast, by Colour 2020 & 2033

- Table 35: Wine Market in Asia Pacific Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 36: Wine Market in Asia Pacific Volume K Liters Forecast, by Distibution Channel 2020 & 2033

- Table 37: Wine Market in Asia Pacific Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Wine Market in Asia Pacific Volume K Liters Forecast, by Geography 2020 & 2033

- Table 39: Wine Market in Asia Pacific Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Wine Market in Asia Pacific Volume K Liters Forecast, by Country 2020 & 2033

- Table 41: Wine Market in Asia Pacific Revenue billion Forecast, by Product Type 2020 & 2033

- Table 42: Wine Market in Asia Pacific Volume K Liters Forecast, by Product Type 2020 & 2033

- Table 43: Wine Market in Asia Pacific Revenue billion Forecast, by Colour 2020 & 2033

- Table 44: Wine Market in Asia Pacific Volume K Liters Forecast, by Colour 2020 & 2033

- Table 45: Wine Market in Asia Pacific Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 46: Wine Market in Asia Pacific Volume K Liters Forecast, by Distibution Channel 2020 & 2033

- Table 47: Wine Market in Asia Pacific Revenue billion Forecast, by Geography 2020 & 2033

- Table 48: Wine Market in Asia Pacific Volume K Liters Forecast, by Geography 2020 & 2033

- Table 49: Wine Market in Asia Pacific Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Wine Market in Asia Pacific Volume K Liters Forecast, by Country 2020 & 2033

- Table 51: Wine Market in Asia Pacific Revenue billion Forecast, by Product Type 2020 & 2033

- Table 52: Wine Market in Asia Pacific Volume K Liters Forecast, by Product Type 2020 & 2033

- Table 53: Wine Market in Asia Pacific Revenue billion Forecast, by Colour 2020 & 2033

- Table 54: Wine Market in Asia Pacific Volume K Liters Forecast, by Colour 2020 & 2033

- Table 55: Wine Market in Asia Pacific Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 56: Wine Market in Asia Pacific Volume K Liters Forecast, by Distibution Channel 2020 & 2033

- Table 57: Wine Market in Asia Pacific Revenue billion Forecast, by Geography 2020 & 2033

- Table 58: Wine Market in Asia Pacific Volume K Liters Forecast, by Geography 2020 & 2033

- Table 59: Wine Market in Asia Pacific Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Wine Market in Asia Pacific Volume K Liters Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wine Market in Asia Pacific?

The projected CAGR is approximately 3.63%.

2. Which companies are prominent players in the Wine Market in Asia Pacific?

Key companies in the market include Wei Long Grape Wine Co Ltd, Grover Vineyards Limited, Dynasty Fine Wines Group Limited, Constellation Brands Inc, Accolade Wines, Yantai Changyu Pioneer Wine Co Ltd, Tonghuagrape Wine Co Ltd, Sula Vineyards Limited, Treasury Wine Estates*List Not Exhaustive, The Wine Group LLC.

3. What are the main segments of the Wine Market in Asia Pacific?

The market segments include Product Type, Colour, Distibution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.61 billion as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications of Oils and Fats in Different End-Use Industries; Government Initiatives and Key Players Adopting Innovative Market Expansion Strategies.

6. What are the notable trends driving market growth?

Increase in the Frequency of Wine Consumption.

7. Are there any restraints impacting market growth?

Volatility in Imports and Supply Chain of Oils.

8. Can you provide examples of recent developments in the market?

In July 2022, Milestone Beverages has planned to relaunch Blowfish Australian wine with an all-new design in China. Blowfish is Milestone's first-born brand, created by founder and managing director Joe Milner in homage to his part Australian heritage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Liters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wine Market in Asia Pacific," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wine Market in Asia Pacific report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wine Market in Asia Pacific?

To stay informed about further developments, trends, and reports in the Wine Market in Asia Pacific, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence