Key Insights

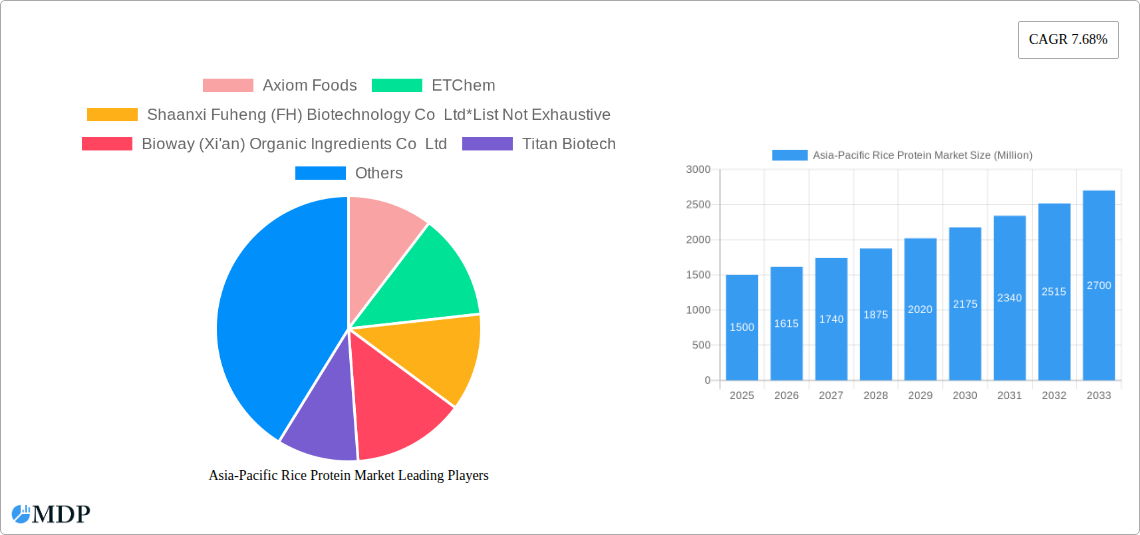

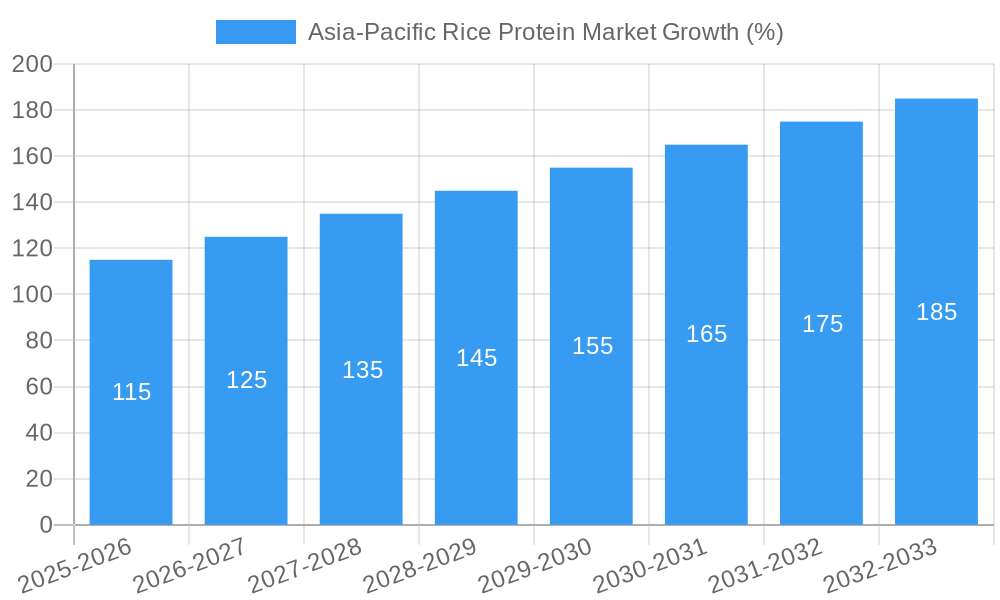

The Asia-Pacific rice protein market is experiencing robust growth, driven by increasing consumer demand for plant-based protein sources and the region's substantial rice production. The market, valued at approximately $XX million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 7.68% from 2025 to 2033. This expansion is fueled by several key factors. The rising prevalence of veganism and vegetarianism, coupled with growing health consciousness, is significantly boosting the demand for plant-based alternatives to traditional animal proteins. Furthermore, the functional benefits of rice protein, including its hypoallergenic nature and high amino acid content, are contributing to its increased adoption in various applications. The burgeoning food and beverage industry in the Asia-Pacific region, particularly in countries like China, India, and Japan, provides a lucrative market for rice protein isolates and concentrates. The expanding dietary supplement and animal feed sectors are also acting as significant growth catalysts. However, challenges remain, including price volatility of rice and potential competition from other plant-based protein sources like soy and pea protein. Nevertheless, the overall market outlook remains positive, with substantial growth anticipated across various segments and countries within the Asia-Pacific region.

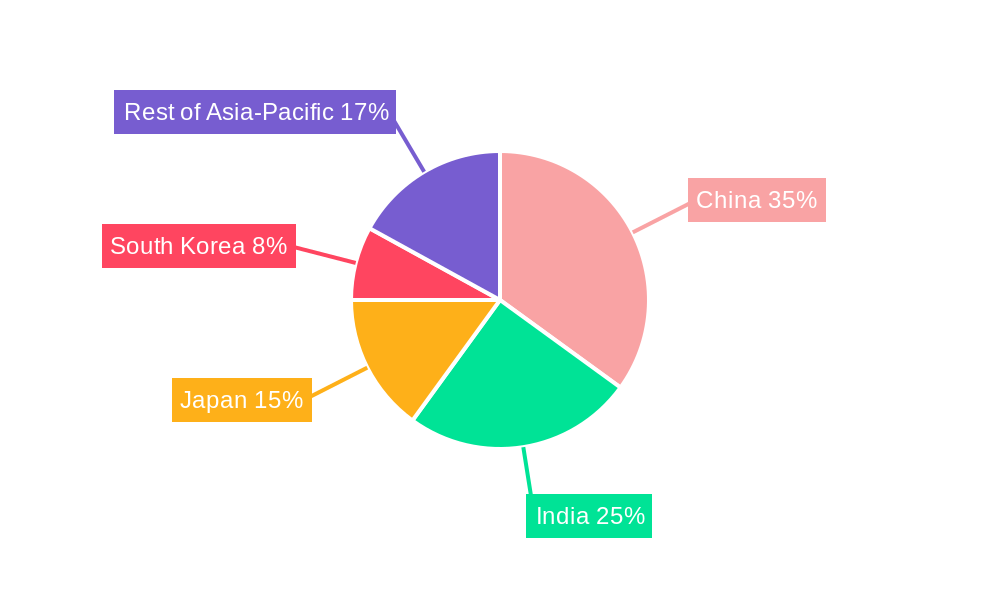

The market segmentation reveals strong performance across key applications. Food ingredients currently represent a dominant segment, driven by increasing incorporation of rice protein in various food products to improve nutritional profile and texture. The bakery and confectionery segment is showing strong growth potential, mirroring consumer demand for healthier baked goods. The dietary supplements segment is also expanding, reflecting the growing popularity of plant-based protein supplements. While precise market share data for individual segments is unavailable, it's likely that Food Ingredients holds the largest share, followed by Dietary Supplements and Bakery & Confectionery. Geographical analysis suggests China, India, and Japan will be major contributors to overall market growth, propelled by their sizable populations and expanding consumer base. The "Rest of Asia-Pacific" region also holds considerable promise due to rising incomes and evolving dietary habits. Continued innovation in processing technologies to improve the functionality and cost-effectiveness of rice protein is crucial for sustained market growth.

Asia-Pacific Rice Protein Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific rice protein market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. From market dynamics and leading players to future growth opportunities, this report unravels the complexities of this rapidly evolving sector. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, encompassing the historical period of 2019-2024. The market is segmented by product (Rice Protein Isolates, Rice Protein Concentrates, Other Products) and application (Food Ingredients, Bakery & Confectionary, Dietary Supplements, Animal Feed). Key players analyzed include Axiom Foods, ETChem, Shaanxi Fuheng (FH) Biotechnology Co Ltd, Bioway (Xi'an) Organic Ingredients Co Ltd, Titan Biotech, Shafi Gluco Chem Pvt, Jiangxi Golden Agriculture Biotech Co Ltd, and TNJ Chemicals.

Asia-Pacific Rice Protein Market Market Dynamics & Concentration

The Asia-Pacific rice protein market is characterized by moderate concentration, with a few major players holding significant market share, while numerous smaller companies compete in niche segments. The market is driven by increasing consumer demand for plant-based proteins, growing health consciousness, and stringent regulations promoting sustainable food sources. Innovation in extraction technologies and product formulations is also a significant driver. Major product substitutes include soy protein, pea protein, and whey protein. However, rice protein's hypoallergenic nature and clean label appeal offer a competitive advantage. The market has witnessed a moderate level of M&A activity, with approximately xx deals recorded between 2019 and 2024. The top five players collectively hold an estimated xx% market share in 2025.

- Market Concentration: Moderate, with top 5 players holding xx% market share.

- Innovation Drivers: Improved extraction techniques, novel product formulations (e.g., rice protein blends).

- Regulatory Frameworks: Increasing focus on labeling and food safety regulations.

- Product Substitutes: Soy protein, pea protein, whey protein.

- End-User Trends: Growing demand for plant-based and clean-label products.

- M&A Activities: Approximately xx deals between 2019-2024.

Asia-Pacific Rice Protein Market Industry Trends & Analysis

The Asia-Pacific rice protein market exhibits robust growth, projected to reach xx Million by 2033, registering a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by the rising popularity of plant-based diets, increasing awareness of the health benefits of rice protein (e.g., high protein content, hypoallergenic nature), and the expanding applications in diverse food and beverage segments. Technological advancements in extraction and processing techniques are further enhancing the quality and affordability of rice protein. Consumer preferences are shifting towards clean-label products with natural ingredients, which favors rice protein's inherent characteristics. Competitive dynamics are intensifying, with existing players focusing on product diversification and innovation while new entrants explore niche markets. Market penetration remains relatively low, with significant potential for expansion across various applications.

Leading Markets & Segments in Asia-Pacific Rice Protein Market

Within the Asia-Pacific region, China and India are currently the leading markets for rice protein, driven by large populations, rising disposable incomes, and increasing health awareness. The food ingredients segment dominates the application landscape, followed by the dietary supplement and animal feed segments. Among product types, rice protein isolates currently hold the largest market share due to their higher protein content and purity.

Key Drivers for China & India:

- Rapidly expanding middle class and increased health consciousness.

- Government initiatives promoting sustainable agriculture and food security.

- Robust food processing and manufacturing infrastructure.

Dominant Segment Analysis:

- Food Ingredients: High demand from the food and beverage industry for functional ingredients.

- Rice Protein Isolates: Superior protein content and purity compared to concentrates.

Asia-Pacific Rice Protein Market Product Developments

Recent product innovations focus on enhancing the functionality and digestibility of rice protein. Manufacturers are developing novel formulations to improve taste, texture, and solubility, expanding application possibilities in various food products. The focus is on achieving a competitive advantage through superior quality, cost-effectiveness, and unique product features. Technological advancements, particularly in protein extraction and purification techniques, are crucial for driving product development.

Key Drivers of Asia-Pacific Rice Protein Market Growth

The Asia-Pacific rice protein market is propelled by several key factors: rising consumer demand for plant-based proteins, the increasing adoption of vegan and vegetarian diets, and the growing awareness of health and wellness. Furthermore, technological advancements in extraction and processing techniques are reducing production costs and improving the quality of rice protein. Government support for sustainable agriculture and favorable regulatory frameworks are also contributing to market expansion.

Challenges in the Asia-Pacific Rice Protein Market Market

The Asia-Pacific rice protein market faces challenges such as price volatility of raw materials, competition from other plant-based proteins, and variations in quality and consistency of rice protein products. Supply chain complexities, particularly in sourcing high-quality rice, pose a significant constraint. Regulatory hurdles related to food safety and labeling also require navigation. These factors impact production costs and limit market penetration.

Emerging Opportunities in Asia-Pacific Rice Protein Market

Long-term growth in the Asia-Pacific rice protein market is fueled by expanding applications in novel food products, strategic collaborations among industry players, and market penetration in underdeveloped regions. Technological breakthroughs in protein extraction and formulation will further enhance product quality and broaden market reach. Growing interest in functional foods and nutraceuticals presents substantial growth avenues.

Leading Players in the Asia-Pacific Rice Protein Market Sector

- Axiom Foods

- ETChem

- Shaanxi Fuheng (FH) Biotechnology Co Ltd

- Bioway (Xi'an) Organic Ingredients Co Ltd

- Titan Biotech

- Shafi Gluco Chem Pvt

- Jiangxi Golden Agriculture Biotech Co Ltd

- TNJ Chemicals

Key Milestones in Asia-Pacific Rice Protein Market Industry

- 2021: Launch of a new rice protein isolate with enhanced solubility by Axiom Foods.

- 2022: Acquisition of a rice processing facility by ETChem, expanding production capacity.

- 2023: Introduction of a rice protein-based dietary supplement by Bioway (Xi'an) Organic Ingredients Co Ltd.

Strategic Outlook for Asia-Pacific Rice Protein Market Market

The Asia-Pacific rice protein market holds immense potential for future growth. Strategic investments in research and development, expansion into new markets, and partnerships with food manufacturers will be crucial for capitalizing on this potential. The focus should be on improving product quality, enhancing sustainability, and meeting evolving consumer preferences to ensure long-term success in this dynamic market.

Asia-Pacific Rice Protein Market Segmentation

-

1. Product

- 1.1. Rice Protein Isolates

- 1.2. Rice Protein Concentrates

- 1.3. Other Products

-

2. Application

-

2.1. Food Ingredients

- 2.1.1. Energy and Sports Drinks

- 2.1.2. Meat Analogues

- 2.1.3. Beverages

- 2.1.4. Bakery and Confectionary

- 2.2. Dietary Supplements

- 2.3. Animal Feed

-

2.1. Food Ingredients

-

3. Geography

-

3.1. Asia-Pacific

- 3.1.1. China

- 3.1.2. India

- 3.1.3. Japan

- 3.1.4. Australia

- 3.1.5. Rest of Asia-Pacific

-

3.1. Asia-Pacific

Asia-Pacific Rice Protein Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. Australia

- 1.5. Rest of Asia Pacific

Asia-Pacific Rice Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.68% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing awareness of health and wellness has boosted demand for plant-based proteins including rice protein

- 3.3. Market Restrains

- 3.3.1. Production of rice protein can be more expensive compared to other plant-based proteins

- 3.4. Market Trends

- 3.4.1. Rise of functional foods and beverages that offer health benefits beyond basic nutrition is driving innovation in rice protein formulations

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Rice Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Rice Protein Isolates

- 5.1.2. Rice Protein Concentrates

- 5.1.3. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food Ingredients

- 5.2.1.1. Energy and Sports Drinks

- 5.2.1.2. Meat Analogues

- 5.2.1.3. Beverages

- 5.2.1.4. Bakery and Confectionary

- 5.2.2. Dietary Supplements

- 5.2.3. Animal Feed

- 5.2.1. Food Ingredients

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia-Pacific

- 5.3.1.1. China

- 5.3.1.2. India

- 5.3.1.3. Japan

- 5.3.1.4. Australia

- 5.3.1.5. Rest of Asia-Pacific

- 5.3.1. Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. China Asia-Pacific Rice Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Rice Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Rice Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Rice Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Rice Protein Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Rice Protein Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Rice Protein Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Axiom Foods

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ETChem

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Shaanxi Fuheng (FH) Biotechnology Co Ltd*List Not Exhaustive

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bioway (Xi'an) Organic Ingredients Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Titan Biotech

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Shafi Gluco Chem Pvt

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Jiangxi Golden Agriculture Biotech Co Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 TNJ Chemicals

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Axiom Foods

List of Figures

- Figure 1: Asia-Pacific Rice Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Rice Protein Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Rice Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Rice Protein Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Rice Protein Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Asia-Pacific Rice Protein Market Volume K Tons Forecast, by Product 2019 & 2032

- Table 5: Asia-Pacific Rice Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Asia-Pacific Rice Protein Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: Asia-Pacific Rice Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Asia-Pacific Rice Protein Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 9: Asia-Pacific Rice Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Asia-Pacific Rice Protein Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: Asia-Pacific Rice Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Asia-Pacific Rice Protein Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: China Asia-Pacific Rice Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: China Asia-Pacific Rice Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Japan Asia-Pacific Rice Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Asia-Pacific Rice Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: India Asia-Pacific Rice Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Asia-Pacific Rice Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: South Korea Asia-Pacific Rice Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia-Pacific Rice Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Taiwan Asia-Pacific Rice Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Taiwan Asia-Pacific Rice Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Australia Asia-Pacific Rice Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Asia-Pacific Rice Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Rest of Asia-Pacific Asia-Pacific Rice Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Asia-Pacific Asia-Pacific Rice Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 27: Asia-Pacific Rice Protein Market Revenue Million Forecast, by Product 2019 & 2032

- Table 28: Asia-Pacific Rice Protein Market Volume K Tons Forecast, by Product 2019 & 2032

- Table 29: Asia-Pacific Rice Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Asia-Pacific Rice Protein Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 31: Asia-Pacific Rice Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Asia-Pacific Rice Protein Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 33: Asia-Pacific Rice Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Asia-Pacific Rice Protein Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 35: China Asia-Pacific Rice Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: China Asia-Pacific Rice Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: India Asia-Pacific Rice Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Asia-Pacific Rice Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Japan Asia-Pacific Rice Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Japan Asia-Pacific Rice Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Australia Asia-Pacific Rice Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Australia Asia-Pacific Rice Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Rest of Asia Pacific Asia-Pacific Rice Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Asia Pacific Asia-Pacific Rice Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Rice Protein Market?

The projected CAGR is approximately 7.68%.

2. Which companies are prominent players in the Asia-Pacific Rice Protein Market?

Key companies in the market include Axiom Foods, ETChem, Shaanxi Fuheng (FH) Biotechnology Co Ltd*List Not Exhaustive, Bioway (Xi'an) Organic Ingredients Co Ltd, Titan Biotech, Shafi Gluco Chem Pvt, Jiangxi Golden Agriculture Biotech Co Ltd, TNJ Chemicals.

3. What are the main segments of the Asia-Pacific Rice Protein Market?

The market segments include Product, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing awareness of health and wellness has boosted demand for plant-based proteins including rice protein.

6. What are the notable trends driving market growth?

Rise of functional foods and beverages that offer health benefits beyond basic nutrition is driving innovation in rice protein formulations.

7. Are there any restraints impacting market growth?

Production of rice protein can be more expensive compared to other plant-based proteins.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Rice Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Rice Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Rice Protein Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Rice Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence