Key Insights

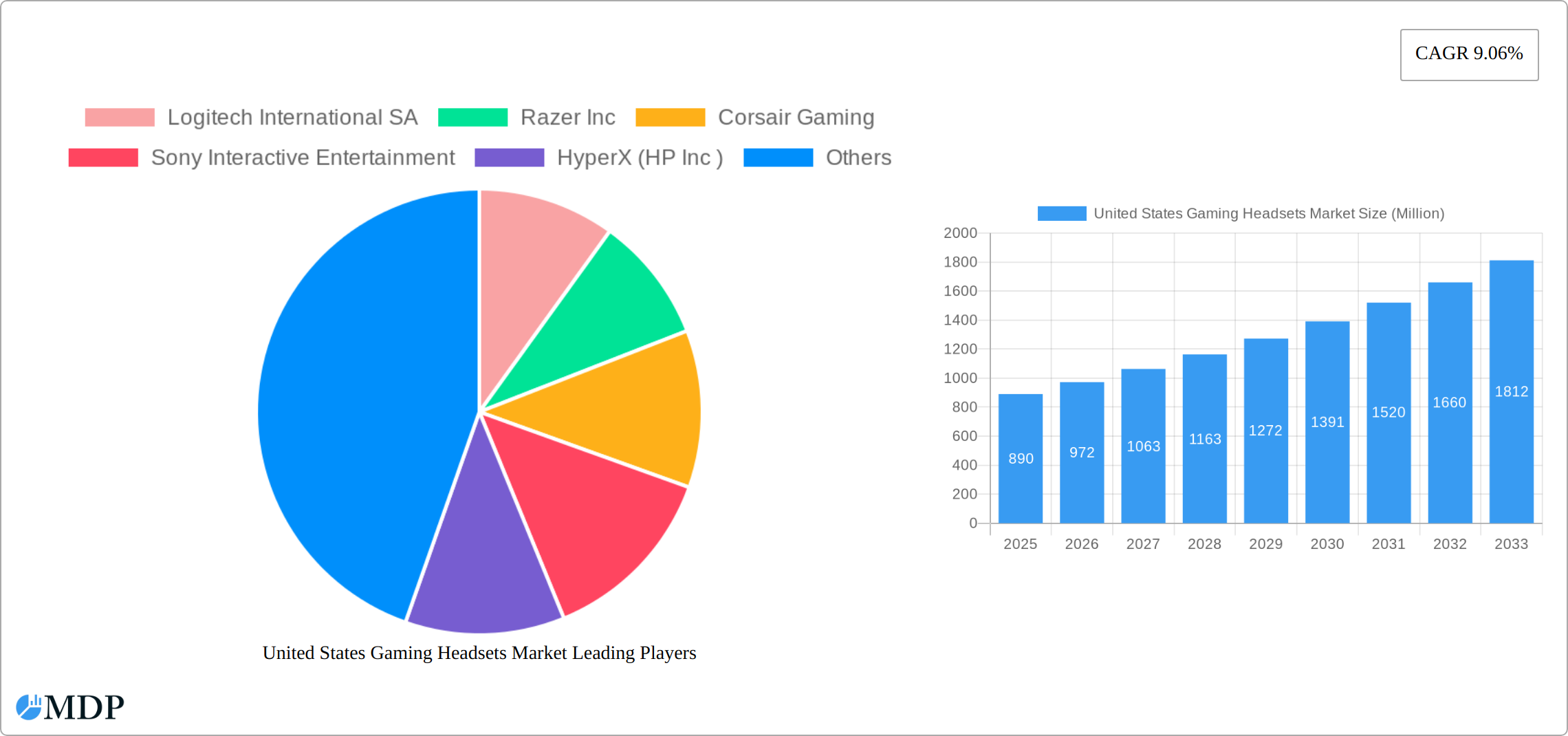

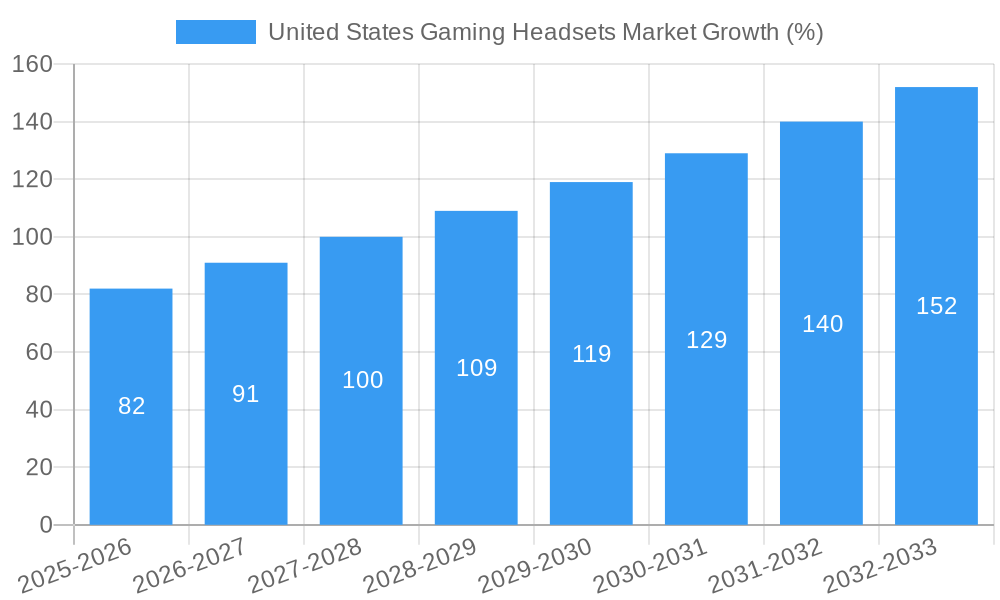

The United States gaming headset market, valued at approximately $0.89 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 9.06% from 2025 to 2033. This expansion is fueled by several key factors. The rising popularity of esports and competitive gaming continues to drive demand for high-quality audio peripherals offering superior positional audio and clear communication. Technological advancements, such as the incorporation of noise-canceling technology, improved comfort features, and wireless connectivity with low latency, are enhancing the user experience and fueling market growth. Furthermore, the increasing adoption of virtual reality (VR) and augmented reality (AR) gaming further contributes to the market's expansion, as immersive experiences demand high-fidelity audio solutions. The market is segmented by product type (wired, wireless, etc.), price range, and platform compatibility (PC, consoles, mobile). Key players like Logitech, Razer, Corsair, and Sony are engaged in intense competition, marked by continuous product innovation and strategic partnerships to maintain market share.

The market's growth trajectory, however, is not without its challenges. Price sensitivity amongst budget-conscious consumers could restrain market growth to some extent, particularly within the entry-level segments. Competition from other audio device manufacturers and the potential for technological disruption (e.g., advancements in haptic feedback) pose further challenges. Despite these factors, the long-term outlook for the US gaming headset market remains positive, driven by continuous technological innovation, the expanding gaming community, and the sustained popularity of esports. The forecast period of 2025-2033 suggests significant growth opportunities, particularly for companies offering premium features and innovative designs to cater to the diverse needs of gamers.

United States Gaming Headsets Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States gaming headsets market, offering invaluable insights for industry stakeholders. The study covers the period 2019-2033, with a focus on the base year 2025 and a forecast period extending to 2033. Discover key trends, growth drivers, challenges, and opportunities shaping this dynamic market. The report includes detailed analysis of market segmentation, leading players, and recent industry developments, providing actionable data for informed decision-making. The market is projected to reach xx Million by 2033.

United States Gaming Headsets Market Market Dynamics & Concentration

The United States gaming headsets market exhibits a moderately concentrated landscape, with a handful of major players holding significant market share. Logitech International SA, Razer Inc., and Corsair Gaming are among the leading brands, constantly innovating to maintain their competitive edge. The market's dynamics are driven by several factors:

- Innovation: Continuous advancements in audio technology, such as spatial audio and noise cancellation, are key innovation drivers. The integration of features like haptic feedback and customizable sound profiles further enhances the user experience, driving demand.

- Regulatory Frameworks: While relatively less stringent compared to other sectors, regulatory compliance related to product safety and electronic waste management influences market operations.

- Product Substitutes: The availability of alternative audio solutions, like standard headphones or earbuds with gaming-focused software, presents a competitive challenge.

- End-User Trends: The growing popularity of esports and cloud gaming is fueling demand for high-performance gaming headsets. Changing consumer preferences toward wireless and multi-platform compatible headsets also play a role.

- M&A Activities: The number of mergers and acquisitions in the gaming headset sector has remained steady over the past five years, with an average of xx deals annually, resulting in increased market consolidation and shifting competitive dynamics. Market share analysis reveals that the top 5 players account for approximately xx% of the total market, indicating a moderately concentrated market structure.

United States Gaming Headsets Market Industry Trends & Analysis

The United States gaming headsets market is characterized by robust growth, driven primarily by the expanding gaming industry and increasing adoption of advanced gaming technologies. The market is anticipated to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key trends:

- Technological Disruptions: The introduction of next-generation consoles and advancements in virtual reality (VR) and augmented reality (AR) technologies are driving the demand for immersive audio experiences.

- Consumer Preferences: Consumers are increasingly prioritizing features like comfort, wireless connectivity, and superior sound quality, leading manufacturers to focus on product enhancements and improved ergonomics.

- Competitive Dynamics: Intense competition among established players and the emergence of new entrants are fostering innovation and driving down prices, thereby making gaming headsets more accessible to a wider consumer base. Market penetration within the gaming community is currently at approximately xx%, with significant growth potential in underserved segments.

Leading Markets & Segments in United States Gaming Headsets Market

The leading segment within the United States gaming headsets market is currently the premium segment, which accounts for xx% of market share. This segment is driven by the increasing demand for high-quality audio features and advanced technologies.

- Key Drivers of Premium Segment Dominance:

- High Disposable Income: A significant portion of the US population has high disposable income, enabling them to invest in premium gaming headsets.

- Demand for Enhanced Audio Quality: Gamers are willing to pay a premium for superior sound quality, immersive experiences, and noise-cancellation features.

- Technological Advancements: The constant introduction of new technologies, such as advanced spatial audio and haptic feedback, drives demand within this segment.

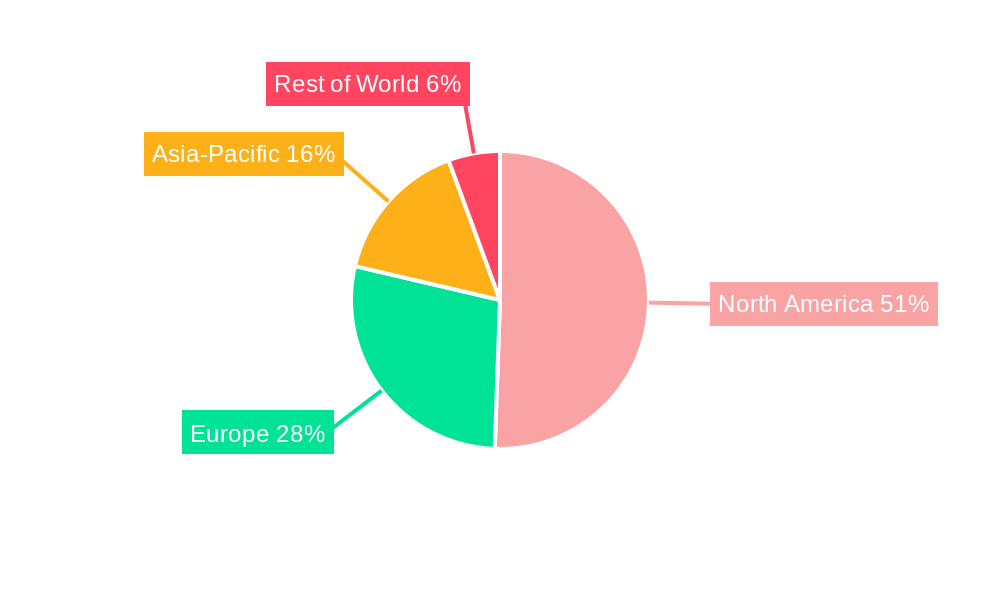

Detailed analysis shows that the xx region dominates the US gaming headset market, primarily due to higher per capita gaming expenditure and robust infrastructure supporting the gaming industry. The region's favorable economic policies and significant investments in esports further enhance its leading position.

United States Gaming Headsets Market Product Developments

Recent product innovations focus on enhancing audio quality, comfort, and connectivity. Manufacturers are incorporating advanced features such as AI-powered noise cancellation, personalized sound profiles, and seamless integration with various gaming platforms. The market is also witnessing a shift toward wireless headsets with longer battery life and improved latency. This trend reflects the growing demand for more convenient and immersive gaming experiences. These developments are enabling better market fit and stronger competitive advantages for manufacturers.

Key Drivers of United States Gaming Headsets Market Growth

Several factors contribute to the robust growth of the United States gaming headsets market:

- Technological advancements: Improved audio processing technologies, like spatial audio and noise cancellation, provide a superior gaming experience.

- Economic growth: Increased disposable income allows consumers to invest in premium gaming accessories.

- Regulatory support: Favorable regulatory frameworks encourage market growth and innovation. The expanding esports industry also fuels demand for high-performance headsets.

Challenges in the United States Gaming Headsets Market Market

Several challenges hinder market growth:

- Supply chain disruptions: Global supply chain issues can affect the availability and pricing of components.

- Competitive pressure: Intense competition among numerous brands requires manufacturers to constantly innovate and maintain competitive pricing.

- High production costs: Advanced technologies and features often lead to higher manufacturing costs, impacting profitability margins. These factors, if not managed effectively, could limit market expansion.

Emerging Opportunities in United States Gaming Headsets Market

The market presents significant growth opportunities:

- Technological breakthroughs: Further advancements in audio technology, like personalized audio profiles and improved haptic feedback, will enhance the gaming experience and drive demand.

- Strategic partnerships: Collaborations between headset manufacturers and game developers can lead to optimized audio experiences and increased product adoption.

- Market expansion: Targeting niche segments, such as mobile gamers and VR/AR enthusiasts, offers untapped potential for growth.

Leading Players in the United States Gaming Headsets Market Sector

- Logitech International SA

- Razer Inc

- Corsair Gaming

- Sony Interactive Entertainment

- HyperX (HP Inc)

- ASUS Computer International

- Microsoft Corporation

- Harman International Industries Incorporated

- SteelSeries

- Turtle Beach Corporation

Key Milestones in United States Gaming Headsets Market Industry

- July 2024: Beats by Dre launched a limited edition Minecraft-themed Beats Solo 4 headphones, leveraging brand synergy for increased market visibility and appeal to a younger demographic.

- May 2024: JBL entered the gaming headset market with its new 'Quantum' line, introducing seven models with varying price points and features, expanding market competition and product diversity.

Strategic Outlook for United States Gaming Headsets Market Market

The future of the United States gaming headsets market appears bright. Continued technological advancements, strategic partnerships, and expanding gaming communities will fuel sustained growth. Manufacturers who focus on innovation, delivering high-quality products with improved features, and establishing strong brand identities will be best positioned to capture market share and capitalize on emerging opportunities. The market's potential for expansion, particularly within niche segments and emerging technologies, is significant, paving the way for substantial future growth.

United States Gaming Headsets Market Segmentation

-

1. Compatibility Type

- 1.1. Console Headset

- 1.2. PC Headset

-

2. Connectivity Type

- 2.1. Wired

- 2.2. Wireless

-

3. Sales Channel

- 3.1. Retail

- 3.2. Online

United States Gaming Headsets Market Segmentation By Geography

- 1. United States

United States Gaming Headsets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.06% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment

- 3.3. Market Restrains

- 3.3.1. Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment

- 3.4. Market Trends

- 3.4.1. Console Headset Segment Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Gaming Headsets Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 5.1.1. Console Headset

- 5.1.2. PC Headset

- 5.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Retail

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Logitech International SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Razer Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Corsair Gaming

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sony Interactive Entertainment

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HyperX (HP Inc )

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ASUS Computer International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Microsoft Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Harman International Industries Incorporated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SteelSeries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Turtle Beach Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Logitech International SA

List of Figures

- Figure 1: United States Gaming Headsets Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Gaming Headsets Market Share (%) by Company 2024

List of Tables

- Table 1: United States Gaming Headsets Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Gaming Headsets Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United States Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 4: United States Gaming Headsets Market Volume Billion Forecast, by Compatibility Type 2019 & 2032

- Table 5: United States Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 6: United States Gaming Headsets Market Volume Billion Forecast, by Connectivity Type 2019 & 2032

- Table 7: United States Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 8: United States Gaming Headsets Market Volume Billion Forecast, by Sales Channel 2019 & 2032

- Table 9: United States Gaming Headsets Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United States Gaming Headsets Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: United States Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 12: United States Gaming Headsets Market Volume Billion Forecast, by Compatibility Type 2019 & 2032

- Table 13: United States Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 14: United States Gaming Headsets Market Volume Billion Forecast, by Connectivity Type 2019 & 2032

- Table 15: United States Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 16: United States Gaming Headsets Market Volume Billion Forecast, by Sales Channel 2019 & 2032

- Table 17: United States Gaming Headsets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Gaming Headsets Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Gaming Headsets Market?

The projected CAGR is approximately 9.06%.

2. Which companies are prominent players in the United States Gaming Headsets Market?

Key companies in the market include Logitech International SA, Razer Inc, Corsair Gaming, Sony Interactive Entertainment, HyperX (HP Inc ), ASUS Computer International, Microsoft Corporation, Harman International Industries Incorporated, SteelSeries, Turtle Beach Corporatio.

3. What are the main segments of the United States Gaming Headsets Market?

The market segments include Compatibility Type, Connectivity Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment.

6. What are the notable trends driving market growth?

Console Headset Segment Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment.

8. Can you provide examples of recent developments in the market?

July 2024: Beats by Dre recently announced a significant collaboration, teaming up with Minecraft to launch a limited edition of Beats Solo 4 headphones. These headphones, inspired by Minecraft's Creepers, boast a bold neon green and black design, complete with a block pattern.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Gaming Headsets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Gaming Headsets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Gaming Headsets Market?

To stay informed about further developments, trends, and reports in the United States Gaming Headsets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence