Key Insights

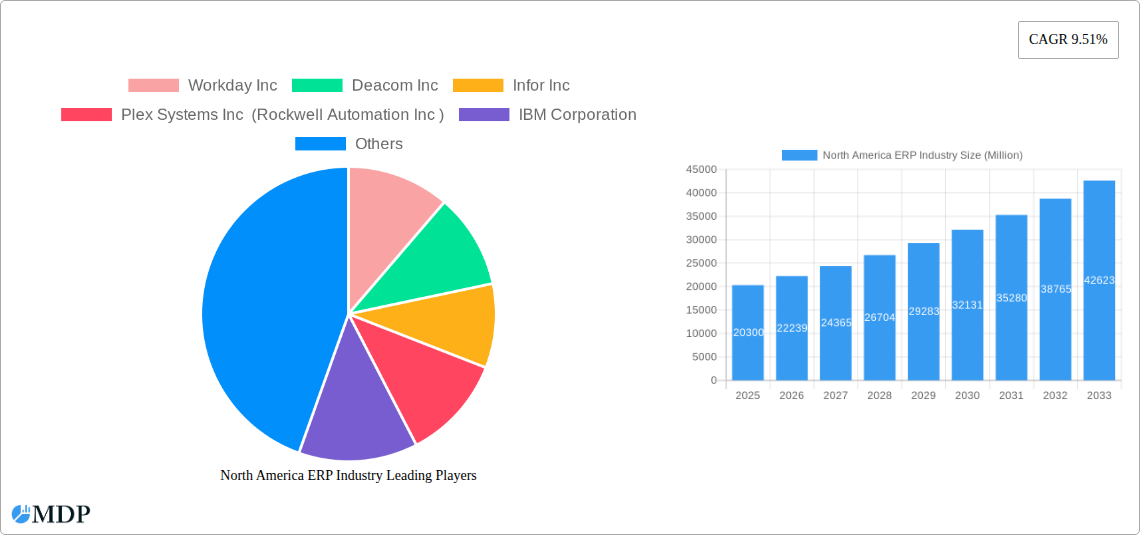

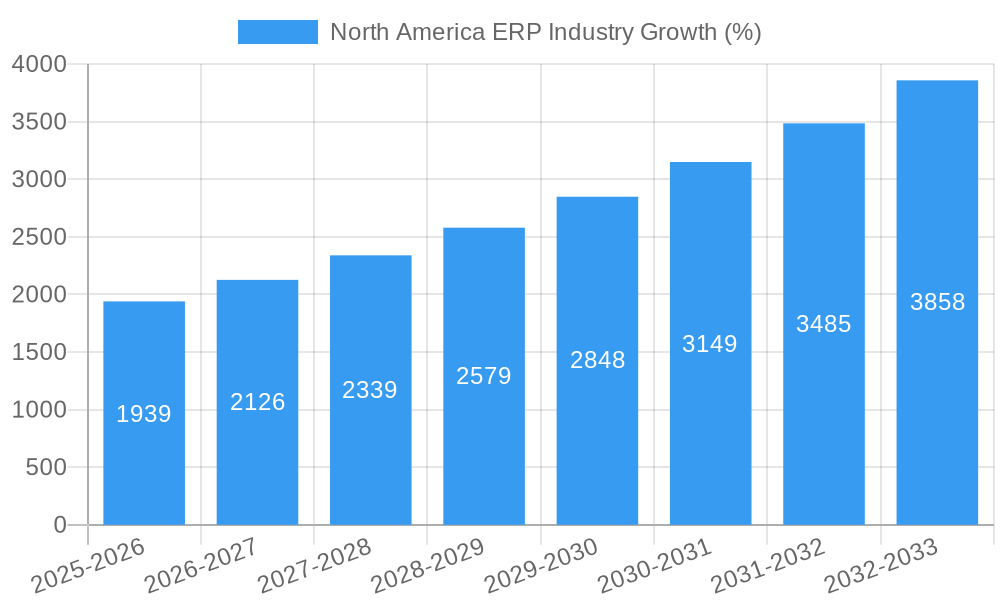

The North American Enterprise Resource Planning (ERP) market, valued at $20.30 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.51% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing adoption of cloud-based ERP solutions offers enhanced scalability, flexibility, and cost-effectiveness, particularly appealing to Small and Medium-sized Businesses (SMBs). Secondly, the surging demand for improved operational efficiency and data-driven decision-making across various sectors, including Retail, Manufacturing, BFSI (Banking, Financial Services, and Insurance), and Government, fuels the ERP market's growth. Furthermore, the integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) into ERP systems is enhancing their capabilities and attracting a wider range of adopters. The preference for hybrid deployment models, combining on-premise and cloud solutions, also contributes to market expansion, allowing organizations to tailor their ERP infrastructure to their specific needs.

However, certain restraints exist. The high initial investment required for ERP implementation, particularly for large-scale deployments, can deter some businesses, especially SMBs. The complexity involved in integrating ERP systems with existing legacy systems also poses a challenge. Moreover, the need for skilled professionals to manage and maintain these sophisticated systems presents an ongoing hurdle. Despite these challenges, the North American ERP market is expected to continue its upward trajectory, driven by technological advancements, increasing digital transformation initiatives across industries, and the sustained need for streamlined business processes and enhanced data management. The major players, including Workday, SAP, Oracle, Microsoft, and others, continue to innovate and expand their offerings, further contributing to market growth and competitiveness. The significant presence of large enterprises in North America, coupled with a growing number of digitally-savvy SMBs, creates a robust market environment for continued ERP adoption and innovation.

North America ERP Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America ERP industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, leading players, and future growth projections. The North American ERP market, valued at xx Million in 2024, is poised for significant expansion, reaching xx Million by 2033, exhibiting a CAGR of xx%. This report is essential for navigating the complexities of this dynamic sector.

North America ERP Industry Market Dynamics & Concentration

The North American ERP market is characterized by a high degree of concentration, with a few major players commanding significant market share. Companies like SAP SE, Oracle Corporation, and Microsoft Corporation hold dominant positions, leveraging their extensive product portfolios and global reach. However, smaller niche players, such as Deacom Inc and Plex Systems Inc (Rockwell Automation Inc), cater to specific industry segments, driving innovation and competition.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2024.

- Innovation Drivers: Cloud adoption, AI integration, and the increasing demand for integrated solutions are key drivers.

- Regulatory Frameworks: Data privacy regulations (like GDPR and CCPA) and industry-specific compliance requirements shape the market landscape.

- Product Substitutes: While ERP systems are crucial, specialized software solutions for specific functions (e.g., CRM, supply chain management) can sometimes serve as substitutes.

- End-User Trends: The shift towards digital transformation, improved operational efficiency, and enhanced data analytics capabilities are shaping end-user demand.

- M&A Activities: The past five years have witnessed xx major mergers and acquisitions (M&A) deals, indicating a high level of consolidation within the industry. These deals aim to expand product portfolios, enhance market reach, and gain a competitive advantage.

North America ERP Industry Industry Trends & Analysis

The North American ERP market is experiencing robust growth, propelled by several key factors. The increasing adoption of cloud-based ERP solutions is a major trend, offering scalability, cost-effectiveness, and improved accessibility. Furthermore, the rising demand for data analytics and business intelligence features within ERP systems is driving market expansion. The integration of artificial intelligence (AI) and machine learning (ML) is revolutionizing ERP functionalities, leading to improved decision-making and enhanced automation. Competition is fierce, with established players and emerging startups vying for market share, creating an environment of continuous innovation. The market exhibits a significant preference for integrated solutions offering a comprehensive suite of functionalities, addressing the diverse needs of various industries.

Leading Markets & Segments in North America ERP Industry

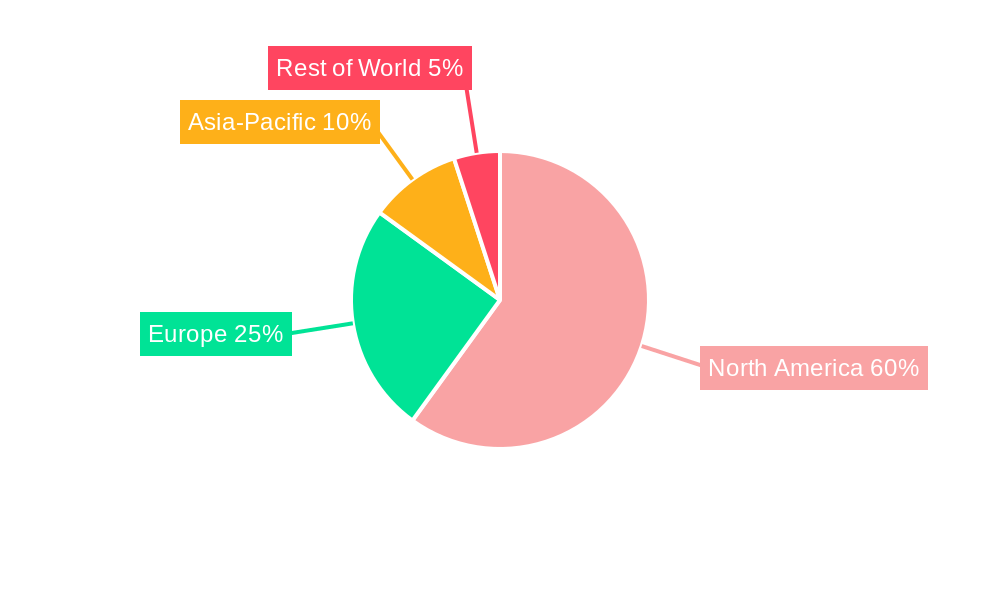

The Cloud segment dominates the North American ERP market by deployment type, with a market share exceeding xx% in 2024. Within applications, the Manufacturing and BFSI (Banking, Financial Services, and Insurance) sectors are leading adopters, due to their critical need for robust financial management and operational efficiency. Large Enterprises represent the largest segment by business size, driving significant demand for enterprise-grade ERP solutions. The United States constitutes the largest market within North America, followed by Canada.

- Key Drivers:

- Economic Policies: Government initiatives promoting digital transformation and technological advancements.

- Infrastructure: Robust digital infrastructure enabling cloud adoption and data connectivity.

- Dominance Analysis: The dominance of cloud deployment and the Manufacturing and BFSI sectors are driven by the need for scalability, enhanced data security, and improved operational efficiency. Large enterprises prioritize comprehensive solutions that integrate various business functions, leading to their strong presence in the market.

North America ERP Industry Product Developments

Recent product innovations focus on AI-powered analytics, enhanced user interfaces, and increased mobility. New applications are emerging that address specific industry needs, such as supply chain optimization and real-time inventory management. This focus on enhanced functionalities and improved user experience positions ERP systems as critical enablers of digital transformation. The integration of blockchain technology for enhanced security is an emerging trend.

Key Drivers of North America ERP Industry Growth

Several factors are driving the growth of the North American ERP industry:

- Technological Advancements: Cloud computing, AI, and mobile technology are transforming ERP systems, making them more accessible and efficient.

- Economic Growth: Strong economic conditions in North America fuel investments in IT infrastructure and business process optimization.

- Regulatory Compliance: Increasing regulatory requirements are driving the demand for robust ERP systems that ensure compliance.

Challenges in the North America ERP Industry Market

The market faces challenges, including:

- High Implementation Costs: ERP implementations can be expensive and time-consuming, posing a barrier to entry for small and medium-sized businesses.

- Integration Complexity: Integrating ERP systems with existing legacy systems can be complex and challenging.

- Data Security Concerns: Data breaches and security vulnerabilities pose a significant risk to businesses relying on ERP systems. The industry experiences an estimated xx Million dollars loss due to security breaches annually.

Emerging Opportunities in North America ERP Industry

Several opportunities exist for growth, including the expansion of cloud-based ERP solutions into new industries and the integration of cutting-edge technologies like AI and machine learning into ERP functionalities. Strategic partnerships between ERP vendors and other technology providers are opening up new market opportunities, creating a collaborative ecosystem.

Leading Players in the North America ERP Industry Sector

- Workday Inc

- Deacom Inc

- Infor Inc

- Plex Systems Inc (Rockwell Automation Inc)

- IBM Corporation

- Epicor Software Corporation

- FinancialForce com Inc

- Microsoft Corporation

- Oracle Corporation

- The Sage Group PLC

- Deltek Inc

- SAP SE

- Unit4 NV

Key Milestones in North America ERP Industry Industry

- October 2022: The city of Lancaster, California, adopts Tyler Technologies' Enterprise ERP solution, demonstrating the growing adoption of comprehensive ERP suites in the public sector.

- July 2022: Meridian Credit Union selects Oracle NetSuite, highlighting the increasing preference for cloud-based ERP solutions in the BFSI sector, indicating a shift towards digital transformation.

Strategic Outlook for North America ERP Industry Market

The future of the North American ERP industry is bright. Continued technological innovation, increasing cloud adoption, and growing demand from various sectors promise robust growth. Strategic partnerships, acquisitions, and a focus on industry-specific solutions will shape the market landscape. The expanding use of AI and machine learning within ERP systems will unlock new efficiencies and opportunities, driving market expansion further.

North America ERP Industry Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud

- 1.3. Hybrid

-

2. Size of Business

- 2.1. SMB's

- 2.2. Large Enterprises

-

3. Type

- 3.1. Mobile

- 3.2. Cloud

- 3.3. Social

- 3.4. Two-Tier

-

4. Application

- 4.1. Retail

- 4.2. Manufacturing

- 4.3. BFSI

- 4.4. Government

- 4.5. Telecom

- 4.6. Military and Defense

- 4.7. Education & Research

- 4.8. Transport & Logistics

- 4.9. Other End-user Industries

North America ERP Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America ERP Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.51% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Real Time Decision Making; Rapid Adoption of Cloud Based ERP Solutions

- 3.3. Market Restrains

- 3.3.1. Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. Cloud ERP To Be a Major Market Attraction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America ERP Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Size of Business

- 5.2.1. SMB's

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Mobile

- 5.3.2. Cloud

- 5.3.3. Social

- 5.3.4. Two-Tier

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Retail

- 5.4.2. Manufacturing

- 5.4.3. BFSI

- 5.4.4. Government

- 5.4.5. Telecom

- 5.4.6. Military and Defense

- 5.4.7. Education & Research

- 5.4.8. Transport & Logistics

- 5.4.9. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. United States North America ERP Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America ERP Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America ERP Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America ERP Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Workday Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Deacom Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Infor Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Plex Systems Inc (Rockwell Automation Inc )

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 IBM Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Epicor Software Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 FinancialForce com Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Microsoft Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Oracle Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 The Sage Group PLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Deltek Inc *List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 SAP SE

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Unit4 NV

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Workday Inc

List of Figures

- Figure 1: North America ERP Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America ERP Industry Share (%) by Company 2024

List of Tables

- Table 1: North America ERP Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America ERP Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: North America ERP Industry Revenue Million Forecast, by Size of Business 2019 & 2032

- Table 4: North America ERP Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 5: North America ERP Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: North America ERP Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: North America ERP Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America ERP Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America ERP Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America ERP Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America North America ERP Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North America ERP Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 13: North America ERP Industry Revenue Million Forecast, by Size of Business 2019 & 2032

- Table 14: North America ERP Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: North America ERP Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: North America ERP Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United States North America ERP Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada North America ERP Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico North America ERP Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America ERP Industry?

The projected CAGR is approximately 9.51%.

2. Which companies are prominent players in the North America ERP Industry?

Key companies in the market include Workday Inc, Deacom Inc, Infor Inc, Plex Systems Inc (Rockwell Automation Inc ), IBM Corporation, Epicor Software Corporation, FinancialForce com Inc, Microsoft Corporation, Oracle Corporation, The Sage Group PLC, Deltek Inc *List Not Exhaustive, SAP SE, Unit4 NV.

3. What are the main segments of the North America ERP Industry?

The market segments include Deployment, Size of Business, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Real Time Decision Making; Rapid Adoption of Cloud Based ERP Solutions.

6. What are the notable trends driving market growth?

Cloud ERP To Be a Major Market Attraction.

7. Are there any restraints impacting market growth?

Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

October 2022: The city of Lancaster, California, and Tyler Technologies, Inc. have agreed to use Tyler's Enterprise ERP solution suite, powered by Munis. The management of the city's finances, personnel, income and expenditures, enterprise assets, content management, and controlled detection and reaction will all be handled by Tyler's solutions for the city.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America ERP Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America ERP Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America ERP Industry?

To stay informed about further developments, trends, and reports in the North America ERP Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence