Key Insights

The United States borescope market, a segment of the broader global market exhibiting a 4.80% CAGR, is experiencing robust growth driven by increasing demand across diverse sectors. Key drivers include the expanding automotive, aerospace, and energy industries, all relying heavily on borescopes for preventative maintenance and non-destructive testing (NDT) to minimize downtime and ensure operational safety. Technological advancements, such as the introduction of flexible and video borescopes with enhanced imaging capabilities and improved maneuverability, are further fueling market expansion. The preference for minimally invasive inspection techniques across various applications, from engine inspection in automobiles to pipeline integrity checks in the oil and gas sector, continues to propel market growth. While the market faces some restraints, like the high initial investment cost for advanced borescope systems, these are outweighed by the significant long-term benefits of preventative maintenance and reduced repair costs. Segmentation analysis reveals strong demand for video borescopes due to their superior image quality and ease of use, while the 3mm to 6mm diameter segment dominates due to its suitability for a wide range of applications. Major players like Olympus America Inc and Waygate Technologies (Baker Hughes Company) are driving innovation and market competition. Given the strong growth trajectory and the continuous adoption of borescopes across various industries, the US market is poised for sustained expansion in the coming years.

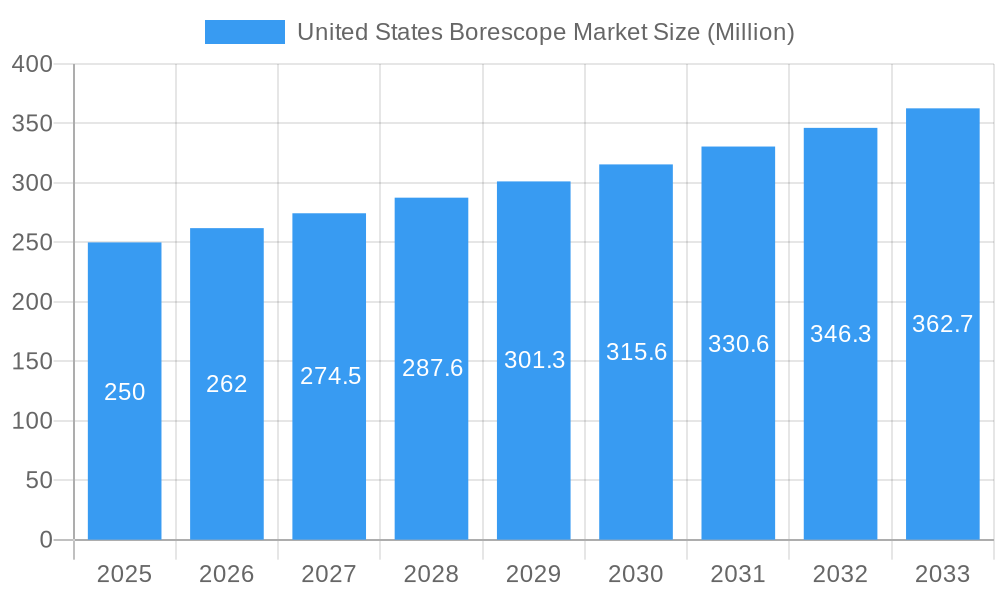

United States Borescope Market Market Size (In Million)

The US market's regional dominance within North America is likely driven by high technological adoption rates, a robust manufacturing base, and strong government regulations emphasizing safety and preventative maintenance. The high concentration of major players in the US further contributes to this market strength. Future growth projections depend significantly on continued investments in infrastructure and the sustained demand for preventative maintenance programs across major industries. The increasing adoption of advanced inspection techniques, paired with technological improvements such as improved image processing and wireless connectivity in borescopes, will continue to shape the landscape of the US borescope market. Further expansion is anticipated within segments like flexible borescopes owing to their accessibility in confined spaces and the rising adoption of remotely operated inspection vehicles (ROVs) for enhanced safety and efficiency.

United States Borescope Market Company Market Share

United States Borescope Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the United States borescope market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future growth prospects. The total market size is projected to reach xx Million by 2033.

United States Borescope Market Dynamics & Concentration

The United States borescope market is characterized by a moderately concentrated landscape, with several key players vying for market share. Market concentration is influenced by factors such as technological advancements, stringent regulatory frameworks, and the emergence of substitute technologies. The market is witnessing a gradual shift towards sophisticated video borescopes, driven by advancements in image processing and AI integration. Consolidation through mergers and acquisitions (M&A) is also observed, with xx M&A deals recorded in the past five years. Key players are focusing on enhancing product features and expanding into new application areas. The market share of the top five players is estimated at xx%.

- Innovation Drivers: Advancements in imaging technology, miniaturization, and AI integration.

- Regulatory Frameworks: Safety standards and regulations related to industrial inspection practices.

- Product Substitutes: Emerging non-destructive testing methods.

- End-User Trends: Growing demand from diverse sectors like automotive, aerospace, and energy.

- M&A Activities: Consolidation among market players, resulting in increased market concentration.

United States Borescope Market Industry Trends & Analysis

The U.S. borescope market exhibits a robust growth trajectory, fueled by rising demand across various industries. Technological disruptions, such as the integration of AI and advanced imaging capabilities, are transforming the market landscape. Consumers increasingly prefer high-resolution, user-friendly borescopes with enhanced features like remote operation and data analysis. The market is witnessing intense competition, with companies differentiating their offerings through innovative designs, superior image quality, and comprehensive service packages. The CAGR for the forecast period (2025-2033) is estimated at xx%, while market penetration in key sectors like oil & gas currently stands at xx%.

Leading Markets & Segments in United States Borescope Market

The automotive and oil & gas sectors currently dominate the U.S. borescope market, driven by stringent inspection requirements and the need for preventive maintenance. The video borescope segment holds the largest market share, followed by the flexible borescope segment. Within diameter categories, the 3mm to 6mm range is most popular. The 90° to 180° angle range dominates due to its versatility in accessing confined spaces.

- Key Drivers (Automotive): Stringent quality control, increasing vehicle complexity.

- Key Drivers (Oil & Gas): Regular pipeline inspections, safety regulations.

- Key Drivers (Manufacturing): Preventive maintenance, quality control in manufacturing processes.

- Dominance Analysis: Video borescopes are preferred for superior image quality and detailed inspection capabilities. The 3mm to 6mm diameter range caters to a wide range of applications, and the 90° to 180° angle range provides optimal access to various inspection locations.

United States Borescope Market Product Developments

Recent product innovations focus on enhancing image quality, increasing resolution, and integrating advanced features like AI-powered analysis and remote operation capabilities. Borescopes with smaller diameters, improved flexibility, and wider viewing angles are also gaining traction. These advancements cater to the need for more efficient and precise inspection in challenging environments, providing competitive advantages in terms of speed, accuracy, and data analysis.

Key Drivers of United States Borescope Market Growth

Technological advancements, increasing industrialization, stringent regulatory standards enforcing regular inspections, and the rising adoption of preventive maintenance practices across various sectors are driving market growth. The need for improved safety and efficiency in inspection processes, coupled with the development of sophisticated borescope technologies, further fuels market expansion.

Challenges in the United States Borescope Market Market

High initial investment costs associated with advanced borescope systems, the availability of substitute inspection technologies, and potential supply chain disruptions can hinder market growth. Competition from international manufacturers and the need for skilled technicians to operate and interpret borescope data also pose challenges. The overall impact of these restraints is estimated to limit market growth by approximately xx% during the forecast period.

Emerging Opportunities in United States Borescope Market

The integration of advanced technologies like AI, robotics, and augmented reality (AR) presents significant opportunities for innovation. Strategic collaborations and partnerships between borescope manufacturers and end-users can create new market segments and drive adoption. Expanding into new applications, particularly in emerging sectors like renewable energy and infrastructure development, offers considerable growth potential.

Leading Players in the United States Borescope Market Sector

- Titan Tool Supply Co

- Klein Tools Inc

- JME Technologies

- Olympus America Inc

- PCE Instruments

- SPI Borescopes LLC

- Lenox Instrument Company

- USA Borescopes

- ViewTech Borescopes

- Waygate Technologies (Baker Hughes Company)

- Gradient Lens Corporation

- Danatronics Corporation

Key Milestones in United States Borescope Market Industry

- April 2022: ViewTech Borescopes showcased its VJ-3 Video Borescope Inspection Technology at CastExpo 2022, exhibiting various models including VJ-3 Dual Camera, VJ-3 3.9mm, VJ-3 2.8mm, and VJ-3 2.2mm. This highlights the growing demand for advanced video borescopes.

- February 2022: Waygate Technology (Baker Hughes) upgraded its Everest Mentor Visual iQ (MViQ) VideoProbe with AI capabilities, enhancing remote visual inspection for sectors like petrochemicals, energy, and aerospace. This signifies a shift toward AI-powered inspection solutions.

Strategic Outlook for United States Borescope Market Market

The future of the U.S. borescope market is bright, driven by continuous technological advancements and increasing adoption across diverse industrial sectors. Companies that focus on innovation, strategic partnerships, and expanding into emerging applications are poised for significant growth. The market’s long-term potential lies in the integration of AI, robotics, and data analytics to create intelligent inspection systems.

United States Borescope Market Segmentation

-

1. Type

- 1.1. Video

- 1.2. Flexible

- 1.3. Endoscopes

- 1.4. Semi-rigid

- 1.5. Rigid

-

2. Diameter

- 2.1. 0 mm to 3 mm

- 2.2. 3 mm to 6 mm

- 2.3. 6 mm to 10 mm

- 2.4. Above 10 mm

-

3. Angle

- 3.1. 0° to 90°

- 3.2. 90° to 180°

- 3.3. 180° to 360°

-

4. End-Uer

- 4.1. Automotive

- 4.2. Aviation

- 4.3. Power Generation

- 4.4. Oil & Gas

- 4.5. Manufacturing

- 4.6. Chemicals

- 4.7. Food & Beverages

- 4.8. Pharmaceuticals

- 4.9. Mining and Construction

- 4.10. Other End-Users

United States Borescope Market Segmentation By Geography

- 1. United States

United States Borescope Market Regional Market Share

Geographic Coverage of United States Borescope Market

United States Borescope Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Need for Power Plant Maintenance Borescope; Increasing Requirement for High Operational Productivity

- 3.3. Market Restrains

- 3.3.1. Performance Limitations in Low Light and Extreme Operating Conditions

- 3.4. Market Trends

- 3.4.1. Aviation Sector to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Borescope Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Video

- 5.1.2. Flexible

- 5.1.3. Endoscopes

- 5.1.4. Semi-rigid

- 5.1.5. Rigid

- 5.2. Market Analysis, Insights and Forecast - by Diameter

- 5.2.1. 0 mm to 3 mm

- 5.2.2. 3 mm to 6 mm

- 5.2.3. 6 mm to 10 mm

- 5.2.4. Above 10 mm

- 5.3. Market Analysis, Insights and Forecast - by Angle

- 5.3.1. 0° to 90°

- 5.3.2. 90° to 180°

- 5.3.3. 180° to 360°

- 5.4. Market Analysis, Insights and Forecast - by End-Uer

- 5.4.1. Automotive

- 5.4.2. Aviation

- 5.4.3. Power Generation

- 5.4.4. Oil & Gas

- 5.4.5. Manufacturing

- 5.4.6. Chemicals

- 5.4.7. Food & Beverages

- 5.4.8. Pharmaceuticals

- 5.4.9. Mining and Construction

- 5.4.10. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Titan Tool Supply Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Klein Tools Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JME Technologies

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Olympus America Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PCE Instruments

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SPI Borescopes LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lenox Instrument Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 USA Borescopes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ViewTech Borescopes

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Waygate Technologies (Baker Hughes Company)*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Gradient Lens Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Danatronics Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Titan Tool Supply Co

List of Figures

- Figure 1: United States Borescope Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Borescope Market Share (%) by Company 2025

List of Tables

- Table 1: United States Borescope Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: United States Borescope Market Revenue undefined Forecast, by Diameter 2020 & 2033

- Table 3: United States Borescope Market Revenue undefined Forecast, by Angle 2020 & 2033

- Table 4: United States Borescope Market Revenue undefined Forecast, by End-Uer 2020 & 2033

- Table 5: United States Borescope Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: United States Borescope Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: United States Borescope Market Revenue undefined Forecast, by Diameter 2020 & 2033

- Table 8: United States Borescope Market Revenue undefined Forecast, by Angle 2020 & 2033

- Table 9: United States Borescope Market Revenue undefined Forecast, by End-Uer 2020 & 2033

- Table 10: United States Borescope Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Borescope Market?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the United States Borescope Market?

Key companies in the market include Titan Tool Supply Co, Klein Tools Inc, JME Technologies, Olympus America Inc, PCE Instruments, SPI Borescopes LLC, Lenox Instrument Company, USA Borescopes, ViewTech Borescopes, Waygate Technologies (Baker Hughes Company)*List Not Exhaustive, Gradient Lens Corporation, Danatronics Corporation.

3. What are the main segments of the United States Borescope Market?

The market segments include Type, Diameter, Angle, End-Uer.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Need for Power Plant Maintenance Borescope; Increasing Requirement for High Operational Productivity.

6. What are the notable trends driving market growth?

Aviation Sector to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Performance Limitations in Low Light and Extreme Operating Conditions.

8. Can you provide examples of recent developments in the market?

April 2022 - ViewTech Borescopes announced to showcase its VJ-3 Video Borescope Inspection Technology at CastExpo 2022. The company would exhibit borescopes, including a VJ-3 Dual Camera, VJ-3 3.9mm, VJ-3 2.8mm, and VJ-3 2.2mm.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Borescope Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Borescope Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Borescope Market?

To stay informed about further developments, trends, and reports in the United States Borescope Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence