Key Insights

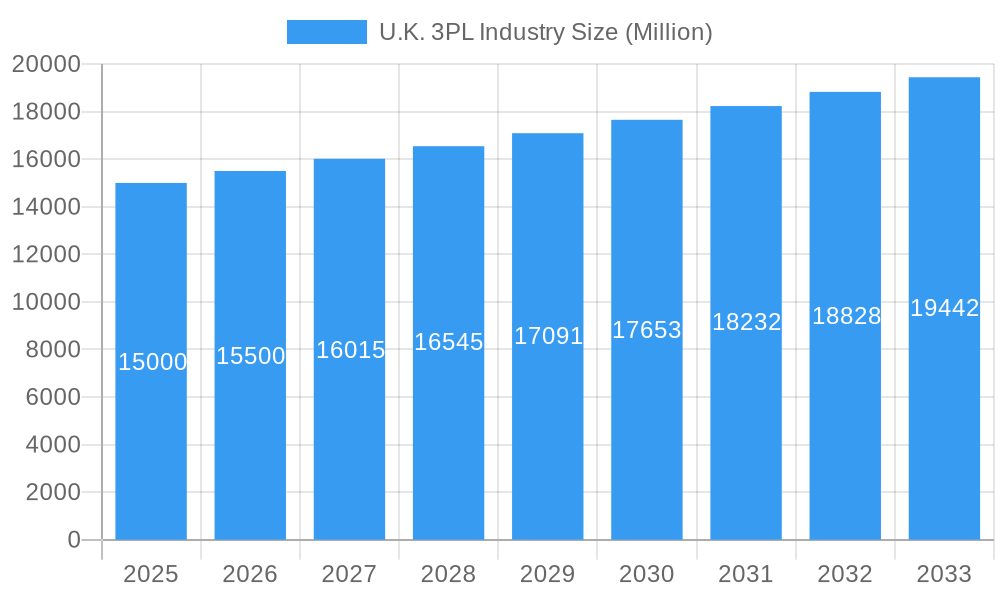

The United Kingdom's Third-Party Logistics (3PL) market, valued at approximately 21.2 billion in 2025, is poised for substantial expansion. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 0.3% from 2025 to 2033. This growth is propelled by the surge in e-commerce, escalating demand for optimized supply chain management, and a growing trend of businesses outsourcing logistics to enhance operational efficiency. Specialized services, including value-added warehousing and distribution within the pharmaceutical and healthcare sectors, are also key growth drivers. Significant expansion is evident across transportation management, both domestically and internationally, underscoring the UK's critical role in global trade. Key end-user industries contributing to market volume include automotive, manufacturing, and oil & gas. Persistent challenges, such as Brexit-related complexities, labor shortages, and volatile fuel prices, may influence growth trajectories. Nevertheless, the projected CAGR signals sustained market development, underpinned by the ongoing digitalization of supply chains and robust consumer demand.

U.K. 3PL Industry Market Size (In Billion)

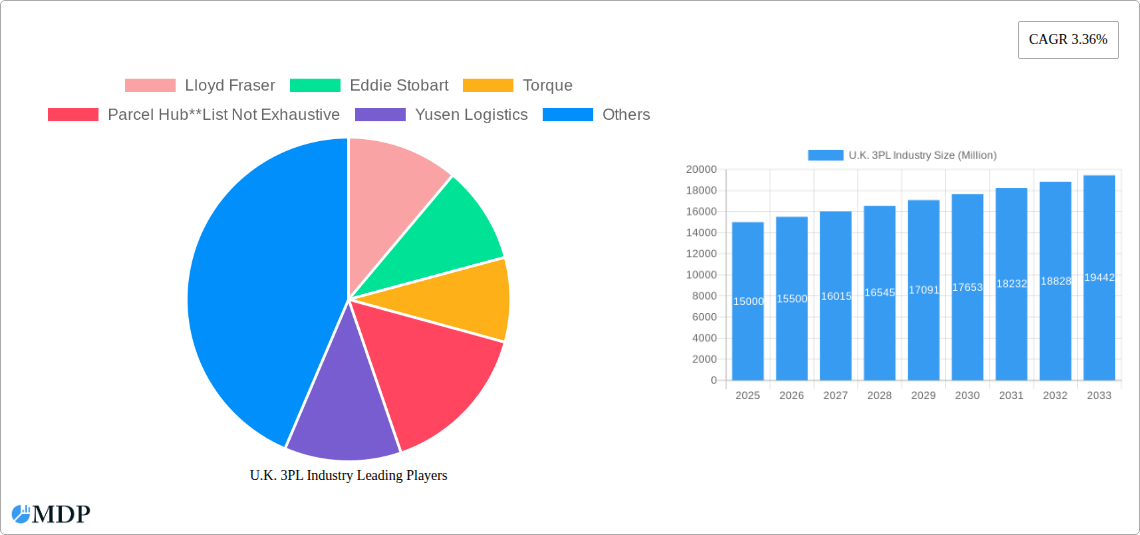

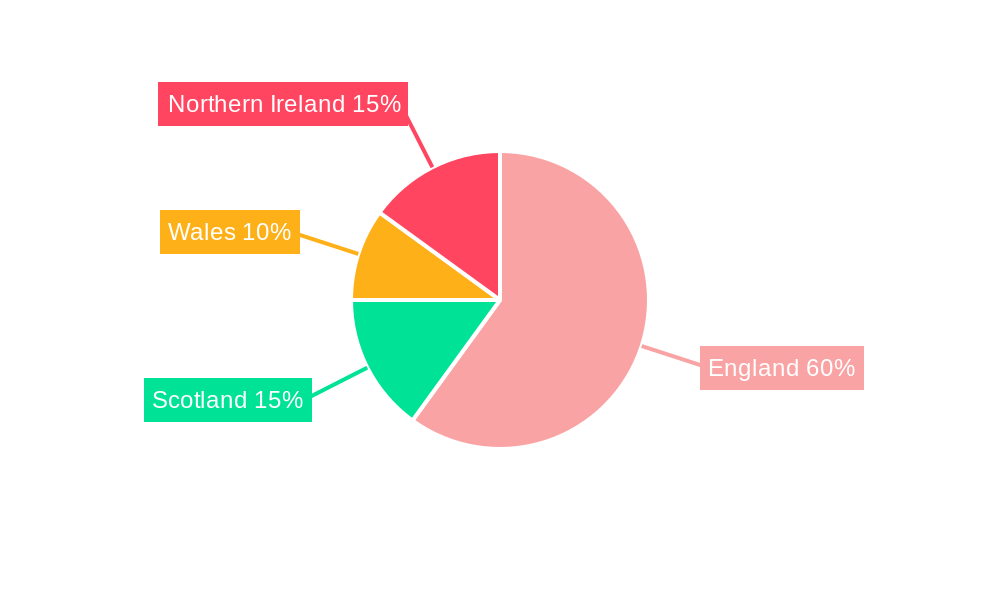

The competitive landscape features established multinational corporations (e.g., FedEx, DHL, Kuehne + Nagel) and specialized regional providers (e.g., Bibby Distribution, Parcel Hub). These companies are leveraging innovative technologies like AI-powered route optimization and advanced warehouse management systems to boost efficiency and secure a competitive advantage. The continuous expansion of e-commerce fuels the demand for effective last-mile delivery solutions, presenting opportunities for specialized 3PL providers. Future growth will likely be shaped by technological advancements in automation and an increasing emphasis on sustainable logistics practices. Industry consolidation is anticipated as larger entities seek to acquire smaller businesses, thereby expanding service portfolios and geographic presence. Regional variations within the UK market (England, Wales, Scotland, Northern Ireland) are expected to exhibit differing growth rates influenced by industrial concentration and infrastructure development.

U.K. 3PL Industry Company Market Share

U.K. 3PL Industry Market Report: 2019-2033 Forecast

This comprehensive report provides a deep dive into the dynamics of the U.K. 3PL (Third-Party Logistics) industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this analysis reveals market trends, leading players, and future opportunities within this rapidly evolving sector. The report leverages extensive data and analysis to present a clear picture of the U.K. 3PL landscape, enabling informed decision-making in this competitive market. Expect detailed breakdowns of market segments, key drivers, challenges, and strategic outlooks, all presented in an accessible and actionable format. The report covers £XX Million market size in 2025 and projects a CAGR of XX% from 2025 to 2033.

U.K. 3PL Industry Market Dynamics & Concentration

The U.K. 3PL market is characterized by a moderate level of concentration, with several large players dominating specific segments. Market share is fluid, with ongoing mergers and acquisitions (M&A) activity shaping the competitive landscape. Innovation, driven by technological advancements and evolving customer demands, is a significant driver of growth. Regulatory frameworks, including environmental regulations and data privacy laws, influence operational strategies and costs. Product substitutes, such as in-house logistics solutions, pose a challenge, while end-user trends, particularly the rise of e-commerce, fuel the demand for flexible and efficient 3PL services.

- Market Concentration: The top 5 players hold approximately XX% of the market share in 2025.

- M&A Activity: An estimated XX M&A deals were recorded between 2019 and 2024.

- Innovation Drivers: Automation, AI, and data analytics are transforming 3PL operations.

- Regulatory Landscape: Compliance with environmental regulations is a key operational consideration.

- End-User Trends: E-commerce growth is driving demand for last-mile delivery solutions.

U.K. 3PL Industry Industry Trends & Analysis

The U.K. 3PL industry is experiencing robust growth, driven by several key factors. The increasing prevalence of e-commerce necessitates efficient and scalable logistics solutions, fueling demand for 3PL services. Technological advancements, such as automation and data analytics, enhance operational efficiency and transparency. Changing consumer preferences, including faster delivery expectations and increased demand for omnichannel fulfillment, are reshaping the industry. Intense competition compels 3PL providers to continuously innovate and optimize their services to retain and attract clients. Market growth is further stimulated by robust investments in logistics infrastructure and supportive government policies.

- Market Growth Drivers: E-commerce boom, technological advancements, and infrastructure development.

- Technological Disruptions: Automation, AI, and real-time tracking are enhancing operational efficiency.

- Consumer Preferences: Faster delivery times and omnichannel fulfillment are key demands.

- Competitive Dynamics: Intense competition drives innovation and efficiency improvements.

Leading Markets & Segments in U.K. 3PL Industry

The Distributive Trade (wholesale and retail trade, including e-commerce) segment constitutes the largest end-user market for U.K. 3PL services in 2025, followed by Manufacturing and Automotive. Within services, Value-added Warehousing and Distribution represents the largest segment, driven by the need for specialized inventory management and value-added services like kitting and labeling. Growth is geographically diverse, with strong performance in major urban centers and logistical hubs across the U.K.

- Key Drivers for Distributive Trade: E-commerce growth, omnichannel fulfillment, and demand for fast delivery.

- Key Drivers for Manufacturing & Automotive: Just-in-time inventory management, supply chain optimization, and global sourcing.

- Key Drivers for Value-added Warehousing & Distribution: Demand for specialized services and increased inventory complexity.

U.K. 3PL Industry Product Developments

Significant product innovations include the adoption of automated guided vehicles (AGVs), warehouse management systems (WMS), and transportation management systems (TMS). These technologies enhance efficiency, accuracy, and traceability, providing competitive advantages. The integration of AI and machine learning is further optimizing routing, forecasting, and inventory management. These developments cater to the increasing demand for real-time visibility and optimized supply chain operations.

Key Drivers of U.K. 3PL Industry Growth

Technological advancements, such as automation and AI, are driving efficiency gains and reducing operational costs. The booming e-commerce sector fuels demand for reliable and scalable logistics solutions. Supportive government policies, including investments in infrastructure and logistics technology, are creating a favorable environment for growth.

Challenges in the U.K. 3PL Industry Market

The industry faces challenges such as driver shortages, impacting transportation reliability. Fluctuations in fuel prices and Brexit-related trade complexities add to operational costs and uncertainty. Intense competition necessitates continuous innovation and cost optimization to maintain profitability. These factors exert pressure on margins and require strategic adaptation from 3PL providers.

Emerging Opportunities in U.K. 3PL Industry

The integration of blockchain technology for enhanced supply chain transparency and security presents a significant opportunity. Strategic partnerships and collaborations offer avenues for growth and market expansion. The rising demand for sustainable logistics solutions opens doors for companies adopting eco-friendly practices.

Leading Players in the U.K. 3PL Industry Sector

- Lloyd Fraser

- Eddie Stobart

- Torque

- Parcel Hub

- Yusen Logistics

- Wincanton

- XPO Logistics

- FedEx

- CEVA Logistics

- Tarlu Ltd

- Kuehne Nagel

- Bibby Distribution

- United Parcel Service of America

- Xpediator

- Schenker Limited

- Pointbid Logistics Systems Ltd

- DHL Supply Chain

- Rhenus Logistics

Key Milestones in U.K. 3PL Industry Industry

- June 2023: Kuehne+Nagel's acquisition of Morgan Cargo expands its reach in perishable goods handling.

- February 2023: Wincanton secures a major contract with Wickes, solidifying its position in the home improvement sector.

Strategic Outlook for U.K. 3PL Industry Market

The U.K. 3PL market is poised for continued growth, driven by e-commerce expansion, technological innovation, and strategic partnerships. Companies that prioritize sustainable practices and embrace technological advancements will be best positioned to capitalize on future opportunities. The focus on enhancing supply chain resilience and efficiency will remain a key strategic priority.

U.K. 3PL Industry Segmentation

-

1. Services

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Oil & Gas and Chemicals

- 2.3. Distribu

- 2.4. Pharmaceuticals and Healthcare

- 2.5. Construction

- 2.6. Other End Users

U.K. 3PL Industry Segmentation By Geography

- 1. U.K.

U.K. 3PL Industry Regional Market Share

Geographic Coverage of U.K. 3PL Industry

U.K. 3PL Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government Initiatives4.; Increase of Trade

- 3.3. Market Restrains

- 3.3.1. 4.; Shortage of Labor

- 3.4. Market Trends

- 3.4.1. Growth in Logistics Parks and Fulfilment Centers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.K. 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil & Gas and Chemicals

- 5.2.3. Distribu

- 5.2.4. Pharmaceuticals and Healthcare

- 5.2.5. Construction

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. U.K.

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lloyd Fraser

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Eddie Stobart

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Torque

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Parcel Hub**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yusen Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wincanton

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 XPO Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FedEx

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CEVA Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tarlu Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kuehne Nagel

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Bibby Distribution

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 United Parcel Service of America

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Xpediator

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Schenker Limited

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Pointbid Logistics Systems Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 DHL Supply Chain

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Rhenus Logistics

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 Lloyd Fraser

List of Figures

- Figure 1: U.K. 3PL Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: U.K. 3PL Industry Share (%) by Company 2025

List of Tables

- Table 1: U.K. 3PL Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 2: U.K. 3PL Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: U.K. 3PL Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: U.K. 3PL Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 5: U.K. 3PL Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: U.K. 3PL Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.K. 3PL Industry?

The projected CAGR is approximately 0.3%.

2. Which companies are prominent players in the U.K. 3PL Industry?

Key companies in the market include Lloyd Fraser, Eddie Stobart, Torque, Parcel Hub**List Not Exhaustive, Yusen Logistics, Wincanton, XPO Logistics, FedEx, CEVA Logistics, Tarlu Ltd, Kuehne Nagel, Bibby Distribution, United Parcel Service of America, Xpediator, Schenker Limited, Pointbid Logistics Systems Ltd, DHL Supply Chain, Rhenus Logistics.

3. What are the main segments of the U.K. 3PL Industry?

The market segments include Services, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.2 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Initiatives4.; Increase of Trade.

6. What are the notable trends driving market growth?

Growth in Logistics Parks and Fulfilment Centers.

7. Are there any restraints impacting market growth?

4.; Shortage of Labor.

8. Can you provide examples of recent developments in the market?

June 2023: Kuehne+Nagel signed an agreement to acquire Morgan Cargo, a leading South African, UK and Kenyan freight forwarder specialised in the transport and handling of perishable goods. During 2022 the company handled more than 40,000 tonnes of air freight and more than 20,000 TEU of sea freight globally, managed by approximately 450 logistics experts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.K. 3PL Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.K. 3PL Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.K. 3PL Industry?

To stay informed about further developments, trends, and reports in the U.K. 3PL Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence