Key Insights

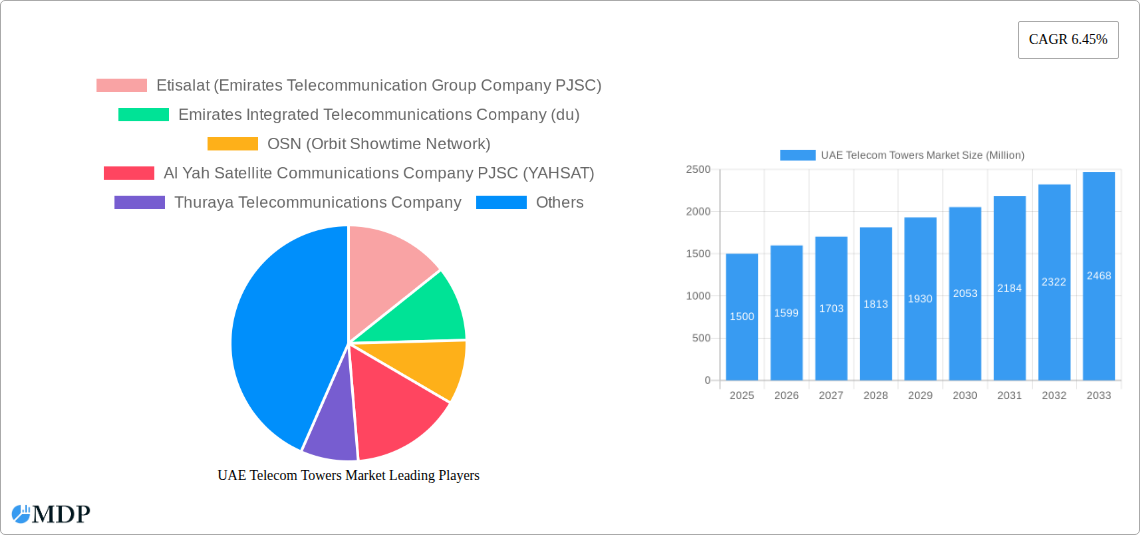

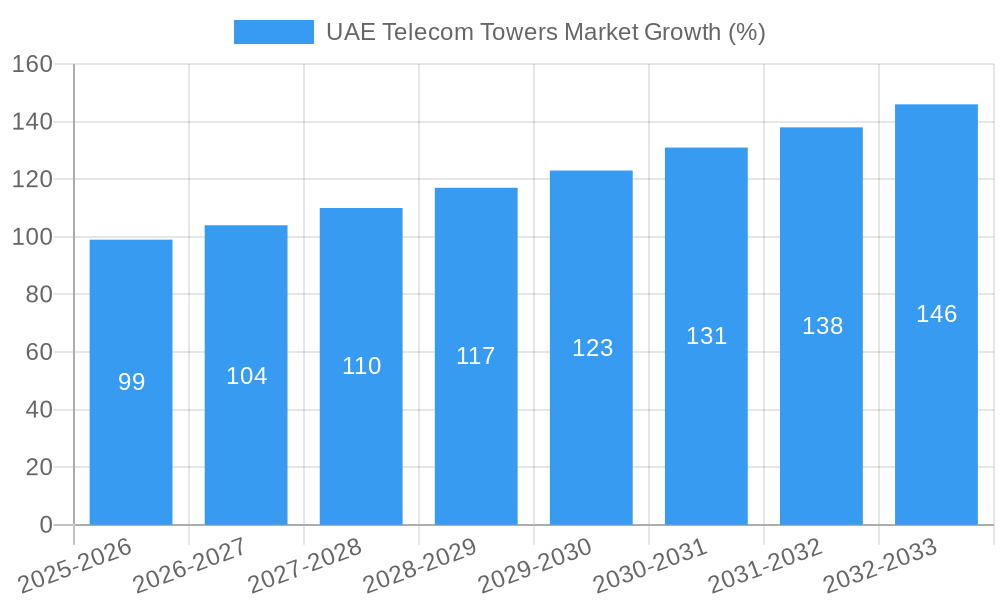

The UAE Telecom Towers market, exhibiting a robust CAGR of 6.45%, presents a significant investment opportunity. Driven by the increasing demand for high-speed data services, 5G network deployment, and the growing adoption of IoT devices, the market is poised for substantial growth. Key players such as Etisalat, du, and Yahsat are actively investing in infrastructure expansion to meet this surging demand. The market segmentation likely includes macro towers, small cells, and rooftop towers, each catering to specific network requirements. The rising urbanization and increasing population density in the UAE further fuel the need for strategically located telecom towers to ensure widespread network coverage and reliable connectivity. Competition among tower companies is expected to remain intense, driving innovation in tower infrastructure and deployment strategies. Regulatory frameworks focusing on efficient spectrum allocation and infrastructure sharing will also shape market dynamics in the coming years.

Over the forecast period (2025-2033), the market is projected to witness consistent expansion, fueled by ongoing investments in network modernization and expansion. The strategic partnerships between tower companies and mobile network operators will play a vital role in optimizing network performance and cost-efficiency. Furthermore, the increasing adoption of cloud-based solutions and virtualization technologies will contribute to the efficient management of telecom tower infrastructure. Challenges may include securing necessary permits and navigating land acquisition processes, along with ensuring environmental compliance in tower deployments. However, the long-term outlook for the UAE Telecom Towers market remains positive, with continuous growth expected throughout the forecast period driven by technological advancements and rising consumer demand for seamless connectivity.

UAE Telecom Towers Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UAE Telecom Towers Market, covering market dynamics, industry trends, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The report analyzes key players including Etisalat, du, OSN, YAHSAT, Thuraya Telecommunications Company, Helios Towers, IHS Towers, NXN Group, Inteltec Emirates, and Gulf Bridge International (GBI).

UAE Telecom Towers Market Dynamics & Concentration

The UAE telecom towers market exhibits a moderately concentrated landscape, dominated by a few major players alongside several smaller, specialized firms. Market share dynamics are influenced by factors such as network expansion plans by major telecom operators, the increasing demand for 5G infrastructure, and government initiatives to promote digitalization. Innovation is driven by the adoption of new technologies like smart towers, which integrate multiple functionalities, and the deployment of advanced antenna systems to enhance network capacity and coverage.

The regulatory framework, established primarily by the Telecommunications and Digital Government Regulatory Authority (TDRA), plays a critical role in shaping market behavior through licensing, spectrum allocation, and infrastructure development policies. While fiber optic cables represent a significant substitute for traditional tower-based infrastructure in certain segments, the need for high-capacity mobile broadband access continues to fuel tower deployment.

End-user trends, particularly the exponential rise in mobile data consumption and the proliferation of IoT devices, exert significant upward pressure on tower demand. Mergers and acquisitions (M&A) activities have played a role in market consolidation, with xx M&A deals recorded in the historical period (2019-2024), resulting in a market concentration ratio of xx%. Key players are continuously seeking strategic partnerships to expand their reach and enhance their technological capabilities.

UAE Telecom Towers Market Industry Trends & Analysis

The UAE telecom towers market exhibits robust growth, propelled by the country’s robust telecommunications infrastructure, accelerated adoption of 5G technology, and the government’s ambitious digital transformation agenda. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is underpinned by several factors: increasing mobile penetration rates, expanding 4G/5G coverage, and rising demand for data services.

Technological advancements, such as the deployment of small cells and distributed antenna systems (DAS), are transforming the industry. Consumer preferences for high-speed internet and seamless connectivity are driving investment in advanced tower infrastructure. The competitive landscape is characterized by intense competition amongst established players and the emergence of new entrants, leading to innovative service offerings and pricing strategies. Market penetration of 5G technology is expected to reach xx% by 2033, fueling further growth in the telecom tower sector. Furthermore, government investments in smart city initiatives and digital infrastructure projects are further stimulating demand.

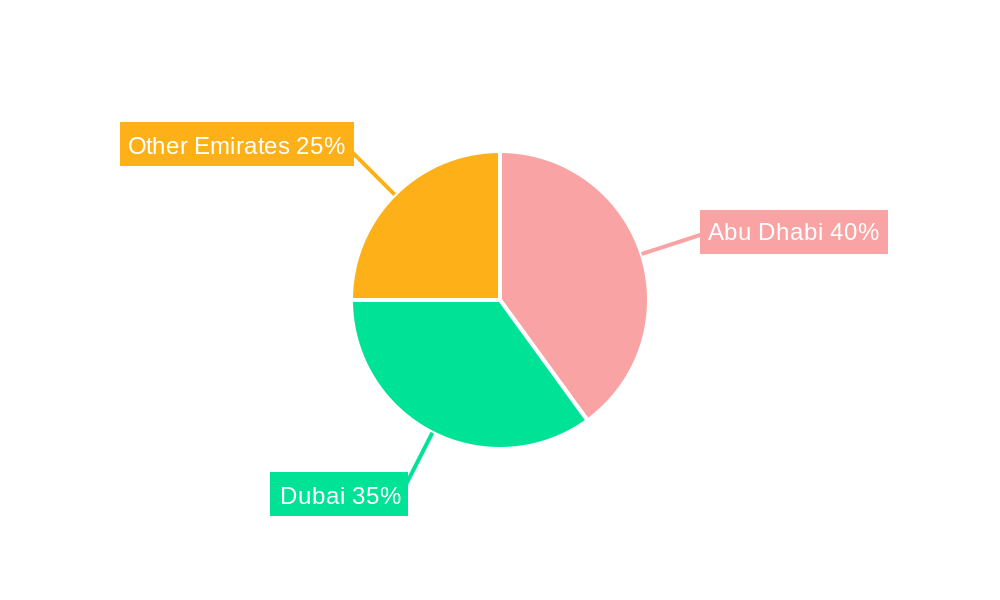

Leading Markets & Segments in UAE Telecom Towers Market

The UAE's urban centers, particularly Dubai and Abu Dhabi, represent the dominant markets for telecom towers due to high population density and concentrated business activity. These areas benefit from well-developed infrastructure and supportive government policies. Key drivers include:

- Robust economic growth: The UAE’s strong economy supports high levels of investment in telecommunications infrastructure.

- Government support for digital transformation: Initiatives aimed at promoting digitalization and smart city development drive demand for telecom towers.

- High mobile penetration and data usage: The UAE boasts a high mobile penetration rate and increasing data consumption, necessitating enhanced network capacity.

The dominance of urban areas is attributed to the concentration of businesses, residential areas, and high population density, creating significant demand for robust mobile connectivity. The market is segmented by tower type (macro, micro, small cells), technology (2G, 3G, 4G, 5G), and ownership (independent operators, telecom operators). Macrocell towers currently hold the largest market share, but the share of smaller cells and DAS deployments is steadily increasing, in line with the 5G rollout.

UAE Telecom Towers Market Product Developments

Recent product innovations focus on enhancing tower efficiency, capacity, and integration capabilities. The trend toward multi-tenant towers, which host multiple operators' equipment, is gaining momentum to improve resource utilization and lower costs. Smart towers, incorporating advanced power management, remote monitoring, and environmental sustainability features, are also gaining traction. These technological advancements optimize network performance, reduce operational costs, and enhance network resilience. The market is witnessing a gradual shift towards more energy-efficient and environmentally friendly solutions, aligning with global sustainability goals.

Key Drivers of UAE Telecom Towers Market Growth

Several factors fuel the growth of the UAE telecom towers market:

- 5G network deployment: The expansion of 5G infrastructure requires a significant increase in tower density to provide ubiquitous coverage.

- Rising mobile data consumption: Increased use of mobile devices and data-intensive applications drives demand for high-capacity networks.

- Government initiatives: Government support for digital transformation and smart city projects stimulates investment in telecom infrastructure.

- Growth of IoT: The increasing number of connected devices (IoT) necessitates robust network infrastructure, further driving tower construction.

Challenges in the UAE Telecom Towers Market

The UAE telecom towers market faces challenges such as:

- High initial investment costs: Constructing and maintaining telecom towers involves substantial upfront investment.

- Regulatory complexities: Obtaining permits and licenses can be a lengthy process, delaying deployment.

- Competition: The presence of several established and emerging players leads to intense competition.

- Site acquisition: Securing suitable locations for tower installation can be challenging due to land scarcity and environmental considerations.

Emerging Opportunities in UAE Telecom Towers Market

The UAE telecom towers market presents compelling long-term opportunities:

- Private 5G networks: The increasing adoption of private 5G networks in various industries creates new demand for specialized towers.

- Tower infrastructure sharing: Collaboration among operators and tower companies can optimize resource utilization and reduce costs.

- Integration of new technologies: Incorporating innovative technologies such as AI and IoT into tower infrastructure can enhance efficiency and performance.

- Expansion into underserved areas: Extending tower coverage to rural and remote areas presents significant growth potential.

Leading Players in the UAE Telecom Towers Market Sector

- Etisalat

- Emirates Integrated Telecommunications Company (du)

- OSN (Orbit Showtime Network)

- Al Yah Satellite Communications Company PJSC (YAHSAT)

- Thuraya Telecommunications Company

- Helios Towers

- IHS Towers

- NXN Group

- Inteltec Emirates

- Gulf Bridge International (GBI)

Key Milestones in UAE Telecom Towers Market Industry

- June 2024: The TDRA's USD 2.21 Million contribution to the ITU for upgrading global radiocommunication databases will streamline frequency allocation processes, potentially accelerating 5G deployment and influencing future tower infrastructure needs.

- May 2024: Sterlite Technologies' partnership with du for advanced optical fiber cables will enhance FTTH network performance, impacting the demand for towers supporting fiber backhaul infrastructure.

Strategic Outlook for UAE Telecom Towers Market Market

The UAE telecom towers market is poised for sustained growth, driven by increasing data demand, 5G expansion, and ongoing digital transformation initiatives. Strategic partnerships, technological innovation, and proactive regulatory measures will be crucial for players seeking to thrive in this competitive landscape. Opportunities exist in deploying next-generation technologies, optimizing tower infrastructure sharing, and expanding into emerging sectors like private 5G networks and IoT. The market's future success hinges on adapting to evolving technological advancements and effectively addressing regulatory and logistical challenges.

UAE Telecom Towers Market Segmentation

-

1. Ownership

- 1.1. Operator-owned

- 1.2. Private-owned

- 1.3. MNO Captive sites

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Fuel Type

- 3.1. Renewable

- 3.2. Non-renewable

UAE Telecom Towers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Telecom Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs

- 3.3. Market Restrains

- 3.3.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs

- 3.4. Market Trends

- 3.4.1. 5G Deployment to Address the Increasing Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Telecom Towers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator-owned

- 5.1.2. Private-owned

- 5.1.3. MNO Captive sites

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Renewable

- 5.3.2. Non-renewable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. North America UAE Telecom Towers Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Ownership

- 6.1.1. Operator-owned

- 6.1.2. Private-owned

- 6.1.3. MNO Captive sites

- 6.2. Market Analysis, Insights and Forecast - by Installation

- 6.2.1. Rooftop

- 6.2.2. Ground-based

- 6.3. Market Analysis, Insights and Forecast - by Fuel Type

- 6.3.1. Renewable

- 6.3.2. Non-renewable

- 6.1. Market Analysis, Insights and Forecast - by Ownership

- 7. South America UAE Telecom Towers Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Ownership

- 7.1.1. Operator-owned

- 7.1.2. Private-owned

- 7.1.3. MNO Captive sites

- 7.2. Market Analysis, Insights and Forecast - by Installation

- 7.2.1. Rooftop

- 7.2.2. Ground-based

- 7.3. Market Analysis, Insights and Forecast - by Fuel Type

- 7.3.1. Renewable

- 7.3.2. Non-renewable

- 7.1. Market Analysis, Insights and Forecast - by Ownership

- 8. Europe UAE Telecom Towers Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Ownership

- 8.1.1. Operator-owned

- 8.1.2. Private-owned

- 8.1.3. MNO Captive sites

- 8.2. Market Analysis, Insights and Forecast - by Installation

- 8.2.1. Rooftop

- 8.2.2. Ground-based

- 8.3. Market Analysis, Insights and Forecast - by Fuel Type

- 8.3.1. Renewable

- 8.3.2. Non-renewable

- 8.1. Market Analysis, Insights and Forecast - by Ownership

- 9. Middle East & Africa UAE Telecom Towers Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Ownership

- 9.1.1. Operator-owned

- 9.1.2. Private-owned

- 9.1.3. MNO Captive sites

- 9.2. Market Analysis, Insights and Forecast - by Installation

- 9.2.1. Rooftop

- 9.2.2. Ground-based

- 9.3. Market Analysis, Insights and Forecast - by Fuel Type

- 9.3.1. Renewable

- 9.3.2. Non-renewable

- 9.1. Market Analysis, Insights and Forecast - by Ownership

- 10. Asia Pacific UAE Telecom Towers Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Ownership

- 10.1.1. Operator-owned

- 10.1.2. Private-owned

- 10.1.3. MNO Captive sites

- 10.2. Market Analysis, Insights and Forecast - by Installation

- 10.2.1. Rooftop

- 10.2.2. Ground-based

- 10.3. Market Analysis, Insights and Forecast - by Fuel Type

- 10.3.1. Renewable

- 10.3.2. Non-renewable

- 10.1. Market Analysis, Insights and Forecast - by Ownership

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Etisalat (Emirates Telecommunication Group Company PJSC)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Emirates Integrated Telecommunications Company (du)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 OSN (Orbit Showtime Network)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Al Yah Satellite Communications Company PJSC (YAHSAT)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thuraya Telecommunications Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Helios Towers

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IHS Towers

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NXN Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inteltec Emirates

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Gulf Bridge International (GBI

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Etisalat (Emirates Telecommunication Group Company PJSC)

List of Figures

- Figure 1: Global UAE Telecom Towers Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America UAE Telecom Towers Market Revenue (Million), by Ownership 2024 & 2032

- Figure 3: North America UAE Telecom Towers Market Revenue Share (%), by Ownership 2024 & 2032

- Figure 4: North America UAE Telecom Towers Market Revenue (Million), by Installation 2024 & 2032

- Figure 5: North America UAE Telecom Towers Market Revenue Share (%), by Installation 2024 & 2032

- Figure 6: North America UAE Telecom Towers Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 7: North America UAE Telecom Towers Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 8: North America UAE Telecom Towers Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America UAE Telecom Towers Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America UAE Telecom Towers Market Revenue (Million), by Ownership 2024 & 2032

- Figure 11: South America UAE Telecom Towers Market Revenue Share (%), by Ownership 2024 & 2032

- Figure 12: South America UAE Telecom Towers Market Revenue (Million), by Installation 2024 & 2032

- Figure 13: South America UAE Telecom Towers Market Revenue Share (%), by Installation 2024 & 2032

- Figure 14: South America UAE Telecom Towers Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 15: South America UAE Telecom Towers Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 16: South America UAE Telecom Towers Market Revenue (Million), by Country 2024 & 2032

- Figure 17: South America UAE Telecom Towers Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe UAE Telecom Towers Market Revenue (Million), by Ownership 2024 & 2032

- Figure 19: Europe UAE Telecom Towers Market Revenue Share (%), by Ownership 2024 & 2032

- Figure 20: Europe UAE Telecom Towers Market Revenue (Million), by Installation 2024 & 2032

- Figure 21: Europe UAE Telecom Towers Market Revenue Share (%), by Installation 2024 & 2032

- Figure 22: Europe UAE Telecom Towers Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 23: Europe UAE Telecom Towers Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 24: Europe UAE Telecom Towers Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe UAE Telecom Towers Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East & Africa UAE Telecom Towers Market Revenue (Million), by Ownership 2024 & 2032

- Figure 27: Middle East & Africa UAE Telecom Towers Market Revenue Share (%), by Ownership 2024 & 2032

- Figure 28: Middle East & Africa UAE Telecom Towers Market Revenue (Million), by Installation 2024 & 2032

- Figure 29: Middle East & Africa UAE Telecom Towers Market Revenue Share (%), by Installation 2024 & 2032

- Figure 30: Middle East & Africa UAE Telecom Towers Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 31: Middle East & Africa UAE Telecom Towers Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 32: Middle East & Africa UAE Telecom Towers Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Middle East & Africa UAE Telecom Towers Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Asia Pacific UAE Telecom Towers Market Revenue (Million), by Ownership 2024 & 2032

- Figure 35: Asia Pacific UAE Telecom Towers Market Revenue Share (%), by Ownership 2024 & 2032

- Figure 36: Asia Pacific UAE Telecom Towers Market Revenue (Million), by Installation 2024 & 2032

- Figure 37: Asia Pacific UAE Telecom Towers Market Revenue Share (%), by Installation 2024 & 2032

- Figure 38: Asia Pacific UAE Telecom Towers Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 39: Asia Pacific UAE Telecom Towers Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 40: Asia Pacific UAE Telecom Towers Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific UAE Telecom Towers Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UAE Telecom Towers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UAE Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 3: Global UAE Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 4: Global UAE Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: Global UAE Telecom Towers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global UAE Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 7: Global UAE Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 8: Global UAE Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 9: Global UAE Telecom Towers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Canada UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Mexico UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global UAE Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 14: Global UAE Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 15: Global UAE Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 16: Global UAE Telecom Towers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of South America UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global UAE Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 21: Global UAE Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 22: Global UAE Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 23: Global UAE Telecom Towers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Kingdom UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Germany UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: France UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Italy UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Russia UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Benelux UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Nordics UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Europe UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global UAE Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 34: Global UAE Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 35: Global UAE Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 36: Global UAE Telecom Towers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Turkey UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Israel UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: GCC UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: North Africa UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: South Africa UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Middle East & Africa UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global UAE Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 44: Global UAE Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 45: Global UAE Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 46: Global UAE Telecom Towers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Telecom Towers Market?

The projected CAGR is approximately 6.45%.

2. Which companies are prominent players in the UAE Telecom Towers Market?

Key companies in the market include Etisalat (Emirates Telecommunication Group Company PJSC), Emirates Integrated Telecommunications Company (du), OSN (Orbit Showtime Network), Al Yah Satellite Communications Company PJSC (YAHSAT), Thuraya Telecommunications Company, Helios Towers, IHS Towers, NXN Group, Inteltec Emirates, Gulf Bridge International (GBI.

3. What are the main segments of the UAE Telecom Towers Market?

The market segments include Ownership, Installation, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs.

6. What are the notable trends driving market growth?

5G Deployment to Address the Increasing Market Demand.

7. Are there any restraints impacting market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs.

8. Can you provide examples of recent developments in the market?

June 2024: The UAE's Telecommunications and Digital Government Regulatory Authority (TDRA) pledged a voluntary contribution of CHF 1.9 million (USD 2.21 million) to the International Telecommunication Union (ITU). This contribution stems from a surplus in the budget allocated for WRC-23, held in Dubai, UAE, late last year in 2023. The ITU plans to utilize these funds to refresh global radiocommunication databases and enhance the software applications and tools offered by the ITU Radiocommunication Bureau (BR). These upgrades will aid countries globally in applying for radio frequency assignments, aligning with the newly revised Radio Regulations (2024 Version).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Telecom Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Telecom Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Telecom Towers Market?

To stay informed about further developments, trends, and reports in the UAE Telecom Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence