Key Insights

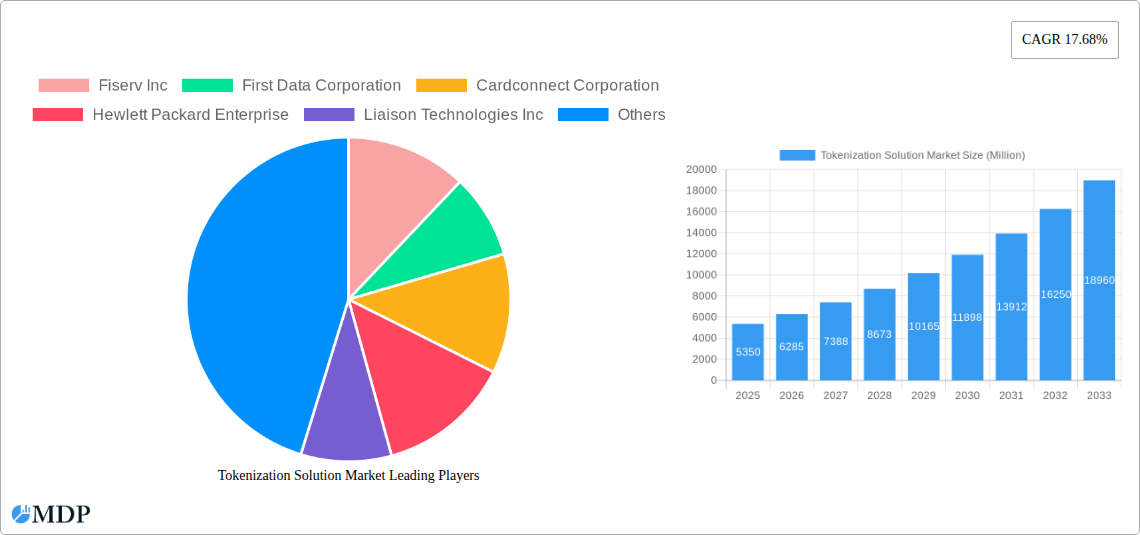

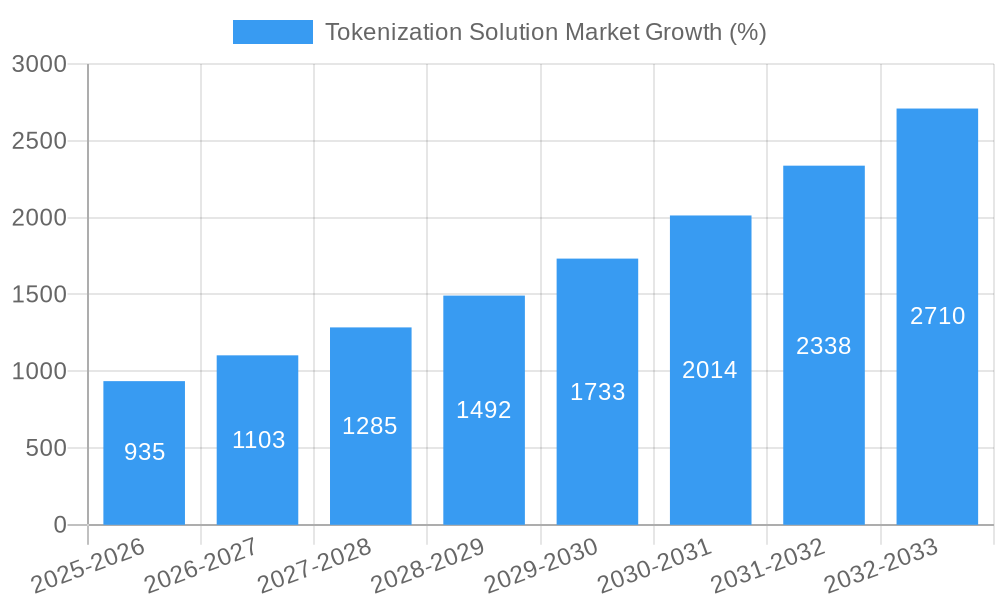

The Tokenization Solution Market is experiencing robust growth, projected to reach a market size of $5.35 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 17.68% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing concerns around data security and privacy breaches across various sectors, from BFSI and healthcare to retail and e-commerce, are driving the adoption of tokenization as a robust security measure. The rising popularity of cloud computing and the growing demand for secure payment processing further contribute to the market's growth. Furthermore, the expanding regulatory landscape, particularly around data protection and compliance (like GDPR and CCPA), necessitates the implementation of secure data handling practices like tokenization, creating significant market opportunities. The market is segmented by type (Solutions and Services), deployment (On-Premise and Cloud), and end-user industry (Retail & E-commerce, Transportation & Logistics, BFSI, IT & Telecommunications, Healthcare, Government, Energy & Utilities, and Other). The cloud deployment segment is expected to show faster growth due to its scalability and cost-effectiveness. The BFSI sector currently dominates market share but significant growth is expected from the healthcare and retail sectors due to rising digitalization and increased data sensitivity. Competitive dynamics are shaped by established players like Fiserv, First Data, and Thales, alongside emerging technology providers. The market's continued expansion is anticipated due to the escalating need for robust data security solutions and the increasing adoption of digital transformation initiatives across various industries.

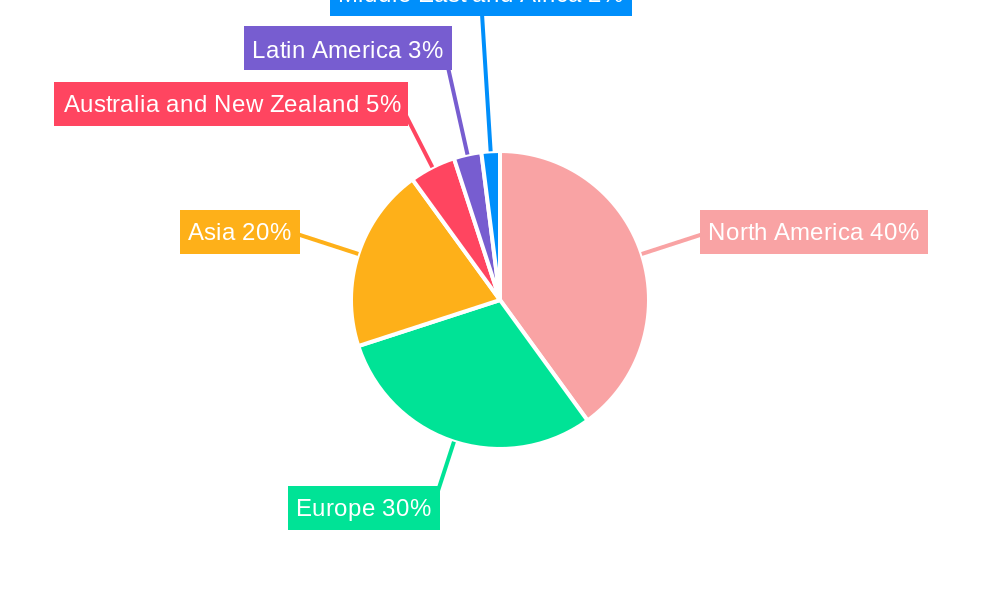

The geographical distribution of the Tokenization Solution Market reveals a strong presence in North America, driven by early adoption and stringent data privacy regulations. Europe is also a significant market, with similar regulatory pressures and a robust technology infrastructure. The Asia-Pacific region, particularly China and India, is expected to witness substantial growth in the coming years, fueled by rapid digitalization and the expanding e-commerce sector. While current market data might not fully reflect future trends, projections based on the existing CAGR of 17.68% indicate a significant increase in market value over the forecast period, suggesting continued high demand for tokenization solutions. The presence of several established players and new entrants indicates a dynamic and competitive landscape that is continuously innovating and improving tokenization technologies to meet evolving security needs.

Tokenization Solution Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Tokenization Solution Market, offering invaluable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and growth opportunities. The market is segmented by type (Solutions, Services), deployment (On-Premise, Cloud), and end-user industry (Retail & E-commerce, Transportation & Logistics, BFSI, IT & Telecommunications, Healthcare, Government, Energy & Utilities, Other End-User Industries). Key players analyzed include Fiserv Inc, First Data Corporation, Cardconnect Corporation, Hewlett Packard Enterprise, Liaison Technologies Inc, Thales Group, Ciphercloud Incorporation, Broadcom Inc, Paymetric Inc (A Worldpay Company), Cybersource Corporation, Protegrity USA Inc, 3delta Systems Inc, and Tokenex LLC (list not exhaustive). The report projects a market valued at xx Million by 2025, experiencing significant growth throughout the forecast period.

Tokenization Solution Market Dynamics & Concentration

The Tokenization Solution Market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the market is witnessing increased competition from emerging startups and technology providers. Innovation in blockchain technology, coupled with increasing regulatory clarity in certain jurisdictions, are key drivers. The market is also influenced by the availability of substitute solutions, evolving end-user preferences (particularly towards cloud-based solutions), and a growing number of mergers and acquisitions (M&A) activities. Between 2019 and 2024, there were approximately xx M&A deals, indicating a consolidated market.

- Market Concentration: The top 5 players hold an estimated xx% of the market share in 2025.

- Innovation Drivers: Blockchain technology advancements, improved security protocols, and rising demand for data privacy solutions.

- Regulatory Frameworks: Varying regulatory landscapes across different regions impact market adoption and growth.

- Product Substitutes: Traditional security and data management solutions represent potential substitutes.

- End-User Trends: Increasing preference for cloud-based solutions and growing adoption of tokenization across various sectors.

- M&A Activities: The number of M&A deals is expected to increase in the forecast period, driven by consolidation and expansion strategies.

Tokenization Solution Market Industry Trends & Analysis

The Tokenization Solution Market is experiencing robust growth, driven by the increasing adoption of blockchain technology across various sectors. The compound annual growth rate (CAGR) is estimated to be xx% during the forecast period (2025-2033). This growth is fueled by several factors, including the rising need for enhanced data security, the demand for improved operational efficiency, and the increasing focus on regulatory compliance. Technological disruptions, such as advancements in blockchain and cryptography, are further accelerating market expansion. Consumer preference is shifting towards secure and transparent solutions, leading to increased adoption of tokenization across multiple industries. Competitive dynamics are characterized by both established players and emerging startups vying for market share, resulting in innovation and price competition. Market penetration is expected to reach xx% by 2033, indicating substantial growth potential.

Leading Markets & Segments in Tokenization Solution Market

The North American region is projected to dominate the Tokenization Solution Market throughout the forecast period. This dominance stems from early adoption of blockchain technology, robust regulatory frameworks (in specific areas), and high technological maturity. Within the segment breakdown, the cloud deployment model shows rapid growth, exceeding the on-premise segment due to scalability, cost-effectiveness, and accessibility advantages. The BFSI and Retail & E-commerce sectors lead in terms of end-user adoption, driven by the need for secure transactions and data management.

- Key Drivers in North America: Strong technological infrastructure, government initiatives promoting digital transformation, and high consumer adoption rate.

- Cloud Deployment Dominance: Increased flexibility, cost-effectiveness, and ease of scalability are key factors.

- BFSI and Retail & E-commerce Leadership: High transaction volumes and data sensitivity drive demand for secure tokenization solutions.

- European Market Growth: Increasing regulatory compliance requirements and rising awareness of data security concerns contribute to the region's growth.

Tokenization Solution Market Product Developments

Recent product developments focus on integrating advanced security features, enhancing interoperability with existing systems, and improving user experience. New solutions are emphasizing the scalability and efficiency of tokenization processes, while simultaneously addressing concerns related to data privacy and regulatory compliance. The market is witnessing the integration of AI and machine learning capabilities to improve the accuracy and efficiency of tokenization operations. These advancements cater to the growing demand for robust, secure, and user-friendly tokenization solutions across diverse industries.

Key Drivers of Tokenization Solution Market Growth

The Tokenization Solution Market's growth is driven by several factors: the increasing need for secure and efficient data management, the rising adoption of blockchain technology, and the growing demand for improved regulatory compliance in various industries. Furthermore, technological advancements such as AI and improved encryption algorithms are enhancing the capabilities and security of tokenization solutions. The expansion of tokenization into new sectors, coupled with supportive government policies and initiatives, accelerates market growth. For example, the increased focus on ESG reporting is driving demand for solutions capable of tracking and verifying carbon credits.

Challenges in the Tokenization Solution Market

The Tokenization Solution Market faces several challenges, including the complexity of regulatory landscapes across different geographies. This can lead to uncertainty and hinder market adoption. Integration issues with existing systems and the lack of interoperability across different platforms also pose significant obstacles. Furthermore, the security of the blockchain itself and potential vulnerabilities represent a challenge, alongside the need for skilled workforce and talent shortage in the blockchain area which limits development and deployment. The market is estimated to lose approximately xx Million annually due to integration challenges and regulatory uncertainty.

Emerging Opportunities in Tokenization Solution Market

The future of the Tokenization Solution Market holds significant opportunities. The increasing adoption of blockchain technology in diverse sectors, coupled with the development of innovative solutions, promises further market expansion. Strategic partnerships between technology providers and industry-specific organizations can drive adoption and integration. The expansion of tokenization solutions into new areas, such as supply chain management, intellectual property rights management, and digital identity verification, presents promising avenues for growth. New applications of tokenization are expected to boost the market by xx Million annually in the coming decade.

Leading Players in the Tokenization Solution Market Sector

- Fiserv Inc

- First Data Corporation

- Cardconnect Corporation

- Hewlett Packard Enterprise

- Liaison Technologies Inc

- Thales Group

- Ciphercloud Incorporation

- Broadcom Inc

- Paymetric Inc (A Worldpay Company)

- Cybersource Corporation

- Protegrity USA Inc

- 3delta Systems Inc

- Tokenex LLC

Key Milestones in Tokenization Solution Market Industry

- May 2023: EY launched EY OpsChain ESG, a tokenization-based solution for carbon footprint management on the Ethereum blockchain. This demonstrates the growing application of tokenization in ESG reporting.

- April 2022: Newrl introduced tokenized equity alternatives for unlisted firms in India, marking a significant step towards enhancing liquidity and governance in the startup ecosystem.

Strategic Outlook for Tokenization Solution Market

The Tokenization Solution Market is poised for significant growth, driven by technological innovation, increased regulatory clarity, and expanding adoption across various sectors. Strategic partnerships, focused R&D, and the development of user-friendly solutions will be crucial for success. Companies focusing on interoperability, scalability, and security will be well-positioned to capture market share. The market's future potential is substantial, and strategic players can leverage this opportunity for significant expansion and profitability.

Tokenization Solution Market Segmentation

-

1. Type

- 1.1. Solutions

- 1.2. Services

-

2. Deployment

- 2.1. On-Premise

- 2.2. Cloud

-

3. End-User Industry

- 3.1. Retail & E-commerce

- 3.2. Transportation & Logistics

- 3.3. BFSI

- 3.4. IT & Telecommunications

- 3.5. Healthcare

- 3.6. Government

- 3.7. Energy & Utilities

- 3.8. Other End-User Industries

Tokenization Solution Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. India

- 4. Australia and New Zealand

-

5. Latin America

- 5.1. Brazil

- 5.2. Mexico

- 5.3. Argentina

- 6. Middle East

-

7. United Arab Emirates

- 7.1. Saudi Arabia

- 7.2. South Africa

Tokenization Solution Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.68% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Secure Payment Gateways; Rising Adoption in E-commerce and Mobile payments; Growing Government Regulations On Data Security

- 3.3. Market Restrains

- 3.3.1. Addressing Vulnerabilities From EMV Standards; Lack of Awareness Due to Similar Products

- 3.4. Market Trends

- 3.4.1. BFSI to hold the largest market size

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tokenization Solution Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solutions

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-Premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Retail & E-commerce

- 5.3.2. Transportation & Logistics

- 5.3.3. BFSI

- 5.3.4. IT & Telecommunications

- 5.3.5. Healthcare

- 5.3.6. Government

- 5.3.7. Energy & Utilities

- 5.3.8. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East

- 5.4.7. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Tokenization Solution Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solutions

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. On-Premise

- 6.2.2. Cloud

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Retail & E-commerce

- 6.3.2. Transportation & Logistics

- 6.3.3. BFSI

- 6.3.4. IT & Telecommunications

- 6.3.5. Healthcare

- 6.3.6. Government

- 6.3.7. Energy & Utilities

- 6.3.8. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Tokenization Solution Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solutions

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. On-Premise

- 7.2.2. Cloud

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Retail & E-commerce

- 7.3.2. Transportation & Logistics

- 7.3.3. BFSI

- 7.3.4. IT & Telecommunications

- 7.3.5. Healthcare

- 7.3.6. Government

- 7.3.7. Energy & Utilities

- 7.3.8. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Tokenization Solution Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solutions

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. On-Premise

- 8.2.2. Cloud

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Retail & E-commerce

- 8.3.2. Transportation & Logistics

- 8.3.3. BFSI

- 8.3.4. IT & Telecommunications

- 8.3.5. Healthcare

- 8.3.6. Government

- 8.3.7. Energy & Utilities

- 8.3.8. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Tokenization Solution Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solutions

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. On-Premise

- 9.2.2. Cloud

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Retail & E-commerce

- 9.3.2. Transportation & Logistics

- 9.3.3. BFSI

- 9.3.4. IT & Telecommunications

- 9.3.5. Healthcare

- 9.3.6. Government

- 9.3.7. Energy & Utilities

- 9.3.8. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Tokenization Solution Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Solutions

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. On-Premise

- 10.2.2. Cloud

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Retail & E-commerce

- 10.3.2. Transportation & Logistics

- 10.3.3. BFSI

- 10.3.4. IT & Telecommunications

- 10.3.5. Healthcare

- 10.3.6. Government

- 10.3.7. Energy & Utilities

- 10.3.8. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East Tokenization Solution Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Solutions

- 11.1.2. Services

- 11.2. Market Analysis, Insights and Forecast - by Deployment

- 11.2.1. On-Premise

- 11.2.2. Cloud

- 11.3. Market Analysis, Insights and Forecast - by End-User Industry

- 11.3.1. Retail & E-commerce

- 11.3.2. Transportation & Logistics

- 11.3.3. BFSI

- 11.3.4. IT & Telecommunications

- 11.3.5. Healthcare

- 11.3.6. Government

- 11.3.7. Energy & Utilities

- 11.3.8. Other End-User Industries

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. United Arab Emirates Tokenization Solution Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Solutions

- 12.1.2. Services

- 12.2. Market Analysis, Insights and Forecast - by Deployment

- 12.2.1. On-Premise

- 12.2.2. Cloud

- 12.3. Market Analysis, Insights and Forecast - by End-User Industry

- 12.3.1. Retail & E-commerce

- 12.3.2. Transportation & Logistics

- 12.3.3. BFSI

- 12.3.4. IT & Telecommunications

- 12.3.5. Healthcare

- 12.3.6. Government

- 12.3.7. Energy & Utilities

- 12.3.8. Other End-User Industries

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. North America Tokenization Solution Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United States

- 13.1.2 Canada

- 14. Europe Tokenization Solution Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 United Kingdom

- 14.1.2 Germany

- 14.1.3 France

- 15. Asia Tokenization Solution Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 China

- 15.1.2 India

- 16. Australia and New Zealand Tokenization Solution Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Latin America Tokenization Solution Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 Brazil

- 17.1.2 Mexico

- 17.1.3 Argentina

- 18. Middle East Tokenization Solution Market Analysis, Insights and Forecast, 2019-2031

- 18.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 18.1.1.

- 19. United Arab Emirates Tokenization Solution Market Analysis, Insights and Forecast, 2019-2031

- 19.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 19.1.1 Saudi Arabia

- 19.1.2 South Africa

- 20. Competitive Analysis

- 20.1. Global Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Fiserv Inc

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 First Data Corporation

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Cardconnect Corporation

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Hewlett Packard Enterprise

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Liaison Technologies Inc

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Thales Group

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Ciphercloud Incorporation

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Broadcom Inc

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Paymetric Inc (A Worldpay Company)

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 Cybersource Corporation

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.11 Protegrity USA Inc

- 20.2.11.1. Overview

- 20.2.11.2. Products

- 20.2.11.3. SWOT Analysis

- 20.2.11.4. Recent Developments

- 20.2.11.5. Financials (Based on Availability)

- 20.2.12 3delta Systems Inc

- 20.2.12.1. Overview

- 20.2.12.2. Products

- 20.2.12.3. SWOT Analysis

- 20.2.12.4. Recent Developments

- 20.2.12.5. Financials (Based on Availability)

- 20.2.13 Tokenex LLC*List Not Exhaustive

- 20.2.13.1. Overview

- 20.2.13.2. Products

- 20.2.13.3. SWOT Analysis

- 20.2.13.4. Recent Developments

- 20.2.13.5. Financials (Based on Availability)

- 20.2.1 Fiserv Inc

List of Figures

- Figure 1: Global Tokenization Solution Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Tokenization Solution Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Tokenization Solution Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Tokenization Solution Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Tokenization Solution Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Tokenization Solution Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Tokenization Solution Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Tokenization Solution Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Tokenization Solution Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Tokenization Solution Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Tokenization Solution Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East Tokenization Solution Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East Tokenization Solution Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: United Arab Emirates Tokenization Solution Market Revenue (Million), by Country 2024 & 2032

- Figure 15: United Arab Emirates Tokenization Solution Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: North America Tokenization Solution Market Revenue (Million), by Type 2024 & 2032

- Figure 17: North America Tokenization Solution Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: North America Tokenization Solution Market Revenue (Million), by Deployment 2024 & 2032

- Figure 19: North America Tokenization Solution Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 20: North America Tokenization Solution Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 21: North America Tokenization Solution Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 22: North America Tokenization Solution Market Revenue (Million), by Country 2024 & 2032

- Figure 23: North America Tokenization Solution Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Tokenization Solution Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Europe Tokenization Solution Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Europe Tokenization Solution Market Revenue (Million), by Deployment 2024 & 2032

- Figure 27: Europe Tokenization Solution Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 28: Europe Tokenization Solution Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 29: Europe Tokenization Solution Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 30: Europe Tokenization Solution Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Tokenization Solution Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Asia Tokenization Solution Market Revenue (Million), by Type 2024 & 2032

- Figure 33: Asia Tokenization Solution Market Revenue Share (%), by Type 2024 & 2032

- Figure 34: Asia Tokenization Solution Market Revenue (Million), by Deployment 2024 & 2032

- Figure 35: Asia Tokenization Solution Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 36: Asia Tokenization Solution Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 37: Asia Tokenization Solution Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 38: Asia Tokenization Solution Market Revenue (Million), by Country 2024 & 2032

- Figure 39: Asia Tokenization Solution Market Revenue Share (%), by Country 2024 & 2032

- Figure 40: Australia and New Zealand Tokenization Solution Market Revenue (Million), by Type 2024 & 2032

- Figure 41: Australia and New Zealand Tokenization Solution Market Revenue Share (%), by Type 2024 & 2032

- Figure 42: Australia and New Zealand Tokenization Solution Market Revenue (Million), by Deployment 2024 & 2032

- Figure 43: Australia and New Zealand Tokenization Solution Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 44: Australia and New Zealand Tokenization Solution Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 45: Australia and New Zealand Tokenization Solution Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 46: Australia and New Zealand Tokenization Solution Market Revenue (Million), by Country 2024 & 2032

- Figure 47: Australia and New Zealand Tokenization Solution Market Revenue Share (%), by Country 2024 & 2032

- Figure 48: Latin America Tokenization Solution Market Revenue (Million), by Type 2024 & 2032

- Figure 49: Latin America Tokenization Solution Market Revenue Share (%), by Type 2024 & 2032

- Figure 50: Latin America Tokenization Solution Market Revenue (Million), by Deployment 2024 & 2032

- Figure 51: Latin America Tokenization Solution Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 52: Latin America Tokenization Solution Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 53: Latin America Tokenization Solution Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 54: Latin America Tokenization Solution Market Revenue (Million), by Country 2024 & 2032

- Figure 55: Latin America Tokenization Solution Market Revenue Share (%), by Country 2024 & 2032

- Figure 56: Middle East Tokenization Solution Market Revenue (Million), by Type 2024 & 2032

- Figure 57: Middle East Tokenization Solution Market Revenue Share (%), by Type 2024 & 2032

- Figure 58: Middle East Tokenization Solution Market Revenue (Million), by Deployment 2024 & 2032

- Figure 59: Middle East Tokenization Solution Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 60: Middle East Tokenization Solution Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 61: Middle East Tokenization Solution Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 62: Middle East Tokenization Solution Market Revenue (Million), by Country 2024 & 2032

- Figure 63: Middle East Tokenization Solution Market Revenue Share (%), by Country 2024 & 2032

- Figure 64: United Arab Emirates Tokenization Solution Market Revenue (Million), by Type 2024 & 2032

- Figure 65: United Arab Emirates Tokenization Solution Market Revenue Share (%), by Type 2024 & 2032

- Figure 66: United Arab Emirates Tokenization Solution Market Revenue (Million), by Deployment 2024 & 2032

- Figure 67: United Arab Emirates Tokenization Solution Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 68: United Arab Emirates Tokenization Solution Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 69: United Arab Emirates Tokenization Solution Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 70: United Arab Emirates Tokenization Solution Market Revenue (Million), by Country 2024 & 2032

- Figure 71: United Arab Emirates Tokenization Solution Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Tokenization Solution Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Tokenization Solution Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Tokenization Solution Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Global Tokenization Solution Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: Global Tokenization Solution Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Tokenization Solution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Tokenization Solution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Germany Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Tokenization Solution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: India Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Tokenization Solution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Tokenization Solution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Brazil Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Argentina Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Tokenization Solution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Tokenization Solution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Saudi Arabia Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Africa Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Tokenization Solution Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Tokenization Solution Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 29: Global Tokenization Solution Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 30: Global Tokenization Solution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: United States Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Tokenization Solution Market Revenue Million Forecast, by Type 2019 & 2032

- Table 34: Global Tokenization Solution Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 35: Global Tokenization Solution Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 36: Global Tokenization Solution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: United Kingdom Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Germany Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Tokenization Solution Market Revenue Million Forecast, by Type 2019 & 2032

- Table 41: Global Tokenization Solution Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 42: Global Tokenization Solution Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 43: Global Tokenization Solution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: China Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: India Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Tokenization Solution Market Revenue Million Forecast, by Type 2019 & 2032

- Table 47: Global Tokenization Solution Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 48: Global Tokenization Solution Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 49: Global Tokenization Solution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Global Tokenization Solution Market Revenue Million Forecast, by Type 2019 & 2032

- Table 51: Global Tokenization Solution Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 52: Global Tokenization Solution Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 53: Global Tokenization Solution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Brazil Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Mexico Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Argentina Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Tokenization Solution Market Revenue Million Forecast, by Type 2019 & 2032

- Table 58: Global Tokenization Solution Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 59: Global Tokenization Solution Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 60: Global Tokenization Solution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 61: Global Tokenization Solution Market Revenue Million Forecast, by Type 2019 & 2032

- Table 62: Global Tokenization Solution Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 63: Global Tokenization Solution Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 64: Global Tokenization Solution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 65: Saudi Arabia Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: South Africa Tokenization Solution Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tokenization Solution Market?

The projected CAGR is approximately 17.68%.

2. Which companies are prominent players in the Tokenization Solution Market?

Key companies in the market include Fiserv Inc, First Data Corporation, Cardconnect Corporation, Hewlett Packard Enterprise, Liaison Technologies Inc, Thales Group, Ciphercloud Incorporation, Broadcom Inc, Paymetric Inc (A Worldpay Company), Cybersource Corporation, Protegrity USA Inc, 3delta Systems Inc, Tokenex LLC*List Not Exhaustive.

3. What are the main segments of the Tokenization Solution Market?

The market segments include Type, Deployment, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Secure Payment Gateways; Rising Adoption in E-commerce and Mobile payments; Growing Government Regulations On Data Security.

6. What are the notable trends driving market growth?

BFSI to hold the largest market size.

7. Are there any restraints impacting market growth?

Addressing Vulnerabilities From EMV Standards; Lack of Awareness Due to Similar Products.

8. Can you provide examples of recent developments in the market?

May 2023 - The EY company announced that EY OpsChain ESG is now usable in beta form on the EY Blockchain SaaS platform. The new solution, created on the Ethereum blockchain, would give businesses that find it difficult to precisely measure and manage their carbon footprint a single, verified picture of CO2 emissions (CO2e). Through tokenization, it will also give customers, business partners, and regulators the transparency required to trace emissions and carbon credits throughout an ecosystem.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tokenization Solution Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tokenization Solution Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tokenization Solution Market?

To stay informed about further developments, trends, and reports in the Tokenization Solution Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence