Key Insights

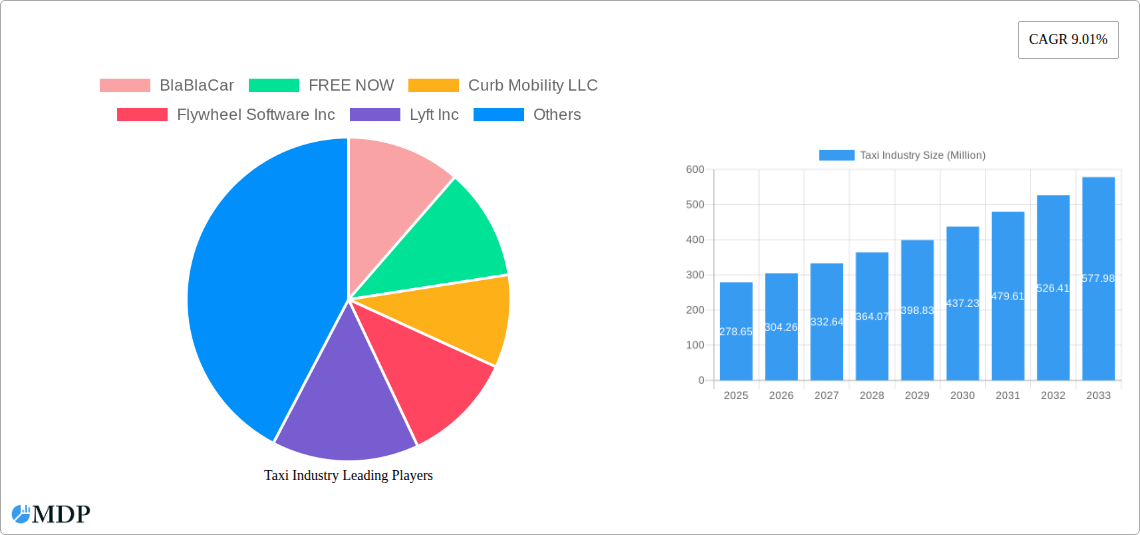

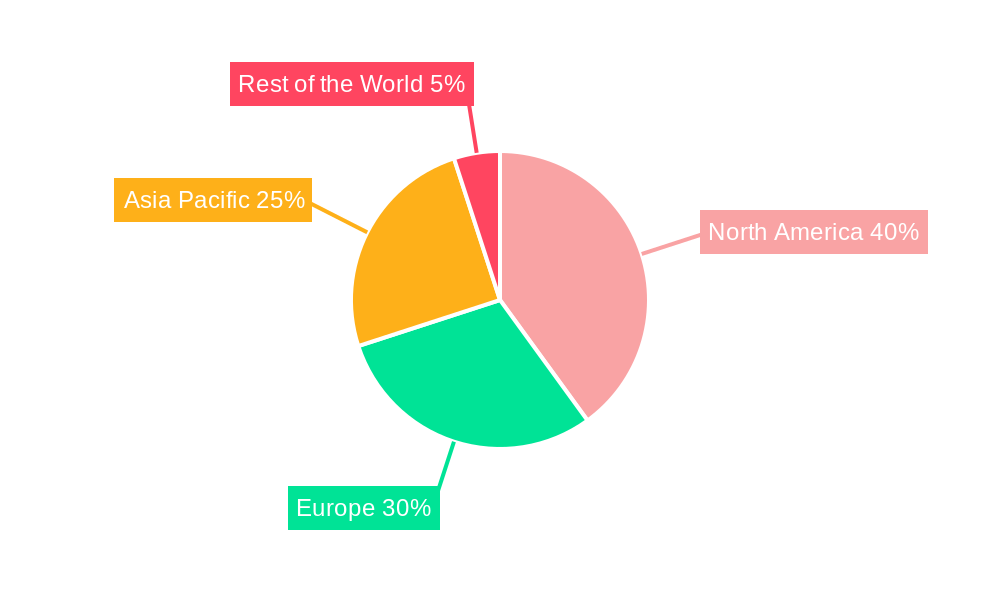

The global taxi industry, valued at $278.65 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 9.01% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of smartphone technology and readily available mobile apps has significantly boosted the convenience and accessibility of online booking services, leading to a substantial shift from traditional offline bookings. Furthermore, the rising urbanization and increasing disposable incomes in developing economies are creating a larger pool of potential customers for ride-hailing services. The diversification of service types, including ride-sharing options that cater to budget-conscious consumers and specialized services like airport transfers, further contributes to market growth. Technological advancements such as improved GPS navigation, real-time tracking, and automated dispatch systems enhance operational efficiency and customer experience, strengthening the industry’s appeal. However, factors such as stringent regulations, competition from other modes of transportation, and fluctuating fuel prices pose potential challenges to sustained growth. The market is segmented by booking type (online vs. offline), service type (ride-hailing vs. ride-sharing), and vehicle type (motorcycles, cars, vans), offering diverse opportunities for players across various segments. North America and Europe currently hold significant market shares, driven by high adoption rates and technological advancements. However, the Asia-Pacific region exhibits substantial growth potential given its burgeoning population and expanding middle class.

Taxi Industry Market Size (In Million)

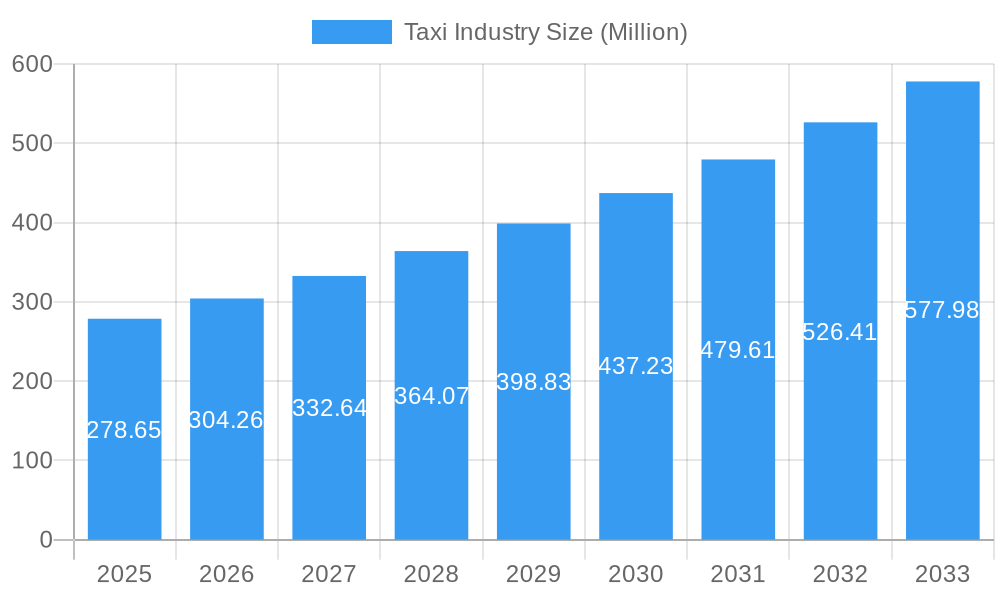

The competitive landscape is characterized by a mix of established global players such as Uber, Lyft, and Didi, and regional players like Ola and Grab, each vying for market dominance. These companies are continually investing in technological innovation, strategic partnerships, and expansion into new markets to maintain their competitive edge. The industry's future hinges on adapting to evolving customer preferences, addressing regulatory concerns, and leveraging technological advancements to enhance operational efficiency, safety, and customer satisfaction. Sustainable practices and environmentally friendly options are also gaining traction, with companies exploring electric vehicle fleets and carbon-neutral initiatives. The continued integration of artificial intelligence and machine learning in areas such as fare optimization and predictive analytics promises to further shape the industry's growth trajectory.

Taxi Industry Company Market Share

Taxi Industry Market Report: 2019-2033 - A Comprehensive Analysis of a $XX Million Market

This comprehensive report provides an in-depth analysis of the global taxi industry, projecting a market value of $XX million by 2033. The study covers the period 2019-2033, with 2025 as the base and estimated year. It examines key market dynamics, leading players like Uber Technologies Inc, Lyft Inc, and Didi Chuxing, and emerging trends shaping the future of transportation. This report is essential for investors, industry stakeholders, and anyone seeking to understand the complexities and opportunities within this rapidly evolving sector.

Taxi Industry Market Dynamics & Concentration

The global taxi industry, valued at $XX million in 2025, exhibits a moderately concentrated market structure. While a few dominant players like Uber and Didi Chuxing hold significant market share, a diverse range of regional and niche players contribute to the overall market. Innovation is driven by technological advancements such as ride-hailing apps, autonomous vehicle technology, and the integration of electric vehicles. Regulatory frameworks vary significantly across geographies, influencing market access and operational costs. Product substitutes, including public transportation and ride-sharing platforms, pose considerable competitive pressure. End-user trends reflect a growing preference for convenient, on-demand transportation options, particularly among younger demographics. Mergers and acquisitions (M&A) activity has been significant, with a total of XX deals recorded between 2019 and 2024, largely driven by consolidation efforts and expansion strategies.

- Market Share: Uber Technologies Inc: xx%, Didi Chuxing: xx%, Lyft Inc: xx%, Others: xx%

- M&A Deal Count (2019-2024): xx

- Key Innovation Drivers: Autonomous vehicles, Electric vehicles, AI-powered dispatch systems

- Regulatory Challenges: Licensing, Permitting, Data privacy

Taxi Industry Industry Trends & Analysis

The taxi industry is experiencing significant transformation, driven by technological advancements and evolving consumer preferences. The market is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching an estimated value of $XX million. This growth is fueled by increasing urbanization, rising disposable incomes, and the growing adoption of smartphones and mobile applications. Technological disruptions, such as the introduction of autonomous vehicles and ride-sharing services, are fundamentally reshaping the competitive landscape. Consumer preferences are shifting towards more convenient, affordable, and technologically advanced transportation options. The competitive dynamics are intense, with existing players facing challenges from new entrants and disruptive technologies. Market penetration of online booking platforms continues to increase, reaching xx% in 2025.

Leading Markets & Segments in Taxi Industry

The North American and Asia-Pacific regions are currently the leading markets for the taxi industry, driven by factors such as high population density, robust infrastructure, and favorable regulatory environments. Online booking is the dominant segment within the booking type category, accounting for xx% of total bookings in 2025. Ride-hailing constitutes the majority of the service type market, followed by ride-sharing. Cars remain the most prevalent vehicle type, although the adoption of motorcycles and other vehicle types (e.g., vans) is gradually increasing.

- Key Drivers for Dominant Regions:

- North America: High disposable incomes, strong technological infrastructure, favorable regulatory environment.

- Asia-Pacific: Rapid urbanization, growing middle class, high smartphone penetration.

- Dominant Segments:

- Booking Type: Online Booking

- Service Type: Ride-hailing

- Vehicle Type: Cars

Taxi Industry Product Developments

Recent product innovations focus on enhancing user experience, improving safety features, and integrating sustainable technologies. The introduction of features like in-app payment options, real-time tracking, and ride-sharing capabilities has transformed the industry. Autonomous vehicle technology holds significant promise for revolutionizing transportation, offering potential cost reductions and improved efficiency. The market fit for electric vehicles and other eco-friendly options is continuously improving as technological advancements reduce costs and increase range.

Key Drivers of Taxi Industry Growth

Several factors are driving the growth of the taxi industry. Technological advancements, such as the development of ride-hailing apps and autonomous vehicles, are improving efficiency and expanding service accessibility. Economic growth and rising disposable incomes are increasing demand for convenient transportation options. Favorable regulatory environments that support innovation and competition are promoting market expansion. Examples include the increasing adoption of electric taxis, as seen in Xanh SM Laos’ expansion in 2024 and the approval of Waymo’s robotaxi services in San Francisco and San Diego.

Challenges in the Taxi Industry Market

The taxi industry faces several challenges, including stringent regulatory hurdles that can restrict market entry and operation. Supply chain disruptions, particularly the availability of skilled drivers and vehicle parts, can negatively impact service provision. Intense competition from both established players and new entrants creates pricing pressure and necessitates continuous innovation. These factors, combined with fluctuating fuel prices and potential economic downturns, can significantly impact profitability and growth. The impact is estimated to reduce overall market growth by xx% annually.

Emerging Opportunities in Taxi Industry

Long-term growth in the taxi industry will be driven by several key opportunities. Technological breakthroughs in autonomous driving and electric vehicle technology will create significant efficiency gains and reduce environmental impact. Strategic partnerships between taxi companies and other businesses, such as hotels and tourism operators, will expand service offerings and enhance customer reach. Aggressive expansion into untapped markets, particularly in developing economies with growing urbanization, will unlock substantial growth potential.

Leading Players in the Taxi Industry Sector

- BlaBlaCar

- FREE NOW

- Curb Mobility LLC

- Flywheel Software Inc

- Lyft Inc

- Gojek Tech

- Kabbee Exchange Limited

- Uber Technologies Inc

- ANI Technologies Pvt Ltd (Ola)

- Bolt Technologies OU

- (Didi Chuxing) Beijing Xiaoju Technology Co Ltd

- Grab Holdings Inc

Key Milestones in Taxi Industry Industry

- January 2024: Launch of Baayu, India's first app-based 100% electric and decentralized bike taxi service. This signifies a move towards sustainable and innovative transportation solutions in emerging markets.

- March 2024: Xanh SM Laos expands electric taxi operations to Savannakhet Province, demonstrating the growing adoption of electric vehicles in the taxi industry.

- March 2024: Waymo secures approval for paid robotaxi rides in San Diego and expands services in the San Francisco Bay Area, marking a significant milestone in the development and deployment of autonomous vehicle technology.

Strategic Outlook for Taxi Industry Market

The taxi industry is poised for continued growth, driven by technological advancements, evolving consumer preferences, and strategic expansion into new markets. The integration of autonomous vehicles, electric vehicles, and advanced data analytics will significantly transform operations and enhance service delivery. Strategic partnerships and acquisitions will shape the competitive landscape, leading to consolidation and increased efficiency. The future of the taxi industry lies in embracing innovation, adapting to regulatory changes, and meeting the evolving demands of a digitally driven society.

Taxi Industry Segmentation

-

1. Booking Type

- 1.1. Online Booking

- 1.2. Offline Booking

-

2. Service Type

- 2.1. Ride-hailing

- 2.2. Ride-sharing

-

3. Vehicle Type

- 3.1. Motorcycle

- 3.2. Cars

- 3.3. Other Vehicle Types (Vans)

Taxi Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Vietnam

- 3.6. South Korea

- 3.7. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Mexico

- 4.2. Brazil

- 4.3. South Africa

- 4.4. Argentina

- 4.5. Other Countries

Taxi Industry Regional Market Share

Geographic Coverage of Taxi Industry

Taxi Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Air Pollution Awareness and Health Concern is Driving the Demand

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation Related to Industrial Robots

- 3.4. Market Trends

- 3.4.1. Online Bookings are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Online Booking

- 5.1.2. Offline Booking

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Ride-hailing

- 5.2.2. Ride-sharing

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Motorcycle

- 5.3.2. Cars

- 5.3.3. Other Vehicle Types (Vans)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. North America Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Booking Type

- 6.1.1. Online Booking

- 6.1.2. Offline Booking

- 6.2. Market Analysis, Insights and Forecast - by Service Type

- 6.2.1. Ride-hailing

- 6.2.2. Ride-sharing

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Motorcycle

- 6.3.2. Cars

- 6.3.3. Other Vehicle Types (Vans)

- 6.1. Market Analysis, Insights and Forecast - by Booking Type

- 7. Europe Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Booking Type

- 7.1.1. Online Booking

- 7.1.2. Offline Booking

- 7.2. Market Analysis, Insights and Forecast - by Service Type

- 7.2.1. Ride-hailing

- 7.2.2. Ride-sharing

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Motorcycle

- 7.3.2. Cars

- 7.3.3. Other Vehicle Types (Vans)

- 7.1. Market Analysis, Insights and Forecast - by Booking Type

- 8. Asia Pacific Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Booking Type

- 8.1.1. Online Booking

- 8.1.2. Offline Booking

- 8.2. Market Analysis, Insights and Forecast - by Service Type

- 8.2.1. Ride-hailing

- 8.2.2. Ride-sharing

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Motorcycle

- 8.3.2. Cars

- 8.3.3. Other Vehicle Types (Vans)

- 8.1. Market Analysis, Insights and Forecast - by Booking Type

- 9. Rest of the World Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Booking Type

- 9.1.1. Online Booking

- 9.1.2. Offline Booking

- 9.2. Market Analysis, Insights and Forecast - by Service Type

- 9.2.1. Ride-hailing

- 9.2.2. Ride-sharing

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Motorcycle

- 9.3.2. Cars

- 9.3.3. Other Vehicle Types (Vans)

- 9.1. Market Analysis, Insights and Forecast - by Booking Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 BlaBlaCar

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 FREE NOW

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Curb Mobility LLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Flywheel Software Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Lyft Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Gojek Tech

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kabbee Exchange Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Uber Technologies Inc *List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 ANI Technologies Pvt Ltd (Ola)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Bolt Technologies OU

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 (Didi Chuxing) Beijing Xiaoju Technology Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Grab Holdings Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 BlaBlaCar

List of Figures

- Figure 1: Global Taxi Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Taxi Industry Revenue (Million), by Booking Type 2025 & 2033

- Figure 3: North America Taxi Industry Revenue Share (%), by Booking Type 2025 & 2033

- Figure 4: North America Taxi Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 5: North America Taxi Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: North America Taxi Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 7: North America Taxi Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: North America Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Taxi Industry Revenue (Million), by Booking Type 2025 & 2033

- Figure 11: Europe Taxi Industry Revenue Share (%), by Booking Type 2025 & 2033

- Figure 12: Europe Taxi Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 13: Europe Taxi Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 14: Europe Taxi Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Europe Taxi Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Taxi Industry Revenue (Million), by Booking Type 2025 & 2033

- Figure 19: Asia Pacific Taxi Industry Revenue Share (%), by Booking Type 2025 & 2033

- Figure 20: Asia Pacific Taxi Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 21: Asia Pacific Taxi Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Asia Pacific Taxi Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: Asia Pacific Taxi Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Asia Pacific Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Taxi Industry Revenue (Million), by Booking Type 2025 & 2033

- Figure 27: Rest of the World Taxi Industry Revenue Share (%), by Booking Type 2025 & 2033

- Figure 28: Rest of the World Taxi Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 29: Rest of the World Taxi Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 30: Rest of the World Taxi Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 31: Rest of the World Taxi Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 32: Rest of the World Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Taxi Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Taxi Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 2: Global Taxi Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Global Taxi Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Taxi Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Taxi Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 6: Global Taxi Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Global Taxi Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Taxi Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 13: Global Taxi Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Global Taxi Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Taxi Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 22: Global Taxi Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 23: Global Taxi Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 24: Global Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Australia Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Vietnam Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Taxi Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 33: Global Taxi Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 34: Global Taxi Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 35: Global Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Mexico Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Brazil Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: South Africa Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Argentina Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Other Countries Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Taxi Industry?

The projected CAGR is approximately 9.01%.

2. Which companies are prominent players in the Taxi Industry?

Key companies in the market include BlaBlaCar, FREE NOW, Curb Mobility LLC, Flywheel Software Inc, Lyft Inc, Gojek Tech, Kabbee Exchange Limited, Uber Technologies Inc *List Not Exhaustive, ANI Technologies Pvt Ltd (Ola), Bolt Technologies OU, (Didi Chuxing) Beijing Xiaoju Technology Co Ltd, Grab Holdings Inc.

3. What are the main segments of the Taxi Industry?

The market segments include Booking Type, Service Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 278.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Air Pollution Awareness and Health Concern is Driving the Demand.

6. What are the notable trends driving market growth?

Online Bookings are Driving the Market.

7. Are there any restraints impacting market growth?

High Cost of Installation Related to Industrial Robots.

8. Can you provide examples of recent developments in the market?

March 2024: After successfully launching services in Vientiane's Capital and the popular tourist destination of Vang Vieng, Xanh SM Laos officially extended its electric taxi operations to Savannakhet Province. This expansion not only signifies the next phase in Xanh SM's brand development but also underscores the company's ongoing dedication to the promotion of electric vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Taxi Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Taxi Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Taxi Industry?

To stay informed about further developments, trends, and reports in the Taxi Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence