Key Insights

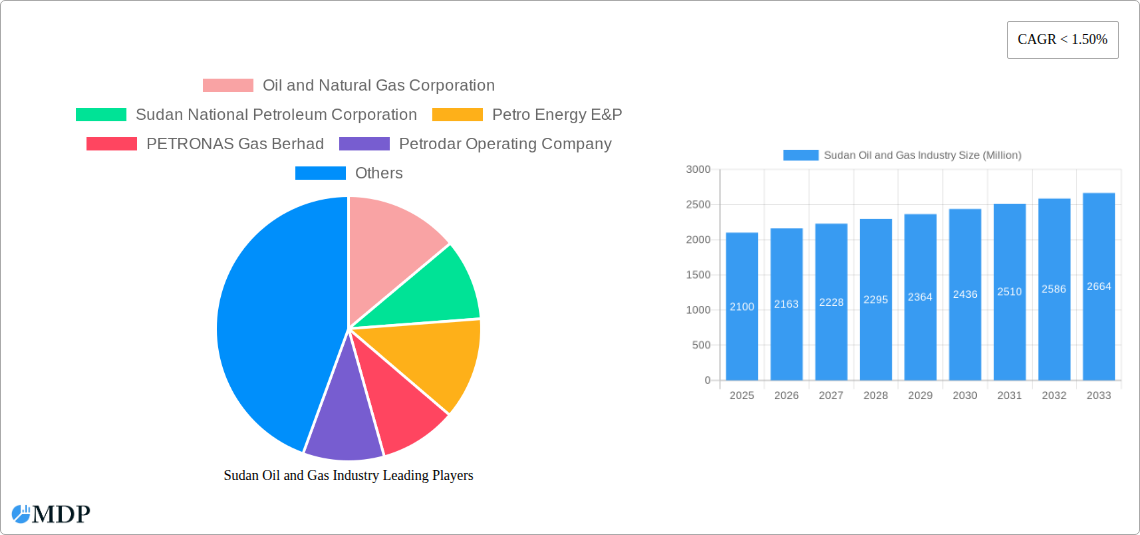

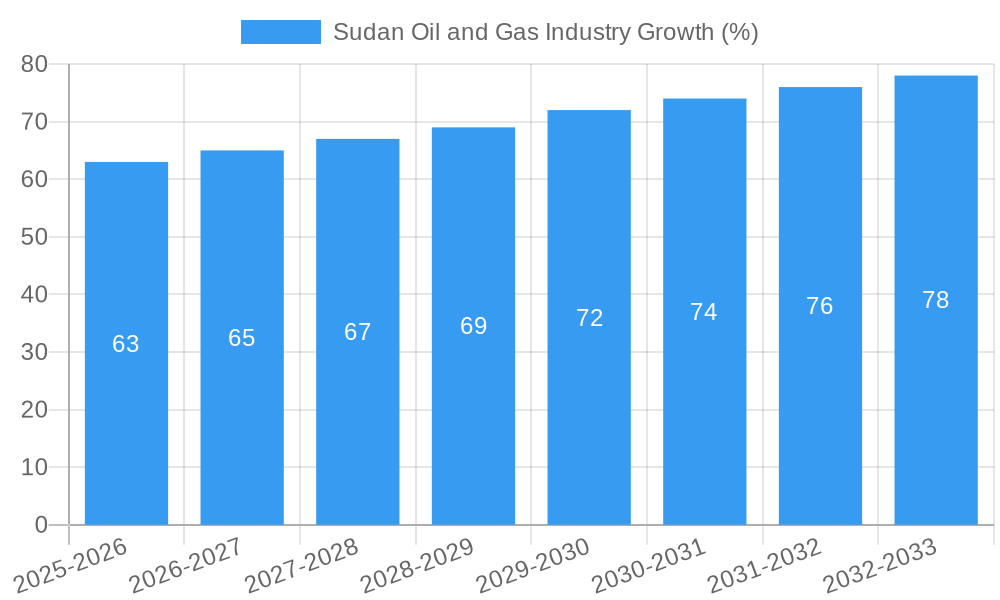

The Sudanese oil and gas industry, while possessing significant untapped potential, currently faces challenges that limit its growth. The historical period (2019-2024) likely saw fluctuating production levels influenced by geopolitical instability, infrastructure limitations, and international sanctions. Assuming a conservative annual growth rate (CAGR) of 3% during this period, considering the country's complex political landscape and ongoing investment uncertainties, the market size in 2024 could be estimated at approximately $2 billion. This is based on a projected market size for 2025 (the base year) of $2.1 billion, working backward using a 3% CAGR. The forecast period (2025-2033) presents opportunities for expansion, particularly if foreign investment increases and political stability improves. Key drivers for growth would include exploration and development of new oil and gas reserves, upgrades to existing infrastructure, and increased domestic consumption. However, substantial investment in technology and infrastructure is needed to unlock this potential, along with improved regulatory frameworks to attract foreign investors and ensure transparency.

The projection for a CAGR of 3% from 2025 to 2033 suggests a steady, albeit modest, expansion of the Sudanese oil and gas sector. Factors influencing this projection include the global energy market demand, the price of crude oil, and the government's ability to create a stable and predictable investment environment. This relatively low CAGR reflects the inherent risks and challenges associated with operating in Sudan. Reaching the full potential requires concerted efforts to improve security, streamline regulations, and attract significant foreign direct investment to finance exploration, production, and infrastructural development. Sustainable growth will also depend on integrating environmental and social considerations into all aspects of the industry's operations. Without such improvements, the sector might fall short of its full potential.

Sudan Oil & Gas Industry Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Sudan oil and gas industry, offering crucial insights for investors, industry stakeholders, and policymakers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report analyzes market dynamics, key players, emerging trends, and future growth potential. The report utilizes a combination of historical data (2019-2024) and projected figures to deliver a realistic and actionable outlook for this dynamic market. Expect detailed analysis of crude oil, natural gas, and natural gas liquids (NGLs) across exploration, development, and production stages. The total market value is projected to reach xx Million by 2033.

Sudan Oil and Gas Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of Sudan's oil and gas industry, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of international and domestic players, with varying degrees of market share. While precise market share figures for each company are unavailable publicly, we estimate that Sudan National Petroleum Corporation holds a significant share, followed by China National Petroleum Corporation and others.

- Market Concentration: Moderate concentration, with a few dominant players and numerous smaller operators.

- Innovation Drivers: Government incentives for exploration and technological advancements in extraction and refining.

- Regulatory Framework: The Sudanese government's policies significantly influence the sector's growth, with recent initiatives focusing on attracting foreign investment.

- Product Substitutes: Limited substitutes for oil and gas in the current energy mix.

- End-User Trends: Increased domestic demand and potential for regional exports.

- M&A Activities: The number of M&A deals over the past five years is estimated at xx, indicating moderate consolidation. Future M&A activity is projected to increase, driven by government initiatives and exploration success.

Sudan Oil and Gas Industry Industry Trends & Analysis

This section provides a detailed analysis of the key trends shaping the Sudanese oil and gas industry. The market is projected to experience significant growth, driven by factors such as increasing domestic energy demand, new exploration activities, and government support. We project a Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

Market penetration of natural gas in the domestic energy mix is expected to gradually increase, driven by infrastructure development. Technological disruptions, like enhanced oil recovery techniques, are enhancing production efficiency. Competitive dynamics are influenced by government policies and the involvement of international oil companies. The industry is also navigating the challenges of fluctuating global oil prices and geopolitical uncertainties. Specific areas of analysis include:

- Exploration and Production Technology Adoption: The influence of advanced exploration and extraction technologies on production output and cost efficiency.

- Regulatory Changes and Impact: How government policies related to licensing, taxation, and environmental regulations are shaping the market.

- Impact of Geopolitical Factors: Analysis of how regional and global political events affect the industry's growth and operations.

Leading Markets & Segments in Sudan Oil and Gas Industry

This section examines the dominant segments within Sudan's oil and gas industry. Based on the available data, crude oil production currently constitutes the largest segment by type of resource, although natural gas production is expected to gain traction in the coming years. In terms of exploration and production stages, the development stage shows significant activity due to ongoing projects and exploration successes.

By Type of Resource:

- Crude Oil: Dominated by established oilfields, contributing the highest volume of production, driven by existing infrastructure and established international partnerships.

- Natural Gas: Shows potential for growth with successful exploration and development leading to increased production and market share.

- Natural Gas Liquids (NGLs): Currently a smaller segment, NGL production is expected to see some growth alongside natural gas production.

By Exploration and Production Stage:

- Exploration: Increased activity due to government incentives and recent exploration successes.

- Development: Significant investments are being made to enhance existing infrastructure and bring new fields online.

- Production: Crude oil currently dominates production, but natural gas is showing promising growth potential.

Key Drivers:

- Economic Policies: Government incentives for exploration and production.

- Infrastructure: Existing infrastructure for crude oil, with ongoing development for natural gas.

- Investment: Significant investment by both domestic and international players.

Sudan Oil and Gas Industry Product Developments

The Sudan oil and gas industry is witnessing incremental product developments focusing on enhancing efficiency and expanding applications. Technological trends include enhanced oil recovery techniques for maximizing production from existing fields and improved refining capabilities to meet growing domestic demand. Recent technological advances have led to increased efficiency in exploration and production, resulting in reduced operational costs and environmental impact.

Key Drivers of Sudan Oil and Gas Industry Growth

The Sudanese oil and gas industry's growth is propelled by several key factors:

- Government Support: Incentives to attract foreign investment and stimulate exploration.

- Technological Advancements: Enhanced oil recovery methods and improved exploration techniques.

- Rising Domestic Demand: Growing energy consumption across various sectors.

Challenges in the Sudan Oil and Gas Industry Market

The Sudan oil and gas industry faces several challenges:

- Geopolitical Instability: Regional conflicts can disrupt operations and impact investment decisions.

- Infrastructure Limitations: Investment in infrastructure is essential to meet the growing energy demands and export potential.

- Fluctuating Global Oil Prices: Price volatility significantly impacts revenue and profitability.

Emerging Opportunities in Sudan Oil and Gas Industry

Significant opportunities exist for long-term growth, including increased exploration in under-explored areas, the development of natural gas infrastructure to meet rising domestic demand, and strategic partnerships with international energy companies. Technological breakthroughs in refining and petrochemical production will also lead to new opportunities.

Leading Players in the Sudan Oil and Gas Industry Sector

- Oil and Natural Gas Corporation

- Sudan National Petroleum Corporation

- Petro Energy E&P

- PETRONAS Gas Berhad

- Petrodar Operating Company

- China National Petroleum Corporation

- Sunagas

- JSC Zarubezhneft

- Khartoum Refinery Co Ltd

Key Milestones in Sudan Oil and Gas Industry Industry

- August 2022: Zarubezhneft expands operations in Sudan, securing new oil exploration blocks, signifying increased foreign investment.

- April 2022: Sudan invites Algerian companies to explore investment opportunities, highlighting the government's proactive approach to attracting foreign expertise.

Strategic Outlook for Sudan Oil and Gas Industry Market

The Sudanese oil and gas industry holds significant long-term growth potential. Continued investment in infrastructure, exploration, and technological advancements will be crucial to unlocking this potential. Strategic partnerships with international companies and fostering a stable investment climate are critical for sustainable growth and development of the sector.

Sudan Oil and Gas Industry Segmentation

- 1. Upstream

- 2. Midstream

- 3. Downstream

Sudan Oil and Gas Industry Segmentation By Geography

- 1. Sudan

Sudan Oil and Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Adoption of Renewable Energy Sources

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Limited Natural Resources

- 3.4. Market Trends

- 3.4.1. Midstream Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sudan Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 5.2. Market Analysis, Insights and Forecast - by Midstream

- 5.3. Market Analysis, Insights and Forecast - by Downstream

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Sudan

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 6. UAE Sudan Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Sudan Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Sudan Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Sudan Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Oil and Natural Gas Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sudan National Petroleum Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Petro Energy E&P

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PETRONAS Gas Berhad

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Petrodar Operating Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 China National Petroleum Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Sunagas

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 JSC Zarubezhneft

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Khartoum Refinery Co Ltd *List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Oil and Natural Gas Corporation

List of Figures

- Figure 1: Sudan Oil and Gas Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sudan Oil and Gas Industry Share (%) by Company 2024

List of Tables

- Table 1: Sudan Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sudan Oil and Gas Industry Revenue Million Forecast, by Upstream 2019 & 2032

- Table 3: Sudan Oil and Gas Industry Revenue Million Forecast, by Midstream 2019 & 2032

- Table 4: Sudan Oil and Gas Industry Revenue Million Forecast, by Downstream 2019 & 2032

- Table 5: Sudan Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Sudan Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: UAE Sudan Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Africa Sudan Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Sudan Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of MEA Sudan Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sudan Oil and Gas Industry Revenue Million Forecast, by Upstream 2019 & 2032

- Table 12: Sudan Oil and Gas Industry Revenue Million Forecast, by Midstream 2019 & 2032

- Table 13: Sudan Oil and Gas Industry Revenue Million Forecast, by Downstream 2019 & 2032

- Table 14: Sudan Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sudan Oil and Gas Industry?

The projected CAGR is approximately < 1.50%.

2. Which companies are prominent players in the Sudan Oil and Gas Industry?

Key companies in the market include Oil and Natural Gas Corporation, Sudan National Petroleum Corporation, Petro Energy E&P, PETRONAS Gas Berhad, Petrodar Operating Company, China National Petroleum Corporation, Sunagas, JSC Zarubezhneft, Khartoum Refinery Co Ltd *List Not Exhaustive.

3. What are the main segments of the Sudan Oil and Gas Industry?

The market segments include Upstream, Midstream, Downstream.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Adoption of Renewable Energy Sources.

6. What are the notable trends driving market growth?

Midstream Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Limited Natural Resources.

8. Can you provide examples of recent developments in the market?

In August 2022, the Russian company Zarubezhneft plans to expand its operations in Sudan, where the government has offered new blocks for oil exploration and production. During the preparation process, Zarubezhneft, in collaboration with Sudan's Energy and Oil Ministry and Sudapec, increased the number of oil blocks that would be developed. As part of the agreement, the companies will discuss extending cooperation beyond production in the oil sector to include technologies related to oil recovery, the use of associated gas, oil refining, petrochemicals, and training.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sudan Oil and Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sudan Oil and Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sudan Oil and Gas Industry?

To stay informed about further developments, trends, and reports in the Sudan Oil and Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence