Key Insights

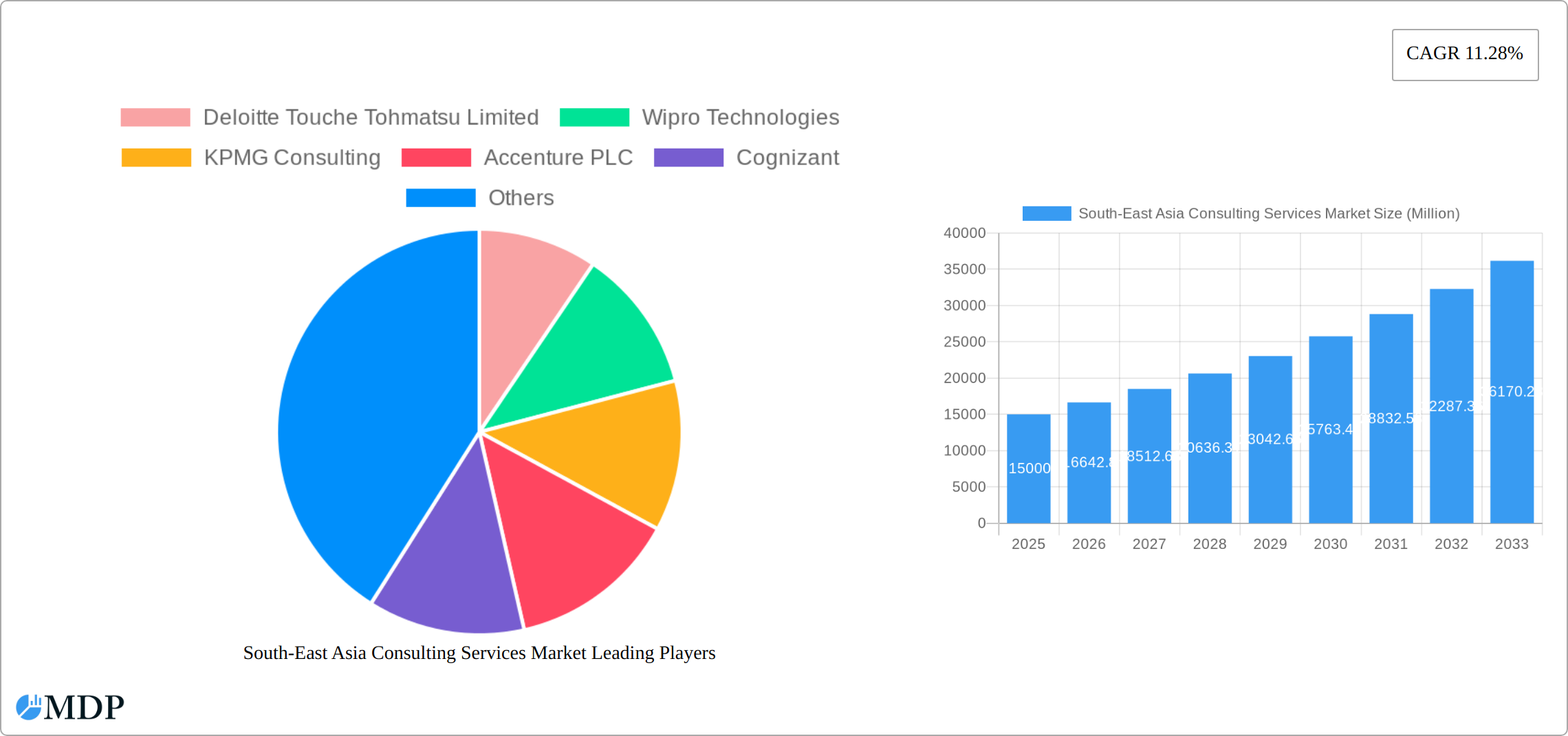

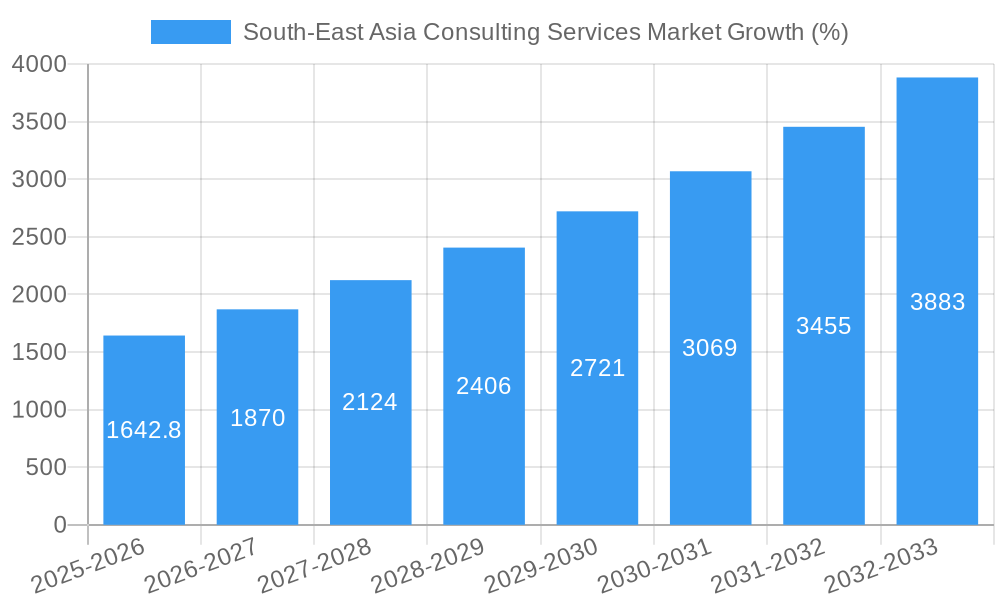

The South-East Asia consulting services market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 11.28% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing government initiatives focused on infrastructure development and digital transformation across countries like Singapore, Indonesia, and Thailand are fueling demand for specialized consulting expertise in areas such as IT & digital consulting, strategy and operations, and financial consulting. Secondly, the burgeoning life sciences and healthcare sectors in the region are creating opportunities for consulting firms specializing in regulatory compliance, operational efficiency, and market entry strategies. The robust growth of the financial services sector also contributes significantly, requiring consulting services for risk management, digitalization, and regulatory compliance. Finally, the rising adoption of advanced technologies like AI and cloud computing across various industries is stimulating demand for expertise in digital transformation and data analytics. The market is segmented by service type (HR Consulting, Financial Consulting, IT & Digital Consulting, Strategy and Operations), end-user industry (Financial Services, Life Sciences and Healthcare, IT and Telecommunication, Government, Energy, Other End-user Industries), and region (Singapore, Indonesia, Thailand, Rest of South-East Asia). Major players like Deloitte, Accenture, KPMG, and McKinsey & Company are key competitors in this dynamic and growing market.

The competitive landscape is characterized by both global giants and regional players vying for market share. While established firms leverage their extensive networks and expertise, smaller, specialized consulting firms are gaining traction by catering to niche market segments and offering tailored solutions. Market restraints include the fluctuating economic conditions impacting investment decisions and the potential talent scarcity in certain specialized areas. However, the overall outlook remains positive due to the sustained growth of key industries and the increasing reliance on external expertise to navigate complex challenges and achieve strategic objectives. The expansion into less developed segments within the region (Rest of South-East Asia) offers significant potential for future market expansion. Further growth is expected as businesses across the region increasingly prioritize strategic planning, technological advancement, and operational excellence.

South-East Asia Consulting Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South-East Asia consulting services market, covering market dynamics, industry trends, leading segments, key players, and future outlook. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is crucial for investors, businesses, and stakeholders seeking to understand this rapidly evolving market. Discover actionable insights and strategic opportunities within the booming South-East Asia consulting landscape. The market is projected to reach xx Million by 2033, exhibiting a compelling CAGR of xx% during the forecast period.

South-East Asia Consulting Services Market Dynamics & Concentration

The South-East Asia consulting services market exhibits a moderately concentrated landscape, with several multinational giants and regional players vying for market share. Market concentration is influenced by factors like mergers and acquisitions (M&A), regulatory frameworks, and the evolving needs of end-user industries. The market share of the top 5 players is estimated at xx% in 2025.

Innovation Drivers: Technological advancements, such as AI and cloud computing, are driving innovation and creating new opportunities for consulting firms. The increasing adoption of digital transformation strategies across various sectors fuels demand for specialized consulting services.

Regulatory Frameworks: Government regulations and policies related to data privacy, cybersecurity, and ethical AI significantly impact the market. Compliance requirements drive the demand for specialized consulting expertise.

Product Substitutes: The availability of readily accessible online resources and self-service tools can be considered as indirect substitutes for certain consulting services, particularly in areas with readily available information.

End-User Trends: Increasing digitalization, growing focus on sustainability, and the rise of the gig economy are shaping end-user demands and influencing consulting service offerings.

M&A Activities: The market has witnessed significant M&A activity in recent years, with key players consolidating their positions through acquisitions of smaller firms. For example, Accenture's acquisition of Entropia in June 2022 expanded its presence in the region. The number of M&A deals in the South-East Asia consulting services market has increased by xx% between 2021 and 2024.

South-East Asia Consulting Services Market Industry Trends & Analysis

The South-East Asia consulting services market is experiencing robust growth, driven by several factors. The region's dynamic economic environment, increasing investments in infrastructure, and growing adoption of technology are key growth drivers. The market is witnessing significant technological disruption, with AI, big data analytics, and cloud computing transforming the way consulting services are delivered.

Consumer preferences are also shifting, with an increasing emphasis on data-driven decision-making and customized solutions. Competitive dynamics are intense, with multinational consulting firms competing with regional players for market share. The market is also influenced by macroeconomic conditions and regional political stability. The market is expected to grow at a CAGR of xx% from 2025 to 2033, with market penetration rates expected to increase from xx% in 2025 to xx% in 2033.

Leading Markets & Segments in South-East Asia Consulting Services Market

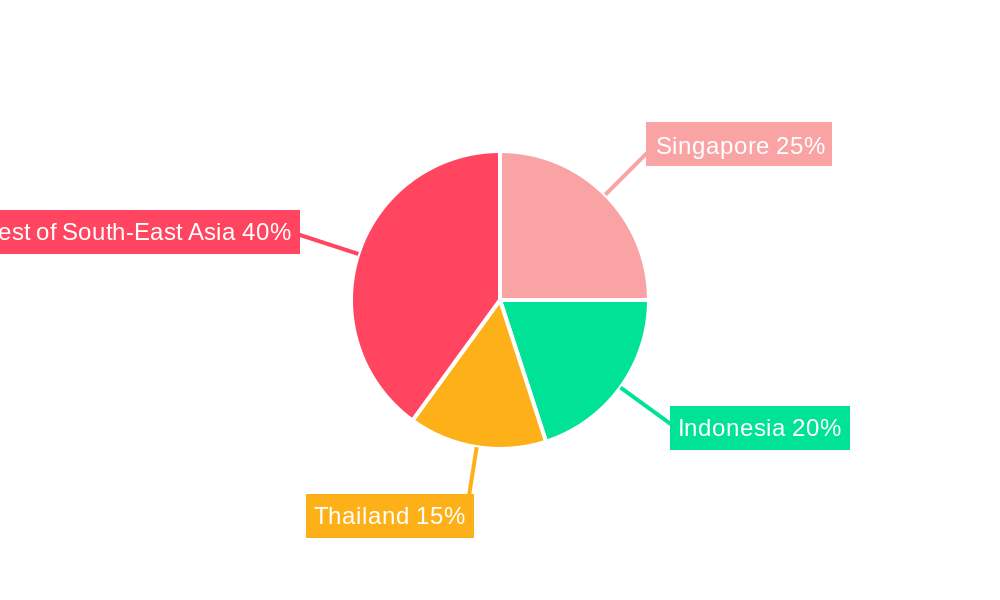

Singapore currently holds the largest market share within South-East Asia, followed by Indonesia and Thailand. The IT & Digital Consulting segment dominates the services landscape, driven by the region’s rapid digital transformation. Within end-user industries, the Financial Services sector demonstrates the highest demand, followed by IT and Telecommunication and Life Sciences and Healthcare.

Key Drivers for Singapore: Strong economic performance, established infrastructure, and a pro-business environment.

Key Drivers for Indonesia: Large population, rapid economic growth, and rising government spending on infrastructure.

Key Drivers for Thailand: Growing digital economy, significant foreign investments, and increasing demand for consulting services across various sectors.

IT & Digital Consulting: High demand due to digital transformation initiatives across industries.

Financial Services: Strong growth propelled by increasing financial regulations and the need for risk management.

South-East Asia Consulting Services Market Product Developments

The South-East Asia consulting services market is witnessing the rapid adoption of innovative technologies, including artificial intelligence (AI), machine learning (ML), and big data analytics, leading to the development of sophisticated consulting solutions that cater to the evolving needs of businesses. These technological advancements are enhancing the efficiency and effectiveness of consulting services, offering clients improved decision-making support and greater cost-effectiveness. These solutions provide competitive advantages by addressing industry-specific challenges with data-driven strategies and precise insights.

Key Drivers of South-East Asia Consulting Services Market Growth

Several factors propel the growth of the South-East Asia consulting services market. Firstly, rapid economic growth in several Southeast Asian countries creates increasing demand for business optimization and strategic guidance. Secondly, the accelerating digital transformation across industries fuels the need for specialized IT and digital consulting services. Finally, supportive government policies promoting business development and infrastructure development further stimulate market expansion.

Challenges in the South-East Asia Consulting Services Market

The South-East Asia consulting services market faces certain challenges. Intense competition from established players and emerging firms creates pressure on pricing and margins. Furthermore, regulatory complexities and evolving data privacy laws demand consistent adaptation from consulting firms. Finally, attracting and retaining highly skilled professionals in a competitive talent market presents a significant hurdle. These challenges, if not adequately addressed, could impact overall market growth by xx% by 2030.

Emerging Opportunities in South-East Asia Consulting Services Market

The South-East Asia consulting services market presents exciting long-term growth opportunities. The increasing adoption of AI and other cutting-edge technologies offers opportunities for developing specialized consulting solutions. Strategic partnerships between consulting firms and technology providers can create synergistic advantages. Moreover, expanding into underserved markets within Southeast Asia offers significant growth potential.

Leading Players in the South-East Asia Consulting Services Market Sector

- Deloitte Touche Tohmatsu Limited

- Wipro Technologies

- KPMG Consulting

- Accenture PLC

- Cognizant

- Boston Consulting Group

- Ernst & Young Global Limited

- Mercer Consulting

- A T Kearney Inc

- PricewaterhouseCoopers LLP

- Tata Consultancy Services

- McKinsey & Company

Key Milestones in South-East Asia Consulting Services Market Industry

- June 2022: Accenture acquired Entropia, its first acquisition in Southeast Asia, strengthening its position in experience-led transformation services.

- March 2023: IBM Consulting launched a new Innovation Hub in the Philippines, focusing on digital transformation, hybrid cloud, and AI solutions for clients in Japan and the region.

Strategic Outlook for South-East Asia Consulting Services Market

The South-East Asia consulting services market holds immense potential for future growth, driven by ongoing digitalization, rising infrastructure investments, and the region's dynamic economic landscape. Strategic partnerships, investments in innovation, and a focus on specialized solutions will be crucial for success. Firms that adapt to evolving regulatory frameworks and effectively address the talent shortage will be best positioned to capitalize on the significant market opportunities.

South-East Asia Consulting Services Market Segmentation

-

1. Service Type

- 1.1. HR Consulting

- 1.2. Financial Consulting

- 1.3. IT and Digital Consulting

- 1.4. Strategy and Operations

-

2. End-user Industry

- 2.1. Financial Services

- 2.2. Life Sciences and Healthcare

- 2.3. IT and Telecommunication

- 2.4. Government

- 2.5. Energy and Utilities

- 2.6. Other End-user Industries

South-East Asia Consulting Services Market Segmentation By Geography

-

1. South East Asia

- 1.1. Indonesia

- 1.2. Malaysia

- 1.3. Singapore

- 1.4. Thailand

- 1.5. Vietnam

- 1.6. Philippines

- 1.7. Myanmar

- 1.8. Cambodia

- 1.9. Laos

South-East Asia Consulting Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-User Domain

- 3.3. Market Restrains

- 3.3.1. Shift in the Consulting Marketplace

- 3.4. Market Trends

- 3.4.1. Financial Advisory to Witness the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South-East Asia Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. HR Consulting

- 5.1.2. Financial Consulting

- 5.1.3. IT and Digital Consulting

- 5.1.4. Strategy and Operations

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Financial Services

- 5.2.2. Life Sciences and Healthcare

- 5.2.3. IT and Telecommunication

- 5.2.4. Government

- 5.2.5. Energy and Utilities

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South East Asia

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. China South-East Asia Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan South-East Asia Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 8. India South-East Asia Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea South-East Asia Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan South-East Asia Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia South-East Asia Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific South-East Asia Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Deloitte Touche Tohmatsu Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Wipro Technologies

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 KPMG Consulting

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Accenture PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Cognizant

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Boston Consulting Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Ernst & Young Global Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Mercer Consulting

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 A T Kearney Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 PricewaterhouseCoopers LLP

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Tata Consultancy Services

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 McKinsey & Company

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Deloitte Touche Tohmatsu Limited

List of Figures

- Figure 1: South-East Asia Consulting Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South-East Asia Consulting Services Market Share (%) by Company 2024

List of Tables

- Table 1: South-East Asia Consulting Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South-East Asia Consulting Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: South-East Asia Consulting Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: South-East Asia Consulting Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South-East Asia Consulting Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: South-East Asia Consulting Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 14: South-East Asia Consulting Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: South-East Asia Consulting Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Indonesia South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Malaysia South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Singapore South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Thailand South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Vietnam South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Philippines South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Myanmar South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Cambodia South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Laos South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South-East Asia Consulting Services Market?

The projected CAGR is approximately 11.28%.

2. Which companies are prominent players in the South-East Asia Consulting Services Market?

Key companies in the market include Deloitte Touche Tohmatsu Limited, Wipro Technologies, KPMG Consulting, Accenture PLC, Cognizant, Boston Consulting Group, Ernst & Young Global Limited, Mercer Consulting, A T Kearney Inc, PricewaterhouseCoopers LLP, Tata Consultancy Services, McKinsey & Company.

3. What are the main segments of the South-East Asia Consulting Services Market?

The market segments include Service Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-User Domain.

6. What are the notable trends driving market growth?

Financial Advisory to Witness the Highest Growth Rate.

7. Are there any restraints impacting market growth?

Shift in the Consulting Marketplace.

8. Can you provide examples of recent developments in the market?

March 2023: IBM Consulting doubled down on its dedication to South East Asia with the introduction of a new Innovation Hub in the Philippines. The primary aim of the Innovation Hub in Cebu City was to cater to the growing demand for IBM Consulting's clients in Japan on topics involving business processes, digital transformation, application management, hybrid cloud, supply chain, artificial intelligence, finance, and procurement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South-East Asia Consulting Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South-East Asia Consulting Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South-East Asia Consulting Services Market?

To stay informed about further developments, trends, and reports in the South-East Asia Consulting Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence