Key Insights

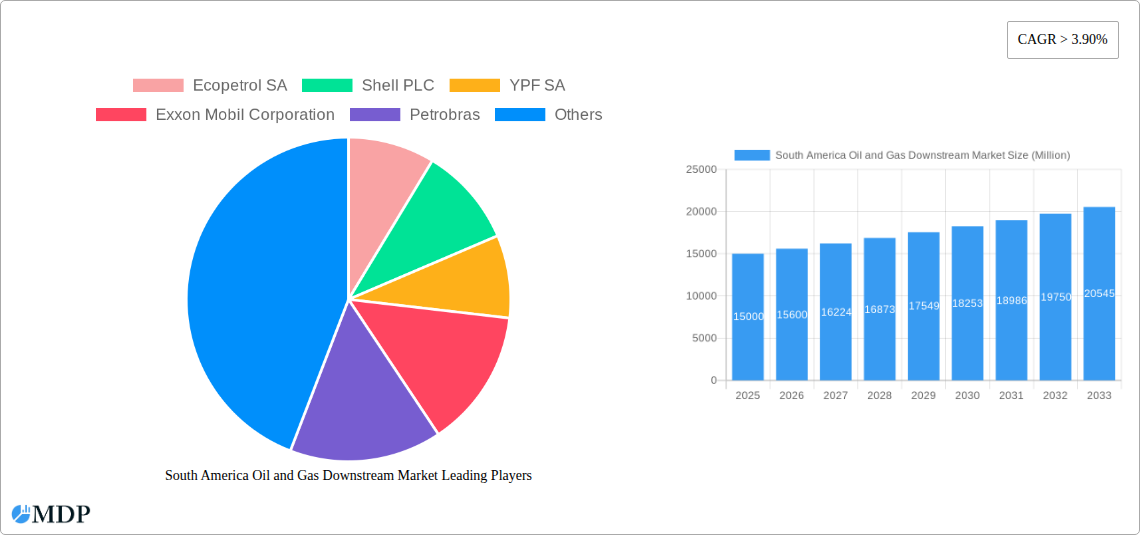

The South American oil and gas downstream market, encompassing refining and petrochemical plants, presents a robust growth trajectory. Driven by increasing energy demand fueled by population growth and industrialization across Brazil, Argentina, and the rest of South America, the market is projected to expand significantly over the forecast period (2025-2033). A compound annual growth rate (CAGR) exceeding 3.90% suggests a substantial market expansion, with key players like Ecopetrol SA, Shell PLC, YPF SA, Exxon Mobil Corporation, Petrobras, and BP PLC strategically positioned to capitalize on this growth. This expansion is further fueled by government initiatives promoting energy infrastructure development and investments in refinery modernization and capacity expansion. However, market growth faces certain challenges, including volatility in crude oil prices, environmental regulations aimed at reducing carbon emissions, and the ongoing transition towards renewable energy sources. These factors necessitate a strategic approach from market players to navigate these challenges and sustain growth.

The historical period (2019-2024) likely witnessed fluctuating growth rates influenced by global economic conditions and regional political factors. The base year of 2025 serves as a pivotal point reflecting the integration of recent market dynamics and projecting future growth. The dominance of Brazil and Argentina as major contributors to the market is anticipated to continue, although the "Rest of South America" segment is poised for gradual expansion driven by increased investments and infrastructure projects in emerging economies. The sector segmentation, focusing on refineries and petrochemical plants, highlights the significance of these two key areas driving market value. This analysis suggests that the South American oil and gas downstream market will experience sustained, albeit potentially volatile, growth, offering considerable opportunities for established and emerging players.

South America Oil & Gas Downstream Market Report: 2019-2033

Unlocking Growth Opportunities in South America's Dynamic Energy Sector

This comprehensive report provides an in-depth analysis of the South America Oil & Gas Downstream Market, covering the period from 2019 to 2033. With a focus on key segments like refineries and petrochemical plants, this study offers actionable insights for industry stakeholders, investors, and strategic decision-makers. Discover detailed market dynamics, leading players (including Ecopetrol SA, Shell PLC, YPF SA, Exxon Mobil Corporation, Petrobras, and BP PLC), and future growth prospects. The report leverages a robust data set and rigorous analytical methodologies to deliver a clear picture of this evolving market. The base year is 2025, with a forecast period extending to 2033.

South America Oil & Gas Downstream Market Market Dynamics & Concentration

The South American oil and gas downstream market is characterized by a moderate level of concentration, with a few major players holding significant market share. Ecopetrol SA, Petrobras, and YPF SA dominate their respective national markets, while international players like Shell PLC, Exxon Mobil Corporation, and BP PLC compete for market share across various segments. Market share dynamics are influenced by factors such as government regulations, investment in refining capacity, and the integration of renewable energy sources. Recent years have witnessed increased mergers and acquisitions (M&A) activity, as companies strive to consolidate their market positions and gain access to new technologies and resources. The number of M&A deals in the sector has fluctuated, with approximately xx deals recorded in 2023. Innovation drivers, such as the adoption of advanced refining technologies and the development of biofuels, are also impacting market structure. Regulatory frameworks vary across countries, creating both challenges and opportunities for market participants. Furthermore, the growing adoption of electric vehicles and alternative energy sources poses a threat to the traditional fuels market.

South America Oil & Gas Downstream Market Industry Trends & Analysis

The South America oil and gas downstream market is projected to experience a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). Key growth drivers include rising energy demand fueled by population growth and economic development, particularly in rapidly expanding economies. Technological advancements in refining processes are improving efficiency and reducing environmental impact. However, consumer preferences are shifting towards cleaner fuels and alternative energy sources, impacting market penetration of traditional petroleum products. Competitive dynamics are shaping the market, with companies focused on optimizing operations, expanding their product portfolios, and seeking strategic partnerships to secure future growth. Market penetration of advanced fuels and biofuels remains relatively low at xx%, but is expected to grow in the coming years driven by government mandates and environmental concerns.

Leading Markets & Segments in South America Oil & Gas Downstream Market

Brazil and Colombia represent the leading markets in the South American oil and gas downstream sector. Brazil's large domestic market and significant refining capacity contribute to its dominance. Colombia's strategic location and investment in upgrading its refining infrastructure are also key factors. Within the refineries segment, the expansion of Ecopetrol's Reficar refinery in Cartagena, Colombia, stands out as a significant development. Petrochemical plants represent a rapidly developing segment, driven by rising demand for plastics and other petrochemical products.

- Brazil: Large domestic market, substantial refining capacity, strong government support.

- Colombia: Strategic location, investments in refining infrastructure, focus on energy sovereignty.

- Argentina: Significant domestic market but facing economic challenges impacting investment and expansion.

- Refineries: Increased capacity, focus on upgrading facilities to produce cleaner fuels.

- Petrochemical Plants: Rapid growth driven by rising demand for plastics and other petrochemical products.

South America Oil & Gas Downstream Market Product Developments

The South American oil and gas downstream market is witnessing the introduction of cleaner fuels with lower sulfur content, driven by environmental regulations and consumer demand. Technological advancements in refinery processes are improving efficiency and yield. The development of biofuels and other alternative fuels is gaining traction, although market penetration remains limited. This reflects a shift toward environmentally friendly alternatives, necessitated by both government regulations and consumer pressure.

Key Drivers of South America Oil & Gas Downstream Market Growth

Several factors are driving the growth of the South American oil and gas downstream market. Firstly, increasing energy demand is fueled by rising populations and economic growth across the region. Secondly, government investments in infrastructure projects and supportive policies promote expansion. Thirdly, technological advancements lead to enhanced efficiency in refining and processing, allowing for a more sustainable industry. Lastly, strategic partnerships and M&A activities facilitate access to new technologies and resources.

Challenges in the South America Oil & Gas Downstream Market Market

The South American oil and gas downstream market faces several challenges. Regulatory hurdles, including varying environmental standards and complex permitting processes, create uncertainties. Supply chain disruptions and volatility in global crude oil prices add to operational complexities. Moreover, intense competition from both domestic and international players pressures profit margins. These factors contribute to a complex operational environment, impacting profitability and investment decisions. These difficulties are reflected in a xx% decrease in investor confidence.

Emerging Opportunities in South America Oil & Gas Downstream Market

Significant long-term growth opportunities exist. Technological breakthroughs in renewable energy integration offer chances for diversification and sustainable development. Strategic partnerships and collaborations between international and domestic players can unlock synergistic benefits and promote innovation. Expansion into new markets and product segments, particularly biofuels, could further boost growth. These developments, coupled with a continued focus on sustainability, promise to transform the industry's future.

Leading Players in the South America Oil & Gas Downstream Market Sector

- Ecopetrol SA

- Shell PLC

- YPF SA

- Exxon Mobil Corporation

- Petrobras

- BP PLC

Key Milestones in South America Oil & Gas Downstream Market Industry

- September 2022: Ecopetrol completes expansion works at its Reficar refinery in Cartagena, increasing domestic fuel supply and improving fuel quality (diesel < 100 ppm sulfur, gasoline < 50 ppm sulfur). This strengthens Colombia's energy security.

- January 2021: Macro Desenvolvimento seeks authorization to build a USD 480 Million natural gas processing unit in Espírito Santo, Brazil, scheduled for completion in 2025. This signals investment in natural gas infrastructure and processing capabilities.

Strategic Outlook for South America Oil & Gas Downstream Market Market

The South American oil and gas downstream market presents a compelling opportunity for long-term growth. Continued investment in refining infrastructure, coupled with a strategic focus on cleaner fuels and the integration of renewable energy sources, will be crucial for future success. Companies that adapt to evolving consumer preferences and regulatory landscapes will be best positioned to capitalize on the market's potential, driving further expansion in the years ahead. A proactive approach to sustainability and collaboration within the industry will be key to realizing this potential.

South America Oil and Gas Downstream Market Segmentation

-

1. Sector

-

1.1. Refineries

- 1.1.1. Market Overview

- 1.1.2. Key Project Information

- 1.2. Petrochemical Plants

-

1.1. Refineries

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Rest of South America

South America Oil and Gas Downstream Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America Oil and Gas Downstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Industrialization across the Globe; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. Refinery Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Refineries

- 5.1.1.1. Market Overview

- 5.1.1.2. Key Project Information

- 5.1.2. Petrochemical Plants

- 5.1.1. Refineries

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Colombia

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Brazil South America Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Refineries

- 6.1.1.1. Market Overview

- 6.1.1.2. Key Project Information

- 6.1.2. Petrochemical Plants

- 6.1.1. Refineries

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Colombia

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. Argentina South America Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Refineries

- 7.1.1.1. Market Overview

- 7.1.1.2. Key Project Information

- 7.1.2. Petrochemical Plants

- 7.1.1. Refineries

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Colombia

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Colombia South America Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Refineries

- 8.1.1.1. Market Overview

- 8.1.1.2. Key Project Information

- 8.1.2. Petrochemical Plants

- 8.1.1. Refineries

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Colombia

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Rest of South America South America Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Refineries

- 9.1.1.1. Market Overview

- 9.1.1.2. Key Project Information

- 9.1.2. Petrochemical Plants

- 9.1.1. Refineries

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Colombia

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Brazil South America Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 11. Argentina South America Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of South America South America Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Ecopetrol SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Shell PLC

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 YPF SA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Exxon Mobil Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Petrobras

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 BP PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.1 Ecopetrol SA

List of Figures

- Figure 1: South America Oil and Gas Downstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Oil and Gas Downstream Market Share (%) by Company 2024

List of Tables

- Table 1: South America Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Oil and Gas Downstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: South America Oil and Gas Downstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 4: South America Oil and Gas Downstream Market Volume Million Forecast, by Sector 2019 & 2032

- Table 5: South America Oil and Gas Downstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: South America Oil and Gas Downstream Market Volume Million Forecast, by Geography 2019 & 2032

- Table 7: South America Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South America Oil and Gas Downstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: South America Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: South America Oil and Gas Downstream Market Volume Million Forecast, by Country 2019 & 2032

- Table 11: Brazil South America Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil South America Oil and Gas Downstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina South America Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina South America Oil and Gas Downstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of South America South America Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America South America Oil and Gas Downstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: South America Oil and Gas Downstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 18: South America Oil and Gas Downstream Market Volume Million Forecast, by Sector 2019 & 2032

- Table 19: South America Oil and Gas Downstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: South America Oil and Gas Downstream Market Volume Million Forecast, by Geography 2019 & 2032

- Table 21: South America Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: South America Oil and Gas Downstream Market Volume Million Forecast, by Country 2019 & 2032

- Table 23: South America Oil and Gas Downstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 24: South America Oil and Gas Downstream Market Volume Million Forecast, by Sector 2019 & 2032

- Table 25: South America Oil and Gas Downstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: South America Oil and Gas Downstream Market Volume Million Forecast, by Geography 2019 & 2032

- Table 27: South America Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: South America Oil and Gas Downstream Market Volume Million Forecast, by Country 2019 & 2032

- Table 29: South America Oil and Gas Downstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 30: South America Oil and Gas Downstream Market Volume Million Forecast, by Sector 2019 & 2032

- Table 31: South America Oil and Gas Downstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: South America Oil and Gas Downstream Market Volume Million Forecast, by Geography 2019 & 2032

- Table 33: South America Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: South America Oil and Gas Downstream Market Volume Million Forecast, by Country 2019 & 2032

- Table 35: South America Oil and Gas Downstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 36: South America Oil and Gas Downstream Market Volume Million Forecast, by Sector 2019 & 2032

- Table 37: South America Oil and Gas Downstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: South America Oil and Gas Downstream Market Volume Million Forecast, by Geography 2019 & 2032

- Table 39: South America Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: South America Oil and Gas Downstream Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Oil and Gas Downstream Market?

The projected CAGR is approximately > 3.90%.

2. Which companies are prominent players in the South America Oil and Gas Downstream Market?

Key companies in the market include Ecopetrol SA, Shell PLC, YPF SA, Exxon Mobil Corporation, Petrobras, BP PLC.

3. What are the main segments of the South America Oil and Gas Downstream Market?

The market segments include Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Industrialization across the Globe; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

Refinery Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

September 2022: The Colombian state oil company Ecopetrol completed expansion works at its Reficar oil refinery in Cartagena as it seeks to meet rising domestic fuel demand. This expansion consolidates the Cartagena refinery as a strategic asset to guarantee Colombia's energy sovereignty. Also, this refinery would now produce diesel and gasoline with sulfur content levels below 100 parts per million (ppm) and 50 ppm, respectively.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Oil and Gas Downstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Oil and Gas Downstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Oil and Gas Downstream Market?

To stay informed about further developments, trends, and reports in the South America Oil and Gas Downstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence