Key Insights

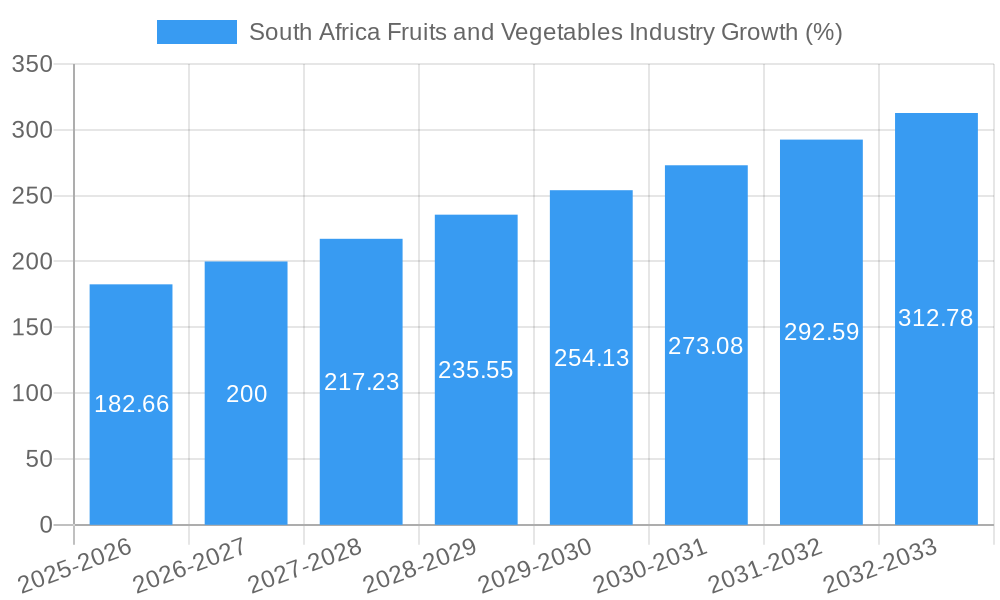

The South African fruits and vegetables industry, valued at approximately $2.38 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.70% from 2025 to 2033. This growth is fueled by several key factors. Rising health consciousness among consumers is driving increased demand for fresh produce, contributing significantly to the consumption analysis segment. Furthermore, government initiatives promoting agricultural development and supporting export activities are bolstering production and creating new market opportunities. The industry's performance is also benefiting from advancements in agricultural technology, leading to improved yields and efficiency in farming practices. However, challenges remain, including water scarcity in certain regions, which impacts production output, particularly for water-intensive fruits and vegetables. Additionally, fluctuating global market prices and the impact of climate change pose risks to the industry's sustained growth. The segmentation of the market into fruits and vegetables allows for targeted strategies by companies and allows for a more nuanced understanding of the market dynamics within the South African context. Within the segments, further analysis of production, consumption, import, and export data highlights opportunities for investment and growth within each category. The South African market is particularly notable due to its significant role within the African continent and presents opportunities for both domestic and international companies.

The competitive landscape is characterized by a mix of large-scale commercial farms and smaller-scale producers. The success of individual companies hinges on factors such as efficient farming techniques, access to modern technology, strong supply chain management, and effective marketing strategies to reach both domestic and international markets. Analyzing trends in consumption patterns is essential for optimizing production and distribution. For instance, understanding shifts in consumer preferences towards organic produce or specific types of fruits and vegetables can inform strategic decisions regarding crop selection and marketing efforts. The continued growth of the industry depends on addressing existing constraints, implementing sustainable farming practices, and adapting to the evolving global market dynamics. Further investment in research and development, improved infrastructure, and effective government policies are crucial to unlock the full potential of the South African fruits and vegetables sector.

South Africa Fruits and Vegetables Industry Report: 2019-2033

Unlocking Growth Opportunities in South Africa's Thriving Produce Sector

This comprehensive report provides an in-depth analysis of South Africa's fruits and vegetables industry, offering valuable insights for investors, businesses, and stakeholders. Covering the period 2019-2033, with a base year of 2025, this study unveils market dynamics, trends, and future projections, empowering informed decision-making. The report meticulously examines production, consumption, import, and export analyses for both fruits and vegetables, identifying key segments and leading players. With detailed company profiles, market concentration analysis, and exploration of emerging opportunities, this report is an indispensable resource for navigating the complexities of this dynamic market. The market size is projected to reach xx Million by 2033.

South Africa Fruits and Vegetables Industry Market Dynamics & Concentration

The South African fruits and vegetables industry is characterized by a moderately concentrated market with a few dominant players controlling significant market share. Market share data reveals that the top 5 players account for approximately xx% of the total market revenue in 2025. Innovation is driven primarily by technological advancements in farming practices (e.g., precision agriculture, hydroponics) and improved post-harvest handling techniques to minimize waste. The regulatory framework, including food safety standards and export regulations, significantly impacts market operations. Substitute products, such as imported processed foods, present competitive pressure. End-user trends, including growing health consciousness and demand for convenience, shape product development. M&A activities in recent years have been modest, with approximately xx deals recorded between 2019 and 2024.

- Market Concentration: Top 5 players hold xx% market share (2025).

- Innovation Drivers: Precision agriculture, hydroponics, improved post-harvest handling.

- Regulatory Framework: Food safety standards, export regulations.

- Product Substitutes: Imported processed foods.

- End-User Trends: Health consciousness, demand for convenience.

- M&A Activity: Approximately xx deals (2019-2024).

South Africa Fruits and Vegetables Industry Industry Trends & Analysis

The South African fruits and vegetables industry is experiencing robust growth, driven by factors such as increasing disposable incomes, changing consumer preferences towards healthier diets, and government initiatives promoting agricultural development. The industry's CAGR is estimated at xx% during the forecast period (2025-2033), with significant market penetration in urban areas. Technological disruptions, including the adoption of smart farming technologies and improved cold chain infrastructure, are enhancing efficiency and reducing post-harvest losses. Consumer preferences are shifting towards organic produce, locally sourced products, and convenient ready-to-eat options. Competitive dynamics are characterized by both domestic and international players vying for market share, leading to increased innovation and price competition.

Leading Markets & Segments in South Africa Fruits and Vegetables Industry

Vegetables:

- Production Analysis: The Western Cape remains the leading region for vegetable production, driven by favorable climatic conditions and established infrastructure.

- Key Drivers: Favorable climate, irrigation infrastructure, government support programs.

- Consumption Analysis: Urban areas exhibit higher per capita consumption due to higher disposable incomes and access to diverse products.

- Key Drivers: Higher disposable incomes in urban areas, increasing health consciousness.

- Import Analysis: South Africa imports specific niche vegetables due to limitations in local production.

- Key Drivers: Supply gaps in specialized vegetable varieties.

- Export Analysis: Exports of certain vegetables, like butternut and green beans, contribute significantly to the industry's revenue.

- Key Drivers: Competitive pricing, favorable export agreements.

Fruits:

- Production Analysis: The Limpopo and Mpumalanga provinces are key fruit-producing regions, known for their citrus and deciduous fruits respectively.

- Key Drivers: Suitable climate, established orchards, export-oriented production.

- Consumption Analysis: Fruit consumption is widespread across the country, with varying preferences based on regional climates and cultural factors.

- Key Drivers: Availability, affordability, cultural preferences.

- Import Analysis: South Africa imports specific fruits to meet domestic demand, particularly during off-seasons.

- Key Drivers: Seasonal gaps in local production.

- Export Analysis: The country is a major exporter of citrus fruits, contributing significantly to the national economy.

- Key Drivers: High-quality production, established export markets.

The Western Cape's dominance in vegetable production and the Limpopo/Mpumalanga region's strength in fruit production showcase regional specialization based on climatic suitability and existing infrastructure.

South Africa Fruits and Vegetables Industry Product Developments

Recent product innovations focus on enhancing shelf life, improving nutritional value, and offering convenient formats. Technological advancements, such as modified atmosphere packaging and irradiation, are extending the shelf life of fresh produce. There is a growing trend towards developing value-added products, including ready-to-eat salads and fruit juices, to cater to consumer demand for convenience. These innovations enhance competitiveness and address market needs for longer shelf-life products and convenient consumption options.

Key Drivers of South Africa Fruits and Vegetables Industry Growth

Several factors fuel the industry's growth. Technological advancements in farming techniques improve yields and efficiency. Economic growth leads to increased disposable incomes and higher demand. Government support programs, such as subsidies and infrastructure development, bolster the sector. Favorable climatic conditions in certain regions contribute to high production volumes. Export opportunities to international markets drive further growth.

Challenges in the South Africa Fruits and Vegetables Industry Market

The industry faces several challenges. Water scarcity in certain regions restricts production. Post-harvest losses due to inadequate storage and transportation infrastructure impact profitability. Fluctuations in global commodity prices affect export earnings. Competition from imported produce puts pressure on local farmers. These challenges, if not effectively addressed, can significantly reduce the industry’s potential.

Emerging Opportunities in South Africa Fruits and Vegetables Industry

The industry is poised for growth through strategic partnerships with processors and retailers to create value-added products. Expansion into new export markets through targeted marketing initiatives presents significant opportunities. Investment in technology like precision agriculture and automated harvesting can improve efficiency and productivity. Focus on sustainable farming practices can increase consumer preference and brand appeal.

Leading Players in the South Africa Fruits and Vegetables Industry Sector

- Company A

- Company B

- Company C

- Company D

Key Milestones in South Africa Fruits and Vegetables Industry Industry

- 2020: Launch of a national food safety program.

- 2022: Significant investment in cold chain infrastructure.

- 2023: Introduction of new export regulations.

- 2024: Merger between two major fruit exporters.

Strategic Outlook for South Africa Fruits and Vegetables Industry Market

The South African fruits and vegetables industry presents a strong outlook. Continued investments in technology, infrastructure, and sustainable farming practices will further enhance its competitiveness and boost its potential. Strategic partnerships, both domestically and internationally, are crucial for leveraging the sector's growth prospects. The long-term market potential remains significant, driven by rising domestic demand and the growing global appetite for fresh produce.

South Africa Fruits and Vegetables Industry Segmentation

-

1. Vegetables

- 1.1. Production Analysis

- 1.2. Consumption Analysis

- 1.3. Import Analysis

- 1.4. Export Analysis

-

2. Fruits

- 2.1. Production Analysis

- 2.2. Consumption Analysis

- 2.3. Import Analysis

- 2.4. Export Analysis

-

3. Vegetables

- 3.1. Production Analysis

- 3.2. Consumption Analysis

- 3.3. Import Analysis

- 3.4. Export Analysis

-

4. Fruits

- 4.1. Production Analysis

- 4.2. Consumption Analysis

- 4.3. Import Analysis

- 4.4. Export Analysis

South Africa Fruits and Vegetables Industry Segmentation By Geography

- 1. South Africa

South Africa Fruits and Vegetables Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Berry Consumption for Health Benefits; Increasing Adoption of High-Technology Farm Practices; Growing Usage of Berries in the Food and Beverage Industries

- 3.3. Market Restrains

- 3.3.1. High Production Cost Involved in Berry Production; Increasing Disease and Pest Infestations

- 3.4. Market Trends

- 3.4.1. Increase in Health Consciousness Among Consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Fruits and Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vegetables

- 5.1.1. Production Analysis

- 5.1.2. Consumption Analysis

- 5.1.3. Import Analysis

- 5.1.4. Export Analysis

- 5.2. Market Analysis, Insights and Forecast - by Fruits

- 5.2.1. Production Analysis

- 5.2.2. Consumption Analysis

- 5.2.3. Import Analysis

- 5.2.4. Export Analysis

- 5.3. Market Analysis, Insights and Forecast - by Vegetables

- 5.3.1. Production Analysis

- 5.3.2. Consumption Analysis

- 5.3.3. Import Analysis

- 5.3.4. Export Analysis

- 5.4. Market Analysis, Insights and Forecast - by Fruits

- 5.4.1. Production Analysis

- 5.4.2. Consumption Analysis

- 5.4.3. Import Analysis

- 5.4.4. Export Analysis

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Vegetables

- 6. South Africa South Africa Fruits and Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Fruits and Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Fruits and Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Fruits and Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Fruits and Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Fruits and Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1. ompany Profile

List of Figures

- Figure 1: South Africa Fruits and Vegetables Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Fruits and Vegetables Industry Share (%) by Company 2024

List of Tables

- Table 1: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 3: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 4: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 5: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 6: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Africa South Africa Fruits and Vegetables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Sudan South Africa Fruits and Vegetables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Uganda South Africa Fruits and Vegetables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Tanzania South Africa Fruits and Vegetables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kenya South Africa Fruits and Vegetables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Africa South Africa Fruits and Vegetables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 15: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 16: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 17: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 18: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Fruits and Vegetables Industry?

The projected CAGR is approximately 7.70%.

2. Which companies are prominent players in the South Africa Fruits and Vegetables Industry?

Key companies in the market include ompany Profile.

3. What are the main segments of the South Africa Fruits and Vegetables Industry?

The market segments include Vegetables, Fruits, Vegetables, Fruits.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Berry Consumption for Health Benefits; Increasing Adoption of High-Technology Farm Practices; Growing Usage of Berries in the Food and Beverage Industries.

6. What are the notable trends driving market growth?

Increase in Health Consciousness Among Consumers.

7. Are there any restraints impacting market growth?

High Production Cost Involved in Berry Production; Increasing Disease and Pest Infestations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Fruits and Vegetables Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Fruits and Vegetables Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Fruits and Vegetables Industry?

To stay informed about further developments, trends, and reports in the South Africa Fruits and Vegetables Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence