Key Insights

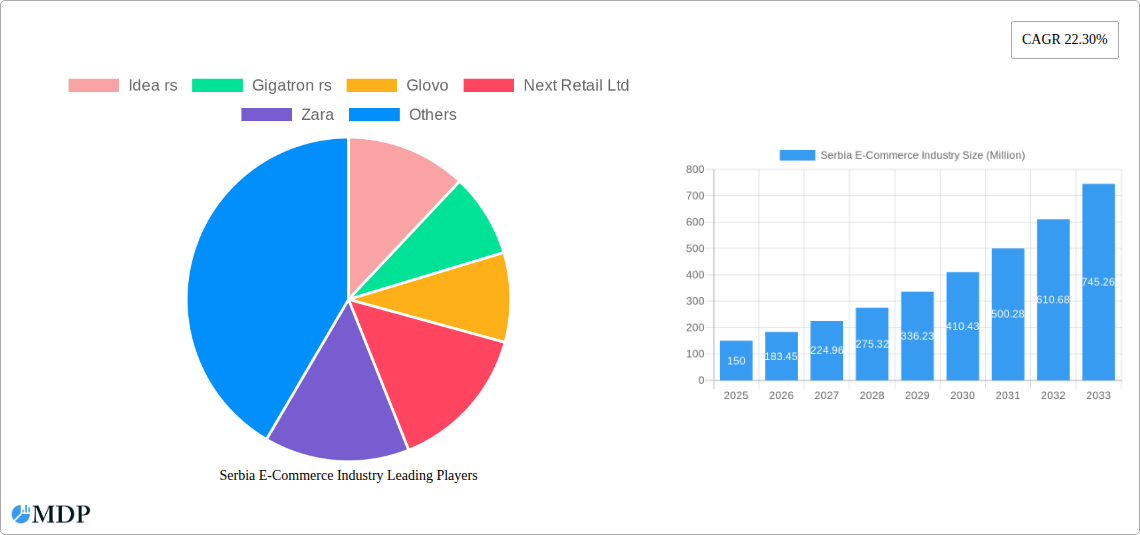

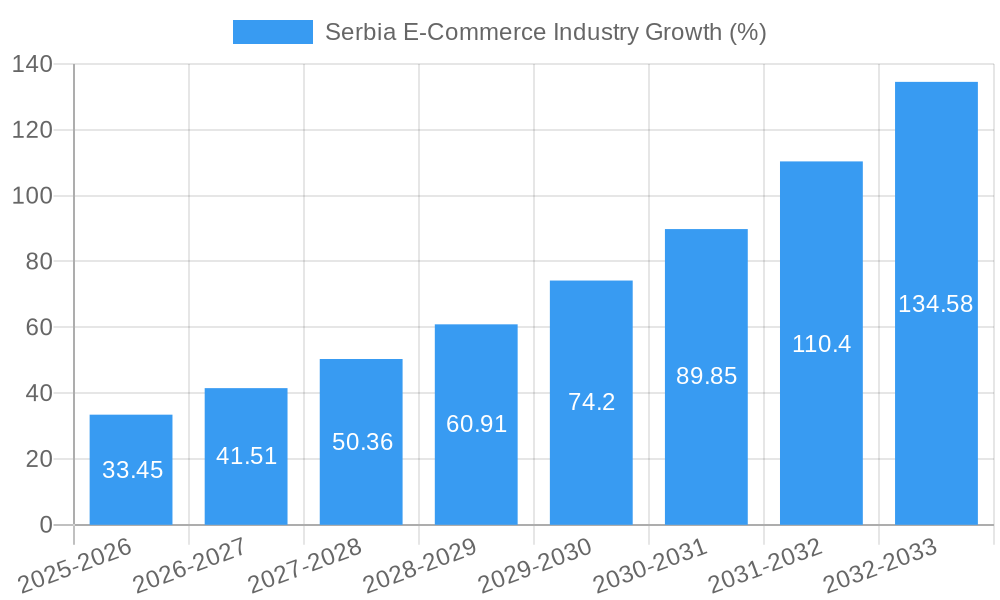

The Serbian e-commerce market, exhibiting a robust Compound Annual Growth Rate (CAGR) of 22.30% from 2019 to 2024, demonstrates significant potential for expansion. While the precise 2025 market size isn't explicitly stated, extrapolating from the provided CAGR and assuming a 2024 market size (a reasonable estimation requires additional data, but assuming the market is in millions of value unit) allows for a projection of substantial growth in the coming years. The market's dynamism is fueled by rising internet penetration, increasing smartphone usage, and a burgeoning young, tech-savvy population embracing online shopping. Key drivers include improved logistics infrastructure, the proliferation of convenient payment gateways, and the growing popularity of online marketplaces and social commerce. Companies like Idea rs, Gigatron rs, and others listed are actively shaping this landscape, showcasing a competitive market with established players and emerging entrants. However, challenges remain. While not explicitly mentioned as restraints, potential factors include concerns about data security, logistical limitations in reaching remote areas, and the need for further development of a robust digital payments infrastructure across the nation.

Looking forward to 2033, the Serbian e-commerce sector is poised for continued expansion. The sustained CAGR suggests a substantial increase in market value, driven by ongoing technological advancements, evolving consumer behavior, and potential government initiatives to further support the digital economy. Continued investment in logistics, payment infrastructure, and cybersecurity will be crucial to realizing the full potential of this growing market. Market segmentation by application (e.g., fashion, electronics, groceries) will likely play an increasingly important role in understanding market dynamics and attracting targeted investments. The success of e-commerce in Serbia hinges on addressing remaining infrastructure gaps and fostering greater consumer trust in online transactions, thus capitalizing on the substantial growth potential ahead.

Serbia E-Commerce Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Serbian e-commerce market, offering invaluable insights for businesses, investors, and policymakers. We analyze market dynamics, growth drivers, challenges, and opportunities, projecting market trends through 2033. The report covers key players, significant milestones, and strategic recommendations for navigating this rapidly evolving landscape. Our study period spans 2019-2033, with 2025 as the base and estimated year.

Serbia E-Commerce Industry Market Dynamics & Concentration

The Serbian e-commerce market exhibits a dynamic interplay of factors influencing its concentration and growth. Market share is currently dominated by a few key players, with Idea rs, Gigatron rs, and Glovo leading the pack. However, increased competition from both domestic and international players is anticipated. Innovation, driven by advancements in logistics and payment technologies, is a major growth catalyst. The regulatory framework, while evolving, presents both opportunities and challenges. Product substitutes, such as traditional brick-and-mortar stores, continue to exert competitive pressure, although their market share is steadily declining. End-user trends show a clear preference for online shopping convenience, fueled by increasing internet penetration and smartphone adoption. M&A activity in the sector has been moderate, with approximately xx deals recorded between 2019 and 2024, indicating consolidation and potential for further growth through strategic acquisitions. The estimated market concentration ratio (CR4) for 2025 is xx%.

- Market Share: Idea rs (xx%), Gigatron rs (xx%), Glovo (xx%), Others (xx%).

- M&A Deal Count (2019-2024): xx

- Key Innovation Drivers: Improved logistics, mobile payment solutions, personalized marketing.

- Regulatory Factors: Evolving data privacy regulations and consumer protection laws.

Serbia E-Commerce Industry Industry Trends & Analysis

The Serbian e-commerce industry is experiencing robust growth, projected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. Rising internet and smartphone penetration are significantly increasing the number of potential online shoppers. Changing consumer preferences are shifting towards convenience and digital experiences, with online shopping becoming increasingly popular, particularly amongst younger demographics. Technological disruptions, including advancements in e-commerce platforms, mobile payment systems, and delivery networks are streamlining operations and enhancing customer experience. Competitive dynamics are intense, with established players facing increased competition from both domestic and international entrants. This necessitates continuous innovation and adaptation to maintain market share. Market penetration for e-commerce in Serbia is estimated at xx% in 2025, expected to increase to xx% by 2033.

Leading Markets & Segments in Serbia E-Commerce Industry

The Serbian e-commerce market is largely concentrated in urban areas, with Belgrade and other major cities exhibiting the highest adoption rates. This dominance is driven by several factors:

- Higher Internet Penetration: Urban areas enjoy significantly higher internet and broadband access compared to rural regions.

- Developed Infrastructure: Better logistics and delivery networks are established in urban centers.

- Higher Disposable Incomes: Urban populations generally have higher purchasing power.

This dominance is expected to continue, although efforts to expand e-commerce into rural areas are anticipated through governmental initiatives and investment in infrastructure. Market Segmentation by Application shows that the leading segment is consumer electronics (xx% market share in 2025), followed by fashion and apparel (xx%), and groceries (xx%).

Serbia E-Commerce Industry Product Developments

Product innovation in the Serbian e-commerce sector is primarily focused on enhancing customer experience and efficiency. This includes the integration of advanced technologies such as AI-powered recommendation engines, personalized marketing tools, and improved mobile app functionalities. Competition is driving the adoption of new technologies to gain a competitive advantage, such as implementing seamless payment gateways and enhancing customer service capabilities through chatbots. The market is also witnessing a rise in specialized e-commerce platforms catering to niche segments like organic food and sustainable products.

Key Drivers of Serbia E-Commerce Industry Growth

Several factors are propelling the growth of Serbia's e-commerce sector:

- Increasing Internet and Smartphone Penetration: A growing number of internet users and smartphone owners are driving adoption.

- Government Initiatives: Policies promoting digitalization and e-commerce are fostering market expansion.

- Improving Logistics and Delivery Networks: Enhanced delivery infrastructure is making online shopping more convenient.

- Rising Disposable Incomes: Increased purchasing power is fueling consumer spending on e-commerce.

Challenges in the Serbia E-Commerce Industry Market

Despite its growth potential, the Serbian e-commerce sector faces significant challenges:

- Limited Logistics Infrastructure: In some areas, particularly rural regions, delivery infrastructure remains underdeveloped.

- Cybersecurity Concerns: Data breaches and online fraud are concerns that need to be addressed.

- Payment Gateway Limitations: Not all online payment methods are widely accepted.

- Consumer Trust: Building trust in online transactions and protecting consumer rights remain crucial.

Emerging Opportunities in Serbia E-Commerce Industry

The Serbian e-commerce market presents several promising opportunities for growth:

- Expansion into Rural Markets: Reaching underserved areas through strategic partnerships and improved infrastructure presents a substantial opportunity.

- Growth of Mobile Commerce: The increasing use of smartphones presents a huge potential for mobile-based e-commerce.

- Niche Market Development: Focus on specialized e-commerce platforms tailored to specific consumer needs is promising.

- Cross-border E-commerce: Expanding operations to reach regional and international markets can boost growth.

Leading Players in the Serbia E-Commerce Industry Sector

- Idea rs

- Gigatron rs

- Glovo

- Next Retail Ltd

- Zara

- BC Group

- Forma Ideale

- Emmezeta rs

- Wolt

- Technomanija doo

- Ikea Systems BV

- Fashion&friends

- SportVision rs

- AU Apoteka "Alek"

Key Milestones in Serbia E-Commerce Industry Industry

- 2020: Government launches a digitalization strategy to boost e-commerce adoption.

- 2021: Major e-commerce players invest in improved logistics and delivery infrastructure.

- 2022: Significant increase in mobile commerce transactions observed.

- 2023: Introduction of new payment gateways and enhanced security measures.

- 2024: Several mergers and acquisitions occur, leading to market consolidation.

Strategic Outlook for Serbia E-Commerce Industry Market

The Serbian e-commerce market is poised for significant growth in the coming years, driven by increasing internet penetration, smartphone adoption, and government support. Strategic opportunities lie in leveraging technological advancements, focusing on customer experience, expanding into underserved markets, and forming strategic partnerships. Companies that adapt to the evolving market dynamics and embrace innovation will be best positioned to succeed in this dynamic and rapidly growing sector. The market is expected to reach xx Million by 2033, presenting substantial potential for investors and businesses.

Serbia E-Commerce Industry Segmentation

- 1. B2C ecommerce

-

2. Application

- 2.1. Beauty & Personal Care

- 2.2. Consumer Electronics

- 2.3. Fashion & Apparel

- 2.4. Food & Beverage

- 2.5. Furniture & Home

- 2.6. Others (Toys, DIY, Media, etc.)

-

3. B2B e-commerce

- 3.1. Market size for 2017-2027

Serbia E-Commerce Industry Segmentation By Geography

- 1. Serbia

Serbia E-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 22.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Fashion Industry; Penetration of Internet and Smartphone Usage

- 3.3. Market Restrains

- 3.3.1. High costs associated with geospatial technologies

- 3.4. Market Trends

- 3.4.1. Internet usage to drive the e-commerce market in the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Serbia E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by B2C ecommerce

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beauty & Personal Care

- 5.2.2. Consumer Electronics

- 5.2.3. Fashion & Apparel

- 5.2.4. Food & Beverage

- 5.2.5. Furniture & Home

- 5.2.6. Others (Toys, DIY, Media, etc.)

- 5.3. Market Analysis, Insights and Forecast - by B2B e-commerce

- 5.3.1. Market size for 2017-2027

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Serbia

- 5.1. Market Analysis, Insights and Forecast - by B2C ecommerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Idea rs

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gigatron rs

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Glovo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Next Retail Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zara

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BC Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Forma Ideale

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Emmezeta rs

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Wolt

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Technomanija doo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ikea Systems BV

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Fashion&friends

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 SportVision rs

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 AU Apoteka "Alek"

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Idea rs

List of Figures

- Figure 1: Serbia E-Commerce Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Serbia E-Commerce Industry Share (%) by Company 2024

List of Tables

- Table 1: Serbia E-Commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Serbia E-Commerce Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Serbia E-Commerce Industry Revenue Million Forecast, by B2C ecommerce 2019 & 2032

- Table 4: Serbia E-Commerce Industry Volume K Unit Forecast, by B2C ecommerce 2019 & 2032

- Table 5: Serbia E-Commerce Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Serbia E-Commerce Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Serbia E-Commerce Industry Revenue Million Forecast, by B2B e-commerce 2019 & 2032

- Table 8: Serbia E-Commerce Industry Volume K Unit Forecast, by B2B e-commerce 2019 & 2032

- Table 9: Serbia E-Commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Serbia E-Commerce Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Serbia E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Serbia E-Commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Serbia E-Commerce Industry Revenue Million Forecast, by B2C ecommerce 2019 & 2032

- Table 14: Serbia E-Commerce Industry Volume K Unit Forecast, by B2C ecommerce 2019 & 2032

- Table 15: Serbia E-Commerce Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Serbia E-Commerce Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 17: Serbia E-Commerce Industry Revenue Million Forecast, by B2B e-commerce 2019 & 2032

- Table 18: Serbia E-Commerce Industry Volume K Unit Forecast, by B2B e-commerce 2019 & 2032

- Table 19: Serbia E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Serbia E-Commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Serbia E-Commerce Industry?

The projected CAGR is approximately 22.30%.

2. Which companies are prominent players in the Serbia E-Commerce Industry?

Key companies in the market include Idea rs, Gigatron rs, Glovo, Next Retail Ltd, Zara, BC Group, Forma Ideale, Emmezeta rs, Wolt, Technomanija doo, Ikea Systems BV, Fashion&friends, SportVision rs, AU Apoteka "Alek".

3. What are the main segments of the Serbia E-Commerce Industry?

The market segments include B2C ecommerce, Application, B2B e-commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Fashion Industry; Penetration of Internet and Smartphone Usage.

6. What are the notable trends driving market growth?

Internet usage to drive the e-commerce market in the country.

7. Are there any restraints impacting market growth?

High costs associated with geospatial technologies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Serbia E-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Serbia E-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Serbia E-Commerce Industry?

To stay informed about further developments, trends, and reports in the Serbia E-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence