Key Insights

The Saudi Arabian fragrance market is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of 5.94%. Valued at $2.12 billion in the base year 2023, the market is anticipated to reach substantial figures by 2033. This growth is underpinned by rising disposable incomes, particularly among the youth, driving demand for premium and luxury fragrances. A heightened focus on personal grooming and self-expression further fuels demand across both traditional oud-based perfumes and international brands. E-commerce platforms are increasingly vital in enhancing market accessibility and driving sales. The market segments into mass and premium categories, with both male and female consumers contributing substantially to its value. While urban centers like Riyadh and Jeddah are expected to exhibit higher demand, regional variations may exist. Potential challenges include the impact of oil price volatility on consumer spending and intense competition from both global and local fragrance houses.

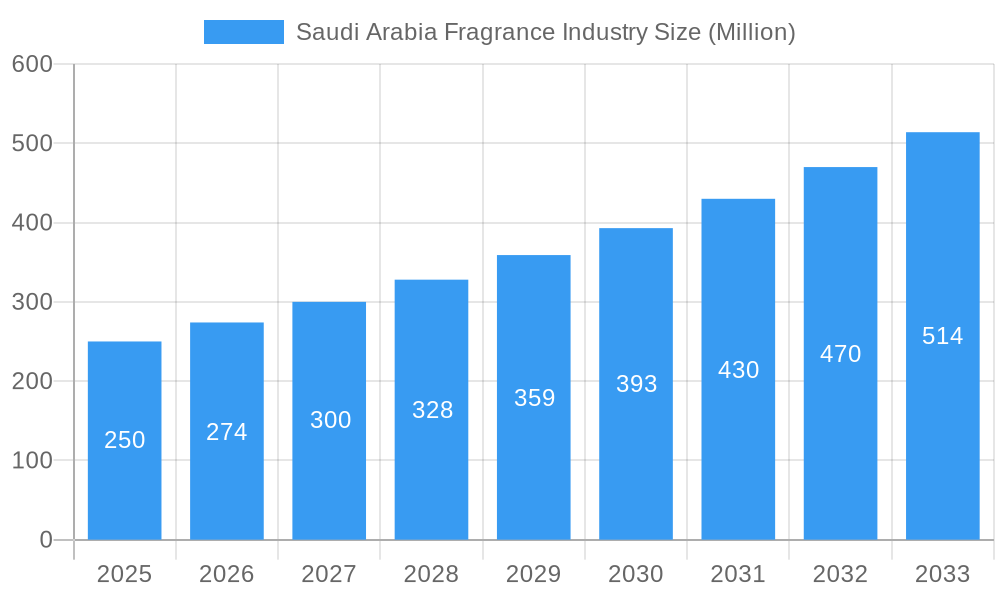

Saudi Arabia Fragrance Industry Market Size (In Billion)

The competitive arena features major global players such as L'Oréal and Unilever, alongside leading regional brands including Arabian Oud and Rasasi. Key strategies for these companies involve product innovation tailored to evolving consumer tastes, and the expansion of distribution networks. Successful approaches include culturally relevant marketing campaigns and strategic engagement with younger demographics via social media. While the mass market benefits from affordability, the premium segment shows strong growth potential due to increasing purchasing power and a desire for luxury. Future market trajectory will depend on companies' adaptability to consumer trends, effective navigation of competitive landscapes, and proactive responses to macroeconomic shifts. In-depth analysis of regional market sizes and specific consumer preferences will provide a more granular understanding of this dynamic sector.

Saudi Arabia Fragrance Industry Company Market Share

Saudi Arabia Fragrance Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Saudi Arabia fragrance industry, offering invaluable insights for stakeholders across the value chain. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, leading players, emerging trends, and future growth prospects. The Saudi Arabian fragrance market, valued at xx Million in 2025, is projected to experience significant growth, reaching xx Million by 2033. This report is a crucial resource for businesses seeking to navigate the complexities and capitalize on the opportunities within this dynamic market.

Saudi Arabia Fragrance Industry Market Dynamics & Concentration

The Saudi Arabian fragrance market is characterized by a mix of established international players and local brands. Market concentration is moderate, with a few dominant players holding significant market share, while numerous smaller brands compete within niche segments. Innovation, particularly in fragrance technology and personalized experiences, is a key driver. The regulatory framework, while evolving, generally supports industry growth. Product substitutes, including natural essential oils and home fragrance diffusers, pose some competitive pressure. End-user trends reveal a growing preference for premium and niche fragrances, driven by rising disposable incomes and a desire for self-expression. M&A activity has been relatively low in recent years, with only xx deals recorded between 2019 and 2024, indicating a relatively stable competitive landscape.

- Market Share: The top 5 players hold approximately xx% of the market share.

- M&A Deal Count (2019-2024): xx

- Innovation Drivers: Technological advancements in fragrance creation and delivery systems.

- Regulatory Framework: Generally supportive, with ongoing developments focusing on product safety and labeling.

- End-User Trends: Shift towards premium and personalized fragrances.

Saudi Arabia Fragrance Industry Industry Trends & Analysis

The Saudi Arabian fragrance market is experiencing robust growth, fueled by several key factors. The increasing disposable income of the population and a growing preference for personal care products drive demand. Technological advancements, particularly in AI and AR, are transforming the consumer experience. Personalized fragrance recommendations and augmented reality try-on tools are gaining popularity. The market shows a clear preference for premium and luxury fragrances, creating opportunities for high-end brands. Competitive dynamics are intense, with both international and local players vying for market share. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is estimated at xx%. Market penetration of premium fragrances is projected to reach xx% by 2033.

Leading Markets & Segments in Saudi Arabia Fragrance Industry

The Saudi Arabian fragrance market is dominated by the premium segment, driven by a growing affluent population with a higher propensity for luxury goods. The fragrance type holds the largest share within the overall market. Within end-user segments, women's fragrances lead, although the unsex segment is demonstrating strong growth. Key drivers for this dominance include:

Economic Policies: Government initiatives supporting the growth of the consumer goods sector.

Infrastructure: Well-developed retail infrastructure, including online channels, facilitates product distribution.

Dominant Segment: Premium Fragrances, followed by Women's Fragrances.

Geographic Concentration: Major cities like Riyadh, Jeddah, and Dammam account for the largest share of consumption.

The Mass market segment also holds significant potential, and the continued diversification of the retail landscape presents opportunities for brands to establish their presence.

Saudi Arabia Fragrance Industry Product Developments

Recent product innovations highlight a trend towards personalization, convenience, and technological integration. L'Oréal's HAPTA and Brow Magic devices represent significant advancements in cosmetic application. The Estée Lauder Companies' Voice-Enabled Makeup Assistant caters to visually impaired users. These technological advancements improve accessibility and enhance the user experience, thereby driving market growth. The market fit for these innovative products is high, given the growing demand for personalized and technologically advanced beauty solutions.

Key Drivers of Saudi Arabia Fragrance Industry Growth

Several factors contribute to the growth of the Saudi Arabian fragrance industry. Rising disposable incomes are increasing consumer spending on personal care and luxury products. The young and growing population is highly receptive to new trends and innovations. Government initiatives to support local businesses create a favorable business environment. Furthermore, technological advancements and the growing popularity of online retail are expanding market access and boosting sales.

Challenges in the Saudi Arabia Fragrance Industry Market

The Saudi Arabian fragrance market faces some challenges, including intense competition from both international and local brands. Maintaining supply chain efficiency amidst global disruptions can also impact operations. Regulatory compliance and maintaining product quality standards are also crucial. These factors, if not managed effectively, could hinder the industry's growth trajectory, potentially reducing projected market values by xx Million by 2033.

Emerging Opportunities in Saudi Arabia Fragrance Industry

The Saudi Arabian fragrance market presents several promising opportunities. The expansion of e-commerce provides new avenues for reaching consumers. Strategic partnerships between international and local brands could accelerate market penetration. Technological advancements in fragrance creation and personalized experiences offer significant potential for innovation and market expansion. These developments hold the potential to increase the market value by xx Million by 2033.

Leading Players in the Saudi Arabia Fragrance Industry Sector

- Shiseido Company Limited

- Arabian Oud

- Rasasi Perfumes Industry LLC

- The Fragrance Kitchen (TFK)

- The Estée Lauder Companies

- Unilever PLC

- Zohoor Alreef

- L'Oréal S A

- Revlon Inc

- The Procter & Gamble Company

Key Milestones in Saudi Arabia Fragrance Industry Industry

- December 2021: Arabian Oud launched the new fragrance Oud07, expanding its product portfolio and reaching both online and offline consumers.

- January 2023: L'Oréal Groupe unveiled HAPTA and Brow Magic, demonstrating technological advancements in beauty applications. These innovations enhance accessibility and offer personalized experiences.

- January 2023: The Estée Lauder Companies launched the Voice-Enabled Makeup Assistant (VMA), an AI-powered software designed to support visually impaired makeup users, significantly enhancing inclusivity.

Strategic Outlook for Saudi Arabia Fragrance Industry Market

The Saudi Arabian fragrance market is poised for continued growth, driven by increasing disposable incomes, a young and dynamic population, and ongoing technological advancements. Strategic partnerships, product innovation, and effective marketing strategies will be crucial for success. The focus on personalized experiences and premium fragrances, alongside leveraging digital channels, will be key to maximizing market potential and achieving significant market share gains.

Saudi Arabia Fragrance Industry Segmentation

-

1. Type

- 1.1. Hair Care

- 1.2. Skin Care

- 1.3. Make-up Products

- 1.4. Deodorants

- 1.5. Fragrances

-

2. Category

- 2.1. Mass

- 2.2. Premium

-

3. End-User

- 3.1. Men

- 3.2. Women

- 3.3. Unsex

Saudi Arabia Fragrance Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Fragrance Industry Regional Market Share

Geographic Coverage of Saudi Arabia Fragrance Industry

Saudi Arabia Fragrance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sustainable Fashion Trend; Strategic Expansion With Respect To E-commerce Subscription

- 3.3. Market Restrains

- 3.3.1. High Cost of Rented Apparel Maintenance

- 3.4. Market Trends

- 3.4.1. Rising Number of Active Social Media Users

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Fragrance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hair Care

- 5.1.2. Skin Care

- 5.1.3. Make-up Products

- 5.1.4. Deodorants

- 5.1.5. Fragrances

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass

- 5.2.2. Premium

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Men

- 5.3.2. Women

- 5.3.3. Unsex

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shiseido Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Arabian Oud

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rasasi Perfumes Industry LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Fragrance Kitchen (TFK)*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Estée Lauder Companies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Unilever PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zohoor Alreef

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 L'Oréal S A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Revlon Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Procter & Gamble Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Shiseido Company Limited

List of Figures

- Figure 1: Saudi Arabia Fragrance Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Fragrance Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Fragrance Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Saudi Arabia Fragrance Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 3: Saudi Arabia Fragrance Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Saudi Arabia Fragrance Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Fragrance Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Saudi Arabia Fragrance Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 7: Saudi Arabia Fragrance Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 8: Saudi Arabia Fragrance Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Fragrance Industry?

The projected CAGR is approximately 5.94%.

2. Which companies are prominent players in the Saudi Arabia Fragrance Industry?

Key companies in the market include Shiseido Company Limited, Arabian Oud, Rasasi Perfumes Industry LLC, The Fragrance Kitchen (TFK)*List Not Exhaustive, The Estée Lauder Companies, Unilever PLC, Zohoor Alreef, L'Oréal S A, Revlon Inc, The Procter & Gamble Company.

3. What are the main segments of the Saudi Arabia Fragrance Industry?

The market segments include Type, Category, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.12 billion as of 2022.

5. What are some drivers contributing to market growth?

Sustainable Fashion Trend; Strategic Expansion With Respect To E-commerce Subscription.

6. What are the notable trends driving market growth?

Rising Number of Active Social Media Users.

7. Are there any restraints impacting market growth?

High Cost of Rented Apparel Maintenance.

8. Can you provide examples of recent developments in the market?

Jan 2023: At CES 2023, the L'Oréal Groupe revealed two new technological prototypes that open up new avenues for the expression of beauty. The first portable, ultra-precise computerized makeup applicator, called HAPTA, was created to improve the demands of those with restricted hand and arm mobility in terms of aesthetics. The first at-home electronic eyebrow makeup applicator, L'Oréal Brow Magic, was intended to give users custom brows in a matter of seconds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Fragrance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Fragrance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Fragrance Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Fragrance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence