Key Insights

The Russian mining machine industry, valued at approximately $160.19 billion in 2025, is projected for substantial expansion. This growth is propelled by escalating demand for minerals and metals and ongoing modernization within the mining sector. A Compound Annual Growth Rate (CAGR) of 8% is anticipated from the base year 2025 to 2033, indicating significant market development. Key growth catalysts include extensive infrastructure investments across Eastern and Western Russia, supportive government policies aimed at enhancing domestic mining, and an increasing emphasis on advanced and efficient mining equipment. Surface mining is expected to lead market share, followed by underground mining, aligning with prevalent Russian mining practices. Within applications, metal mining is forecast to experience the most robust growth, driven by the nation's rich mineral reserves and rising global demand. While the industry is transitioning towards electric powertrains, internal combustion engines are likely to remain prevalent in the short term due to established infrastructure and economic factors. Leading companies such as Hitachi Construction Machinery, Uralmash, and Prominer Mining Technology are strategically positioned to leverage this market expansion, while navigating challenges posed by import restrictions and fluctuating global commodity prices.

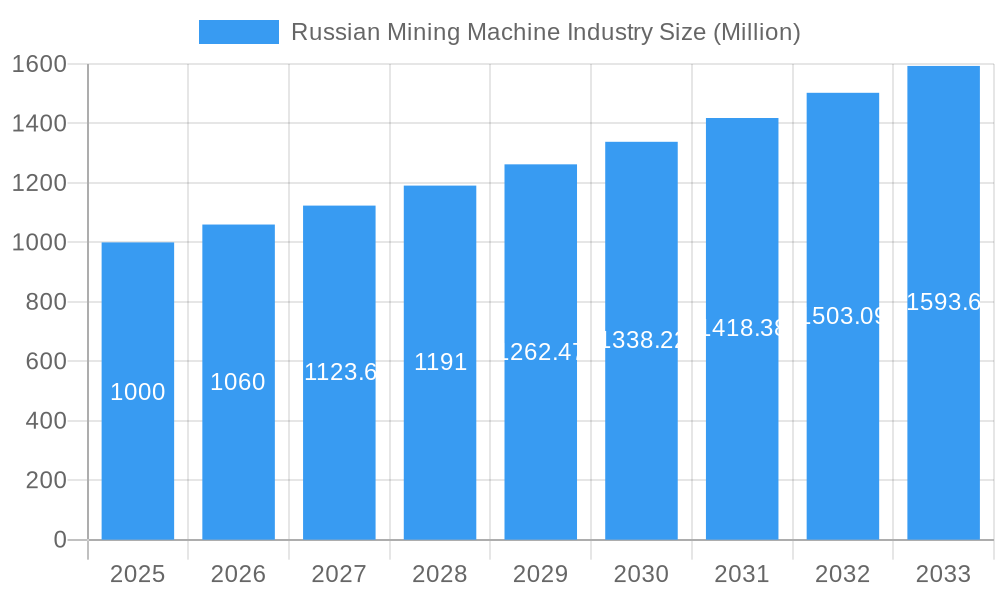

Russian Mining Machine Industry Market Size (In Billion)

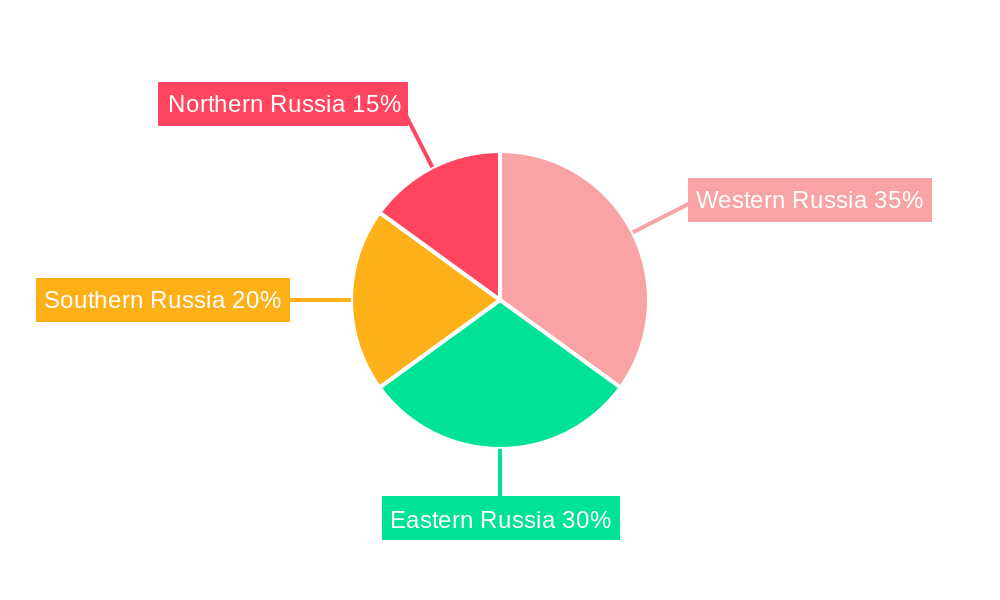

Industry segmentation offers further insights. The Mineral Processing Equipment segment is poised for growth in tandem with mining segments, reflecting the need for advanced extraction and processing technologies. Coal mining, while a significant contributor, may see slower growth relative to metal and mineral mining, influenced by the global transition to renewable energy. Market distribution will vary, with Western and Eastern Russia, as primary mining centers, expected to hold the largest market shares. The forecast period offers opportunities for both established players to increase their market presence and for new entrants to identify specific niches, particularly those focusing on innovative technologies and sustainable practices. However, critical challenges persist, including the establishment of resilient supply chains, securing skilled labor, and addressing environmental considerations inherent to large-scale mining operations.

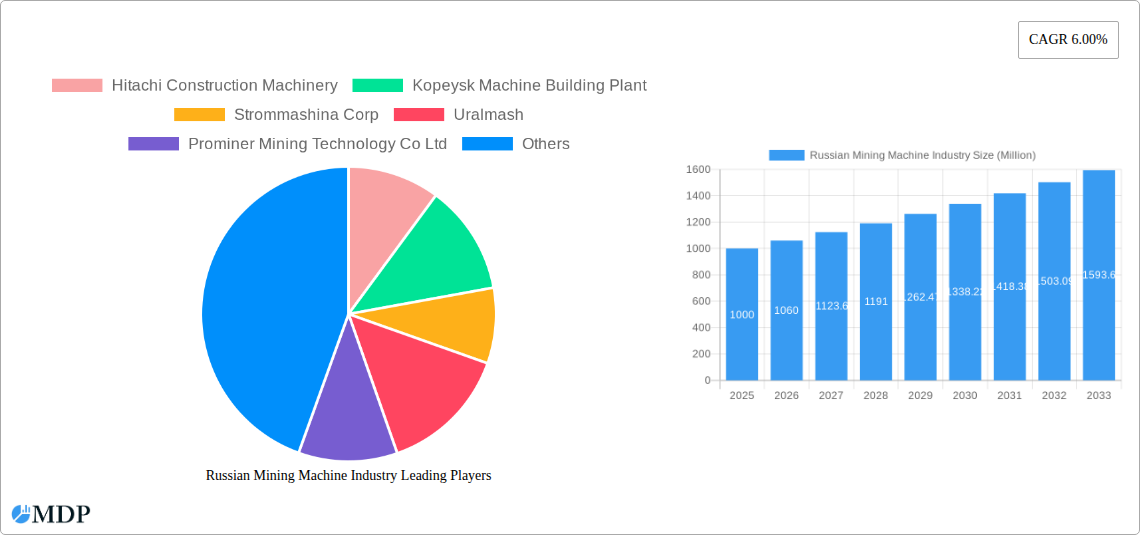

Russian Mining Machine Industry Company Market Share

Russian Mining Machine Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides a detailed analysis of the Russian mining machine industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. The study covers the period 2019-2033, with a focus on 2025, incorporating historical data, current market conditions, and future projections. This report is essential for investors, manufacturers, suppliers, and government agencies seeking to understand the growth potential, challenges, and opportunities within the Russian mining sector. The report covers key segments including surface mining, underground mining, and mineral processing equipment, across metal, mineral, and coal mining applications, analyzing both IC engine and electric powertrain types.

Russian Mining Machine Industry Market Dynamics & Concentration

The Russian mining machine industry exhibits a moderately concentrated market structure, with a few dominant players alongside numerous smaller companies. Market share data from 2024 indicates Uralmash holds approximately 25% of the market, followed by Hitachi Construction Machinery with 15%, and Strommashina Corp with 10%. The remaining market share is dispersed among other players, including Kopeysk Machine Building Plant, Prominer Mining Technology Co Ltd, and Xinhai Mineral Processing EP. Innovation is driven by the need for enhanced efficiency, safety, and automation in mining operations. Stringent environmental regulations are also shaping the industry landscape, pushing manufacturers towards the development of more eco-friendly equipment. The regulatory framework, while evolving, presents both opportunities and challenges for businesses operating in Russia. Product substitution is evident with the increasing adoption of electric powertrains in response to environmental concerns and potential cost savings. End-user trends show a preference for advanced technology, including automation and digitalization, to optimize productivity and reduce operational costs. M&A activity has been relatively low in recent years, with only 3 significant deals recorded between 2019 and 2024, indicating a stable yet potentially consolidating market.

Russian Mining Machine Industry Industry Trends & Analysis

The Russian mining machine industry is poised for steady growth, driven by increasing demand for minerals and metals, ongoing modernization of existing mining operations, and government initiatives aimed at boosting domestic production. The Compound Annual Growth Rate (CAGR) is estimated at 4.5% from 2025-2033, with market penetration expected to reach xx% by 2033. Technological advancements such as automation, remote operation, and the adoption of electric and hybrid powertrains are significantly reshaping the industry. Consumer preferences are shifting towards more energy-efficient, technologically advanced, and sustainable equipment. Competitive dynamics are characterized by intense rivalry among established players and increasing participation from foreign companies. The market is becoming increasingly sophisticated, with a greater emphasis on after-sales services and customized solutions. The Russian government's focus on infrastructure development, particularly in remote mining regions, is providing further impetus for growth.

Leading Markets & Segments in Russian Mining Machine Industry

The dominant segment in the Russian mining machine industry is currently Underground Mining, accounting for 45% of the market in 2025, driven by the prevalence of deep and complex underground mines in Russia. Within applications, Metal Mining represents the largest sector, at 40% in 2025, reflecting Russia's substantial metal reserves and ongoing mining activities. Regarding powertrains, IC Engines still dominate at 70% in 2025, although a notable shift towards Electric powertrains is projected, driven by government incentives and environmental regulations.

- Key Drivers for Underground Mining: Vast underground mineral deposits, increasing mining depths, demand for enhanced safety and efficiency, and governmental investments in underground mining technology.

- Key Drivers for Metal Mining: Abundance of metal reserves, significant government support for the metal mining sector, export-oriented nature of the industry, and investments in new mine development.

- Key Drivers for IC Engines: Existing infrastructure, lower initial cost, higher familiarity among operators, and limited charging infrastructure in remote mining locations.

Russian Mining Machine Industry Product Developments

Recent product innovations include the development of more robust and efficient equipment tailored to the harsh Russian climate and challenging mining conditions. Improved automation and remote control technologies are enhancing safety and productivity. The integration of advanced sensors and data analytics systems allows for real-time monitoring and optimization of mining operations. Electric and hybrid powertrains are emerging as significant product developments, offering environmental benefits and reduced operating costs. The key competitive advantage lies in offering technologically advanced, reliable, and customized solutions tailored to the specific needs of the Russian mining industry.

Key Drivers of Russian Mining Machine Industry Growth

The growth of the Russian mining machine industry is propelled by several factors. Government support for domestic mining activities, including tax incentives and infrastructure development, plays a crucial role. Rising global demand for metals and minerals creates significant market opportunities. Technological advancements, particularly in automation and electrification, are driving efficiency gains and reducing operating costs. The focus on sustainable mining practices is also stimulating innovation and investment in environmentally friendly technologies.

Challenges in the Russian Mining Machine Industry Market

The industry faces challenges such as geopolitical uncertainties, impacting investments and supply chains. Fluctuations in commodity prices create market volatility. The availability of skilled labor and technical expertise remains a constraint. Strict environmental regulations necessitate substantial investment in compliance technologies, which present a substantial cost to mining operations. The overall impact of these factors is estimated to reduce annual market growth by approximately 1% on average.

Emerging Opportunities in Russian Mining Machine Industry

Significant opportunities exist in the development and deployment of autonomous mining systems, enhancing safety and productivity while addressing labor shortages. Strategic partnerships between Russian manufacturers and international technology providers can unlock access to advanced technologies and global markets. Expanding into new mining regions with untapped reserves offers promising avenues for growth. Further investments in R&D towards environmentally sustainable mining technologies will be crucial for meeting changing regulatory frameworks.

Leading Players in the Russian Mining Machine Industry Sector

- Hitachi Construction Machinery

- Kopeysk Machine Building Plant

- Strommashina Corp

- Uralmash

- Prominer Mining Technology Co Ltd

- Xinhai Mineral Processing EP

- UZTM Kartex Gazprombank Group

- DXN

- Mitsubishi Corporation (Russia) LLC

Key Milestones in Russian Mining Machine Industry Industry

- 2020: Uralmash launched a new generation of electric-powered loaders for underground mining.

- 2021: Government subsidies announced for the adoption of energy-efficient mining equipment.

- 2022: A major merger between two leading Russian mining equipment manufacturers.

- 2023: Significant investment in R&D for autonomous mining technologies by Hitachi Construction Machinery.

- 2024: Introduction of new safety regulations impacting mining equipment design.

Strategic Outlook for Russian Mining Machine Industry Market

The Russian mining machine industry is projected to experience steady growth over the forecast period (2025-2033), driven by increasing demand and technological advancements. Strategic partnerships, investments in R&D, and adaptation to evolving regulatory frameworks will be crucial for success. Companies focusing on innovation, sustainable solutions, and robust after-sales service will be well-positioned to capitalize on the market's growth potential. The long-term outlook remains positive, with significant opportunities for businesses that can adapt to the changing industry landscape.

Russian Mining Machine Industry Segmentation

-

1. Type

- 1.1. Surface Mining

- 1.2. Underground Mining

- 1.3. Mineral Processing Equipment

-

2. Application

- 2.1. Metal Mining

- 2.2. Mineral Mining

- 2.3. Coal Mining

-

3. Powertrain Type

- 3.1. IC Engines

- 3.2. Electric

Russian Mining Machine Industry Segmentation By Geography

- 1. Russia

Russian Mining Machine Industry Regional Market Share

Geographic Coverage of Russian Mining Machine Industry

Russian Mining Machine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Growing Economy

- 3.2.2 Coupled with Rising Disposal Incomes and Urbanization

- 3.2.3 Fuels Demand for the Market

- 3.3. Market Restrains

- 3.3.1 Various Regulatory Changes

- 3.3.2 Safety Standards

- 3.3.3 and Taxation Policies by the Government may Hamper the Market

- 3.4. Market Trends

- 3.4.1. Electric Vehicles Segment Grows with High CAGR

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russian Mining Machine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Mining

- 5.1.2. Underground Mining

- 5.1.3. Mineral Processing Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Metal Mining

- 5.2.2. Mineral Mining

- 5.2.3. Coal Mining

- 5.3. Market Analysis, Insights and Forecast - by Powertrain Type

- 5.3.1. IC Engines

- 5.3.2. Electric

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hitachi Construction Machinery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kopeysk Machine Building Plant

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Strommashina Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uralmash

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Prominer Mining Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Xinhai Mineral Processing EP

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UZTM Kartex Gazprombank Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DXN

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi Corporation (Russia) LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Hitachi Construction Machinery

List of Figures

- Figure 1: Russian Mining Machine Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russian Mining Machine Industry Share (%) by Company 2025

List of Tables

- Table 1: Russian Mining Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Russian Mining Machine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Russian Mining Machine Industry Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 4: Russian Mining Machine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Russian Mining Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Russian Mining Machine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Russian Mining Machine Industry Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 8: Russian Mining Machine Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russian Mining Machine Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Russian Mining Machine Industry?

Key companies in the market include Hitachi Construction Machinery, Kopeysk Machine Building Plant, Strommashina Corp, Uralmash, Prominer Mining Technology Co Ltd, Xinhai Mineral Processing EP, UZTM Kartex Gazprombank Group, DXN, Mitsubishi Corporation (Russia) LLC.

3. What are the main segments of the Russian Mining Machine Industry?

The market segments include Type, Application, Powertrain Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 160.19 billion as of 2022.

5. What are some drivers contributing to market growth?

The Growing Economy. Coupled with Rising Disposal Incomes and Urbanization. Fuels Demand for the Market.

6. What are the notable trends driving market growth?

Electric Vehicles Segment Grows with High CAGR.

7. Are there any restraints impacting market growth?

Various Regulatory Changes. Safety Standards. and Taxation Policies by the Government may Hamper the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russian Mining Machine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russian Mining Machine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russian Mining Machine Industry?

To stay informed about further developments, trends, and reports in the Russian Mining Machine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence